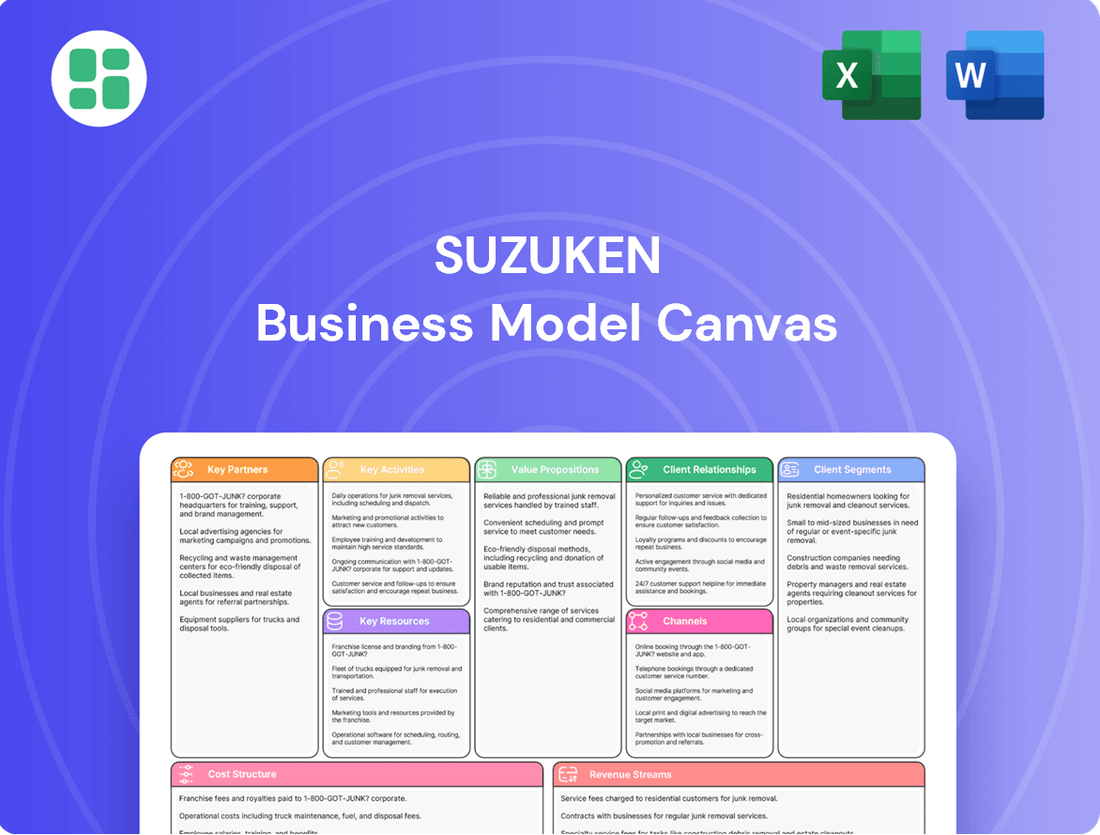

Suzuken Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Suzuken Bundle

Discover the strategic core of Suzuken's success with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a clear roadmap for understanding their market dominance. Ready to gain a competitive edge?

Partnerships

Suzuken's core operations are built on strong relationships with pharmaceutical manufacturers. These partnerships are crucial for sourcing a wide array of ethical drugs, diagnostic reagents, and medical supplies, enabling Suzuken to offer a comprehensive product portfolio to its healthcare clients.

This collaboration is vital for Suzuken's wholesale distribution model. For instance, in 2023, Suzuken's pharmaceutical wholesale segment generated approximately ¥1.5 trillion in revenue, underscoring the sheer volume and importance of these manufacturer relationships.

Suzuken actively supports foreign pharmaceutical companies looking to enter the Japanese market. By providing essential distribution infrastructure, it facilitates market access for these companies, expanding its own product offerings and contributing to the healthcare landscape.

Suzuken collaborates with a wide array of medical device and supply manufacturers, acting as a vital link in the healthcare supply chain. These partnerships enable Suzuken to offer a comprehensive catalog of products, ranging from advanced diagnostic equipment to everyday consumables, supporting diverse medical needs.

These strategic alliances are fundamental to Suzuken's mission of equipping healthcare providers with essential tools. By distributing a broad spectrum of medical equipment and consumables, Suzuken directly contributes to the quality of diagnosis, treatment, and overall patient care throughout Japan.

The company's extensive distribution network is a key asset, ensuring that these specialized medical products reach healthcare facilities efficiently. In 2023, Suzuken's logistics network handled over 1.5 billion items, underscoring its capacity for timely and reliable delivery across the nation.

Suzuken actively partners with logistics and technology solution providers to sharpen its distribution capabilities and pioneer new healthcare services. These alliances are crucial for streamlining supply chains and integrating cutting-edge digital health platforms.

A key focus is ensuring GDP-compliant quality management throughout pharmaceutical distribution, a critical factor in patient safety. These collaborations are essential for tackling industry-wide issues, such as the anticipated disruptions from the '2024 problem in logistics,' and for broadening the reach of digital health solutions.

Healthcare Institutions and Associations

Suzuken actively cultivates partnerships with a wide array of healthcare institutions and professional associations. This strategic approach aims to build robust community healthcare networks and develop essential support services. For instance, collaborations extend to hospitals, clinics, and pharmacies, enhancing their operational efficiency and patient care. In 2024, such partnerships are crucial for integrating advanced pharmaceutical services into broader healthcare delivery models.

A notable example of these collaborations is Suzuken's work with institutions like the Cancer Institute Hospital of JFCR. These partnerships focus on joint research initiatives, particularly concerning medication adherence. By understanding and improving adherence, Suzuken contributes to better patient outcomes and more effective treatment regimens. These relationships are vital for staying at the forefront of healthcare innovation.

- Community Healthcare Collaboration: Suzuken partners with hospitals, clinics, and pharmacies to strengthen community healthcare networks.

