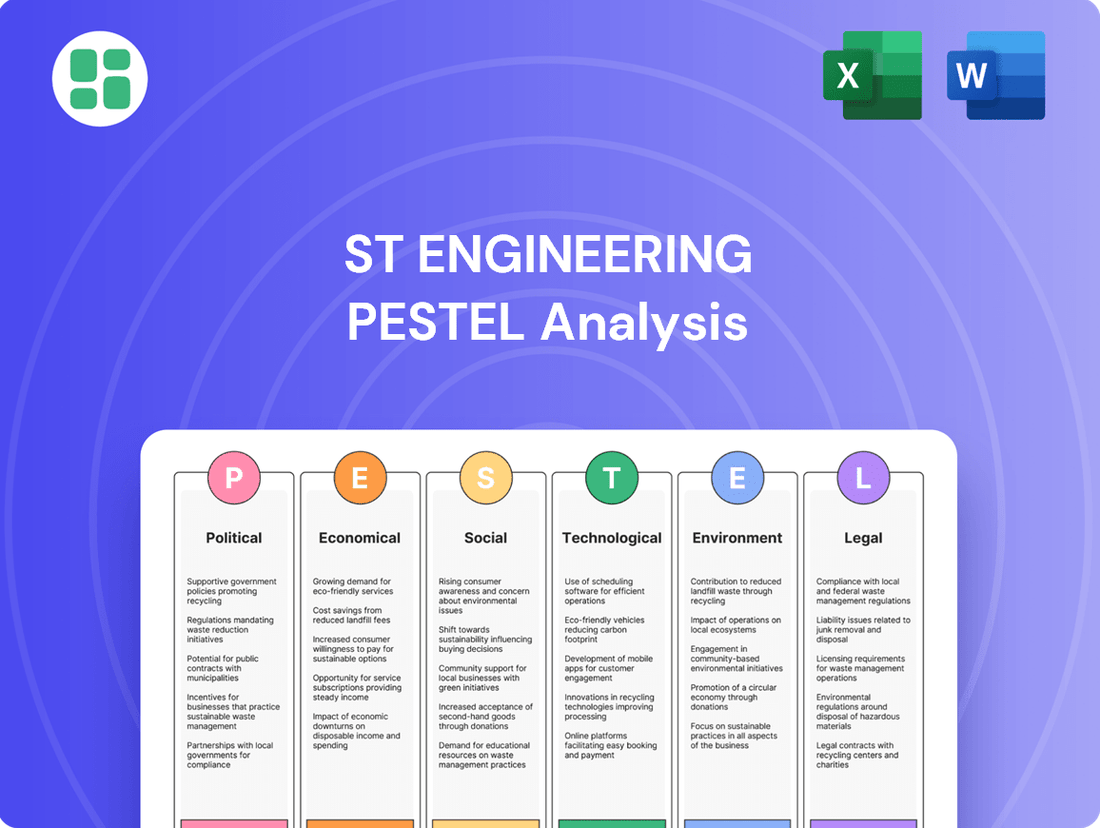

ST Engineering PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ST Engineering Bundle

Navigate the complex external forces shaping ST Engineering's trajectory with our comprehensive PESTLE analysis. From evolving political landscapes to emerging technological advancements, understand the critical factors influencing their operations and strategic decisions. Gain a competitive edge by leveraging these expert insights to refine your own market approach. Download the full PESTLE analysis now for actionable intelligence and strategic clarity.

Political factors

ST Engineering, a major player in the global defense sector, is closely tied to how governments allocate their defense budgets and what military capabilities they prioritize. Changes in these areas directly affect the company's prospects for winning contracts and developing new technologies.

For example, Singapore's defense budget saw a 2.5% rise in fiscal year 2024, reaching S$20.2 billion. This increase, largely aimed at managing inflation and bolstering military readiness, creates more potential business for ST Engineering in securing defense contracts and advancing its sophisticated systems.

Global geopolitical tensions and regional conflicts are significant drivers for ST Engineering's defense and public security segments. As nations bolster their national security and invest in defense modernization, demand for advanced solutions increases. For instance, the company secured a contract in late 2023 to supply 200 of its Terrex 8x8 amphibious multi-purpose armored vehicles to Kazakhstan, highlighting its success in navigating and capitalizing on evolving international security landscapes.

ST Engineering operates within a landscape shaped by stringent international trade policies and export controls, especially concerning defense and dual-use technologies. These regulations directly impact the company's global business operations, requiring careful navigation of complex legal frameworks. For instance, in 2024, the global defense trade faced ongoing scrutiny, with many nations reinforcing their export licensing requirements for advanced military hardware and sensitive technologies, directly affecting companies like ST Engineering that supply these sectors.

