Time Technoplast Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Time Technoplast Bundle

Curious about Time Technoplast's product portfolio performance? Our BCG Matrix preview highlights their market position, revealing potential Stars, Cash Cows, Dogs, and Question Marks. Don't settle for a glimpse; purchase the full BCG Matrix for a comprehensive analysis and actionable strategies to optimize your investments and product development.

Stars

Time Technoplast's composite CNG cylinders are a shining star in their portfolio, experiencing robust growth. Sales for these cylinders, especially for CNG Cascades, have surged by over 30% year-on-year, reflecting strong market demand.

To meet this escalating demand, the company is actively pursuing Phase-II expansion. This strategic move aims to significantly boost their manufacturing capacity, with a target of producing 1080 cascades annually by the close of FY 2024-25.

This stellar performance is driven by the broader trend of increasing natural gas vehicle adoption. Coupled with government initiatives promoting cleaner energy solutions, the composite CNG cylinder segment is well-positioned for continued success.

Composite LPG Cylinders (Type IV) represent a significant growth driver for Time Technoplast. The company's consistent supply to Indian Oil Corporation Limited (IOCL) and exports to over 48 countries highlight its strong market penetration. This segment is experiencing robust demand due to the advantages of Type IV cylinders: they are lighter, safer, and resistant to corrosion.

Time Technoplast has secured substantial orders for these composite cylinders and is actively expanding its manufacturing capacity to meet this burgeoning demand. The Indian government's recommendation to transition from traditional metal cylinders to composite ones further solidifies the positive outlook for this product line. This strategic shift is expected to boost sales and market share for Time Technoplast's Type IV cylinders.

Time Technoplast is at the forefront of India's hydrogen storage solutions, having secured the first PESO approval for High-Pressure Type-IV Composite Cylinders. This positions them as a pioneer in a rapidly evolving market.

While commercial production for mobility is anticipated in FY27, the strategic importance of this segment is undeniable, driven by the projected surge in green hydrogen demand. This makes it a significant future star for the company.

The company's proactive engagement is evident through its supply of test modules to DRDO and ongoing fuel-cell trials, underscoring their commitment to advancing hydrogen technology.

Intermediate Bulk Containers (IBCs)

Time Technoplast stands as the third-largest manufacturer of Intermediate Bulk Containers (IBCs) globally and a trailblazer in India, solidifying its market leadership in this sector. IBCs represent a key component of Time Technoplast's value-added product portfolio, anticipated to drive both significant growth and enhanced profitability for the company. The global IBC market is witnessing accelerated expansion, fueled by the burgeoning chemical industry and a rise in international trade. For instance, the global IBC market size was valued at approximately USD 3.5 billion in 2023 and is projected to grow at a CAGR of around 5.5% from 2024 to 2030, reaching an estimated USD 5.2 billion by 2030.

The company's strong position in the IBC market is a testament to its innovation and strategic focus on high-demand products. This segment is crucial for Time Technoplast's future financial performance, aligning with the company's strategy to capitalize on expanding industrial needs. The increasing adoption of IBCs over traditional drums is also a significant market trend, driven by factors like improved handling efficiency, reduced waste, and enhanced safety in product transportation and storage.

- Market Position: Time Technoplast is the 3rd largest IBC manufacturer globally and a pioneer in India.

- Growth Driver: IBCs are a value-added product segment expected to lead in growth and profitability.

- Market Trends: Rapid growth driven by chemical industry expansion and increasing global trade.

- Market Size: Global IBC market valued at approx. USD 3.5 billion in 2023, projected to reach USD 5.2 billion by 2030.

Value-Added Products Segment Overall

The value-added products segment, encompassing composite cylinders and Intermediate Bulk Containers (IBCs), is a significant growth driver for Time Technoplast. This segment is anticipated to expand at a robust Compound Annual Growth Rate (CAGR) of 20-25%. By fiscal year 2028, it is projected to represent a substantial 35% of the company's total revenue.

This strategic emphasis on high-margin, technologically advanced products positions the value-added segment as a key engine for future growth. The segment has already demonstrated impressive momentum, with value-added products experiencing a 20% increase in the first half of fiscal year 2025 when compared to the same period in fiscal year 2024.

- Projected CAGR: 20-25% for composite cylinders and IBCs.

- Revenue Contribution by FY28: Expected to reach 35% of total company revenue.

