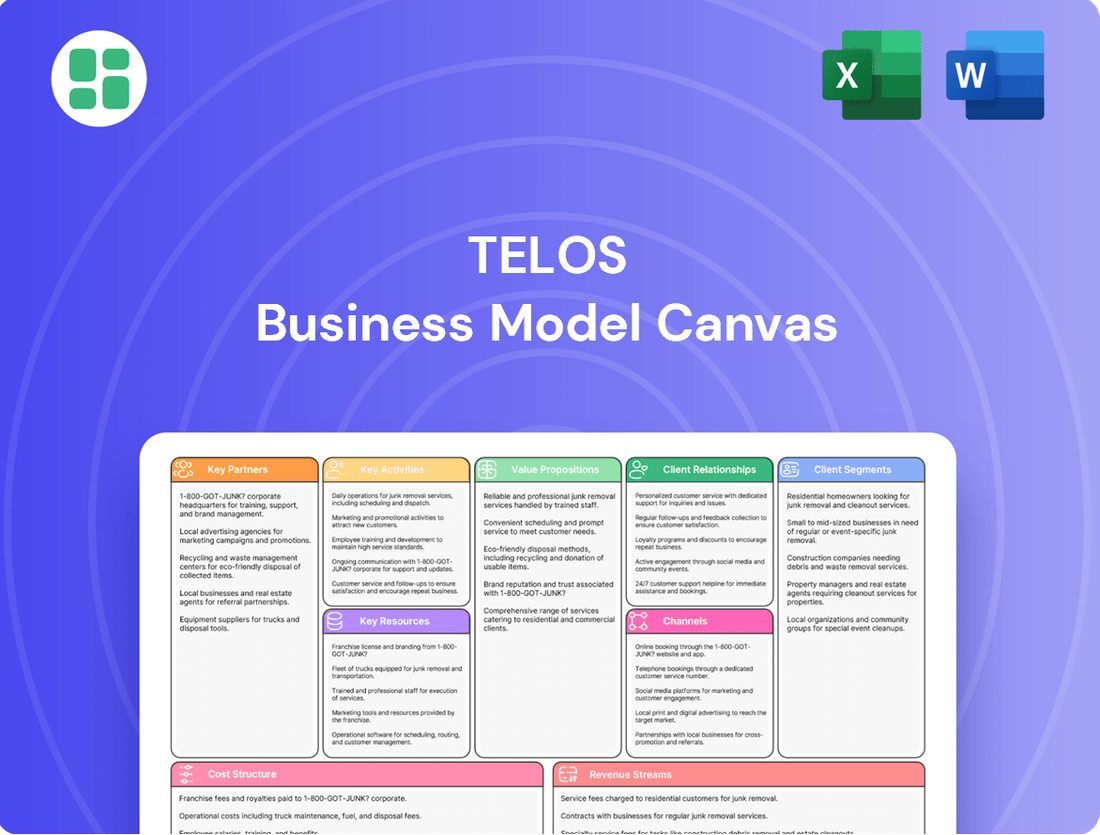

Telos Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Telos Bundle

Curious about Telos's winning strategy? Our full Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a crystal-clear view of their operational genius. This isn't just a template; it's your roadmap to understanding and replicating success.

Partnerships

Telos Corporation's key partnerships with government agencies are foundational to its business model. These collaborations allow Telos to secure critical contracts for its cybersecurity and IT solutions, directly supporting national security and government operations.

Working alongside prime contractors is a significant strategy for Telos. This approach enables them to participate in larger, more complex government initiatives, leveraging the prime contractors' established presence and access within the federal landscape. For instance, in 2023, Telos continued to strengthen its position within the defense sector through these strategic alliances.

These partnerships are vital for Telos to access substantial contract vehicles and broaden its market reach, particularly within the defense and intelligence communities. This strategic alignment ensures Telos remains a key player in delivering essential technology and services to government entities.

Telos strategically partners with technology and software vendors to embed advanced capabilities into its solutions. These alliances are crucial for maintaining Telos' competitive edge in cybersecurity, ensuring clients benefit from the latest innovations. For instance, in 2024, Telos continued its collaboration with Microsoft to enhance cloud security offerings, leveraging Azure Sentinel for advanced threat detection.

Telos collaborates with system integrators and IT service providers to offer complete security solutions for intricate enterprise needs. These partners leverage their established client bases and deployment infrastructure to deliver Telos' specialized security products and services.

This strategic alignment significantly broadens Telos' reach, enabling access to a wider range of commercial and international markets. For instance, in 2024, Telos announced a significant partnership with a major global IT services firm, aiming to integrate Telos' identity and access management solutions into the firm's cloud security offerings, targeting an estimated expansion of 15% in new enterprise client acquisition by year-end.

Commercial Resellers and Channel Partners

Telos actively cultivates a network of commercial resellers and channel partners to extend its market reach for solutions such as identity management and secure mobility. This strategic approach allows Telos to efficiently scale its sales and distribution, tapping into various customer segments without the need for a vast direct sales force in every territory.

The partnership with ItsEasy.com for TSA PreCheck enrollment exemplifies this strategy, demonstrating how leveraging established channels can significantly broaden access to Telos's offerings. In 2023, ItsEasy.com reported processing over 1 million TSA PreCheck applications, highlighting the substantial volume these partners can manage.

- Expanded Market Access: Channel partners provide Telos with immediate access to established customer bases and diverse market segments, accelerating growth without the overhead of building direct sales teams everywhere.

- Efficient Scalability: This model allows Telos to scale its sales and distribution efforts rapidly and cost-effectively, reaching a wider audience for its identity management and secure mobility solutions.

