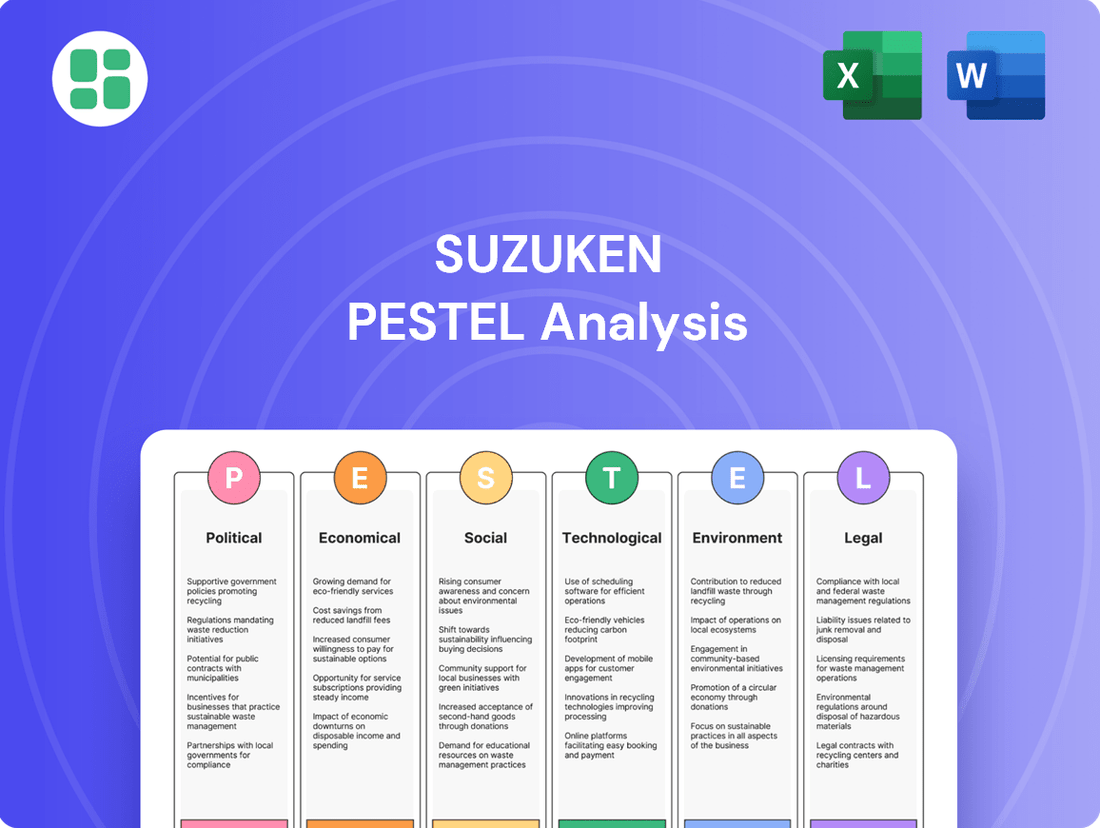

Suzuken PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Suzuken Bundle

Suzuken operates within a dynamic global landscape, and understanding the political, economic, social, technological, environmental, and legal forces at play is crucial for strategic success. Our comprehensive PESTLE analysis delves deep into these external factors, providing you with the critical intelligence needed to anticipate challenges and capitalize on opportunities. Gain a competitive edge by unlocking actionable insights that can inform your investment decisions and business strategies. Purchase the full PESTLE analysis today and equip yourself with the knowledge to navigate Suzuken's future with confidence.

Political factors

Government healthcare spending is a major driver for Suzuken, as its business relies heavily on the budgets of healthcare providers. For instance, in Japan, the Ministry of Health, Labour and Welfare's decisions on drug pricing and reimbursement rates directly affect the volume and profitability of Suzuken's distribution business. Changes in these policies, such as potential reforms to the universal health insurance system or increased investment in public health initiatives, could significantly alter demand for the medical products Suzuken handles.

The Japanese government's approach to pharmaceutical pricing, including biennial revisions that can lower drug costs, directly impacts Suzuken's profitability. For instance, the 2024 drug price revision is expected to see an average price cut of approximately 3.7%, a significant factor for wholesalers whose margins are tied to these prices.

Furthermore, regulations on drug approval, distribution, and stringent quality control standards, overseen by bodies like the Ministry of Health, Labour and Welfare (MHLW), shape Suzuken's operational landscape. Compliance with these evolving rules is crucial for maintaining market access and operational integrity.

While Suzuken's core operations are domestic, Japan's trade policies significantly impact its indirect exposure. For instance, Japan's participation in agreements like the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) can influence the cost and availability of imported medical supplies or components used in distribution systems. In 2024, Japan continued its active engagement in global trade discussions, aiming to secure stable supply chains for critical goods, which could indirectly benefit Suzuken by ensuring access to necessary products.