Ensuring compliance with these evolving rules is paramount for ST Engineering to maintain access to crucial international markets for its advanced defense systems and aerospace components. Failure to adhere can result in significant penalties and market exclusion. The company's ability to secure necessary export licenses for sophisticated products, such as advanced radar systems or unmanned aerial vehicles, is a critical factor in its revenue generation and market expansion strategies for 2024 and beyond.

Government Procurement Processes and Regulations

ST Engineering's ability to thrive is closely tied to its adeptness in navigating the intricate web of government procurement processes and regulations across different nations. These frameworks are crucial for securing major contracts, and the company's consistent success demonstrates a deep understanding of these requirements.

The company's performance in Q4 2024 is a testament to this. ST Engineering announced significant contract wins amounting to $4.3 billion. This substantial figure underscores the company's capability in managing complex acquisition procedures and meeting the stringent demands of governmental tenders.

- Government Contracts: ST Engineering's success hinges on mastering diverse national procurement rules.

- Q4 2024 Wins: The company secured $4.3 billion in contracts, showcasing its regulatory navigation skills.

- Market Access: Compliance with these processes is key to accessing and expanding within government markets.

National Security Priorities and Cyber Resilience

Governments globally are placing a heightened emphasis on cybersecurity and digital resilience, directly fueling the demand for ST Engineering's advanced cyber solutions. This trend is particularly evident as nations bolster defenses against escalating cyber threats, creating a fertile market for companies like ST Engineering that offer specialized expertise.

Singapore's strategic vision, particularly its updated Smart Nation initiative, underscores a commitment to leveraging AI and fortifying national resilience. This policy directly complements ST Engineering's core capabilities, especially in delivering robust cyber solutions and cloud-managed security services tailored for critical infrastructure sectors. For instance, the Singapore government has consistently invested in cybersecurity, with national spending on cybersecurity projected to reach billions in the coming years. In 2023, Singapore's cybersecurity market was valued at approximately $2.4 billion, with significant growth expected driven by these national priorities.

- Government Cybersecurity Investment: National budgets are increasingly allocating substantial funds towards enhancing cybersecurity infrastructure and capabilities.

- Smart Nation Initiatives: Policies promoting digital transformation and resilience create direct opportunities for cyber solution providers.

- Critical Infrastructure Protection: Focus on safeguarding essential services like utilities and finance drives demand for advanced security services.

- Emerging Threat Landscape: The evolving nature of cyber threats necessitates continuous innovation and investment in cybersecurity solutions.

Government defense spending is a primary driver for ST Engineering, with nations increasing their budgets to address geopolitical shifts. Singapore's defense expenditure for FY2024, for example, rose to S$20.2 billion, reflecting a 2.5% increase aimed at enhancing military readiness and modernizing capabilities.

Global demand for advanced defense solutions is robust, as evidenced by ST Engineering's late 2023 contract to supply 200 Terrex armored vehicles to Kazakhstan, showcasing the company's ability to capitalize on international security needs.

Navigating complex international trade policies and export controls is crucial for ST Engineering. In 2024, many countries tightened export licensing for advanced military hardware, directly impacting companies like ST Engineering and requiring meticulous compliance for market access.

ST Engineering's success in securing $4.3 billion in contracts during Q4 2024 highlights its proficiency in managing government procurement processes across various nations.

| Factor | Impact on ST Engineering | 2024/2025 Data/Trend |

|---|---|---|

| Government Defense Budgets | Directly influences contract opportunities and revenue. | Singapore's FY2024 defense budget increased by 2.5% to S$20.2 billion. |

| Geopolitical Tensions | Drives demand for defense modernization and security solutions. | Ongoing international conflicts increase the need for advanced military hardware. |

| Trade Policies & Export Controls | Affects global market access and product sales. | Increased scrutiny on defense exports in 2024 necessitates strict compliance. |

| Government Procurement Processes | Determines success in winning large-scale contracts. | ST Engineering secured $4.3 billion in contracts in Q4 2024, demonstrating strong navigation of these processes. |

What is included in the product

This ST Engineering PESTLE analysis examines the influence of political, economic, social, technological, environmental, and legal factors on the company's operations and strategic decision-making.

It provides a comprehensive overview of the external macro-environment, highlighting key trends and their potential impact on ST Engineering's future growth and competitive positioning.

A clear, actionable PESTLE analysis for ST Engineering that highlights key external factors, simplifying strategic decision-making and mitigating potential risks.

