ST Engineering Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ST Engineering Bundle

ST Engineering operates in a dynamic landscape influenced by intense rivalry and the significant bargaining power of its diverse customer base. Understanding these forces is crucial for navigating its strategic path.

The full analysis reveals the strength and intensity of each market force affecting ST Engineering, complete with visuals and summaries for fast, clear interpretation.

Suppliers Bargaining Power

ST Engineering's reliance on highly specialized components for its sophisticated defense, aerospace, and smart city technologies significantly amplifies supplier bargaining power. For instance, in the aerospace sector, the scarcity of unique, high-performance engine parts or advanced avionics systems, often with few global manufacturers, means suppliers can dictate terms. This dependency is a critical factor, as demonstrated by the long lead times and specialized knowledge required for certain defense-grade electronics, where ST Engineering might face limited alternative sourcing options.

For ST Engineering, switching suppliers for critical systems, particularly in the defense and aerospace sectors, is a complex undertaking. These transitions involve rigorous qualification processes, re-certification of components, and the potential for significant disruptions to ongoing production schedules. This inherent difficulty in changing providers significantly limits ST Engineering's flexibility.

The high switching costs inherently strengthen the bargaining position of existing suppliers. It becomes both costly and time-consuming for ST Engineering to move to new providers, meaning they often have to accept the terms offered by incumbent suppliers for essential inputs.

In specialized technology sectors crucial for ST Engineering, such as advanced sensor systems or bespoke cybersecurity solutions, a limited number of suppliers often hold significant sway. This concentration means these few providers can exert considerable influence over pricing and delivery terms.

For instance, in the realm of high-performance, radiation-hardened microprocessors essential for defense and aerospace applications, the supplier base is extremely narrow. Companies like Xilinx (now AMD) or Intel, with their specialized offerings, can command premium prices and dictate lead times, directly impacting ST Engineering's procurement costs and project timelines.

Proprietary Technology and Intellectual Property

Suppliers possessing exclusive intellectual property or proprietary technologies for critical components can leverage this position to demand higher prices or dictate more demanding contract terms. ST Engineering's commitment to advanced solutions means it frequently partners with external technology developers, whose specialized innovations give them significant leverage in price and supply negotiations.

This reliance on unique technological inputs directly impacts ST Engineering's cost structure and operational flexibility. For instance, in the defense sector, where ST Engineering is a major player, the development of advanced radar systems or secure communication modules often involves highly specialized, patented technologies. Suppliers of these niche components can therefore exert considerable bargaining power.

- Proprietary Defense Technology: Suppliers of advanced aerospace and defense components, such as specialized sensors or encrypted communication systems, hold significant sway due to their unique, often patented, technology.

- Exclusive Software Licenses: ST Engineering's reliance on sophisticated software for system integration and operational platforms means that providers of exclusive or highly customized software solutions can command premium pricing.

- Limited Supplier Pool: For certain highly specialized technological inputs, the number of qualified suppliers is inherently limited, amplifying their bargaining power.

- R&D Collaboration Leverage: Suppliers who have collaborated on ST Engineering's research and development projects may use their intimate knowledge of the technology to negotiate favorable terms for future supply.

Impact of Global Supply Chain Disruptions

Global events, like the lingering effects of the COVID-19 pandemic and ongoing geopolitical tensions, significantly disrupt supply chains. For ST Engineering, this translates to potential shortages and longer lead times for essential components. For instance, in 2023, the aerospace sector continued to grapple with extended delivery schedules for certain raw materials and specialized parts, impacting production timelines.

These disruptions inherently strengthen suppliers' bargaining power. When demand outstrips supply, and the availability of critical inputs dwindles, suppliers can dictate terms. ST Engineering might find itself compelled to accept less favorable pricing or payment schedules to ensure it secures the necessary materials to maintain its operations and fulfill its own contracts.

- Increased Component Costs: Suppliers can leverage shortages to demand higher prices for components, directly impacting ST Engineering's cost of goods sold.

