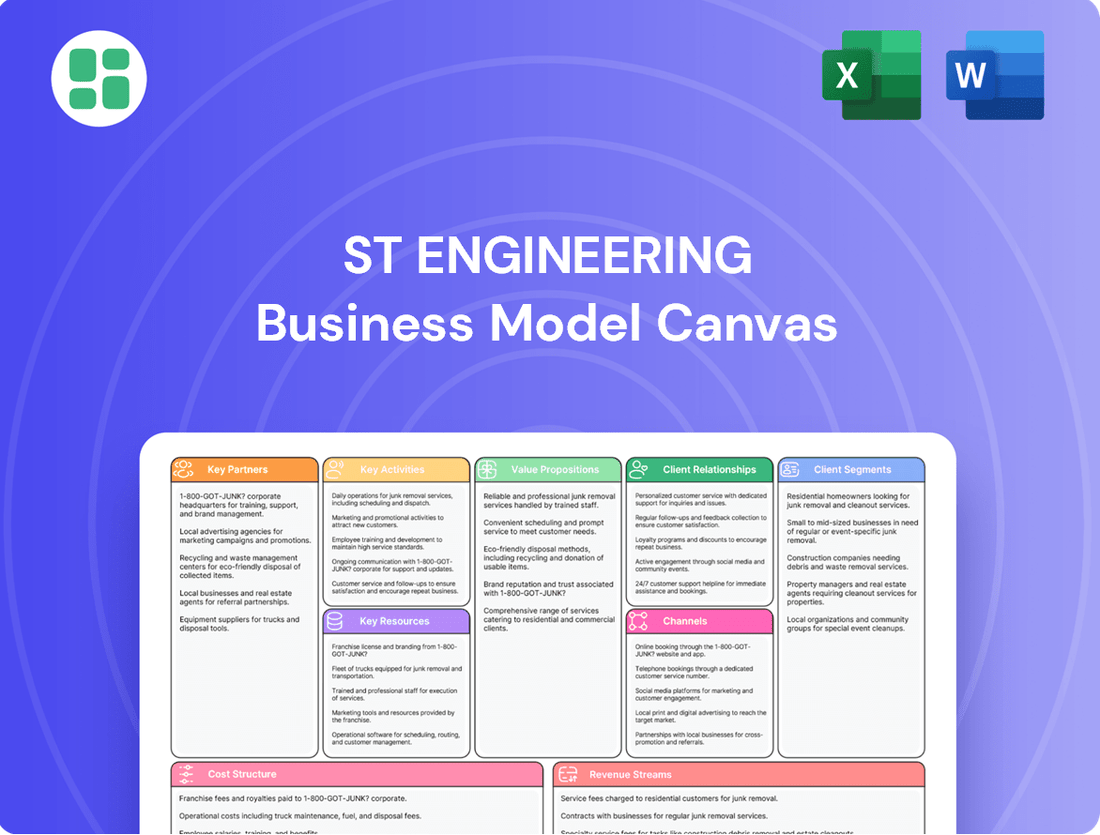

ST Engineering Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ST Engineering Bundle

Unlock the strategic core of ST Engineering's operations with our comprehensive Business Model Canvas. This detailed analysis breaks down their customer relationships, revenue streams, and key resources, offering invaluable insights for any business strategist. See how they build value and achieve market dominance.

Ready to gain a competitive edge? Download the full ST Engineering Business Model Canvas to explore their unique value propositions, cost structures, and channels. It's your roadmap to understanding and replicating their success.

Partnerships

ST Engineering cultivates vital relationships with leading global Original Equipment Manufacturers (OEMs) in the aerospace and defense industries. These partnerships, including those with giants like Boeing and major engine manufacturers, are crucial for delivering comprehensive Maintenance, Repair, and Overhaul (MRO) services, alongside specialized aerostructures and systems components.

These strategic alliances are instrumental in securing long-term, recurring revenue streams and firmly embedding ST Engineering within complex, critical global supply chains. For instance, in the first quarter of 2025, the company announced a significant three-year agreement for the reconditioning of Boeing 787 aircraft and secured multi-year contracts for the maintenance of LEAP-1A engines, demonstrating the tangible benefits of these collaborations.

ST Engineering actively cultivates partnerships with government agencies and public sector bodies, particularly within Singapore. These collaborations are crucial for developing and deploying sophisticated defense systems, smart city initiatives, and public safety technologies. This strategic alignment ensures their solutions meet critical national needs.

A prime example of this partnership is the S$200 million contract awarded by the Home Team Science and Technology Agency (HTX) for an island-wide public camera system. This significant deal underscores the trust and reliance placed on ST Engineering's capabilities by key government entities.

Furthermore, ST Engineering is engaged in various smart mobility projects in collaboration with public sector organizations. These projects aim to enhance urban living through innovative technological solutions, demonstrating the company's commitment to public infrastructure development.

ST Engineering actively cultivates a robust technology and innovation ecosystem, partnering with leading tech firms, universities, and agile startups. These collaborations are crucial for co-developing and embedding advanced solutions in fields such as artificial intelligence, robotics, and cybersecurity. For instance, ST Engineering has forged alliances to build high-performance GPU data centers and develop AI-driven command and control systems, significantly bolstering their digital capabilities and market competitiveness.

International Defence Collaborations

ST Engineering actively cultivates key partnerships with international defense firms to broaden its global reach and satisfy local content mandates. These collaborations are crucial for market penetration and technology transfer.

A prime example of this strategy is ST Engineering's partnership with Kazakhstan Paramount Engineering. This collaboration focuses on developing an 8x8 amphibious multi-purpose armored vehicle, signaling a significant entry into new and emerging defense markets.

These international defense collaborations are not just about market access; they also facilitate the sharing of technological expertise and manufacturing capabilities. For instance, ST Engineering’s involvement in such projects often requires adherence to specific national defense industrial participation goals.

