ST Engineering Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ST Engineering Bundle

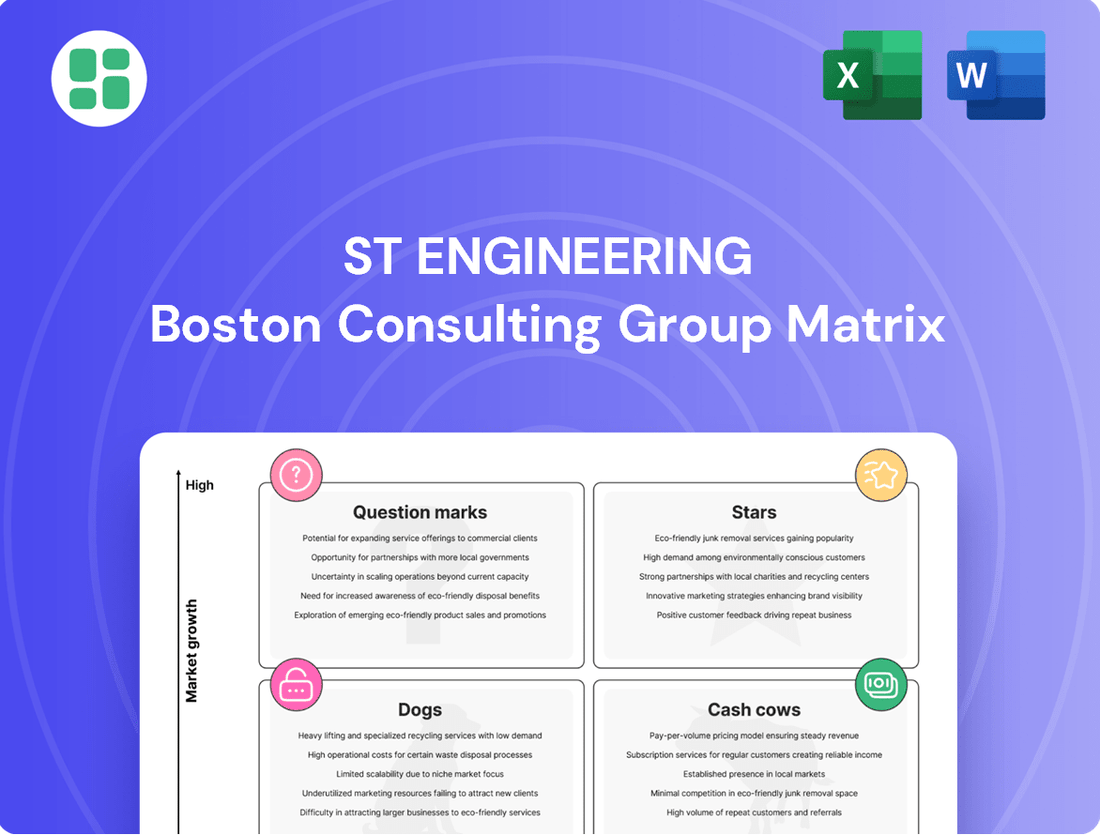

Curious about ST Engineering's strategic positioning? Our BCG Matrix preview highlights key product categories, offering a glimpse into their market share and growth potential. See which areas are poised for success and which might need a closer look.

Don't miss out on the full picture! Purchase the complete ST Engineering BCG Matrix to unlock detailed quadrant analysis, understand the underlying data, and receive actionable recommendations for optimizing your portfolio and investment strategies. Elevate your decision-making today.

Stars

Defence Digital Systems & Cyber, a key player in ST Engineering's portfolio, is a star performer. Its AI-powered solutions are seeing impressive growth, fueled by worldwide defense upgrades and smart nation projects.

ST Engineering has landed substantial deals for AI-driven camera systems and cloud infrastructure, underscoring its robust market standing and promising future. For instance, in 2023, the company announced a significant contract to provide its AI-enabled camera systems for a major urban mobility project, showcasing the practical application of its advanced technologies.

This segment's importance is amplified by escalating geopolitical tensions and the growing need for sophisticated digital security. The global cybersecurity market alone was projected to reach over $200 billion in 2024, highlighting the immense opportunity and strategic relevance of ST Engineering's cyber capabilities.