- Extended Lead Times: Reliant suppliers can impose longer delivery periods, potentially delaying ST Engineering's project completion and revenue recognition.

- Reduced Supplier Choice: In highly disrupted markets, ST Engineering may have fewer alternative suppliers, further concentrating power in the hands of existing providers.

- Contractual Leverage: Suppliers might use their strong position to negotiate more stringent contract terms, including penalties for early termination or less flexible payment arrangements.

ST Engineering faces significant supplier bargaining power, particularly for specialized components in its defense and aerospace segments. The scarcity of unique, high-performance parts, often produced by a limited number of global manufacturers, allows these suppliers to dictate terms and pricing. For example, in 2023, the aerospace industry continued to experience extended lead times for critical materials and specialized components, a trend that directly impacts ST Engineering's procurement and production schedules.

The high costs and complexity associated with switching suppliers for these critical systems further solidify supplier leverage. This difficulty in changing providers means ST Engineering often accepts incumbent supplier terms, impacting its cost structure and operational flexibility. For instance, proprietary technologies in areas like advanced sensor systems or bespoke cybersecurity solutions, where only a few qualified providers exist, grant these suppliers considerable influence over pricing and delivery.

| Supplier Characteristic | Impact on ST Engineering | Example Scenario (2023/2024) |

|---|---|---|

| Limited Supplier Pool for Specialized Components | Increased pricing power, longer lead times | Scarcity of radiation-hardened microprocessors for defense electronics |

| Proprietary Technology/IP | Higher component costs, less negotiation flexibility | Exclusive software licenses for advanced system integration |

| High Switching Costs | Reduced ability to change suppliers, reliance on incumbents | Rigorous re-certification of aerospace engine parts |

| Supply Chain Disruptions (Global Events) | Potential shortages, acceptance of less favorable terms | Extended delivery schedules for raw materials impacting aerospace production |