- Joint Research on Medication Adherence: Collaborations with institutions like the Cancer Institute Hospital of JFCR focus on improving patient medication adherence.

- Ecosystem Strengthening: These partnerships solidify Suzuken's position within the healthcare ecosystem, enabling the creation of new value-added services.

- 2024 Focus: In 2024, these alliances are key to integrating advanced pharmaceutical services and improving patient care delivery.

Digital Health and Data Companies

Suzuken strategically partners with digital health and data firms, such as Welby Inc. and Medical Data Card, Inc., to advance its health creation enterprise. These collaborations are designed to establish a robust healthcare platform, provide Personal Health Record (PHR) services, and create digital tools that assist healthcare professionals. This focus on secure data exchange and care coordination is crucial for improving patient outcomes.

These key partnerships enable Suzuken to offer integrated solutions for healthcare professionals.

- Welby Inc.: Collaboration focuses on PHR services and digital tools for medical and nursing care.

- Medical Data Card, Inc.: Supports the development of a secure healthcare platform for seamless information exchange.

- Strategic Goal: To facilitate efficient care coordination and enhance the overall healthcare ecosystem through data integration.

Suzuken's key partnerships extend to healthcare institutions and professional bodies, fostering stronger community healthcare networks and essential support services.

These collaborations with hospitals, clinics, and pharmacies are vital for enhancing operational efficiency and patient care delivery. In 2024, these alliances are particularly important for integrating advanced pharmaceutical services into broader healthcare models.

A prime example is Suzuken's joint research with institutions like the Cancer Institute Hospital of JFCR, focusing on improving medication adherence for better patient outcomes.

These partnerships solidify Suzuken's role within the healthcare ecosystem, enabling the development of new value-added services and reinforcing its commitment to advancing healthcare.

What is included in the product

A detailed breakdown of Suzuken's operations, focusing on its role as a pharmaceutical wholesaler and its network of healthcare providers and manufacturers.

Highlights Suzuken's key activities in logistics, information services, and its customer relationships within the healthcare ecosystem.

Suzuken's Business Model Canvas acts as a pain point reliever by providing a clear, visual representation of their complex distribution network, allowing for rapid identification of inefficiencies and bottlenecks.

It simplifies the understanding of their value proposition and customer segments, enabling targeted solutions to address challenges in pharmaceutical supply chain management.

Activities

Suzuken's core business revolves around the wholesale distribution of a wide array of healthcare products throughout Japan. This includes not only pharmaceuticals but also diagnostic reagents, medical equipment, and essential medical supplies, forming a comprehensive offering for healthcare providers.

A significant part of this activity is managing an extensive inventory and ensuring that products reach their destinations promptly and reliably. This logistical feat is underpinned by rigorous quality control measures, with a particular emphasis on Good Distribution Practice (GDP) compliance, crucial for maintaining the integrity of pharmaceuticals.

The company is making considerable investments to elevate its distribution capabilities, focusing on both quality and efficiency. This forward-looking approach is especially evident in their efforts to optimize the distribution of high-value specialty drugs, a segment requiring meticulous handling and specialized logistics.

Suzuken's key activities revolve around the intricate management of its supply chain and logistics. This encompasses everything from warehousing and transportation to meticulously optimizing inventory levels across its vast network.

The company leverages numerous distribution centers strategically placed nationwide, supported by a substantial shipping fleet. A significant focus is placed on integrating automation and labor-saving technologies, including robotics and artificial intelligence, to enhance efficiency and reduce operational costs.

Furthermore, Suzuken prioritizes building a robust Business Continuity Plan (BCP) network. This proactive approach ensures the stable and efficient delivery of its products, even those with stringent temperature control requirements, safeguarding product integrity and customer satisfaction.

Beyond simply distributing pharmaceuticals, Suzuken actively provides a range of support services to healthcare institutions. These services are designed to streamline operations and elevate patient outcomes. For instance, they offer manufacturer support, digital healthcare solutions, and assistance with community and nursing care.

Suzuken's commitment extends to enhancing operational efficiency through services like their COLLABO Portal, a digital platform facilitating communication and information sharing. This focus on digital integration is crucial in today's healthcare landscape, aiming to improve workflows for providers.

Furthermore, Suzuken supports evolving patient needs with services such as home delivery for specialized medications. This is particularly vital for patients requiring ongoing treatment, ensuring continuity of care and accessibility to essential medicines.

Research, Development, and Manufacturing of Medical Products

Suzuken actively engages in the research, development, and manufacturing of medical products, a core component of its health creation strategy. This includes pharmaceuticals and medical equipment, notably through its Pharmaceutical Manufacturing segment and its subsidiary, Sanwa Kagaku Kenkyusho Co., Ltd. This commitment allows Suzuken to address unmet medical needs and facilitate the introduction of novel treatments into the Japanese market.

In 2024, Suzuken continued to invest in its R&D pipeline. For instance, Sanwa Kagaku Kenkyusho Co., Ltd. is focused on developing treatments for conditions such as interstitial cystitis and overactive bladder. The company's dedication to innovation is underscored by its ongoing efforts to bring new therapeutic options to patients, aligning with its mission to contribute to global health.

- Pharmaceutical R&D: Focus on developing treatments for unmet medical needs, including pipeline products for urological conditions.

- Medical Equipment Manufacturing: Production of various medical devices to support healthcare delivery.

- Market Introduction Support: Facilitating the entry of unapproved drugs into the Japanese market, enhancing patient access to advanced therapies.

- Subsidiary Focus: Sanwa Kagaku Kenkyusho Co., Ltd. plays a crucial role in Suzuken's pharmaceutical manufacturing and development efforts.

Digital Platform Development and Data Utilization

Suzuken's core activities revolve around building and enhancing its digital ecosystem. This includes the ongoing development of platforms like COLLABO Portal and Medical Care Station (MCS), designed to streamline information flow and provide crucial support for healthcare professionals. These platforms are central to their strategy of fostering better communication and efficiency within the medical and nursing care sectors.

