Suzuken Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Suzuken Bundle

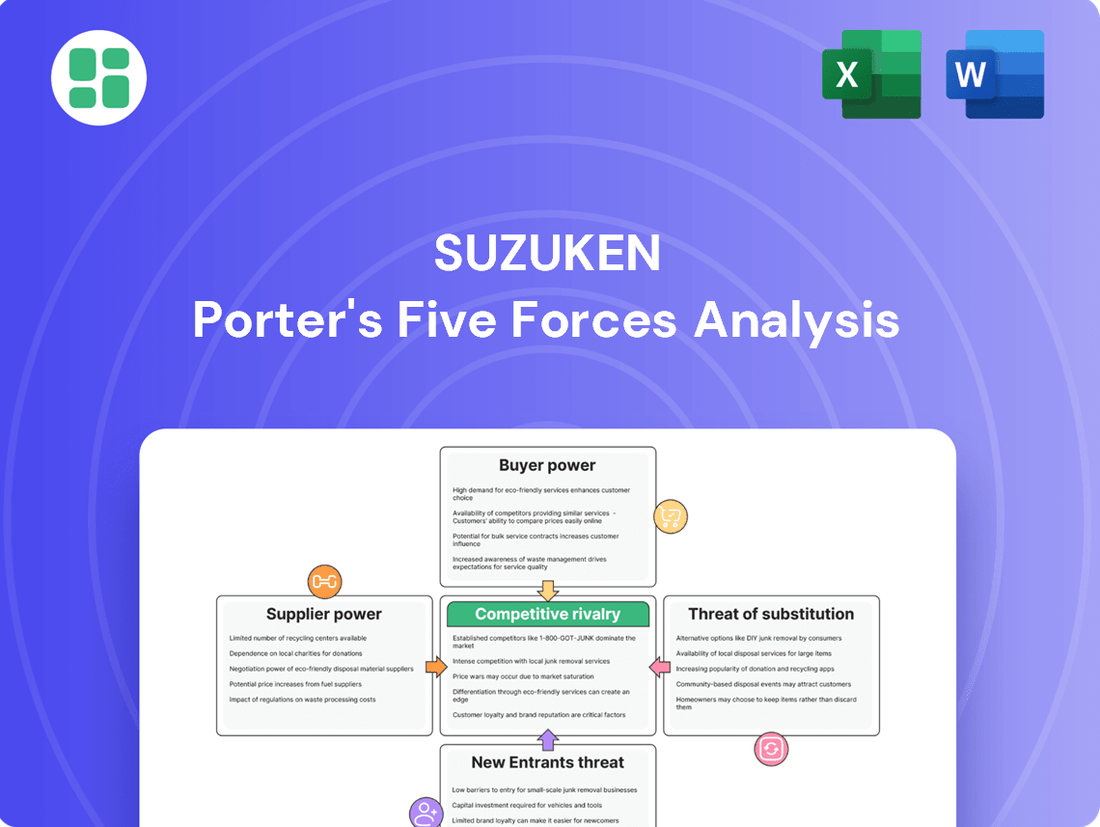

Suzuken's competitive landscape is shaped by the interplay of five key forces, influencing its profitability and strategic direction. Understanding the power of buyers, the threat of substitutes, and the intensity of rivalry is crucial for navigating this market.

The complete report reveals the real forces shaping Suzuken’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The concentration of pharmaceutical manufacturers and medical device companies, particularly those holding patents or offering highly specialized products, directly influences their sway over Suzuken. When a handful of major suppliers dominate the market for crucial drugs or equipment, Suzuken's capacity to secure advantageous pricing diminishes, especially if finding suitable replacements is challenging or unfeasible for vital supplies.

Suppliers who offer highly differentiated, patented, or unique pharmaceuticals and medical devices wield significant bargaining power. For instance, a critical patented drug with no immediate generic alternatives allows the manufacturer to dictate terms to wholesalers like Suzuken, who depend on these specialized products to serve their hospital and pharmacy clients. This reliance grants the supplier leverage in pricing and supply agreements, impacting Suzuken's cost of goods sold.