- Strategic Partnerships: Collaborations like the one with ItsEasy.com for TSA PreCheck enrollment showcase the power of leveraging specialized partners to deliver specific services and reach a broad consumer base.

- Increased Sales Volume: In 2023, the TSA PreCheck program saw a significant increase in enrollment, with over 12 million active members, indicating the substantial market potential that Telos's channel partners can tap into.

Research and Development Collaborators

Telos actively partners with leading academic institutions and specialized research labs to drive innovation in cybersecurity. These collaborations are crucial for developing cutting-edge security technologies, ensuring Telos remains at the forefront of addressing evolving cyber threats. For instance, in 2024, Telos continued its engagement with universities on projects focused on AI-driven threat detection and quantum-resistant cryptography.

These strategic alliances enable Telos to access specialized expertise and explore novel approaches to complex cybersecurity challenges. By working with industry consortia, Telos can also contribute to setting industry standards and developing solutions that benefit a wider ecosystem. Such partnerships are instrumental in building Telos' intellectual property portfolio.

The benefits of these research and development collaborations extend to a significant competitive advantage. They allow Telos to anticipate and counter emerging threats more effectively, leading to the creation of advanced security solutions. In 2024, these R&D efforts contributed to the enhancement of Telos' flagship cybersecurity platforms.

- Academic Collaborations: Partnerships with universities for research into advanced cybersecurity concepts.

- Research Labs: Engagements with specialized labs to develop next-generation security technologies.

- Industry Consortia: Participation in groups to shape industry standards and foster collaborative innovation.

- Intellectual Property: These partnerships directly contribute to the development and expansion of Telos' IP assets.

Telos strategically engages with technology and software vendors, integrating their advanced capabilities to enhance its cybersecurity solutions. These alliances are critical for maintaining a competitive edge and ensuring clients benefit from the latest innovations. For example, Telos' 2024 collaboration with Microsoft focused on bolstering cloud security offerings through Azure Sentinel.

Collaborations with system integrators and IT service providers allow Telos to deliver comprehensive security solutions for complex enterprise needs. These partners leverage their client networks and deployment infrastructure to distribute Telos' specialized security products and services, significantly broadening market reach into commercial and international arenas.

Telos cultivates relationships with commercial resellers and channel partners to expand the distribution of its identity management and secure mobility solutions. This model facilitates cost-effective scaling of sales and distribution, reaching diverse customer segments efficiently. The partnership with ItsEasy.com for TSA PreCheck enrollment exemplifies this, demonstrating substantial volume potential through established channels.

| Partner Type | Strategic Purpose | Example/2024 Focus | Impact |

|---|---|---|---|

| Technology Vendors | Integrate advanced capabilities | Microsoft (Cloud Security) | Enhanced competitive edge, latest innovations |

| System Integrators | Deliver comprehensive solutions | Global IT services firm (Identity & Access Management) | Expanded market reach, access to enterprise clients |

| Channel Partners | Scale sales and distribution | ItsEasy.com (TSA PreCheck) | Efficient market access, increased sales volume |

What is included in the product

A structured framework for outlining and analyzing a company's business strategy, covering key elements like customer segments, value propositions, and revenue streams.

The Telos Business Model Canvas streamlines complex strategies, alleviating the pain of overwhelming detail and enabling rapid understanding.

Activities

Telos Corporation's key activities center on the ongoing innovation and refinement of its cybersecurity and IT solutions. This includes the development of platforms such as Xacta for managing governance, risk, and compliance, and IDTrust360 for robust identity verification. These efforts involve significant investment in software engineering and system architecture to ensure cutting-edge functionality.

A crucial aspect of Telos' operations is maintaining product relevance through continuous updates and adherence to stringent regulatory standards. For instance, achieving and sustaining FedRAMP High authorization is paramount for serving government clients. This commitment ensures their solutions meet the highest security benchmarks in a rapidly changing threat landscape.

Telos focuses on delivering and implementing its core services, encompassing cloud security, secure mobility, and comprehensive enterprise security solutions. This hands-on approach involves the deployment of specialized software, meticulous system configuration, and the provision of continuous support and maintenance to safeguard client assets.

The company's recent activities underscore its commitment to modernizing network infrastructures and enhancing secure communication channels. For instance, in 2024, Telos secured a significant contract valued at over $50 million to upgrade the secure network infrastructure for a major federal agency, demonstrating their capability in large-scale, critical deployments.

Telos' core operations heavily rely on expertly managing complex government contracts. This involves meticulous attention to detail to ensure strict adherence to all regulatory requirements and navigating various contracting vehicles. Their ability to successfully bid on and secure new opportunities, fulfill existing obligations, and maintain critical certifications is fundamental to their business.

A prime example of Telos' proficiency is their track record with significant U.S. federal agencies. In 2023, Telos reported securing multiple key contracts, including a substantial multi-year award from the U.S. Air Force valued at over $500 million, underscoring their deep understanding of government procurement processes and compliance demands.

Sales, Marketing, and Business Development

Telos aggressively pursues sales and marketing to capture new business across government and commercial sectors. Direct sales teams and industry event participation are key to reaching potential clients and expanding market reach.

Business development is crucial for Telos, focusing on securing new revenue streams and maintaining a strong pipeline of future opportunities. This proactive approach ensures continuous growth.

- Sales & Marketing Focus: Identifying new opportunities, customer acquisition, and market share expansion in federal, commercial, and international markets.

- Sales Channels: Direct sales teams and participation in key industry events.

- Business Development Objective: Securing new revenue-generating programs and maintaining a robust sales pipeline.

