ST Engineering Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ST Engineering Bundle

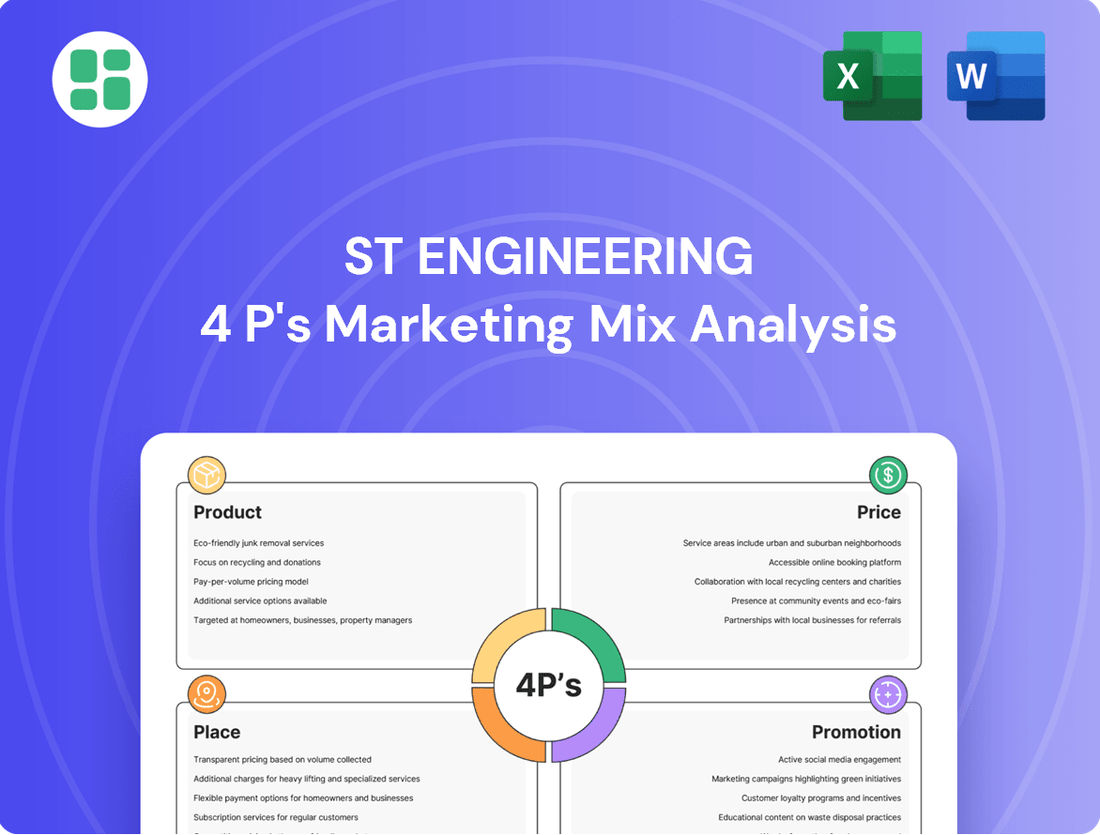

Uncover the strategic brilliance behind ST Engineering's market dominance. This analysis delves deep into their innovative product development, competitive pricing, expansive distribution networks, and impactful promotional campaigns.

Go beyond the surface-level understanding and gain a comprehensive view of how ST Engineering masterfully orchestrates its Product, Price, Place, and Promotion strategies. This in-depth report is your key to unlocking actionable insights.

Save yourself countless hours of research. Our ready-made, editable 4Ps Marketing Mix Analysis for ST Engineering provides structured thinking and real-world examples, perfect for business planning or academic study.

Ready to elevate your marketing strategy? Access the full, professionally written 4Ps analysis of ST Engineering and discover the secrets to their market success. Get instant, editable access now!

Product

ST Engineering's Commercial Aerospace division provides comprehensive lifecycle support, encompassing MRO for airframes, components, and engines. They are a key MRO partner for CFM LEAP engines and handle conversions for aircraft like the Boeing 787 and Airbus A330. This extensive service portfolio directly addresses the robust demand for aviation maintenance and upgrade solutions.

Smart City Solutions, under ST Engineering's Urban Solutions & Satcom segment, directly addresses the Product element of the 4Ps by offering integrated systems for connected, resilient, and sustainable urban environments. Their portfolio spans smart mobility, including advanced metro systems and traffic management, alongside smart utilities like intelligent car parks and water management. This comprehensive approach is backed by over 800 smart city projects globally, demonstrating a proven capability in deploying AI and IoT technologies for urban enhancement.

