Time Technoplast PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Time Technoplast Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Time Technoplast's trajectory. Our meticulously researched PESTLE analysis provides the essential external intelligence you need to anticipate market shifts and identify strategic opportunities. Download the full version now to gain a competitive edge and make informed decisions.

Political factors

The Indian government's intensified focus on plastic waste management, particularly through Extended Producer Responsibility (EPR) mandates and phased bans on specific single-use plastics, directly influences Time Technoplast. New regulations, such as the Plastic Waste Management (Amendment) Rules for 2024 and 2025, are setting ambitious recycling targets and requiring the use of recycled materials. This necessitates adjustments in Time Technoplast's packaging operations, from product development to sourcing strategies.

The Indian government, in partnership with industry leaders such as the Confederation of Indian Industry (CII), is increasingly championing circular economy principles for plastics. A key example is the India Plastics Pact, which sets an ambitious target: all plastic packaging must be reusable, recyclable, or compostable by 2030.

Given Time Technoplast's core business revolving around sustainable and recyclable plastic products, these government-backed initiatives present a significant opportunity. The company's existing focus aligns perfectly with national objectives, positioning it to capitalize on the growing demand for eco-friendly solutions and potentially benefit from policy incentives or preferential treatment.

Government initiatives promoting alternative fuels like Compressed Natural Gas (CNG) and Liquefied Natural Gas (LNG) are creating substantial growth avenues for Time Technoplast's composite cylinder business. For instance, India's SATAT initiative, launched in 2018, aims to establish 10,000 CNG dispensing stations by 2023, a target that has seen significant progress and continues to drive demand for robust storage and transportation solutions. This aligns perfectly with Time Technoplast's strategic emphasis on composite products for the burgeoning energy sector.

Production-Linked Incentive (PLI) Schemes

The plastics industry is actively seeking government support through Production-Linked Incentive (PLI) schemes, as highlighted by the All-India Plastics Manufacturers' Association (AIPMA) in their pre-Budget 2025 recommendations. These incentives are seen as crucial for enhancing domestic production capabilities and elevating India's position in the global plastics market. For a company like Time Technoplast, such schemes could translate into significant advantages, potentially funding expansion projects and facilitating the adoption of advanced manufacturing technologies.

PLI schemes for the plastics sector could directly benefit Time Technoplast by providing financial impetus for growth. This could manifest as subsidies for capital expenditure, incentives for increased production volumes, or support for research and development in new materials and processes. For instance, if a PLI scheme offers a percentage of incremental sales as an incentive, it would directly encourage higher output and market penetration for Time Technoplast's products.

The potential impact of PLI schemes on Time Technoplast's financial performance and strategic direction is substantial. By reducing the cost of capital investment and operational expenses, these incentives can improve profitability and competitiveness. Furthermore, a focus on technological upgrades, often a component of PLI programs, could lead to enhanced product quality and the development of more sustainable and innovative plastic solutions, aligning with evolving market demands and environmental regulations.

- PLI Scheme Advocacy: AIPMA's call for PLI schemes in the 2025 Budget aims to bolster the Indian plastics industry.

- Economic Impact: These incentives are projected to boost domestic manufacturing and increase India's global market share in plastics.

- Company Benefits: Time Technoplast could leverage PLI schemes for expansion, technological upgrades, and enhanced competitiveness.

- Financial Support: Potential benefits include subsidies, production-linked incentives, and R&D support, improving financial viability.

Geopolitical Stability and Trade Policies

Global geopolitical stability and evolving trade policies significantly impact Time Technoplast's import/export of raw materials and finished polymer products. The company's worldwide operations mean it's directly exposed to these shifts.

While precise 2024-2025 data on these specific influences is still emerging, Time Technoplast's strategic moves, such as consolidating and restructuring its overseas operations, signal a proactive approach to navigating the international business landscape. These adjustments are likely aimed at mitigating risks and capitalizing on opportunities presented by changing global trade dynamics.

- Impact on Raw Material Sourcing: Fluctuations in global stability can disrupt supply chains for key polymers, potentially increasing costs for Time Technoplast.

- Trade Policy Effects: Tariffs or trade agreements enacted in 2024-2025 could alter the competitiveness of Time Technoplast's products in various international markets.

- Operational Restructuring: The company's efforts to streamline overseas operations reflect an adaptation to the current geopolitical and trade policy environment.

