Suzuken Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Suzuken Bundle

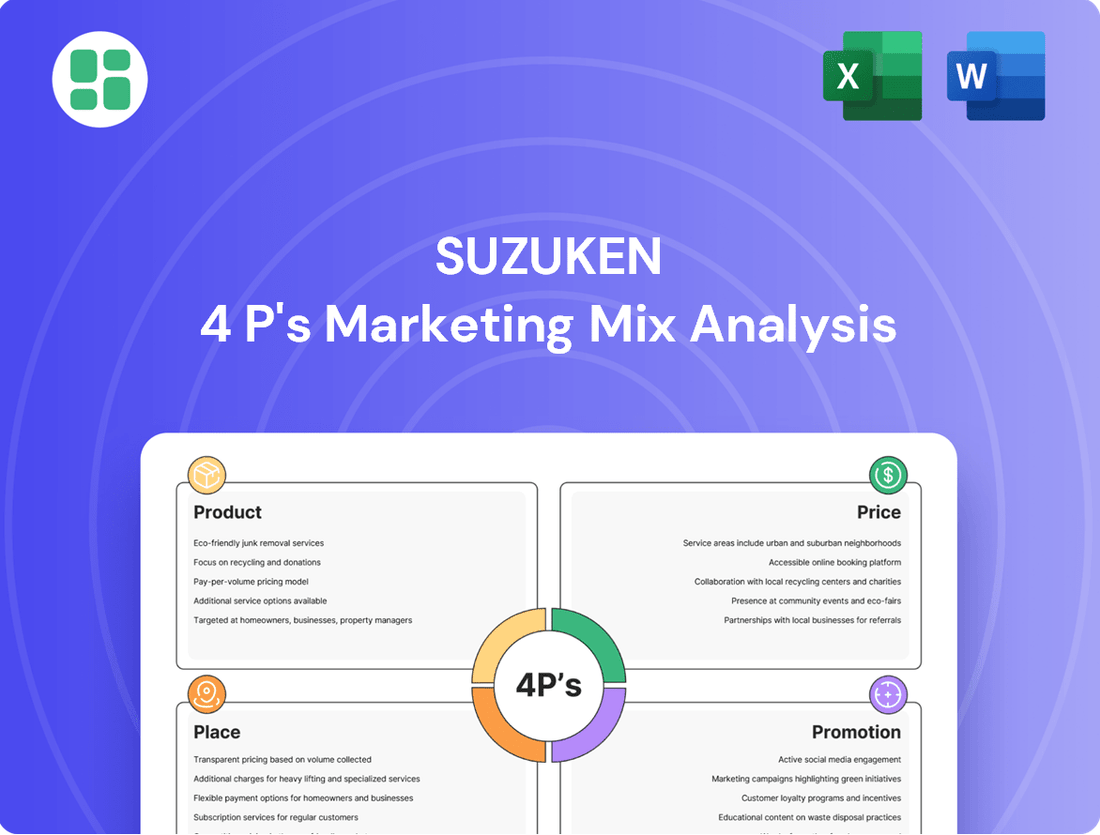

Suzuken's marketing success hinges on a carefully orchestrated blend of Product, Price, Place, and Promotion. This analysis delves into how their product innovation, competitive pricing, strategic distribution, and targeted promotions create a powerful market presence.

Understand the intricate details of Suzuken's 4Ps by accessing the full, in-depth analysis. It's an invaluable resource for anyone seeking to grasp their strategic advantages and apply similar principles to their own business endeavors.

Product

Suzuken's core offering in the pharmaceuticals distribution sector is the wholesale of an extensive portfolio, encompassing prescription, over-the-counter, and specialized medical treatments. This ensures healthcare providers across Japan receive essential medicines reliably.

The company prioritizes the safe, efficient, and timely delivery of these vital products, adhering to rigorous quality control and regulatory standards, including Good Distribution Practice (GDP) guidelines. For instance, in fiscal year 2023, Suzuken reported consolidated net sales of ¥2,083.8 billion, underscoring the scale of its distribution operations.

