Telos Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Telos Bundle

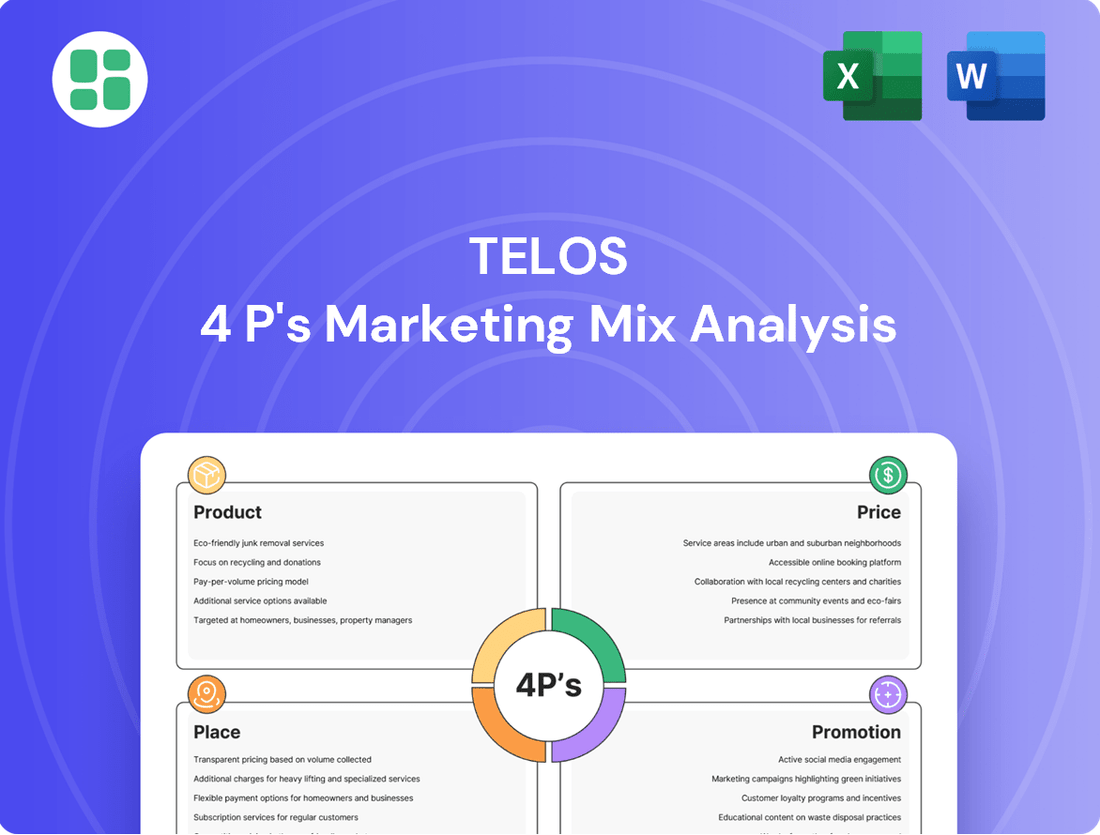

Dive into the strategic brilliance behind Telos's market dominance with our comprehensive 4Ps Marketing Mix Analysis. Uncover how their innovative product development, competitive pricing, strategic distribution, and impactful promotion work in synergy to capture market share.

Go beyond the surface-level understanding and gain access to a fully editable, presentation-ready report. This in-depth analysis is your key to unlocking actionable insights for your own business strategy or academic pursuits.

Save countless hours of research and analysis. Our pre-written report provides structured thinking, real-world examples, and expert insights into Telos's marketing effectiveness, making it ideal for benchmarking or business planning.

Product

Telos Corporation's comprehensive cybersecurity solutions form a critical part of their Product offering, addressing the escalating digital threats faced by organizations. Their portfolio includes IT risk management, information security, and continuous security assurance, designed to protect vital infrastructure and sensitive data.

These solutions are engineered to comply with demanding regulatory mandates, ensuring clients meet standards like NIST and FedRAMP. For instance, Telos's security assurance services are crucial for government agencies and enterprises handling classified information, a market projected to grow significantly as cyber threats become more sophisticated.

