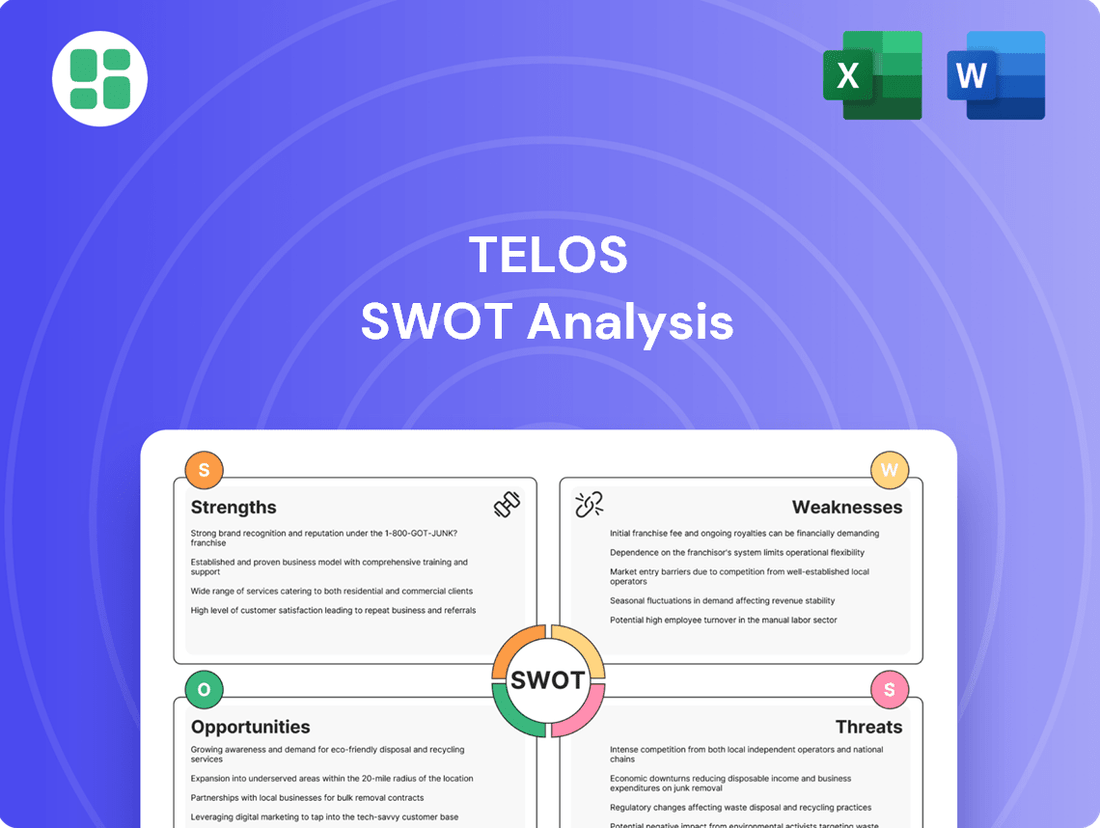

Telos SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Telos Bundle

Telos is strategically positioned with robust technological capabilities and a growing user base, but faces intense competition and evolving regulatory landscapes. Our full SWOT analysis provides an in-depth look at these dynamics, offering actionable insights for navigating the market.

Want to truly understand Telos's competitive edge and potential challenges? Purchase the complete SWOT analysis to unlock expert commentary, detailed market analysis, and strategic recommendations designed to inform your investment or business decisions.

Strengths

Telos Corporation possesses a profound and enduring expertise in government and highly regulated sectors. This specialization is built on a long history of serving clients with critical security needs, including numerous federal agencies, major commercial entities, and international bodies. Their deep understanding of complex regulatory environments and demanding security protocols enables them to craft precisely tailored solutions.

This established market position is underscored by consistent contract wins and renewals, such as their recent agreements with the U.S. Air Force. These successes highlight Telos's ability to meet rigorous standards and foster enduring, trust-based relationships within these sensitive markets.