Government focus on waste management, including EPR mandates and phased bans on single-use plastics, directly impacts Time Technoplast's operations and product development. New regulations for 2024-2025 are pushing for higher recycling rates and increased use of recycled materials.

The government's promotion of alternative fuels like CNG and LNG is creating significant growth opportunities for Time Technoplast's composite cylinder business, aligning with national energy transition goals.

Industry bodies are advocating for Production-Linked Incentive (PLI) schemes for the plastics sector in the 2025 Budget, which could provide crucial financial support for Time Technoplast's expansion and technological advancements.

Global geopolitical shifts and evolving trade policies in 2024-2025 will continue to influence Time Technoplast's raw material sourcing and the competitiveness of its international sales.

What is included in the product

This PESTLE analysis of Time Technoplast delves into the Political, Economic, Social, Technological, Environmental, and Legal factors impacting the company's operations and strategic planning.

It provides a comprehensive understanding of the external forces shaping Time Technoplast's market landscape, highlighting potential challenges and growth avenues.

A concise, actionable summary of Time Technoplast's PESTLE analysis, presented in a digestible format, alleviates the pain of sifting through dense reports for critical strategic insights.

Economic factors

Time Technoplast, a major player in polymer products, faces significant challenges from the volatile pricing of crude oil and its derivatives, the fundamental building blocks for plastics. For instance, in early 2024, Brent crude oil prices saw fluctuations, impacting the cost of polyethylene and polypropylene, key inputs for the company.

Global events, such as the ongoing geopolitical tensions in Eastern Europe and supply chain bottlenecks reported throughout 2023 and into 2024, directly translate into unpredictable raw material costs. This volatility can compress profit margins for manufacturers like Time Technoplast, making consistent profitability a difficult target.

To navigate this, Time Technoplast must employ sophisticated procurement strategies, potentially including forward contracts or diversified sourcing, to buffer against sharp price swings and maintain cost stability in its production processes.

Time Technoplast's diverse product portfolio caters to crucial sectors like industrial packaging, automotive components, and various consumer solutions. This broad market reach is a significant advantage.

The Indian packaging market, a key area for Time Technoplast, is experiencing substantial growth. Projections indicate a compound annual growth rate (CAGR) of around 9-10% for the period leading up to 2027, fueled by rising disposable incomes, rapid urbanization, and the ever-expanding e-commerce landscape. This upward trend directly translates into increased demand for Time Technoplast's offerings, particularly in areas like industrial drums and intermediate bulk containers (IBCs) used for logistics and storage.

Rising inflation in 2024 and projected into 2025 can indeed squeeze consumer spending power, potentially dampening demand for products that rely on packaging and lifestyle solutions from companies like Time Technoplast. Higher prices for essentials leave less discretionary income for non-essential purchases.

Despite these inflationary concerns, India's economic outlook remains robust. Per Capita Final Consumption Expenditure in India saw a healthy increase, reaching approximately INR 1.49 lakh in FY2024, signaling a growing and recovering consumer market. This upward trend is expected to continue, providing a supportive backdrop for demand in the packaged goods sector.

Investment in Infrastructure Projects

Government initiatives to boost infrastructure, such as the National Infrastructure Pipeline (NIP) in India, which aims for ₹111 lakh crore (approximately $1.3 trillion) in infrastructure investment by 2025, directly benefit companies like Time Technoplast. This increased spending on roads, water supply, and smart city development fuels demand for their high-density polyethylene (HDPE) pipes and other polymer solutions.

The focus on smart cities specifically drives the need for advanced piping systems for water management, sanitation, and energy distribution, aligning perfectly with Time Technoplast's product offerings. For instance, the Indian government's Smart Cities Mission, launched in 2015, continues to drive projects requiring robust and durable infrastructure components.

This government-driven demand provides Time Technoplast with significant growth opportunities, leveraging its diversified product portfolio across various construction and infrastructure segments. The company's ability to supply these essential materials positions it to capitalize on these large-scale development projects.

- Government Infrastructure Spending: India's National Infrastructure Pipeline targets ₹111 lakh crore (approx. $1.3 trillion) by 2025, creating substantial demand for construction materials.

- Smart City Development: Initiatives like the Smart Cities Mission accelerate the adoption of advanced piping systems for water, sanitation, and energy.

- Product Alignment: Time Technoplast's HDPE pipes and polymer products are crucial for these infrastructure projects, offering diversified revenue streams.