In 2024, the global cybersecurity market was valued at over $250 billion and is expected to continue its upward trajectory, driven by increased digitalization and remote workforces. Telos's ability to provide end-to-end security, from risk assessment to ongoing monitoring, positions them to capture a substantial share of this expanding market.

Telos offers robust cloud security and compliance solutions, with Xacta being a flagship product. This cyber governance, risk, and compliance platform is designed to safeguard cloud environments and ensure adherence to stringent security standards.

Xacta's FedRAMP High Authorization is a critical differentiator, demonstrating its capability to protect sensitive unclassified government data in the cloud. This authorization is vital for government agencies and contractors seeking secure cloud solutions.

The market for cloud security is experiencing significant growth. Gartner projected worldwide spending on cloud security to reach $25.6 billion in 2024, an increase of 26.6% from 2023, highlighting the demand for solutions like Telos Xacta.

Telos's enterprise security and identity management offerings are central to its product strategy, providing robust solutions for identity and access management, secure mobility, and network defense. Key products like IDTrust360 and IDVetting are vital for federal, defense, and commercial clients needing secure authentication and vetting processes.

In 2023, the global identity and access management market was valued at approximately $15.7 billion and is projected to grow significantly, underscoring the demand for Telos's specialized identity solutions. This growth reflects the increasing need for strong security measures in an evolving digital landscape.

TSA PreCheck Enrollment Services

Telos's TSA PreCheck enrollment services represent a key product offering, leveraging its status as an authorized provider to simplify the application and renewal process for travelers seeking expedited security screening. This consumer-focused service has experienced substantial growth, reflecting increased demand for convenient travel solutions.

The expansion of Telos's TSA PreCheck enrollment footprint is a strategic move, with locations proliferating across the United States. This accessibility is further amplified through partnerships with major retail chains, making it easier for a broader customer base to access these essential travel benefits. As of late 2024, Telos operates hundreds of enrollment centers nationwide, a figure expected to continue its upward trajectory.

- Convenient Enrollment: Telos offers a streamlined process for applying for and renewing TSA PreCheck credentials.

- Nationwide Expansion: The service has significantly increased its physical presence, with hundreds of locations available across the US.

- Retail Partnerships: Collaborations with major retailers enhance accessibility and customer reach.

- Growing Demand: The product taps into the increasing desire for efficient and hassle-free air travel.

Secure Networks and Communications

Telos Corporation's Secure Networks and Communications product line addresses critical needs for secure data transmission across various environments. Their offerings encompass both wired and wireless solutions, designed for fixed installations as well as deployable scenarios. This includes the capability to secure voice, data, and video communications, catering to both classified and unclassified networks.

A cornerstone of their secure communications is the Telos Automated Message Handling System (AMHS). This system has become a de facto standard for mission-critical messaging within the U.S. government and military sectors. By providing robust and reliable message handling, AMHS ensures the secure and timely delivery of vital information, a capability that remains paramount in defense and governmental operations.

The demand for secure communications solutions continues to grow, driven by increasing cyber threats and the need for resilient information sharing. In 2023, the global cybersecurity market was valued at approximately $214.4 billion, with secure network solutions forming a significant component of this. Telos's focus on government and defense clients positions them within a market segment that prioritizes high-assurance security, often backed by substantial government spending on secure IT infrastructure.

- Comprehensive Secure Network Architectures: Telos provides end-to-end secure solutions for voice, data, and video across classified and unclassified networks, supporting both fixed and deployable environments.

- Telos AMHS as a Mission-Critical Standard: The Telos Automated Message Handling System is a recognized and trusted platform for secure organizational messaging, particularly within the U.S. government and military.

- Market Relevance: The global cybersecurity market, which includes secure networking, is substantial, with continued investment from government entities emphasizing the importance of Telos's offerings.

Telos's product portfolio is a robust suite of cybersecurity and IT solutions designed to meet stringent government and enterprise requirements. This includes advanced cyber governance, risk, and compliance platforms like Xacta, which are critical for cloud security and FedRAMP compliance.

