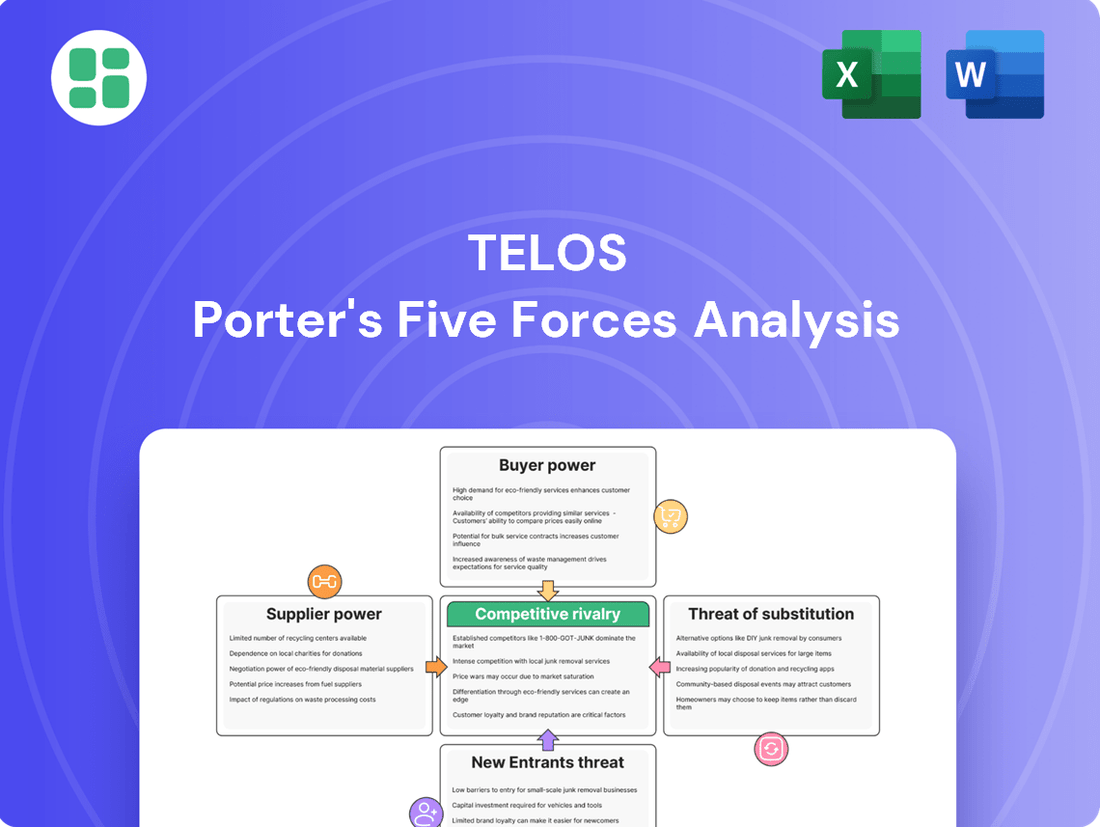

Telos Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Telos Bundle

Telos operates within a dynamic market, influenced by the bargaining power of buyers and suppliers, the threat of new entrants, and the intensity of rivalry. Understanding these forces is crucial for navigating its competitive landscape.

The complete report reveals the real forces shaping Telos’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Telos Corporation's reliance on specialized technology components, software licenses, and highly skilled cybersecurity talent places it at the mercy of its suppliers. If the market for these critical inputs is dominated by a small number of providers, those suppliers gain significant leverage. This concentration means they can dictate terms, potentially driving up costs for Telos or imposing less favorable contract conditions.

For instance, in the cybersecurity talent market, the demand for specialized skills often outstrips supply. In 2024, reports indicated a persistent shortage of cybersecurity professionals, with some specialized roles seeing salary increases of 15-20% year-over-year. This scarcity empowers the few individuals or firms possessing these niche skills, allowing them to command higher rates and exert greater bargaining power over companies like Telos.

The ease or difficulty for Telos to switch between its suppliers is a critical factor influencing supplier power. If Telos faces significant hurdles, like the expense of integrating new software platforms, retraining its workforce, or re-certifying existing solutions, its current suppliers gain considerable leverage. For instance, a major network infrastructure upgrade could cost millions and take months to implement, making a switch from a current provider extremely disruptive.