ST Engineering's Passenger-to-Freighter (PTF) conversion business is a star performer, surpassing its 2026 revenue goal by 2024. This achievement highlights the strong demand for their specialized conversion services.

While 2025 might see a slight dip in conversion rates due to limited aircraft availability, the outlook remains exceptionally bright. Global air cargo traffic is projected for sustained growth, fueling continued robust demand for PTF solutions.

ST Engineering commands a dominant position in this lucrative and expanding PTF market. Their expertise and capacity make them a key player in meeting the evolving needs of the air cargo industry.

ST Engineering's Commercial Aerospace Engine MRO is a strong performer, benefiting from the global rebound in air travel. The company's investment in facilities like Changi Creek underscores its commitment to capturing this growth. In 2024, the demand for engine MRO services remained robust, with ST Engineering securing key contracts that reflect its leading position in this essential segment of the aerospace industry.

International Defence Business

ST Engineering's international defence business is a significant growth driver, fueled by increasing global defence spending and geopolitical instability. The company is experiencing robust demand for its diverse range of defence systems and ammunition, extending its footprint beyond its home market. This expansion is supported by key partnerships and a widening addressable market, positioning the business for continued upward trajectory.

In 2023, ST Engineering reported a strong performance in its Defence & Public Security segment, which includes its international defence operations. The company secured notable overseas contracts for artillery systems and naval solutions. For instance, in late 2023, ST Engineering announced a significant contract to supply its advanced artillery systems to a European nation, highlighting its growing international appeal. This segment is a key contributor to the company's overall revenue, demonstrating its competitive edge in the global defence arena.

- Accelerated Growth: Geopolitical tensions have spurred faster-than-expected growth in ST Engineering's international defence sector.

- Order Acquisition: The company is actively securing overseas orders for defence systems and ammunition, broadening its global market presence.

- Market Expansion: Strategic partnerships are crucial for ST Engineering to meet escalating global demand and tap into a substantial, expanding addressable market.

- Financial Performance: The Defence & Public Security segment, a core part of the international defence business, showed strong performance in 2023, with significant contract wins contributing to revenue.

Smart Mobility Solutions

Smart Mobility Solutions, within ST Engineering's Urban Solutions segment, is positioned as a star in the BCG matrix. This sector, encompassing vital areas like rail contracts and intelligent tolling systems, is experiencing robust growth, and ST Engineering is strategically investing to capture this momentum.

The company has set ambitious targets to substantially increase its smart city revenue by 2029. A key driver for this expansion is the smart mobility sub-segment, which is projected to outpace overall industry growth rates. This is being achieved through the deployment of advanced, next-generation solutions.

ST Engineering's focus on smart mobility underscores a significant commitment to high-tech urban infrastructure development. For instance, in 2024, the company secured contracts for intelligent transportation systems, contributing to its expanding smart city portfolio.

- High Growth Potential: Smart mobility, including rail and tolling, is a key growth engine for ST Engineering.

- Market Outperformance: The company aims for smart mobility to grow faster than the industry average.

- Strategic Investment: ST Engineering is actively deploying next-generation solutions to capture market share.

- Urban Infrastructure Focus: This segment represents a significant push into advanced urban technology.

ST Engineering's Defence Digital Systems & Cyber is a star performer, driven by global defense upgrades and smart nation initiatives. The company's AI-powered solutions are in high demand, evidenced by significant contracts for AI camera systems and cloud infrastructure, with the global cybersecurity market projected to exceed $200 billion in 2024.

The Passenger-to-Freighter (PTF) conversion business is another star, exceeding its 2026 revenue target by 2024 due to strong market demand, despite potential aircraft availability constraints in 2025. Global air cargo traffic's sustained growth ensures continued robust demand for these specialized conversion services.

ST Engineering's Commercial Aerospace Engine MRO is a solid performer, benefiting from the air travel rebound, with continued robust demand in 2024 reflected in key contract wins. The international defence business is also a star, fueled by rising global defence spending and geopolitical instability, leading to strong demand for its systems and ammunition.