What is included in the product

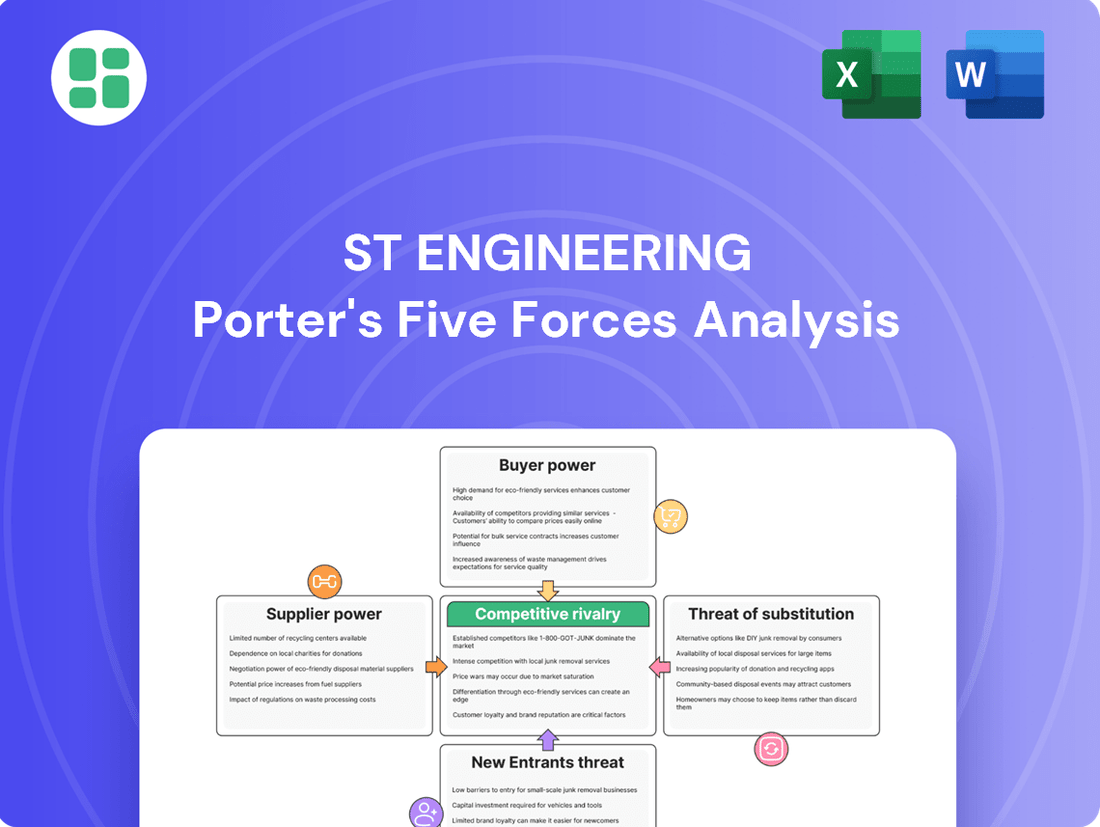

ST Engineering's Porter's Five Forces analysis reveals the intensity of competition, the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, all within its specific industry context.

ST Engineering's Porter's Five Forces Analysis provides a clear, one-sheet summary of all competitive forces, enabling quick and informed strategic decision-making.

Customers Bargaining Power

The government and public sector are major clients for ST Engineering, particularly in defense, public safety, and smart city projects. These entities typically have substantial purchasing power, often consolidating demand and leveraging it during extensive tender processes. For instance, in 2023, ST Engineering reported that its aerospace sector, which includes defense work, saw revenue growth, indicating continued government engagement.

These sophisticated buyers frequently use competitive bidding and lengthy procurement cycles. This allows them to negotiate favorable pricing and contract conditions, directly impacting ST Engineering's margins. The sheer scale of government orders means they can significantly influence the terms of business, making their bargaining power a key consideration.

While government clients, a significant customer base for ST Engineering, possess considerable bargaining power, the inherent complexity of its integrated solutions significantly elevates switching costs. For instance, the deep integration of ST Engineering's advanced defence systems or comprehensive smart city platforms into existing national infrastructure makes a change of provider exceptionally expensive and operationally disruptive.

This high degree of integration, spanning areas like aircraft maintenance, repair, and overhaul (MRO) where specialized training and equipment are involved, means that once a system is in place, the cost, time, and risk associated with transitioning to a competitor are substantial. This post-sale reality somewhat mitigates the initial bargaining power of these customers.

ST Engineering's reliance on a concentrated customer base in specific niches, like major airlines for maintenance, repair, and overhaul (MRO) or national defense ministries, amplifies customer bargaining power. For instance, if a few key airlines represent a significant portion of ST Engineering's aerospace revenue, these clients can exert considerable pressure on pricing and terms. The loss of even a single large customer in such a scenario can materially impact ST Engineering's financial performance, underscoring the heightened leverage these major clients possess.

Customization and Bespoke Requirements

ST Engineering's strength in delivering highly customized solutions, particularly for defence and smart city projects, can inadvertently empower its customers. When solutions are built to exact specifications, clients gain leverage by dictating specific features and performance benchmarks. This bespoke approach means customers can negotiate more aggressively on price and terms, as switching to another provider for such specialized systems becomes more complex and costly.

The intricate nature of these tailored projects, often involving long-term contracts and significant integration, allows customers to exert considerable influence. For instance, in the defence sector, a government client might have the bargaining power to demand specific technological advancements or phased delivery schedules that align with their strategic needs. This customer-centric customization, while a differentiator, directly translates into increased customer leverage during negotiations.

In 2024, ST Engineering's focus on advanced solutions for sectors like urban mobility and cybersecurity means that clients in these areas often have unique operational requirements. These specialized needs can lead to situations where customers possess significant bargaining power, especially if they are large, strategic buyers. The ability to influence design and performance specifications, coupled with the potential for long-term partnerships, amplifies this power.