Conversely, if Telos can readily transition between suppliers with minimal disruption and cost, its ability to negotiate favorable terms or explore alternative providers is greatly enhanced. For example, if Telos primarily uses cloud-based services with standardized APIs, switching providers might only involve data migration and a short period of parallel operation. This low switching cost environment empowers Telos to drive down prices and demand better service levels from its suppliers.

The bargaining power of suppliers for Telos hinges significantly on the uniqueness of their offerings. If suppliers provide highly differentiated or proprietary technologies crucial for Telos's advanced cybersecurity solutions, such as specialized encryption algorithms or unique hardware components, their leverage increases. For instance, if a key supplier develops a novel quantum-resistant encryption module that Telos integrates into its flagship offerings, that supplier gains substantial power due to the difficulty in finding alternatives.

Conversely, if the inputs Telos requires are largely commoditized and readily available from multiple sources, supplier bargaining power is considerably weaker. In such scenarios, Telos can easily switch suppliers or negotiate more favorable terms, as the cost of switching is low and the differentiation among suppliers is minimal. This was evident in 2024 with the widespread availability of standard network interface cards, where Telos could source these components from numerous vendors at competitive prices, limiting any single supplier's ability to dictate terms.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Telos's core business, offering their own cybersecurity solutions, significantly bolsters their bargaining power. This potential for suppliers to become direct competitors can pressure Telos into accepting less favorable terms, impacting profitability and market share.

For instance, if a key software component supplier for Telos's cloud security platform were to develop and market a competing cloud security solution, it would directly challenge Telos's market position. Such a move would give the supplier leverage to demand higher prices for their components or dictate more stringent contract terms, knowing Telos might be hesitant to switch providers due to integration costs and potential disruptions.

- Supplier Forward Integration Threat: Suppliers developing competing cybersecurity solutions increase their leverage over Telos.

- Impact on Telos: This threat can lead to less favorable contract terms and increased costs for Telos.

- Example Scenario: A software component supplier launching a direct competitor to Telos's offerings.

Importance of Telos to Suppliers

The bargaining power of suppliers for Telos is significantly influenced by Telos's importance as a customer. If Telos constitutes a substantial portion of a supplier's revenue, that supplier is likely to offer more favorable terms to secure Telos's continued business. This financial dependence gives Telos leverage.

Conversely, if Telos is a minor client for a supplier, its ability to negotiate favorable terms or influence pricing is considerably diminished. In such scenarios, the supplier holds greater power, potentially dictating terms and pricing without significant concessions.

For instance, in 2024, companies heavily reliant on a single major client often see that client gain significant bargaining power. If Telos represents, say, over 15% of a key component supplier's annual sales, that supplier would be incentivized to maintain a strong relationship through competitive pricing and reliable supply chains.

- Telos's revenue contribution to suppliers

- Supplier reliance on Telos's business

- Impact on supplier willingness to offer favorable terms

- Telos's leverage based on its customer size

Telos's bargaining power with its suppliers is diminished when suppliers offer unique, critical inputs with few substitutes. This is particularly true for specialized cybersecurity components or proprietary software that Telos integrates deeply into its solutions. In 2024, the demand for advanced AI-driven threat detection modules, often developed by a limited number of firms, meant Telos faced suppliers with considerable pricing power. The high cost and complexity of switching such specialized technology further solidify supplier leverage.

Conversely, Telos gains leverage when it procures commoditized goods or services available from numerous providers, as seen with standard IT hardware in 2024. When Telos represents a significant portion of a supplier's business, that supplier is more inclined to offer favorable terms to retain Telos as a customer. This creates a dynamic where Telos can negotiate better pricing and service agreements.

| Factor | Impact on Supplier Bargaining Power | Telos's Position (2024 Context) |

|---|---|---|

| Uniqueness of Input | High power for unique/proprietary inputs | Elevated power for specialized AI modules |

| Availability of Substitutes | Low power with many substitutes | Reduced power for standard IT hardware |

| Switching Costs | High power with high switching costs | Increased power for integrated software platforms |

| Telos's Customer Importance | Low power if Telos is a small client | High power if Telos is a major client (e.g., >15% revenue) |

What is included in the product

This analysis dissects the competitive landscape for Telos by examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within its industry.