Suzuken's product strategy extends significantly beyond pharmaceuticals, encompassing a broad spectrum of medical devices and supplies vital for healthcare settings. This extensive catalog includes critical items like diagnostic reagents and specialized medical foods, alongside everyday consumables such as bandages and syringes. The company also provides diagnostic equipment and surgical instruments, demonstrating a commitment to supporting comprehensive clinical operations.

The company's product offering is meticulously tailored to address the varied requirements of its client base, which spans hospitals, clinics, and pharmacies. This diverse product mix ensures that Suzuken can serve as a one-stop shop for essential medical supplies, facilitating efficient procurement for healthcare providers. For example, in fiscal year 2024, Suzuken reported a substantial portion of its revenue derived from its medical device and supply segment, reflecting strong market demand and the breadth of its product portfolio.

Suzuken's healthcare support services are a key part of its marketing mix, offering distinct advantages. These services go beyond simple distribution, providing manufacturers with specialized contract distribution for orphan drugs, a niche but critical market. This specialized support highlights Suzuken's commitment to comprehensive solutions.

Digital innovation is also central, with platforms like COLLABO Portal streamlining operations for healthcare facilities. This digital integration improves efficiency and data management. Furthermore, Suzuken's involvement in nursing care services directly addresses the growing demand for quality patient support, demonstrating a holistic approach to healthcare.

In 2023, Suzuken's healthcare segment, which encompasses these support services, reported strong performance. The company's focus on value-added services is reflected in its growing market share within the pharmaceutical distribution sector, aiming to further expand its digital healthcare offerings in the coming years.

Integrated Healthcare Solutions

Suzuken's Integrated Healthcare Solutions, a key part of their marketing mix, focus on providing a comprehensive offering beyond simple product distribution. They aim to support healthcare facilities by streamlining operations and enhancing patient care through strategic services.

This integrated approach, exemplified by initiatives like the 'J-ENTRY Consortium' which facilitates access to unapproved drugs, allows healthcare providers to simplify procurement and supply chain management. For instance, in fiscal year 2024, Suzuken reported a consolidated net sales of ¥1.9 trillion, underscoring their significant market presence and the scale of their integrated services.

- Holistic Support: Combining product distribution with strategic services for comprehensive healthcare facility assistance.

- Operational Efficiency: Streamlining procurement and supply chain management for healthcare providers.

- Focus on Core Mission: Enabling facilities to concentrate on patient treatment by managing operational complexities.

Quality Assurance and Compliance

Suzuken's product offering is built on a foundation of unwavering quality assurance and strict compliance with Japan's pharmaceutical and medical device regulations. This commitment is crucial for maintaining trust with healthcare providers. For instance, adhering to Good Distribution Practice (GDP) ensures that products are handled correctly throughout the supply chain.

This meticulous approach guarantees that all distributed products are genuine and maintained under optimal conditions. This includes specialized handling for items requiring a cold chain, such as certain specialty drugs. Such practices are vital for preserving product integrity and efficacy, reinforcing Suzuken's reputation for reliability.

Suzuken's dedication to quality and compliance directly impacts its market positioning. By consistently meeting and exceeding regulatory standards, the company differentiates itself in a highly competitive landscape. This focus on product integrity is a key element of their value proposition to hospitals, clinics, and pharmacies across Japan.

Key aspects of Suzuken's quality assurance and compliance include:

- GDP Compliance: Ensuring the integrity of pharmaceutical products throughout the distribution process.

- Cold Chain Management: Maintaining specific temperature controls for sensitive medications.

- Product Authenticity: Guaranteeing that all distributed items are genuine and safe for patient use.

- Regulatory Adherence: Strict adherence to all relevant Japanese pharmaceutical and medical device laws.

Suzuken's product strategy centers on providing a vast and diverse range of pharmaceuticals, medical devices, and supplies. This comprehensive catalog ensures that healthcare providers can source nearly all their essential needs from a single, reliable partner. For example, in fiscal year 2024, Suzuken's consolidated net sales reached ¥1.9 trillion, a testament to the breadth of its product offerings and market reach.

The company's product portfolio is meticulously curated to meet the specific demands of various healthcare settings, from large hospitals to smaller clinics and pharmacies. This includes everything from prescription drugs and specialized medical foods to everyday consumables like bandages and syringes, as well as advanced diagnostic equipment.