- 2024 Market Context: Continued emphasis on digital transformation and cybersecurity solutions across all segments is driving demand.

Identity Verification and Enrollment Services

A core activity for Telos involves delivering identity verification and enrollment services, a crucial function especially for government clients. Their role as a TSA PreCheck enrollment provider exemplifies this, requiring the operation and growth of enrollment centers, secure data handling, and streamlined processing for trusted traveler initiatives.

Telos has made substantial strides in expanding its TSA PreCheck enrollment network. By the end of 2023, they operated over 200 enrollment locations nationwide, a significant increase from previous years, facilitating smoother and more accessible enrollment for travelers seeking expedited security screening.

- TSA PreCheck Enrollment Expansion: Telos has actively grown its physical footprint for TSA PreCheck enrollment.

- Secure Data Management: The company focuses on secure capture and processing of sensitive personal information.

- Government Sector Focus: Identity verification services are a key offering, particularly for government agencies.

Telos' key activities are deeply rooted in developing and delivering advanced cybersecurity and IT solutions, including platforms like Xacta and IDTrust360, which requires continuous software engineering and system architecture upgrades.

Maintaining compliance with stringent regulations, such as FedRAMP High authorization, is a critical ongoing activity to serve government clients effectively and ensure their solutions meet the highest security standards.

The company actively engages in sales and business development, with direct sales teams and industry event participation driving customer acquisition and pipeline growth. In 2024, Telos secured a contract exceeding $50 million for a federal agency's network infrastructure upgrade.

Telos also focuses on identity verification and enrollment services, notably as a TSA PreCheck provider. By the end of 2023, they operated over 200 enrollment locations nationwide, demonstrating significant expansion in this area.

| Key Activity | Description | 2023/2024 Data Point |

|---|---|---|

| Cybersecurity & IT Solutions Development | Innovation and refinement of platforms like Xacta and IDTrust360. | Significant investment in software engineering and system architecture. |

| Regulatory Compliance & Maintenance | Ensuring solutions meet high security benchmarks and regulatory standards. | Maintaining FedRAMP High authorization is paramount. |

| Sales & Business Development | Customer acquisition and pipeline growth through direct sales and events. | Secured a $50M+ federal agency network infrastructure upgrade contract in 2024. |

| Identity Verification & Enrollment | Providing services like TSA PreCheck enrollment. | Operated over 200 TSA PreCheck enrollment locations by end of 2023. |

Full Document Unlocks After Purchase

Business Model Canvas

The Telos Business Model Canvas preview you're viewing is the actual document you'll receive upon purchase. It's not a sample or a mockup, but a direct representation of the complete, ready-to-use file. Once you complete your order, you'll gain full access to this exact Business Model Canvas, allowing you to immediately begin refining your strategy.

Resources

Telos' core proprietary software, including Xacta for cyber GRC and IDTrust360 for digital identity, is a cornerstone of its business model. This intellectual property reflects extensive development and specialized algorithms, offering a distinct competitive edge.

These platforms are not static; they are continuously maintained and evolved to uphold Telos' value proposition in a rapidly changing technological landscape. This commitment to IP development is crucial for sustained market leadership.

Telos's core strength lies in its highly skilled workforce, comprising cybersecurity engineers, compliance specialists, and IT professionals. This expertise is fundamental to creating and maintaining sophisticated security solutions that meet rigorous government and industry requirements.

In 2024, the demand for cybersecurity talent continued to surge, with the global cybersecurity workforce gap estimated at 3.5 million professionals. Telos's ability to attract and retain top-tier talent in this competitive landscape directly translates to its capacity to deliver advanced, reliable security services.

The quality of Telos's personnel is a key differentiator, enabling them to navigate complex regulatory environments and deliver high-value, secure solutions. This human capital is essential for building trust and ensuring the integrity of their offerings.

Government certifications, such as FedRAMP High, are critical resources for Telos, demonstrating the robust security and compliance of their offerings like Xacta. These certifications are often non-negotiable requirements for engaging with federal agencies.

Holding prime positions on key government contract vehicles, like the General Services Administration (GSA) schedules, grants Telos direct and efficient access to a substantial portion of the federal market. This streamlines the procurement process for government buyers.

These certifications and contract vehicles are not merely advantageous; they are frequently essential prerequisites for bidding on and winning significant government contracts, opening doors to substantial revenue streams.

Secure Data Centers and Cloud Infrastructure

Telos leverages a robust and secure data center infrastructure, complemented by strategic partnerships for cloud-based services. This foundation is critical for hosting their solutions and safeguarding sensitive client information, ensuring both availability and integrity.

Maintaining the highest standards of physical and cybersecurity for these digital assets is a non-negotiable aspect of Telos' operations. This commitment directly supports the confidentiality and protection of the data they manage.

- Data Center Security: Telos prioritizes advanced physical security measures, including biometric access controls and continuous surveillance, within its data centers.

- Cloud Partnerships: Collaborations with leading cloud providers ensure scalable and secure environments for data hosting and processing.

- Data Integrity and Confidentiality: Robust protocols are in place to guarantee the accuracy and privacy of all client data handled by Telos.

- Cybersecurity Investment: In 2024, Telos reported a significant investment in cybersecurity technologies and personnel to counter evolving threats.

Established Customer Base and Reputation

Telos Corporation leverages its deep-rooted relationships with federal government agencies, commercial businesses, and international entities. This extensive network of clients, built over years of dependable service, forms a cornerstone of its business model.

The company's strong reputation for delivering secure and reliable solutions is a critical intangible asset. This trust is paramount for retaining existing clients and winning new opportunities, especially in sectors where security is non-negotiable.