Public Health Initiatives and Disease Control

Government-led public health initiatives and disease control efforts significantly shape the market for pharmaceuticals and medical supplies. For instance, in 2024, Japan's Ministry of Health, Labour and Welfare continued its focus on infectious disease prevention, which directly impacts the demand for vaccines and antiviral medications distributed by companies like Suzuken. These campaigns often necessitate rapid adjustments in inventory and supply chain logistics to meet heightened demand for specific products.

Suzuken's ability to align its operations with national health priorities, such as those aimed at combating chronic diseases or responding to emerging health threats, is crucial. Proactive government investments in healthcare infrastructure, a trend observed throughout 2024 and projected into 2025, can unlock new avenues for Suzuken's distribution and related services. For example, expansions in diagnostic testing capabilities often require a robust supply of reagents and equipment.

- Government Health Spending: Japan's healthcare expenditure was projected to reach approximately ¥47.5 trillion in fiscal year 2024, with a significant portion allocated to public health programs and disease management.

- Pandemic Preparedness: Following the COVID-19 pandemic, governments globally, including Japan, have increased investments in pandemic preparedness and response mechanisms, creating sustained demand for related medical supplies.

- Vaccination Rates: Public health campaigns promoting higher vaccination rates for influenza and other preventable diseases directly influence the volume of vaccine distribution handled by entities like Suzuken.

Healthcare System Reforms

Japan's ongoing healthcare system reforms, focused on efficiency and accessibility, directly impact Suzuken's operating environment. These changes, such as the push for regional healthcare networks and hospital consolidation, necessitate adaptable service offerings. For instance, the Ministry of Health, Labour and Welfare's initiatives to strengthen primary care physician roles and streamline hospital functions by 2025 aim to create more integrated care pathways.

Suzuken's success hinges on its capacity to provide support services that align with these systemic shifts. The company's ability to facilitate greater integration of care, perhaps through enhanced logistics for pharmaceuticals or improved data management for regional health information, will be crucial. As of early 2024, discussions are intensifying around the expansion of telemedicine services and the digital transformation of medical records, areas where Suzuken can leverage its expertise.

- Efficiency Drive: Reforms aim to reduce healthcare costs and improve patient flow, potentially increasing demand for Suzuken's logistics and distribution services.

- Regional Integration: The emphasis on regional healthcare networks could create opportunities for Suzuken to develop localized supply chain solutions.

- Digital Health: Government support for digital health initiatives presents avenues for Suzuken to integrate technology into its service offerings, enhancing data sharing and operational visibility.

Government policies heavily influence Suzuken's pharmaceutical distribution business, particularly through healthcare spending and drug pricing regulations. For example, Japan's Ministry of Health, Labour and Welfare's biennial drug price revisions, such as the anticipated 3.7% average cut in 2024, directly impact wholesaler margins. Government-led public health initiatives, like those focusing on infectious disease prevention in 2024, also shape demand for specific medical products Suzuken distributes.

Japan's healthcare system reforms, aiming for efficiency and integration by 2025, create opportunities for Suzuken to adapt its logistics and support services. The government's push for regional healthcare networks and digital health initiatives, actively discussed in early 2024, could lead to new service models for the company.

| Policy Area | Impact on Suzuken | 2024/2025 Relevance |

|---|---|---|

| Drug Pricing Revisions | Affects profitability of distribution | 2024 revision expected ~3.7% cut |

| Healthcare Spending | Drives demand for medical products | FY2024 projected ¥47.5 trillion |

| Public Health Initiatives | Influences demand for specific items | Focus on infectious disease prevention |

| Healthcare System Reforms | Requires adaptable service offerings | Push for regional networks & digital health by 2025 |

What is included in the product

This Suzuken PESTLE analysis offers a comprehensive examination of how political, economic, social, technological, environmental, and legal forces impact the company's operations and strategic planning.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for actionable strategic discussions.

Economic factors

Japan's economic performance, particularly its GDP growth and consumer spending trends, directly influences the national healthcare budget. For instance, in 2023, Japan's GDP grew by 1.9%, a modest but positive sign that can support healthcare expenditure. A stronger economy generally translates to a more robust healthcare budget, which benefits companies like Suzuken by potentially increasing demand for pharmaceuticals and medical supplies.

Conversely, economic slowdowns or recessions can put pressure on government spending, including the healthcare sector. If Japan experiences economic stagnation, the government might need to implement austerity measures, potentially leading to reduced healthcare budgets for hospitals and clinics. This could dampen their purchasing power and consequently affect Suzuken's sales volumes and overall revenue.