- Growth Driver: Focus on higher-margin, technology-driven products.

- H1FY25 Performance: 20% growth in value-added products compared to H1FY24.

Time Technoplast's composite CNG cylinders are a standout performer, showing over 30% year-on-year sales growth, particularly for CNG Cascades. The company is expanding capacity to meet this demand, aiming for 1080 cascades annually by FY 2024-25, driven by increased natural gas vehicle adoption and government support for cleaner energy.

Composite LPG Cylinders (Type IV) are another key growth area, with strong demand due to their lighter, safer, and corrosion-resistant properties. Time Technoplast's consistent supply to IOCL and exports to 48 countries, along with government recommendations for Type IV cylinders, solidify this segment's positive outlook.

The company is also a pioneer in hydrogen storage, holding the first PESO approval for High-Pressure Type-IV Composite Cylinders, positioning it for future growth as green hydrogen demand rises, with commercial production anticipated in FY27.

Time Technoplast is the third-largest global manufacturer of Intermediate Bulk Containers (IBCs), a segment expected to drive significant growth and profitability. The global IBC market, valued at approximately USD 3.5 billion in 2023, is projected to reach USD 5.2 billion by 2030, with a CAGR of 5.5%.

The value-added products segment, including composite cylinders and IBCs, is projected to grow at a 20-25% CAGR and contribute 35% of total revenue by FY28. This segment saw a 20% increase in H1 FY25 compared to H1 FY24, highlighting its strong momentum.

| Product Segment | Key Growth Drivers | Market Position/Outlook | Recent Performance/Projections |

| Composite CNG Cylinders | Natural gas vehicle adoption, government clean energy initiatives | Robust demand, capacity expansion to 1080 cascades annually by FY 2024-25 | Over 30% YoY sales growth for CNG Cascades |

| Composite LPG Cylinders (Type IV) | Lighter, safer, corrosion-resistant properties; government transition recommendations | Strong market penetration (exports to 48 countries), consistent supply to IOCL | Significant growth driver, expanding manufacturing capacity |

| Hydrogen Storage Solutions (Type IV) | Surging green hydrogen demand, government support | Pioneer with first PESO approval, strategic importance for future growth | Commercial production anticipated in FY27; test modules supplied to DRDO |

| Intermediate Bulk Containers (IBCs) | Chemical industry expansion, global trade growth, preference over traditional drums | 3rd largest global manufacturer, market leadership in India | Global market valued at USD 3.5 billion in 2023, projected to reach USD 5.2 billion by 2030 (5.5% CAGR) |

| Value-Added Products (Overall) | Focus on high-margin, technologically advanced products | Key engine for future growth | Projected 20-25% CAGR; expected to contribute 35% of revenue by FY28; 20% growth in H1 FY25 vs H1 FY24 |