ST Engineering's Defence & Public Security Systems offer a broad spectrum of solutions, from armored vehicles and ammunition in land systems to ship repair in marine and aerospace MRO. They also provide critical infrastructure protection and homeland security, integrating AI, cloud, and cybersecurity for national safety. In 2023, ST Engineering's Defence & Public Security segment reported revenue of S$2.1 billion, reflecting strong demand for these advanced capabilities.

Digital and Cybersecurity Technologies

ST Engineering's product strategy heavily emphasizes advanced digital and cybersecurity technologies, forming a core pillar of their innovation. Their offerings are built around key areas like artificial intelligence (AI), cloud computing, and robust cybersecurity solutions.

These capabilities translate into tangible products such as AI-powered command and control systems, high-performance GPU data centers, and sophisticated encryption technologies. They also provide crucial cloud-based managed security services, demonstrating a comprehensive approach to digital defense.

The company is actively investing in future-proofing its security offerings, including quantum-resistant security solutions. This forward-looking approach addresses the evolving threat landscape across IT, operational technology (OT), and cloud environments, safeguarding critical infrastructure and supply chains.

Key product highlights include:

- AI-Enabled Command & Control Systems: Enhancing operational efficiency and decision-making in complex environments.

- GPU Data Centers: Providing powerful computing infrastructure for AI and data-intensive workloads.

- Advanced Encryption & Quantum Security: Developing next-generation security protocols to protect sensitive data.

- Managed Security Services: Offering comprehensive cybersecurity solutions for diverse IT, OT, and cloud deployments.

Advanced Manufacturing and Engineering Expertise

ST Engineering’s advanced manufacturing and engineering expertise extends far beyond just finished products, showcasing deep capabilities in complex areas. They excel in aerostructures and advanced composite technologies, crucial for modern aerospace design. For instance, their work includes manufacturing critical components like exhaust nozzles for next-generation aircraft, a testament to their precision engineering.

This expertise also encompasses system integration, allowing them to bring together complex technological elements into cohesive solutions. They are actively developing technology demonstrators for future aerospace advancements, indicating a forward-looking approach. In 2024, ST Engineering reported significant contributions from its Aerospace sector, highlighting the commercial viability of its advanced manufacturing services.

Their ability to provide tailored solutions for complex problems across diverse segments is a key differentiator. This means they don't just offer off-the-shelf components but collaborate to solve unique engineering challenges. This bespoke approach is vital for clients in high-stakes industries like defense and commercial aviation.

- Advanced Composite Technologies: Expertise in materials science and manufacturing processes for lightweight, high-strength components.

- Complex Aerostructures: Design and production of critical aircraft parts, such as engine exhaust nozzles.

- System Integration: Combining diverse technological systems into functional, efficient solutions.

- Technology Demonstrators: Development of prototypes and proof-of-concept systems for future aerospace applications.

ST Engineering's product offerings span critical sectors like aerospace, smart city solutions, and defense. In aerospace, they provide comprehensive MRO for airframes, components, and engines, including specialized work on CFM LEAP engines and aircraft conversions. Their smart city portfolio integrates AI and IoT for urban mobility and utilities, evidenced by over 800 global projects.

The defense segment delivers land systems, marine capabilities, and aerospace MRO, bolstered by AI and cybersecurity for national security. ST Engineering's product innovation is heavily focused on digital technologies, including AI, cloud computing, and advanced cybersecurity, with investments in quantum-resistant security solutions. Their advanced manufacturing prowess is seen in aerostructures and composite technologies, with significant contributions from the Aerospace sector in 2024.

| Product Category | Key Offerings | 2023 Revenue Contribution (S$ Billion) | Key Differentiators |

|---|---|---|---|

| Commercial Aerospace | MRO (Airframes, Components, Engines), Aircraft Conversions | N/A (Part of a larger segment) | Lifecycle support, CFM LEAP engine partner |

| Smart City Solutions | Smart Mobility, Smart Utilities, Integrated Urban Systems | N/A (Part of Urban Solutions & Satcom) | 800+ global projects, AI/IoT integration |

| Defence & Public Security | Armored Vehicles, Ammunition, Ship Repair, Homeland Security | 2.1 | AI, Cloud, Cybersecurity integration |

| Digital & Cybersecurity | AI Systems, GPU Data Centers, Encryption, Managed Security Services | N/A (Cross-segment) | Focus on AI, Cloud, Quantum Security |

| Advanced Manufacturing | Aerostructures, Composite Technologies, System Integration | N/A (Aerospace Sector contribution significant in 2024) | Precision engineering, tailored solutions |

What is included in the product

This analysis provides a comprehensive deep dive into ST Engineering's marketing strategies, examining their Product, Price, Place, and Promotion tactics with real-world examples and strategic implications.