- Global Footprint Expansion: Partnerships enable ST Engineering to establish a presence in diverse geographical regions, overcoming market entry barriers.

- Local Content Fulfillment: Collaborations help meet the regulatory requirements of various countries that mandate a certain percentage of local production or content.

- Technology and Capability Enhancement: Working with international partners allows for the co-development and integration of advanced defense technologies.

- Market Diversification: These alliances reduce reliance on any single market, spreading risk and opening up new revenue streams.

Local and Regional Infrastructure Developers

ST Engineering actively collaborates with local and regional infrastructure developers and operators, a crucial element in their Urban Solutions segment. These partnerships are vital for deploying smart mobility, advanced tolling systems, and smart utility projects.

These collaborations have led to significant contracts, including the provision of rail electronics solutions, comprehensive car park management systems, and electronic road tolling infrastructure across numerous cities. For instance, in 2024, ST Engineering secured contracts for smart city solutions in Southeast Asia, contributing to the modernization of urban transportation networks.

- Smart Mobility Solutions: Partnering for intelligent transportation systems and integrated public transit management.

- Tolling Systems: Collaborating on the implementation and operation of electronic toll collection for highways and urban roads.

- Smart Utilities: Working with developers on smart metering and grid management technologies for enhanced efficiency.

- Rail Electronics: Providing critical electronic systems for urban rail networks, ensuring safety and operational reliability.

ST Engineering's key partnerships are foundational to its diverse business model, enabling access to advanced technologies and critical markets. These collaborations span aerospace OEMs, government agencies, international defense firms, and urban infrastructure developers, fostering innovation and ensuring market relevance.

In 2024, ST Engineering continued to strengthen its ties with major aerospace players, securing multi-year agreements for aircraft maintenance and component supply. These partnerships are vital for maintaining its position in the competitive MRO sector, with a significant portion of its aerospace revenue derived from these long-term engagements.

Collaborations with government entities, particularly in Singapore, remain a cornerstone, driving advancements in defense, smart city, and public safety technologies. The S$200 million contract for a public camera system awarded by HTX in 2024 exemplifies the scale and importance of these public sector alliances.

International defense partnerships are crucial for expanding global reach and fulfilling local content requirements, as seen in projects like the 8x8 armored vehicle development. These alliances not only facilitate market entry but also drive technology transfer and capability enhancement, crucial for staying competitive in the global defense landscape.

Partnerships with infrastructure developers are instrumental in the Urban Solutions segment, supporting the deployment of smart mobility and utility projects. The securing of contracts for smart city solutions in Southeast Asia during 2024 highlights the growing importance of these collaborations in modernizing urban environments.

| Partner Type | Key Activities | 2024 Impact/Example |

|---|---|---|

| Aerospace OEMs (e.g., Boeing) | MRO Services, Aerostructures, Systems Components | Multi-year engine maintenance contracts, 787 reconditioning agreement |

| Government Agencies (e.g., HTX) | Defense Systems, Smart City, Public Safety Tech | S$200 million public camera system contract |

| International Defense Firms | Market Access, Technology Transfer, Local Content | 8x8 armored vehicle development with Kazakhstan Paramount Engineering |

| Infrastructure Developers | Smart Mobility, Tolling, Smart Utilities | Smart city solutions contracts in Southeast Asia |

What is included in the product

A comprehensive, pre-written business model tailored to ST Engineering's strategy, covering customer segments, channels, and value propositions in full detail.

Reflects the real-world operations and plans of the featured company, organized into 9 classic BMC blocks with full narrative and insights.

ST Engineering's Business Model Canvas acts as a pain point reliever by providing a structured, visual framework that simplifies complex strategic thinking.

It helps alleviate the pain of information overload and strategic ambiguity by condensing ST Engineering's operations into a clear, actionable one-page overview.

Activities

ST Engineering's key activities heavily feature its robust Maintenance, Repair, and Overhaul (MRO) services. This encompasses a wide range of offerings for aircraft, engines, and essential components, notably including freighter conversions.

The company secured substantial contract wins in the first quarter of 2025, highlighting the strength of this segment. These include a significant 15-year exclusive contract with Akasa Air and a six-year agreement for heavy maintenance on Boeing 787 fleets.

ST Engineering's core strength lies in its comprehensive approach to defense system development and integration. They design, build, and combine sophisticated systems for air, land, and sea applications, including crucial C5ISR capabilities. This holistic strategy ensures their offerings are robust and interconnected for optimal battlefield performance.

In 2024, ST Engineering continued to secure significant orders in this domain. For instance, their naval segment saw continued activity with contracts for ship repair and maintenance, underscoring the ongoing need for lifecycle support of defense assets. Furthermore, their ammunition business also contributed to revenue, highlighting their role in providing essential ordnance to armed forces.

ST Engineering's key activities in smart city solutions revolve around the implementation of integrated systems. These include developing and deploying smart mobility solutions like rail electronics and automated tolling systems. They also focus on smart utilities, enhancing efficiency in energy and water management, and implementing robust smart security management platforms.

The company's expertise is demonstrated through significant project wins. For instance, ST Engineering secured contracts for smart metro solutions for multiple lines in Bangkok and Kaohsiung, showcasing their capability in large-scale urban transit infrastructure. In Singapore, they are providing car park management systems, optimizing urban parking experiences.

Digital and Cybersecurity Solutions Provision

ST Engineering is increasingly focusing on digital and cybersecurity solutions, a rapidly expanding sector. This includes offering advanced services like artificial intelligence (AI), cloud computing, data analytics, and robust cyber defense. The company is actively developing sophisticated AI cloud infrastructure and AI-powered command and control systems to meet evolving market demands.

The business also provides cloud-based managed security services, aiming to protect clients from increasingly complex cyber threats. This strategic push into digital and cybersecurity reflects a significant growth area for ST Engineering, as organizations globally prioritize digital transformation and enhanced security measures. For instance, the global cybersecurity market alone was projected to reach over $250 billion in 2024, highlighting the immense opportunity.