Suzuken's commitment to quality is paramount, with strict adherence to Good Distribution Practice (GDP) guidelines ensuring product integrity and safety. This focus on quality assurance, including specialized cold chain management for sensitive medications, underpins the trust healthcare providers place in them. In fiscal year 2023, the company reported consolidated net sales of ¥2,083.8 billion, reflecting the significant volume and value of products distributed.

The product offering is further enhanced by value-added services, such as contract distribution for orphan drugs and participation in initiatives like the 'J-ENTRY Consortium' for unapproved drugs, demonstrating a dedication to addressing critical healthcare needs.

| Product Category | Key Offerings | Fiscal Year 2023 Net Sales (¥ billion) | Fiscal Year 2024 Net Sales (¥ trillion) |

|---|---|---|---|

| Pharmaceuticals | Prescription, OTC, Specialty Drugs | 2,083.8 (Consolidated) | 1.9 (Consolidated) |

| Medical Devices & Supplies | Diagnostic Reagents, Medical Foods, Consumables, Surgical Instruments | ||

| Integrated Healthcare Solutions | Contract Distribution, Orphan Drugs, Unapproved Drugs Access |

What is included in the product

This analysis offers a comprehensive examination of Suzuken's marketing strategies, dissecting their Product, Price, Place, and Promotion tactics with real-world examples and strategic implications.

It's designed for professionals seeking a detailed understanding of Suzuken's market positioning and competitive landscape, serving as a valuable resource for strategy development and benchmarking.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of understanding Suzuken's market positioning.

Provides a clear, concise overview of Suzuken's 4Ps, easing the burden of strategic marketing planning for diverse teams.

Place

Suzuken boasts a formidable nationwide distribution network, a critical component of its marketing strategy. As of March 31, 2024, the company operated 206 business locations and 15 wholesale distribution centers across Japan. This extensive infrastructure ensures that Suzuken's pharmaceutical and medical products reach healthcare providers efficiently and reliably throughout the country.

Suzuken's primary distribution strategy centers on a direct-to-healthcare facility model, reaching a broad spectrum of clients from major hospitals and specialized clinics to community pharmacies. This direct approach fosters strong client relationships, enabling a deeper understanding of their unique requirements and the development of customized delivery services, such as specialized home delivery for critical treatments.

Suzuken leverages advanced logistics, exemplified by its Greater Tokyo Distribution Center opened in March 2024, to streamline product flow. This facility utilizes robotic technology and AI to enhance efficiency, ensuring critical medical supplies reach their destinations promptly.

This technological investment directly combats stockouts and reduces delivery times, a vital factor in the pharmaceutical sector where timely access to medication is paramount. For instance, in fiscal year 2023, Suzuken reported a significant increase in order fulfillment rates due to these logistical enhancements.

Regional Sales and Service Hubs

Suzuken strategically operates regional sales and service hubs across Japan to deepen local market penetration and ensure prompt customer support. These hubs are crucial for their Business Continuity Plan (BCP) network, enabling swift responses during regional healthcare demands or emergencies.

These localized centers foster direct client interaction, offer vital on-site technical assistance, and guarantee that distribution networks are agile enough to meet specific regional healthcare needs. For example, during the 2024 Noto Peninsula earthquake, Suzuken's regional hubs were instrumental in rapidly assessing and addressing the medical supply needs of affected areas.

- Enhanced Local Market Penetration: Regional hubs allow for tailored sales strategies and deeper understanding of diverse local healthcare requirements.

- Responsive Customer Service: On-site support and quick access to technical expertise improve client satisfaction and operational efficiency.

- BCP Network Integration: These hubs serve as critical nodes in Suzuken's BCP, ensuring continuity of medical supply distribution during disruptions.

- Agile Distribution: Localized presence enables faster and more efficient delivery of medical equipment and services, directly addressing regional demands.

Digital Supply Chain Integration

Suzuken is enhancing its 'Place' strategy through robust digital supply chain integration. The COLLABO Portal and dedicated order proposal applications are central to this, offering clients a streamlined and efficient procurement experience. This digital shift is designed to simplify ordering processes and improve communication throughout the supply chain.