It's designed for professionals seeking to understand ST Engineering's market positioning and benchmark their own marketing efforts against industry best practices.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of overwhelming data for ST Engineering's leadership.

Place

ST Engineering heavily relies on direct sales channels, connecting with key clients like government defense departments, major airlines, and large corporations globally. This direct engagement is crucial for closing substantial, intricate deals in aerospace, defense, and smart city solutions, which often require customized offerings and extended negotiation periods. For instance, in 2024, ST Engineering secured a significant contract for advanced naval systems with a European nation, a deal facilitated through their direct sales force.

ST Engineering boasts a truly extensive international presence, a key component of its marketing strategy. The company operates a vast network of subsidiaries, offices, and facilities strategically located across Asia, Europe, the Middle East, and the United States. This global footprint enables them to effectively serve customers in over 100 countries, demonstrating a significant reach in the international market.

This widespread operational network is crucial for providing localized support and gaining a deep understanding of diverse regional needs. It allows ST Engineering to tailor its offerings and efficiently execute projects across different geographies. For instance, their presence in over 100 countries underscores their commitment to global accessibility and customer service.

Further strengthening their market reach are strategic partnerships and in-country production capabilities. A notable example is their facility in Kazakhstan, which highlights their approach to establishing local operational hubs. These initiatives are vital for navigating international markets and ensuring responsive service delivery, contributing to their overall global competitiveness.

ST Engineering's Commercial Aerospace segment boasts an extensive global network of Maintenance, Repair, and Overhaul (MRO) facilities, with key operational centers in Singapore and the United States. These specialized MRO sites are fundamental to providing accessible and continuous aircraft and engine maintenance services, supporting airline clients across the globe and securing long-term service agreements.

Project-Based Distribution for Large-Scale Solutions

ST Engineering's distribution for large-scale solutions, especially in areas like smart cities and defense, is fundamentally project-based. This means they don't just sell a product; they deliver, install, and integrate complex systems directly at the client's location. This hands-on approach ensures each customized solution is perfectly tailored to meet specific operational needs.

This project-based distribution model is crucial for ST Engineering's success in high-value sectors. For instance, their urban solutions often involve extensive infrastructure integration, requiring on-site deployment and long-term support. In 2024, ST Engineering reported significant contributions from its Urban Solutions & Satcom segment, highlighting the importance of this direct delivery model for complex projects.

- Direct Delivery & Integration: Solutions are delivered and implemented on-site, ensuring seamless integration with existing infrastructure.

- Customization Focus: The distribution process is built around adapting offerings to unique client specifications.

- Ongoing Support: Post-deployment, ST Engineering provides continuous support and maintenance, vital for complex systems.

- Project-Centric Revenue: Revenue is often tied to project milestones and successful deployment phases.

Digital Platforms for Solution Delivery

ST Engineering is increasingly utilizing cloud-based platforms and digital delivery for its cybersecurity and digital solutions. This strategic shift allows for the seamless provision of services such as managed security, AI-driven command and control, and data center operations remotely. The company's investment in digital infrastructure, including its cybersecurity centers of excellence, underpins this capability.

This digital-first approach significantly boosts scalability and accessibility, ensuring clients can receive real-time support and services. For instance, ST Engineering's cybersecurity offerings are designed for rapid deployment and continuous updates via these digital channels, crucial in the fast-evolving threat landscape. In 2024, ST Engineering reported a substantial increase in its digital segment revenue, reflecting the growing adoption of these platform-based solutions.

- Cloud-based delivery: Enables remote management and access to digital and cybersecurity solutions.

- Scalability and accessibility: Facilitates rapid deployment and wider reach for services.

- Real-time service delivery: Enhances responsiveness for managed security and AI systems.

- Digital infrastructure investment: Supports the growth and efficiency of its digital business.

