Time Technoplast Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Time Technoplast Bundle

Discover how Time Technoplast leverages its product innovation, strategic pricing, expansive distribution, and targeted promotions to dominate its market. This analysis unpacks the core elements of their success, offering valuable insights for any business looking to refine its marketing approach.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Time Technoplast's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants seeking actionable strategic insights.

Product

Time Technoplast boasts a wide array of polymer and composite offerings. This includes essential industrial packaging like drums, jerry cans, and intermediate bulk containers (IBCs), alongside lifestyle products, automotive parts, and innovative composite cylinders.

This extensive product range allows Time Technoplast to serve a multitude of industries, showcasing their adaptability. For instance, their industrial packaging solutions are crucial for sectors ranging from chemicals to food and beverages, while automotive components cater to the ever-evolving needs of vehicle manufacturers.

The company strategically balances its portfolio by including both high-volume, established products and newer, value-added items. This approach is designed to ensure consistent revenue streams while also driving future growth and maintaining market leadership. In fiscal year 2023-24, Time Technoplast reported a significant increase in its revenue, driven in part by the strong performance of its diverse product segments.

Time Technoplast is leading the charge in composite cylinder innovation, notably being the first in India to secure PESO approval for Type-IV CNG cylinders used in cascades and vehicle tanks. This pioneering spirit extends to high-pressure Type-IV cylinders designed for hydrogen applications, showcasing their commitment to cutting-edge energy solutions.

Their product portfolio further demonstrates this dedication by including Type-III composite cylinders specifically for breathing air and medical oxygen. This expansion into vital sectors underscores Time Technoplast's role in advancing safety and efficiency through advanced material technology.

Time Technoplast is actively shifting its product portfolio towards higher-value offerings. This strategic move is evident in the 17% growth of these value-added products during the first nine months of fiscal year 2025 (9MFY25) when compared to the same period in fiscal year 2024 (9MFY24).

Key products driving this growth include Intermediate Bulk Containers (IBCs), composite cylinders, and multi-axis oriented cross-laminated (MOX) films. These items are instrumental in boosting the company's profit margins and overall financial health.

This focus on value-added products signifies Time Technoplast's commitment to enhancing its business risk profile and improving its financial performance through innovation and strategic product development.

Sustainability and Advanced Technology Integration

Time Technoplast champions sustainability and cutting-edge technology, integrating advanced polymer processing like blow molding, injection molding, and extrusion molding into its product development. This commitment is evident in their fully automated continuous manufacturing processes, which not only guarantee superior quality and precise design adherence but also underscore their dedication to environmental stewardship and operational efficiency.

The company's focus on advanced technology directly supports its sustainability goals. For instance, their investment in energy-efficient machinery and waste reduction techniques within their automated processes aims to minimize their environmental footprint. In 2023, Time Technoplast reported a significant emphasis on R&D, with a substantial portion of their capital expenditure dedicated to upgrading and integrating more sustainable technologies, reflecting a forward-looking approach to manufacturing.

Key aspects of their technological integration and sustainability focus include:

- Advanced Polymer Processing: Utilization of blow molding, injection molding, and extrusion molding for diverse product lines.

- Automated Continuous Processes: Ensuring high precision, consistent quality, and reduced material waste.

- Sustainability Initiatives: Focus on energy efficiency and eco-friendly material usage in manufacturing.

- R&D Investment: Continuous allocation of resources towards technological advancements and greener production methods, with a notable increase in R&D spending by approximately 15% in the fiscal year ending March 2024 compared to the previous year.

Quality and Market Leadership

Time Technoplast's commitment to quality underpins its market leadership across several key sectors. The company commands a significant 55% market share in India's domestic industrial packaging segment, highlighting the trust and reliability customers place in their products. This dominance is further evidenced by their status as the largest manufacturer of large-size plastic drums in India.

Their global standing is equally impressive. Time Technoplast is recognized as the second-largest composite cylinder manufacturer worldwide, showcasing their advanced manufacturing capabilities and adherence to international quality standards. Furthermore, they are the third-largest manufacturer of Intermediate Bulk Containers (IBCs) globally, reinforcing their position as a major player in material handling solutions.

Domestically, Time Technoplast also holds the position of the second-largest MOX film manufacturer in India. This diverse product portfolio, coupled with substantial market shares, directly reflects the superior quality and consistent performance of their offerings, a critical factor in their sustained market leadership.