Foreign Direct Investment (FDI) Policies

India's policy allowing 100% Foreign Direct Investment (FDI) under the automatic route in the packaging sector is a significant factor for Time Technoplast. This open-door policy is designed to attract global capital and expertise, potentially leading to increased competition from international packaging companies entering the Indian market. For instance, in FY 2023-24, India saw a substantial inflow of FDI, indicating the attractiveness of its market to foreign investors.

This increased foreign participation can also spur innovation and drive market expansion, offering opportunities for Time Technoplast to collaborate, acquire new technologies, or expand its own global reach. The competitive landscape will likely intensify, necessitating strategic agility and a focus on differentiation to maintain and grow market share.

- Increased Competition: More foreign players entering the packaging sector due to liberal FDI norms.

- Capital Inflows: Potential for greater foreign investment in the Indian packaging industry.

- Technological Advancement: FDI can bring in advanced manufacturing technologies and R&D capabilities.

- Market Expansion: Opportunities for Time Technoplast to explore partnerships or acquisitions with foreign entities.

The economic landscape presents a dual-edged sword for Time Technoplast. While India's robust economic growth, evidenced by a projected GDP growth of approximately 6.5-7.0% for FY2025, fuels demand for its products, rising inflation and fluctuating commodity prices pose significant challenges. For example, the Consumer Price Index (CPI) in India remained elevated in early 2024, impacting consumer purchasing power for non-essential goods that utilize polymer packaging.

The company's reliance on crude oil derivatives as raw materials means that global oil price volatility, influenced by geopolitical factors, directly affects its input costs. In early 2024, Brent crude prices hovered around $80-$85 per barrel, a key indicator for polyethylene and polypropylene costs. This makes consistent profit margins a continuous balancing act for Time Technoplast.

However, government initiatives like the National Infrastructure Pipeline, targeting ₹111 lakh crore (approximately $1.3 trillion) by 2025, create substantial demand for Time Technoplast's polymer solutions in sectors like construction and water management, offering a counterbalancing growth driver.