Trends in public and private healthcare expenditure in Japan directly impact the demand for pharmaceuticals and medical supplies, Suzuken's core products. In 2023, Japan's total healthcare expenditure reached approximately ¥48.4 trillion (around $320 billion USD), with government spending comprising a significant portion.

The aging population is a key driver, with individuals aged 65 and over accounting for over 29% of Japan's population as of 2024. This demographic shift naturally increases healthcare utilization and overall spending, creating a consistent demand base for Suzuken's offerings.

Monitoring these expenditure patterns is crucial for Suzuken to accurately forecast demand for its diverse product portfolio and to strategically allocate resources, ensuring efficient supply chain management and market responsiveness.

Inflationary pressures are a significant concern for Suzuken, impacting key operational costs. For instance, rising fuel prices directly affect transportation expenses, a critical component for a distributor. In Japan, inflation reached 3.1% in 2023, and while it showed signs of moderating in early 2024, ongoing global supply chain issues and geopolitical events could reignite these pressures.

The energy sector also plays a vital role in Suzuken's operations, from powering warehouses to supporting logistics. Higher energy costs can directly translate to increased expenditures. Similarly, labor costs are subject to inflationary trends, with wage demands often rising to keep pace with the cost of living. These combined cost increases can put a strain on Suzuken's profitability.

As a distributor, Suzuken manages a substantial inventory, which requires significant capital investment and incurs ongoing costs for storage and handling. When operational costs like energy, transportation, and labor rise due to inflation, these costs can squeeze profit margins. Suzuken must therefore focus on efficiency improvements and explore strategies to pass on increased costs to customers or absorb them through operational optimizations to maintain healthy profitability.

Interest Rates and Investment Environment

The Bank of Japan's monetary policy significantly influences Suzuken's financial flexibility. For instance, as of early 2024, the Bank of Japan maintained its ultra-loose monetary policy, with the short-term interest rate at -0.1% and the target for the 10-year Japanese government bond yield around 0%. This environment generally lowers borrowing costs for companies like Suzuken looking to invest in infrastructure or technology.

However, signals of potential policy shifts in 2024 and 2025, such as moves away from negative interest rates, could lead to increased borrowing expenses for Suzuken. This would impact the financial feasibility of capital-intensive projects, potentially slowing down upgrades to distribution networks or IT systems.

The broader investment climate, influenced by interest rate expectations and economic growth prospects, also plays a crucial role. A robust investment environment can encourage greater spending on healthcare facilities, indirectly boosting demand for Suzuken's pharmaceutical wholesale and distribution services.

- Bank of Japan's Policy Rate: As of early 2024, the policy rate remained at -0.1%, facilitating lower borrowing costs.

- Yield Curve Control: The target for the 10-year JGB yield was around 0%, influencing long-term borrowing costs.

- Inflationary Pressures: Rising inflation in Japan during 2023 and into 2024 has led to discussions about potential monetary policy normalization, which could increase future borrowing costs.

- Investment Climate Impact: A positive investment outlook can spur capital expenditure in the healthcare sector, indirectly benefiting Suzuken's demand.

Currency Exchange Rate Fluctuations

While Suzuken's core business is in Japan, currency exchange rate fluctuations can still impact its operations. For instance, if the Japanese Yen weakens against currencies like the US Dollar or Euro, the cost of any imported medical devices or specialized pharmaceuticals would rise. This could directly affect Suzuken's procurement expenses.

For example, if the Yen depreciates by 5% against the US Dollar, a product that previously cost $100 would now cost approximately ¥15,750 instead of ¥15,000 (assuming an exchange rate of 150 JPY/USD). This increase in import costs might then influence Suzuken's pricing strategies for those specific products sold to its customers.

- Impact on Import Costs: A weaker Yen increases the JPY cost of goods sourced internationally.

- Procurement Expenses: Higher import costs can lead to increased overall operational expenses for Suzuken.

- Pricing Strategy: Suzuken may need to adjust product prices to offset increased import costs, potentially affecting customer affordability.

Japan's economic performance, marked by a GDP growth of 1.9% in 2023, directly influences healthcare budgets and consumer spending on medical supplies. A stronger economy generally supports increased healthcare expenditure, which benefits distributors like Suzuken by boosting demand for their products.

Inflationary pressures, with Japan's inflation at 3.1% in 2023, impact Suzuken's operational costs, particularly transportation and labor. Managing these rising expenses is critical for maintaining profitability amidst fluctuating global supply chains.

The Bank of Japan's monetary policy, maintaining a -0.1% policy rate as of early 2024, offers low borrowing costs for investment but signals potential future increases. This influences the financial feasibility of Suzuken's capital-intensive projects and network upgrades.