What is included in the product

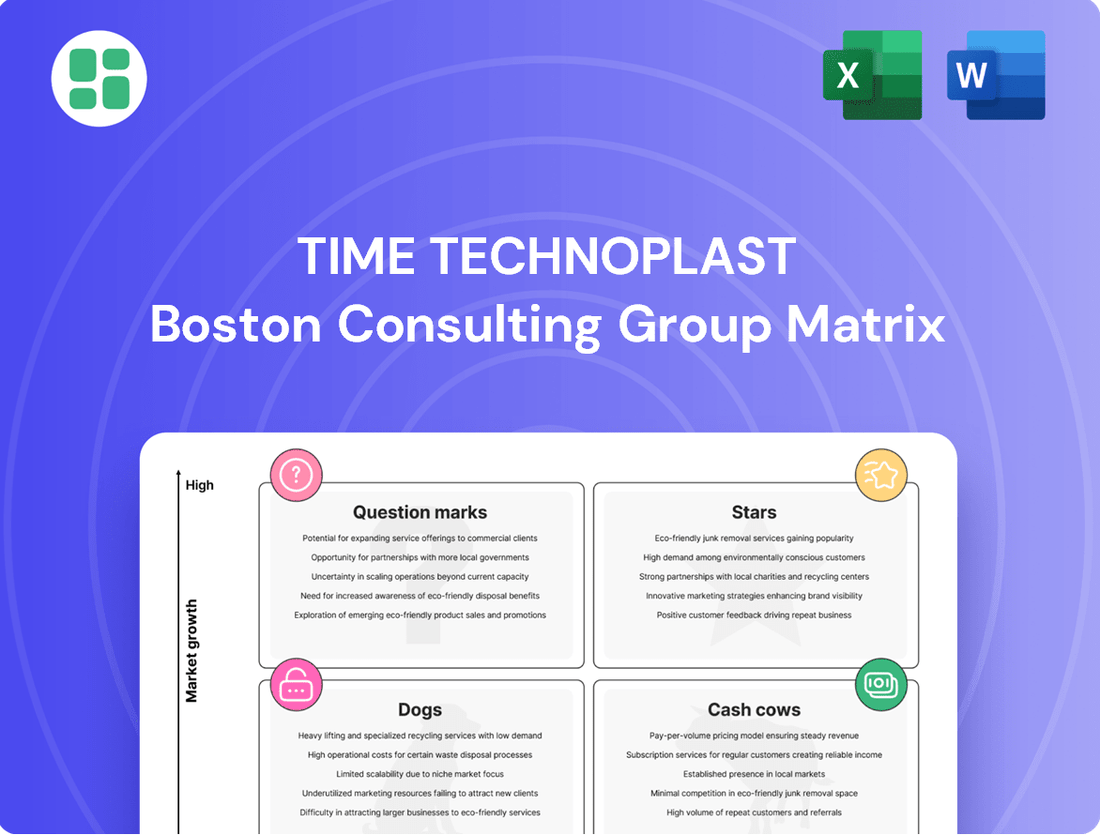

The Time Technoplast BCG Matrix offers a strategic overview of its product portfolio, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

This analysis guides decisions on investment, divestment, or maintenance for each business unit within Time Technoplast.

Provides a clear, actionable visual of Time Technoplast's portfolio, easing the pain of strategic resource allocation.

Cash Cows

Time Technoplast's traditional industrial packaging, particularly polymer drums and containers, represents a strong Cash Cow. The company commands an impressive 55-60% market share domestically and is the global leader in large-size plastic drum production.

This segment is the company's core revenue generator, providing a stable and significant cash flow. Despite a projected moderate CAGR of around 6.91% for the Indian industrial packaging market between 2025 and 2033, Time Technoplast's established dominance ensures continued profitability and reliable earnings.

Jerry cans and pails represent a significant Cash Cow for Time Technoplast, firmly rooted in their core industrial packaging business. This segment benefits from a mature market where the company has established a robust market share, thanks to its consistent product quality and widespread application.

These essential containers are vital across diverse industries, including chemicals, paints, and food processing, guaranteeing a steady and predictable demand. This consistent demand underpins the stable revenue streams characteristic of a Cash Cow.

Time Technoplast's investment in advanced molding technologies and highly automated production lines allows for exceptional efficiency and cost control. This operational excellence translates directly into high profit margins for their jerry cans and pails, reinforcing their status as a reliable Cash Cow within the company's portfolio.

Time Technoplast's established products, mainly industrial packaging, represent a significant portion of its business, contributing around 73% to the company's overall revenue. This segment is characterized by consistent demand from institutional clients worldwide, ensuring a steady and dependable cash flow for the company.

While this segment operates with lower profit margins, its market leadership and inherent stability position it as a vital source of cash generation. This reliable income stream fuels investments in other areas of the business, supporting growth initiatives and innovation.

Global Industrial Packaging Presence

Time Technoplast's robust global industrial packaging operations solidify its cash cow status. The company commands a strong presence in over 10 countries, a testament to its established market position.

This extensive reach diversifies revenue, offering a stable foundation for consistent cash generation. In fact, Time Technoplast is a market leader in 9 out of the 11 countries where it operates, underscoring its dominance and ability to extract significant value from these mature markets.

- Market Leadership: Dominant in 9 of 11 operating countries for polymer-based industrial packaging.

- Global Footprint: Operations spanning over 10 countries provide diversified revenue streams.

- Revenue Stability: High market share across these regions ensures consistent and reliable cash flow.

- Mature Markets: Exploiting established demand in these regions fuels its cash cow designation.

HDPE Pipes

HDPE pipes represent a significant segment for Time Technoplast, firmly positioned within the Cash Cows quadrant of the BCG Matrix. This classification stems from the product's established market presence and its crucial role in India's ongoing infrastructure development. While specific growth figures for HDPE pipes weren't explicitly detailed, their consistent demand in construction and irrigation projects ensures a stable revenue stream.