- AI-Powered Solutions: Development of AI cloud infrastructure and AI-enabled command and control systems.

- Cloud Services: Offering a range of cloud-based solutions, including managed security services.

- Data Analytics: Leveraging data analytics to provide insights and enhance decision-making for clients.

- Cyber Defense: Providing comprehensive cyber defense strategies and solutions to protect against digital threats.

Research and Development in Frontier Technologies

ST Engineering’s commitment to innovation is evident through its consistent investment in Research and Development, a cornerstone of its business model. This focus is particularly directed towards emerging fields like artificial intelligence, robotics, advanced manufacturing, and composite materials.

These R&D efforts are crucial for creating cutting-edge products and solutions that span ST Engineering’s diverse business segments. By staying at the forefront of technological advancements, the company aims to secure a leading position in future markets.

- AI and Robotics: Developing intelligent systems and autonomous capabilities for defense, commercial, and smart city applications.

- Advanced Manufacturing: Enhancing production efficiency and creating novel materials and components through technologies like additive manufacturing.

- Composite Technologies: Pioneering lightweight and durable materials for aerospace, marine, and land systems.

- Digitalization: Integrating digital solutions across operations to improve performance and create new service offerings.

ST Engineering's key activities revolve around its extensive Maintenance, Repair, and Overhaul (MRO) services, particularly for aircraft and engines, including freighter conversions. They also excel in developing and integrating sophisticated defense systems for air, land, and sea, with a strong emphasis on C5ISR capabilities. Furthermore, the company is a significant player in smart city solutions, deploying integrated systems for mobility, utilities, and security, alongside a growing focus on digital and cybersecurity services powered by AI and cloud technologies.

ST Engineering's commitment to R&D is a critical activity, driving innovation in AI, robotics, advanced manufacturing, and composite materials to create next-generation products and solutions across its diverse business segments.

| Key Activity Segment | Description | 2024/2025 Data Points |

|---|---|---|

| MRO Services | Aircraft and engine maintenance, repair, overhaul, and freighter conversions. | Secured a 15-year exclusive contract with Akasa Air and a six-year agreement for Boeing 787 heavy maintenance in Q1 2025. |

| Defense Systems | Design, build, and integration of air, land, and sea defense systems, including C5ISR. | Continued securing orders for naval ship repair and maintenance; ammunition business contributed to revenue in 2024. |

| Smart City Solutions | Integrated systems for smart mobility, utilities, and security management. | Contracts for smart metro solutions in Bangkok and Kaohsiung; car park management systems in Singapore. |

| Digital & Cybersecurity | AI, cloud computing, data analytics, and cyber defense services. | Developing AI cloud infrastructure and AI-powered command and control systems; global cybersecurity market projected over $250 billion in 2024. |

| Research & Development | Innovation in AI, robotics, advanced manufacturing, and composite materials. | Consistent investment to develop cutting-edge products and maintain market leadership. |

Full Version Awaits

Business Model Canvas

The ST Engineering Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means the structure, content, and formatting are precisely as they will be delivered, ensuring no surprises. You're seeing a direct representation of the comprehensive analysis you'll gain access to, ready for your strategic planning.

Resources

ST Engineering's most critical asset is its global team of over 27,000 highly skilled engineers, technicians, and specialists. This vast pool of talent is the backbone of their operations, enabling them to tackle complex projects across diverse sectors.

The deep domain expertise within this workforce, particularly in aerospace, defense, and smart technologies, is indispensable for developing and delivering sophisticated, integrated solutions. This specialized knowledge allows ST Engineering to innovate and maintain a competitive edge.

In 2024, ST Engineering continued to invest in its people, with a significant portion of its operating expenses dedicated to talent development and retention. This commitment ensures their workforce remains at the forefront of technological advancements, directly impacting their ability to secure and execute high-value contracts.

ST Engineering leverages an extensive global network of facilities, encompassing Maintenance, Repair, and Overhaul (MRO) hangars, advanced production plants, cutting-edge R&D centers, and specialized testing sites. This vast infrastructure underpins its ability to deliver comprehensive solutions and maintain a significant global presence.

The company's physical assets are critical enablers of its operational capabilities. For instance, the upcoming Changi Creek facility, slated for operation by mid-2025, exemplifies ST Engineering's commitment to expanding its infrastructure to meet growing market demands and enhance service delivery across its diverse business segments.

ST Engineering's competitive advantage is deeply rooted in its substantial portfolio of proprietary technologies, including patents in artificial intelligence, robotics, cybersecurity, and advanced engineering. This intellectual property is not just a collection of assets; it's the engine driving the creation of unique, high-value solutions for its diverse clientele.

These technological innovations allow ST Engineering to offer differentiated products and services, setting them apart in competitive markets. For instance, their advancements in AI and robotics are crucial for developing sophisticated autonomous systems and intelligent automation solutions, which are in high demand across various sectors.

By continuously investing in research and development, ST Engineering ensures its intellectual property remains cutting-edge. This commitment to innovation is vital for maintaining leadership and capturing market share in rapidly evolving technological landscapes, directly impacting their ability to generate revenue and secure long-term growth opportunities.

Robust Order Book and Financial Capital

ST Engineering's robust order book, standing at S$28.5 billion as of the close of 2024, is a critical resource. This substantial backlog, coupled with strong financial capital, provides the essential funding for strategic initiatives.

This financial muscle allows ST Engineering to confidently invest in research and development, pursue strategic acquisitions, and fuel its expansion plans. The company's ability to generate significant cash flow further solidifies its financial foundation, supporting these growth-oriented activities and reinforcing its long-term viability.

- Order Book Strength: S$28.5 billion as of end-2024.

- Capital for Investment: Enables R&D, acquisitions, and expansion.

- Financial Stability: Underpinned by significant cash flow.