Their identity and access management solutions, such as IDTrust360, address the growing need for secure authentication and vetting. Furthermore, Telos enhances traveler convenience through its TSA PreCheck enrollment services, operating hundreds of centers nationwide by late 2024.

The company also offers secure network and communication solutions, exemplified by the Telos Automated Message Handling System (AMHS), a vital tool for secure messaging in defense and government sectors.

| Product Category | Key Offerings | Market Relevance (2024-2025 Data) | Key Differentiator |

|---|---|---|---|

| Cybersecurity & Compliance | Xacta (Cloud Security & GRC) | Global Cloud Security Market: Projected to exceed $25.6 billion in 2024. | FedRAMP High Authorization |

| Identity & Access Management | IDTrust360, IDVetting | Global IAM Market: Valued at approx. $15.7 billion in 2023, with strong growth anticipated. | Specialized vetting processes for federal/defense clients. |

| Traveler Services | TSA PreCheck Enrollment | Hundreds of nationwide enrollment centers by late 2024. | Convenient, accessible enrollment and renewal. |

| Secure Networks & Communications | AMHS, Secure Network Solutions | Global Cybersecurity Market: Valued over $250 billion in 2024. | De facto standard for U.S. government mission-critical messaging. |

What is included in the product

This analysis provides a comprehensive examination of Telos's marketing strategies across Product, Price, Place, and Promotion, offering actionable insights for strategic decision-making.

Simplifies complex marketing strategies by clearly outlining the Telos 4P's, alleviating the pain of overwhelming data for quick decision-making.

Provides a clear, actionable framework for understanding and optimizing the Telos 4P's, removing the guesswork from marketing planning.

Place

Telos Corporation's go-to-market strategy heavily relies on direct sales to government and commercial entities, a key element of its marketing mix. This approach is particularly effective for its cybersecurity and IT solutions, which often require tailored implementations for sophisticated clients.

In 2023, Telos reported significant revenue from its government contracts, underscoring the importance of this direct sales channel. The company's ability to engage directly with federal agencies allows for a deep understanding of their unique security needs and regulatory requirements, leading to customized and effective solution delivery.

This direct engagement also extends to commercial enterprises and international organizations. By working directly with these clients, Telos can foster strong relationships and provide specialized support, ensuring that its cybersecurity offerings meet the evolving threat landscape faced by businesses and global institutions.

Government contract vehicles are a cornerstone of Telos's market access strategy, particularly within the federal sector. A substantial portion of their business stems from prime positions on key vehicles like the Base Infrastructure Modernization (BIM) contract for the Department of the Air Force and various agreements with the Defense Information Systems Agency (DISA). These established channels are crucial for competing on large-scale government projects.

Telos strategically partners with commercial entities, such as The ODP Corporation (Office Depot), to expand its TSA PreCheck enrollment services. This allows Telos to quickly increase its footprint across the U.S., making enrollment more convenient for travelers and reducing the expenses associated with new location setups.

Physical Enrollment Centers for TSA PreCheck

Telos actively manages and grows its physical footprint for TSA PreCheck enrollment, strategically placing centers in major cities and hosting temporary pop-up events. This physical presence is crucial for accessibility and customer convenience.

As of mid-2025, Telos had established 350 TSA PreCheck enrollment and renewal sites nationwide. The company aims to significantly expand this network, targeting 500 locations by the close of 2025, demonstrating a commitment to increasing service availability.

- Network Expansion: Telos is actively increasing its number of physical enrollment centers.

- Current Reach: By June 2025, 350 TSA PreCheck locations were operational.

- Future Goals: The company plans to reach 500 enrollment centers by the end of 2025.

- Strategic Placement: Centers are located in key metropolitan areas and through pop-up events for broad accessibility.

Online Presence and Digital Platforms

Telos leverages its corporate website and specific product pages, such as those for Xacta, to inform potential enterprise and government clients about its cybersecurity and IT solutions. This digital footprint acts as a crucial informational resource and a gateway for prospective customers seeking demonstrations or further details on Telos' offerings.