This reliability makes HDPE pipes a cornerstone for Time Technoplast's cash flow generation. The company's substantial footprint in this mature sector, which benefits from consistent government spending on infrastructure, underscores its Cash Cow status. For instance, India's infrastructure sector saw significant investment in 2024, with the government allocating substantial funds towards projects like water supply and sanitation, directly benefiting HDPE pipe manufacturers like Time Technoplast.

- Established Market Presence: Time Technoplast is a leading manufacturer of HDPE pipes in India.

- Steady Income Generation: The product contributes reliably to the company's cash flow due to its utility in infrastructure.

- Mature Sector Contribution: HDPE pipes are vital for ongoing construction and irrigation, ensuring consistent demand.

- Infrastructure Link: Benefits from sustained government focus on infrastructure development, as seen in 2024 budget allocations.

Time Technoplast's established industrial packaging, particularly polymer drums and jerry cans, are strong Cash Cows. The company holds a dominant 55-60% domestic market share and is the global leader in large plastic drum production, ensuring stable revenue. This segment, contributing around 73% to overall revenue, benefits from consistent institutional demand worldwide, despite lower profit margins, providing reliable cash flow to fund growth initiatives.

HDPE pipes also represent a significant Cash Cow, crucial for India's infrastructure development. Benefiting from consistent government spending, as evidenced by substantial 2024 infrastructure allocations for water and sanitation, this mature sector guarantees a stable revenue stream for Time Technoplast.

| Product Segment | BCG Category | Key Strengths | Market Data/Contribution | Financial Impact |

| Industrial Packaging (Polymer Drums, Jerry Cans) | Cash Cow | Global leadership, 55-60% domestic market share, operations in 10+ countries, market leader in 9 countries. | Contributes ~73% of revenue. Mature market with stable demand. | Significant, reliable cash flow generation, funding other business areas. |

| HDPE Pipes | Cash Cow | Established market presence in India, crucial for infrastructure and irrigation. | Benefits from consistent government infrastructure spending (e.g., 2024 allocations for water/sanitation). | Stable revenue stream and predictable earnings. |

What You’re Viewing Is Included

Time Technoplast BCG Matrix

The document you are currently previewing is the complete and final Time Technoplast BCG Matrix report that you will receive immediately after your purchase. This includes all detailed analysis, strategic insights, and professional formatting, ensuring you get exactly what you need for informed decision-making. You can confidently expect this preview to be the identical, ready-to-use file for your business planning purposes.

Dogs

While Time Technoplast is a player in automotive components, certain segments like older fuel tank technologies or less advanced air duct systems might not be experiencing robust market growth. These areas could be characterized by lower market share compared to the company's more dynamic offerings, potentially placing them in a less strategic position within the BCG matrix.

The company's strategic emphasis appears to be on its high-growth composite cylinders and established packaging solutions. This focus suggests that investments in less innovative or slower-growing automotive product lines might be limited, as capital is likely being channeled towards areas with greater future potential.

Consequently, these "less strategic" automotive components could be generating modest returns or consuming resources without offering significant upside. In 2023, Time Technoplast reported a consolidated revenue of INR 20.3 billion, with a significant portion attributed to their composite LPG cylinders and industrial packaging segments, underscoring the relative weight of these more strategic business units.

Time Technoplast's decision to sell non-core assets, such as land and plant equipment, is a strategic maneuver aimed at debt reduction. This move signals a clear intent to streamline operations by divesting underperforming or non-essential assets that haven't delivered substantial returns. For example, in the fiscal year ending March 31, 2024, the company reported a significant portion of its debt, and shedding these assets is a direct approach to bolster its financial health.

Certain lifestyle products within Time Technoplast, such as specific types of turf and matting or disposable bins, might be categorized as Stagnant Lifestyle Products if they haven't gained substantial market traction or operate in intensely competitive, low-profitability sectors. While the company does have a lifestyle products segment, recent financial disclosures and strategic discussions have predominantly highlighted the expansion of its composites and industrial packaging divisions.

Products in this lifestyle category that are not undergoing innovation or failing to capture new market segments may be kept in the company's portfolio but are unlikely to receive significant investment for future growth. For instance, if a particular line of decorative mats, which saw initial interest, now faces declining demand and numerous low-cost competitors, it would fit this classification.