Instantly identify and quantify competitive threats with a visual, easy-to-understand dashboard, simplifying complex market dynamics.

Customers Bargaining Power

Telos's customer base is notably concentrated, with a significant portion of its revenue stemming from a few large clients, including federal government agencies, commercial enterprises, and international organizations. This concentration, particularly with major government entities like the U.S. Air Force and the Department of Defense, grants these customers substantial bargaining power. The sheer volume of their contracts and the financial impact of losing such significant business can heavily influence pricing and contract terms for Telos.

Customers face significant costs when switching cybersecurity providers. These expenses can include the complex process of re-integrating new systems, the time and resources needed to train staff on unfamiliar platforms, and the potential for operational disruptions during the transition period. These switching costs effectively anchor customers to their current providers, diminishing their leverage to demand lower prices or better terms.

Telos, with its deep integration into critical government systems, particularly through its Xacta platform for cyber governance, risk, and compliance (GRC), benefits from exceptionally high switching costs for its federal clients. This level of entanglement means that a change in provider would necessitate extensive re-validation and potentially significant rework, making it a less attractive option for government agencies.

Customer price sensitivity significantly amplifies their bargaining power. For instance, in government cybersecurity contracts, strict budget limitations and the nature of competitive bidding often make these clients highly attuned to price, pushing vendors towards lower margins.

Similarly, commercial businesses, particularly those procuring more standardized cybersecurity solutions, actively seek cost-effective options. This focus on affordability directly translates into increased customer leverage, compelling providers to justify their pricing or risk losing business to more budget-friendly competitors.

Customer Information and Transparency

When customers possess comprehensive information regarding Telos's pricing structures, underlying costs, and the availability of alternative solutions, their ability to negotiate favorable terms significantly increases. This transparency acts as a powerful lever, allowing them to benchmark offers and push for better value.

In the government sector, the inherent transparency surrounding bidding processes and contract award notifications directly enhances customer bargaining power. For instance, public tenders require clear disclosure of pricing and specifications, enabling government entities to solicit and secure the most competitive offers, often driving down prices for telecommunications services.

Similarly, for Telos's commercial clientele, the widespread availability of market comparisons and independent service reviews empowers them. Customers can easily access data on competitor pricing and service quality, enabling them to confidently negotiate for better rates or service level agreements, thereby increasing their leverage.

- Information Availability: Customers with access to pricing, cost breakdowns, and alternative provider information can negotiate more effectively.

- Government Sector Transparency: Public bidding and contract award processes empower government customers to demand competitive pricing from Telos.

- Commercial Client Leverage: Readily available market comparisons and service reviews allow commercial clients to negotiate from a position of strength.

Threat of Backward Integration by Customers

Customers, particularly large enterprises or government bodies, can enhance their bargaining power by developing cybersecurity solutions in-house. This threat of backward integration, while challenging for highly specialized functions, becomes a viable option if external providers like Telos are perceived as too costly or fail to meet unique requirements.

For instance, in 2024, the increasing availability of open-source security tools and the growing in-house cybersecurity expertise within major corporations could fuel this trend. If a significant customer base were to shift towards self-sufficiency, it would directly pressure Telos on pricing and service offerings.

- Customer Threat: The potential for customers to develop their own cybersecurity solutions in-house (backward integration) directly impacts Telos's pricing power.

- Cost and Specialization: While developing highly specialized cybersecurity tools in-house is resource-intensive, for certain broad needs, it can become economically feasible for large customers.

- Market Pressure: In 2024, the growing accessibility of advanced cybersecurity technologies and skilled talent globally could empower more large clients to consider developing proprietary solutions, increasing their leverage over vendors like Telos.

Telos's bargaining power with its customers is influenced by several factors, including customer concentration, switching costs, price sensitivity, information availability, and the threat of backward integration. A significant portion of Telos's revenue comes from a few large clients, particularly government agencies, which amplifies their negotiating leverage due to the sheer volume of their business.

High switching costs for customers, especially for federal clients using platforms like Xacta, create stickiness and reduce their inclination to seek alternatives. However, price sensitivity, particularly in government bidding and for commercial clients seeking cost-effective solutions, can pressure Telos on pricing. The availability of market information and transparency in government procurement processes further empowers customers to negotiate favorable terms.