Telos boasts a wide array of cybersecurity and IT solutions, covering vital areas like identity management, secure mobility, cloud security, and enterprise security. This broad offering ensures they can meet a variety of client demands.

Key products such as Xacta, which automates cyber risk management and compliance, and Telos ID, focused on digital identity services, highlight the depth and effectiveness of their solutions. These tools are designed to tackle complex security challenges.

The company's extensive portfolio facilitates cross-selling, allowing them to offer integrated solutions and enhance their overall value proposition. This integrated approach is a significant advantage in the competitive cybersecurity landscape.

A significant strength for Telos lies in its unwavering commitment to compliance and assurance, a crucial differentiator in its operating sectors. This focus directly addresses the complex and ever-evolving regulatory landscapes faced by government agencies and other highly regulated industries.

The Xacta platform exemplifies this strength, recently securing FedRAMP High Authorization. This achievement underscores Telos's ability to deliver robust, automated solutions for continuous security assurance and streamlined compliance processes, a vital capability for their clientele.

Strategic Government Contracts and Initiatives

Telos leverages substantial, enduring agreements with the U.S. federal government, including the significant Base Infrastructure Modernization (BIM) contract with the Department of the Air Force, which boasts a ceiling of $12.5 billion. This long-term commitment, alongside its involvement in the Defense Manpower Data Center (DMDC) program, establishes a predictable revenue stream and underscores the government's trust in Telos's expertise.

The ongoing expansion of the Transportation Security Administration (TSA) PreCheck program is a key growth catalyst for Telos, further solidifying its strategic position within government initiatives.

- Base Infrastructure Modernization (BIM) Contract: A $12.5 billion ceiling IDIQ with the Department of the Air Force, providing a stable revenue foundation.

- Defense Manpower Data Center (DMDC) Program: Demonstrates continued reliance on Telos for critical government data management.

- TSA PreCheck Expansion: A significant growth driver, highlighting Telos's role in enhancing security and traveler efficiency.

Innovation in Identity and Access Management (IAM) and Biometrics

Telos is making significant strides in identity and access management (IAM) and biometrics through its Telos ID and IDTrust360® platforms. These solutions are designed for continuous trust monitoring, integrating advanced biometrics with digital credentials. This focus on secure identity verification is crucial in today's digital landscape.

Their involvement as a TSA PreCheck enrollment provider, with a strategic plan to broaden their physical presence, underscores their practical application of these technologies. This expansion directly taps into the growing need for efficient and secure identity solutions in travel and beyond.

- Telos ID and IDTrust360®: Platforms for advanced identity trust and digital services, incorporating biometrics and credentials for continuous monitoring.

- TSA PreCheck Expansion: Serving as a TSA PreCheck enrollment provider, with plans to increase enrollment locations, demonstrating practical application of IAM solutions.

- Market Demand: Positioned to capitalize on the escalating demand for robust and reliable identity verification and management systems across various sectors.

Telos Corporation's deep specialization in government and highly regulated sectors is a cornerstone strength, built on decades of serving critical security needs for federal agencies and major commercial entities. This expertise allows them to navigate complex regulatory environments and deliver precisely tailored solutions, evidenced by consistent contract wins and renewals, such as their ongoing work with the U.S. Air Force.

Their comprehensive suite of cybersecurity and IT solutions, including identity management and cloud security, provides a broad offering to meet diverse client demands. Key products like Xacta for automated cyber risk management and Telos ID for digital identity services further solidify their position by addressing complex security challenges effectively.

Telos's unwavering commitment to compliance and assurance is a significant differentiator, particularly with their Xacta platform achieving FedRAMP High Authorization. This achievement highlights their capability in delivering robust, automated solutions for continuous security and streamlined compliance, a vital asset for their clientele in sensitive markets.

