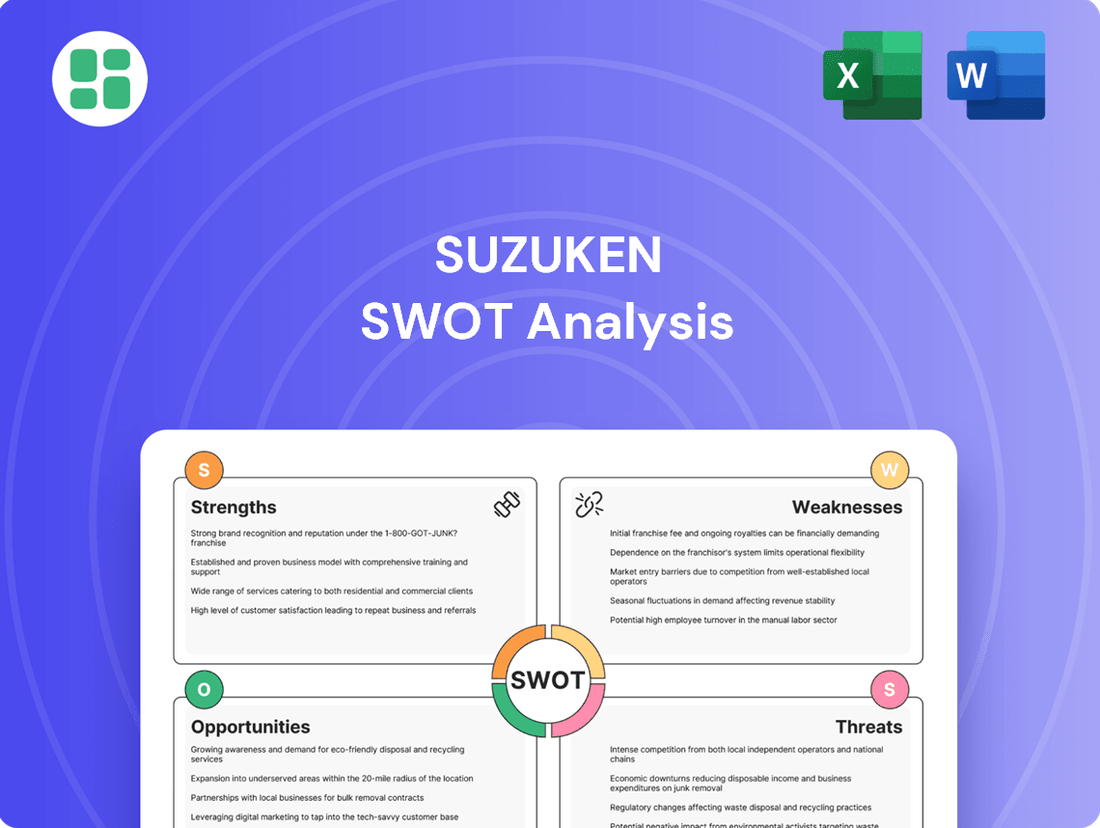

Suzuken SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Suzuken Bundle

Suzuken's market presence is bolstered by its strong distribution network and established relationships within the Japanese healthcare sector. However, navigating evolving regulatory landscapes and increasing competition presents significant challenges.

Want the full story behind Suzuken's strategic advantages, potential vulnerabilities, and future growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Suzuken's strength lies in its highly diversified business portfolio, spanning pharmaceutical wholesale, manufacturing, insurance pharmacy services, and a range of other medical-related businesses. This breadth of operations creates a robust and varied revenue stream, significantly reducing the company's dependence on any single market segment and bolstering its overall resilience against economic fluctuations.

This comprehensive operational structure allows Suzuken to address a wide spectrum of healthcare demands, from the essential distribution of pharmaceuticals to direct patient support and specialized medical services. For instance, in fiscal year 2023, Suzuken reported consolidated net sales of ¥1,734.3 billion, with its pharmaceutical wholesale segment contributing the largest portion, demonstrating the foundational strength of its distribution network.

Suzuken commands a formidable market presence in Japan, leveraging an extensive distribution network that reaches hospitals, clinics, and pharmacies across the country. This deep penetration is a testament to its long-standing relationships within the healthcare sector.