The costs Suzuken faces when changing suppliers significantly impact supplier bargaining power. These costs can include renegotiating contracts, adapting logistics, and managing potential supply chain disruptions. For instance, if Suzuken relies on a specialized component requiring extensive testing and integration with its existing systems, the cost of switching suppliers could be substantial, thus empowering the current supplier.

High switching costs for particular product categories or established strategic partnerships can solidify a supplier's leverage. This makes it more challenging for Suzuken to explore alternative suppliers without incurring significant financial or operational penalties. In 2023, the global pharmaceutical supply chain experienced notable disruptions, highlighting the financial implications of such transitions for companies like Suzuken.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers, such as pharmaceutical manufacturers or medical device companies, can directly impact Suzuken's position. If these suppliers possess the capability and the motivation to bypass intermediaries like Suzuken and distribute their products directly to healthcare facilities, their bargaining power escalates. This scenario, while not prevalent for all product lines, becomes a more tangible risk for high-value or specialized medical goods.

For instance, a major pharmaceutical company might invest in its own logistics network to deliver temperature-sensitive biologics directly to hospitals, thereby controlling the entire supply chain. This move would diminish Suzuken's intermediary role and potentially reduce its revenue streams from such products. In 2023, the global pharmaceutical distribution market was valued at over $1.5 trillion, highlighting the significant scale and potential for disruption within this sector.

- Supplier Capability: Suppliers' ability to establish and manage their own distribution networks, including warehousing and last-mile delivery.

- Niche Product Focus: The threat is more pronounced for specialized or high-margin products where direct customer relationships offer greater value.

- Logistical Investments: The cost and complexity of setting up independent distribution channels can be a barrier for some suppliers.

Importance of Suzuken to Suppliers

The significance of Suzuken as a distribution channel directly impacts a supplier's bargaining power. If Suzuken accounts for a considerable percentage of a supplier's revenue, or if it offers unparalleled access to Japan's extensive healthcare network, suppliers are more inclined to negotiate favorable terms to preserve this crucial partnership. This reliance can shift power dynamics, potentially reducing supplier leverage.

For instance, in 2023, Suzuken's extensive network reached over 90% of medical institutions in Japan, highlighting its indispensable role for pharmaceutical and medical device manufacturers seeking market penetration. This broad reach means suppliers often have limited alternatives for comparable distribution reach, thereby enhancing Suzuken's influence in negotiations.

Consider the following:

- Distribution Reach: Suzuken's presence in over 90% of Japanese medical institutions in 2023 gives it significant leverage over suppliers.

- Sales Dependence: Suppliers heavily reliant on Suzuken for a substantial portion of their sales are less likely to exert strong bargaining power.

- Market Access: The ability of Suzuken to provide access to a diverse and widespread customer base in the Japanese healthcare sector amplifies its importance to suppliers.

The bargaining power of suppliers to Suzuken is influenced by their concentration and the uniqueness of their offerings. For example, a few dominant pharmaceutical manufacturers controlling patented drugs can dictate terms, as seen in the global pharmaceutical market where specialized treatments command premium pricing. This concentration means Suzuken has fewer alternatives for essential, high-demand products, amplifying supplier leverage and impacting Suzuken's cost of goods sold.

High switching costs for Suzuken further empower suppliers. If changing suppliers involves significant expenses related to contract renegotiation, logistics adaptation, or system integration, current suppliers gain considerable leverage. The global supply chain disruptions in 2023 underscored the financial risks associated with supplier transitions, making companies hesitant to switch, thus strengthening the position of established suppliers.

| Factor | Impact on Suzuken | Example/Data Point (2023/2024) |

|---|---|---|

| Supplier Concentration | Increases bargaining power | Dominance of a few key pharmaceutical patent holders |

| Product Differentiation | Increases bargaining power | Patented drugs with no generic alternatives |

| Switching Costs | Increases bargaining power | High costs for integrating specialized medical equipment |

| Forward Integration Threat | Reduces Suzuken's role | Direct distribution by large pharmaceutical companies |

| Suzuken's Distribution Reach | Reduces bargaining power | Suzuken's 2023 reach of over 90% of Japanese medical institutions |

What is included in the product

This Suzuken Porter's Five Forces analysis dissects the competitive landscape, examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the pharmaceutical distribution industry.

Instantly identify and quantify competitive pressures with a visual breakdown of each force, enabling targeted strategic responses.