Smart Mobility Solutions, encompassing rail and intelligent tolling, is a star within the Urban Solutions segment, with ST Engineering strategically investing to capture its robust growth. The company aims for this sub-segment to outpace industry growth, evidenced by 2024 contracts for intelligent transportation systems.

| Business Segment | BCG Category | Key Drivers | 2024 Data Point |

|---|---|---|---|

| Defence Digital Systems & Cyber | Star | Global defense upgrades, smart nation projects, geopolitical tensions | Global cybersecurity market projected >$200 billion |

| Passenger-to-Freighter (PTF) Conversion | Star | Global air cargo traffic growth, demand for specialized services | Exceeded 2026 revenue goal by 2024 |

| Commercial Aerospace Engine MRO | Star | Rebound in air travel, investment in facilities | Robust demand in 2024, securing key contracts |

| International Defence | Star | Increasing global defence spending, geopolitical instability | Strong demand for systems and ammunition, notable overseas contracts in 2023 |

| Smart Mobility Solutions | Star | Urban infrastructure development, smart city initiatives | Secured contracts for intelligent transportation systems in 2024 |

What is included in the product

ST Engineering's BCG Matrix provides a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

This analysis guides decisions on resource allocation, highlighting which units to invest in, hold, or divest for optimal portfolio performance.

ST Engineering's BCG Matrix provides a clear, one-page overview, instantly relieving the pain of complex strategic analysis.

Cash Cows

ST Engineering's core defence and public security segment, primarily serving the Singapore government, acts as a robust cash cow. This is due to consistent, long-term contracts for land systems and naval shipbuilding, ensuring a stable and significant revenue stream with high market share in a mature domestic market.

This segment is the largest contributor to ST Engineering's overall revenue. For instance, in 2023, the Defence & Public Security sector reported revenues of S$2.9 billion, representing a substantial portion of the group's total S$5.0 billion revenue.

Aerostructures & Systems Manufacturing is a classic cash cow for ST Engineering. This segment, focused on producing vital aircraft components such as nacelles and composite panels, thrives in a mature yet steady commercial aerospace market. ST Engineering's substantial market share, built on deep expertise and enduring partnerships with key players like Boeing and Airbus, ensures predictable earnings.

The unit's consistent revenue generation and positive impact on segment profit margins underscore its cash cow status. For instance, ST Engineering's aerospace segment, which includes aerostructures, reported revenue of S$1.5 billion in 2023, demonstrating its significant and stable contribution to the company's financial health.

ST Engineering's conventional marine engineering, focusing on maintenance and overhaul for commercial and naval fleets, acts as a reliable cash cow. This segment, though mature, leverages the company's established expertise and strong market position to generate consistent revenue.

In 2024, ST Engineering's Marine segment, which includes these foundational services, reported a revenue of S$2.3 billion, highlighting the enduring contribution of its non-specialized marine engineering work. This steady performance underpins the company's overall financial stability.

Legacy Satellite Communications (Ground Infrastructure)

ST Engineering's legacy satellite communications ground infrastructure likely functions as a cash cow. Despite evolving satellite technologies, these established services continue to provide essential support for existing clients, ensuring a consistent revenue stream. This segment benefits from high market share in its specialized niches, underpinned by long-term contracts that offer predictable income.

The company's deep-rooted presence in ground segment solutions, including network operations centers and earth stations, continues to be a reliable revenue generator. For instance, ST Engineering's involvement in maintaining and upgrading critical satellite ground infrastructure for defense and commercial entities contributes significantly to its financial stability. This steady cash flow allows for investment in newer, more dynamic areas of the business.

- Steady Revenue: Predictable income from long-term contracts for ground infrastructure maintenance and operations.

- High Market Share: Dominance in specific, established niches within the satellite ground segment.

- Critical Services: Essential ongoing support for existing clients' satellite communication needs.

- Financial Stability: Contributes reliably to overall company cash flow, supporting growth initiatives.

Large-Scale Urban Infrastructure Projects

ST Engineering's significant presence in large-scale urban infrastructure, particularly in rail networks and tolling systems, positions these ventures as robust cash cows. These long-term, often government-backed projects, while operating in mature, low-growth markets, command a high market share for ST Engineering. This dominance translates into stable and predictable revenue streams with healthy profit margins, underpinning the company's financial stability.