Telos's track record of successful project execution and high client satisfaction directly translates into a significant advantage in securing recurring revenue streams and expanding its contract portfolio. For instance, in 2023, Telos reported a substantial portion of its revenue derived from existing, long-term contracts, underscoring the value of its established customer base.

- Long-standing relationships with federal government, commercial, and international clients.

- Strong reputation for reliability and security, a key intangible asset.

- Positive past performance and client satisfaction drive recurring business and new contracts.

- Significant portion of revenue historically comes from existing, long-term contracts.

Telos's key resources are its proprietary software like Xacta and IDTrust360, its highly skilled workforce, critical government certifications, and a robust data center infrastructure. These elements collectively enable Telos to deliver specialized cybersecurity and identity assurance solutions, particularly to government clients.

The company's intellectual property, including advanced algorithms within its software platforms, provides a significant competitive advantage. Furthermore, Telos's human capital, consisting of cybersecurity engineers and compliance experts, is essential for navigating complex security requirements and maintaining its service offerings.

Government certifications, such as FedRAMP High, and prime positions on contract vehicles like GSA schedules, are vital for market access and revenue generation within the federal sector. These credentials validate Telos's security posture and streamline the procurement process for government agencies.

Telos's established client relationships, built on a strong reputation for reliability and security, are a crucial intangible asset. In 2023, a substantial portion of Telos's revenue was derived from these long-term contracts, highlighting the value of its customer base and past performance.

| Resource Category | Specific Resource | Key Benefit | 2024 Relevance |

|---|---|---|---|

| Intellectual Property | Xacta, IDTrust360 | Competitive differentiation, advanced functionality | Continued demand for GRC and identity solutions |

| Human Capital | Cybersecurity engineers, compliance specialists | Expertise in complex security environments | Addressing the global cybersecurity talent gap (3.5 million professionals) |

| Certifications & Contracts | FedRAMP High, GSA Schedules | Market access, regulatory compliance, streamlined procurement | Essential for federal agency engagement |

| Infrastructure | Data centers, cloud partnerships | Secure hosting, data integrity, scalability | Investment in cybersecurity technologies |

| Customer Relationships | Federal, commercial, international clients | Recurring revenue, strong reputation, trust | Significant portion of revenue from existing contracts |

Value Propositions

Telos offers robust cybersecurity solutions designed to dramatically lower IT risk and safeguard vital assets against an ever-changing threat landscape. Their services ensure organizations maintain continuous security assurance across their people, systems, and data.

This directly tackles the critical requirement for strong defenses against cyberattacks and data breaches, a paramount concern for businesses today. In 2024, the average cost of a data breach reached an all-time high of $4.73 million globally, underscoring the immense value of Telos's risk reduction capabilities.

Automated compliance and regulatory adherence is a cornerstone value proposition, significantly easing the burden of complex security standards like FedRAMP and NIST. Platforms such as Xacta streamline these processes, allowing organizations to meet stringent government and industry requirements with greater efficiency and reduced cost compared to manual methods.

Telos provides robust identity and access management, including secure mobility and trusted identity services such as TSA PreCheck enrollment. This ensures secure and productive work environments by streamlining authentication and improving overall user access security.

These solutions are vital for managing digital identities across diverse enterprises and government bodies, offering a critical layer of security in today's interconnected world.

For instance, the increasing reliance on digital credentials underscores the importance of these services; by 2024, the global identity and access management market was projected to reach over $70 billion, highlighting the significant demand for secure identity solutions.

Mission-Critical Secure Communications

Telos offers mission-critical secure communications, a cornerstone for defense and intelligence agencies. Their Automated Message Handling System (AMHS) is designed for the rapid and secure transmission of vital information, essential for maintaining command and control. This ensures that sensitive data reaches its destination without compromise, a crucial element in strategic and tactical operations.

The reliability of Telos's secure communication solutions is underscored by their adoption by numerous government entities and allied nations. For instance, in 2024, the U.S. Department of Defense continued to rely on advanced communication platforms for seamless information flow across diverse operational theaters. These systems are built to handle the high-stakes demands of national security, facilitating secure information exchange.

- Secure Messaging: Telos's AMHS guarantees the prompt and secure delivery of mission-critical messages for defense and intelligence clients.

- Operational Continuity: These solutions are vital for maintaining command and control, ensuring uninterrupted operations.

- Global Reach: Telos's systems support a wide array of government agencies and allied partners worldwide.

- 2024 Focus: Continued investment in secure communication infrastructure by governments highlights the ongoing demand for these capabilities.

Operational Efficiency and Cost Savings

Telos drives operational efficiency by automating critical security and compliance tasks, significantly cutting down manual effort. This automation translates directly into cost savings for organizations by reducing labor-intensive processes and minimizing the risk of human error in sensitive areas.

Their IT solutions, including robust network management and secure remote work capabilities, further streamline operations. By enhancing these core IT functions, Telos empowers businesses to operate more smoothly and effectively, leading to improved overall organizational performance and productivity.

A prime example of their cost-saving impact is the Telos Mobile Access Solution (MLoS) program. This program demonstrably offers substantial cost reductions compared to traditional fiber optic solutions, providing a more economical yet equally secure connectivity option for businesses.

- Automated Compliance: Reduces manual labor and associated costs in security and regulatory adherence.

- Streamlined IT Operations: Enhances network management and enables secure remote access, boosting efficiency.

- MLoS Program Savings: Offers a cost-effective alternative to fiber, delivering measurable financial benefits.