The company benefits from substantial, long-term agreements with the U.S. federal government, including the $12.5 billion ceiling Base Infrastructure Modernization (BIM) contract with the Department of the Air Force. This provides predictable revenue and reinforces government trust, further bolstered by their role in the Defense Manpower Data Center (DMDC) program and the expansion of the TSA PreCheck program.

| Contract/Program | Client | Ceiling/Value | Significance |

|---|---|---|---|

| Base Infrastructure Modernization (BIM) | U.S. Air Force | $12.5 billion | Stable revenue foundation, long-term commitment. |

| Defense Manpower Data Center (DMDC) | U.S. Government | N/A | Demonstrates critical data management reliance. |

| TSA PreCheck Enrollment | Transportation Security Administration | N/A | Growth driver, practical application of IAM. |

What is included in the product

Analyzes Telos’s competitive position through key internal and external factors, including its technological strengths and market opportunities.

Offers a clear, actionable framework to identify and address strategic weaknesses, alleviating the pain of uncertainty.

Weaknesses

While government contracts provide a stable revenue stream, Telos's significant reliance on them presents a notable weakness. This dependency exposes the company to risks stemming from potential government budget cuts, shifts in national priorities, or increased competition for contract renewals, which could impact future revenue streams.

A substantial portion of Telos's income is tied to these large, often multi-year, federal contracts, creating a concentration risk. This means that the company's financial performance can be heavily influenced by the success or failure of a few key agreements, making it vulnerable to unforeseen changes.

This dependency can lead to revenue volatility. If major contracts are not renewed or if new ones are not secured at a comparable level, Telos could experience significant fluctuations in its financial results, making long-term financial planning more challenging.

Recent financial reports for Telos highlight that while new programs such as DMDC and TSA PreCheck are indeed boosting revenue, they are simultaneously contributing to margin compression. This is particularly noticeable in the short term as these initiatives may involve significant upfront investments or initially lower profit margins, thereby affecting overall gross and cash margins.

For instance, Telos's Q1 2024 earnings call revealed that the initial rollout costs for these expanded government programs, while essential for long-term growth, did put pressure on their profitability metrics. Investors are keenly observing Telos's strategy to manage this balance between aggressive growth in new program adoption and the imperative to sustain robust profitability.

Telos's Secure Networks segment has seen a notable downturn, with revenue decreasing significantly year-over-year. Projections suggest this trend will continue as older, established programs reach their conclusion.

This decline in Secure Networks is a key weakness, as it counterbalances the positive momentum seen in the Security Solutions business. The company needs to address this underperformance to prevent it from hindering overall financial results.

Highly Competitive Market Landscape

The cybersecurity and IT solutions arena is incredibly crowded, featuring many well-established companies alongside nimble new entrants. Telos must navigate this intense competition, which can impact its ability to secure market share and dictate pricing strategies. This dynamic necessitates a constant focus on developing cutting-edge solutions to stay ahead.

Telos contends with formidable rivals, including large technology conglomerates and specialized cybersecurity firms. This competitive pressure can constrain pricing flexibility and demand significant ongoing investment in research and development to maintain a leading position. For instance, the global cybersecurity market was valued at an estimated $217.9 billion in 2023 and is projected to reach $424.9 billion by 2030, highlighting the scale of investment required.

- Intense Competition: The cybersecurity market is highly saturated with both legacy providers and innovative startups.

- Pressure on Margins: Competition from larger tech firms and specialized players can lead to pricing pressure and impact profitability.

- Innovation Imperative: Maintaining market relevance requires substantial and continuous investment in research and development (R&D) to counter evolving threats and technological advancements.

- Market Share Challenges: Gaining and retaining market share is difficult amidst a landscape populated by numerous established and emerging competitors.

Historical Revenue Declines and Profitability Challenges

Telos has grappled with a history of revenue declines in recent fiscal years, alongside persistent profitability challenges. The company reported net losses in prior periods, underscoring these ongoing struggles.

While the first quarter of 2025 demonstrated sequential revenue growth and a positive adjusted EBITDA, Telos has characterized the period as a transition year. This focus on rebuilding its revenue base, following previous difficulties, is crucial for future stability.