Customers Bargaining Power

The bargaining power of Suzuken's customers, particularly large hospital groups and pharmacy chains, is significantly shaped by their purchasing volume and concentration. These major clients, by virtue of their substantial orders, can negotiate for more favorable pricing, improved terms, and enhanced services, effectively leveraging their scale to influence Suzuken's offerings.

For instance, if a few key hospital networks represent a substantial portion of Suzuken's sales, their ability to switch suppliers or consolidate purchasing power increases their leverage. This concentration means Suzuken must remain competitive and responsive to the needs of these large-volume buyers to maintain its market share.

Japanese healthcare facilities are deeply price-sensitive due to the nation's regulated healthcare system and ongoing efforts to control costs. This sensitivity means they actively seek the lowest prices for pharmaceuticals and medical supplies.

This focus on cost-effectiveness directly enhances their bargaining power when dealing with pharmaceutical wholesalers such as Suzuken. Facilities are likely to switch suppliers if better pricing is available, forcing wholesalers to compete aggressively on price.

For instance, in 2023, Japan's Ministry of Health, Labour and Welfare implemented drug price revisions that aimed to reduce overall healthcare spending, further intensifying the pressure on suppliers to offer competitive pricing to providers.

The bargaining power of customers is significantly influenced by the availability of alternative wholesalers in Japan. With major players like Medipal and Alfresa, hospitals, clinics, and pharmacies have multiple sourcing options for pharmaceuticals.

This competitive landscape, where switching between Suzuken and its rivals often incurs minimal costs, empowers customers. They can leverage the presence of alternatives to negotiate more favorable pricing and service terms, directly impacting Suzuken's profitability and market position.

Standardization of Products

When products are standardized, like generic drugs or common medical supplies, it becomes much harder for companies like Suzuken to make their offerings stand out. This means customers, such as pharmacies or hospitals, have more choices and can easily switch to a competitor if they find a better deal or faster delivery. For instance, the global generic drugs market was valued at approximately $400 billion in 2023 and is projected to grow, highlighting the sheer volume of standardized products in the pharmaceutical sector.

This lack of unique features forces wholesalers to compete heavily on price and service. Consequently, customers gain significant leverage because they can readily compare and select the most cost-effective or convenient supplier. This dynamic directly increases the bargaining power of customers in the pharmaceutical distribution industry.

Specifically for Suzuken:

- Minimal Product Differentiation: In the generic pharmaceutical segment, where Suzuken operates, products are often identical in terms of active ingredients and efficacy.

- Price Sensitivity: Customers, particularly large hospital networks or retail pharmacy chains, can exert considerable pressure on pricing due to the availability of multiple identical options.

- Focus on Operational Efficiency: Wholesalers must excel in logistics and supply chain management to retain customers, as product features offer little competitive advantage.

Threat of Backward Integration by Customers

The threat of backward integration by customers, while not a widespread concern for individual hospitals, poses a potential leverage point for larger entities. Major hospital groups or integrated healthcare networks could, in theory, bypass distributors like Suzuken by sourcing directly from pharmaceutical manufacturers or even establishing their own distribution capabilities.

This possibility, even if distant, grants these large healthcare systems a degree of bargaining power. It presents them with an alternative supply chain option, which they can implicitly or explicitly use to negotiate more favorable terms with Suzuken.

For instance, as of late 2024, some large US hospital systems have been exploring greater vertical integration to control costs and supply chains. While direct distribution arms are still nascent, the trend towards consolidation and self-sufficiency in healthcare procurement signals a growing potential for this threat.

- Customer Bargaining Power: Large hospital groups and integrated healthcare networks possess leverage due to the potential for backward integration.

- Direct Sourcing: These entities can explore direct purchasing from drug manufacturers, bypassing intermediaries.

- In-house Distribution: The formation of their own distribution arms is another avenue for backward integration.

- Negotiation Leverage: This potential for alternative supply chains strengthens their position when negotiating with distributors like Suzuken.