The potential for large customers to develop cybersecurity solutions in-house, fueled by the increasing availability of open-source tools and in-house expertise, poses a direct threat to Telos's pricing power. This trend, observed in 2024, could lead to increased negotiation pressure on vendors like Telos.

| Factor | Impact on Telos's Customer Bargaining Power | Supporting Data/Observation (as of mid-2025) |

|---|---|---|

| Customer Concentration | High | Significant revenue derived from a few key federal agencies and large enterprises. |

| Switching Costs | Low for Customers (High for Telos to lose) | Deep integration of Xacta platform into government systems means high re-validation costs for clients. |

| Price Sensitivity | High | Government budget constraints and competitive bidding drive price focus; commercial clients seek cost-effectiveness. |

| Information Availability | High | Transparency in government tenders and accessible market comparisons for commercial clients. |

| Threat of Backward Integration | Growing | Increased availability of open-source tools and in-house expertise in 2024 empowers larger clients to consider self-sufficiency. |

Same Document Delivered

Telos Porter's Five Forces Analysis

This preview shows the exact Telos Porter's Five Forces Analysis you'll receive immediately after purchase, offering a comprehensive examination of competitive pressures within the industry. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors. This professionally formatted document is ready for your immediate use, ensuring no surprises and complete transparency.

Rivalry Among Competitors

The cybersecurity and IT solutions arena is a bustling marketplace, teeming with a vast array of companies. Telos finds itself in direct competition with a diverse group, including giants like Science Applications International and SHI, alongside specialized firms such as InfoObjects and PwC. This crowded field also features security-focused players like Thales Cloud Security, Delinea, SailPoint, Tenable, Optiv Security, and CynergisTek, all vying for market share.

The cybersecurity market is booming, with global growth projected at a 9.3% CAGR from 2025 to 2033. In the U.S. alone, this sector is expected to expand even faster, at a 12.5% CAGR from 2025 to 2032. This rapid expansion, while generally positive, intensifies competitive rivalry.

High industry growth acts as a magnet, drawing in new players eager to capture a piece of the expanding market. Simultaneously, it spurs existing competitors to ramp up their efforts, investing more in innovation and market penetration to secure a larger share. This dynamic fuels a constant state of competition.

Telos Corporation distinguishes itself through specialized offerings such as identity management, secure mobility, and robust cloud and enterprise security solutions, notably its Xacta platform. This high degree of product differentiation, often coupled with customer-specific integrations like the FedRAMP High Authorization for Xacta, serves to dampen direct competitive rivalry by creating unique value propositions.

However, the intensity of rivalry escalates if competitors can readily replicate Telos's specialized services or offer comparable functionalities. In such scenarios, the market pressure shifts towards competing on price or the continuous addition of new features, potentially eroding profit margins and increasing the overall competitive friction within the cybersecurity sector.

Exit Barriers

High exit barriers can significantly intensify competitive rivalry within an industry. When companies face substantial costs or difficulties in leaving the market, they are often compelled to continue operations even when facing low profitability. This persistence can lead to prolonged periods of overcapacity, which in turn fuels aggressive price competition as firms fight for market share.

Consider the airline industry, a prime example where exit barriers are notably high. The substantial investment in aircraft, specialized maintenance facilities, and long-term labor agreements makes exiting extremely costly. For instance, in 2023, global airlines continued to grapple with the aftermath of the pandemic, with many operating at reduced capacity but unwilling to divest expensive assets, leading to ongoing competitive pressures on ticket pricing.

- High Fixed Asset Investments: Industries with significant investments in specialized machinery or infrastructure, like manufacturing or telecommunications, present high exit barriers.

- Specialized Labor Skills: The need for highly trained or specialized employees can make it difficult and costly to downsize or exit, as severance and retraining costs mount.

- Long-Term Contracts and Commitments: Government contracts, leases, or long-term supply agreements can lock companies into an industry, even if market conditions deteriorate.

- Emotional and Managerial Attachment: Sometimes, founders or long-tenured management teams have a strong emotional or strategic attachment to a particular business, resisting closure.

Strategic Stakes and Aggressiveness of Competitors

The strategic goals and inherent aggressiveness of competitors in the cybersecurity market significantly shape the rivalry Telos faces. Companies focused on capturing market share or defending their existing positions often resort to aggressive tactics like price reductions, intensified research and development, and expansive marketing campaigns. This dynamic is particularly pronounced in cybersecurity, where the constant evolution of threats and the essential nature of these solutions necessitate continuous innovation and competitive maneuvering.