The company's online strategy focuses on providing accessible information about its core competencies, facilitating lead generation and initial customer engagement. As of early 2024, Telos reported a significant increase in website traffic for its Xacta product, indicating growing market interest in its automated compliance solutions.

- Website as an Informational Hub: Telos.com provides detailed information on its cybersecurity solutions, including compliance, identity, and network security.

- Product-Specific Pages: Dedicated sections for products like Xacta highlight features, benefits, and use cases for target audiences.

- Lead Generation and Contact: The digital platforms serve as primary channels for inquiries, demo requests, and direct contact with sales teams.

- Digital Marketing Efforts: Telos actively utilizes digital channels to promote its solutions, with a reported 15% year-over-year growth in qualified leads generated online in late 2023.

Telos Corporation's place strategy is multifaceted, focusing on direct engagement with government and commercial clients through established contract vehicles and strategic partnerships. For its TSA PreCheck enrollment services, Telos is rapidly expanding its physical presence, aiming for 500 locations by the end of 2025, up from 350 operational sites by mid-2025. This expansion includes strategically placed centers in major cities and temporary pop-up events to maximize accessibility and customer convenience.

| Service Area | Channel | Key Data Point (as of mid-2025/late 2023) | Strategic Importance |

|---|---|---|---|

| Cybersecurity & IT Solutions | Direct Sales (Government & Commercial) | Significant revenue from government contracts in 2023; 15% YoY growth in online leads (late 2023) | Tailored solutions, deep client understanding, regulatory compliance |

| TSA PreCheck Enrollment | Physical Enrollment Centers & Pop-ups | 350 active sites (mid-2025); Target of 500 sites by end of 2025 | Broad accessibility, customer convenience, rapid market penetration |

| TSA PreCheck Enrollment | Commercial Partnerships (e.g., The ODP Corp) | Expanded nationwide footprint | Reduced setup costs, increased service availability |

Full Version Awaits

Telos 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Telos 4P's Marketing Mix Analysis details Product, Price, Place, and Promotion strategies. It's ready for immediate application to your business needs.

Promotion

Telos prioritizes transparent engagement with the financial community. This includes hosting quarterly earnings calls and webcasts, which in 2024, consistently saw participation from over 150 analysts and institutional investors, providing key financial results and strategic updates.

Furthermore, Telos actively participates in major investor conferences, such as the Needham Growth Conference and the J.P. Morgan Technology, Media & Telecom Conference. In 2025, the company aims to expand its reach by presenting at an additional three industry-specific events, further disseminating its business outlook and growth strategies.

Telos actively engages in key industry events like the Needham Technology, Media, & Consumer Conference and the B. Riley Securities Investor Conference. These platforms are crucial for showcasing their advanced security solutions directly to a concentrated audience of potential clients and investors.

During 2024, Telos executives leveraged these conferences to articulate their strategic vision and market positioning. For instance, at the Needham conference, discussions often center on the growing demand for secure cloud solutions and network access, areas where Telos has demonstrated significant innovation.

Participation in these investor-focused events provides Telos with invaluable opportunities to connect with financial analysts and portfolio managers, fostering greater understanding of their technological advancements and financial performance. This direct engagement helps to solidify their value proposition within the competitive cybersecurity landscape.

Telos actively uses press releases to share key company milestones, such as securing new contracts and achieving significant product certifications like FedRAMP High Authorization for their Xacta product in early 2024. This strategic communication aims to inform investors, customers, and the broader market about their progress and capabilities.

These announcements are disseminated via reputable newswire services, ensuring wide reach. Additionally, Telos prominently features these press releases on their corporate news and investor relations sections of their website, making crucial information readily accessible to all stakeholders.

Targeted Government and Commercial Outreach

Telos's promotional strategy heavily focuses on targeted outreach to key sectors, including federal government agencies, commercial enterprises, and international organizations. This often involves direct engagement, with the company delivering tailored presentations to highlight its solutions.

The core message emphasizes Telos's ability to assist these entities in safeguarding critical assets and ensuring adherence to stringent regulatory compliance. For instance, in 2023, Telos secured significant contract wins with U.S. federal agencies, underscoring the effectiveness of this targeted approach.