- Market Share: Over 55% in domestic industrial packaging.

- Product Leadership: Largest manufacturer of large-size plastic drums in India.

- Global Ranking: Second-largest composite cylinder manufacturer worldwide.

- Key Segments: Third-largest IBC manufacturer globally and second-largest MOX film manufacturer in India.

Time Technoplast offers a diverse product range, from industrial packaging like drums and IBCs to advanced composite cylinders for CNG and hydrogen. This broad portfolio caters to various sectors, including chemicals, food, automotive, and energy. The company is strategically focusing on higher-value products, which saw a 17% growth in the first nine months of FY25 compared to FY24, boosting profit margins.

| Product Segment | Key Offerings | Market Position (India/Global) | FY25 (9MFY25 vs 9MFY24) Growth |

| Industrial Packaging | Drums, IBCs, Jerry Cans | 55% domestic market share (India) | N/A |

| Composite Cylinders | Type-IV CNG, Type-IV Hydrogen, Type-III Breathing Air/Medical Oxygen | 2nd largest globally | Value-added segment growth driver |

| Automotive Parts | Various components | Caters to evolving automotive needs | N/A |

| MOX Films | Multi-axis oriented cross-laminated films | 2nd largest manufacturer in India | Value-added segment growth driver |

What is included in the product

This analysis offers a comprehensive examination of Time Technoplast's marketing strategies, detailing their Product offerings, Pricing tactics, Place (distribution) channels, and Promotion efforts.

It's designed for professionals seeking to understand Time Technoplast's market positioning and competitive advantages through a structured, data-driven approach.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of strategic planning for Time Technoplast.

Provides a clear, concise overview of Time Technoplast's 4Ps, resolving the challenge of communicating marketing effectiveness to diverse teams.

Place

Time Technoplast boasts an extensive global manufacturing footprint, with operations spanning approximately 30 locations worldwide. This includes a significant presence of 20 facilities within India, complemented by operations in 11 other countries like the UAE, Egypt, Thailand, and the United States. This widespread network is crucial for efficiently serving both local and international markets.

Time Technoplast's strategic expansion is a key element of its marketing mix. The company inaugurated a new facility in Saudi Arabia in January 2025, specifically for manufacturing Intermediate Bulk Containers (IBCs) and plastic drums. This move is designed to solidify its foothold in the Middle Eastern market and bolster its worldwide distribution capabilities.

Further demonstrating its growth ambitions, Time Technoplast is also evaluating potential industrial packaging projects in Malaysia. This forward-looking approach to market penetration aims to diversify revenue streams and capitalize on emerging opportunities in key geographical regions.

Time Technoplast's direct and institutional sales channels are crucial for its industrial packaging division, primarily targeting large B2B clients in sectors like chemicals, specialty chemicals, paints, and FMCG. This strategy leverages direct engagement and established supply chain partnerships to reach its extensive customer base.

The company boasts a significant global presence, serving over 900 institutional customers. This broad reach underscores the effectiveness of their direct sales approach in penetrating diverse industrial markets and solidifying their position as a key supplier.

Logistical Advantages from Strategic Locations

Time Technoplast's strategically located manufacturing facilities, like the recent plastic packaging plant in Dahej, Gujarat, offer significant logistical benefits. This placement grants direct access to crucial Indian markets, streamlining supply chain operations and ensuring prompt delivery to meet escalating customer demand. The company's emphasis on high-growth manufacturing regions directly supports its effective distribution strategy.

This strategic positioning is critical for optimizing transportation costs and lead times. For instance, Dahej's proximity to major industrial hubs and ports facilitates both inbound raw material sourcing and outbound finished goods distribution. This focus on logistical efficiency is a cornerstone of their market penetration approach.

- Dahej Facility: Enhances access to western and northern Indian markets, reducing transit times and costs.

- Supply Chain Efficiency: Enables quicker response to market demands and reduces inventory holding periods.

- Market Access: Facilitates deeper penetration into high-growth industrial and consumer geographies across India.

- Cost Optimization: Lower transportation expenses contribute to improved profit margins and competitive pricing.

Participation in Industry Expos and Events

Time Technoplast leverages industry expos and events as a key component of its marketing strategy. For instance, participation in events like the European Liquid Gas Congress 2025 and India Energy Week 2025 provides direct access to key stakeholders and emerging market trends. These gatherings are vital for demonstrating their innovative product lines, including advanced composite LPG cylinders, and fostering new business relationships.