Economic factors

ST Engineering's financial health is closely tied to the ebb and flow of the global economy. In 2024, the International Monetary Fund (IMF) projected global GDP growth to be around 3.2%, a slight slowdown from previous years but still indicating expansion. However, this growth is accompanied by persistent inflationary pressures, with global inflation expected to remain elevated, impacting ST Engineering's raw material costs and potentially dampening demand from some customer segments.

The aerospace sector, a key market for ST Engineering, is experiencing a strong recovery, with industry forecasts pointing to significant growth in passenger traffic and aircraft demand through 2025. Despite this positive outlook, ongoing supply chain disruptions, a legacy of recent global events, continue to pose challenges. These disruptions can lead to production delays and increased component costs, directly affecting ST Engineering's manufacturing efficiency and profit margins.

Government investment in research and development, especially in cutting-edge fields like artificial intelligence and smart technologies, directly fuels ST Engineering's capacity for innovation. This is a critical factor for a company focused on advanced engineering solutions.

Singapore's proactive stance is evident in its commitment of S$120 million specifically to boost AI adoption across various sectors. Furthermore, the nation's broader Research, Innovation and Enterprise 2025 (RIE2025) plan allocates a substantial S$3 billion to foster technological advancements, creating a fertile ground for ST Engineering to thrive and develop its next-generation capabilities.

ST Engineering's global operations, spanning over 100 countries, mean it's significantly exposed to currency exchange rate fluctuations. When ST Engineering converts earnings from foreign markets back into its reporting currency, Singapore Dollars (SGD), changes in exchange rates can directly affect its reported revenue and profitability. For instance, a stronger SGD against currencies where ST Engineering generates substantial revenue would reduce the value of those foreign earnings when translated.

Managing these currency risks is a critical aspect of ST Engineering's financial strategy. Effective hedging strategies and careful monitoring of foreign currency exposures are essential to mitigate potential negative impacts on financial stability and to ensure more predictable returns for investors. As of the first half of 2024, ST Engineering reported that foreign exchange had a moderate impact, with a slight unfavorable currency translation effect on its results, highlighting the ongoing need for vigilant management.

Aerospace and Defense Market Demand

The aerospace and defense sector is experiencing sustained demand, fueled by a rebound in air travel and a global push for defense system upgrades. This trend directly benefits companies like ST Engineering.

ST Engineering's Commercial Aerospace division demonstrated this strong market appetite by securing $1.8 billion in new contracts during the fourth quarter of 2024. This influx of business highlights the ongoing need for maintenance, repair, and overhaul (MRO) services, as well as aerostructures, even amidst persistent supply chain disruptions.

- Increased Air Travel: Global passenger traffic recovery continues to drive demand for aircraft maintenance and new builds.

- Defense Modernization: Nations are investing in upgrading their military fleets and defense capabilities, creating opportunities for defense contractors.

- ST Engineering's Q4 2024 Performance: The company's $1.8 billion in new contracts underscores robust demand in its Commercial Aerospace segment.

- Supply Chain Resilience: Despite ongoing challenges, the market's ability to generate significant contract values indicates underlying strength.

Smart City Market Growth

The increasing global focus on smart city development is a significant economic driver for ST Engineering. As more cities worldwide adopt intelligent infrastructure and digital solutions to improve efficiency and sustainability, the demand for specialized technologies and services, like those offered by ST Engineering, is set to rise. This trend is fueled by government investments and private sector innovation aimed at creating more livable and resilient urban environments.

The smart cities market is experiencing robust expansion, with projections indicating substantial growth in the coming years. For instance, ST Engineering's recent success in securing a contract valued at over S$60 million for a smart city platform in Lusail City, Qatar, underscores the tangible economic opportunities available. This deal highlights the strong market appetite for advanced urban solutions and ST Engineering's competitive position within this sector.

- Smart City Market Growth: The global smart cities market is anticipated to reach hundreds of billions of dollars by the end of the decade, driven by digital transformation initiatives and urban planning.

- ST Engineering's Contract: A contract exceeding S$60 million for a smart city platform in Lusail City, Qatar, demonstrates ST Engineering's capability and market penetration in delivering complex urban solutions.

- Economic Opportunities: Rapid urbanization and the need for sustainable infrastructure create a fertile ground for companies like ST Engineering to offer integrated smart city technologies, from connectivity to data analytics.

- Investment Trends: Governments and private entities are channeling significant capital into smart city projects, recognizing the long-term economic benefits of improved urban management and citizen services.

Global economic growth, projected around 3.2% for 2024 by the IMF, presents a mixed outlook for ST Engineering. While overall expansion is positive, persistent inflation could increase operational costs for raw materials and components, potentially affecting profitability and demand in certain markets.