This financial performance history can understandably lead to investor skepticism and place significant pressure on management to demonstrate sustained improvement.

- Historical Revenue Trends: Telos experienced revenue declines in fiscal years leading up to 2024.

- Profitability Concerns: The company has reported net losses, indicating difficulties in achieving consistent profitability.

- Q1 2025 Performance: A sequential revenue increase and positive adjusted EBITDA were noted in Q1 2025, signaling a potential shift.

- Investor Sentiment: Past financial performance may create hesitation among investors, demanding strong execution from leadership.

Telos's heavy reliance on government contracts, while providing stability, also presents a significant weakness. This concentration makes the company susceptible to shifts in government spending, policy changes, and competition for renewals, potentially impacting future revenue streams. For instance, the company's financial results can be disproportionately affected by the success or failure of a few major agreements.

The company is also experiencing margin compression, particularly with new program rollouts like DMDC and TSA PreCheck. While these are crucial for growth, the initial investment and potentially lower short-term margins put pressure on profitability. This was noted in their Q1 2024 earnings, where upfront costs for expanded programs impacted financial metrics.

Telos faces intense competition in the cybersecurity and IT solutions market, a sector valued at an estimated $217.9 billion in 2023. This crowded landscape, featuring both large tech firms and specialized startups, can limit pricing power and necessitates continuous, substantial investment in research and development to stay competitive.

Furthermore, Telos has a history of revenue declines and profitability challenges, with net losses reported in prior periods. While Q1 2025 showed sequential revenue growth and positive adjusted EBITDA, the company is still navigating a transition year, which can lead to investor skepticism.

Full Version Awaits

Telos SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version.

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

Get a look at the actual SWOT analysis file. The entire document will be available immediately after purchase.

Opportunities

The global cybersecurity market is booming, with projections indicating it will reach over $400 billion by 2034. This massive growth is fueled by a relentless rise in cyber threats, costly data breaches, and the ongoing digital transformation across all industries.

This expanding market presents a significant opportunity for Telos to not only grow its current business but also to innovate and introduce new solutions that address evolving security needs.

The increasing reliance on cloud computing and the widespread adoption of remote work arrangements are further accelerating the demand for robust cybersecurity measures, creating a fertile ground for Telos's offerings.

Federal governments, especially the U.S., are significantly boosting their cybersecurity budgets. For instance, the U.S. federal government's cybersecurity spending is projected to reach $13.7 billion in fiscal year 2024, a notable increase from previous years. This heightened investment is driven by new mandates, such as the push for Zero Trust architectures and the Cybersecurity Maturity Model Certification (CMMC) for defense contractors.

These evolving regulatory landscapes and sustained government spending create a consistent demand for sophisticated security solutions and tools that help organizations achieve compliance. Telos is well-positioned to capitalize on this trend, given its established expertise in advanced security solutions and compliance automation.

Telos' established position as a TSA PreCheck enrollment provider offers significant expansion potential. The company aims to reach 500 enrollment locations by the end of 2025, catering to a growing demand for expedited airport security screening. This expansion directly translates into increased revenue streams and a larger customer footprint.

Furthermore, Telos' IDTrust360 platform provides a robust foundation for diversifying its identity verification services. By extending these capabilities beyond aviation into commercial and public sectors, Telos can address the widespread need for secure digital identity solutions. This diversification leverages existing technology for new market penetration and revenue growth.

Strategic Partnerships and Acquisitions

Telos can strategically leverage partnerships and acquisitions to broaden its market presence and onboard innovative technologies. Collaborations, similar to its past work with IBM Security, can bolster its technical expertise and market penetration. In 2024, the cybersecurity market saw significant M&A activity, with over $20 billion in disclosed deal values, indicating a robust environment for such growth strategies.

These inorganic growth avenues can expedite Telos's entry into new industry sectors or solidify its standing in established markets. For instance, acquiring a company with specialized AI-driven threat detection capabilities could significantly enhance Telos's existing portfolio.