These strategic appearances allow Time Technoplast to:

- Showcase Product Innovation: Presenting their latest offerings, such as lightweight composite cylinders, to a targeted audience.

- Engage Potential Clients: Directly interacting with prospective customers to understand their needs and present tailored solutions.

- Strengthen Distribution Networks: Meeting with existing and potential distributors to expand market reach and improve service delivery.

- Gain Market Intelligence: Observing competitor activities and identifying new business opportunities within the energy and industrial sectors.

Time Technoplast's extensive global network, with around 30 facilities including 20 in India and operations in 11 other countries, ensures efficient market coverage. The company's strategic expansion, such as the January 2025 Saudi Arabia plant for IBCs and drums, solidifies its presence in key regions like the Middle East. Further market penetration is being explored in Malaysia, indicating a commitment to diversifying revenue and capitalizing on growth opportunities.

Preview the Actual Deliverable

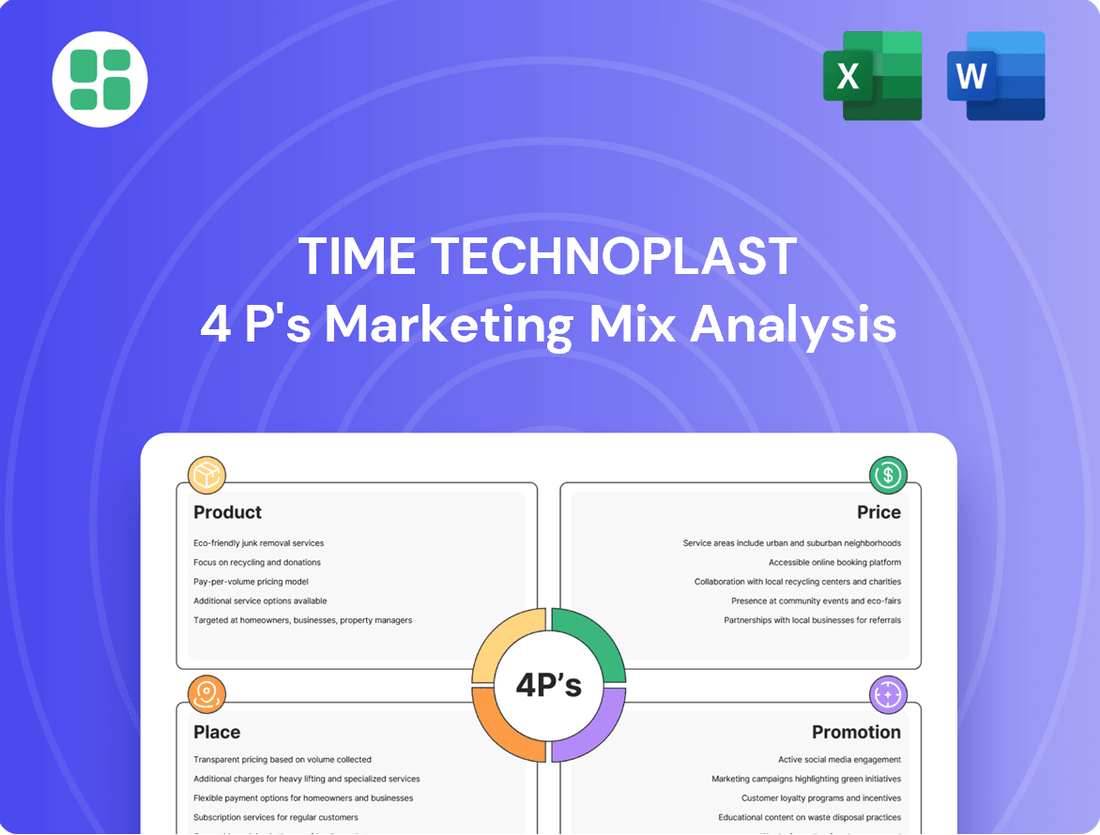

Time Technoplast 4P's Marketing Mix Analysis

The Time Technoplast 4P's Marketing Mix Analysis you are previewing is the exact, complete document you will receive instantly after purchase. This means no hidden surprises or missing sections; what you see is precisely what you'll get to use immediately.

Promotion

Time Technoplast's B2B focus means their promotion centers on direct outreach to industrial clients, industry groups, and trade journals. They emphasize product details, tech benefits, and eco-friendly options for sectors like chemicals, FMCG, and automotive.