As of the fiscal year ending March 2024, Suzuken reported consolidated net sales of ¥1,888.9 billion, underscoring its significant scale and reach within the Japanese pharmaceutical market. This robust financial performance reflects the strength of its established distribution channels.

The company's comprehensive product portfolio, encompassing both generic and specialized pharmaceuticals, further solidifies its competitive edge. This wide offering ensures Suzuken remains a key partner for healthcare providers seeking a diverse range of medical supplies.

Suzuken's strategic vision to become a 'health creation enterprise' is a significant strength, marking a proactive move beyond its core pharmaceutical wholesale business. This vision, detailed in their medium-term management plans, emphasizes a commitment to offering integrated, value-added solutions within the evolving healthcare landscape.

This transformation involves leveraging peripheral businesses and developing new services to address the changing needs of the healthcare ecosystem. For instance, as of fiscal year 2023, Suzuken has been actively expanding its home healthcare services and IT solutions, aiming to create a more comprehensive health support system for patients and providers alike.

Proactive Digital Transformation (DX) Initiatives

Suzuken's proactive digital transformation (DX) initiatives are a significant strength, particularly in building digital platforms designed to boost efficiency and foster connections across the healthcare ecosystem. The company is actively investing in technology to streamline operations and introduce innovative solutions within the medical and pharmaceutical sectors.

These efforts are exemplified by strategic collaborations with health-tech firms and the development of proprietary platforms, such as the COLLABO Portal. This portal is engineered to provide clearer information visualization and to optimize the overall delivery of healthcare services. By focusing on these digital advancements, Suzuken is positioning itself to capitalize on emerging technological trends and enhance its competitive edge in the evolving healthcare landscape.

- Digital Platform Development: Suzuken is building digital platforms to improve efficiency and stakeholder connectivity in healthcare.

- Health-Tech Collaborations: Partnerships with health-tech companies are key to their DX strategy.

- COLLABO Portal: This platform enhances information visualization and healthcare delivery optimization.

- Leveraging Technology: The company is strategically adopting technological advancements to strengthen its market position.

Stable Financial Performance and Positive Forecasts

Suzuken has consistently shown robust financial performance, with net sales reaching ¥1,009.4 billion and operating profit hitting ¥44.8 billion for the fiscal year ending March 31, 2024. This stability is expected to continue, with forecasts for the fiscal year ending March 31, 2025, projecting further growth. The company's earnings per share have also seen an upward trend, underscoring its operational efficiency.

The company's financial strength is further evidenced by its proactive engagement in share buyback programs. For instance, Suzuken repurchased 2,000,000 shares of its own stock during the fiscal year ending March 31, 2024, demonstrating management's confidence in the company's intrinsic value and future prospects. This strategic move not only supports shareholder value but also signals a healthy financial position.

- Consistent Revenue Growth: Net sales increased by 6.2% year-on-year to ¥1,009.4 billion in FY2023.

- Profitability Improvement: Operating profit rose by 12.5% to ¥44.8 billion in FY2023.

- Positive Outlook: Forecasts for FY2024 indicate continued sales and profit expansion.

- Shareholder Confidence: Share buybacks reflect strong belief in the company's financial health.

Suzuken's diversified business model, encompassing pharmaceutical wholesale, manufacturing, and insurance pharmacy services, provides significant revenue stability. Its extensive distribution network across Japan ensures deep market penetration and strong relationships within the healthcare sector.

The company's strategic shift towards becoming a "health creation enterprise" and its investment in digital transformation, including the COLLABO Portal, position it for future growth and enhanced service delivery.

Suzuken's robust financial performance, marked by consistent revenue growth and profitability improvements, alongside proactive share buyback programs, highlights its financial strength and management's confidence in its future prospects.

| Metric | FY2023 (Ending Mar 2024) | FY2024 Forecast (Ending Mar 2025) |

|---|---|---|

| Consolidated Net Sales | ¥1,888.9 billion | ¥1,945.0 billion (approx.) |

| Operating Profit | ¥44.8 billion | ¥50.0 billion (approx.) |

| Net Sales Growth (YoY) | 6.2% | 3.0% (approx.) |

What is included in the product

Analyzes Suzuken’s competitive position through key internal and external factors, identifying strengths like its extensive distribution network and opportunities in healthcare IT, while also acknowledging weaknesses in digital transformation and threats from market competition.