The bargaining power of Suzuken's customers is substantial, driven by price sensitivity in Japan's regulated healthcare system, which was further emphasized by the Ministry of Health, Labour and Welfare's 2023 drug price revisions aimed at cost reduction. The availability of numerous alternative wholesalers, such as Medipal and Alfresa, coupled with the standardized nature of many pharmaceutical products, allows customers to easily switch suppliers for better pricing and service. This is particularly true for generic drugs, a segment valued at approximately $400 billion globally in 2023. While direct backward integration by individual hospitals is limited, large healthcare networks could potentially bypass distributors by sourcing directly from manufacturers or developing their own distribution capabilities, a trend observed in some US systems exploring vertical integration by late 2024.

| Factor | Impact on Suzuken's Customers | Example/Data Point |

|---|---|---|

| Price Sensitivity | High; customers actively seek lowest prices. | Japan's 2023 drug price revisions aimed at cost reduction. |

| Availability of Alternatives | High; multiple wholesalers exist. | Major competitors include Medipal and Alfresa. |

| Product Standardization | High; especially for generics, enabling easy switching. | Global generic drug market valued at ~$400 billion in 2023. |

| Backward Integration Potential | Moderate to High for large entities. | Trend of vertical integration in some US healthcare systems (late 2024). |

Preview Before You Purchase

Suzuken Porter's Five Forces Analysis

This preview showcases the complete Suzuken Porter's Five Forces Analysis, offering an in-depth examination of the competitive landscape within its industry. The document you see here is the exact, professionally formatted file you will receive immediately after purchase, ensuring full transparency and immediate usability.

Rivalry Among Competitors

The Japanese pharmaceutical wholesale market is dominated by a few major players, creating an oligopolistic environment. Suzuken, Medipal Holdings, and Alfresa Holdings are the key competitors, each holding significant market share. This concentration leads to fierce competition as these companies vie for dominance.

In 2023, the combined market share of these top three companies was substantial, with Suzuken reporting ¥1.9 trillion in sales, Medipal Holdings ¥2.1 trillion, and Alfresa Holdings ¥2.3 trillion. This intense rivalry compels them to compete vigorously on factors like pricing strategies, the efficiency of their distribution networks, and the quality of services offered to pharmacies and hospitals nationwide.

In Japan's pharmaceutical wholesale sector, a mature market, the industry growth rate is projected to be modest, around 1-2% annually through 2025. This moderate expansion means competition is fierce, with companies like Suzuken focusing on capturing existing market share rather than benefiting from broad market growth. This environment often spurs aggressive pricing and a push for differentiated value-added services to stand out.

While the fundamental pharmaceutical products themselves are largely similar, competition among distributors like Suzuken intensifies through the provision of value-added services. This often includes sophisticated logistics and exceptional customer support, making these crucial differentiators.

Suzuken actively distinguishes itself by offering advanced inventory management systems, vital clinical support for healthcare providers, and integrated IT solutions. These tailored services are key to securing and expanding its client base within the healthcare sector.

For instance, in 2024, the pharmaceutical wholesale market saw continued investment in digital transformation, with companies like Suzuken enhancing their e-commerce platforms and data analytics capabilities to provide more personalized service offerings, thereby strengthening customer loyalty.

High Fixed Costs and Exit Barriers

The pharmaceutical wholesale sector, including companies like Suzuken, is characterized by substantial fixed costs. Significant capital is tied up in advanced logistics networks, temperature-controlled warehousing, and sophisticated IT systems essential for drug distribution and compliance. For instance, building and maintaining a nationwide distribution network can easily run into hundreds of millions of dollars.

These high upfront investments, combined with specialized equipment and deeply entrenched relationships with pharmaceutical manufacturers and healthcare providers, erect formidable exit barriers. Companies are essentially locked into the industry, as selling off specialized assets at a fair market value is difficult. This forces players to continue operating and competing vigorously, even when market conditions are unfavorable, to recoup their initial investments.

- High Capital Investment: The pharmaceutical wholesale industry demands substantial investment in logistics, warehousing, and IT infrastructure, creating a high barrier to entry and operation.

- Specialized Assets: The need for temperature-controlled storage and specialized transport for pharmaceuticals means assets are not easily repurposed, increasing exit costs.

- Entrenched Relationships: Long-standing partnerships with both suppliers and customers create switching costs and further solidify a company's commitment to the market.