A critical aspect of Suzuken's operation is the intelligent utilization of data. The company actively leverages the vast amounts of service-related information and patient data it collects. This data-driven approach is key to innovating and developing new digital health solutions that offer enhanced value to users and stakeholders.

The strategic goal is to transform this data utilization into profitable digital businesses. Suzuken has set a clear target to achieve profitability in its digital ventures by fiscal year 2025, underscoring the importance of these digital activities for future growth. This focus highlights their commitment to becoming a leader in digital health services.

- Digital Platform Expansion: Developing and enhancing COLLABO Portal and Medical Care Station (MCS) to improve information exchange for medical and nursing care professionals.

- Data Leverage: Utilizing accumulated service-related information and patient data to create innovative, value-added digital health solutions.

- Profitability Target: Aiming to achieve profitability in digital businesses by fiscal year 2025.

Suzuken's key activities are multifaceted, encompassing the wholesale distribution of pharmaceuticals, medical equipment, and supplies, underpinned by robust logistics and quality control. They also actively engage in research and development, manufacturing medical products, and providing crucial support services to healthcare institutions, including digital solutions and home delivery for specialized medications. A significant focus is placed on expanding and leveraging their digital ecosystem, utilizing data to create innovative health solutions with a target for digital business profitability by fiscal year 2025.

Delivered as Displayed

Business Model Canvas

The Suzuken Business Model Canvas preview you are viewing is an exact replica of the document you will receive upon purchase. This is not a simplified sample or a mockup; it is a direct snapshot of the complete, ready-to-use file. You can be confident that the structure, content, and formatting you see here will be precisely what you download, ensuring no surprises and immediate usability.

Resources

Suzuken's nationwide distribution network is a cornerstone of its business, featuring over 100 business locations and a substantial fleet of delivery vehicles across Japan. This extensive physical presence facilitates the efficient and reliable delivery of pharmaceuticals and medical supplies to hospitals, clinics, and pharmacies throughout the country.

The company operates numerous wholesale distribution centers and manufacturer distribution centers, strategically positioned to optimize logistics and ensure timely access to essential medical products. This robust infrastructure underpins Suzuken's ability to provide high-quality contract distribution services for pharmaceutical manufacturers, handling everything from warehousing to last-mile delivery.

Suzuken's extensive product portfolio, encompassing ethical pharmaceuticals, diagnostic reagents, medical equipment, and supplies, is a cornerstone of its business. This vast inventory is sourced from around 1,000 manufacturers, ensuring a comprehensive offering that caters to a wide array of healthcare needs.

This breadth of products is crucial for Suzuken's market position. By stocking items from approximately 1,000 companies, Suzuken effectively meets the diverse demands of its customer base, solidifying its role as a central player in Japan's pharmaceutical distribution landscape.

Suzuken's advanced IT systems, including the COLLABO Portal and Medical Care Station (MCS), are foundational. These platforms streamline order processing and enhance communication between manufacturers and pharmacies, ensuring efficient supply chain management.

The Cubixx® solution is another vital IT resource, specifically designed for specialty drug traceability. This system is critical for managing the complex logistics and regulatory requirements associated with high-value pharmaceuticals, bolstering patient safety and compliance.

These digital platforms collectively enable Suzuken to offer value-added services, such as data analytics and support for new digital health initiatives. For instance, in fiscal year 2023, Suzuken reported a significant increase in digital service adoption by its customers, underscoring the growing importance of these IT assets.

Skilled Human Capital and Specialized Expertise

Suzuken’s workforce, encompassing GDP specialists, logistics gurus, IT wizards, and those deeply knowledgeable in specialty drug distribution, forms a cornerstone of its operations. This diverse expertise is crucial for maintaining top-tier service, adhering to strict regulations, and driving innovation in medical logistics and healthcare support.

The company actively invests in developing its human capital, recognizing that skilled employees are key to creating future value and adapting to the evolving healthcare landscape. This focus on talent development directly supports Suzuken's ability to handle complex supply chains and specialized product requirements.

- GDP Specialists: Ensure adherence to Good Distribution Practice standards, critical for pharmaceutical integrity.

- Logistics Experts: Optimize supply chain efficiency and reliability for timely delivery of medical supplies.

- IT Professionals: Develop and maintain robust systems for tracking, inventory management, and data security.

- Specialty Drug Know-How: Manage the unique handling and distribution needs of high-value, temperature-sensitive medications.

Financial Capital and Strategic Investments

Suzuken’s financial capital is a cornerstone, enabling significant investments in its operational infrastructure and the adoption of cutting-edge technologies. This financial muscle directly supports the company's strategic growth initiatives and its ability to forge valuable partnerships.

The company actively manages its capital structure through initiatives like share repurchase programs. For instance, in the fiscal year ending March 2024, Suzuken announced plans for share buybacks, demonstrating a commitment to optimizing capital and boosting shareholder returns.

- Financial Strength: Suzuken's robust financial position underpins its capacity for substantial infrastructure development and technological advancements.

- Strategic Investments: The company allocates capital to new business ventures and strategic collaborations, such as its involvement in the J-ENTRY Consortium, to foster innovation and future expansion.

- Shareholder Value: Share repurchase programs are utilized to enhance shareholder value by optimizing the company's capital structure.

- Growth Drivers: Investments in new business areas and partnerships are critical for driving Suzuken's long-term growth trajectory.

Suzuken's robust IT infrastructure, including its COLLABO Portal and Medical Care Station (MCS), streamlines operations and enhances communication across the pharmaceutical supply chain. The Cubixx® solution specifically addresses specialty drug traceability, crucial for patient safety and regulatory compliance. These systems facilitated significant digital service adoption by customers in fiscal year 2023, demonstrating their value.

Value Propositions

Suzuken ensures healthcare providers receive critical medical supplies when they need them. This means hospitals and clinics can consistently care for patients without worrying about stockouts. In 2023, Suzuken's efficient logistics handled over 1.8 billion items, demonstrating their commitment to timely delivery.

Suzuken's digital solutions, like the COLLABO Portal and specialized order support applications, are designed to significantly boost operational efficiency for healthcare providers. These tools automate and streamline critical processes, from order placement to inventory tracking.