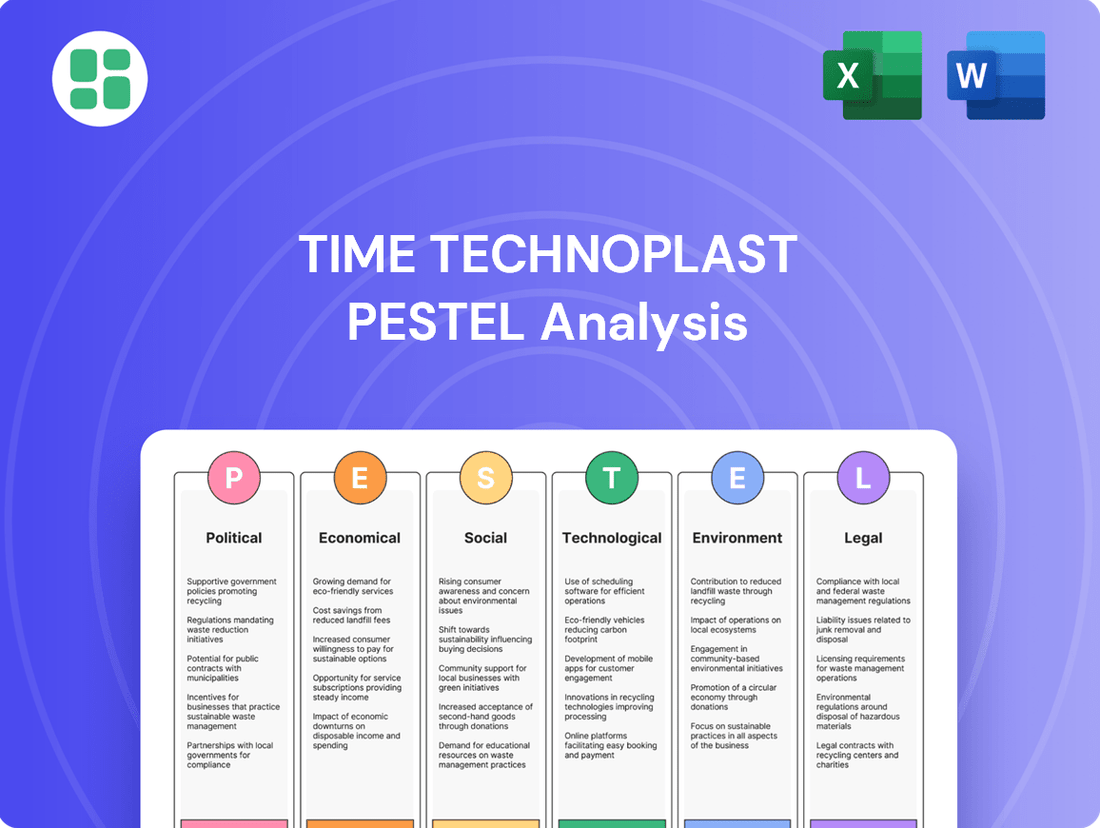

What You See Is What You Get

Time Technoplast PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis for Time Technoplast.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, detailing the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Time Technoplast.

The content and structure shown in the preview is the same document you’ll download after payment, providing a deep dive into the external forces shaping Time Technoplast's strategic landscape.

Sociological factors

Globally, consumer demand for sustainable and eco-friendly products, including packaging, is on a significant upswing. In 2024, for instance, a significant percentage of consumers across major markets indicated a willingness to pay a premium for sustainable goods, a trend that directly impacts packaging choices.

This societal shift compels manufacturers like Time Technoplast to actively innovate in biodegradable, recyclable, and reusable polymer solutions. The move away from traditional single-use plastics is driven by evolving consumer preferences and increasing regulatory scrutiny on waste management.

India's rapid urbanization, with an estimated 40% of its population projected to live in cities by 2030, significantly boosts the demand for convenient and packaged consumer goods. This shift in lifestyle, favoring ready-to-use and processed items, directly translates into increased need for diverse packaging solutions. Time Technoplast, with its wide range of products from industrial drums to consumer packaging, is well-positioned to capitalize on these evolving consumer habits.

India's e-commerce sector has seen remarkable growth, with projections indicating it could reach $350 billion by 2030, up from $80 billion in 2023. This surge directly fuels the demand for sophisticated packaging. Consumers now expect more than just protection; they seek an engaging unboxing experience, pushing brands to invest in customized and visually appealing packaging solutions.

Time Technoplast is well-positioned to capitalize on this trend. The company's ability to offer tailored plastic packaging, from intricate designs for premium products to robust solutions for electronics, aligns perfectly with evolving consumer preferences. For instance, the rise of direct-to-consumer (DTC) brands, which heavily rely on online sales, means a greater need for packaging that not only safeguards goods during transit but also enhances brand perception upon arrival.

Health and Safety Concerns Regarding Packaging

Growing consumer awareness regarding the health implications of packaging materials, particularly for food and beverage products, is a significant sociological factor. This heightened concern means Time Technoplast must prioritize the development of food-grade and non-toxic polymer solutions. For instance, the global demand for safe food packaging is projected to reach $320 billion by 2027, highlighting the market's emphasis on health and safety.

Adherence to rigorous safety standards is paramount for maintaining consumer trust and market share. Time Technoplast's commitment to producing packaging that is free from harmful chemicals, such as BPA or phthalates, directly addresses these evolving consumer expectations. By investing in research and development for advanced polymer technologies, the company can ensure its products meet and exceed international safety regulations.

- Consumer Demand: Increasing consumer preference for products with transparent and safe packaging.

- Regulatory Scrutiny: Heightened government regulations on food contact materials, impacting production processes.

- Brand Reputation: Packaging safety directly influences brand perception and consumer loyalty.

Workforce Skills and Development

The availability of a skilled workforce is paramount for Time Technoplast, especially given the increasing complexity of polymer processing technologies. For instance, in 2023, the Indian manufacturing sector faced a notable skills gap, with reports indicating that over 70% of engineers lacked the necessary practical skills for industry roles, highlighting a critical area for development.

To maintain its competitive edge and foster innovation, Time Technoplast must prioritize continuous investment in training and employee development programs. These initiatives are essential for equipping employees with the expertise needed to operate advanced machinery and contribute to research and development efforts. By doing so, the company can ensure its workforce remains adept at handling cutting-edge polymer processing techniques and driving product innovation forward.

- Skills Gap in Manufacturing: In 2023, a significant portion of India's manufacturing workforce required upskilling to meet the demands of advanced technologies.

- R&D Investment: Time Technoplast's ability to innovate is directly linked to the R&D capabilities of its workforce, necessitating ongoing training.

- Employee Welfare: Investing in employee welfare not only boosts morale but also contributes to a more stable and productive workforce, crucial for long-term operational efficiency.