- Customization creates customer leverage: Bespoke solutions mean clients can dictate specific features and performance metrics.

- Defence and smart cities are key sectors: These areas often involve large, strategic buyers with unique demands.

- Increased negotiation power: Customers can demand specific terms due to the tailored nature of the projects.

- Switching costs amplify power: The complexity of specialized systems makes it difficult for customers to switch providers.

Budgetary Constraints and Economic Cycles

ST Engineering's customers, particularly government entities and major airlines, often operate under strict budgetary constraints that are heavily influenced by national fiscal policies and broader economic cycles. For instance, a slowdown in global economic growth, as seen in certain periods of 2023 and early 2024, can lead to reduced defense spending or airline capital expenditure. This economic sensitivity directly amplifies customer bargaining power.

During times of fiscal austerity or economic contraction, customers are more likely to delay or reduce their procurement of ST Engineering's products and services. They may also aggressively negotiate for lower prices or more flexible payment schedules. This was evident in the aerospace sector’s recovery post-pandemic, where airlines, facing financial pressures, sought concessions on new aircraft orders and maintenance contracts, impacting revenue streams and profit margins for suppliers like ST Engineering.

- Government Budget Cycles: Defense spending, a significant revenue source for ST Engineering, is tied to national budget allocations, which can fluctuate based on geopolitical events and economic conditions. For example, in 2023, many nations reviewed their defense budgets amidst evolving security landscapes, potentially leading to shifts in procurement priorities.

- Airline Industry Performance: The financial health of airlines, a key customer base for ST Engineering's aerospace division, directly impacts their ability to invest in new aircraft, upgrades, and maintenance. In 2024, while the aviation sector showed signs of recovery, profitability remained varied across regions, influencing order backlogs and service contracts.

- Economic Downturn Impact: Periods of economic recession or slowdown can force customers to cut discretionary spending, including on advanced technological solutions and large-scale projects. This increases their leverage to demand price reductions or extended payment terms from ST Engineering.

ST Engineering's customers, particularly government bodies and large corporations, possess significant bargaining power due to the specialized and integrated nature of its solutions. This power is amplified when customers are few, large, and represent a substantial portion of ST Engineering's revenue. For instance, in 2023, the company's defense and aerospace segments, which often deal with large, concentrated clients, continued to be key revenue drivers, highlighting the importance of managing these relationships.

The complexity of ST Engineering's offerings, such as advanced defense systems or comprehensive smart city platforms, results in high switching costs for customers. This makes it difficult and expensive for clients to transition to a competitor once a system is implemented. For example, the deep integration of ST Engineering's smart city infrastructure into national systems means that changing providers would involve substantial operational disruption and financial outlay, thereby mitigating some of the initial customer leverage.

ST Engineering's reliance on custom-built solutions, especially for defense and smart city projects, can also empower its customers. When solutions are tailored to exact specifications, clients gain leverage by dictating specific features and performance benchmarks. This bespoke approach allows customers to negotiate more aggressively on price and terms, as finding alternative providers for such specialized systems is complex and costly.

| Customer Segment | Key Factors Influencing Bargaining Power | Impact on ST Engineering |

|---|---|---|

| Government & Public Sector (Defense, Smart Cities) | Large order volumes, consolidated demand, extensive tender processes, budget cycles, geopolitical influences. | Ability to negotiate favorable pricing, contract terms, and delivery schedules. High switching costs due to system integration. |

| Major Airlines (Aerospace MRO) | Fleet size, financial health, economic sensitivity, demand for specialized maintenance. | Leverage in negotiating MRO contracts and pricing. Vulnerability to airline industry downturns impacting revenue. |

| Other Commercial Clients (Urban Mobility, Cybersecurity) | Unique operational requirements, long-term partnership potential, industry-specific regulations. | Potential for significant leverage in highly specialized niche markets. Influence on design and performance specifications. |

Preview the Actual Deliverable

ST Engineering Porter's Five Forces Analysis

This preview showcases the comprehensive ST Engineering Porter's Five Forces Analysis, detailing the competitive landscape and strategic positioning of the company. The document you see here is the exact, professionally formatted analysis you'll receive immediately after purchase, offering actionable insights without any hidden placeholders or samples. You're looking at the actual, ready-to-use document; once your purchase is complete, you'll gain instant access to this complete file, enabling you to leverage its strategic information without delay.