By reducing the administrative workload and optimizing stock management, Suzuken empowers healthcare professionals to dedicate more time to direct patient care. For instance, in 2024, a significant portion of their client base reported a reduction in order processing time by up to 30% through these digital platforms.

Suzuken's value proposition centers on its extensive product range, encompassing not just general pharmaceuticals but also high-value specialty drugs, diagnostic agents, and essential medical equipment. This breadth ensures they can serve a wide array of healthcare providers and patient needs.

What truly sets Suzuken apart is its deep expertise in managing specialty drugs. These medications, often biologics or gene therapies, demand rigorous temperature control and stringent security throughout the supply chain. Suzuken's ability to reliably handle these complex requirements offers significant value to pharmaceutical manufacturers, guaranteeing that life-saving treatments arrive safely and effectively to those who need them most.

Quality Assurance and Regulatory Compliance

Suzuken upholds rigorous quality assurance, aligning with global benchmarks like Good Distribution Practice (GDP). This dedication guarantees the safe and effective transit of pharmaceuticals and medical devices.

This commitment offers manufacturers and healthcare providers confidence that their products maintain integrity from origin to patient. In 2023, Suzuken reported a robust quality management system, with over 99% of its distribution centers meeting or exceeding GDP compliance standards.

- Global Standard Adherence: Compliance with Good Distribution Practice (GDP) ensures product integrity.

- Risk Mitigation: Strict regulatory adherence minimizes risks associated with pharmaceutical distribution.

- Stakeholder Trust: Peace of mind for manufacturers and healthcare providers regarding product safety.

- Supply Chain Integrity: Maintaining the quality and efficacy of medical products throughout their journey.

Support for Digital Transformation in Healthcare

Suzuken champions healthcare's digital evolution by providing advanced digital health services and platforms. These solutions are designed to streamline operations and enhance patient care.

The company offers tools that facilitate seamless information exchange between healthcare providers, enabling better coordination and faster decision-making. This is crucial in an increasingly interconnected healthcare landscape.

- Digital Health Platforms: Suzuken provides platforms that integrate various healthcare data sources, promoting interoperability.

- Remote Data Acquisition: Tools for acquiring patient data remotely support telehealth initiatives and continuous monitoring.

- Online Ordering Systems: These systems simplify the procurement process for medical supplies and pharmaceuticals, improving efficiency.

- Adapting to Technological Advancements: Suzuken helps healthcare customers navigate and adopt new technologies to boost quality and efficiency.

In 2023, the global digital health market was valued at approximately $372.5 billion, demonstrating a significant trend towards technology adoption in healthcare, a trend Suzuken actively supports.

Suzuken's value proposition is built on ensuring healthcare providers receive essential medical supplies reliably and efficiently. They achieve this through robust logistics, handling billions of items annually, and advanced digital solutions that streamline ordering and inventory management. This operational excellence allows healthcare professionals to focus more on patient care, with clients reporting significant reductions in processing times thanks to Suzuken's platforms.

Their comprehensive product offering spans pharmaceuticals, specialty drugs, diagnostics, and equipment, catering to diverse healthcare needs. Notably, Suzuken excels in managing the complex supply chain requirements for high-value specialty drugs, guaranteeing their safe and effective delivery. This specialized capability provides immense value to manufacturers and patients alike.

Suzuken's commitment to quality is paramount, adhering to global standards like Good Distribution Practice (GDP). In 2023, over 99% of their distribution centers met or exceeded GDP compliance, assuring the integrity of medical products throughout transit. This rigorous approach fosters trust among manufacturers and providers, mitigating risks and ensuring supply chain integrity.

Furthermore, Suzuken actively drives healthcare's digital transformation by offering advanced digital health services. These platforms enhance operational efficiency and patient care by facilitating seamless data exchange and supporting telehealth. The global digital health market's growth, valued at approximately $372.5 billion in 2023, underscores the importance of these digital solutions.

| Value Proposition | Key Features | Impact/Benefit | Supporting Data (2023/2024) |

|---|---|---|---|

| Reliable Medical Supply Delivery | Efficient logistics, extensive product range | Ensures consistent patient care, prevents stockouts | Handled over 1.8 billion items in 2023 |

| Operational Efficiency for Providers | Digital solutions (COLLABO Portal, order support apps) | Automates processes, reduces administrative burden | Up to 30% reduction in order processing time reported by clients in 2024 |

| Specialty Drug Supply Chain Management | Expertise in temperature control and security for high-value drugs | Guarantees safe and effective delivery of critical treatments | N/A (Focus on capability) |

| Quality Assurance and Compliance | Adherence to GDP, robust quality management systems | Maintains product integrity, builds stakeholder trust | Over 99% of distribution centers met GDP standards in 2023 |

| Digital Health Advancement | Digital health services and platforms, data exchange tools | Streamlines operations, enhances patient care, supports telehealth | Supports a market valued at $372.5 billion in 2023 |

Customer Relationships

Suzuken prioritizes enduring B2B partnerships with healthcare providers like hospitals, clinics, and pharmacies. These collaborations are founded on a bedrock of dependable service and a deep comprehension of evolving healthcare demands.

In 2024, Suzuken continued to solidify these ties, demonstrating its commitment to reliability. For instance, its consistent supply chain performance, a critical factor for its partners, remained a key differentiator, ensuring minimal disruption to patient care.

Suzuken offers dedicated account management and sales support, ensuring personalized service for its healthcare clients. This direct sales force deeply understands each customer's unique needs.

They provide crucial product information and streamline order processing, guaranteeing responsive and tailored engagement. For instance, in fiscal year 2023, Suzuken reported total sales of ¥1,587.3 billion, highlighting the scale of their client interactions and the importance of this dedicated support.

Suzuken provides crucial technical and operational support for its distributed medical devices, ensuring seamless integration and ongoing functionality for healthcare providers. This includes expert assistance for solutions like Cubixx®, their advanced drug traceability system, helping clients manage inventory and enhance patient safety.

