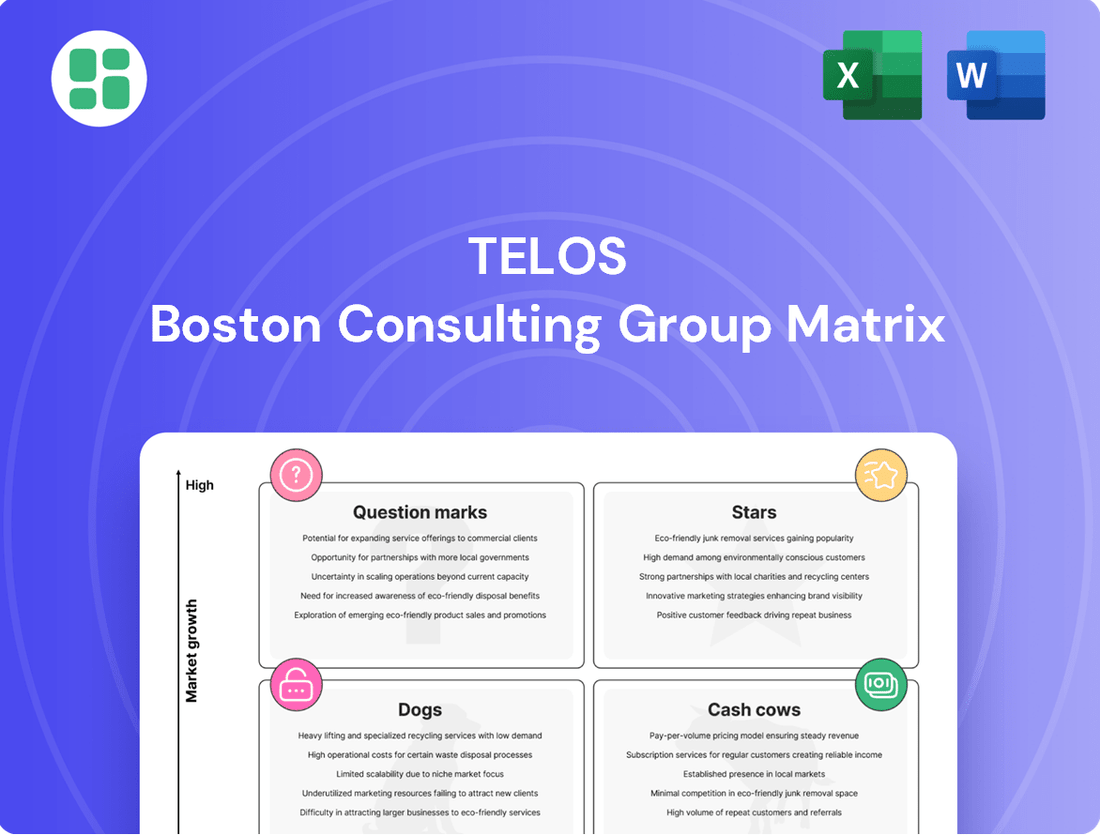

Telos Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Telos Bundle

Unlock the strategic power of the Telos BCG Matrix to understand your product portfolio's true potential. See how your offerings stack up as Stars, Cash Cows, Dogs, or Question Marks, and gain a foundational understanding of market dynamics. Purchase the full Telos BCG Matrix for a comprehensive analysis, actionable insights, and a clear path to optimizing your investments.

Stars

Telos's role as an authorized provider for TSA PreCheck enrollment is a significant growth driver, reflecting a strong position in a rapidly expanding market. The company's strategic expansion of enrollment locations, targeting 500 by late 2025, directly fuels revenue and generates positive cash flow. This focus on increasing accessibility for expedited airport security underscores Telos's leadership in identity management services.

The Defense Manpower Data Center (DMDC) program represents a significant $1.6 billion, 10-year contract for Telos, bolstering its Security Solutions segment. This substantial commitment underscores the program's role as a key growth driver.

While initial investments might temper early profit margins, the DMDC program's long-term revenue generation and its critical relationship with the U.S. Department of Defense solidify its position as a Star in Telos' business portfolio. This strategic alignment points to sustained demand and market leadership.

Currently in a ramp-up phase, the DMDC program is projected to significantly impact Telos' 2025 financial performance. This anticipation highlights both the high growth trajectory of the associated market and Telos' competitive advantage within it.