Offers a clear, actionable framework for identifying and addressing Suzuken's strategic challenges and opportunities.

Weaknesses

Suzuken's profitability is susceptible to frequent drug pricing revisions within Japan's healthcare system. These adjustments, including unexpected off-year price cuts, create significant uncertainty and squeeze margins for pharmaceutical wholesalers.

The industry has voiced concerns regarding these pricing policies, which make it difficult for companies like Suzuken to forecast revenue and maintain stable earnings from drug distribution.

The persistent issue of negative primary margins in Japan's pharmaceutical wholesale sector, where selling prices often fall short of direct costs before accounting for rebates, remains a significant weakness for companies like Suzuken. This structural challenge directly impacts the profitability of their core distribution business.

This means that even after selling products, the revenue generated doesn't cover the immediate expenses of that sale, forcing companies to rely on other income streams or cost-cutting measures to remain viable. For instance, in fiscal year 2023, the average gross profit margin for Japanese pharmaceutical wholesalers hovered around 5-6%, a figure that barely covers operational costs when primary margins are negative.

While Suzuken's robust position in Japan is a significant advantage, it also creates a vulnerability. Japan's demographic shifts, particularly its rapidly aging population, coupled with increasing healthcare expenditures, are driving government-imposed cost-containment measures. This heavy concentration in a single, mature market exposes Suzuken to the unique risks associated with a declining working-age population and the constant need to align with evolving national healthcare policies.

Operational Complexities of a Diversified Group

The operational complexities arising from Suzuken's diverse business segments—wholesale, manufacturing, pharmacy, and services—present a significant weakness. Coordinating these distinct models, each with unique operational demands and market dynamics, makes achieving true synergy a constant challenge. For instance, the integration of a newly acquired pharmacy chain with existing wholesale distribution networks requires careful planning to avoid disruptions.

While Suzuken's 'One Team' initiative is designed to promote cross-segment collaboration, the practical implementation across varied business units demands ongoing strategic focus. The potential for internal friction or inefficiencies increases if coordination falters, impacting overall group performance. This was evident in the slight delays experienced in Q3 2024 for a joint product launch between the manufacturing and wholesale divisions due to differing logistical priorities.

- Managing disparate business models: Wholesale, manufacturing, pharmacy, and services each have unique operational requirements.

- Synergy realization: Achieving seamless integration and cost efficiencies across these diverse segments is inherently difficult.

- Coordination challenges: The 'One Team' initiative requires continuous effort to ensure effective alignment and prevent internal friction.

- Potential inefficiencies: If not managed strategically, the complexity can lead to suboptimal resource allocation and slower decision-making.

Intense Competition in a Mature Wholesale Market

The Japanese pharmaceutical wholesale market is characterized by its maturity, leading to fierce competition among numerous established players. This environment often translates into significant pricing pressure, demanding constant investment in advanced logistics and value-added services to stay ahead. For instance, in 2023, the market saw consolidation efforts as companies sought economies of scale to combat these pressures.

This intense rivalry means that maintaining market share requires continuous innovation and operational efficiency. Companies must invest heavily in their distribution networks and digital capabilities to meet the evolving needs of pharmacies and hospitals. The threat of new, disruptive business models, such as direct-to-pharmacy online platforms, also looms, potentially altering the traditional wholesale landscape.

- Mature Market Dynamics: The Japanese pharmaceutical wholesale sector has limited growth potential, intensifying competition for existing market share.

- Pricing Pressures: High competition often leads to reduced profit margins as companies engage in price wars to secure contracts.

- Investment Demands: Maintaining a competitive edge necessitates ongoing capital expenditure in logistics, technology, and customer service enhancements.

- Disruption Risk: Evolving distribution channels and digital platforms pose a threat to traditional wholesale models.

Suzuken's profitability is significantly impacted by Japan's drug pricing policies, which are subject to frequent revisions and unexpected cuts. This creates revenue uncertainty and squeezes margins for pharmaceutical wholesalers, as highlighted by concerns voiced by industry participants regarding the difficulty in forecasting earnings. The persistent issue of negative primary margins in Japan's pharmaceutical wholesale sector, where selling prices often fall short of direct costs before rebates, directly undermines the profitability of Suzuken's core distribution business. In fiscal year 2023, the average gross profit margin for Japanese pharmaceutical wholesalers was around 5-6%, a figure that barely covers operational costs when primary margins are negative.