- Long-Term Growth Support: Financial strength is key to sustained development.

Strategic Partnerships and Customer Relationships

ST Engineering’s strategic partnerships and customer relationships are a cornerstone of its business model. The company cultivates deep, long-standing ties with governments, defense ministries, and leading commercial airlines worldwide. These relationships are not merely transactional; they represent a foundation of trust and proven capability, crucial for securing recurring contracts and expanding market reach.

These established networks are vital intangible assets that enable ST Engineering to consistently win significant projects. For instance, in 2024, the company continued to leverage its strong relationships to secure notable defense and aerospace contracts, underscoring the value of this key resource. The confidence placed in ST Engineering by its partners directly translates into market access and sustained revenue streams.

- Government and Defense Ties: ST Engineering maintains robust relationships with defense ministries globally, facilitating access to sensitive projects and long-term procurement cycles.

- Commercial Aerospace Collaborations: Partnerships with major airlines and aircraft manufacturers are essential for its MRO (Maintenance, Repair, and Overhaul) services and the development of new aviation solutions.

- Technology Ecosystem: Collaborations with technology firms enhance ST Engineering's innovation capabilities, allowing it to integrate cutting-edge solutions into its offerings.

- Customer Loyalty and Trust: Decades of reliable service have fostered deep customer loyalty, a critical factor in contract renewals and the acquisition of new business.

ST Engineering's key resources are its extensive intellectual property portfolio, robust financial capital, and a strong global network of partnerships. These elements are critical for innovation, operational execution, and market penetration.

The company's intellectual property, including patents in AI, robotics, and cybersecurity, drives the creation of differentiated solutions. Its financial strength, evidenced by a S$28.5 billion order book at the end of 2024, fuels research and development and strategic investments.

Furthermore, ST Engineering's deep relationships with governments, defense ministries, and commercial entities worldwide provide consistent access to significant projects and recurring revenue streams, underscoring the value of its collaborative approach.

| Resource Category | Key Assets | 2024 Data/Significance |

|---|---|---|

| Human Capital | Global workforce of 27,000+ engineers and specialists | Significant investment in talent development for technological advancement. |

| Physical Assets | Global MRO hangars, production plants, R&D centers | Expansion planned with new facilities like Changi Creek by mid-2025. |

| Intellectual Property | Patents in AI, robotics, cybersecurity, advanced engineering | Enables differentiated products and services, driving innovation. |

| Financial Capital | Order book of S$28.5 billion (end-2024) | Provides funding for R&D, acquisitions, and expansion initiatives. |

| Partnerships & Relationships | Global government, defense, and commercial ties | Facilitates securing recurring contracts and market access. |

Value Propositions

ST Engineering's integrated end-to-end solutions provide a significant value proposition by consolidating diverse capabilities into a single, cohesive offering. This approach simplifies complex challenges for clients, allowing them to address multiple needs through a single partner, from advanced aerospace MRO services to the development of smart city infrastructure.

For instance, in 2024, ST Engineering's aerospace division continued to secure multi-year contracts for airframe maintenance and component repair, demonstrating the breadth of their integrated service offerings. This holistic approach streamlines operations for aviation clients, offering a one-stop shop for a wide range of technical requirements.

ST Engineering leverages cutting-edge technology, including artificial intelligence and advanced robotics, to develop and deliver innovative solutions. This focus ensures clients receive future-ready products and services designed for peak efficiency.

In 2024, ST Engineering continued its investment in R&D, with a significant portion of its revenue dedicated to developing next-generation capabilities in areas like smart city solutions and advanced manufacturing. This commitment to innovation directly translates into their value proposition of providing clients with solutions that stay ahead of the curve.

ST Engineering's value proposition centers on delivering enhanced safety, security, and efficiency across its diverse customer base. In the defense sector, their advanced systems, such as integrated command and control solutions, bolster the protection of critical assets and personnel. For instance, their naval combat systems are designed to provide superior situational awareness and defensive capabilities.

The company's smart city initiatives directly contribute to improved public safety and operational efficiency. Their intelligent transportation systems, for example, help manage traffic flow and reduce congestion, leading to smoother urban operations. In 2023, ST Engineering secured contracts for smart city projects aimed at enhancing urban resilience and citizen safety, demonstrating a tangible impact on efficiency and security.

Furthermore, ST Engineering's commitment to innovation ensures that their solutions remain at the forefront of technological advancement, offering customers a competitive edge. Their cybersecurity offerings, a key component of their security proposition, protect against evolving threats, ensuring business continuity and data integrity for clients in both public and private sectors.

Reliability and Proven Track Record

ST Engineering's reliability is a cornerstone of its value proposition, evidenced by a long history of successful project execution across diverse sectors. This proven track record, built over decades, assures customers of dependable performance and delivery, fostering deep trust and enabling enduring partnerships.

The company's robust financial health further underpins this assurance. For instance, in 2023, ST Engineering reported a revenue of S$10.5 billion, demonstrating consistent operational strength and financial stability. This financial resilience translates directly into reliability for clients undertaking significant, long-term projects.

This reputation for dependable execution is crucial for attracting and retaining a global customer base. It allows ST Engineering to secure complex, high-value contracts, knowing that its commitment to quality and timely delivery is a recognized strength.

- Decades of experience in delivering complex engineering solutions globally.

- Consistent financial performance, with S$10.5 billion in revenue reported for 2023, showcasing operational stability.

- Strong reputation for quality and timely project completion, building significant customer trust.

Global Reach and Localized Support

ST Engineering's value proposition of Global Reach and Localized Support is a cornerstone of its business model. They effectively deliver advanced solutions worldwide while ensuring each client receives tailored assistance. This is achieved through a vast network, enabling them to navigate diverse market needs.

With operations spanning over 100 countries, ST Engineering demonstrates a commitment to understanding and addressing specific regional requirements. This extensive footprint allows them to combine global technological prowess with on-the-ground expertise.