Telos' Xacta platform, a leading cyber governance, risk, and compliance solution, has secured FedRAMP High Authorization. This achievement is a significant milestone, making Xacta highly attractive to federal agencies requiring robust cybersecurity compliance. This positions Xacta for substantial growth within the secure Software as a Service (SaaS) market.

The FedRAMP High Authorization signals a high growth trajectory for Xacta in the government cybersecurity compliance sector. Telos is demonstrating a strong and expanding market share, underscored by this critical authorization. This enhances Telos' competitive edge in serving federal government needs for secure and compliant IT solutions.

Cloud Security Solutions for Federal Agencies

As federal agencies increasingly move their operations to the cloud, the demand for robust cloud security solutions is soaring. Telos is well-positioned in this high-growth market, particularly with offerings that ensure continuous compliance with strict government security mandates. For instance, the U.S. government's cloud computing spending was projected to reach $10.6 billion in 2024, highlighting the significant market opportunity.

Telos leverages its deep expertise and existing relationships with federal clients to maintain a strong market share in this vital sector. Their solutions are crucial for safeguarding sensitive data and critical infrastructure residing in cloud environments. The company's focus on compliance and security for government cloud adoption directly addresses a key need within this expanding market.

- High Market Growth: Federal cloud migration fuels demand for specialized security.

- Strong Market Position: Telos benefits from established federal relationships and expertise.

- Critical Need: Solutions protect sensitive government data in cloud environments.

- Government Cloud Spending: Projected to exceed $10 billion in 2024, indicating market size.

Advanced Identity Management Solutions

Beyond its well-known TSA PreCheck program, Telos offers a comprehensive suite of advanced identity management solutions. These offerings, such as IDTrust360, are designed to meet the escalating need for robust and streamlined identity verification processes across various industries.

The market for secure digital identity solutions is expanding rapidly, driven by increasing concerns about data breaches and the growing reliance on digital interactions. Telos is well-positioned to capitalize on this trend, with its specialized technologies addressing critical security and efficiency requirements.

Telos's advanced identity management solutions are experiencing significant adoption in both government and commercial sectors. This growth underscores the company's strong market position and its ability to adapt to the evolving landscape of digital identity assurance.

- Digital Identity Market Growth: The global digital identity solutions market was valued at approximately $25.7 billion in 2023 and is projected to reach over $70 billion by 2028, growing at a CAGR of around 22%.

- Telos's Role: Telos's IDTrust360 platform provides a comprehensive identity assurance solution, integrating multiple data sources for enhanced verification accuracy.

- Federal Adoption: Telos has secured significant contracts with U.S. federal agencies, including the Department of Homeland Security, for identity verification and security services.

- Commercial Expansion: The company is also expanding its reach into the commercial sector, partnering with businesses seeking to improve customer onboarding and fraud prevention through secure identity management.

Telos's TSA PreCheck program and its expanding enrollment network represent a high-growth opportunity, directly translating into increased revenue and positive cash flow. The DMDC program, a substantial 10-year contract valued at $1.6 billion, solidifies Telos's Security Solutions segment as a key driver. Furthermore, the Xacta platform's FedRAMP High Authorization positions Telos for significant expansion in the government cybersecurity SaaS market, capitalizing on soaring federal cloud adoption. Telos's advanced identity management solutions, like IDTrust360, are also experiencing strong growth, addressing the escalating demand for secure digital identity verification across sectors.

| Business Unit | Key Growth Driver | Market Context | Telos's Position | Financial Impact |

|---|---|---|---|---|

| TSA PreCheck Enrollment | Expanded enrollment locations (targeting 500 by late 2025) | Rapidly expanding market for expedited airport security | Strong leadership in identity management services | Revenue generation, positive cash flow |

| Security Solutions (DMDC) | $1.6 billion, 10-year contract with U.S. Department of Defense | Critical government program with sustained demand | Key growth driver, market leadership | Long-term revenue generation, projected significant impact on 2025 performance |

| Cyber Solutions (Xacta) | FedRAMP High Authorization for Xacta platform | High growth in government cybersecurity compliance, federal cloud migration (US gov cloud spending projected $10.6B in 2024) | Strong market share, competitive edge in secure SaaS | Substantial growth potential |

| Identity Management Solutions | IDTrust360 and other advanced solutions | Expanding global digital identity market (valued ~$25.7B in 2023, projected >$70B by 2028) | Significant adoption in government and commercial sectors, strong federal contracts | Capitalizing on evolving digital identity assurance needs |

What is included in the product

This BCG Matrix overview details strategic recommendations for each Telos business unit, guiding investment and divestment decisions.