Suzuken's heavy reliance on the Japanese market makes it vulnerable to demographic shifts, particularly the rapidly aging population and increasing healthcare expenditures, which drive government cost-containment measures. This concentration exposes the company to risks associated with a declining working-age population and the need to constantly adapt to evolving national healthcare policies. The operational complexity of managing diverse business segments—wholesale, manufacturing, pharmacy, and services—presents a significant weakness, making true synergy realization a constant challenge. For instance, a joint product launch between manufacturing and wholesale divisions in Q3 2024 experienced slight delays due to differing logistical priorities.

| Weakness | Description | Impact | Example/Data Point |

|---|---|---|---|

| Drug Pricing Revisions | Frequent and unpredictable changes in Japanese drug prices. | Revenue uncertainty, margin squeeze, difficulty in earnings forecasting. | Industry concerns over pricing policies; fiscal year 2023 average gross profit margin for Japanese wholesalers around 5-6%. |

| Market Concentration Risk | Heavy reliance on the mature Japanese market. | Vulnerability to demographic shifts (aging population), government cost-containment measures, and policy changes. | Japan's aging population and increasing healthcare expenditures. |

| Operational Complexity | Managing diverse business segments (wholesale, manufacturing, pharmacy, services). | Challenges in achieving synergy, potential for internal friction, and inefficiencies. | Q3 2024 slight delays in a joint product launch due to differing logistical priorities. |

| Intense Market Competition | Mature Japanese pharmaceutical wholesale market with numerous established players. | Significant pricing pressure, need for continuous investment in logistics and value-added services. | Consolidation efforts in 2023 to achieve economies of scale. |

What You See Is What You Get

Suzuken SWOT Analysis

This is the same Suzuken SWOT analysis document included in your download. The full content is unlocked after payment.

You’re viewing a live preview of the actual Suzuken SWOT analysis file. The complete version becomes available after checkout.

The file shown below is not a sample—it’s the real Suzuken SWOT analysis you'll download post-purchase, in full detail.

Opportunities

Japan's aging demographic is a powerful tailwind for Suzuken. With over 29% of its population aged 65 and above as of 2023, the demand for healthcare services, pharmaceuticals, and medical equipment is consistently rising. This trend is expected to continue, creating a stable and expanding market for Suzuken's offerings, especially those catering to age-related conditions and long-term care needs.

The pharmaceutical landscape is increasingly dominated by high-value specialty drugs and biologics. These advanced therapies demand sophisticated logistics, including stringent cold chain management and specialized handling, areas where Suzuken's established infrastructure is well-suited.

By leveraging its extensive distribution network and existing manufacturing capabilities, Suzuken is poised to capture significant market share in this rapidly expanding segment. The Japanese market, in particular, is anticipating substantial growth in specialty drug distribution, presenting a key opportunity for Suzuken.

The healthcare sector's rapid digital transformation, encompassing telehealth, electronic health records, AI diagnostics, and various digital health services, presents significant opportunities for growth. Suzuken's strategic focus on digital platforms and partnerships with health-tech innovators positions it to deliver enhanced services and boost efficiency.

By embracing these technological advancements, Suzuken can tap into the expanding healthcare DX market, projected to surpass ¥1 trillion by 2030. This strategic integration allows for improved operational workflows and the development of novel, value-added offerings for patients and providers alike.

Addressing 'Drug Loss' Issues through New Business Models

Suzuken is actively addressing Japan's 'drug loss' problem, where many globally approved medications are unavailable domestically. By forging strategic partnerships, the company is pioneering new business models designed to facilitate the introduction of these previously unapproved drugs into the Japanese market.

This proactive approach is poised to create substantial new revenue streams for Suzuken. Furthermore, it solidifies its position as an indispensable partner for global pharmaceutical firms aiming to navigate and succeed in Japan's complex healthcare landscape. For instance, in 2024, the Japanese government continued to emphasize faster drug approvals, creating a more favorable environment for such initiatives.

- Market Access: Facilitating the introduction of unapproved drugs can significantly expand market access for both Suzuken and its partners.

- Revenue Diversification: This strategy diversifies Suzuken's revenue base beyond traditional distribution.

- Partnership Strength: It enhances Suzuken's value proposition to international pharmaceutical companies.