Currency exchange rates, particularly the Yen's fluctuation against major currencies, affect Suzuken's import costs for medical devices and pharmaceuticals. A weaker Yen can increase procurement expenses, potentially impacting pricing strategies.

| Economic Factor | 2023 Data/Status | Impact on Suzuken | Outlook/Consideration |

|---|---|---|---|

| GDP Growth (Japan) | 1.9% | Supports healthcare spending, increasing demand. | Modest growth indicates stable market conditions. |

| Inflation Rate (Japan) | 3.1% | Increases operational costs (transport, labor). | Potential for further increases impacting margins. |

| Bank of Japan Policy Rate | -0.1% (early 2024) | Lowers borrowing costs for investment. | Potential for rate hikes could increase future borrowing expenses. |

| Yen Exchange Rate | Fluctuating | Weakening Yen increases import costs. | Requires careful management of procurement and pricing. |

Preview the Actual Deliverable

Suzuken PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Suzuken PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the strategic landscape and make informed decisions with this detailed report.

Sociological factors

Japan's demographic landscape is characterized by a rapidly aging population, with projections indicating that by 2025, over 30% of the population will be 65 years or older. This trend directly correlates with an increased prevalence of chronic diseases and age-related health conditions. Consequently, there's a sustained and growing demand for pharmaceuticals, medical devices, and healthcare services, creating a stable market for companies like Suzuken.

This demographic shift presents a significant opportunity for Suzuken's pharmaceutical wholesale and logistics business. The company is well-positioned to capitalize on this by strategically expanding its portfolio and services to cater specifically to the elderly care sector and the management of chronic diseases. For instance, an increase in demand for long-term care medications and home healthcare supplies directly benefits Suzuken's distribution network.

Growing public awareness about health and preventive care is significantly shaping how people approach their well-being. This heightened consciousness means consumers are increasingly seeking out solutions that support healthier lifestyles, potentially driving demand for specific types of medications and health-promoting products.

For Suzuken, this trend translates into a need to closely observe shifts in consumer preferences and public health priorities. Aligning its product portfolio to meet these evolving demands is crucial for continued relevance and market success.

For example, in 2024, global spending on preventive healthcare was projected to reach over $1.5 trillion, highlighting a substantial market opportunity for companies that can cater to this growing health-conscious demographic.

Japan's continued shift towards urban centers, with an estimated 92.8% of its population residing in urban areas as of 2024, exacerbates existing healthcare access inequalities. Rural regions, facing depopulation, often struggle with fewer medical facilities and a shortage of healthcare professionals, impacting the availability of specialized treatments and timely care.

Suzuken's national distribution network must therefore evolve to bridge these geographical gaps. This could involve strategic investments in logistics and warehousing in underserved rural areas, ensuring consistent supply of pharmaceuticals and medical equipment, while also potentially streamlining operations in high-density urban markets where demand is concentrated.

Patient Expectations and Empowerment

Patients are increasingly taking charge of their health, demanding better quality, easier access, and more treatment options. This shift means healthcare providers must focus more on the patient experience. For distributors like Suzuken, this translates into a need for services that streamline medication access and improve pharmacy efficiency, making them more valuable to the healthcare ecosystem.

This growing patient empowerment is reflected in rising healthcare consumerism. For instance, in 2024, reports indicate a significant increase in patients actively researching their conditions and treatment options online, often before even consulting a doctor. This proactive engagement necessitates that support services, like those Suzuken provides, offer greater transparency and convenience.

- Patient-Centric Services: Demand for services that improve medication adherence and patient convenience is growing.

- Information Access: Patients are accessing more health information, influencing their choices and expectations from healthcare providers and distributors.

- Quality Focus: A strong emphasis on higher quality care drives demand for more efficient and reliable pharmaceutical distribution.

Workforce Demographics in Healthcare

Japan's healthcare sector faces a significant challenge with an aging workforce. By 2025, it's projected that a substantial portion of healthcare professionals will be nearing retirement age, potentially leading to labor shortages in hospitals and clinics. This demographic shift directly impacts Suzuken's client base, affecting their operational capacity and efficiency.

This situation presents Suzuken with a prime opportunity to expand its service offerings. By providing advanced inventory management solutions and digital tools, Suzuken can empower healthcare facilities to better manage their existing labor, optimize resource allocation, and enhance overall operational productivity. For instance, implementing automated dispensing systems could alleviate pressure on nursing staff.

- Aging Workforce Impact: An estimated 30% of Japanese physicians are expected to be over 65 by 2025, increasing the strain on younger medical staff and potentially reducing service availability.

- Labor Shortage Effects: This can lead to longer patient wait times and decreased efficiency in hospitals and clinics, impacting the demand for pharmaceutical and medical supplies.

- Suzuken's Opportunity: Offering digital solutions for supply chain management and inventory optimization can help clients mitigate labor challenges and improve cost-effectiveness.