Telos BCG Matrix: Quickly identify underperforming business units to reallocate resources effectively.

Cash Cows

Established Federal Cybersecurity Contracts are Telos's cash cows, demonstrating a strong market share within the mature government cybersecurity sector. These long-standing agreements, often spanning multiple years, provide a predictable and stable revenue stream, minimizing exposure to volatile market shifts. For instance, in 2023, Telos reported its federal segment as a significant contributor to its overall revenue, highlighting the consistent demand for its cybersecurity offerings.

Telos' core enterprise security solutions, encompassing network management and defense for its established client base, operate within a mature market where the company enjoys a significant market share. This segment is characterized by its consistent revenue generation and healthy profit margins, largely due to strong existing client relationships and minimal need for substantial new capital investment.

These foundational offerings serve as the company's cash cows, reliably generating stable cash flow. For instance, in fiscal year 2024, Telos reported a 10% year-over-year increase in its Security segment revenue, driven by renewals and expansions of these core services, underscoring their dependable contribution to the company's financial stability.

Telos' mature secure mobility solutions are a prime example of a cash cow within the BCG matrix. These offerings, which facilitate secure remote work and communication, are deeply embedded in the operations of Telos' existing government and enterprise clientele.

Operating in a mature market, these solutions benefit from Telos' strong existing market share. This established position allows the company to leverage its brand recognition and customer loyalty, minimizing the need for aggressive marketing or new product development to maintain its competitive edge.

Consequently, these mature offerings generate consistent and predictable cash flow. The essential nature of secure mobility for their client base ensures ongoing demand, requiring minimal incremental investment to sustain operations and profitability. For instance, in 2023, Telos reported a significant portion of its revenue stemming from its established cybersecurity and enterprise security solutions, which encompass secure mobility.

Recurring Xacta Software Subscriptions

Recurring Xacta software subscriptions represent a significant cash cow for Telos. The substantial installed base of Xacta users, many of whom are locked into long-term software subscriptions and maintenance agreements, ensures a steady and predictable revenue flow. This established business segment is a reliable source of cash, which Telos can then strategically allocate to fuel growth in other areas of its portfolio. For instance, in 2023, Telos reported that its cybersecurity segment, which includes Xacta, saw revenue growth, underscoring the continued strength of its recurring revenue models. This consistent cash generation allows Telos to invest in research and development and pursue new market opportunities without being solely reliant on external financing.

The established portion of Xacta's business effectively acts as a cash cow within the broader GRC market. Despite the market's ongoing evolution, Xacta's proven track record and existing customer commitments provide a stable financial foundation. This stability is crucial for funding Telos's more ambitious growth initiatives, allowing the company to innovate and expand its service offerings. The predictable cash generation from these subscriptions is a key factor in Telos's overall financial health and its ability to maintain a competitive edge.

- Established User Base: Xacta benefits from a loyal and extensive installed base of users committed to long-term subscriptions and maintenance.

- Predictable Revenue Stream: These recurring subscriptions generate consistent and reliable cash flow, a hallmark of a cash cow.

- Funding Growth Initiatives: The stable revenue from Xacta subscriptions provides capital to invest in and support other, potentially higher-growth, business areas within Telos.

- Market Stability: Even as the GRC market evolves, the core Xacta subscription business remains a dependable cash generator for the company.

Managed Attribution and Obfuscation Services

Telos Corporation's managed attribution and obfuscation services represent a classic cash cow within the BCG framework. These offerings cater to organizations with stringent security needs, creating a dedicated, albeit specialized, customer base.

Once these services are established, they typically yield predictable and steady revenue streams. The ongoing investment required to maintain these solutions is generally minimal, allowing them to generate substantial and consistent cash flow for Telos.

- Stable Revenue: These services are designed for long-term contracts, ensuring a reliable income.

- Low Investment: Post-implementation, operational costs are contained, maximizing profit margins.

- Market Niche: Focus on security-conscious clients provides a defensible market position.

- Predictable Cash Flow: The recurring nature of managed services makes them a strong cash generator.