- Federal Government Contracts: Telos reported a substantial increase in federal contract revenue in 2024, driven by demand for cybersecurity solutions.

- Commercial Sector Growth: The company has seen a notable uptick in commercial client acquisition throughout 2024, particularly in sectors requiring robust data protection.

- International Expansion: Telos is actively pursuing partnerships with international organizations in 2025 to address global cybersecurity challenges.

- Regulatory Compliance Focus: A key selling point for Telos is its role in helping clients meet evolving compliance mandates, a critical factor for many government and commercial entities.

Digital Content and Thought Leadership

Telos leverages its corporate blog and extensive resource center to disseminate valuable content. This content focuses on emerging cybersecurity trends, critical compliance issues, and the specific solutions Telos offers to address these challenges. This deliberate thought leadership approach is designed to establish Telos as a credible authority and educate prospective clients on their deep expertise within the intricate cybersecurity and IT solutions landscape.

This strategy is crucial for attracting and nurturing leads, particularly in a market where understanding complex threats and regulatory environments is paramount. By consistently publishing informative pieces, Telos aims to become a go-to source for businesses seeking guidance and solutions in cybersecurity. For instance, in 2024, businesses increasingly sought clarity on evolving data privacy regulations, a topic Telos actively addresses.

- Content Focus: Cybersecurity trends, compliance, and Telos's solutions.

- Objective: Build credibility and inform potential clients.

- Impact: Positions Telos as an expert in a complex market.

- Market Relevance: Addresses growing demand for cybersecurity guidance in 2024.

Telos's promotional efforts center on transparent communication with the financial community through earnings calls and investor conferences, aiming to disseminate its strategic vision and market positioning. The company also utilizes press releases to announce key milestones, such as FedRAMP High Authorization for Xacta in early 2024, and engages in targeted outreach to federal government agencies and commercial enterprises, highlighting its cybersecurity solutions and compliance expertise.

Telos actively cultivates thought leadership through its corporate blog and resource center, addressing emerging cybersecurity trends and regulatory issues to establish itself as a credible authority. This content strategy is designed to educate potential clients and nurture leads in a market demanding clear guidance on complex threats and compliance. For example, in 2024, the increasing focus on data privacy regulations saw Telos actively providing relevant information.

| Promotional Activity | 2024/2025 Focus | Key Impact |

|---|---|---|

| Investor Relations (Calls/Conferences) | Expand participation in industry events; over 150 analysts attended 2024 calls. | Enhanced understanding of financial performance and value proposition. |

| Press Releases & Newswires | Announce contract wins and certifications (e.g., FedRAMP High for Xacta in 2024). | Broad market awareness of company progress and capabilities. |

| Targeted Sector Outreach | Focus on federal and commercial sectors; significant federal contract wins in 2023. | Direct engagement highlighting solutions for critical asset safeguarding and compliance. |

| Content Marketing (Blog/Resources) | Address cybersecurity trends and compliance issues; inform potential clients. | Establishes Telos as an expert, guides businesses through complex regulatory environments. |

Price

Telos primarily utilizes contract-based pricing for its government and enterprise cybersecurity and IT solutions. This approach is common for large, multi-year indefinite-delivery/indefinite-quantity (IDIQ) contracts, which are awarded through competitive bidding.

For instance, in fiscal year 2023, Telos secured significant contract wins, including a $120 million recompete for its cybersecurity services with a major federal agency. These long-term agreements reflect the specialized, ongoing nature of the services provided.

The company's pricing strategy within these contracts is often tied to specific deliverables, service levels, and project milestones, ensuring alignment with government requirements and budgets.

For flagship platforms such as Xacta, Telos likely utilizes a value-based pricing approach. This strategy aligns the platform's cost with the substantial benefits it delivers, particularly in compliance automation, robust risk management, and enhanced security assurance for organizations with stringent security requirements.

The intrinsic value of these platforms is directly linked to the efficiency gains and the lessened operational burden companies experience when navigating complex cybersecurity standards. For instance, in 2024, the cybersecurity compliance market is projected to reach over $40 billion, highlighting the significant demand for solutions that streamline these critical processes.