- Value-Added Services: Suzuken can leverage its expertise to provide consulting on workflow optimization, further supporting healthcare providers in adapting to demographic changes.

Societal shifts in Japan, such as an aging population and increased health consciousness, directly influence demand for Suzuken's pharmaceutical and medical services. By 2025, over 30% of Japan's population is projected to be 65 or older, driving sustained demand for chronic disease management and elder care products.

The growing trend of patients actively seeking health information online, a phenomenon amplified in 2024, empowers consumers and necessitates greater transparency and convenience from healthcare distributors like Suzuken.

Furthermore, the concentration of Japan's population in urban areas, with approximately 92.8% living in cities as of 2024, creates disparities in healthcare access that Suzuken's distribution network must address by serving both dense urban centers and underserved rural regions.

The increasing patient-centricity in healthcare means Suzuken must focus on services that streamline medication access and enhance pharmacy efficiency, thereby adding value to the broader healthcare ecosystem.

Technological factors

The healthcare sector is rapidly integrating digital solutions, with a significant increase in the use of electronic health records (EHRs) and telemedicine. For instance, by the end of 2024, it's projected that over 90% of U.S. hospitals will have certified EHR technology in place. This digital shift directly influences procurement processes and operational efficiency for medical supply companies like Suzuken.

Suzuken can capitalize on this trend by enhancing its digital platforms for streamlined order management and robust supply chain optimization. Utilizing data analytics derived from these digital interactions will allow Suzuken to offer more responsive and efficient services to healthcare providers, anticipating their needs and improving delivery times. This proactive approach is crucial for maintaining a competitive edge in the evolving healthcare market.

Advancements in automation, like robotic warehouses and autonomous delivery systems, are set to revolutionize Suzuken's pharmaceutical distribution. These technologies promise to boost efficiency and accuracy within their network.

Implementing cutting-edge logistics tech can significantly cut operational expenses and slash delivery times. For instance, the global warehouse automation market was valued at approximately $20 billion in 2023 and is projected to reach over $40 billion by 2028, indicating substantial investment in these areas.

By minimizing errors and speeding up the supply chain, Suzuken can sharpen its competitive advantage in the wholesale pharmaceutical market, ensuring timely and reliable access to medicines.

Suzuken can leverage big data analytics and AI to gain deeper insights into healthcare demand, optimize its extensive inventory, and understand customer purchasing habits. This allows for more precise prediction of market needs and the tailoring of support services. For instance, in 2024, the global healthcare analytics market was valued at approximately $35 billion and is projected to grow significantly, indicating the increasing reliance on data-driven insights.

By analyzing large datasets, Suzuken can anticipate market trends, personalize its offerings, and uncover novel avenues for business expansion. AI's role in streamlining internal processes and improving decision-making is crucial, especially as the healthcare sector becomes more complex. The adoption of AI in healthcare operations is expected to drive substantial efficiency gains, with studies suggesting potential cost savings of up to 20% in certain operational areas by 2025.

E-commerce and Online Pharmacy Platforms

The growing e-commerce sector in Japan presents a significant technological factor for Suzuken. Online pharmacy platforms are gaining traction, potentially disrupting traditional pharmaceutical distribution models. Suzuken must consider how this shift impacts its core wholesale business and identify opportunities to partner with or adapt to these digital channels to maintain its market position.

The Japanese government has been cautiously expanding regulations around online drug sales, with pilot programs and discussions ongoing. For instance, by late 2024, further clarity on the scope of over-the-counter (OTC) drug sales via online channels is anticipated. This evolving regulatory landscape directly influences the viability and scale of e-commerce in the pharmaceutical sector.

Suzuken's strategic response could involve several approaches:

- Developing its own e-commerce capabilities for pharmaceutical distribution, offering a direct-to-consumer or business-to-business online portal.

- Forging partnerships with existing online pharmacies and e-commerce giants to leverage their customer reach and logistical networks.

- Investing in technology that enhances supply chain visibility and efficiency for online pharmaceutical sales, ensuring compliance and timely delivery.

Medical Device Innovation and Connectivity

The medical device industry, particularly in 2024 and 2025, is seeing rapid advancements in smart devices and connected health technologies. This trend demands a distribution infrastructure that can manage a wider array of sophisticated products. Suzuken's capacity to distribute these high-tech items, coupled with offering essential support, training, and integration services, will be a significant factor in its expansion within the medical supplies sector.

For instance, the global connected health market was projected to reach over $200 billion by 2024, with wearable medical devices and remote patient monitoring systems being key drivers. Suzuken's ability to adapt its logistics and service offerings to meet the specialized needs of these innovative products, such as ensuring cold chain integrity for certain biosensors or providing cybersecurity support for connected diagnostic tools, will be paramount. This adaptability directly impacts their ability to capture market share in a segment that relies heavily on seamless technological integration and reliable supply chains.