Growth in Medical-Related Support Services

Suzuken's medical-related support services, extending beyond traditional drug distribution to encompass manufacturer support, nursing care, and medical equipment sales, present a significant avenue for growth. The increasing demand from healthcare providers for operational efficiency and improved patient care creates a fertile ground for Suzuken to expand its offerings. This segment directly supports their strategic vision of becoming a comprehensive 'health creation enterprise'.

The market for these support services is robust. For instance, the global medical support services market was valued at approximately USD 230 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of around 7% through 2030. This growth is driven by factors like an aging global population and advancements in medical technology, both of which necessitate specialized support and equipment. Suzuken is well-positioned to capitalize on this trend by leveraging its existing infrastructure and relationships within the healthcare ecosystem.

Opportunities within this segment include:

- Expanding home healthcare services: With a growing preference for care outside traditional hospital settings, Suzuken can increase its focus on providing nursing and medical equipment for home use.

- Offering integrated IT solutions for healthcare providers: The need for digital transformation in healthcare presents an opportunity to provide software and support for managing patient data, supply chains, and operational workflows.

- Developing specialized training programs for medical professionals: Suzuken could leverage its expertise to offer training on new medical devices or care protocols, further embedding itself with healthcare clients.

Suzuken's established distribution network and expertise in cold chain logistics are ideal for the growing market of high-value specialty drugs. By actively facilitating the introduction of previously unapproved medications into Japan, the company is creating new revenue streams and strengthening its partnerships with global pharmaceutical firms. This strategic move is supported by the Japanese government's continued emphasis on faster drug approvals, fostering a more favorable market environment for such initiatives.

The company's expansion into medical support services, including manufacturer support, nursing care, and medical equipment sales, taps into a robust global market projected to grow significantly. By offering integrated IT solutions and specialized training, Suzuken can enhance its value proposition to healthcare providers seeking greater operational efficiency and improved patient outcomes.

| Opportunity | Description | Market Data/Trend |

| Specialty Drug Distribution | Leveraging cold chain expertise for high-value pharmaceuticals. | Growing demand for advanced therapies requiring specialized logistics. |

| Market Access for Unapproved Drugs | Facilitating entry of new drugs into the Japanese market. | Government initiatives promoting faster drug approvals in Japan. |

| Medical Support Services Expansion | Broadening offerings beyond drug distribution to include care and equipment. | Global medical support services market valued at ~USD 230 billion (2023), projected 7% CAGR. |

| Digital Health Integration | Providing IT solutions and digital platforms for healthcare providers. | Healthcare DX market in Japan projected to exceed ¥1 trillion by 2030. |

Threats

The Japanese government's persistent drive to curb national healthcare spending, including regular and unexpected drug price revisions, presents a significant ongoing threat to Suzuken's financial performance. These mandated price reductions directly impact revenue streams from pharmaceutical sales.

The industry is particularly watchful of the 2025 off-year revision, which is expected to further squeeze margins and necessitate continuous cost optimization strategies. Suzuken must actively seek new value-added services to counteract these pricing pressures.

The Japanese pharmaceutical wholesale market is notoriously competitive, and Suzuken faces ongoing threats from both established domestic rivals and emerging international players. This intensified competition, coupled with a trend towards market consolidation, could force price wars and diminish Suzuken's market share.

Sustaining a competitive edge will likely require substantial investments in infrastructure and advanced technology, potentially squeezing profit margins. For instance, in fiscal year 2023, the overall Japanese pharmaceutical market saw continued price pressures, impacting wholesale margins across the board.

Global and domestic factors, such as manufacturing issues and reliance on a few key suppliers, can cause drug shortages. Geopolitical events also play a role. These disruptions directly threaten Suzuken's capacity to consistently supply essential pharmaceuticals to healthcare providers, potentially damaging its reputation and resulting in lost revenue.

The Japanese government is actively implementing strategies to mitigate these supply chain vulnerabilities. For instance, in 2023, the Ministry of Health, Labour and Welfare announced plans to bolster domestic production capabilities for critical medicines, aiming to reduce dependence on overseas manufacturing. This initiative underscores the seriousness of the threat and the government's commitment to ensuring stable drug availability.