- Expand Market Reach: Partnerships and acquisitions can open doors to new customer segments and geographical regions.

- Acquire New Technologies: Gaining access to cutting-edge solutions, such as advanced AI or quantum-resistant cryptography, is a key benefit.

- Diversify Service Offerings: Broadening the product and service portfolio can create new revenue streams and reduce reliance on single markets.

Leveraging Emerging Technologies like AI and Cloud Security

The growing need for AI-driven security tools and cloud-native cybersecurity strategies presents a substantial opportunity for Telos. The cybersecurity market, particularly the segment focused on AI and cloud security, is experiencing rapid expansion. For instance, the global cloud security market was valued at approximately $35 billion in 2023 and is projected to reach over $80 billion by 2028, demonstrating robust growth driven by increasing cloud adoption and sophisticated cyber threats.

Telos is well-positioned to benefit from this trend due to its established cloud security solutions and its commitment to ensuring continuous compliance within cloud infrastructures. This expertise allows the company to address the evolving security needs of organizations migrating to or operating within cloud environments. The company's focus on automated compliance and security management in the cloud directly aligns with market demands.

Further investment in and integration of artificial intelligence (AI) and machine learning (ML) into Telos' product portfolio could significantly enhance its competitive edge. By leveraging AI for threat detection, anomaly identification, and automated response, Telos can offer more proactive and efficient security solutions. This strategic move is crucial as cyber attackers increasingly employ sophisticated AI-powered techniques, necessitating equally advanced defensive measures.

- Growing Demand: The global cybersecurity market is projected for significant growth, with AI and cloud security being key drivers.

- Telos' Position: Existing cloud security offerings and compliance expertise provide a strong foundation.

- AI Integration: Investing in AI/ML can create a competitive advantage in threat detection and response.

- Market Value: The cloud security market is expected to more than double by 2028, reaching over $80 billion, highlighting the scale of the opportunity.

The expanding global cybersecurity market, projected to exceed $400 billion by 2034, offers substantial growth avenues for Telos due to increasing cyber threats and digital transformation initiatives.

Heightened government cybersecurity budgets, with the U.S. federal government spending an estimated $13.7 billion in FY2024, create consistent demand for Telos's compliance and advanced security solutions.

Telos's established TSA PreCheck enrollment program, aiming for 500 locations by the end of 2025, presents a direct opportunity for increased revenue and customer reach, capitalizing on the demand for expedited security screening.

Strategic partnerships and acquisitions, supported by over $20 billion in cybersecurity M&A activity in 2024, allow Telos to broaden its market presence and integrate innovative technologies like AI-driven threat detection.

Threats

The cybersecurity landscape is fiercely competitive, with established giants and agile startups vying for market share. This crowded field often results in price pressures, making it challenging for companies like Telos to maintain healthy margins. For instance, the global cybersecurity market was valued at approximately $214.9 billion in 2023 and is projected to reach $345.3 billion by 2028, indicating significant growth but also intense rivalry.

The cybersecurity landscape is a constantly shifting battleground, with new threats and attack methods appearing all the time. This rapid evolution demands ongoing investment in research and development, ensuring Telos' solutions remain cutting-edge and effective. For instance, the global cybersecurity market was valued at over $214 billion in 2023 and is projected to reach $425 billion by 2028, highlighting the intense competition and the need for continuous innovation.

Failure to innovate at pace or predict emerging threats could quickly make Telos' offerings outdated, diminishing its competitive edge and market position. Companies that don't keep up risk losing market share to more agile competitors. In 2024, the average cost of a data breach reached $4.73 million, underscoring the high stakes for both providers and users of cybersecurity solutions.

Telos Corporation's substantial reliance on government contracts makes it vulnerable to shifts in federal spending. For instance, a projected 5% decrease in the U.S. defense budget for fiscal year 2025, as indicated by Congressional Budget Office reports, could directly affect Telos' revenue streams if its services are deprioritized.