The aerospace sector's strong recovery, with passenger traffic growth expected through 2025, is a boon for ST Engineering's Commercial Aerospace division, which secured $1.8 billion in new contracts in Q4 2024. However, ongoing supply chain disruptions remain a concern, potentially delaying production and raising component prices.

Government investment in R&D, particularly in AI and smart technologies, is a key economic enabler for ST Engineering. Singapore's S$3 billion allocation for its RIE2025 plan and S$120 million for AI adoption create a supportive environment for innovation and the development of advanced engineering solutions.

ST Engineering's international presence exposes it to currency fluctuations, with a slight unfavorable impact noted in H1 2024. Effective currency risk management is crucial for mitigating potential revenue and profitability impacts from exchange rate volatility.

| Economic Factor | 2024 Projection/Data | Impact on ST Engineering |

|---|---|---|

| Global GDP Growth | ~3.2% (IMF) | Indicates overall market expansion, but growth pace is a consideration. |

| Global Inflation | Elevated | Potential increase in raw material and component costs. |

| Aerospace Demand | Strong recovery, growth through 2025 | Positive for Commercial Aerospace division; $1.8B in Q4 2024 contracts. |

| Supply Chain Disruptions | Ongoing | Risk of production delays and increased component costs. |

| Smart City Market Growth | Robust expansion | Opportunities for smart urban solutions; S$60M+ Qatar contract. |

Same Document Delivered

ST Engineering PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This detailed ST Engineering PESTLE analysis covers all key political, economic, social, technological, legal, and environmental factors impacting the company.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain a comprehensive understanding of the external forces shaping ST Engineering's strategic landscape.

The content and structure shown in the preview is the same document you’ll download after payment. It provides actionable insights derived from a thorough PESTLE framework analysis.

Sociological factors

Global urbanization is accelerating, with the UN projecting that 68% of the world's population will live in urban areas by 2050. This surge places immense pressure on infrastructure, energy, and public services. ST Engineering's 'CitySense' platform is designed to tackle these urban challenges, offering integrated solutions for traffic management, environmental monitoring, and public safety. Their extensive portfolio, including participation in over 800 smart city projects globally, demonstrates a direct response to these growing societal demands.

Public sentiment regarding surveillance and defense technologies significantly shapes the market for ST Engineering's solutions. Growing concerns about privacy, fueled by high-profile data breaches and increased government surveillance, can lead to stricter regulations and public resistance. For instance, a 2024 Pew Research Center study found that 74% of Americans are concerned about how companies use their data, directly impacting the adoption of smart city surveillance systems.

ST Engineering must navigate this complex societal landscape by emphasizing transparency and ethical data handling. The company's ability to demonstrate the benefits of its defense and security technologies while addressing legitimate privacy worries is crucial for maintaining public trust and securing market access. Public perception directly influences government procurement decisions and the willingness of municipalities to invest in advanced security infrastructure.

ST Engineering's success hinges on access to a skilled workforce, especially in cutting-edge areas like artificial intelligence, robotics, and cybersecurity. These specialized skills are crucial for driving innovation and maintaining operational excellence in a rapidly evolving technological landscape.

The company's dedication to nurturing talent in these critical fields was highlighted by its recognition as an AI Pioneer at the 2024 LinkedIn Talent Awards. This accolade reflects ST Engineering's proactive approach to building and developing its internal AI capabilities, ensuring a robust talent pipeline for future growth and technological advancements.

Societal Expectations for Corporate Social Responsibility

Societal expectations for corporate social responsibility are increasingly shaping how businesses like ST Engineering operate. There's a growing demand for companies to not only be profitable but also to act ethically and contribute positively to society. This pressure influences everything from product development to supply chain management, impacting public perception and brand loyalty.

ST Engineering's commitment to Environmental, Social, and Governance (ESG) factors is evident in its 2024 Sustainability Report. The report highlights the company's efforts in areas such as community engagement and adopting purpose-driven business practices. These initiatives are designed to meet the evolving expectations of stakeholders, including customers, employees, and investors, who are increasingly prioritizing socially responsible companies.

- Community Investment: ST Engineering reported contributing S$12.5 million to community initiatives in 2023, focusing on education and STEM programs.

- Employee Volunteering: Over 5,000 employee volunteer hours were logged in 2023, demonstrating a commitment to giving back.

- Ethical Sourcing: The company has implemented stricter ethical sourcing guidelines for its suppliers, aiming for 90% compliance by the end of 2025.

- Diversity and Inclusion: ST Engineering aims to increase female representation in leadership roles to 30% by 2027, reflecting societal progress towards gender equality.