For TSA PreCheck enrollment and renewal services, Telos adheres to the pricing established by the Transportation Security Administration. This means the fee is consistent across all authorized enrollment providers, ensuring a uniform cost for consumers.

The current standard fee for a five-year TSA PreCheck membership is $78, a price point that has been in effect since late 2022. This transparent, publicly available pricing structure makes the service accessible and understandable for individual travelers.

Competitive Bidding and Market Positioning

Telos faces intense competition, particularly in the government sector where pricing is a critical factor. Their strategy balances competitive bidding with their premium market positioning as a provider of high-assurance security solutions. This means that while they must remain price-competitive, they also leverage the unique value and perceived quality of their offerings to justify their pricing.

In 2024, the government contracting market continues to see significant pressure on pricing, with many agencies seeking cost efficiencies. For instance, in the cybersecurity space, a key area for Telos, average contract values can fluctuate based on the scope and duration, but competitive bids often shave percentages off initial proposals. Telos's approach likely involves demonstrating superior technical capabilities and long-term value to differentiate from lower-cost alternatives.

- Competitive Pricing: Telos must align its pricing with market benchmarks in government contracting, a sector known for its bid-based procurement.

- Value Proposition: The company emphasizes the high-assurance nature of its security solutions, justifying potentially higher price points through superior performance and reliability.

- Market Positioning: As a leading provider, Telos aims to capture market share by offering solutions that meet stringent government security requirements, often commanding a premium.

- Competitor Analysis: Continuous monitoring of competitor pricing and offerings is essential to maintain a competitive edge while upholding brand value.

Revenue Mix and Margin Considerations

Telos's revenue mix significantly shapes its profitability, with a strategic need to balance higher-margin cybersecurity offerings against potentially lower-margin government contracts like TSA PreCheck and DMDC. This dynamic requires careful pricing across its portfolio to maintain overall financial health.

For instance, while specific margin data for 2024 and projections for 2025 are proprietary, historical trends suggest that government-facilitated programs often operate with tighter margins due to competitive bidding and regulatory requirements. This contrasts with Telos's advanced cybersecurity solutions, which typically command higher gross margins due to their specialized nature and value proposition.

- Revenue Stream Diversification: Telos balances its cybersecurity solutions with government programs like TSA PreCheck and DMDC.

- Margin Variances: Government programs may exhibit lower gross margins compared to core cybersecurity products.

- Pricing Strategy Imperative: A balanced pricing approach across the diverse portfolio is crucial for overall profitability.

Telos employs a multifaceted pricing strategy, primarily leveraging contract-based pricing for its extensive government and enterprise cybersecurity solutions. This approach is standard for large, multi-year indefinite-delivery/indefinite-quantity (IDIQ) contracts, often secured through competitive bidding processes.

For its flagship platforms like Xacta, value-based pricing is likely employed, aligning the cost with the significant benefits of compliance automation and risk management. This is particularly relevant as the cybersecurity compliance market is projected to exceed $40 billion in 2024, underscoring the demand for such solutions.

For services like TSA PreCheck, Telos adheres strictly to pricing set by the Transportation Security Administration, with the standard five-year membership currently costing $78. This ensures a consistent and transparent price for consumers across all authorized providers.

| Service/Product | Pricing Model | Key Considerations | Example Pricing/Data |

|---|---|---|---|

| Government/Enterprise Cybersecurity & IT Solutions | Contract-Based (IDIQ) | Competitive Bidding, Deliverables, Service Levels | $120M recompete contract (FY23) |

| Xacta Platform | Value-Based | Compliance Automation, Risk Management, Security Assurance | Cybersecurity Compliance Market: >$40B (2024 projection) |

| TSA PreCheck | Regulated Fixed Pricing | TSA Set Fee | $78 for 5-year membership |

4P's Marketing Mix Analysis Data Sources

Our Telos 4P's Marketing Mix Analysis is grounded in a comprehensive review of official company disclosures, including annual reports and investor presentations. We also incorporate insights from industry-specific databases and competitive analysis to ensure accuracy.