For instance, in 2024, the cybersecurity sector saw substantial investment and strategic plays. Major industry players reported significant increases in R&D spending to counter emerging AI-driven threats. Telos itself has been actively pursuing growth, as evidenced by its strategic partnerships and product development initiatives aimed at expanding its footprint in areas like cloud security and identity assurance.

The intensity of this rivalry is further underscored by:

- Aggressive Pricing Strategies: Competitors frequently adjust pricing to gain an edge, impacting market share and profitability for all involved.

- Accelerated Innovation Cycles: The rapid pace of cyber threat evolution forces companies to constantly update and improve their offerings, leading to a relentless R&D arms race.

- High Marketing Spend: Firms invest heavily in marketing and sales to build brand awareness and capture customer loyalty in a crowded marketplace.

- Mergers and Acquisitions: Consolidation through M&A activity is common as companies seek to acquire new technologies or expand their customer base, further intensifying competition.

The cybersecurity market is highly competitive, with numerous players vying for market share. Telos competes against large, diversified technology firms as well as specialized cybersecurity providers. This intense rivalry is fueled by high industry growth, with the global cybersecurity market projected to grow at a 9.3% CAGR from 2025 to 2033, and the U.S. market even faster at 12.5% CAGR from 2025 to 2032. This expansion attracts new entrants and encourages existing companies to innovate aggressively, often leading to price competition and increased R&D spending.

Telos differentiates itself through specialized solutions like identity management and its Xacta platform, which can mitigate direct rivalry. However, if competitors can easily replicate these offerings, competition intensifies, pushing firms to compete on price or features, potentially squeezing profit margins. High exit barriers, such as significant investments in specialized assets and labor, can further exacerbate rivalry by keeping less profitable firms in the market, leading to sustained competitive pressure.

Competitors' strategic goals, including aggressive market share capture, drive intense rivalry through price reductions, enhanced R&D, and extensive marketing. For example, in 2024, major cybersecurity firms increased R&D spending to counter AI threats, with Telos also pursuing growth through partnerships and product development. This dynamic results in aggressive pricing, rapid innovation cycles, high marketing expenditures, and frequent M&A activity as companies seek to gain a competitive edge.

| Metric | Value | Source/Year |

|---|---|---|

| Global Cybersecurity Market CAGR (2025-2033) | 9.3% | Projected |

| U.S. Cybersecurity Market CAGR (2025-2032) | 12.5% | Projected |

| Telos Xacta Platform Focus | Identity Management, Cloud Security | Company Information |

| Key Competitive Tactics | Price Reduction, R&D Investment, Marketing | Industry Analysis |

SSubstitutes Threaten

Telos faces a significant threat from substitutes as large organizations and government clients increasingly explore building their own cybersecurity defenses. Many are leveraging in-house IT expertise, which can reduce reliance on specialized vendors like Telos. This trend is amplified by the growing maturity and accessibility of generic IT services and open-source security solutions, offering cost-effective alternatives that chip away at Telos's addressable market.

The threat of substitutes for Telos's offerings hinges on the price-performance trade-off. If alternative solutions provide comparable security at a lower price point or superior performance at a similar cost, they become significantly more appealing to customers.

For example, the rise of robust open-source security tools, while demanding internal technical expertise, can present a more cost-effective option for organizations with the necessary capabilities. This forces customers to critically assess whether Telos's specialized features genuinely justify their premium over simpler or more budget-friendly alternatives.

In 2024, the cybersecurity market saw continued growth in the adoption of cloud-native security solutions and integrated platforms, often offered by hyperscalers, which can present a bundled value proposition that competes with specialized providers like Telos.

Customer willingness to switch from Telos to substitute cybersecurity providers hinges on the perceived risk and effort involved. While Telos's deeply integrated solutions can create high switching costs, a substantial perceived benefit, such as significantly lower pricing or a demonstrably superior new technology, could incentivize customers to navigate these barriers.