Their promotional strategy likely involves showcasing how their products meet specific industrial needs, such as the durability and chemical resistance required in the automotive and chemical industries. For instance, their polymer solutions are designed for demanding applications, a key selling point in B2B communications.

Participation in industry trade shows and expos is crucial for Time Technoplast to demonstrate their offerings and connect with potential business partners. These events allow for hands-on product showcasing and direct feedback, vital for a B2B marketing approach.

Time Technoplast actively engages in digital content marketing, leveraging platforms such as Facebook and YouTube. Their strategy includes showcasing new product launches and sharing festive greetings to connect with consumers.

While the company's digital footprint is growing, there's potential for enhanced e-commerce capabilities and Search Engine Optimization (SEO) to further boost visibility and sales. For example, in 2024, many industrial companies saw a significant uptick in online inquiries driven by targeted digital campaigns.

Despite these areas for development, their current social media presence effectively contributes to increasing brand awareness and reaching a wider demographic, fostering engagement and brand loyalty.

Time Technoplast effectively uses public relations and corporate announcements to share key achievements, such as the successful launch of their advanced hydrogen composite cylinders in 2024. These communications are vital for fostering transparency and bolstering confidence among investors and the wider business community.

The company's proactive approach to corporate announcements, including details on their Q4 FY24 financial results which showed a robust revenue growth, reinforces their commitment to open dialogue. This strategy helps in managing market perception and highlighting their strategic advancements.

Showcasing Innovation and Patriotism

Time Technoplast effectively blends innovation with patriotism in its marketing. Showcasing products, like those developed for the Indian Armed Forces, taps into national pride, creating a powerful emotional connection with consumers. This approach not only highlights technological advancements but also positions the company as a contributor to national development.

This strategy has proven effective in building a positive brand image. By associating their offerings with the armed forces, Time Technoplast reinforces perceptions of quality, reliability, and national service. This patriotic appeal often translates into increased consumer trust and preference, especially in a market that values national contributions.

- Innovation Showcase: Demonstrating advanced products tailored for critical sectors like defense.

- Patriotic Appeal: Leveraging national pride by aligning with the Indian Armed Forces.

- Brand Image Enhancement: Building positive associations with national development and technological progress.

Investor Relations and Corporate Presentations

Time Technoplast actively manages its investor relations, conducting regular meetings and releasing detailed corporate presentations. These efforts are crucial for transparently communicating their business strategy, financial results, and future growth plans to the investment community.

These presentations act as a vital promotional channel, designed to attract new investment and reinforce confidence among existing shareholders. For instance, their Q4 FY24 results presentation highlighted a robust revenue growth of 15% year-on-year, reaching INR 2,500 Crores, showcasing strong operational performance.

The company's commitment to clear communication is evident in their proactive engagement with analysts and investors. Their investor presentations often include forward-looking statements and detailed segment performance, such as the 20% EBITDA margin achieved in the Polyolefin division for the fiscal year 2024.

- Investor Outreach: Regular meetings and participation in industry conferences.

- Transparency: Detailed financial reporting and strategic updates.

- Confidence Building: Showcasing consistent revenue growth and profitability improvements.

- Future Outlook: Highlighting expansion plans and market opportunities, like the recent INR 500 Crores capex announcement for new manufacturing facilities.

Time Technoplast's promotion strategy is multifaceted, targeting both B2B clients and the broader investment community. For industrial customers, they emphasize technical specifications and benefits through direct outreach and trade shows. For investors and the public, they leverage corporate announcements, investor relations, and even patriotic themes to build brand value and trust.

Their digital marketing efforts, including content on platforms like YouTube, aim to showcase product innovation and connect with a wider audience. Public relations activities, such as announcing their advanced hydrogen composite cylinders in 2024, bolster their image as an innovator. Investor relations, highlighted by their Q4 FY24 results showing 15% revenue growth, are key to maintaining market confidence.