- Innovation in Wearables: The market for wearable medical devices is expected to grow by approximately 15% annually through 2025, requiring specialized handling and distribution.

- Remote Patient Monitoring: Adoption of RPM solutions is projected to increase by over 20% in the next two years, creating demand for devices that need reliable connectivity and support.

- Data Security: As devices become more connected, the need for secure data transmission and storage solutions becomes critical, influencing distribution partners' service offerings.

- Training and Integration: Healthcare providers will increasingly require training and integration services for new medical technologies, presenting an opportunity for distributors like Suzuken to add value.

Technological advancements are reshaping pharmaceutical distribution, with digital health solutions like EHRs and telemedicine becoming standard. By the end of 2024, over 90% of U.S. hospitals are expected to utilize certified EHR technology, a trend Suzuken can leverage by enhancing its digital platforms for efficient order management and supply chain optimization.

Automation in logistics, such as robotic warehouses, is poised to significantly boost efficiency and accuracy in Suzuken's operations. The global warehouse automation market, valued around $20 billion in 2023 and projected to exceed $40 billion by 2028, highlights substantial investment in these transformative technologies.

The increasing adoption of big data analytics and AI in healthcare, with the global market valued at approximately $35 billion in 2024, offers Suzuken opportunities to refine inventory management and predict market demand more accurately, potentially achieving up to 20% cost savings in operational areas by 2025.

Legal factors

The Pharmaceuticals and Medical Devices Act (formerly Pharmaceutical Affairs Law) in Japan is a critical legal framework for Suzuken, dictating the rules for making, selling, and distributing drugs and medical equipment. Adherence to its stringent requirements, such as obtaining proper licenses, maintaining specific storage environments, and implementing robust quality control, is non-negotiable for Suzuken to continue its operations legally and maintain its business licenses.

As a leading pharmaceutical wholesaler in Japan, Suzuken is subject to the nation's Anti-Monopoly Act, overseen by the Japan Fair Trade Commission (JFTC). This legislation is designed to ensure fair competition and prevent monopolistic practices within the healthcare sector. For instance, in 2023, the JFTC continued its efforts to monitor market dynamics, including those within pharmaceutical distribution, to safeguard against unfair trade practices that could disadvantage smaller players or inflate costs for consumers.

Suzuken must diligently ensure its operations do not involve price fixing, bid rigging, or the abuse of a dominant market position. Failure to comply can result in significant penalties, including fines and sanctions that could impact business operations and reputation. The company's ongoing commitment to regular internal audits and legal reviews helps maintain compliance with these critical anti-monopoly regulations, ensuring a level playing field in the Japanese pharmaceutical market.

Suzuken's operations, particularly those involving sensitive patient and healthcare provider information, are governed by Japan's Act on the Protection of Personal Information (APPI). This legislation, akin to global standards like GDPR, mandates robust data privacy and security measures. Failure to comply can result in significant penalties and reputational damage, underscoring the critical importance of safeguarding confidential data.

Labor Laws and Employment Regulations

Suzuken, operating primarily in Japan, must adhere to stringent labor laws. These cover aspects like maximum working hours, minimum wage requirements, mandatory employee benefits, and comprehensive workplace safety standards. For instance, Japan's Labor Standards Act sets strict limits on overtime and mandates paid leave, directly influencing Suzuken's staffing and operational cost calculations.

Potential shifts in labor legislation present significant implications for Suzuken. Reforms aimed at improving work-life balance, such as enhanced parental leave or regulations on overtime, could necessitate adjustments in staffing levels and compensation structures, potentially increasing operational expenses. Furthermore, changes to rules governing contract or part-time employment might affect Suzuken's flexible workforce management strategies.

- Compliance with Japan's Labor Standards Act: This includes adherence to regulations on working hours, overtime pay, and statutory paid leave.

- Impact of Work-Life Balance Reforms: Legislation promoting better work-life balance may influence staffing needs and increase labor costs for Suzuken.

- Regulation of Contract Employment: Changes in laws governing non-regular employees could affect Suzuken's human resource flexibility and cost management.

Environmental Protection Laws and Waste Management

Environmental protection laws significantly shape Suzuken's operations, particularly regarding the disposal of medical waste and packaging. For instance, Japan's Waste Management and Public Cleansing Act mandates strict procedures for handling and disposing of industrial and medical waste, impacting Suzuken's logistics and warehousing. Failure to comply can result in substantial fines, with penalties under the act potentially reaching millions of yen for severe violations, underscoring the financial risk associated with non-adherence. This necessitates robust internal protocols and rigorous oversight of third-party waste management services to ensure full compliance and maintain corporate social responsibility.