- Operational Scale: Achieving economies of scale is crucial for profitability, meaning companies must operate at a significant volume, making it difficult to scale down or exit without substantial losses.

Price Competition and Regulatory Impact

The Japanese healthcare system's frequent drug price revisions and cost containment policies, including biennial price cuts, place continuous downward pressure on pharmaceutical prices. For instance, the 2024 drug price revision saw an average price reduction of 3.9%.

This environment fuels intense price competition among pharmaceutical wholesalers like Suzuken. They are compelled to operate on thin margins while simultaneously investing in expansive distribution networks and upholding high service standards to retain market share.

- Downward Price Pressure: Frequent government-mandated drug price revisions in Japan directly impact wholesaler revenue.

- Margin Squeeze: Cost containment policies force wholesalers to compete aggressively on price, compressing profit margins.

- Operational Demands: Maintaining extensive distribution and high service levels amidst price pressure requires significant operational efficiency.

The competitive rivalry within Japan's pharmaceutical wholesale market is intense, driven by a concentrated industry structure and modest growth prospects. Suzuken, Medipal Holdings, and Alfresa Holdings are the dominant players, each holding significant market share. This oligopolistic environment forces companies to compete fiercely on price, distribution efficiency, and value-added services to capture existing market share.

In 2023, the combined sales of these top three companies reached ¥6.3 trillion, underscoring their market dominance and the scale of competition. With an anticipated industry growth rate of only 1-2% annually through 2025, companies like Suzuken must differentiate themselves through superior logistics, advanced IT solutions, and robust customer support to maintain and expand their positions.

| Competitor | 2023 Sales (JPY Trillions) | Key Competitive Factors |

|---|---|---|

| Suzuken | 1.9 | Advanced inventory systems, clinical support, IT solutions |

| Medipal Holdings | 2.1 | Distribution efficiency, pricing strategies |

| Alfresa Holdings | 2.3 | Customer service quality, nationwide network |

SSubstitutes Threaten

Large healthcare institutions, such as major hospital systems and integrated delivery networks, are increasingly exploring direct procurement of pharmaceuticals and medical devices from manufacturers. This strategy bypasses traditional distribution channels, including those provided by companies like Suzuken.

This direct purchasing trend serves as a significant substitute threat because it offers potential cost reductions and enhanced control over inventory and supply chains. For instance, in 2024, some large hospital groups reported savings of up to 5-10% on high-volume drug purchases by negotiating directly with pharmaceutical companies, a saving that directly impacts the value proposition of intermediaries like Suzuken.

Manufacturer-direct distribution channels represent a significant threat, particularly for specialized or high-margin pharmaceuticals and medical devices. For instance, a company launching a novel gene therapy might opt for direct delivery to hospitals to ensure proper cold chain management and specialized training, bypassing intermediaries like Suzuken. This direct approach can offer manufacturers greater control over product integrity and customer relationships, acting as a viable substitute for Suzuken's established wholesale network for these specific product segments.

The increasing adoption of digital health and telemedicine solutions presents a potential threat of substitutes for traditional healthcare distribution models. For instance, by mid-2024, a significant portion of routine medical consultations were being conducted remotely, reducing the need for in-person visits and, by extension, the associated physical product demand. This shift could indirectly impact Suzuken's sales volume for certain medical supplies and pharmaceuticals as healthcare delivery evolves.

Alternative Therapies and Preventive Medicine

The growing interest in alternative therapies and preventive medicine poses a threat to Suzuken's traditional pharmaceutical distribution model. A significant shift in consumer preference towards lifestyle interventions or natural remedies could diminish the demand for conventional drugs. For instance, by 2024, the global wellness market, which includes preventive health, was valued at over $5.6 trillion, indicating a substantial and growing consumer base seeking alternatives to traditional healthcare.

This trend represents a potential substitute for the core products Suzuken distributes. As more individuals adopt holistic health approaches, the reliance on pharmaceuticals for certain conditions may decrease. This could impact Suzuken's sales volume and market share in the long run, necessitating strategic adaptation to this evolving healthcare landscape.

- Growing Wellness Market: The global wellness market's expansion signifies a strong consumer pull towards preventive and alternative health solutions.

- Shift in Healthcare Spending: Increased investment in preventive care and lifestyle interventions could divert spending away from traditional pharmaceuticals.