- Global Network: ST Engineering operates in over 100 countries, facilitating worldwide solution deployment.

- Localized Expertise: Subsidiaries and local teams provide support that is attuned to regional nuances and regulations.

- Synergistic Approach: The company leverages global R&D and best practices while adapting them to local contexts.

- Client-Centricity: This model ensures that clients receive relevant and effective solutions, backed by accessible local support.

ST Engineering offers integrated, end-to-end solutions that simplify complex client needs, providing a single point of contact for diverse requirements from aerospace MRO to smart city infrastructure.

Their commitment to innovation, demonstrated by significant R&D investment in 2024 for smart city and advanced manufacturing capabilities, ensures clients receive future-ready, efficient solutions.

The company's value proposition also emphasizes enhanced safety, security, and efficiency, as seen in their defense systems and smart city initiatives like intelligent transportation systems, which contributed to improved urban operations in 2023.

ST Engineering's reliability, backed by decades of experience and consistent financial performance, such as S$10.5 billion in revenue for 2023, builds deep customer trust and enables long-term partnerships.

| Value Proposition Element | Description | Supporting Fact/Data |

|---|---|---|

| Integrated Solutions | Consolidating diverse capabilities into single offerings. | Aerospace division securing multi-year MRO contracts in 2024. |

| Innovation & Future-Readiness | Developing next-generation capabilities using advanced technologies. | Significant R&D investment in 2024 for smart city and advanced manufacturing. |

| Enhanced Safety, Security & Efficiency | Boosting protection and operational effectiveness for clients. | Smart city projects in 2023 aimed at enhancing urban resilience and citizen safety. |

| Reliability & Trust | Proven track record of successful project execution and financial stability. | S$10.5 billion revenue in 2023; decades of experience. |

Customer Relationships

ST Engineering prioritizes building enduring strategic partnerships, particularly with major government agencies and large corporations. These collaborations are often formalized through multi-year agreements, ensuring sustained engagement and mutual benefit.

The company's approach focuses on fostering trust and aligning with client objectives, leading to successful execution of significant national defense and commercial initiatives. This deep engagement is a cornerstone of their business model.

For instance, in 2023, ST Engineering secured a significant contract extension with a major European defense ministry, valued at over S$500 million, underscoring the long-term nature of these crucial relationships.

ST Engineering offers dedicated account management for its complex, high-value solutions, ensuring clients receive personalized attention and expert guidance. This approach is crucial for fostering long-term partnerships and understanding evolving client needs.

Comprehensive technical support is integrated into ST Engineering's customer relationships, providing prompt issue resolution throughout the lifecycle of deployed solutions. For instance, in 2023, ST Engineering reported a significant increase in its service revenue, partly driven by its commitment to ongoing customer support and maintenance for its advanced systems.

ST Engineering actively involves its customers in the innovation process, co-creating solutions that precisely match their operational needs and anticipate future requirements. This collaborative spirit is particularly evident in their digital and defense segments, where tailored development and seamless integration of cutting-edge technologies are paramount.

This strategy not only results in highly customized and effective solutions but also cultivates deeper, more resilient customer relationships. For instance, ST Engineering's work with defense clients often involves iterative feedback loops, ensuring that advanced systems meet evolving battlefield demands, a testament to their commitment to co-creation.

Performance-Based Contracts and Service Level Agreements

ST Engineering frequently structures customer relationships through performance-based contracts and rigorous service level agreements (SLAs). This approach is particularly prevalent in their Maintenance, Repair, and Overhaul (MRO) and managed services divisions, ensuring that deliverables meet specific, measurable outcomes.

These agreements are designed to guarantee high standards of service delivery, thereby building and maintaining customer trust. For instance, in the aerospace sector, SLAs might stipulate aircraft turnaround times or component reliability metrics.

- Aerospace MRO: Contracts often include penalties for delayed maintenance exceeding agreed-upon schedules, directly tying revenue to operational efficiency.

- Managed Services: Performance metrics can encompass system uptime percentages or response times for technical support, crucial for clients relying on continuous operational availability.

- Defense Sector: Long-term support agreements frequently feature availability-based payment structures, where ST Engineering is compensated based on the operational readiness of the equipment provided.

- Public Transport Systems: For rail maintenance contracts, SLAs can define the number of service disruptions per million kilometers traveled, directly impacting customer satisfaction and ST Engineering's reputation.

Industry Engagement and Thought Leadership

ST Engineering actively engages in industry forums, conferences, and investor days, consistently sharing its expertise and gathering valuable feedback from stakeholders. This proactive approach solidifies its position as a thought leader within the aerospace, defense, and technology sectors.

By participating in these events, ST Engineering fosters a community around its core competencies, thereby enhancing its reputation and strengthening relationships with investors, partners, and customers. For instance, in 2024, the company presented at over 15 major industry conferences, including the Singapore Airshow and the Eurosatory defence exhibition.

- Industry Forums and Conferences: ST Engineering regularly participates in key industry events to present its latest innovations and strategic outlook.

- Investor Days: The company hosts dedicated investor days to provide in-depth updates on performance and future growth strategies, fostering transparency and trust.

- Thought Leadership: Through these engagements, ST Engineering aims to shape industry discourse and demonstrate its technical and strategic acumen.

- Stakeholder Feedback: Actively soliciting and incorporating feedback from diverse stakeholders is crucial for refining its business approach and strengthening customer relationships.

ST Engineering cultivates deep customer relationships through dedicated account management and co-creation, ensuring solutions align with specific needs. Performance-based contracts and stringent SLAs are key, particularly in MRO and managed services, reinforcing trust through guaranteed high standards.