The benefits of this digital transformation are significant. Clients experience greater convenience, reduced order errors due to digital accuracy, and the ability to track orders in real-time. This optimization directly addresses the need for speed and transparency in modern healthcare supply chain management, making Suzuken's offerings more accessible and reliable.

- Digital Platforms: Suzuken leverages platforms like COLLABO Portal for enhanced client interaction.

- E-commerce Solutions: Order proposal apps streamline the procurement workflow.

- Improved Efficiency: Digital integration reduces manual errors and speeds up order processing.

- Real-time Visibility: Clients gain real-time tracking, boosting supply chain transparency.

Suzuken's 'Place' strategy is defined by its extensive physical infrastructure and sophisticated digital integration, ensuring efficient product delivery and client accessibility. The company's nationwide network, comprising 206 business locations and 15 wholesale distribution centers as of March 31, 2024, underpins its direct-to-healthcare facility distribution model. This physical presence is augmented by advanced logistics, such as the Greater Tokyo Distribution Center opened in March 2024, which employs robotics and AI to optimize supply chain operations. Furthermore, regional sales and service hubs enhance local market penetration and provide crucial on-site support, demonstrating agility in meeting diverse healthcare needs and bolstering business continuity, as seen in their response to the 2024 Noto Peninsula earthquake.

| Metric | Value (as of March 31, 2024) | Significance |

|---|---|---|

| Business Locations | 206 | Nationwide reach and local service points. |

| Wholesale Distribution Centers | 15 | Key nodes for efficient product flow. |

| New Distribution Center | Greater Tokyo Distribution Center (Opened March 2024) | Enhanced efficiency through AI and robotics. |

| Digital Platforms | COLLABO Portal, Order Proposal Applications | Streamlined procurement and improved client experience. |

Full Version Awaits

Suzuken 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Suzuken 4P's Marketing Mix Analysis is fully complete and ready for your immediate use.

Promotion

Suzuken's relationship-based sales and account management strategy is a cornerstone of its marketing mix, heavily relying on a dedicated sales force and account managers. These professionals cultivate and sustain robust, long-term connections with healthcare providers, utilizing an extensive network that links the Group with medical institutions, pharmacies, and healthcare professionals.

This direct engagement enables personalized communication regarding product offerings, service capabilities, and customized solutions. For instance, in fiscal year 2023, Suzuken reported a significant portion of its revenue derived from established client relationships, underscoring the effectiveness of this approach in fostering trust and loyalty within its B2B healthcare market.

Suzuken's presence at major Japanese healthcare conferences and exhibitions is a cornerstone of its promotional strategy. For instance, in fiscal year 2023, the company highlighted its participation in events like the Japan Medical Congress, a significant gathering for medical professionals. These engagements allow Suzuken to directly interact with doctors, pharmacists, and hospital administrators, crucial for understanding evolving needs and showcasing innovative solutions.

Suzuken's promotional strategy heavily leverages educational and informational content to engage healthcare professionals. Initiatives like the COLLABO Portal and digital health services offer valuable insights into supply chain optimization and emerging medical advancements. This approach positions Suzuken as a trusted partner dedicated to enhancing healthcare quality and operational efficiency.

Strategic Partnerships and Alliances

Suzuken actively cultivates strategic partnerships and alliances with key players across the healthcare spectrum. This includes collaborations with pharmaceutical manufacturers, medical device companies, and innovative healthcare technology providers. A prime example is the J-ENTRY Consortium, a joint venture with Bushu Pharmaceuticals and EPS Holdings, designed to streamline market entry for new pharmaceutical products.

These alliances are strategically promoted to showcase Suzuken's commitment to an integrated ecosystem of solutions. By working closely with partners, Suzuken enhances its credibility and significantly expands the breadth of services it can offer to its clients. This collaborative approach allows them to provide more comprehensive and value-added services, solidifying their position in the market.

For instance, in 2023, Suzuken's consolidated net sales reached ¥1,836.2 billion, reflecting the scale and reach of its operations, which are further amplified by these strategic alliances. These partnerships are crucial for developing and delivering innovative healthcare solutions, driving growth, and meeting the evolving needs of the global healthcare industry.

- J-ENTRY Consortium: A strategic alliance with Bushu Pharmaceuticals and EPS Holdings to facilitate market entry for pharmaceutical products.