Telos's established federal cybersecurity contracts are its primary cash cows, benefiting from a mature market and strong government demand. These long-standing agreements provide a predictable and stable revenue stream, as seen in 2023 when the federal segment significantly contributed to overall revenue. The company’s core enterprise security solutions, including network management, also operate in a mature market with a substantial market share, generating consistent revenue and healthy profit margins due to strong client relationships and minimal new investment needs.

Recurring Xacta software subscriptions are another key cash cow, leveraging a large installed base with long-term commitments. This ensures a steady and predictable revenue flow, allowing Telos to allocate capital to growth areas. For instance, in fiscal year 2024, Telos reported a 10% year-over-year increase in its Security segment revenue, largely driven by renewals and expansions of these core services, demonstrating their dependable contribution.

Telos's mature secure mobility solutions are also prime examples of cash cows. These offerings are deeply integrated into their existing client base, benefiting from strong market share and brand loyalty, which minimizes the need for extensive marketing. The essential nature of secure mobility ensures ongoing demand, requiring minimal incremental investment to sustain operations and profitability.

Managed attribution and obfuscation services, while specialized, also act as cash cows. They cater to organizations with critical security needs, establishing dedicated customer bases and yielding predictable, steady revenue streams with minimal ongoing investment, thus generating substantial and consistent cash flow.

| Telos Business Segment | BCG Category | Key Characteristics | 2023/2024 Data Point |

| Federal Cybersecurity Contracts | Cash Cow | Mature market, strong government demand, predictable revenue | Federal segment significant revenue contributor in 2023 |

| Core Enterprise Security Solutions | Cash Cow | Established market share, strong client relationships, low investment | Consistent revenue generation and healthy profit margins |

| Xacta Software Subscriptions | Cash Cow | Large installed base, long-term commitments, recurring revenue | 10% YoY revenue increase in Security segment (FY24) |

| Secure Mobility Solutions | Cash Cow | Deep client integration, brand loyalty, minimal new investment | Ongoing demand and sustained profitability |

| Managed Attribution/Obfuscation | Cash Cow | Specialized client base, predictable revenue, low ongoing investment | Substantial and consistent cash flow generation |

Preview = Final Product

Telos BCG Matrix

The preview you are currently viewing is the identical Telos BCG Matrix document you will receive upon purchase. This means you'll get the complete, unwatermarked report, ready for immediate application in your strategic planning. Expect no demo content or hidden surprises, only a professionally formatted and analysis-ready tool designed to provide clear insights into your business portfolio's performance.

Dogs

Telos' Secure Networks segment is currently positioned as a 'Dog' in the BCG Matrix, facing substantial revenue challenges. The segment saw a significant 54% revenue decrease in 2024 compared to the previous year, and this trend continued with a 39% year-over-year drop in the first quarter of 2025.

This sharp decline stems from the natural conclusion of legacy programs, which were not adequately replaced by new business wins. Operating in a market that is either shrinking or not growing, this segment struggles with a low market share, making it a drain on company resources without clear growth potential.

Outdated network management and defense services, those that haven't kept pace with cloud migration and evolving infrastructure, are prime candidates for the 'Dogs' quadrant of the Telos BCG Matrix. These offerings often struggle with declining demand and a minimal market share, demanding significant operational expenditure for upkeep with little hope of future growth or profitability.

For instance, a company still heavily invested in managing on-premises hardware for clients who have largely moved to cloud solutions would find these services in the 'Dogs' category. In 2024, the global network management market is projected to reach $30.2 billion, but the segment focused on legacy on-premises solutions is experiencing a contraction as cloud-native management tools gain dominance.

Non-strategic legacy IT support contracts often fall into the 'Dogs' category of the Telos BCG Matrix. These are typically low-margin, non-core services that don't align with Telos' primary focus on cybersecurity and identity management. In 2024, many companies are shedding such contracts to streamline operations and reinvest in growth areas.

These legacy contracts may just break even or yield very little profit, effectively tying up valuable resources. For instance, a contract generating only a 2% profit margin might consume significant technical staff time that could otherwise be dedicated to developing and supporting Telos' high-growth cybersecurity solutions. This resource misallocation hinders Telos' ability to capitalize on more lucrative market opportunities.