Societal trends are significantly shaping the packaging industry, with a growing demand for sustainable and safe materials. Consumers are increasingly willing to pay more for eco-friendly products, pushing companies like Time Technoplast to innovate in biodegradable and recyclable polymers. This shift, coupled with rapid urbanization in India, is driving demand for convenient packaging solutions.

The rise of e-commerce further fuels the need for specialized packaging that enhances brand perception and ensures product safety during transit. Time Technoplast's focus on food-grade, non-toxic materials directly addresses consumer concerns about health implications, a critical factor for brand loyalty in the food and beverage sector.

The company must also address the skills gap in the manufacturing sector by investing in employee training to keep pace with advanced polymer processing technologies. This ensures a capable workforce to drive innovation and maintain operational efficiency.

| Sociological Factor | Impact on Time Technoplast | Supporting Data (2023-2025 Projections) |

|---|---|---|

| Sustainability Demand | Increased need for eco-friendly polymer solutions | Global sustainable packaging market projected to grow significantly, with consumer willingness to pay premiums for eco-friendly options. |

| Urbanization & Lifestyle Changes | Higher demand for convenient and packaged goods | India's urban population projected to reach 40% by 2030, increasing consumption of packaged items. |

| E-commerce Growth | Demand for enhanced, branded, and protective packaging | Indian e-commerce market expected to reach $350 billion by 2030, driving need for sophisticated packaging. |

| Health & Safety Awareness | Prioritization of food-grade and non-toxic materials | Global safe food packaging market expected to reach $320 billion by 2027, emphasizing consumer safety. |

| Workforce Skills | Necessity for upskilling in advanced polymer processing | Significant skills gap reported in India's manufacturing sector in 2023, impacting technological adoption. |

Technological factors

Time Technoplast utilizes sophisticated polymer processing methods like blow molding, injection molding, and extrusion molding. These technologies are crucial for producing their diverse range of plastic products.

Ongoing progress in these areas, such as the integration of AI for optimizing production cycles and increased automation, directly impacts Time Technoplast's operational effectiveness. For instance, in 2024, the global polymer processing market saw significant investment in automation, with reports indicating a 15% year-over-year increase in adoption for efficiency gains.

These technological enhancements are key drivers for reducing manufacturing expenses and elevating the overall quality and consistency of Time Technoplast's output. By embracing these advancements, the company aims to maintain a competitive edge in product development and cost management.

Innovation in material science is rapidly advancing, with a significant focus on biodegradable and bio-based polymers. This trend is largely fueled by global sustainability objectives and increasing consumer demand for eco-friendly products.

Time Technoplast's strategic alignment with sustainable offerings positions them to capitalize on this technological shift. The company's interest in materials like Polylactic acid (PLA) and Polyhydroxyalkanoates (PHA) highlights their commitment to providing alternatives to traditional petroleum-based plastics.

The market for bioplastics is projected for substantial growth, with estimates suggesting it could reach over $10 billion by 2027, demonstrating a clear technological and market opportunity for companies like Time Technoplast that embrace these material innovations.

Time Technoplast's leadership in Type IV composite cylinders for CNG, LPG, and Hydrogen is a significant technological advantage. Their commitment to ongoing research and development in composite materials, focusing on making these cylinders lighter and more robust, directly addresses the increasing market need for safer and more efficient fuel storage. This innovation is particularly relevant as the global automotive sector continues its shift towards alternative fuels, with the hydrogen fuel cell market alone projected to reach $130.9 billion by 2030, according to Precedence Research.

Smart Packaging Solutions and IoT Integration

The rise of smart packaging, featuring QR codes, barcodes, and sensors, is a key technological shift. These innovations enhance product traceability and provide consumers with detailed information, a growing expectation in the market.

Time Technoplast must adopt these smart packaging technologies to align with increasing regulatory demands and consumer desires for greater transparency. For instance, the global smart packaging market was valued at approximately USD 32.5 billion in 2023 and is projected to reach USD 67.1 billion by 2030, showcasing significant growth and adoption.

- Enhanced Traceability: Smart packaging allows for real-time tracking of products throughout the supply chain.

- Consumer Engagement: QR codes can link to product details, origin stories, and promotional content.

- Regulatory Compliance: Technologies like RFID and advanced sensors can help meet stringent tracking and safety regulations.