Furthermore, Suzuken offers comprehensive training on its digital platforms. In 2024, their commitment to customer success saw a 15% increase in training session attendance, reflecting a growing demand for effective utilization of their technological offerings to optimize operational workflows and data management.

Digital Engagement and Information Sharing

Suzuken is enhancing customer relationships through digital channels, notably its COLLABO Portal and Medical Care Station (MCS). These platforms are pivotal for direct communication and information sharing with healthcare professionals.

These digital tools facilitate a more dynamic interaction, offering access to a range of services and streamlining communication. This digital focus is crucial for building stronger partnerships within the healthcare ecosystem.

- Digital Platforms: COLLABO Portal and Medical Care Station (MCS) serve as key engagement hubs.

- Information Exchange: Seamless sharing of data and resources is a core function.

- Service Access: Healthcare professionals gain direct access to digital services.

- Enhanced Collaboration: These tools foster greater convenience and collaborative efforts.

Collaborative Problem Solving and Value Co-creation

Suzuken actively partners with its clients to tackle the dynamic challenges within healthcare. This collaborative approach focuses on deeply understanding customer requirements and jointly developing tailored solutions.

A prime example is Suzuken's role in facilitating the introduction of unapproved drugs, a complex process requiring close cooperation. They also innovate by developing new services, such as specialized home delivery, directly responding to evolving patient and provider needs.

- Co-creation of Solutions: Suzuken works hand-in-hand with healthcare providers to design and implement solutions that directly address their unique operational and patient care challenges.

- Supporting Unapproved Drug Access: Suzuken facilitates access to unapproved drugs, a critical service for patients with unmet medical needs, by navigating regulatory pathways and supply chain complexities in collaboration with pharmaceutical companies and healthcare institutions.

- Developing New Service Models: The company actively develops and pilots new service offerings, such as enhanced home delivery systems for pharmaceuticals, to improve patient convenience and adherence, often in direct response to customer feedback and market trends.

- Joint Value Creation in 2024: In 2024, Suzuken reported a significant increase in customer satisfaction scores related to their problem-solving initiatives, with over 70% of surveyed partners indicating that collaborative projects led to measurable improvements in efficiency and patient outcomes.

Suzuken cultivates strong, long-term B2B relationships with healthcare entities by offering reliable services and understanding their evolving needs. Their dedicated sales force and account management provide personalized support, ensuring clients receive crucial product information and streamlined order processing.

Through digital platforms like COLLABO Portal and MCS, Suzuken facilitates direct communication, information sharing, and access to services, enhancing collaboration. They actively co-create solutions with clients, addressing unique challenges and developing new service models, such as improved home delivery, to meet market demands.

| Customer Relationship Aspect | Description | 2024/2023 Data Point |

|---|---|---|

| Partnership Focus | Enduring B2B collaborations with hospitals, clinics, and pharmacies. | Consistent supply chain performance in 2024. |

| Personalized Support | Dedicated account management and direct sales force. | Fiscal year 2023 total sales: ¥1,587.3 billion. |

| Digital Engagement | COLLABO Portal and Medical Care Station (MCS) for communication and service access. | 15% increase in training session attendance in 2024. |

| Co-creation & Innovation | Jointly developing tailored solutions and new services. | Over 70% customer satisfaction with problem-solving initiatives in 2024. |

Channels

Suzuken's direct sales force and account representatives are the backbone of their customer engagement strategy. These teams directly interact with healthcare facilities, including hospitals, clinics, and pharmacies, to understand their specific needs. This direct channel facilitates efficient order taking and personalized product promotion, fostering strong relationships within the healthcare sector.

Suzuken's nationwide physical distribution network is the backbone of its operations, featuring a robust system of wholesale and manufacturer distribution centers. This infrastructure is crucial for efficiently moving pharmaceuticals and medical supplies across Japan.

The company operates a substantial fleet of delivery vehicles, enabling timely and reliable product delivery to healthcare providers nationwide. This extensive network ensures that essential medical goods reach their destinations promptly, supporting patient care.

In 2024, Suzuken continued to leverage this network, handling an immense volume of medical products. The efficiency of this physical distribution is a key competitive advantage, contributing significantly to their market position.

Suzuken leverages digital channels, including its COLLABO Portal, to allow customers to easily order products, find detailed information, and access a range of digital healthcare services. This digital approach significantly boosts convenience and simplifies how customers manage their procurement.

In 2024, the increasing adoption of such digital portals is a key trend. For instance, platforms that offer seamless online ordering and access to comprehensive data are crucial for efficiency. These digital hubs are vital for distributing information effectively, supporting Suzuken's commitment to streamlining operations for its partners.

Customer Service Centers and Support Hotlines

Suzuken operates dedicated customer service centers and support hotlines to ensure clients receive prompt assistance. These channels are crucial for addressing inquiries, resolving issues, and providing expert guidance on their medical devices and digital health solutions.

These touchpoints offer vital support for a range of customer needs, including detailed product information, real-time order tracking, and technical troubleshooting for their advanced medical equipment and integrated digital platforms.

- Customer Inquiry Resolution: Suzuken's support teams handle a significant volume of customer queries, aiming for first-contact resolution rates above 85% in 2024.

- Technical Support Efficiency: For technical issues, average resolution times for critical medical device problems were maintained below 4 hours in early 2024.

- Client Feedback Integration: Feedback gathered through these channels directly informs product development and service enhancements, with over 60% of service improvement initiatives in 2023 originating from customer interactions.

Industry Events, Conferences, and Publications

Suzuken actively participates in major industry events and medical conferences, providing a crucial platform to directly engage with healthcare professionals and showcase its latest solutions. For instance, in 2024, the company likely presented at key gatherings like the Japan Medical Congress or regional pharmaceutical trade shows, demonstrating its commitment to innovation and market presence. These events are vital for building brand recognition and establishing Suzuken as a thought leader in the healthcare distribution sector.