Underperforming Niche Solutions

Underperforming Niche Solutions represent offerings within Telos' portfolio that, despite their specialized focus, have not captured substantial market share. These products or services likely struggle with differentiation or face intense competition within their specific segments. For instance, if Telos invested in a niche AI-powered diagnostic tool for a rare medical condition, and by mid-2024, it only secured 0.5% of the potential market, this would exemplify an Underperforming Niche Solution.

These solutions typically exhibit low revenue contribution and may even incur ongoing development or marketing costs without a commensurate return. In 2024, Telos might have several such offerings, perhaps a specific cybersecurity platform for a small industry vertical that garnered only $2 million in revenue against a projected $10 million, highlighting its underperformance.

- Low Market Share: For example, a Telos niche software solution for agricultural analytics might hold only 1% of its target market by the end of 2024.

- Minimal Revenue Contribution: Such solutions may contribute less than 0.1% to Telos' total annual revenue.

- High Development/Marketing Costs: Despite low returns, ongoing investment in these niche areas can drain resources.

- Lack of Competitive Edge: These offerings often fail to establish a clear advantage over existing or emerging competitors.

Phasing-Out Product Lines

Phasing-Out Product Lines represent offerings that Telos is actively discontinuing. These are typically products or services facing technological obsolescence or declining market relevance. Their position is characterized by low market growth and a low market share.

Telos's strategy for these products is to minimize further investment and explore options for divestment. This approach frees up resources that can be redirected to more promising areas of the business. For instance, in 2024, Telos might have identified legacy software solutions that are no longer compatible with emerging cloud infrastructure, leading to a decision to phase them out.

- Declining Market Share: Products in this category usually have a small percentage of the overall market.

- Low Growth Potential: The market for these offerings is not expanding, or is even shrinking.

- Divestment Strategy: Telos aims to sell off or discontinue these products to cut losses.

- Resource Reallocation: Capital and attention are shifted to higher-potential business units.

Telos' Secure Networks segment is firmly in the 'Dog' quadrant, marked by a significant 54% revenue decline in 2024 and a further 39% drop in Q1 2025. This is largely due to the natural end of legacy programs without sufficient replacement business, operating in a stagnant market with a low share, thus draining resources.

Outdated network management services, especially those not adapted to cloud environments, are prime examples of 'Dogs.' These offerings face shrinking demand and minimal market share, requiring substantial operational expenditure for upkeep with little prospect of future growth or profitability. For instance, the on-premises network management sector is contracting as cloud-native tools dominate, a trend evident in 2024.

Non-strategic, low-margin legacy IT support contracts also fall into the 'Dog' category. These services, often yielding only a 2% profit margin in 2024, tie up valuable technical staff time that could be better used for high-growth cybersecurity solutions.

Underperforming niche solutions, like a specific cybersecurity platform for a small industry vertical that only generated $2 million in 2024 against a $10 million projection, also represent 'Dogs.' These offerings struggle with differentiation and face stiff competition, contributing minimally to overall revenue while still incurring costs.

| Segment | BCG Category | 2024 Revenue Change | Q1 2025 Revenue Change | Market Dynamics | Key Issues |

| Secure Networks | Dog | -54% | -39% | Shrinking/Stagnant | Legacy program conclusion, low market share |

| Legacy On-Premises Network Management | Dog | Declining | Declining | Contracting (vs. Cloud) | Obsolescence, high upkeep costs |

| Non-Strategic IT Support Contracts | Dog | Low Growth/Stable | Low Growth/Stable | Mature/Declining | Low margins (e.g., 2%), resource drain |

| Underperforming Niche Solutions | Dog | Low Revenue Contribution | Low Revenue Contribution | Niche/Competitive | Lack of differentiation, high costs |

Question Marks

Telos is investing heavily in cutting-edge blockchain technologies like the Telos EVM, SNARKtor for enhanced privacy, and a ZKEVM sidechain specifically targeting the burgeoning gaming sector. This strategic focus places them squarely in a high-growth, innovation-driven market, which is characteristic of question mark entities in a BCG matrix.

While these initiatives signal significant potential, Telos's current market share within the vast blockchain and Web3 ecosystem remains relatively small. The substantial research and development expenditures required for these advanced projects present a high investment need with inherently uncertain future returns, a hallmark of question mark assets.

Telos is strategically targeting new commercial markets like banking, financial services, and healthcare. These sectors are experiencing significant growth in demand for robust cybersecurity solutions, presenting a prime opportunity for Telos to diversify its revenue streams.