- Data Collection: Integrated sensors can monitor product conditions, such as temperature, providing valuable data for quality control.

Circular Economy Technologies (Recycling and Reuse)

Technological advancements are fundamentally reshaping the recycling landscape. Innovations like chemical recycling, which breaks down plastics into their molecular building blocks, and sophisticated AI-powered sorting systems are making it more feasible to recover valuable materials that were previously difficult to recycle. For Time Technoplast, embracing these technologies is crucial for their stated goal of improving product recyclability and minimizing waste, directly supporting a circular economy model.

These advancements enable a more efficient and effective closed-loop manufacturing process. By investing in or adopting technologies that enhance material recovery and purity, Time Technoplast can reduce its reliance on virgin plastic feedstocks. This aligns with global trends and regulatory pressures pushing for greater sustainability in the plastics industry. For instance, the global chemical recycling market is projected to grow significantly, with some estimates suggesting it could reach tens of billions of dollars by the early 2030s, indicating a strong future for these technologies.

- Chemical Recycling: Technologies like pyrolysis and depolymerization are gaining traction, offering higher recovery rates for mixed plastic waste.

- Advanced Sorting: Near-infrared (NIR) and AI-driven optical sorters are improving the precision and speed of separating different plastic types.

- Closed-Loop Systems: Implementing manufacturing processes that directly reuse recycled materials reduces energy consumption and environmental impact.

- Material Innovation: Development of new polymers designed for easier recycling and biodegradability is also a key technological factor.

Technological advancements in polymer processing, such as AI-driven optimization and automation, are enhancing Time Technoplast's operational efficiency. The global polymer processing market saw a notable 15% year-over-year increase in automation adoption in 2024, driving productivity gains.

Innovations in material science, particularly biodegradable and bio-based polymers, are crucial. The bioplastics market is anticipated to exceed $10 billion by 2027, presenting a significant opportunity for companies like Time Technoplast that adopt these sustainable materials.

Time Technoplast's leadership in Type IV composite cylinders for alternative fuels is a key technological advantage, especially as the hydrogen fuel cell market is projected to reach $130.9 billion by 2030. Furthermore, the smart packaging market, valued at approximately USD 32.5 billion in 2023, is expected to grow to USD 67.1 billion by 2030, highlighting the importance of enhanced traceability and consumer engagement technologies.

Advancements in recycling technologies, including chemical recycling and AI-powered sorting, are vital for Time Technoplast's sustainability goals. The chemical recycling market is expected to reach tens of billions of dollars by the early 2030s, underscoring the potential for a more circular economy in plastics manufacturing.

Legal factors

India's evolving Extended Producer Responsibility (EPR) framework, particularly the Plastic Waste Management Rules updated in 2024 and 2025, directly impacts Time Technoplast. These regulations mandate that producers, importers, and brand owners take ownership of their plastic waste lifecycle.

Time Technoplast faces stringent compliance obligations, including meeting specific recycling targets and reuse requirements for rigid packaging. The company must also adhere to detailed reporting mandates, ensuring transparency in its waste management efforts.

The Plastic Waste Management (Amendment) Rules, particularly those updated in March 2024 and anticipated for January/July 2025, are set to significantly impact Time Technoplast. These amendments are tightening regulations around biodegradable plastics, a key area for innovation and compliance. For instance, the 2024 revisions expanded the scope of who is considered an importer or manufacturer, potentially bringing more of Time Technoplast's supply chain under direct regulatory scrutiny.

Furthermore, the upcoming 2025 mandates will likely enforce mandatory on-pack product information, requiring QR codes or barcodes to detail product composition and recyclability. This necessitates an investment in traceability systems and updated packaging processes. Companies like Time Technoplast must proactively adapt their product lines and operational procedures to align with these increasingly stringent legal frameworks, ensuring full adherence to the evolving environmental standards.

Time Technoplast operates under strict product safety and quality regulations, crucial for its industrial and consumer goods. This means ensuring all products meet rigorous domestic and international standards. For instance, their composite cylinders require specific certifications, such as PESO approval for hydrogen cylinders, a key area of growth.

Compliance extends to the materials used, particularly in food contact packaging, where adherence to regulations like those set by the Food Safety and Standards Authority of India (FSSAI) is paramount. Failure to meet these standards can result in significant penalties and reputational damage, impacting market access and consumer trust. In 2024, the global market for industrial gases, including hydrogen, continued to see increased regulatory scrutiny concerning safety protocols.