Evolving Threat Landscape and Generic Solutions

The cybersecurity threat landscape is a dynamic battlefield, with sophisticated attacks like AI-driven malware and the proliferation of ransomware-as-a-service models constantly emerging. Generic or internally developed security solutions often lag behind these advancements, struggling to provide robust protection against novel threats. For instance, a 2024 report indicated that organizations relying solely on legacy systems faced a 30% higher risk of successful ransomware attacks compared to those with updated, adaptive defenses.

However, the threat of substitutes is amplified if a competitor can offer solutions that rapidly adapt to these evolving threats. Imagine a substitute provider that can quickly deploy broad, easily implementable defenses against newly identified malware strains. Such agility could significantly diminish the perceived necessity for Telos's highly specialized, often custom-built, security offerings. For example, if a cloud-based security platform can integrate new threat intelligence and update its protection protocols across all clients within hours, it presents a compelling alternative to on-premises, manually updated systems.

- Rapidly evolving threats: AI-driven attacks and ransomware-as-a-service are increasing the complexity of cybersecurity challenges.

- Lagging generic solutions: In-house or outdated security measures often fail to keep pace with emerging threats.

- Substitute adaptability: A competitor offering swift adaptation to new threats with broad, easily deployed defenses poses a significant risk.

- Impact on Telos: Such agile substitutes could reduce customer reliance on Telos's specialized, potentially slower-to-update, solutions.

Regulatory and Compliance Requirements

Telos's role in ensuring regulatory and compliance adherence, particularly within the federal government, significantly mitigates the threat of substitutes. For instance, achieving FedRAMP authorization, a key benchmark for cloud services used by federal agencies, is a complex and resource-intensive process. Many in-house or generic IT solutions may lack the specialized expertise or dedicated resources to navigate these stringent requirements effectively, thereby making Telos a more attractive option.

The threat of substitutes is therefore lower when these alternatives cannot readily meet demanding compliance standards. However, the landscape can shift. If new, innovative solutions emerge that demonstrably and cost-effectively simplify compliance with regulations like NIST SP 800-53 or HIPAA, they could present a more substantial competitive challenge to Telos.

Consider the market for secure data management. While Telos offers robust solutions, a hypothetical new entrant that provides an equally secure platform with a significantly streamlined compliance onboarding process, perhaps leveraging AI for automated compliance checks, could attract customers seeking efficiency. This highlights the dynamic nature of substitute threats in a compliance-driven market.

- FedRAMP Authorization: A complex process requiring significant investment, potentially deterring less specialized IT solutions.

- NIST and HIPAA Compliance: Critical for government and healthcare sectors, respectively, demanding specific security controls.

- Emerging Technologies: AI-driven compliance tools could lower the barrier to entry for substitute solutions.

- Cost-Benefit Analysis: Customers weigh the cost of compliance against the perceived value and security offered by Telos versus alternatives.

The threat of substitutes for Telos is influenced by the availability of cost-effective, albeit less specialized, alternatives. Organizations with strong internal IT capabilities or those prioritizing budget might opt for open-source security tools or managed IT services that offer a baseline level of protection. In 2024, the market saw a continued push towards integrated cloud security platforms, which can bundle various security functions, potentially reducing the need for standalone solutions like those Telos specializes in.

Entrants Threaten

Entering the cybersecurity and IT solutions market, particularly for government and large enterprise clients, demands significant capital. This includes substantial investments in research and development, robust infrastructure, obtaining crucial certifications, and attracting top-tier talent. For instance, the cybersecurity market alone was projected to reach $345 billion in 2024, highlighting the scale of investment needed to compete.

Telos Corporation's strategic focus on intricate solutions and securing government contracts inherently involves high upfront expenditures. These considerable financial barriers effectively deter new, smaller players from entering and challenging established companies like Telos, thereby reducing the threat of new entrants.

Serving the federal government and highly regulated industries, like defense and healthcare, necessitates obtaining specific certifications and adhering to stringent regulatory requirements. For example, achieving FedRAMP High Authorization, as Telos's Xacta platform did, requires significant investment in time, resources, and expertise.

New companies face a significant hurdle in accessing established distribution channels and customer relationships, particularly within the federal government and large commercial sectors. Building trust and securing long-term contracts with these entities is a time-consuming and resource-intensive endeavor.

Telos benefits from its deep-rooted network and existing partnerships. For instance, its substantial $12.5 billion DAF contract, alongside numerous other contracts secured through 2024 and into 2025, demonstrates a strong market presence. This established customer base and the ongoing revenue streams from these agreements create a formidable barrier to entry for newcomers attempting to penetrate these lucrative markets.