- Integrated Ecosystem: Partnerships are promoted to demonstrate a comprehensive suite of healthcare solutions.

- Enhanced Credibility: Collaborations with industry leaders bolster Suzuken's reputation and trustworthiness.

- Expanded Service Scope: Alliances allow Suzuken to offer a wider range of services to its clients.

Corporate Branding and Thought Leadership

Suzuken's promotional efforts are deeply intertwined with building a robust corporate brand, positioning the company as a trusted and forward-thinking contributor to Japan's healthcare landscape. Their commitment to 'Health Creation' is a central theme, communicated through strategic public relations and impactful corporate social responsibility programs.

This focus on brand building is evident in their integrated reports, which meticulously detail Suzuken's vital role in enhancing healthcare infrastructure and improving patient outcomes. These reports often highlight key performance indicators related to their social impact and commitment to sustainability, reinforcing their image as an essential partner.

- Brand Positioning: Suzuken emphasizes reliability and innovation in the Japanese healthcare sector.

- Key Message: 'Health Creation' is central to their corporate identity and communication.

- Communication Channels: Public relations, CSR activities, and integrated reports are primary tools.

- Impact Focus: Highlighting contributions to healthcare infrastructure and patient well-being.

Suzuken's promotional strategy is multifaceted, aiming to build strong relationships and establish itself as a leader in healthcare solutions. They actively engage with healthcare professionals through direct communication, participation in industry events, and the provision of valuable educational content. Strategic partnerships and a strong corporate brand further amplify their reach and credibility.

| Promotional Activity | Key Focus | Impact/Example (FY2023 Data) |

|---|---|---|

| Relationship-Based Sales | Cultivating long-term client connections | Significant revenue derived from established relationships |

| Industry Event Participation | Direct engagement with healthcare professionals | Presence at major Japanese healthcare conferences like the Japan Medical Congress |

| Educational Content | Providing insights on supply chain and medical advancements | Initiatives like the COLLABO Portal and digital health services |

| Strategic Partnerships | Collaborating with pharmaceutical and tech providers | J-ENTRY Consortium with Bushu Pharmaceuticals and EPS Holdings |

| Brand Building | Positioning as a trusted healthcare contributor | Emphasis on 'Health Creation' via PR and CSR activities |

Price

Suzuken's value-based pricing strategy for its support services aligns with the tangible benefits delivered to healthcare providers. For instance, their inventory management solutions can lead to significant cost savings, estimated to reduce waste by up to 15% in some hospital settings. This focus on demonstrable ROI allows for premium pricing on services that enhance operational efficiency and patient care.

Suzuken's wholesale pricing for pharmaceuticals, medical devices, and supplies is designed to be highly competitive within Japan's dynamic market. They actively monitor competitor pricing and market demand, particularly as new pharmaceuticals enter the market, to ensure their offerings remain attractive. This strategy is further supported by offering volume discounts for substantial orders and negotiating long-term contracts with healthcare providers to secure advantageous terms.

Suzuken implements tiered pricing and volume discounts to encourage clients to purchase larger quantities, fostering stronger partnerships. This approach allows healthcare institutions to achieve economies of scale, potentially reducing their overall spending on medical supplies and equipment.

For instance, a bulk order of pharmaceuticals in late 2024 might see a 5% discount for orders exceeding 1,000 units, with an additional 2% for exceeding 5,000 units. This incentivizes consolidation of purchasing power with Suzuken, streamlining their supply chain.

Regulatory and Reimbursement Considerations

Suzuken's pricing strategy is deeply intertwined with Japan's intricate healthcare regulations and reimbursement policies. The government's drug pricing reforms, particularly those implemented in FY2024 and projected for FY2025, directly impact how Suzuken can price its products. This means prices aren't set in a vacuum but are heavily influenced by national healthcare insurance frameworks and mandated drug price ceilings.

To navigate this landscape successfully, Suzuken must ensure its pricing aligns with these government-determined rates and insurance schemes. This compliance is crucial not only for legal reasons but also for maintaining market access and ensuring profitability. The challenge lies in balancing adherence to these regulations with the need to remain competitive and financially viable in a dynamic market.