Intellectual Property Rights (IPR) Protection

Intellectual Property Rights (IPR) protection is paramount for Time Technoplast, given its significant investment in innovation and research and development within the polymer and composite product sectors. Strong legal frameworks are vital to secure patents and trademarks, thereby safeguarding its unique technologies and maintaining a competitive edge against potential infringements. For instance, in 2023, companies in the manufacturing sector globally spent over $200 billion on R&D, highlighting the importance of IP in a competitive landscape.

The effectiveness of IPR laws directly impacts Time Technoplast's ability to monetize its innovations and prevent competitors from unfairly benefiting from its proprietary advancements. A robust legal environment for IPR ensures that the company can confidently invest in developing new materials and manufacturing processes, knowing its creations are legally protected. This protection is a key driver for sustained growth and market leadership.

- Patent Filings: Time Technoplast's strategy relies on securing patents for novel polymer formulations and composite manufacturing techniques.

- Trademark Enforcement: Protecting brand names and product identifiers through trademarks is essential for market recognition and preventing counterfeiting.

- Legal Recourse: Access to effective legal mechanisms to address IP infringement is critical for deterring unauthorized use and seeking damages.

- Global IP Strategy: Navigating varying international IPR laws is necessary for protecting innovations in all key markets where Time Technoplast operates or plans to expand.

Labor Laws and Occupational Safety

Time Technoplast faces ongoing legal requirements to comply with labor laws, covering fair wages, working conditions, and occupational health and safety. For instance, India's Code on Wages, 2019, aims to simplify wage-related laws and ensure a minimum wage for all workers, a key consideration for Time Technoplast's operations. Failure to meet these standards can lead to legal challenges and damage the company's public image.

With manufacturing sites in India and abroad, Time Technoplast must navigate a complex web of differing labor regulations. This includes adhering to specific safety protocols, such as those outlined by India's Factories Act, 1948, which mandates safety measures in industrial establishments. Ensuring compliance across all locations is crucial for avoiding penalties and maintaining operational continuity.

- Compliance with India's Code on Wages, 2019 regarding minimum wages and timely payment.

- Adherence to the Factories Act, 1948 for workplace safety and health standards in manufacturing units.

- Managing diverse international labor laws, potentially including regulations on working hours, employee benefits, and unionization.

- Ensuring consistent occupational health and safety standards across all global facilities to prevent accidents and related legal liabilities.

The evolving regulatory landscape in India, particularly concerning plastic waste management and Extended Producer Responsibility (EPR), directly impacts Time Technoplast. New rules, such as the Plastic Waste Management (Amendment) Rules of 2024 and anticipated 2025 updates, impose stricter compliance burdens, including recycling targets and detailed reporting for rigid packaging. These regulations also extend to mandatory product information, like QR codes, necessitating investments in traceability systems.

Product safety and quality are governed by stringent domestic and international standards, crucial for Time Technoplast's diverse product portfolio. Obtaining certifications, like PESO approval for hydrogen composite cylinders, is vital for market access and growth. Compliance with food contact material regulations, such as those from FSSAI, is also paramount to avoid penalties and maintain consumer trust, with global industrial gas safety protocols seeing increased scrutiny in 2024.

Intellectual Property Rights (IPR) protection is a critical legal factor for Time Technoplast, given its R&D investments in polymer and composite technologies. Strong IPR laws safeguard patents and trademarks, ensuring the company can monetize innovations and prevent infringement. The global manufacturing sector's significant R&D spending, exceeding $200 billion in 2023, underscores the importance of robust IP protection for competitive advantage.

Labor laws, including fair wages and occupational health and safety, are a continuous compliance area for Time Technoplast. India's Code on Wages, 2019, and the Factories Act, 1948, set benchmarks for working conditions and safety. Navigating diverse international labor regulations across its global facilities is essential to avoid legal liabilities and maintain operational integrity.

Environmental factors

Growing global and national anxieties about plastic pollution directly impact Time Technoplast, a significant player in polymer product manufacturing. The company is increasingly pressured to enhance waste reduction strategies, boost product recyclability, and actively participate in developing robust waste management solutions.

In 2024, the United Nations Environment Programme highlighted that only about 9% of all plastic ever produced has been recycled, underscoring the urgent need for manufacturers like Time Technoplast to innovate in this area. This situation necessitates a focus on circular economy principles and the development of biodegradable or easily recyclable materials to mitigate environmental impact and comply with evolving regulations.