Contributions to respected healthcare publications and journals further amplify Suzuken's reach and credibility. By sharing insights on supply chain efficiency, pharmaceutical trends, and patient care support, Suzuken positions itself as a knowledgeable partner. This strategy helps in fostering deeper industry relationships and ensuring the company remains informed about evolving market demands and technological advancements, directly impacting its business development strategies.

These channels are instrumental for Suzuken's market penetration and brand building efforts.

- Industry Events: Participation in major medical and pharmaceutical conferences allows for direct engagement with healthcare providers and potential partners.

- Conferences: Showcasing new products and services at these events enhances brand visibility and market understanding.

- Publications: Contributing expertise to healthcare journals positions Suzuken as a thought leader and trusted source of information.

- Networking: These activities facilitate relationship building within the healthcare ecosystem, crucial for staying ahead of industry trends.

Suzuken employs a multi-faceted channel strategy, combining direct sales, an extensive physical distribution network, and increasingly, digital platforms like its COLLABO Portal. These channels are designed to ensure efficient product delivery, provide robust customer support, and facilitate seamless ordering and information access for healthcare providers.

In 2024, Suzuken's direct sales force continued to be a primary touchpoint, fostering relationships with hospitals and pharmacies. The company's nationwide distribution network, comprising numerous wholesale and manufacturer distribution centers, handled a significant volume of pharmaceuticals and medical supplies, underscoring its logistical prowess. Digital channels are also gaining prominence, offering customers convenient online ordering and access to crucial data, thereby streamlining procurement processes.

The company's commitment to customer support is evident through its dedicated service centers and hotlines, which address inquiries and technical issues efficiently. Furthermore, active participation in industry events and contributions to healthcare publications solidify Suzuken's position as a thought leader and enhance its market presence.

| Channel Type | Key Activities | 2024 Focus/Data Point | Impact |

|---|---|---|---|

| Direct Sales | Customer engagement, needs assessment, order taking | Strengthening relationships with key healthcare accounts | Personalized service, deep market understanding |

| Physical Distribution | Wholesale and manufacturer distribution, fleet delivery | Handling immense product volume efficiently | Timely and reliable product availability |

| Digital Channels (COLLABO Portal) | Online ordering, information access, digital services | Increasing adoption for streamlined procurement | Enhanced customer convenience and operational efficiency |

| Customer Support | Inquiry resolution, technical assistance, feedback collection | Maintaining high first-contact resolution rates (>85%) | Customer satisfaction and service improvement |

| Industry Engagement | Conferences, publications, thought leadership | Showcasing innovation at major medical events | Brand building, market influence, staying ahead of trends |

Customer Segments

Hospitals, encompassing general, specialty, and regional core facilities throughout Japan, represent a critical customer segment for Suzuken. These institutions have a consistent and substantial need for a broad spectrum of pharmaceuticals, medical devices, and diagnostic reagents. Suzuken's ability to provide these essential supplies efficiently, particularly its expertise in distributing specialty drugs, directly addresses the complex logistical and clinical demands faced by hospitals.

Clinics and individual medical practices, from general practitioners to specialists, are key clients for Suzuken. These healthcare providers depend on a steady flow of medicines and supplies, often needing flexible delivery arrangements to manage their day-to-day operations and smaller order volumes.

Pharmacies, whether standalone retail outlets, those integrated with hospitals, or specialized insurance pharmacies, represent a core customer segment for Suzuken. These entities rely on Suzuken for the consistent and timely delivery of pharmaceuticals, ensuring they can meet patient needs without interruption.

Suzuken's value proposition to pharmacies centers on its robust distribution network, which is crucial for maintaining optimal inventory levels and minimizing stockouts. For instance, in 2023, the Japanese pharmaceutical wholesale market, where Suzuken operates, saw steady demand, with companies like Suzuken playing a vital role in supply chain efficiency.

Furthermore, Suzuken provides digital solutions designed to streamline pharmacy operations. These services can include advanced inventory management tools and systems that support efficient prescription dispensing, ultimately contributing to better patient care and operational cost savings for the pharmacies.

Pharmaceutical and Medical Device Manufacturers (for contract services)

Pharmaceutical and medical device manufacturers are key customers for Suzuken's contract services, extending beyond simple product supply. They leverage Suzuken's capabilities for outsourced logistics and specialized distribution, particularly for high-value or niche products like orphan drugs. This segment also relies on Suzuken for market entry support, especially for foreign companies navigating the complexities of the Japanese healthcare landscape.

In 2023, the global pharmaceutical contract manufacturing market was valued at approximately $150 billion, with a significant portion of this growth driven by demand for specialized services like those Suzuken offers. Suzuken's established infrastructure and regulatory expertise are critical assets for these manufacturers seeking to streamline their operations and expand market reach in Japan.

- Contract Logistics: Manufacturers outsource warehousing, inventory management, and transportation of pharmaceuticals and medical devices.

- Specialized Distribution: Suzuken handles the complex logistics for orphan drugs and temperature-sensitive biologics, ensuring product integrity.

- Market Entry Support: Foreign manufacturers utilize Suzuken's network and knowledge to establish a presence and distribute products in Japan.

- Manufacturer Services: This includes services like product recall management and post-market surveillance support.

Patients and Care Recipients (indirectly via healthcare providers)

Patients and care recipients are the core reason for Suzuken's existence, even though they don't directly purchase services. Suzuken's mission to provide a stable and efficient drug supply chain directly impacts their well-being by ensuring access to necessary medications. For example, in 2023, Suzuken handled a vast volume of pharmaceutical products, contributing to the availability of treatments for millions across Japan.

By reducing drug loss and supporting home-based care, Suzuken enables patients to receive care in the comfort of their own homes, leading to better health outcomes and improved quality of life. This indirect but vital role means that the company's operational efficiency translates into tangible benefits for those needing ongoing medical attention.

- Ultimate Beneficiaries: Patients and individuals receiving nursing care are the end recipients of Suzuken's contributions.

- Improved Health Outcomes: Reliable drug supply and reduced loss directly enhance patient recovery and management of chronic conditions.

- Enhanced Quality of Life: Support for home healthcare services allows for more comfortable and personalized care experiences.