Specialized Expertise and Talent Shortage

The cybersecurity sector grapples with a pronounced shortage of qualified professionals, evidenced by millions of vacant roles worldwide. This talent deficit creates a substantial barrier for new companies aiming to establish themselves, as building the specialized teams necessary for cutting-edge cybersecurity solutions is exceptionally difficult.

This skills gap directly benefits established players like Telos, who have already invested in and cultivated their expert workforce. For instance, in 2024, estimates suggest the global cybersecurity workforce gap could exceed 3.5 million professionals, making it a significant hurdle for any nascent competitor.

- Talent Shortage: Millions of unfilled cybersecurity positions globally in 2024.

- Specialized Skills: Developing advanced solutions requires highly specific expertise.

- Barrier to Entry: New entrants struggle to assemble the necessary skilled teams.

- Incumbent Advantage: Existing firms like Telos benefit from their established talent pools.

Economies of Scale and Experience Curve

Existing players like Telos leverage significant economies of scale in their research, development, and deployment of advanced cybersecurity solutions. This scale allows them to spread fixed costs over a larger output, leading to lower per-unit costs. For instance, in 2024, Telos reported substantial investments in its cloud security platforms, benefiting from existing infrastructure and customer bases to drive down marginal costs for new clients.

Furthermore, Telos benefits from an experience curve, accumulating deep knowledge in navigating complex regulatory landscapes and understanding evolving threat vectors, particularly in areas like cyber governance, risk, and compliance (GRC). This accumulated expertise translates into more effective and tailored solutions. New entrants face the daunting task of matching these cost efficiencies and the nuanced understanding that comes from years of practical application and client engagement, potentially hindering their ability to compete on price and solution sophistication.

For example, the cybersecurity market in 2024 saw continued consolidation, with larger firms acquiring smaller ones to gain market share and technological capabilities. This trend underscores the advantage of scale. New entrants must overcome substantial barriers to entry, including the high cost of R&D, establishing brand trust, and building a robust sales and support infrastructure, which Telos has already cultivated over decades.

- Economies of Scale: Telos can achieve lower production costs per unit due to its large operational capacity, making its offerings more price-competitive.

- Experience Curve: Decades of operation have allowed Telos to refine its processes and develop specialized expertise, particularly in niche GRC markets.

- High Entry Costs for Newcomers: Significant upfront investment is required for R&D, talent acquisition, and market penetration, posing a challenge for new entrants.

- Brand Reputation and Trust: Telos's established reputation provides a competitive edge, as clients often prioritize reliability and proven performance in cybersecurity solutions.

The threat of new entrants for Telos is significantly mitigated by high capital requirements, with the cybersecurity market projected to reach $345 billion in 2024, demanding substantial R&D and infrastructure investment. Furthermore, stringent certifications like FedRAMP High, which Telos's Xacta platform has achieved, create considerable financial and operational hurdles for newcomers. The established customer relationships and distribution channels, particularly within the federal government, represent another formidable barrier, as evidenced by Telos's extensive contract portfolio, including a $12.5 billion DAF contract. Finally, the severe talent shortage in cybersecurity, with millions of unfilled roles globally in 2024, makes it exceedingly difficult for new companies to assemble the specialized teams necessary to compete effectively.

| Barrier Type | Description | Impact on New Entrants | Telos's Advantage |

| Capital Requirements | High R&D, infrastructure, and certification costs | Significant financial hurdle | Economies of scale from existing investments |

| Regulatory & Certification | Need for specialized compliance (e.g., FedRAMP) | Time-consuming and resource-intensive | Established compliance expertise and existing certifications |

| Customer Relationships & Distribution | Access to government and large enterprise clients | Difficult to build trust and secure contracts | Deeply entrenched network and long-term contracts |

| Talent Acquisition | Shortage of skilled cybersecurity professionals | Challenging to build specialized teams | Cultivated and experienced workforce |

Porter's Five Forces Analysis Data Sources

Our Telos Porter's Five Forces analysis is built upon a robust foundation of data, including company annual reports, industry-specific market research, and publicly available financial disclosures. This comprehensive approach ensures a thorough understanding of competitive dynamics.