These established infrastructure assets, such as the extensive rail systems ST Engineering maintains and operates, represent a mature but highly profitable segment. For instance, ST Engineering's involvement in Singapore's Mass Rapid Transit (MRT) system, a critical piece of urban mobility, generates consistent revenue through maintenance, operations, and system upgrades. This consistent demand, coupled with the company's established expertise, ensures a reliable cash flow, a hallmark of a cash cow.

- Stable Revenue: Operations and maintenance contracts for established rail networks and tolling systems provide predictable, recurring income.

- High Market Share: ST Engineering's deep involvement and expertise in these sectors often result in a dominant market position.

- Mature Market: While growth is slow, the essential nature of these infrastructure services ensures continued demand and profitability.

- Profitability: Once initial development costs are amortized, these projects typically yield stable and attractive profit margins.

ST Engineering's Defence & Public Security segment is a prime example of a cash cow. Its strong market position in Singapore, secured by long-term contracts for land systems and naval shipbuilding, generates consistent and substantial revenue. This segment is a cornerstone of the company's financial performance.

In 2023, this sector brought in S$2.9 billion, a significant portion of ST Engineering's total S$5.0 billion revenue, underscoring its role as a stable income generator. The mature domestic market and high barriers to entry further solidify its cash cow status.

The Aerostructures & Systems Manufacturing unit also functions as a cash cow, supplying vital components to major aerospace players like Boeing and Airbus. Its established market share and deep expertise in a mature commercial aerospace sector ensure predictable earnings and profitability.

The aerospace segment, including aerostructures, reported S$1.5 billion in revenue in 2023, demonstrating its consistent contribution to ST Engineering's financial health and its reliable cash flow generation capabilities.

ST Engineering's conventional marine engineering services, focused on maintenance and overhaul for commercial and naval fleets, are another reliable cash cow. Despite the maturity of this market, the company's established expertise and strong market position ensure consistent revenue generation.

In 2024, the Marine segment, which encompasses these services, generated S$2.3 billion in revenue, highlighting the enduring financial contribution of its foundational marine engineering work. This steady performance bolsters the company's overall financial stability.

| Segment | 2023 Revenue (S$ billion) | Key Characteristics | BCG Matrix Status |

|---|---|---|---|

| Defence & Public Security | 2.9 | Long-term contracts, high domestic market share, mature market | Cash Cow |

| Aerospace (incl. Aerostructures) | 1.5 | Established partnerships, stable commercial aerospace market, high market share in components | Cash Cow |

| Marine (Conventional Services) | 2.3 | Mature market, established expertise, consistent demand for maintenance and overhaul | Cash Cow |

What You See Is What You Get

ST Engineering BCG Matrix

The ST Engineering BCG Matrix preview you are seeing is the complete, unwatermarked document you will receive immediately after purchase. This comprehensive analysis is ready for immediate strategic application, offering actionable insights without any hidden content or trial limitations. You're getting the full, professionally formatted report designed to empower your decision-making processes.

Dogs

ST Engineering's legacy Satellite Communications (Satcom) offerings have seen a downturn, with revenue decline and losses reported in the first half of 2024. While a Q4 2024 uptick offered some hope, these specific products likely hold a small market share in a fiercely competitive or fast-changing sector. This situation risks tying up valuable capital without generating substantial returns.

ST Engineering's older public security hardware, those lacking advanced digital or AI features, are likely positioned in the Dogs quadrant. These products face fierce price wars and shrinking market relevance as the industry rapidly embraces smart, connected security systems. For instance, basic CCTV camera systems without analytics are seeing significant price erosion globally.

Within ST Engineering's digital segment, certain IT service contracts might fall into the 'dog' category. These are often highly commoditized, meaning they offer little unique value and are easily replicated by competitors. Think of basic IT support or legacy system maintenance that doesn't tap into advanced technologies.

These services typically operate on thin margins, making profitability a challenge. For instance, in 2023, the IT services market globally saw growth, but for non-strategic areas, margins could be as low as 5-10%, barely covering costs. This lack of scalability means they don't benefit from economies of scale, further hindering their financial performance.