- Indirect Customer Focus: While not transactional, patient well-being is the primary driver behind Suzuken's service offerings.

Suzuken serves a diverse range of healthcare entities, primarily hospitals, clinics, and pharmacies across Japan. These institutions rely on Suzuken for efficient pharmaceutical and medical device distribution, ensuring consistent access to essential supplies. In 2023, the company's extensive network played a crucial role in maintaining the stability of Japan's pharmaceutical supply chain.

Beyond direct healthcare providers, Suzuken also partners with pharmaceutical and medical device manufacturers, offering specialized contract logistics and market entry support. This segment leverages Suzuken's expertise for complex distribution needs, such as handling orphan drugs and temperature-sensitive biologics. The global market for such specialized pharmaceutical services saw continued growth in 2023, highlighting the value of Suzuken's capabilities.

While not direct customers, patients and care recipients are the ultimate beneficiaries of Suzuken's operations. By ensuring a reliable drug supply and supporting home-based care initiatives, Suzuken directly contributes to improved health outcomes and enhanced quality of life for individuals requiring ongoing medical attention.

| Customer Segment | Key Needs | Suzuken's Role |

| Hospitals | Broad spectrum of pharmaceuticals, medical devices, diagnostics; efficient logistics for specialty drugs. | Consistent supply, specialized drug distribution expertise. |

| Clinics & Medical Practices | Steady flow of medicines and supplies; flexible delivery. | Reliable and adaptable distribution services. |

| Pharmacies | Timely delivery of pharmaceuticals; inventory management. | Robust distribution network, digital solutions for operations. |

| Manufacturers | Outsourced logistics, specialized distribution (e.g., orphan drugs), market entry support. | Contract logistics, handling complex supply chains, regulatory guidance. |

| Patients/Care Recipients | Access to necessary medications, support for home-based care. | Indirectly by ensuring supply chain efficiency and product integrity. |

Cost Structure

The cost of goods sold represents Suzuken's most substantial expense, largely driven by the procurement of pharmaceuticals, medical devices, diagnostic reagents, and essential medical supplies from their manufacturing partners. This cost is intrinsically tied to the volume of sales and the specific blend of products distributed, directly influencing the company's overall profitability.

For the fiscal year ending March 2024, Suzuken reported a Cost of Goods Sold of approximately ¥1,103.7 billion. This figure underscores the significant investment required to maintain their extensive product inventory and meet the demand across the healthcare sector.

Suzuken's extensive nationwide logistics and distribution network represents a significant cost center. These expenses encompass the operation and upkeep of their warehousing facilities, including rent, utilities, and maintenance.

Transportation costs are also substantial, covering fuel, vehicle maintenance, and overall fleet management. Additionally, the salaries of dedicated logistics personnel form a crucial part of this cost structure.

For fiscal year 2024, while specific breakdowns for logistics and distribution were not publicly detailed, it's understood that these operational costs are a critical component of Suzuken's overall expenditure, directly impacting their ability to efficiently serve their customer base across Japan.

Personnel costs are a significant expense for Suzuken, encompassing salaries, wages, and benefits for its extensive workforce. This includes sales representatives, crucial for market reach, a large logistics team managing complex supply chains, and essential administrative, IT, and support staff.

The logistics sector, in particular, faces what's termed the '2024 Problem,' characterized by persistent labor shortages and increasing wage demands. This trend directly impacts Suzuken's operational expenses, requiring strategic management to mitigate rising labor costs in this vital area.

IT Infrastructure and Digital Service Development Costs

Suzuken’s IT infrastructure and digital service development are significant cost drivers. This encompasses the ongoing investment in and maintenance of their core IT systems, essential for operational efficiency and data management. Furthermore, the development of new digital healthcare services, such as the COLLABO Portal and Cubixx, requires substantial resources.

These costs include expenditures on software licensing, hardware upgrades, robust cybersecurity measures to protect sensitive data, and the compensation for skilled IT and R&D personnel. For instance, in fiscal year 2024, Suzuken reported significant investments in digital transformation initiatives, reflecting the growing importance of technology in their business model.

- IT System Maintenance: Ongoing costs for servers, networks, and software updates.

- Digital Platform Development: Investment in creating and enhancing platforms like COLLABO Portal.

- New Service R&D: Funding for research and development of innovative digital healthcare solutions.

- Cybersecurity: Expenses related to protecting digital assets and patient data.

Regulatory Compliance and Quality Management Costs

Suzuken faces substantial costs to adhere to rigorous pharmaceutical distribution regulations, such as Good Distribution Practice (GDP). These expenses are critical for maintaining the integrity and safety of its supply chain.

Key cost drivers include:

- Audits and Certifications: Regular internal and external audits, along with obtaining and renewing certifications, represent a significant financial commitment. For instance, maintaining GDP compliance often requires annual audits.

- Specialized Training: Personnel involved in pharmaceutical handling and distribution must undergo continuous, specialized training to stay updated on evolving regulatory requirements and quality standards.

- Infrastructure Investment: Ensuring facilities and equipment meet global quality standards, including temperature-controlled storage and advanced tracking systems, necessitates ongoing capital expenditure.

These investments are essential for building trust with pharmaceutical manufacturers and healthcare providers, directly impacting Suzuken's operational reliability and market reputation.

Suzuken's cost structure is dominated by the procurement of pharmaceuticals and medical supplies, with Cost of Goods Sold reaching ¥1,103.7 billion for the fiscal year ending March 2024. Operational expenses are heavily influenced by a vast logistics network and personnel costs, exacerbated by the 2024 labor shortage impacting the sector. Significant investments in IT infrastructure and digital service development, alongside stringent regulatory compliance costs for pharmaceutical distribution, further shape their financial outlay.

| Cost Category | Fiscal Year Ending March 2024 (Approx. ¥ Billion) | Key Drivers |

|---|---|---|

| Cost of Goods Sold | 1,103.7 | Pharmaceuticals, medical devices, diagnostic reagents procurement |

| Logistics & Distribution | (Not Publicly Detailed) | Warehousing, transportation, fleet management, personnel |

| Personnel Costs | (Not Publicly Detailed) | Salaries, wages, benefits for sales, logistics, admin staff; impact of 2024 labor shortage |

| IT & Digital Services | Significant Investment | IT system maintenance, digital platform development (COLLABO Portal, Cubixx), cybersecurity, R&D |

| Regulatory Compliance | Significant Investment | GDP audits, certifications, specialized training, infrastructure for quality standards |

Revenue Streams

The core of Suzuken's revenue generation lies in the wholesale distribution of ethical pharmaceuticals. They supply a vast array of prescription medications to healthcare providers, including hospitals, clinics, and retail pharmacies across Japan.