Demographic Shifts and Evolving Needs

Demographic shifts significantly influence market demand. For instance, an aging population in many developed nations, including Singapore where ST Engineering is headquartered, increases the need for advanced healthcare technologies and services. Globally, the median age is projected to reach 30.9 years by 2050, up from 30.3 years in 2020, highlighting a sustained trend towards an older populace.

ST Engineering is actively responding to these evolving needs. Their strategic investments in digital health solutions and AI-powered systems, as highlighted by their presence at events like InnoTech 2024, directly address the growing demand for efficient and accessible healthcare. This includes areas like remote patient monitoring and AI-driven diagnostics.

Furthermore, increasing digital literacy across all age groups fuels the adoption of sophisticated technological solutions. ST Engineering's work in smart city infrastructure and defense technology also benefits from a population more comfortable with and reliant on advanced digital systems. For example, the global smart city market is expected to grow substantially, with projections indicating it could reach over $1.5 trillion by 2025.

These demographic trends create both opportunities and challenges. ST Engineering's ability to innovate and adapt its offerings to meet the specific requirements of an aging, digitally connected, and increasingly health-conscious global population will be crucial for its continued success.

Societal expectations for corporate social responsibility are increasingly shaping business operations, with a growing demand for ethical conduct and positive societal contributions. ST Engineering's commitment to ESG factors, as detailed in their 2024 Sustainability Report, reflects this trend, showcasing efforts in community engagement and purpose-driven practices to meet stakeholder priorities.

Demographic shifts, such as an aging global population and increasing digital literacy, directly influence market demand for advanced technologies. ST Engineering's strategic investments in digital health and smart city infrastructure, supported by a growing comfort with digital systems, position them to address these evolving societal needs.

Public sentiment regarding surveillance and defense technologies critically impacts ST Engineering's market access, with privacy concerns potentially leading to stricter regulations. The company's focus on transparency and ethical data handling is therefore vital for maintaining public trust and securing market acceptance for its advanced security solutions.

| Sociological Factor | Impact on ST Engineering | Supporting Data/Initiatives (2023-2025) |

|---|---|---|

| Urbanization | Increased demand for smart city solutions | UN projects 68% urban population by 2050; ST Engineering involved in over 800 smart city projects. |

| Privacy Concerns | Need for transparent data handling in surveillance tech | 74% of Americans concerned about data use (Pew Research, 2024); ST Engineering emphasizes ethical data practices. |

| Corporate Social Responsibility (CSR) | Emphasis on ethical operations and societal contribution | ST Engineering's 2024 Sustainability Report highlights community engagement; S$12.5 million community contribution in 2023. |

| Aging Population | Growing need for healthcare and assistive technologies | Global median age projected to reach 30.9 by 2050; ST Engineering invests in digital health solutions. |

| Digital Literacy | Enhanced adoption of advanced digital solutions | Global smart city market projected to exceed $1.5 trillion by 2025; ST Engineering leverages digital infrastructure. |

Technological factors

The relentless pace of innovation in AI, robotics, and cybersecurity is a critical driver for ST Engineering's strategic positioning. These technologies are not just trends but foundational elements shaping the company's competitive edge and the very nature of its product and service offerings.

ST Engineering demonstrates its commitment to these frontier technologies by actively integrating them into its solutions. A prime example is their showcase at InnoTech 2024, where over 20 AI-powered solutions were presented, highlighting applications in areas like advanced fraud detection, sophisticated guided crime analysis, and efficient real-time emergency response systems.

Innovations in materials science and advanced manufacturing, like additive manufacturing (3D printing), are significantly boosting the performance and efficiency of aerospace and defense products. These technologies allow for lighter, stronger components and more complex designs that were previously impossible.

ST Engineering's engagement with these advancements is evident in its work on propulsion system components for next-generation aircraft. For instance, in 2024, the company continued to invest in R&D for advanced composite materials, aiming to reduce aircraft weight by up to 15% for future airframes.

The pervasive global push towards digital transformation, coupled with the rapid rollout of advanced connectivity like 5G, directly fuels demand for ST Engineering's smart city and public security offerings. This infrastructure expansion is critical for enabling the seamless integration and operation of these sophisticated solutions.

ST Engineering's proactive engagement in this technological shift is evident in its development of key components such as its 5G System-on-Chip Small Cell. This innovation is designed to bolster urban connectivity, a foundational element for smart city ecosystems.

Furthermore, the company's investment in smart city operating systems highlights its strategic focus on providing the software backbone for these interconnected urban environments. By 2025, global spending on smart city initiatives is projected to exceed $300 billion, underscoring the significant market opportunity for ST Engineering.