Suzuken's commitment to environmental standards extends to its entire supply chain. The company must verify that its logistics partners and suppliers also adhere to national and international environmental regulations, such as those concerning the reduction of single-use plastics in packaging, a growing concern globally. In 2023, the Japanese government announced targets to reduce plastic waste by 25% by 2030, a policy that will likely influence packaging choices and material sourcing for companies like Suzuken. This proactive approach not only mitigates legal risks but also enhances brand reputation among environmentally conscious stakeholders.

Key legal considerations for Suzuken include:

- Compliance with Japan's Waste Management and Public Cleansing Act for medical waste disposal.

- Adherence to regulations on packaging materials and plastic waste reduction targets.

- Ensuring supply chain partners meet environmental protection standards.

- Mitigating financial risks associated with environmental non-compliance.

Suzuken operates under a complex web of Japanese legislation, including the Pharmaceuticals and Medical Devices Act, which governs the production, sale, and distribution of its core products. Compliance with this act, along with the Anti-Monopoly Act to ensure fair competition, is fundamental to its business continuity. The Act on the Protection of Personal Information (APPI) also mandates strict data privacy, crucial given the sensitive nature of healthcare information Suzuken handles.

Labor laws, such as the Labor Standards Act, dictate working hours and benefits, impacting operational costs and workforce management. Environmental regulations, like the Waste Management and Public Cleansing Act, are critical for proper disposal of medical waste and packaging. Japan's push for plastic waste reduction, aiming for a 25% decrease by 2030, will likely influence Suzuken's packaging strategies and supply chain requirements.

| Legal Area | Key Regulations | Impact on Suzuken | Example/Data Point |

|---|---|---|---|

| Pharmaceuticals & Medical Devices | Pharmaceuticals and Medical Devices Act | Licenses, quality control, distribution rules | Strict adherence required for market access. |

| Competition | Anti-Monopoly Act | Prevents monopolistic practices, ensures fair trade | JFTC monitoring of pharmaceutical distribution dynamics (2023). |

| Data Privacy | Act on the Protection of Personal Information (APPI) | Mandates robust data security and privacy measures | Penalties for non-compliance, akin to GDPR. |

| Labor | Labor Standards Act | Working hours, overtime, paid leave, safety | Influences staffing and labor cost calculations. |

| Environment | Waste Management and Public Cleansing Act | Medical waste disposal, packaging regulations | Potential fines for non-compliance, plastic waste reduction targets (25% by 2030). |

Environmental factors

Climate change is increasingly impacting global supply chains, and Suzuken is not immune. The rising frequency of extreme weather events, such as typhoons and floods, poses a significant threat to the timely delivery of pharmaceuticals and medical supplies. For instance, in 2024, Japan experienced several severe weather incidents that caused widespread disruptions to transportation networks.

To counter these risks, Suzuken must prioritize building resilience within its distribution networks. This involves developing robust contingency plans and optimizing logistics routes to navigate potential disruptions. Maintaining diversified warehousing facilities across different geographical locations can also serve as a crucial buffer against localized natural disasters, ensuring continuity of operations.

Growing environmental awareness and stricter regulations are pushing companies like Suzuken to prioritize sustainable packaging and waste management. For instance, the European Union's Packaging and Packaging Waste Regulation aims to reduce packaging waste and increase recycling rates across member states, influencing global supply chains. This regulatory push, coupled with consumer demand for greener products, means businesses must adapt.

Suzuken can significantly improve its environmental impact by adopting eco-friendly packaging materials, such as biodegradable plastics or recycled paper, and by optimizing package sizes to minimize material usage. Implementing robust recycling programs within its distribution network, as seen with many logistics companies adopting circular economy principles, can further reduce waste. For example, many companies in the pharmaceutical distribution sector are exploring reusable packaging solutions to cut down on single-use materials.

Companies like Suzuken, with significant logistics operations, are under growing pressure to address their carbon footprint. This includes emissions generated by their transportation fleets and warehousing activities.

In 2023, the global logistics sector contributed an estimated 10% of total greenhouse gas emissions, highlighting the scale of the challenge. Suzuken can mitigate this by investing in more fuel-efficient vehicles, a trend seen across the industry, and by optimizing delivery routes to reduce mileage.

Furthermore, exploring renewable energy sources for its facilities, such as solar power for warehouses, is a key strategy. For instance, many companies in 2024 are setting targets to power a significant portion of their operations with renewables, aiming for a substantial reduction in Scope 1 and Scope 2 emissions.

Resource Scarcity and Supply Chain Inputs

The potential for scarcity or increased costs of raw materials critical for medical supplies and packaging directly impacts Suzuken's procurement expenses. Even though Suzuken operates as a distributor, its upstream supply chain partners face these challenges head-on.