In 2023, ST Engineering's service revenue saw a notable increase, partly attributed to its robust customer support for advanced systems. The company's proactive engagement in industry forums, including presentations at over 15 major conferences in 2024, further solidifies its thought leadership and strengthens stakeholder connections.

| Customer Relationship Type | Key Characteristics | Example Metric/Focus | 2023 Data Point |

| Strategic Partnerships | Multi-year agreements, trust-based collaboration | Contract value and duration | S$500M+ contract extension with European defense ministry |

| Dedicated Account Management | Personalized attention, expert guidance | Client satisfaction scores | Increased service revenue driven by ongoing support |

| Co-creation & Innovation | Joint development, iterative feedback | Tailored solution effectiveness | Iterative feedback loops in defense projects |

| Performance-Based Contracts/SLAs | Measurable outcomes, guaranteed service delivery | Uptime, turnaround times, availability | Aerospace MRO: Penalties for delayed maintenance |

Channels

ST Engineering heavily relies on its direct sales and business development teams to forge relationships with key clients, particularly government bodies and major commercial organizations. These teams are crucial for navigating the intricate sales cycles involved in securing large, high-value contracts, often requiring bespoke solutions.

In 2024, ST Engineering's focus on direct engagement facilitated significant wins, including a substantial contract for advanced cybersecurity solutions with a European defense ministry, highlighting the effectiveness of this approach in complex B2G environments.

The direct sales model enables ST Engineering to deeply understand client needs, allowing for the customization of offerings and fostering long-term partnerships, which is vital for recurring revenue streams in sectors like aerospace and defense.

ST Engineering's global network is a cornerstone of its business model, with operations spanning Asia, Europe, the Middle East, and the U.S. This extensive reach allows the company to tap into a wide array of markets and maintain a strong local presence. In 2023, ST Engineering reported revenue of S$10.5 billion, underscoring the scale of its international operations and market penetration.

This strategic positioning of subsidiaries and regional offices ensures closer engagement with customers, fostering deeper relationships and understanding of local needs. It also significantly enhances the company's ability to execute and support regional projects efficiently, leveraging local expertise and resources. For instance, their presence in the U.S. is crucial for securing contracts within the defense sector, a key market for the company.

ST Engineering actively utilizes strategic partnerships and joint ventures as key channels for market entry and expansion, especially in complex international defense and smart city initiatives. These collaborations are vital for navigating diverse regulatory environments and accessing specialized expertise. For instance, in 2024, ST Engineering continued to foster alliances to secure significant contracts, leveraging local presence and technological synergy.

By teaming up with local partners, ST Engineering can more effectively address specific market needs and regulatory requirements. This approach allows them to gain a deeper understanding of regional dynamics and build trust with stakeholders. Such joint ventures are instrumental in projects like smart city development, where local knowledge and established networks are paramount to successful implementation and long-term sustainability.

Industry Trade Shows and Conferences

ST Engineering actively participates in key industry events like the Singapore Airshow, Farnborough Airshow, and Eurosatory. These platforms are crucial for demonstrating their latest innovations in aerospace, defense, and smart city technologies, directly engaging with a global audience of potential clients and collaborators.

These trade shows and conferences are vital for lead generation and fostering strategic partnerships. In 2024, ST Engineering continued to leverage these events to highlight their advanced capabilities, from unmanned systems to cybersecurity solutions, reinforcing their position as a technology leader.

Beyond showcasing products, these gatherings serve as significant avenues for thought leadership and market intelligence. ST Engineering uses these opportunities to share insights on emerging trends and challenges within their sectors, contributing to industry discourse and solidifying their reputation.

Key benefits of this channel include:

- Showcasing new technologies and solutions

- Generating qualified leads and business opportunities

- Networking with potential customers, partners, and industry influencers

- Establishing thought leadership and brand visibility

Digital Platforms and Online Presence

ST Engineering leverages its corporate website and dedicated investor relations portals as key digital touchpoints. These platforms are crucial for broadcasting company updates, financial performance, and highlighting its diverse technological capabilities to a worldwide audience. In 2024, the company continued to emphasize these channels for transparent communication with stakeholders.

Social media channels further amplify ST Engineering's reach, enabling direct engagement and information dissemination. This digital ecosystem is vital for attracting investors, potential clients, and talent by showcasing the company's innovation and global impact. For instance, their LinkedIn presence actively shares insights into their projects and corporate developments.

- Corporate Website: Primary hub for company information, news, and financial reports.

- Investor Relations Portal: Dedicated space for financial data, presentations, and shareholder communications.

- Social Media: Platforms like LinkedIn and Twitter for broader outreach and engagement.

ST Engineering employs a multi-faceted channel strategy, prioritizing direct sales for high-value contracts and leveraging a global network of subsidiaries for localized engagement. Strategic partnerships and industry events are crucial for market expansion and showcasing innovation.

Digital platforms, including their corporate website and social media, serve as vital communication hubs for stakeholders, reinforcing brand visibility and transparency.

In 2024, ST Engineering's direct sales efforts secured key defense contracts, while their global presence facilitated efficient project execution in major markets like the U.S.

The company's participation in major airshows and defense exhibitions in 2024 underscored its commitment to demonstrating cutting-edge technologies and fostering new business opportunities.

Customer Segments

ST Engineering serves national defense ministries, armed forces, and public security agencies worldwide. These entities are key purchasers of sophisticated defense systems, homeland security solutions, and C5ISR technologies.

This segment is a crucial revenue generator for ST Engineering, particularly as global defense expenditures continue to rise. For instance, in 2023, global military spending reached an estimated $2.4 trillion, a 6.8% increase in real terms from 2022, highlighting the robust demand in this sector.

Global commercial airlines, cargo operators, and private aviation companies represent a crucial customer segment for ST Engineering's Commercial Aerospace division. These entities rely on comprehensive Maintenance, Repair, and Overhaul (MRO) services, aircraft conversion solutions, and advanced aerostructures. This segment is a significant revenue driver, bolstered by the ongoing recovery in air travel and the industry's push for fleet modernization.