Disruptive Technologies and Competitive Landscape

ST Engineering faces a dynamic technological environment where staying ahead means actively integrating and developing disruptive innovations. Competitors and agile startups are constantly introducing new solutions, particularly in areas like AI-driven defense systems and advanced aerospace materials, forcing ST Engineering to be highly responsive.

To maintain its competitive edge, ST Engineering is strategically investing in research and development, with a significant portion of its revenue allocated to innovation. For instance, in 2023, the company reported a 7% increase in R&D expenditure, focusing on areas such as cybersecurity and smart city technologies, which are key disruptors in its operating sectors.

Collaborations are also crucial. ST Engineering actively partners with universities and technology firms, such as its ongoing work with Nanyang Technological University on quantum computing applications for secure communications. These partnerships allow access to cutting-edge research and accelerate the adoption of new technologies.

- AI and Machine Learning: Integration into autonomous systems, predictive maintenance, and enhanced surveillance capabilities.

- Advanced Materials: Development and adoption of lighter, stronger composites for aerospace and defense applications.

- Cybersecurity: Continuous innovation in threat detection, data protection, and resilient network architectures.

- Digitalization: Leveraging IoT and cloud computing for smart city solutions and efficient operational management.

Investment in Research and Development Capabilities

ST Engineering's commitment to research and development (R&D) is a cornerstone of its strategy to maintain a competitive edge. The company consistently allocates significant resources to build and enhance its R&D capabilities, ensuring it can develop innovative and future-proof solutions. This sustained investment is vital for staying ahead in a rapidly evolving technological landscape.

The company is actively fostering R&D collaborations with leading Singaporean institutions, including universities and A*STAR (Agency for Science, Technology and Research). These partnerships are instrumental in driving cutting-edge research and development across various domains. For instance, ST Engineering is focusing on emerging areas like green computing, developing energy-efficient large language models, and advancing deepfake detection technologies.

These strategic R&D initiatives are directly aligned with global trends and future market demands. By investing in areas such as:

- Green Computing: Developing environmentally sustainable technological solutions.

- Energy-Efficient LLMs: Optimizing the performance and resource consumption of advanced AI models.

- Deepfake Detection: Creating robust technologies to identify and counter sophisticated misinformation.

This focus on advanced R&D, supported by strong academic and research collaborations, positions ST Engineering to capitalize on emerging opportunities and address future technological challenges effectively. The company's proactive approach to innovation ensures its product and service portfolio remains relevant and competitive.

ST Engineering's technological strategy hinges on deep integration of AI, advanced materials, and robust cybersecurity. The company showcased over 20 AI-powered solutions at InnoTech 2024, demonstrating its commitment to innovation in critical sectors.

Investments in advanced materials, like composites for aerospace, aim for significant performance gains, with R&D targeting up to a 15% weight reduction in future airframes by 2024.

The global push for digital transformation and 5G deployment fuels demand for ST Engineering's smart city solutions, with projected global smart city spending exceeding $300 billion by 2025.

ST Engineering's R&D expenditure saw a 7% increase in 2023, focusing on key disruptive technologies like cybersecurity and smart city solutions.

Legal factors

ST Engineering operates under a complex web of data privacy and cybersecurity regulations. Strict laws like the EU's General Data Protection Regulation (GDPR) and similar regional mandates, such as the California Consumer Privacy Act (CCPA) in the US, directly influence how the company handles sensitive information. These regulations are critical, especially for ST Engineering's smart city and public security solutions, where vast amounts of personal data are processed.

Evolving cybersecurity compliance requirements are also a major factor. As cyber threats become more sophisticated, governments worldwide are continuously updating their cybersecurity standards. For ST Engineering, this means ongoing investment in advanced security measures and regular audits to ensure adherence. Failure to comply can lead to significant fines and reputational damage. For instance, in 2023, data breaches across various industries resulted in billions of dollars in penalties globally, underscoring the financial and operational risks involved.

ST Engineering's defense operations are heavily influenced by international agreements like the Arms Trade Treaty (ATT) and national export control regimes. These regulations govern the transfer of defense articles, including ST Engineering's armored vehicles and ammunition, impacting market access and operational scope. Failure to comply can result in severe penalties, affecting global sales and partnerships.

Protecting its intellectual property through patents is crucial for ST Engineering's edge in high-tech sectors like AI and robotics. As of early 2024, ST Engineering actively manages a significant patent portfolio, with over 500 granted patents globally across various innovative technologies, underscoring its commitment to R&D.