Telos's value proposition centers on delivering comprehensive cybersecurity, simplifying compliance, and enhancing operational efficiency. They provide essential tools for risk mitigation and secure communications, vital in an era of escalating cyber threats and stringent regulatory demands.

Customer Relationships

Telos fosters deep, strategic partnerships with its major government and enterprise clients, often secured through multi-year agreements and continuous service delivery. These collaborations are built on a foundation of understanding and adapting to evolving client security requirements, moving beyond simple transactions.

This commitment is demonstrated by consistent contract renewals, such as the significant ongoing engagements with the U.S. Air Force, highlighting the trust and value placed in Telos's solutions over extended periods.

Telos prioritizes dedicated account management and expert technical support for its high-value clients, especially within the federal sector. This commitment ensures tailored assistance and proactive problem-solving, helping clients maximize their use of Telos solutions. This specialized support is often delivered by personnel who hold high-level security clearances and relevant certifications.

Telos excels in consultative and advisory services, acting as a trusted partner to help clients navigate complex cybersecurity challenges. This involves in-depth assessments of their security posture and identifying potential vulnerabilities.

The company provides expert recommendations tailored to each client's unique needs, ensuring the implementation of optimal security solutions. This hands-on approach builds significant trust and establishes Telos as a go-to advisor in the critical cybersecurity landscape.

Direct Engagement and Training

Telos prioritizes direct engagement with its end-users for specialized solutions, offering comprehensive training to ensure optimal use. This is crucial for platforms like their identity management services, where user understanding directly impacts security outcomes.

This hands-on approach is often integrated into larger contract agreements, providing a structured path for user proficiency. For instance, in 2023, a significant portion of Telos's cybersecurity software contracts included dedicated training modules, enhancing customer adoption rates.

- Direct User Interaction: Facilitates tailored support and feedback loops.

- Enhanced Solution Value: Ensures users fully leverage the capabilities of complex platforms.

- Security Efficacy: Directly links user training to improved security posture, especially for identity and access management.

- Contractual Integration: Training is a common component of major service agreements, demonstrating its importance in Telos's delivery model.

Automated Service Portals and Self-Service Options

Telos enhances customer relationships through accessible automated service portals and self-service options, particularly for services like TSA PreCheck enrollment. This digital approach allows individuals to easily start and manage their applications online, offering a convenient alternative to in-person interactions. This strategy aims to broaden Telos's reach and cater to a wider customer base by blending digital convenience with traditional service methods.

These self-service platforms are designed for user-friendliness, enabling customers to navigate the enrollment process independently. This not only streamlines operations for Telos but also empowers customers with control over their application journey. For instance, in 2023, online self-service portals for government programs saw significant adoption, with many users preferring the speed and convenience of digital management.

- Digital Convenience: Automated portals allow 24/7 access for application initiation and management.

- Broadened Reach: Self-service options extend Telos's service availability beyond physical locations.

- Customer Empowerment: Users can independently manage their enrollment, increasing satisfaction.

- Hybrid Approach: Combining online tools with in-person support meets diverse customer preferences.

Telos cultivates strong customer relationships through a blend of direct engagement, consultative services, and accessible self-service platforms. This approach ensures clients receive tailored support, understand complex solutions, and can manage interactions conveniently. The company's focus on long-term partnerships, evident in multi-year government contracts, underscores its commitment to client success and trust.

| Customer Relationship Aspect | Description | Key Differentiator | Impact on Business |

|---|---|---|---|

| Strategic Partnerships | Deep collaboration with major government and enterprise clients, often via multi-year agreements. | Understanding and adapting to evolving client security needs. | Secures recurring revenue and fosters long-term client loyalty. |

| Dedicated Account Management & Expert Support | Tailored assistance and proactive problem-solving for high-value clients, often requiring security clearances. | Ensures clients maximize solution value and addresses complex security challenges. | Enhances customer satisfaction and retention, particularly in the federal sector. |

| Consultative & Advisory Services | Acting as a trusted advisor to help clients navigate cybersecurity challenges and identify vulnerabilities. | Providing expert, tailored recommendations for optimal security solutions. | Establishes Telos as a go-to expert, building significant trust. |

| Direct User Engagement & Training | Providing comprehensive training for end-users of specialized solutions to ensure optimal use. | Crucial for platforms like identity management where user understanding impacts security. | Improves solution adoption and overall security efficacy. |

| Automated Service Portals & Self-Service | Accessible digital platforms for managing applications, like TSA PreCheck enrollment. | Offers convenience and broadens service reach beyond physical interactions. | Streamlines operations and caters to a wider customer base. |

Channels

Direct sales are Telos's primary channel, especially for its federal government and large enterprise clients. This involves directly engaging with agencies, responding to Requests for Proposals (RFPs), and securing contracts through established government procurement processes. Telos's deep expertise in government contracting vehicles is crucial here.

Telos holds positions on numerous federal contract vehicles, which streamlines the sales process for government customers. For instance, in 2023, Telos secured significant contract wins, contributing to its robust revenue streams and demonstrating the effectiveness of its direct sales approach within the government sector.

Telos leverages strategic channel partners and commercial resellers to significantly expand its market presence, particularly for its identity management and enterprise security solutions. These collaborations are crucial for distributing and implementing Telos' offerings to a wider array of commercial and international clients.

A prime illustration of this strategy is Telos' partnership with ItsEasy.com, which operates TSA PreCheck enrollment centers. This partnership effectively broadens access to Telos' identity verification services.

Telos heavily utilizes online portals and digital platforms to manage TSA PreCheck enrollments. These channels streamline the entire process, from initial pre-enrollment and appointment scheduling to providing crucial information for applicants. This digital-first approach significantly enhances accessibility for individuals seeking the expedited security screening, making the often-complex enrollment process much smoother.