In 2024, the aviation industry continued its robust rebound. For instance, the International Air Transport Association (IATA) projected that global airline industry net profits would reach $25.7 billion in 2024, a substantial increase from $23.3 billion in 2023. This positive financial outlook directly translates to increased demand for MRO and aircraft modification services, benefiting ST Engineering.

Urban developers and city authorities, including municipal governments and urban planners, are key customers for ST Engineering. These entities are actively investing in smart city initiatives to enhance sustainability and efficiency. For instance, in 2024, global smart city spending was projected to reach over $180 billion, with a significant portion allocated to smart mobility and infrastructure upgrades.

These customers are particularly interested in ST Engineering's smart mobility solutions, such as advanced rail systems and intelligent tolling technologies. They also seek integrated security management systems and smart utilities to improve urban living conditions and operational effectiveness. The demand for such integrated solutions is driven by the increasing urbanization trend and the need for resilient infrastructure.

Critical Infrastructure Operators

Critical infrastructure operators, including those managing energy grids, transportation systems, and water utilities, represent a key customer segment. They are actively seeking advanced solutions to bolster their cybersecurity defenses and implement smart monitoring and management capabilities. For instance, in 2023, the global cybersecurity market for critical infrastructure was estimated to be worth billions, with significant growth projected as threats escalate.

These operators prioritize solutions that guarantee the uninterrupted and secure delivery of essential services. Their investment in technology is driven by the need to mitigate risks associated with cyberattacks and operational failures.

- Focus on Resilience: Operators need solutions that enhance the operational resilience of their critical systems.

- Cybersecurity Imperative: Protecting against sophisticated cyber threats is a paramount concern for this segment.

- Smart Operations Demand: There's a growing need for intelligent monitoring and management tools to optimize performance and detect anomalies.

- Regulatory Compliance: Meeting stringent industry regulations and standards for security and reliability is a key driver for technology adoption.

Enterprises and Commercial Businesses

ST Engineering extends its expertise to a broad range of enterprises and commercial businesses, offering tailored digital transformation solutions. This encompasses everything from sophisticated cloud services designed to optimize operations to cutting-edge cybersecurity products that safeguard critical assets.

The company is particularly active in providing high-performance GPU data centers, essential for advanced computing needs, and comprehensive managed security services. These offerings are crucial for businesses looking to enhance their digital capabilities and maintain a robust security posture in an increasingly complex threat landscape.

In 2024, ST Engineering reported significant growth in its commercial business segment, driven by demand for these digital and security solutions. For instance, their cybersecurity services saw a notable uptick in adoption by mid-sized enterprises seeking to bolster their defenses against sophisticated cyber threats.

Key offerings for this segment include:

- Digital Transformation Services: Cloud migration, data analytics, and application modernization.

- Advanced Cybersecurity: Managed detection and response (MDR), threat intelligence, and secure network solutions.

- High-Performance Computing: GPU data center solutions for AI, machine learning, and simulation workloads.

- Managed IT Services: Outsourced IT support, infrastructure management, and end-user computing.

ST Engineering’s customer base is diverse, spanning government defense entities, commercial aviation, urban development, critical infrastructure operators, and a broad spectrum of commercial enterprises. These segments are united by a need for advanced technological solutions, from defense systems and aerospace services to smart city infrastructure and digital transformation. The company's ability to cater to these varied needs underscores its broad market reach and technological capabilities.

Cost Structure

ST Engineering's commitment to innovation means significant investment in Research and Development is a major cost. These funds are channeled into developing cutting-edge technologies such as artificial intelligence, robotics, and advanced materials.

This continuous pursuit of innovation is not just about staying current; it's vital for maintaining a competitive edge in the global market and driving future growth. For example, in 2023, ST Engineering reported R&D expenditure as part of its overall operating expenses, reflecting its dedication to technological advancement.

ST Engineering's personnel and workforce costs are a significant expense, reflecting its status as a global technology and engineering leader. With a workforce exceeding 27,000 individuals spread across numerous countries, the company invests heavily in attracting and retaining top talent, covering salaries, comprehensive benefits packages, and continuous professional development. This investment in human capital is crucial for maintaining its innovative edge and operational capabilities across its diverse business segments.

Manufacturing and production costs are a substantial part of ST Engineering's operations, encompassing the creation of defense systems, aerospace components, and smart city hardware. These expenses include the procurement of raw materials, the maintenance and operation of specialized machinery, and various factory overheads. For instance, in 2023, ST Engineering reported significant investments in its manufacturing capabilities, reflecting the complexity and scale of its production processes.

Maintenance, Repair, and Overhaul (MRO) Operations Costs

Operating Maintenance, Repair, and Overhaul (MRO) facilities requires significant investment in specialized equipment, ongoing certifications, and substantial parts inventory. These elements are critical for ensuring aircraft airworthiness and maintaining ST Engineering's competitive edge in the Commercial Aerospace sector.

The efficiency of MRO operations is a direct driver of profitability. For instance, ST Engineering reported that its Commercial Aerospace segment revenue grew by 11% to S$1.46 billion in 2023, with MRO activities forming a significant portion of this growth, highlighting the importance of cost-effective operations.

- Specialized Equipment: Costs associated with advanced diagnostic tools, heavy lifting machinery, and precision repair equipment.

- Certifications and Compliance: Expenses for maintaining regulatory approvals and quality standards from aviation authorities.

- Inventory Management: Capital tied up in spare parts, engines, and components, including warehousing and logistics.

- Skilled Labor: Compensation and training for licensed engineers, technicians, and support staff are a major cost component.

Sales, Marketing, and Administrative Expenses

ST Engineering's cost structure is significantly influenced by its global sales, marketing, and administrative (SMA) activities. These encompass participation in key international trade shows, the upkeep of a network of regional offices to support its worldwide operations, and the general administrative overhead required to manage a large, diversified enterprise.