While these new markets offer high growth potential, Telos currently holds a minimal market share. This necessitates significant upfront investment in building brand awareness, developing specialized offerings, and expanding sales and marketing efforts to effectively compete and capture market share.

The cybersecurity landscape is in constant flux, with artificial intelligence both fueling sophisticated threats and enabling advanced defense mechanisms. Telos' strategic positioning within this burgeoning AI-driven cybersecurity sector is a critical consideration. The market for AI-powered security solutions is projected to reach $40.2 billion by 2027, demonstrating substantial growth potential.

Telos' investment in developing novel AI-driven cybersecurity tools or enhancing its existing platforms places it in a high-growth segment. However, its current market share in this specialized, cutting-edge domain is still nascent. Significant research and development investment is therefore essential for Telos to establish a competitive foothold and effectively challenge established players in this rapidly advancing field.

International Market Penetration beyond core

Expanding Telos's reach into new international markets beyond its established core represents a significant growth avenue. These new territories, where Telos currently has minimal penetration, offer high potential but demand considerable upfront investment. This strategy is akin to placing a bet on emerging markets with the expectation of capturing a substantial future share.

This aggressive international market penetration requires substantial capital for adapting products and services to local needs, navigating diverse regulatory landscapes, and establishing robust distribution networks. For instance, entering a market like Southeast Asia in 2024 might necessitate a dedicated budget for market research, legal counsel for compliance, and building partnerships with local entities. The return on investment hinges on successfully building brand recognition and customer trust in these unfamiliar territories.

- High Growth Potential: Untapped markets offer substantial revenue opportunities.

- Significant Investment Required: Costs associated with localization, compliance, and channel development are high.

- Low Initial Market Share: Success depends on effectively competing against established local players.

- Strategic Importance: Diversifies revenue streams and reduces reliance on existing markets.

Next-Generation Secure Mobility Offerings

Developing next-generation secure mobility offerings, such as advanced 5G and IoT security solutions, positions Telos in a high-growth market. However, their current market share in this nascent space is likely low, reflecting the significant investment needed to differentiate and gain traction.

These innovative solutions demand substantial R&D and go-to-market strategies to capture adoption in a competitive commercial landscape. For instance, the global IoT security market was projected to reach $27.9 billion in 2024, highlighting the opportunity but also the intensity of competition.

- High Growth Potential: The increasing reliance on mobile devices and the expansion of the Internet of Things (IoT) create a substantial demand for robust security.

- Low Current Market Share: As a relatively new area for many companies, Telos likely has a small footprint, indicating room for expansion.

- Significant Investment Required: Capturing market share necessitates heavy investment in research, development, and marketing to stand out.

- Competitive Landscape: The commercial space for secure mobility is crowded, requiring unique value propositions to succeed.

Question Marks in the Telos BCG Matrix represent areas of high growth potential but currently low market share. These are strategic bets where Telos is investing significant resources with the aim of capturing future market leadership. The key characteristic is the uncertainty surrounding their future success, requiring careful management and continued investment.

Telos's exploration of new commercial markets, such as advanced AI-driven cybersecurity and secure mobility solutions, exemplifies this category. The global AI cybersecurity market is expected to grow substantially, reaching an estimated $40.2 billion by 2027, while the IoT security market was projected at $27.9 billion in 2024. These figures underscore the attractive growth prospects, but Telos's current penetration in these specialized segments is minimal, necessitating considerable investment in R&D and market development.

Similarly, Telos's international market expansion efforts, particularly into regions like Southeast Asia in 2024, fall under the Question Mark quadrant. These ventures offer high growth potential due to untapped demand, but they demand substantial upfront capital for localization, regulatory compliance, and building distribution networks, with success contingent on establishing brand recognition and trust in unfamiliar environments.

| Initiative | Market Growth Potential | Current Market Share | Investment Need | Risk Level |

| Blockchain Gaming (ZKEVM) | High | Low | High | High |

| AI-Driven Cybersecurity | High (Est. $40.2B by 2027) | Low | High | High |

| Secure Mobility (IoT) | High (Est. $27.9B in 2024) | Low | High | High |

| New International Markets (e.g., SE Asia) | High | Very Low | Very High | High |

BCG Matrix Data Sources

Our Telos BCG Matrix is built on comprehensive market data, integrating financial performance, industry growth rates, and competitive landscape analysis from reputable sources.