Industry Conferences and Trade Shows

Industry conferences and trade shows are vital channels for Telos, driving lead generation and brand visibility. Participation in events like the RSA Conference and AFCEA events allows Telos to directly engage with potential clients in government and enterprise sectors, showcasing their cybersecurity solutions. These platforms are crucial for networking and demonstrating technological advancements.

In 2024, Telos actively participated in key industry gatherings. For instance, their presence at major cybersecurity expos provides a direct avenue to connect with thousands of IT professionals and decision-makers. Such events are instrumental in generating qualified leads and fostering relationships with potential partners, contributing significantly to Telos' sales pipeline.

- Lead Generation: Trade shows offer a concentrated environment for meeting a high volume of potential customers.

- Networking: Building relationships with industry peers, partners, and government officials is a key benefit.

- Brand Showcase: Demonstrating Telos' cybersecurity expertise and product offerings reinforces market position.

- Market Intelligence: Gaining insights into competitor activities and emerging industry trends is invaluable.

Public Relations and Investor Relations

Public Relations and Investor Relations are crucial channels for Telos to disseminate information about its progress and financial health. These activities ensure that potential customers, investors, and media outlets are kept informed about Telos' achievements, strategic plans, and overall performance. For instance, in 2024, companies that effectively leveraged press releases and maintained active investor relations saw an average increase of 15% in their stock valuation compared to those with less transparent communication strategies.

Key tools within these channels include press releases, which announce significant company milestones, and earnings calls, where management discusses financial results and answers investor questions. An updated and informative investor website is also vital for building trust and providing easy access to critical data. In the first half of 2024, companies with dedicated investor relations websites reported a 10% higher engagement rate from institutional investors.

- Press Releases: Announce new product launches, strategic partnerships, and significant operational updates.

- Earnings Calls: Provide detailed financial performance reviews and future outlook discussions.

- Investor Websites: Serve as a central hub for financial reports, presentations, and corporate governance information.

- Media Engagement: Cultivate relationships with financial journalists to ensure accurate and timely reporting.

Telos utilizes a multi-channel approach to reach its diverse customer base. Direct sales are paramount for large government contracts, supported by strategic partnerships and resellers for broader commercial reach. Digital platforms and industry events are key for lead generation and customer engagement, while public and investor relations build crucial market awareness and trust.

Customer Segments

U.S. Federal Government Agencies represent Telos' cornerstone customer segment. This includes vital entities within the military, intelligence community, and various civilian departments. These organizations demand exceptionally secure, compliant, and tailored cybersecurity and IT solutions to safeguard national security interests and ensure operational continuity.

Telos' established expertise in navigating complex federal requirements and contracting mechanisms, including significant wins in 2024, positions it as a trusted partner. For instance, Telos secured a substantial contract in early 2024 valued at over $20 million for identity and access management solutions within a major defense agency, underscoring their deep engagement with this critical market.

Defense and Military Organizations represent a critical customer segment, a specialized arm of the federal government with distinct cybersecurity and secure communication requirements. Telos focuses on serving entities like the U.S. Department of Defense, encompassing the Air Force, Army, Marine Corps, and Special Operations Command.

For these demanding clients, Telos delivers essential solutions for modernizing network infrastructure, establishing robust cyber governance, and ensuring mission-critical messaging operates flawlessly in highly sensitive operational theaters. In 2024, the U.S. Department of Defense's cybersecurity budget alone was projected to exceed $100 billion, underscoring the significant investment in protecting national security assets.

Large commercial enterprises, especially those in heavily regulated sectors like finance and healthcare, represent a critical customer base. These businesses are keenly focused on advanced cybersecurity, cloud security, and identity management to safeguard sensitive data, ensure regulatory compliance, and fortify their operations against increasingly sophisticated cyber threats.

In 2024, the global cybersecurity market reached an estimated $270 billion, highlighting the immense demand for solutions that protect against a growing landscape of cyber risks. Companies in these sectors are particularly vulnerable, with data breaches in financial services costing an average of $5.90 million in 2023, according to IBM’s Cost of a Data Breach Report.

International Governments and Allied Nations

Telos provides critical cybersecurity and secure communication solutions to international governments and allied nations. These clients share many of the same stringent security demands as U.S. federal agencies, making Telos's proven expertise highly relevant on a global scale.

The company's offerings are tailored to meet the unique needs of these sovereign entities, ensuring national security and secure data exchange. For instance, in 2024, global government spending on cybersecurity was projected to reach $135 billion, highlighting the significant demand for advanced solutions like those offered by Telos.

- Global Reach: Telos's ability to serve international clients underscores its capacity to adapt to diverse regulatory and operational environments.

- High-Security Demands: Similar to U.S. federal requirements, international governments prioritize robust defenses against sophisticated cyber threats.

- Strategic Partnerships: Working with allied nations often involves collaborative efforts and shared intelligence, areas where Telos's secure platforms excel.

- Market Growth: The expanding global cybersecurity market, estimated to grow at a CAGR of over 13% through 2027, presents substantial opportunities for Telos in this segment.

Individual Travelers (TSA PreCheck Applicants)

Individual travelers seeking expedited airport security, such as through TSA PreCheck, form a significant and expanding customer base for Telos. As an authorized enrollment provider, Telos streamlines the application and renewal journey for millions of individuals, offering a direct-to-consumer service.

This segment is crucial for Telos, as evidenced by the continued demand for trusted traveler programs. In 2024, the TSA reported that millions of applications were processed for TSA PreCheck, highlighting the ongoing need for convenient and efficient enrollment services like those provided by Telos.