For example, in 2023, ST Engineering reported that its selling, distribution, and administrative expenses amounted to SGD 1.41 billion. This figure reflects the substantial investment in maintaining a global presence and brand visibility necessary to compete effectively in its various sectors, including aerospace, smart city solutions, and defense.

- Global Reach: Costs associated with international trade shows and regional office maintenance are crucial for market penetration and customer engagement worldwide.

- Administrative Overhead: General administrative expenses cover essential functions like finance, human resources, and legal, supporting the company's extensive operations.

- Cost Optimization: ST Engineering actively pursues cost management and operational efficiencies to mitigate these SMA expenses and enhance profitability.

- 2023 Performance: Selling, distribution, and administrative expenses represented a notable portion of the company's overall expenditure in 2023, totaling SGD 1.41 billion.

ST Engineering’s cost structure is heavily weighted towards its substantial investments in research and development, aimed at fostering innovation across its diverse sectors. This commitment is further amplified by significant personnel costs, reflecting a global workforce of over 27,000 employees. Manufacturing and production expenses are also a major component, covering raw materials and specialized machinery for defense, aerospace, and smart city solutions.

The company also incurs considerable costs in operating and maintaining its repair and overhaul facilities, essential for its Commercial Aerospace segment. Global sales, marketing, and administrative activities, including international trade shows and regional office upkeep, represent another significant expenditure category, totaling SGD 1.41 billion in 2023.

| Cost Category | Description | 2023 Impact (SGD) |

|---|---|---|

| Research & Development | Investment in new technologies and innovation | Significant portion of operating expenses |

| Personnel Costs | Salaries, benefits, and training for over 27,000 employees | Major expense reflecting global talent investment |

| Manufacturing & Production | Raw materials, machinery, and factory overheads | Substantial investment in production capabilities |

| MRO Operations | Specialized equipment, certifications, inventory, skilled labor | Key to Commercial Aerospace segment performance |

| Sales, Marketing & Admin (SMA) | Global trade shows, regional offices, general administration | 1.41 billion |

Revenue Streams

Commercial Aerospace Services Revenue is a significant driver for ST Engineering, largely generated through Maintenance, Repair, and Overhaul (MRO) activities. This includes crucial services for aircraft engines, airframe upkeep, and the conversion of passenger planes into freighters.

Beyond MRO, this revenue stream also encompasses the sale of aerostructures and essential systems components to the commercial aviation sector. In 2024, this vital segment accounted for a substantial 39% of ST Engineering's total group revenue, underscoring its importance to the company's financial performance.

Defence and Public Security Sales represent a significant revenue driver, encompassing advanced defense systems, public security technologies, and digital solutions tailored for governments and public agencies. This segment was the largest contributor to ST Engineering's revenue in 2024, making up a substantial 44% of the group's total earnings.

Revenue streams for ST Engineering's Urban Solutions and Satcom segment are diverse, stemming from the deployment of smart city technologies. This includes vital rail electronics that keep urban transit systems running smoothly, intelligent transportation systems like automated tolling, and smart utility management solutions. Furthermore, the company generates income from its satellite communications services.

In 2024, this crucial segment represented a significant portion of ST Engineering's overall financial performance, contributing 17% to the group's total revenue. This demonstrates the growing importance of integrated urban solutions and advanced communication technologies in the company's business model.

Digital Business and Cybersecurity Services

ST Engineering's digital business and cybersecurity services represent a significant and rapidly expanding revenue stream. This segment focuses on delivering advanced digital transformation solutions, including AI-powered systems, robust cloud services, and critical cybersecurity offerings. These services cater to a diverse clientele, encompassing both government agencies and commercial enterprises.

The demand for these digital capabilities has fueled impressive growth. In 2024, this digital business experienced a remarkable surge of 39%. This substantial increase highlights the market's strong appetite for ST Engineering's expertise in navigating the complexities of digital integration and security.

- Digital Transformation Solutions: Providing end-to-end services to help organizations modernize their operations and embrace new technologies.

- AI-Enabled Systems: Developing and deploying artificial intelligence solutions to enhance efficiency, decision-making, and customer experiences.

- Cloud Services: Offering secure and scalable cloud infrastructure and management to support clients' digital journeys.

- Cybersecurity Solutions: Delivering comprehensive protection against evolving cyber threats for sensitive data and critical infrastructure.

Long-Term Service and Maintenance Contracts

ST Engineering benefits significantly from recurring revenue through long-term service and maintenance contracts. These agreements span across all its business segments, ensuring a consistent and predictable income flow.

For example, in 2023, ST Engineering reported a substantial order book, with a significant portion attributed to these long-term service agreements. This stability underpins the company's financial resilience and ability to plan for future investments.

- Recurring Revenue: A large part of ST Engineering's income is recurring, stemming from service agreements and maintenance contracts.

- Segment-Wide Application: These contracts are integral to all ST Engineering segments, providing broad revenue stability.

- Predictable Income: Long-term contracts offer a predictable revenue stream, enhancing financial planning and stability.

- Robust Order Book: The presence of these contracts contributes to a strong and reliable order book, reflecting sustained customer commitment.

ST Engineering's revenue streams are robust and diversified, reflecting its broad operational capabilities. The company’s business model is built on providing a range of services and products across key sectors. These revenue streams are critical to its overall financial health and market position.

| Revenue Stream | 2024 Contribution | Key Activities |

|---|---|---|

| Defence and Public Security | 44% | Advanced defense systems, public security technologies, digital solutions for governments. |

| Commercial Aerospace | 39% | MRO services, aerostructures, engine components, freighter conversions. |

| Urban Solutions and Satcom | 17% | Smart city tech, rail electronics, intelligent transport, satellite communications. |

Business Model Canvas Data Sources

The ST Engineering Business Model Canvas is informed by a blend of internal financial data, comprehensive market research reports, and strategic insights derived from industry analysis. These diverse data sources ensure a robust and accurate representation of the company's operational and strategic framework.