Outdated Polymer Solutions

Outdated polymer solutions represent older technologies or products within Time Technoplast's portfolio that have been surpassed by more advanced, efficient, or environmentally friendly alternatives. These legacy offerings often struggle to maintain competitiveness in a rapidly evolving market. For instance, older injection molding techniques might be less energy-efficient than newer processes, leading to higher operational costs.

Without continuous investment in research and development, polymer products can quickly become commoditized, experiencing declining market share and generating minimal profits. Companies must adapt to stay relevant. In 2024, the global polymer market saw significant shifts towards bio-based and recycled polymers, making older, virgin-plastic-dependent products less attractive.

- Low Market Share: Products using outdated polymer processing may have seen their market share erode significantly by 2024 due to the availability of superior alternatives.

- Low Profitability: These solutions often generate low returns, barely covering their operational expenses as newer, more cost-effective methods emerge.

- Need for Innovation: The polymer industry demands constant innovation to avoid commoditization; failure to adapt means products quickly become obsolete.

- Sustainability Concerns: Older polymer solutions may not align with the growing demand for sustainable and eco-friendly materials, further impacting their viability.

Underperforming International Ventures

Underperforming International Ventures for Time Technoplast, when viewed through the lens of the BCG Matrix, would represent its Dogs. These are segments where the company, despite its broader market leadership in industrial packaging, might have specific international operations or product lines struggling to capture significant market share. Such ventures are often characterized by operating within mature or declining markets, leading to low growth prospects and limited competitive advantage. For instance, if Time Technoplast had invested in a new manufacturing facility in a region experiencing economic stagnation or intense, entrenched local competition, that specific venture could be classified as a Dog. These situations demand careful evaluation, as they tie up capital without generating substantial returns.

Identifying these Dog segments is crucial for strategic resource allocation. Time Technologoplast's 2024 financial reports might highlight specific international subsidiaries or product categories exhibiting stagnant or negative revenue growth, coupled with low profitability margins. For example, a venture in a European market with a saturated packaging sector and strong local players might show minimal sales growth, perhaps only 1-2% annually, significantly below the company's overall growth targets. These underperforming units would likely have low market share within their respective geographies, failing to establish a strong competitive foothold.

- Stagnant Market Growth: Ventures operating in geographies where the industrial packaging market is experiencing minimal or negative growth, such as certain developed economies with mature industrial bases.

- Low Market Share: Specific international product lines or subsidiaries that have failed to gain substantial traction against established local or global competitors.

- Reduced Investment Focus: These segments typically receive reduced capital investment as the company prioritizes its Stars and Cash Cows, with potential divestment or restructuring considered.

- Negative or Low ROI: A history of consistently low or negative returns on investment, indicating inefficient use of company resources.

Certain older automotive components, like basic fuel tanks or less advanced air duct systems, could be considered Dogs for Time Technoplast. These segments likely have low market share and low growth potential, especially as newer, more efficient technologies emerge. For instance, if the company still produces components for older vehicle models with declining production volumes, these would fit the Dog category.

These products may generate minimal profits and require significant resources for maintenance or compliance, without offering substantial future returns. Time Technoplast's strategic focus on high-growth areas like composite cylinders means less investment is likely directed towards these lagging automotive parts.

The company's divestment of non-core assets, such as land and plant equipment in FY24, also signals an effort to shed underperforming units, which could include these less strategic automotive product lines.

By 2024, the automotive industry's push towards electric vehicles and advanced materials would further diminish the market relevance of older component technologies.

Question Marks

Time Technoplast's foray into hydrogen storage for new applications, beyond initial approvals for drones and mobility, places this segment firmly in the Question Mark category of the BCG Matrix. The company's current market share in these broader, emerging hydrogen ecosystems is likely minimal, necessitating substantial capital outlay to establish a foothold and capitalize on burgeoning demand.

This strategic direction represents a high-growth, high-risk, and potentially high-reward venture. For instance, the global hydrogen storage market is projected to reach USD 28.7 billion by 2028, growing at a CAGR of 6.5%, according to a 2024 report by Mordor Intelligence, highlighting the significant future potential.