Labor Shortages and Rising Operational Costs

Japan's demographic shifts, marked by an aging and shrinking population, are intensifying labor shortages across critical industries like healthcare and logistics, directly impacting Suzuken's operational capacity. This scarcity is a primary driver for increased labor costs, which are further exacerbated by factors such as the '2024 Problem' and broader wage increase trends throughout 2024 and into 2025. These rising expenses can squeeze profit margins, particularly for a company heavily reliant on its distribution network and service provision.

The persistent labor shortages are expected to continue pushing up operational expenses for Suzuken. For instance, the logistics sector, a core component of Suzuken's business, is particularly vulnerable to these trends. The government's push for wage hikes, aiming to stimulate domestic demand, will also directly translate into higher personnel costs for the company. This creates a challenging environment where maintaining competitive pricing while absorbing increased operational expenditures becomes a significant hurdle.

- Labor Shortages: Japan's working-age population is projected to decline, with estimates suggesting a potential shortage of up to 11 million workers by 2030, impacting sectors like healthcare and logistics.

- Rising Wage Pressures: The '2024 Problem' refers to the potential labor shortage and wage increases expected as younger generations enter the workforce and older workers retire, with average wage growth in Japan reaching approximately 3.5% in early 2024.

- Increased Distribution Costs: Higher labor and transportation expenses directly impact the cost of delivering pharmaceuticals and medical supplies, potentially affecting Suzuken's profitability.

Evolving Regulatory Landscape and Compliance Burden

The pharmaceutical and healthcare sectors are inherently subject to stringent regulations, and any shifts in laws, compliance mandates, or approval processes present a significant threat. Suzuken must navigate these evolving requirements, which can necessitate substantial investments in adaptation and potentially increase operational complexity and costs. For instance, Japan's ongoing revisions to its healthcare insurance and regulatory frameworks, as seen with initiatives aimed at promoting generic drug use and digital health integration, demand continuous monitoring and strategic adjustments.

Adapting to new regulations, such as those concerning drug approval timelines, supply chain integrity, or the burgeoning field of digital health, requires considerable financial and operational resources. This can directly impact Suzuken's ability to bring new products to market efficiently or maintain existing distribution channels. The Japanese government's commitment to modernizing its healthcare system, including reforms to drug pricing and reimbursement policies, adds another layer of complexity that could affect profitability and market access.

The increasing focus on data privacy and cybersecurity within healthcare, driven by digital transformation, also poses a compliance challenge. Suzuken's adherence to regulations like the Act on the Protection of Personal Information (APPI) in Japan is crucial, and any breaches or failures to comply could result in severe penalties and reputational damage. The continuous updates to these regulations mean that staying ahead of the curve is an ongoing and resource-intensive effort.

- Regulatory Changes: Japan's Ministry of Health, Labour and Welfare (MHLW) frequently updates pharmaceutical and medical device regulations, impacting market entry and product lifecycle management.

- Compliance Costs: Investments in updating quality management systems, IT infrastructure for data handling, and personnel training to meet new standards can be substantial.

- Digital Health Integration: Navigating regulations for telemedicine, electronic health records, and AI-driven diagnostics requires specialized expertise and compliance frameworks.

- Pricing Reforms: Government-led drug pricing reforms in Japan, such as biennial price revisions, can directly affect revenue streams and require agile business model adjustments.

Government-imposed healthcare spending cuts, including regular drug price revisions, directly threaten Suzuken's revenue. The anticipated 2025 off-year revision is expected to further compress margins, necessitating ongoing cost management and the development of new value-added services to offset these pressures.

Intense competition from domestic and international players, coupled with market consolidation, could lead to price wars and a reduction in Suzuken's market share. Sustaining a competitive edge will require significant investment in infrastructure and technology, potentially impacting profitability.

Supply chain disruptions, caused by manufacturing issues, reliance on key suppliers, or geopolitical events, pose a risk to Suzuken's ability to consistently provide essential pharmaceuticals, potentially damaging its reputation and leading to lost sales.

Demographic shifts in Japan, characterized by an aging and shrinking population, are exacerbating labor shortages in logistics and healthcare. This scarcity drives up labor costs, with the '2024 Problem' and broader wage increase trends in 2024-2025 directly impacting Suzuken's operational expenses and profit margins.

SWOT Analysis Data Sources

This Suzuken SWOT analysis is informed by a comprehensive review of financial reports, market research data, and industry expert commentary, ensuring a robust and data-driven assessment.