Changes in government procurement policies, such as increased competition or stricter vetting processes, could also pose a threat. In 2024, new cybersecurity compliance mandates were introduced, requiring significant investment from contractors like Telos, potentially impacting profitability.

Loss of Key Contracts or Failure to Win New Business

Telos faces a significant threat from the potential loss of key contracts or the inability to secure new business. Past revenue declines have been directly attributed to an insufficient pipeline of new wins to offset the completion of existing programs. This vulnerability is particularly pronounced concerning major government contracts.

The failure to renew or secure new large-scale contracts, such as those with the DMDC (Defense Medical Logistics Standard) or BIM (Building Information Modeling) initiatives, presents a direct risk to Telos' financial stability and future expansion. These contracts are crucial for maintaining consistent revenue streams.

- Revenue Vulnerability: Past performance indicates that insufficient new business wins have led to revenue declines, highlighting a dependency on program continuity.

- Contract Renewal Risk: The inability to renew existing critical government contracts, like DMDC, poses a substantial threat to Telos' operational revenue.

- New Business Acquisition: A failure to win new large-scale contracts directly impacts the company's growth trajectory and market position.

- Financial Stability Impact: The loss of major contracts could significantly destabilize Telos' financial performance, affecting profitability and investment capacity.

Talent Acquisition and Retention Challenges

The cybersecurity sector is grappling with a pronounced talent deficit, making it difficult for companies like Telos to recruit and keep experienced professionals. This scarcity directly impacts Telos' capacity to innovate and deliver cutting-edge solutions, potentially hindering its expansion and operational effectiveness.

For instance, a 2024 report indicated that the global cybersecurity workforce gap stood at approximately 3.4 million professionals, highlighting the intense competition for skilled individuals. This shortage means Telos must invest heavily in competitive compensation and robust professional development to secure and retain the talent essential for its advanced offerings.

- Talent Gap Impact: A shortfall in cybersecurity experts can slow product development and service delivery.

- Retention Costs: High turnover necessitates increased spending on recruitment and training, impacting profitability.

- Market Demand for Support: Workforce deficiencies in the broader market drive demand for outsourced cybersecurity services, a segment Telos operates within.

Telos faces intense competition in the cybersecurity market, with pricing pressures impacting margins. The sector's rapid evolution demands continuous R&D investment to avoid obsolescence, as seen in the projected growth of the cybersecurity market to $425 billion by 2028, indicating fierce rivalry.

The company's significant reliance on government contracts makes it susceptible to federal spending cuts, such as potential defense budget reductions for fiscal year 2025. Furthermore, changes in procurement policies and the risk of losing key contracts, like those for DMDC, directly threaten Telos' revenue stability and growth prospects.

A critical threat stems from the cybersecurity talent deficit; a global gap of 3.4 million professionals in 2024 intensifies competition for skilled employees, potentially hindering Telos' innovation and service delivery capabilities.

| Threat Category | Specific Threat | Impact on Telos | Supporting Data/Example |

|---|---|---|---|

| Market Competition | Intense Rivalry & Price Pressure | Reduced Profit Margins | Global cybersecurity market projected to reach $425B by 2028, signifying high competition. |

| Technological Evolution | Rapid Threat Landscape Changes | Risk of Product Obsolescence | Average cost of data breach in 2024 was $4.73M, highlighting the need for constant innovation. |

| Government Contract Dependency | Shifts in Federal Spending & Procurement Policies | Revenue Volatility & Loss of Business | Projected 5% decrease in U.S. defense budget for FY2025 could impact Telos. |

| Talent Acquisition & Retention | Cybersecurity Workforce Shortage | Impaired Innovation & Service Delivery | Global cybersecurity workforce gap estimated at 3.4 million professionals in 2024. |

SWOT Analysis Data Sources

This Telos SWOT analysis is built upon a robust foundation of data, drawing from official financial filings, comprehensive market intelligence reports, and expert industry evaluations to provide a precise and actionable strategic overview.