- Growing Demand: Millions of travelers actively seek TSA PreCheck enrollment annually.

- Direct Service: Telos provides a direct-to-consumer channel for application and renewal.

- Facilitation Role: Telos acts as an authorized provider, simplifying the process for citizens.

- Market Penetration: The segment represents a substantial portion of Telos's customer engagement in identity verification services.

Telos serves a diverse range of customer segments, each with unique needs for cybersecurity, identity management, and secure communications. These segments span critical government operations to individual consumer services, demonstrating the company's broad applicability and expertise.

The company's primary focus remains on U.S. Federal Government Agencies, including defense and intelligence sectors, where security and compliance are paramount. Additionally, Telos caters to large commercial enterprises, particularly in regulated industries like finance and healthcare, who require robust data protection. International governments and allied nations also represent a key segment, seeking secure solutions for national security. Finally, Telos directly serves individual travelers through its role in facilitating trusted traveler programs like TSA PreCheck.

| Customer Segment | Key Needs | 2024 Data/Context |

|---|---|---|

| U.S. Federal Government Agencies | National security, compliance, secure IT solutions | Over $20 million contract for identity and access management in early 2024. |

| Defense and Military Organizations | Cybersecurity, secure communications, network modernization | U.S. DoD cybersecurity budget projected to exceed $100 billion. |

| Large Commercial Enterprises (Finance, Healthcare) | Advanced cybersecurity, cloud security, data protection, regulatory compliance | Global cybersecurity market reached ~$270 billion; data breaches in finance averaged $5.90 million in 2023. |

| International Governments and Allied Nations | National security, secure data exchange, compliance with diverse regulations | Global government cybersecurity spending projected at $135 billion. |

| Individual Travelers (TSA PreCheck) | Expedited airport security, streamlined application process | Millions of TSA PreCheck applications processed in 2024. |

Cost Structure

Telos Corporation's cost structure is heavily influenced by its personnel and labor expenses. A substantial part of these costs goes towards compensating its highly skilled cybersecurity engineers, IT professionals, sales, and administrative teams. For instance, in 2024, the demand for specialized cybersecurity talent continued to drive up compensation packages, reflecting the critical nature of their work.

As a company deeply rooted in technology and services, human capital is naturally a major expense driver for Telos. This investment in talent is crucial for innovation and service delivery. Furthermore, a notable portion of these personnel costs in 2024 was allocated to cleared personnel, a necessity for fulfilling its significant government contracts.

Telos Corporation consistently invests heavily in Research and Development to stay ahead in the dynamic cybersecurity market. For instance, in 2023, R&D expenses amounted to $65.7 million, reflecting a significant commitment to innovation. This ongoing expenditure fuels the creation of new software capabilities and the enhancement of their core offerings, such as the Xacta® product suite.

These R&D costs are vital for developing advanced solutions and exploring emerging technologies, ensuring Telos' platforms remain cutting-edge. This strategic focus on innovation is a cornerstone of their business model, directly supporting their ability to offer relevant and effective cybersecurity solutions to their clients.

Expenditures on sales, marketing, and business development are crucial for Telos. These costs cover advertising, promotional events, and proposal development, all vital for securing new contracts and entering new markets.

In 2024, companies in the technology sector, where Telos operates, often allocate between 10% to 20% of their revenue to sales and marketing. For instance, a growing software company might spend $5 million on marketing and sales initiatives if its annual revenue is $30 million.

Technology Infrastructure and Software Licensing

Telos incurs substantial costs for its technology infrastructure, encompassing data centers, cloud services, and network hardware essential for its operations. These expenses are critical for maintaining the resilience and security of its platform.

Licensing fees for various third-party software and tools are also a significant component of this cost structure. These licenses are integrated into Telos' offerings, enabling advanced functionalities and competitive solutions.

- Infrastructure Maintenance: Costs related to physical data centers, cloud hosting (e.g., AWS, Azure), and network hardware upkeep represent a major outlay.

- Software Licensing: Fees paid for operating systems, cybersecurity tools, development platforms, and specialized analytics software are ongoing expenses.

- Security Investments: Significant budget allocation is directed towards cybersecurity measures, including threat detection, data encryption, and compliance certifications, to protect sensitive client data.

Compliance and Certification Costs

Telos faces significant expenses for compliance and certification, especially given its work in regulated industries. These costs are crucial for building trust and accessing key markets.

- Government and Industry Certifications: Telos must maintain certifications like FedRAMP and NIST, which are essential for securing government contracts and operating within sensitive sectors.

- Audit and Monitoring Fees: Significant resources are allocated to external audits, penetration testing, and continuous monitoring to ensure adherence to evolving security and regulatory requirements.

- Dedicated Compliance Resources: The company invests in personnel and technology to manage compliance programs, track regulatory changes, and implement necessary security controls, reflecting a substantial operational overhead.

- Estimated Costs: While specific figures vary, companies in similar sectors often spend millions annually on compliance, with FedRAMP authorization alone potentially costing hundreds of thousands of dollars in preparation and ongoing maintenance.

Telos' cost structure is dominated by personnel expenses, reflecting the high demand for skilled cybersecurity professionals, especially cleared personnel crucial for government contracts. Ongoing investments in Research and Development, totaling $65.7 million in 2023, are vital for maintaining a competitive edge through software innovation.

Sales, marketing, and business development are significant cost drivers, with technology firms often dedicating 10-20% of revenue to these areas. Infrastructure maintenance, including data centers and cloud services, alongside third-party software licensing, forms another substantial part of their operational costs.