The global drive towards a circular economy for plastics, emphasizing extended material lifecycles, presents a major environmental shift. Time Technoplast is embracing this by prioritizing product design for recyclability and increasing its use of recycled plastic content. For instance, in 2023, the company reported a significant increase in the proportion of recycled materials used across its product lines.

Time Technoplast is actively working to shrink its environmental impact. A key part of this strategy is boosting its use of green energy, aiming for 32% of its total energy consumption to come from renewable sources by the fiscal year 2025. This goal is largely driven by significant investments in solar power projects across its operations.

This commitment to sustainability isn't just about meeting environmental targets; it's also about building a stronger brand image and aligning with increasing global expectations for corporate responsibility. By prioritizing solar power, Time Technoplast is positioning itself to benefit from the growing demand for eco-friendly products and practices.

Sustainable Raw Material Sourcing

The growing consumer and regulatory push for eco-friendly products is significantly influencing raw material sourcing. This trend is compelling companies like Time Technoplast to prioritize materials that minimize environmental impact, such as recycled plastics and bio-based alternatives. For instance, the global recycled plastics market was valued at approximately USD 45.7 billion in 2023 and is projected to reach USD 72.9 billion by 2030, demonstrating a clear market shift.

Time Technoplast's strategic integration of recycled plastics into its manufacturing processes is paramount for both environmental stewardship and adherence to evolving environmental regulations. The company's exploration of bio-based materials, which are derived from renewable biological sources, further supports its long-term sustainability goals and can offer a competitive edge in a market increasingly focused on circular economy principles. By 2025, it's anticipated that over 30% of plastic packaging in Europe will incorporate recycled content, a benchmark that many global manufacturers are striving to meet.

The company's commitment to sustainable sourcing directly impacts its operational resilience and brand reputation. Successfully navigating these environmental factors requires robust supply chain management and continuous innovation in material science.

Water Management and Resource Efficiency

Effective water management and resource efficiency are critical environmental factors for manufacturers. Time Technoplast's commitment to these areas is evident in its operational strategies, aiming to reduce its environmental footprint.

The company's initiatives, such as rainwater harvesting, directly contribute to responsible resource utilization. This approach not only conserves water but also demonstrates a proactive stance on environmental stewardship.

By focusing on minimizing waste throughout its manufacturing processes, Time Technoplast aligns with growing global demands for sustainability. This focus is crucial for long-term operational viability and corporate responsibility.

- Water Conservation: Time Technoplast's efforts in water management are key to reducing operational costs and environmental impact.

- Resource Efficiency: The company's drive to minimize waste in production processes enhances its sustainability profile.

- Rainwater Harvesting: Implementing such initiatives supports responsible water usage and reduces reliance on municipal sources.

- Environmental Stewardship: These practices underscore Time Technoplast's commitment to being an environmentally conscious organization.

Time Technoplast faces increasing pressure to adopt sustainable practices due to growing concerns over plastic pollution, with only about 9% of all plastic ever produced being recycled as of 2024. The company is responding by prioritizing product design for recyclability and increasing its use of recycled plastic content, aiming for 32% of its total energy consumption to come from renewable sources by fiscal year 2025 through solar power investments.

The global push for a circular economy is driving Time Technoplast to source more eco-friendly materials, as evidenced by the global recycled plastics market, valued at approximately USD 45.7 billion in 2023. Furthermore, effective water management and resource efficiency are critical, with initiatives like rainwater harvesting demonstrating a commitment to responsible resource utilization and minimizing waste throughout its manufacturing processes.

| Environmental Factor | Time Technoplast's Action/Impact | Supporting Data/Trend |

|---|---|---|

| Plastic Pollution & Recycling | Focus on recyclability, use of recycled content | Only 9% of plastic ever produced recycled (2024). Global recycled plastics market USD 45.7 billion (2023). |

| Renewable Energy Adoption | Targeting 32% renewable energy by FY2025 | Investments in solar power projects. |

| Sustainable Material Sourcing | Prioritizing recycled and bio-based alternatives | Market shift towards eco-friendly materials. |

| Water & Resource Management | Implementing rainwater harvesting, minimizing waste | Enhances sustainability profile and reduces operational costs. |

PESTLE Analysis Data Sources

Our Time Technoplast PESTLE Analysis is meticulously constructed using a blend of public government data, reputable industry publications, and leading economic indicators. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.