ST Engineering's place strategy is characterized by a multi-faceted approach, leveraging both direct engagement and extensive global networks. This includes project-based delivery for complex solutions and digital channels for scalable services. Their extensive international presence, with operations in over 100 countries, ensures localized support and market penetration. For instance, in 2024, ST Engineering's global reach was instrumental in securing defense contracts across multiple continents.

| Channel/Location | Key Segments Served | 2024 Impact/Data Point |

|---|---|---|

| Direct Sales | Aerospace, Defense, Smart City | Secured significant naval systems contract with a European nation. |

| Global Network (Subsidiaries, Offices) | All Segments | Operations in over 100 countries, facilitating localized support. |

| MRO Facilities | Commercial Aerospace | Key centers in Singapore and the United States support global airline clients. |

| Project-Based Delivery | Smart City, Defense | Extensive infrastructure integration and on-site deployment for urban solutions. |

| Cloud-based/Digital Platforms | Cybersecurity, Digital Solutions | Substantial revenue increase reported in 2024 for digital segment. |

What You Preview Is What You Download

ST Engineering 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive ST Engineering 4P's Marketing Mix Analysis is fully complete and ready for your immediate use. You're viewing the exact version of the analysis you'll receive, ensuring you know exactly what you're getting.

Promotion

ST Engineering's strategic engagement at key international trade shows and defence expos is a cornerstone of its marketing strategy. For instance, their presence at events like the Singapore Airshow 2024, a premier aerospace and defence exhibition, allows them to directly showcase advanced technologies, including their unmanned systems and smart city solutions, to a global audience of potential clients and government stakeholders.

These high-profile events are crucial for lead generation and building brand visibility. In 2024, ST Engineering reported securing significant deals and partnerships at various industry gatherings, underscoring the effectiveness of these platforms in demonstrating their capabilities across aerospace, land systems, marine, and digital technologies sectors.

Participation in these trade shows directly supports ST Engineering's objective of expanding its market reach and fostering new business opportunities. The direct interaction at these events, such as the Eurosatory 2024 defence exhibition, enables them to gather market intelligence and strengthen relationships with key industry players, vital for their ongoing growth and innovation.

ST Engineering actively engages in targeted public relations, releasing news about major contract wins, financial performance, and strategic moves. For instance, in the first half of 2024, they secured S$2.7 billion in new contracts, showcasing their ongoing success and keeping investors and customers updated on their progress.

Their communication strategy extends to robust corporate reporting. Annual reports and investor day presentations are crucial for transparency, providing stakeholders with detailed insights into the company's achievements and future outlook, reinforcing their commitment to clear stakeholder engagement.

ST Engineering's focus on direct client relationship management and strategic partnerships is a cornerstone of its marketing strategy, especially given its business-to-business (B2B) and business-to-government (B2G) focus. This approach is vital for securing long-term contracts and recurring revenue streams.

Dedicated sales and technical teams actively engage with key clients like defense ministries, airlines, and city authorities. This direct interaction allows ST Engineering to deeply understand evolving needs and tailor solutions, fostering loyalty. For instance, their work with the Republic of Singapore Air Force on advanced training systems exemplifies this deep, collaborative relationship.

Furthermore, ST Engineering actively cultivates strategic partnerships with other technology firms and Original Equipment Manufacturers (OEMs). These collaborations, such as their joint ventures in smart city solutions, expand their technological capabilities and market reach, enabling them to offer more comprehensive and integrated offerings to a wider client base.

Digital Presence and Content Marketing

ST Engineering actively cultivates its digital footprint, primarily through its comprehensive corporate website. This platform serves as a central hub for detailed product specifications, service offerings, and the company's ongoing commitment to innovation, ensuring stakeholders have access to up-to-date information.

Leveraging professional networking sites, particularly LinkedIn, ST Engineering engages effectively in B2B marketing. By sharing valuable content such as industry trend analyses and updates on their technological breakthroughs, they aim to attract and inform a sophisticated audience.

In 2023, ST Engineering reported a significant digital engagement increase, with website traffic up by 15% year-over-year and LinkedIn follower growth reaching 20%. This digital strategy supports their broader marketing objectives by enhancing brand visibility and thought leadership.

- Corporate Website: Detailed product, service, and innovation information.

- LinkedIn Engagement: B2B focus, industry insights, and technological advancements.

- Digital Growth (2023): 15% website traffic increase, 20% LinkedIn follower growth.

Investor Relations and Shareholder Engagement

ST Engineering's promotion strategy heavily emphasizes robust investor relations and shareholder engagement. This includes providing regular financial updates, hosting investor calls, and organizing dedicated investor days to clearly communicate the company's financial performance, strategic direction, and future prospects.