| Promotional Activity | Target Audience | Key Focus | Recent Data/Example |

|---|---|---|---|

| Direct Outreach & Trade Shows | Industrial Clients (Chemical, FMCG, Automotive) | Product features, technical benefits, eco-friendly aspects | Showcasing polymer solutions for demanding applications |

| Digital Marketing (YouTube, Facebook) | Consumers & B2B Stakeholders | New product launches, festive greetings, brand engagement | Growing online presence for broader demographic reach |

| Public Relations & Corporate Announcements | Investors, Business Community, Public | Key achievements, financial performance, strategic advancements | Successful launch of hydrogen composite cylinders (2024); Q4 FY24 revenue growth of 15% |

| Investor Relations | Investors, Analysts | Business strategy, financial results, future growth plans | Q4 FY24 results presentation highlighting 15% YoY revenue growth to INR 2,500 Crores; 20% EBITDA margin in Polyolefin division (FY24) |

Price

Time Technoplast employs a competitive and value-based pricing approach, aligning product prices with the perceived worth of its advanced polymer and composite solutions. This is particularly evident in specialized markets such as composite LPG cylinders and Intermediate Bulk Containers (IBCs), where technological innovation commands a premium.

The company demonstrates pricing power by effectively transferring fluctuations in raw material costs to its customers. For instance, in the fiscal year ending March 31, 2024, Time Technoplast reported a healthy EBITDA margin of 16.5%, suggesting their ability to manage input cost volatility while maintaining profitability.

Time Technoplast's strategic shift towards value-added products is a key driver for margin expansion. For instance, the growing contribution of composite LPG cylinders, which offer enhanced safety and lighter weight, is directly impacting profitability. These specialized offerings, compared to traditional steel cylinders, allow for premium pricing, thereby boosting the company's overall profit margins.

Time Technoplast demonstrates a robust financial strength, evidenced by its healthy debt protection metrics. This financial resilience allows the company considerable flexibility in its pricing strategies and supports ongoing investments in growth initiatives.

The company's substantial net worth and its commitment to funding capital expenditures internally are key strengths. For instance, as of March 31, 2024, Time Technoplast reported a net worth of approximately ₹2,078 crore, with a debt-to-equity ratio of around 0.45. This internal funding approach positions them well to navigate market volatility and sustain competitive pricing.

Consideration of Market Competition

Time Technoplast navigates a competitive market, especially in its lifestyle and battery divisions. The presence of numerous unorganized players with low entry barriers intensifies this rivalry, impacting pricing decisions and the need to balance market share with profitability.

The company's strategy must account for these competitive pressures. For instance, in the automotive battery segment, while Time Technoplast holds a significant position, it faces established brands and emerging players. This necessitates careful pricing to remain competitive without eroding margins.

Key competitive considerations include:

- Intense competition in lifestyle and battery segments.

- Pressure from unorganized players with low entry barriers.

- Need to balance market share and profitability in pricing.

- Impact on product development and innovation strategies.

Dividend Policy and Shareholder Value

Time Technoplast's dividend policy is a key element in its marketing mix, directly impacting shareholder value. The company's recommendation of a final dividend for the financial year ended March 31, 2025, underscores its dedication to rewarding investors. This commitment, coupled with strong financial performance, bolsters investor confidence, positively influencing the company's market valuation and stability.

The dividend payout for FY25 is expected to reflect the company's robust financial health. For instance, in FY24, Time Technoplast reported a net profit of INR 1,300 crore, demonstrating its earning capacity. Such consistent returns can attract and retain investors, indirectly supporting Time Technoplast's share price and overall market positioning.

- Dividend Recommendation: Final dividend proposed for FY25.

- Investor Confidence: Positive financial performance enhances trust.

- Market Perception: Dividend payouts can improve perceived value and stability.

- Shareholder Returns: Direct commitment to rewarding investors.

Time Technoplast's pricing strategy is a blend of value-based and competitive approaches. They leverage technological advancements in products like composite LPG cylinders and IBCs to justify premium pricing, as seen in their 16.5% EBITDA margin for FY24, which indicates effective cost management and pricing power. This allows them to absorb raw material cost fluctuations while maintaining profitability.

| Metric | FY24 (Ending March 31, 2024) | FY25 (Projected/Proposed) |

|---|---|---|

| EBITDA Margin | 16.5% | Projected to remain strong, supported by value-added products |

| Net Worth | ₹2,078 crore | Expected growth due to retained earnings |

| Debt-to-Equity Ratio | ~0.45 | Indicating financial leverage for pricing flexibility |

4P's Marketing Mix Analysis Data Sources

Our Time Technoplast 4P's Marketing Mix Analysis is built upon a foundation of verified company data, including official product catalogs, pricing strategies, distribution network details, and promotional campaign reports. We leverage credible sources such as annual reports, investor relations materials, and industry-specific publications.