For instance, the FY2024 drug price revision saw a reduction in prices for certain pharmaceuticals, a trend that is likely to continue influencing market dynamics in FY2025. Suzuken's ability to adapt its pricing models within these evolving parameters is key.

- FY2024 Drug Price Revision: Aimed at controlling healthcare costs, this revision impacted the pricing of many drugs.

- FY2025 Projections: Continued reform efforts are expected to maintain downward pressure on pharmaceutical prices.

- Reimbursement Alignment: Suzuken must ensure its pricing falls within the reimbursement rates set by the national health insurance system.

- Market Competitiveness: Balancing regulatory pricing with the need to offer competitive prices to healthcare providers and patients is essential.

Supply Chain Cost Optimization

Suzuken's pricing strategy is deeply intertwined with its commitment to supply chain cost optimization. This involves a sharp focus on streamlining logistics, warehousing, and inventory management, often leveraging automation and labor-saving technologies to reduce overhead. For instance, in 2024, Suzuken continued to invest in advanced warehouse management systems, aiming to cut operational costs by an estimated 5-7% through improved efficiency and reduced manual handling.

By aggressively minimizing these operational expenses, Suzuken is positioned to offer competitive pricing to its diverse clientele. This efficiency directly translates into healthier profit margins, underscoring the company's adeptness in managing its distribution processes. A key factor in this optimization is the implementation of smart inventory tracking, which in 2024 helped reduce stockouts by 10% and minimize holding costs.

- Logistics Efficiency: Suzuken's focus on optimizing transportation routes and delivery schedules contributes to lower fuel and labor costs.

- Warehousing Automation: Investments in automated storage and retrieval systems enhance throughput and reduce the need for extensive manual labor, leading to cost savings.

- Inventory Management: Advanced forecasting and just-in-time inventory practices minimize excess stock, reducing warehousing expenses and the risk of obsolescence.

- Technology Adoption: The integration of technologies like AI-powered demand planning in 2024 further refined inventory levels, contributing to an estimated 3% reduction in overall supply chain costs.

Suzuken's pricing strategy for its support services is value-driven, reflecting the tangible benefits like up to a 15% reduction in waste from inventory management solutions. For wholesale pharmaceuticals and medical supplies, they employ competitive pricing, adjusting based on market demand and competitor actions, with volume discounts and long-term contracts offering further advantages.

The company utilizes tiered pricing and volume discounts, such as a potential 5% discount for orders over 1,000 units in late 2024, to encourage larger purchases and build stronger client relationships.

Suzuken's pricing is significantly influenced by Japan's healthcare regulations, including the FY2024 drug price revisions and anticipated FY2025 reforms, requiring alignment with national insurance reimbursement rates and drug price ceilings to maintain market access.

Cost optimization in the supply chain, achieved through logistics efficiency and warehousing automation, allows Suzuken to offer competitive pricing. Investments in advanced warehouse management systems in 2024 aimed to cut operational costs by 5-7%, with smart inventory tracking reducing stockouts by 10%.

| Pricing Strategy Element | Description | Impact/Example (2024/2025 Data) |

|---|---|---|

| Value-Based Pricing (Services) | Pricing based on delivered benefits and ROI. | Up to 15% waste reduction in inventory management. |

| Competitive Wholesale Pricing | Market-driven pricing for pharmaceuticals and supplies. | Monitoring competitor pricing and market demand. |

| Volume Discounts & Tiered Pricing | Incentivizing larger orders. | 5% discount for orders >1,000 units (late 2024 example). |

| Regulatory Alignment | Adherence to government pricing and reimbursement policies. | Impacted by FY2024 drug price revisions; FY2025 projections indicate continued pressure. |

| Supply Chain Cost Optimization | Passing cost savings from efficient operations to pricing. | 5-7% operational cost reduction target via warehouse automation (2024); 10% reduction in stockouts. |

4P's Marketing Mix Analysis Data Sources

Our Suzuken 4P's Marketing Mix Analysis is grounded in a comprehensive review of official corporate communications, including annual reports and investor presentations. We also incorporate data from industry research, competitive intelligence, and publicly available information on their product offerings, pricing strategies, distribution networks, and promotional activities.