Such offerings may also have limited growth potential, struggling to adapt to evolving market demands. If these IT services don't align with ST Engineering's strategic focus on AI, cloud, or cybersecurity, they might consume resources without significantly contributing to the company's long-term vision or competitive advantage.

Outdated Defence Systems with Limited Upgrade Potential

Certain legacy defence systems within ST Engineering's portfolio, particularly those with older platforms and limited technological integration capabilities, may fall into the 'dog' category. These could include older generation artillery systems or specific vehicle platforms that have seen their market relevance diminish due to advancements in modern warfare technology. For instance, older armoured personnel carriers that lack modularity for significant upgrades might represent such a segment.

These outdated systems often require substantial investment in maintenance and support, while their contribution to revenue and market share is declining. The cost of keeping these systems operational can outweigh the benefits derived from their diminishing operational roles or limited export potential. For ST Engineering, managing these legacy assets efficiently is key to reallocating resources towards more promising growth areas.

- Limited Upgrade Pathways: Systems like older radar platforms or communication suites designed for pre-digital eras may lack the architecture for seamless integration with modern networked warfare capabilities.

- Diminishing Market Share: Competitors offering newer, more advanced solutions have captured a larger portion of the defence market, leaving legacy systems with a shrinking customer base.

- High Support Costs: Maintaining the operational readiness of older equipment, such as specific naval gun systems, can incur disproportionately high costs for spare parts and specialized technical support.

- Reduced Strategic Relevance: In the context of evolving geopolitical landscapes and military doctrines, some older platforms may no longer align with current defence needs or operational requirements.

Small, Non-Core Ventures from Past Acquisitions

Smaller business units or product lines acquired by ST Engineering that haven't gained substantial market share or integrated well into the company's main growth plans could be classified as dogs. These might be draining resources without meeting their expected growth targets.

Such ventures could be prime candidates for divestiture, allowing ST Engineering to reallocate capital and focus on more promising core activities. For instance, if a specific acquired technology platform, as part of a broader acquisition, has seen minimal adoption or revenue generation by 2024, it would likely fall into this category.

- Divestiture Consideration: Ventures with low market share and poor integration are candidates for sale or closure.

- Resource Reallocation: Selling off "dog" units frees up capital for more strategic investments.

- Performance Metrics: A lack of significant revenue growth or market penetration by 2024 would signal a "dog" status.

- Strategic Focus: Exiting these ventures allows ST Engineering to concentrate on its core, high-growth areas.

ST Engineering's "Dogs" represent business segments with low market share and low growth prospects, often consuming resources without significant returns. These include legacy Satcom products facing market decline and older public security hardware struggling against advanced digital solutions. The company's strategy likely involves managing or divesting these units to reallocate capital towards more promising ventures.

| Segment/Product Area | Market Share | Growth Prospects | Financial Performance (H1 2024 Indication) | Strategic Consideration |

| Legacy Satcom | Low | Low | Revenue decline, losses | Divestiture or restructuring |

| Older Public Security Hardware | Low | Low | Price erosion, shrinking relevance | Phased exit or niche focus |

| Commoditized IT Services | Low | Low | Thin margins, low profitability | Streamline or exit |

| Legacy Defence Systems | Low | Low | High support costs, declining revenue | Managed phase-out |

Question Marks

Quantum-safe cybersecurity solutions represent a burgeoning market, fueled by the anticipated threat quantum computing poses to current encryption methods. This sector is poised for significant growth as organizations worldwide prepare for the post-quantum era.

ST Engineering is actively developing and demonstrating quantum-safe encryption technologies, signaling its strategic entry into this high-potential, albeit early-stage, market. While the market's adoption rate is still developing, ST Engineering's investment in this area positions it to capture future market share.

ST Engineering is actively investing in foundational technologies for Advanced Air Mobility (AAM), a sector poised for significant future growth. This strategic focus positions them to capitalize on emerging opportunities in electric vertical takeoff and landing (eVTOL) aircraft and related infrastructure. For instance, in 2024, global investment in AAM startups reached an estimated $6 billion, highlighting the sector's rapid expansion and ST Engineering's forward-thinking approach.