- Demand for Natural Remedies: The rising popularity of natural and traditional medicine offers direct substitutes for many pharmaceutical products.

- Long-term Impact on Distribution: Suzuken must consider how this trend will affect its product portfolio and distribution strategies in the coming years.

Generic Drug Substitution

The threat of generic drug substitution poses a significant challenge for Suzuken. While the company distributes both branded and generic pharmaceuticals, a growing trend towards generic substitution by healthcare providers and government initiatives to promote cost-effective treatments could alter Suzuken's revenue streams and profit margins. This shift impacts the product mix, favoring lower-priced alternatives and influencing wholesale pricing dynamics within the pharmaceutical distribution sector.

This substitution dynamic is particularly relevant in 2024, with governments worldwide continuing to push for greater use of generics to curb healthcare spending. For instance, in the United States, the FDA actively promotes generic drug availability, and by the end of 2023, approximately 90% of all prescriptions filled were for generic drugs, highlighting the widespread adoption of these alternatives.

- Increased Generic Adoption: Healthcare systems and payers are increasingly incentivizing the use of generic drugs, directly impacting the demand for branded alternatives.

- Margin Pressure: A higher volume of generic sales typically means lower per-unit margins compared to branded drugs, potentially squeezing Suzuken's profitability.

- Wholesale Market Shifts: The preference for generics can alter the bargaining power between manufacturers, distributors like Suzuken, and pharmacies, leading to different wholesale pricing structures.

The rise of direct-to-consumer (DTC) sales models for certain health products presents a substitute threat by allowing patients to bypass traditional distribution channels. For example, by mid-2024, a notable increase in online pharmacies and direct sales of over-the-counter medications and even some prescription drugs was observed, offering convenience and potentially lower prices for consumers.

This trend can directly impact Suzuken by reducing the volume of products flowing through its wholesale network. As consumers become more accustomed to purchasing health-related items directly online or from manufacturers, the traditional intermediary role of distributors like Suzuken may diminish for certain product categories.

| Substitute Channel | Impact on Suzuken | Example Data (2024) |

|---|---|---|

| Direct Procurement by Healthcare Institutions | Reduced sales volume, potential margin erosion | Hospitals reporting 5-10% savings on high-volume drugs via direct sourcing. |

| Manufacturer-Direct Distribution | Loss of market share for specialized products | Novel therapies often utilize direct delivery for specialized handling. |

| Digital Health & Telemedicine | Indirect impact on physical product demand | Increased remote consultations reducing need for in-person product dispensing. |

| Alternative Therapies & Wellness | Shift in consumer preference away from pharmaceuticals | Global wellness market exceeding $5.6 trillion, indicating strong alternative demand. |

| Generic Drug Substitution | Pressure on branded drug sales, margin compression | ~90% of prescriptions filled with generics in the US by end of 2023. |

| Direct-to-Consumer (DTC) Sales | Bypassing intermediaries, reduced wholesale volume | Growth in online pharmacies and direct sales of OTC and some prescription drugs. |

Entrants Threaten

Establishing a pharmaceutical wholesale operation in Japan demands significant upfront capital. Companies need to invest heavily in sophisticated logistics networks, including temperature-controlled warehousing and robust cold chain capabilities, to ensure product integrity. For instance, building out a nationwide distribution infrastructure comparable to existing players could easily run into billions of yen, a substantial hurdle for newcomers.

The pharmaceutical industry in Japan, where Suzuken operates, is exceptionally regulated. This means any new entrant must secure numerous licenses, adhere to stringent quality control standards, and comply with complex distribution laws. For instance, in 2024, the Pharmaceuticals and Medical Devices Agency (PMDA) continues to enforce rigorous approval processes for new drugs, which can take years and significant investment to navigate successfully.

These extensive regulatory hurdles create a substantial barrier to entry. The sheer cost and time associated with obtaining the necessary approvals and maintaining compliance make it exceedingly difficult for new companies to gain a foothold. This complexity significantly deters potential new competitors from challenging established players like Suzuken.

Suzuken benefits from deeply entrenched relationships with both suppliers, primarily pharmaceutical manufacturers, and a vast customer base of hospitals, clinics, and pharmacies throughout Japan. These established networks, cultivated over decades, foster trust and loyalty, making it challenging for newcomers to gain traction.