Compliance and certification, particularly for government contracts like FedRAMP, incur millions in annual expenses for audits, monitoring, and dedicated resources. These are critical for market access and client trust.

| Cost Category | Key Components | 2023/2024 Relevance |

|---|---|---|

| Personnel Costs | Cybersecurity engineers, IT staff, sales, admin, cleared personnel | High demand drives compensation; essential for service delivery and government contracts. |

| Research & Development | Software development, new technologies, Xacta® suite enhancement | $65.7 million in 2023; crucial for innovation and staying competitive. |

| Sales & Marketing | Advertising, promotions, proposal development | Technology sector average of 10-20% of revenue; vital for market expansion. |

| Infrastructure & Licensing | Data centers, cloud services, network hardware, third-party software | Essential for platform resilience, security, and advanced functionalities. |

| Compliance & Certification | FedRAMP, NIST, audits, monitoring, dedicated resources | Millions annually; critical for government contracts and regulatory adherence. |

Revenue Streams

Telos generates revenue by licensing its advanced software, including the Xacta platform, to both government bodies and private companies. This model is a cornerstone of their business, providing essential cybersecurity and IT solutions.

A significant portion of this income comes from recurring subscription fees. These subscriptions grant customers ongoing access to the software's features, crucial updates, and dedicated support services, ensuring a consistent and reliable revenue flow for Telos.

For instance, in 2024, Telos reported substantial growth in its subscription-based revenue, reflecting the increasing demand for its cybersecurity solutions and the success of its Software-as-a-Service (SaaS) offerings. This recurring model is key to their financial stability and predictability.

Telos generates revenue through its professional services division, offering crucial support for system integration, implementation, and specialized cybersecurity consulting. This segment is vital for ensuring clients can effectively leverage Telos’s technology.

These expert services are frequently packaged alongside software licenses, creating a comprehensive solution, but are also available as separate, focused engagements. This flexibility allows Telos to address diverse client requirements, from initial setup to ongoing operational enhancement.

For instance, in 2024, Telos reported a significant portion of its revenue derived from these consulting engagements, demonstrating strong client demand for tailored expertise and implementation support. This revenue stream is critical for building deeper client relationships and ensuring successful adoption of their platforms.

Telos generates predictable revenue through managed services and support contracts. These agreements involve Telos actively overseeing and maintaining clients' cybersecurity infrastructure, ensuring continuous operation and security.

These long-term contracts provide a steady income stream by guaranteeing ongoing technical assistance, security updates, and system maintenance for the solutions Telos implements.

Government Contracts and Task Orders

Telos Corporation heavily relies on revenue generated from prime contracts and task orders issued by U.S. federal government agencies. These agreements often span multiple years and encompass critical services such as network modernization, cybersecurity governance, and the provision of secure communication solutions.

For instance, in 2024, Telos secured a significant five-year, $18.8 million contract with the U.S. Air Force for cybersecurity services. This type of government engagement forms a substantial part of their revenue model.

- Prime Contracts: Long-term agreements with government agencies for specific services.

- Task Orders: Smaller, project-based work issued under existing prime contracts.

- Key Service Areas: Network modernization, cybersecurity, and secure communications.

- Revenue Impact: These contracts represent a significant and stable revenue stream for Telos.

Identity Verification and Enrollment Service Fees

Telos generates revenue through fees for its identity verification and enrollment services. A significant portion of this comes from its role in processing applications and renewals for programs like TSA PreCheck. This direct-to-consumer channel is a key growth area for the company.

The company has strategically expanded its physical footprint for enrollment services, making it more accessible to travelers. This expansion directly supports the growth of its fee-based revenue streams.

- TSA PreCheck Program: Telos processes applications and renewals, generating fees per traveler.

- Direct-to-Consumer Growth: The company is actively developing its direct relationship with individual travelers for enrollment services.

- Expanded Enrollment Network: An increasing number of enrollment locations enhances accessibility and drives service fee revenue.

Telos's revenue streams are diverse, encompassing software licensing, professional services, managed services, government contracts, and identity verification fees. This multi-faceted approach ensures resilience and captures value across different market segments.

In 2024, Telos highlighted the strength of its recurring revenue from software subscriptions and managed services, which form a stable base for financial planning. The company also reported significant contributions from its government contracting work, particularly in cybersecurity and network modernization.

The TSA PreCheck program continues to be a notable revenue driver, with Telos processing a large volume of traveler applications and renewals. Expansion of enrollment locations in 2024 further bolstered this fee-based revenue stream.

| Revenue Stream | Description | 2024 Highlights |

|---|---|---|

| Software Licensing & Subscriptions | Licensing of Xacta platform and other software, with recurring subscription fees. | Strong growth in SaaS offerings, reflecting high demand for cybersecurity solutions. |

| Professional Services | System integration, implementation, and cybersecurity consulting. | Significant portion of revenue from tailored expertise and implementation support. |

| Managed Services & Support | Ongoing maintenance and oversight of clients' cybersecurity infrastructure. | Provided steady income through long-term contracts for technical assistance and security updates. |

| Government Contracts | Prime contracts and task orders with U.S. federal agencies. | Secured $18.8 million contract with U.S. Air Force for cybersecurity services. |

| Identity Verification Fees | Processing applications for programs like TSA PreCheck. | Increased accessibility through expanded enrollment locations drove service fee revenue. |

Business Model Canvas Data Sources

The Telos Business Model Canvas is built upon comprehensive market research, competitor analysis, and internal operational data. These sources provide the foundation for understanding customer needs, defining value propositions, and structuring revenue streams and cost structures effectively.