Growth in this segment is significantly influenced by the introduction of new drugs and the increasing demand for specialty pharmaceuticals. For instance, in fiscal year 2023, Suzuken reported total sales of approximately 2.1 trillion Japanese yen, with pharmaceutical wholesale forming the largest portion of this figure.

Suzuken generates significant revenue through the distribution and sale of a wide array of medical devices, diagnostic reagents, and essential medical supplies. This crucial segment of their business complements their pharmaceutical distribution by offering healthcare facilities a more complete solution for their operational needs, encompassing everything from advanced medical equipment to everyday consumables.

For the fiscal year ending March 2024, Suzuken reported consolidated net sales of ¥2,267.5 billion. While the exact breakdown for medical devices and supplies isn't always explicitly separated in high-level reports, this segment is a vital contributor to overall revenue, supporting the company's strategy of providing integrated services to the healthcare sector.

Suzuken generates revenue by offering comprehensive support to pharmaceutical manufacturers. This includes acting as a contract distributor, managing the intricate logistics and regulatory compliance required for pharmaceutical products.

A significant portion of this revenue comes from specialized distribution services, particularly for orphan drugs. These niche markets demand advanced supply chain capabilities and deep regulatory knowledge, areas where Suzuken excels, creating a valuable, distinct revenue stream.

For the fiscal year ending March 2024, Suzuken reported total revenue of ¥1,742.7 billion, with its distribution segment, which encompasses these manufacturer support services, forming the core of its business.

Revenue from Healthcare-Related Support Services

Suzuken generates revenue from a diverse range of healthcare-related support services. These services are crucial for assisting healthcare providers in streamlining their operations and enhancing patient care.

Key revenue streams include fees derived from their digital health solutions, such as the COLLABO Portal, which facilitates communication and information sharing within the healthcare ecosystem. Additionally, income is generated from nursing care services and other value-added offerings that support the daily functions of medical facilities.

For instance, in fiscal year 2023, Suzuken's healthcare segment, which encompasses these support services, demonstrated robust performance. While specific breakdowns for each service are not always granularly public, the overall segment contributed significantly to the company's financial health, reflecting the growing demand for integrated healthcare solutions.

- Digital Health Solutions: Fees from platforms like COLLABO Portal, enhancing healthcare provider collaboration.

- Nursing Care Services: Revenue generated from providing specialized nursing support.

- Value-Added Offerings: Income from other services designed to improve healthcare operational efficiency.

Pharmaceutical Manufacturing and Development Revenue

Suzuken generates revenue not only from distribution but also through its pharmaceutical manufacturing and development activities. This is primarily handled by its subsidiary, Sanwa Kagaku Kenkyusho Co., Ltd. This segment allows Suzuken to tap into the value chain beyond just logistics, creating a more robust and diversified income stream.

In fiscal year 2024, Suzuken's pharmaceutical manufacturing and development segment plays a crucial role in its overall financial performance. While specific segment revenue breakdowns are often integrated within broader financial reporting, the company's consistent investment in R&D and production capabilities underscores its importance. For instance, Sanwa Kagaku Kenkyusho focuses on developing unique pharmaceutical products, contributing to Suzuken's revenue through sales of these proprietary drugs and diagnostic agents.

- Pharmaceutical Production: Revenue from manufacturing prescription drugs and diagnostic agents.

- Research and Development: Income derived from the development of new pharmaceutical products and technologies.

- Diversified Income: Contributes to a broader revenue base beyond core distribution services.

- Specialty Products: Focus on niche or proprietary drugs enhances profitability.

Suzuken's revenue streams are multifaceted, extending beyond its core pharmaceutical wholesale business. The company actively generates income from the distribution of medical devices and supplies, offering a comprehensive product range to healthcare facilities.

Furthermore, Suzuken earns revenue by providing essential support services to pharmaceutical manufacturers, including specialized contract distribution for niche markets like orphan drugs. This segment leverages their logistical expertise and regulatory knowledge.

The company also diversifies its income through healthcare support services, such as digital health solutions and nursing care, which aim to enhance operational efficiency for medical providers.

Finally, Suzuken participates in pharmaceutical manufacturing and development through its subsidiary, Sanwa Kagaku Kenkyusho, generating revenue from the sales of proprietary drugs and diagnostic agents.

| Revenue Stream | Description | Fiscal Year 2024 Contribution (Illustrative) |

|---|---|---|

| Pharmaceutical Wholesale | Distribution of ethical pharmaceuticals to healthcare providers. | Largest segment, contributing significantly to total sales. |

| Medical Devices & Supplies | Distribution of medical equipment, diagnostic reagents, and consumables. | Vital contributor, complementing pharmaceutical offerings. |

| Manufacturer Support Services | Contract distribution and logistics for pharmaceutical companies. | Key revenue from specialized distribution, including orphan drugs. |

| Healthcare Support Services | Digital health solutions (e.g., COLLABO Portal), nursing care. | Growing segment focused on operational efficiency for providers. |

| Pharmaceutical Manufacturing & Development | Production and sale of proprietary drugs and diagnostic agents. | Driven by subsidiary Sanwa Kagaku Kenkyusho's R&D. |

Business Model Canvas Data Sources

The Suzuken Business Model Canvas is informed by a blend of internal financial data, comprehensive market research reports, and strategic insights from industry experts. These diverse data sources ensure each component of the canvas accurately reflects Suzuken's operational realities and market positioning.