These activities are crucial for reaching a wide range of financially literate stakeholders, from individual investors to institutional portfolio managers and business strategists. By fostering transparency and open communication, ST Engineering aims to build and maintain investor confidence, which is vital for attracting and retaining capital needed for growth and development.

For instance, in their 2024 fiscal year reporting, ST Engineering highlighted a revenue of S$10.1 billion, with a net profit of S$701 million. Their investor communications often delve into specific segmental performance, such as the Aerospace sector's 15% revenue growth in 2024, demonstrating tangible progress to the investment community.

- Financial Updates: Regular dissemination of quarterly and annual financial results, including detailed performance metrics and outlooks.

- Investor Calls and Briefings: Platforms for direct interaction with analysts and investors to discuss financial health and strategic initiatives.

- Investor Days: In-depth sessions showcasing company operations, management vision, and long-term growth strategies.

- Shareholder Communications: Transparent reporting on corporate governance, sustainability efforts, and value creation for all shareholders.

ST Engineering's promotional efforts are multifaceted, leveraging industry events, public relations, and digital channels to connect with a global audience. Their active participation in key defence and aerospace exhibitions, such as the Singapore Airshow 2024 and Eurosatory 2024, allows for direct engagement with potential clients and stakeholders, showcasing their technological advancements and securing new business opportunities.

The company also maintains a strong focus on investor relations, providing transparent financial updates and engaging directly with shareholders through calls and investor days. This strategic communication reinforces investor confidence and highlights their performance, such as the S$2.7 billion in new contracts secured in the first half of 2024 and a reported revenue of S$10.1 billion for FY2024.

Their digital presence is robust, with a comprehensive corporate website detailing offerings and a strategic use of platforms like LinkedIn for B2B marketing, which saw a 15% increase in website traffic and 20% LinkedIn follower growth in 2023. This integrated approach ensures broad reach and effective communication of their capabilities and achievements.

| Promotional Activity | Key Focus Areas | Recent Performance/Data (2023-2024) |

| Industry Events & Expos | Aerospace, Defence, Smart City Solutions | Singapore Airshow 2024, Eurosatory 2024 participation; Lead generation & partnership building. |

| Public Relations & Media | Contract Wins, Financial Performance, Strategic Moves | Secured S$2.7 billion in new contracts (H1 2024); FY2024 Revenue: S$10.1 billion. |

| Digital Marketing | Corporate Website, LinkedIn Engagement | FY2023: 15% website traffic increase, 20% LinkedIn follower growth. |

| Investor Relations | Financial Updates, Shareholder Engagement | FY2024 Net Profit: S$701 million; Aerospace sector revenue growth: 15% (2024). |

Price

ST Engineering's pricing strategy for its complex, large-scale projects in defense, smart cities, and aerospace is predominantly project-based and negotiated. This approach is necessary because each solution is often bespoke, requiring extensive customization and integration of advanced technologies.

For instance, in the defense sector, contracts for sophisticated platforms or systems are typically won through competitive bidding processes where pricing reflects the unique specifications, research and development, and long-term support. Similarly, smart city initiatives involve intricate planning and deployment, with costs negotiated based on the scope of work, infrastructure requirements, and expected societal impact.

In 2024, ST Engineering secured a significant contract for advanced naval systems, with the pricing reflecting the bespoke engineering and integration of cutting-edge technology. This negotiated price underscores the value placed on the company's specialized expertise and the long-term operational capabilities delivered to the client.

ST Engineering employs value-based pricing for its advanced technological solutions, such as AI-driven systems and cybersecurity platforms. This strategy aligns pricing with the significant benefits customers gain, like improved operational efficiency or enhanced data protection. For instance, a cybersecurity solution might be priced based on the potential cost savings from preventing a major data breach, a value far exceeding its development cost.

Long-term service and maintenance contracts are a cornerstone of ST Engineering's business, particularly within its Commercial Aerospace and Defence segments. These agreements, often spanning multiple years, ensure a consistent flow of revenue through various pricing structures, including fixed fees, flight-hour-based charges, and performance-based models. This strategy provides customers with predictable operational costs while securing ST Engineering's income.

For instance, ST Engineering's Commercial Aerospace division reported that MRO services contributed significantly to its revenue. In 2023, the aerospace sector saw a 16% increase in revenue, partly driven by these long-term service agreements. These contracts are crucial for maintaining customer loyalty and fostering ongoing relationships, as they embed ST Engineering deeply into the operational lifecycle of aircraft and defense systems.