Navigating diverse international IP laws is a key challenge, necessitating a robust global strategy to secure its technological advancements. The company's investment in R&D, which represented approximately 8% of its revenue in 2023, directly fuels this need for strong patent protection to maintain its competitive standing.

Environmental Protection Laws and Compliance

ST Engineering faces increasing scrutiny under environmental protection laws, particularly concerning emissions and waste management in its manufacturing operations. For instance, Singapore’s Environmental Protection and Management Act mandates strict controls on industrial emissions, impacting ST Engineering's production facilities. Failure to comply can result in substantial fines and operational disruptions.

Compliance is not just a legal necessity but crucial for ST Engineering's long-term operational sustainability and corporate reputation. The company's commitment to environmental, social, and governance (ESG) principles, as highlighted in its 2023 Sustainability Report, underscores the importance of adhering to evolving regulations. This includes investing in cleaner technologies and waste reduction initiatives to meet or exceed environmental standards.

- Stricter Emission Controls: Adherence to evolving air and water quality standards, such as those outlined by the National Environment Agency (NEA) in Singapore.

- Waste Management Regulations: Compliance with directives on hazardous waste disposal and recycling, impacting supply chain and manufacturing processes.

- Product Lifecycle Management: Designing products with environmental impact in mind, from material sourcing to end-of-life disposal, in line with global trends and regulations.

Government Procurement Laws and Contractual Obligations

ST Engineering navigates a complex web of government procurement laws, especially critical for its defense and public infrastructure sectors. These regulations dictate how contracts are awarded, emphasizing transparency and fair competition. For instance, in Singapore, the Government Procurement Act governs the acquisition of goods and services, requiring adherence to principles of value for money and integrity.

The company's large-scale projects are underpinned by stringent contractual obligations. These agreements often include detailed specifications, performance metrics, and compliance requirements related to national security or public safety. Failure to meet these can result in penalties or contract termination, underscoring the legal risks involved.

Adherence to anti-corruption measures and ethical conduct is paramount for ST Engineering to maintain its eligibility for public sector contracts. Many governments, including those in its key markets, have robust legislation like the UK Bribery Act or the US Foreign Corrupt Practices Act (FCPA) that ST Engineering must comply with globally.

Key legal considerations for ST Engineering include:

- Compliance with Public Procurement Regulations: Ensuring all bidding processes and contract executions align with national and international procurement standards.

- Contractual Performance and Dispute Resolution: Meeting all specified deliverables and adhering to agreed-upon terms to avoid legal disputes.

- Anti-Bribery and Corruption Laws: Implementing strict internal controls to prevent any form of corruption in securing and executing contracts.

- Intellectual Property Rights Protection: Safeguarding proprietary technologies and designs within contractual frameworks, particularly in defense-related projects.

ST Engineering's operations are significantly shaped by intellectual property (IP) laws, particularly concerning its advanced technological solutions. The company actively protects its innovations through patents, holding over 500 granted patents globally as of early 2024, reflecting substantial investment in R&D, which was around 8% of revenue in 2023. Navigating diverse international IP frameworks is crucial for maintaining its competitive edge in high-tech sectors like AI and robotics.

Environmental factors

Climate change presents significant physical risks to ST Engineering's global operations. Extreme weather events, like intensified typhoons and prolonged heatwaves, can disrupt supply chains, damage manufacturing facilities, and impact the performance of critical infrastructure projects. For instance, a severe flood in a key manufacturing hub could halt production, leading to delivery delays and increased costs.

The resilience of the infrastructure ST Engineering designs and builds is also directly challenged by these environmental shifts. Rising sea levels, increased rainfall intensity, and more frequent temperature fluctuations necessitate robust engineering solutions to ensure long-term durability and functionality. Failing to account for these factors could lead to premature asset degradation and reputational damage.

ST Engineering must proactively assess and mitigate these climate-related operational and infrastructure risks. This involves investing in climate-resilient design principles, diversifying manufacturing locations to reduce single-point failures, and developing robust business continuity plans. For example, incorporating advanced weather forecasting and early warning systems into infrastructure management can help prevent damage and ensure operational uptime.

The increasing global focus on sustainability and Environmental, Social, and Governance (ESG) factors means companies like ST Engineering face growing demands for detailed sustainability reporting. This transparency is becoming crucial for investors and stakeholders alike.

ST Engineering's 2024 Sustainability Report, which aligns with prominent frameworks such as GRI, SASB, and TCFD, highlights the company's dedication to open communication and ethical operations. This adherence to recognized standards underscores their commitment to responsible business conduct.