For instance, global demand for key medical components and packaging materials, such as specialized plastics and sterile fabrics, has seen significant upward pressure. Reports from early 2024 indicated a 10-15% increase in the cost of certain pharmaceutical-grade polymers due to supply chain disruptions and heightened demand, a trend expected to continue through 2025.

To navigate these risks, Suzuken can focus on proactive measures:

- Monitoring Global Resource Trends: Staying informed about geopolitical events, climate impacts, and manufacturing capacity shifts that could affect resource availability.

- Diversifying Supplier Relationships: Building a robust network of suppliers across different geographical regions to reduce reliance on any single source.

- Long-Term Contracts: Securing favorable pricing and supply commitments through strategic, longer-term agreements with key material providers.

- Inventory Management: Optimizing inventory levels for critical supplies to buffer against short-term supply shocks without incurring excessive holding costs.

Corporate Social Responsibility (CSR) and Stakeholder Expectations

Stakeholders, including investors, customers, and the public, are increasingly scrutinizing companies for their environmental and social impact. Suzuken's proactive approach to Corporate Social Responsibility (CSR) is vital for meeting these evolving expectations. For instance, in 2023, a significant majority of global investors, around 70%, considered ESG (Environmental, Social, and Governance) factors when making investment decisions, according to a report by PwC.

Suzuken's dedication to environmental sustainability can significantly bolster its brand image and attract a wider customer base. Companies with strong CSR initiatives often see improved customer loyalty and a more positive public perception. This commitment can also foster partnerships with like-minded organizations, creating synergistic opportunities.

Demonstrating robust environmental stewardship can translate into tangible market advantages. Companies that prioritize sustainability may experience reduced operational costs through resource efficiency and may be better positioned to navigate stricter environmental regulations. Suzuken's efforts in this area could lead to enhanced market positioning and long-term resilience.

- Investor Scrutiny: Over 70% of global investors factored ESG into decisions in 2023, highlighting the financial relevance of CSR.

- Customer Loyalty: Strong environmental commitments resonate with consumers, potentially boosting brand preference and sales.

- Partnership Opportunities: Aligning with sustainable partners can unlock new markets and collaborative innovations.

- Competitive Edge: Proactive environmental management can lead to cost savings and a stronger market position.

Climate change and extreme weather events, such as those impacting Japan in 2024, pose direct risks to Suzuken's supply chain operations, necessitating robust contingency planning and diversified logistics. Increased environmental awareness and regulations, like the EU's Packaging and Packaging Waste Regulation, are compelling companies to adopt sustainable packaging and waste management practices, a trend expected to intensify through 2025.

The logistics sector's significant contribution to greenhouse gas emissions, estimated at 10% globally in 2023, pressures Suzuken to invest in fuel-efficient fleets and renewable energy sources for its facilities, with many companies targeting substantial emission reductions by 2025.

Potential raw material scarcity, evidenced by a 10-15% cost increase for certain pharmaceutical polymers in early 2024, impacts upstream supply chains and necessitates proactive supplier diversification and strategic inventory management for Suzuken.

Growing investor and public scrutiny on ESG factors, with over 70% of global investors considering them in 2023, underscores the importance of Suzuken's CSR initiatives for brand image, customer loyalty, and competitive advantage.

| Environmental Factor | Impact on Suzuken | Data/Example | Mitigation Strategy |

|---|---|---|---|

| Climate Change & Extreme Weather | Supply chain disruption, logistics challenges | Japan experienced severe weather in 2024 causing transportation network disruptions. | Contingency planning, diversified warehousing, optimized logistics routes. |

| Environmental Regulations & Awareness | Pressure for sustainable packaging and waste reduction | EU Packaging and Packaging Waste Regulation drives global changes. | Eco-friendly materials, optimized packaging, robust recycling programs. |

| Carbon Footprint | Emissions from transportation and warehousing | Global logistics sector contributed ~10% of GHG emissions in 2023. | Fuel-efficient vehicles, route optimization, renewable energy adoption (e.g., solar for warehouses). |

| Resource Scarcity & Costs | Increased procurement expenses for upstream suppliers | 10-15% cost increase for some pharmaceutical polymers in early 2024. | Monitoring trends, diversifying suppliers, long-term contracts, optimized inventory. |

| Stakeholder Expectations (CSR/ESG) | Reputational risk and opportunity | ~70% of global investors considered ESG in 2023 (PwC). | Enhanced brand image, customer loyalty, partnership opportunities, competitive edge. |

PESTLE Analysis Data Sources

Our Suzuken PESTLE Analysis draws from a comprehensive blend of official government publications, reputable industry associations, and leading market research firms. This ensures that our insights into political, economic, social, technological, legal, and environmental factors are grounded in verified, current data.