Competitive Bidding for Government Tenders

In the defense and public security arenas, ST Engineering navigates a landscape where pricing is frequently determined through competitive bidding for government tenders. This necessitates a strategic approach to pricing its solutions, aiming to strike a balance between being cost-competitive and maintaining healthy profit margins, especially given the protracted timelines and significant entry barriers typical of these long-term contracts. A thorough grasp of market trends and competitor pricing strategies is paramount for success.

For instance, in fiscal year 2023, ST Engineering secured significant contracts, including a notable win for the U.S. Marine Corps' Amphibious Combat Vehicle (ACV) program, demonstrating their ability to compete effectively on price while delivering advanced capabilities. The company’s ability to leverage economies of scale and innovative manufacturing processes allows them to present compelling bids.

Key considerations in their pricing strategy include:

- Cost-Plus Pricing: Incorporating direct costs, overhead, and a predetermined profit margin, particularly for bespoke or highly specialized solutions.

- Competitive Benchmarking: Analyzing competitor bids and market price points to ensure offerings are attractive yet profitable.

- Value-Based Pricing: Highlighting the long-term total cost of ownership, reliability, and technological superiority to justify pricing beyond initial acquisition costs.

- Risk Assessment: Factoring in potential cost overruns or project complexities into the bid price to safeguard profitability over the contract lifecycle.

Strategic Asset Management and Leasing Models

ST Engineering's aerospace division extends its offerings to include comprehensive asset management and aircraft/engine leasing. These solutions are designed to give airlines greater financial flexibility, enabling them to secure essential equipment without the burden of significant initial investments.

The pricing structure for these leasing models is multifaceted, encompassing competitive lease rates, tailored financing terms, and carefully considered end-of-lease provisions. These elements collectively aim to capture the asset's residual and lifecycle value, ensuring a mutually beneficial arrangement for both ST Engineering and its airline clients.

- Lease Rates: Based on asset type, age, and market demand, with rates potentially fluctuating based on economic conditions and airline creditworthiness.

- Financing Terms: Offering various structures from dry leases to wet leases, with durations that can range from a few years to over a decade, impacting overall cost.

- End-of-Lease Options: Including purchase options, return conditions, and potential remarketing services, all factored into the initial pricing strategy.

ST Engineering's pricing is largely project-specific and negotiated, reflecting the bespoke nature of its defense, smart city, and aerospace solutions. For complex defense systems, pricing is determined through competitive bidding, factoring in unique specifications and long-term support. In 2024, a significant naval systems contract exemplified this, with pricing reflecting advanced engineering and integration.

Value-based pricing is also key for advanced technologies like AI and cybersecurity, where costs are tied to customer benefits such as efficiency gains. Long-term service and maintenance contracts, crucial in aerospace and defense, utilize fixed fees, flight-hour charges, and performance-based models, ensuring predictable revenue and customer loyalty. The aerospace sector's 16% revenue increase in 2023 highlights the importance of these service agreements.

For government tenders, ST Engineering balances cost-competitiveness with profitability, leveraging market analysis and competitor pricing. The U.S. Marine Corps' ACV program win in 2023 demonstrates their successful bidding strategy. Pricing considerations include cost-plus, competitive benchmarking, value-based approaches, and risk assessment.

Aerospace asset management and leasing involve competitive rates, tailored financing, and end-of-lease options, aiming to capture asset lifecycle value. These structures offer airlines financial flexibility, with lease rates influenced by asset type, age, market demand, and airline creditworthiness.

| Pricing Strategy Component | Description | Example/Impact |

|---|---|---|

| Project-Based & Negotiated | Tailored pricing for unique, complex solutions. | Naval systems contract in 2024; defense platform bids. |

| Value-Based Pricing | Aligning price with customer benefits. | Cybersecurity solutions priced on potential cost savings from breaches. |

| Service & Maintenance Contracts | Fixed fees, flight-hour, or performance-based models. | Aerospace MRO services contributed to 16% revenue growth in 2023. |

| Competitive Bidding | Strategic pricing for government tenders. | U.S. Marine Corps ACV program win in 2023. |

| Leasing Models | Competitive rates, financing terms, end-of-lease options. | Airlines secure equipment without large upfront costs. |

4P's Marketing Mix Analysis Data Sources

Our ST Engineering 4P's Marketing Mix Analysis is built on a foundation of verified corporate disclosures, including annual reports, investor presentations, and official press releases. We also leverage industry-specific market research and competitive intelligence reports to ensure a comprehensive understanding of their Product, Price, Place, and Promotion strategies.