ST Engineering's new generation 5G System-on-Chip (SoC) small cells, featuring AI for intelligent network management, are positioned to capitalize on the burgeoning connectivity market. This innovation places them in a sector experiencing rapid technological advancement and increasing demand for enhanced mobile broadband and low-latency applications.

While the technology is cutting-edge, ST Engineering is likely in the initial phases of market penetration for these advanced small cells. The telecommunications infrastructure landscape is highly competitive, with established players and emerging technologies vying for market share, requiring substantial investment in sales and marketing to gain traction.

Broader Commercial AI and Data Analytics Platforms

ST Engineering's AI and data analytics platforms are venturing beyond defense and smart city applications into the broader commercial enterprise market. This strategic move targets a sector experiencing rapid growth, with global AI market revenues projected to reach over $500 billion by 2024. However, to truly compete and capture significant share, ST Engineering faces the challenge of robustly investing in marketing and sales efforts to stand out against established technology leaders.

The company's expansion into broader commercial AI and data analytics positions it within a competitive landscape. Key considerations for ST Engineering's success include:

- Market Penetration Strategy: Developing targeted marketing campaigns and building a strong sales force to reach diverse commercial sectors.

- Product Differentiation: Highlighting unique value propositions and tailored solutions that address specific industry needs, potentially leveraging existing defense-grade security and reliability.

- Partnership Ecosystem: Collaborating with other technology providers and industry players to expand reach and offer integrated solutions.

- Customer Acquisition Costs: Managing and optimizing the expense of acquiring new commercial clients in a crowded marketplace.

Digital Health Solutions Partnerships

ST Engineering's strategic partnerships in digital health are designed to create a synergistic ecosystem for advanced healthcare delivery. The global digital health market is projected to reach over $660 billion by 2025, indicating significant growth potential.

While ST Engineering is actively building its presence, its market share in specific digital health applications is likely nascent, positioning these ventures as potential Question Marks in the BCG matrix. This requires significant ongoing investment.

- Market Expansion: Significant capital is needed for research and development, alongside strategic alliances to enhance product offerings and gain traction.

- Partnership Synergies: Collaborations are key to integrating diverse technologies and services, aiming to capture a larger segment of the expanding digital health market.

- Investment Focus: The company must allocate substantial resources to marketing, sales infrastructure, and continuous innovation to move these digital health solutions towards becoming market leaders.

- Growth Potential: Success hinges on effectively navigating the competitive landscape and demonstrating clear value propositions to healthcare providers and patients.

ST Engineering's ventures into quantum-safe cybersecurity and digital health represent potential Question Marks. These areas exhibit high growth potential but currently hold a smaller market share, necessitating significant investment to establish a stronger market position.

The company's focus on Advanced Air Mobility (AAM) also falls into this category. While global investment in AAM startups reached an estimated $6 billion in 2024, ST Engineering is still building its presence in this nascent, high-growth sector.

Similarly, their new generation 5G small cells with AI capabilities are in an emerging market. Despite the rapid technological advancement, gaining substantial traction against established players requires focused sales and marketing efforts.

ST Engineering's AI and data analytics platforms, expanding into broader commercial markets, face intense competition. Success hinges on differentiating their offerings and building robust sales and marketing capabilities to capture share in a market projected to exceed $500 billion by 2024.

| Business Unit/Initiative | Market Growth | Market Share | BCG Category | Key Considerations |

|---|---|---|---|---|

| Quantum-Safe Cybersecurity | High | Low | Question Mark | Market adoption, R&D investment |

| Digital Health | High (Projected >$660B by 2025) | Low | Question Mark | Partnerships, market penetration |

| Advanced Air Mobility (AAM) | High (Est. $6B investment in 2024) | Low | Question Mark | Technology development, regulatory landscape |

| 5G Small Cells (AI-enabled) | High | Low | Question Mark | Sales & marketing, competitive differentiation |

| Commercial AI & Data Analytics | High (Projected >$500B by 2024) | Low | Question Mark | Marketing, sales force, product value |

BCG Matrix Data Sources

Our ST Engineering BCG Matrix leverages comprehensive data from financial reports, market research, and internal performance metrics to provide strategic insights.