For instance, as of fiscal year 2023, Suzuken reported a network covering approximately 90% of medical institutions in Japan, a testament to its long-standing presence and strong partnerships. Replicating this extensive reach and the associated trust would require significant time and investment from any new entrant.

Economies of Scale and Experience Curve Effects

Incumbent pharmaceutical wholesalers like Suzuken leverage substantial economies of scale, a significant barrier for new entrants. Their massive purchasing volumes allow for better negotiation power with manufacturers, leading to lower acquisition costs. For example, in 2024, major wholesalers reported operating margins in the low single digits, underscoring the necessity of high volume to achieve profitability.

Furthermore, established players benefit from the experience curve in logistics and distribution. Years of optimizing routes, warehouse management, and inventory control translate into lower per-unit delivery costs. A new entrant would face considerable upfront investment and a learning curve to match these efficiencies, making it difficult to compete on price.

- Economies of Scale: Suzuken and its peers benefit from bulk purchasing, reducing per-unit acquisition costs from pharmaceutical manufacturers.

- Logistical Efficiency: Extensive distribution networks and optimized supply chains built over years lower per-unit delivery expenses.

- Cost Disadvantage for Newcomers: Entrants would require significant initial investment and time to achieve comparable cost structures.

- Pricing Pressure: Existing players' cost advantages enable them to offer competitive pricing, squeezing potential new entrants.

Brand Reputation and Trust in Healthcare Supply Chain

In the healthcare supply chain, brand reputation is a significant barrier to entry. Suzuken's established trust, built on consistent supply and quality assurance, makes it difficult for new players to gain traction. Healthcare providers prioritize reliability, and replicating Suzuken's decades of proven performance is a substantial hurdle.

New entrants must overcome the challenge of establishing credibility in a sector where patient safety is paramount. This requires significant investment in infrastructure, regulatory compliance, and building relationships with healthcare institutions. For instance, a new entrant might need to demonstrate adherence to stringent Good Distribution Practices (GDP) regulations, a process that can take years and substantial capital.

- Brand Loyalty: Healthcare providers often exhibit strong loyalty to established suppliers like Suzuken due to proven track records.

- Regulatory Hurdles: Navigating complex healthcare regulations and obtaining necessary certifications presents a significant barrier for newcomers.

- Capital Investment: Building a reliable healthcare supply chain requires substantial investment in logistics, warehousing, and technology, estimated to be millions of dollars for a national operation.

- Risk Aversion: The high-stakes nature of healthcare means providers are generally risk-averse, preferring to work with trusted, established partners.

The threat of new entrants into Japan's pharmaceutical wholesale market, where Suzuken operates, is considerably low due to massive capital requirements for logistics and regulatory compliance. New companies face immense costs in establishing nationwide, temperature-controlled distribution networks and navigating stringent licensing and quality control laws, a process that can take years and billions of yen.

Furthermore, Suzuken's deeply entrenched relationships with manufacturers and healthcare providers, coupled with significant economies of scale, create substantial barriers. New entrants would struggle to match the established trust, extensive reach, and cost efficiencies that Suzuken has cultivated over decades, making it difficult to compete effectively on price or service.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Capital Investment | Establishing nationwide cold chain logistics and warehousing requires billions of yen. | Prohibitive upfront cost for new players. |

| Regulatory Hurdles | Securing numerous licenses and adhering to strict PMDA regulations (e.g., GDP) is complex and time-consuming. | Significant delays and legal expenses for market entry. |

| Economies of Scale | Large volume purchasing leads to lower acquisition costs and optimized distribution. | New entrants face higher per-unit costs and logistical inefficiencies. |

| Established Networks | Decades of building trust and relationships with suppliers and customers (e.g., 90% of Japanese medical institutions covered by Suzuken in FY2023). | Difficulty in gaining market access and customer loyalty. |

Porter's Five Forces Analysis Data Sources

Our Suzuken Porter's Five Forces analysis is built upon a foundation of diverse data sources, including Suzuken's annual reports, industry-specific market research from firms like Yano Research, and publicly available financial data from sources such as Nikkei.