Time Technoplast's strategic acquisition of NED Energy Ltd. signifies a bold entry into the burgeoning e-mobility battery sector, particularly for applications like e-rickshaws. This move positions the e-mobility battery business as a Question Mark within the BCG matrix, reflecting its high-growth potential coupled with Time Technoplast's nascent market presence.

The e-mobility market is experiencing rapid expansion, with global sales of electric vehicles projected to reach over 30 million units annually by 2024. However, as a new player, Time Technoplast faces the challenge of building significant market share in a competitive landscape. This necessitates substantial investment in research and development to enhance battery technology, scaling up manufacturing capabilities, and implementing aggressive market penetration strategies.

Successfully navigating these challenges could transform the e-mobility battery segment into a Star performer for Time Technoplast. The company's ability to innovate and capture a meaningful share of the growing electric vehicle battery market will be crucial for future success. For instance, by 2025, the global battery market for electric vehicles is anticipated to exceed $100 billion, offering substantial opportunities for well-positioned companies.

While HDPE pipes are a mature product for Time Technoplast, the company is likely exploring or has recently introduced newer infrastructure and construction products. These could include advanced composite materials for bridges or specialized polymer-based solutions for water management systems. These emerging products, though targeting significant growth opportunities, would currently represent a small portion of the company's revenue, placing them in the question mark category of the BCG matrix.

Specialty MOX Films (Emerging Applications)

Time Technoplast's MOX films find application in agriculture, infrastructure, and packaging. While these established sectors offer steady demand, the company is actively exploring emerging, high-tech applications for MOX films. These represent potential future growth drivers where market penetration is still developing.

Emerging applications for MOX films are primarily focused on areas with significant technological advancement and high growth potential. These include specialized applications within the renewable energy sector, such as advanced solar panel backsheets, and in the medical device industry for specialized packaging and components. The company is also investigating use in advanced construction materials for enhanced durability and insulation.

- Renewable Energy: High-performance backsheets for solar panels, improving efficiency and longevity.

- Medical Devices: Specialized films for sterile packaging and biocompatible components.

- Advanced Construction: Films for enhanced insulation and protective coatings in building materials.

Advanced Composite Solutions for Emerging Industries

Time Technoplast's advanced composite solutions for emerging industries, such as specialized components for next-generation aerospace and cutting-edge defense applications, represent significant question marks in their BCG matrix. These areas are characterized by high growth potential but currently low market share.

For instance, the global aerospace composites market is projected to reach $14.5 billion by 2028, indicating substantial future demand. Time Technoplast's investment in developing lightweight, high-strength composite materials for unmanned aerial vehicles (UAVs) or advanced missile systems positions them to capture a portion of this expanding market.

- Focus on niche, high-growth sectors: Developing composite solutions for emerging applications in renewable energy beyond current wind turbine components, aerospace, and advanced defense.

- Strategic investment imperative: Significant investment is required to gain a leading edge and substantial market share in these nascent but high-potential areas.

- Market potential: The global aerospace composites market is expected to grow significantly, presenting a strong opportunity for specialized solutions.

- Technological advancement: These initiatives require substantial R&D to create innovative composite materials and manufacturing processes tailored to specific, demanding applications.

Time Technoplast's ventures into new, high-growth sectors like hydrogen storage and e-mobility batteries clearly position these as Question Marks on the BCG matrix. These areas demand significant investment to build market share, despite the substantial future potential. For example, the global hydrogen storage market was projected to reach USD 28.7 billion by 2028, with a 6.5% CAGR, according to a 2024 Mordor Intelligence report.

Similarly, the company's exploration of advanced applications for MOX films in renewable energy and medical devices, along with its development of composite solutions for aerospace and defense, also fall into the Question Mark category. These segments offer considerable growth prospects but require substantial R&D and strategic investment to establish a strong market presence.

| Business Segment | BCG Category | Market Growth | Time Technoplast's Market Share | Investment Need |

| Hydrogen Storage | Question Mark | High | Low | High |

| E-Mobility Batteries | Question Mark | High | Low | High |

| Advanced MOX Film Applications | Question Mark | High | Low | High |

| Advanced Composite Solutions (Aerospace/Defense) | Question Mark | High | Low | High |

BCG Matrix Data Sources

Our Time Technoplast BCG Matrix leverages comprehensive data from financial statements, market research reports, and industry-specific growth projections to accurately assess product performance and market share.