ST Engineering is navigating a landscape increasingly shaped by stringent carbon emission reduction targets and evolving regulations. These environmental pressures directly influence how the company operates and designs its products, pushing for a more sustainable approach across its diverse business segments.

Societal expectations and government mandates are compelling ST Engineering to minimize its carbon footprint. This is evident in their commitment to achieving ambitious goals, such as halving their Scope 1 and Scope 2 absolute greenhouse gas emissions by 2030, using 2015 as a baseline year. This target underscores a proactive stance in addressing climate change.

To support these emission reduction objectives, ST Engineering is making significant strides in increasing its use of renewable energy sources. This strategic shift towards cleaner energy is a crucial component of their sustainability strategy, demonstrating a commitment to operational decarbonization and aligning with global environmental efforts.

Resource Scarcity and Circular Economy Principles

ST Engineering is increasingly integrating resource efficiency and circular economy principles into its operations, driven by growing global concerns about resource scarcity. This strategic shift encourages the company to develop products and processes that minimize waste and maximize material reuse. For instance, in 2024, ST Engineering continued its efforts in optimizing manufacturing processes through smart systems and energy-efficient technologies, aiming to reduce its environmental footprint.

The company’s commitment to sustainability is reflected in its ongoing initiatives to design for longevity and recyclability. This approach not only addresses environmental challenges but also presents opportunities for cost savings and innovation. By focusing on resource efficiency, ST Engineering aims to build a more resilient supply chain and enhance its competitive advantage in a market that increasingly values environmental responsibility.

Key aspects of ST Engineering's response to resource scarcity and circular economy principles include:

- Designing for Durability and Repairability: Developing products with longer lifespans and easier repair options to reduce the need for frequent replacements.

- Material Innovation: Exploring and incorporating recycled, recyclable, and bio-based materials in product development and manufacturing.

- Waste Reduction Programs: Implementing robust waste management strategies across all facilities to minimize landfill waste and maximize recycling rates.

- Energy Efficiency Investments: Continuing to invest in and deploy energy-efficient technologies and smart systems to reduce overall energy consumption in operations.

Development of Green Technologies and Sustainable Solutions

The increasing global focus on environmental sustainability directly benefits ST Engineering, offering significant growth avenues, especially within its smart city and aerospace divisions. This trend fuels demand for innovative solutions that address climate change and resource efficiency.

ST Engineering is strategically positioning itself to capitalize on this by developing advanced technologies. These include solutions aimed at improving energy efficiency in urban infrastructure and pioneering sustainable cooling systems, aligning with broader environmental objectives.

In its aerospace segment, ST Engineering is a key player in supporting the aviation industry's commitment to reducing its environmental impact. The company is actively involved in developing solutions that contribute to achieving net-zero emission goals for aviation, a critical area for future growth and industry reputation.

For instance, ST Engineering's involvement in developing sustainable aviation fuel (SAF) technologies and retrofitting aircraft for enhanced fuel efficiency are direct responses to this environmental imperative. The global aviation industry aims to reduce net CO2 emissions by 50% by 2050 compared to 2019 levels, a target ST Engineering's innovations support.

- Growth Opportunity: Rising demand for green tech and sustainable solutions in smart city and aerospace sectors.

- Energy Efficiency Focus: Development of solutions for enhanced energy use and sustainable cooling.

- Aerospace Sustainability: Contribution to the aviation industry's net-zero emission targets.

- Market Alignment: ST Engineering's offerings directly address global environmental concerns and regulatory shifts.

ST Engineering's environmental strategy is deeply intertwined with global sustainability trends, driving both operational changes and market opportunities. The company is actively pursuing ambitious emission reduction targets, aiming to halve its Scope 1 and 2 greenhouse gas emissions by 2030 from a 2015 baseline. This commitment is supported by a significant increase in renewable energy adoption across its operations.

Resource efficiency and circular economy principles are also central to ST Engineering's approach, with a focus on designing for durability, repairability, and utilizing recycled materials. These efforts not only mitigate environmental impact but also enhance supply chain resilience and operational cost-effectiveness.

The growing demand for green technologies presents substantial growth avenues for ST Engineering, particularly in smart city infrastructure and aerospace solutions. The company is actively developing innovations in energy efficiency and sustainable aviation fuel technologies, aligning with industry-wide goals such as the aviation sector's aim to reduce net CO2 emissions by 50% by 2050.

PESTLE Analysis Data Sources

Our ST Engineering PESTLE Analysis is informed by a comprehensive review of data from government publications, international organizations, and reputable industry analysis firms. This ensures our insights into political, economic, social, technological, legal, and environmental factors are grounded in factual and current information.