Rivalry Among Competitors

ST Engineering navigates a fiercely competitive global landscape across its core sectors like aerospace, smart city solutions, and defense. For instance, in the aerospace sector, it contends with giants such as Boeing and Airbus, alongside specialized maintenance, repair, and overhaul (MRO) providers. This intense rivalry means constant pressure on pricing and innovation to secure lucrative contracts.

ST Engineering operates in sectors like aerospace and defence, where substantial investments in research, development, and specialized manufacturing facilities are standard. These high initial outlays, coupled with stringent regulatory requirements, mean that companies must continue operating to recoup their significant fixed costs. For instance, the aerospace sector alone demands billions in R&D for new aircraft development, creating a formidable barrier to entry and exit.

The aerospace and defense industries are notorious for their high fixed costs, encompassing everything from advanced manufacturing plants to extensive R&D programs and rigorous safety certifications. These capital-intensive operations mean that once a company is invested, it faces considerable challenges in divesting its assets. For example, a defense contractor might have specialized production lines that are difficult to repurpose, leading them to compete aggressively for contracts to maintain operational viability and cover their substantial overheads.

Competitive rivalry in ST Engineering's sector is intensely driven by technological advancements, especially in AI, robotics, and cybersecurity. Companies are constantly seeking to outdo each other through cutting-edge product features and enhanced performance.

Differentiation is key, with firms focusing on offering superior performance, cost-effectiveness, and comprehensive, integrated solutions. This necessitates substantial, ongoing investment in research and development to secure and maintain a competitive advantage.

Government Procurement and Geopolitical Factors

In the defense and public security arenas, competitive rivalry is significantly shaped by government procurement policies and national security imperatives. These elements often favor domestic suppliers or erect hurdles for international firms, making market access more intricate than just technological prowess or price competitiveness.

Geopolitical alliances also play a crucial role, influencing which countries' companies are favored for defense contracts. For instance, a nation's strategic partnerships might lead to preferential treatment for defense contractors from allied nations, impacting the competitive landscape for companies like ST Engineering.

- Government Procurement Policies: These dictate which companies can bid for contracts, often with clauses favoring local content or specific technological capabilities.

- National Security Priorities: A nation's focus on certain defense technologies or capabilities can create concentrated competition among firms specializing in those areas.

- Geopolitical Alliances: Partnerships between countries can lead to collaborative defense projects and favored supplier relationships, influencing market access and competition.

Consolidation and Strategic Partnerships

The defense and aerospace sectors, where ST Engineering operates, are experiencing significant consolidation. This trend means larger, more integrated entities are emerging, capable of offering a wider range of services and products. For instance, in 2023, the global aerospace and defense market saw a number of notable mergers and acquisitions, though specific figures for ST Engineering's direct competitors are often proprietary or part of ongoing market dynamics. This consolidation directly increases the intensity of competition.

Strategic partnerships are also a hallmark of this industry, enabling companies to pool resources and expertise. These alliances allow firms to jointly pursue lucrative contracts, particularly for large-scale defense systems or complex aerospace projects. This collaborative approach can create formidable bidding blocs, making it more challenging for independent players like ST Engineering to compete effectively on their own.

- Industry Consolidation: Mergers and acquisitions are reshaping the competitive landscape, creating larger, more powerful rivals.

- Strategic Alliances: Partnerships are common, allowing companies to combine capabilities and expand market reach.

- Joint Bidding: Alliances facilitate joint bids on major projects, intensifying rivalry for standalone companies.

- Market Dynamics: The trend towards fewer, larger players and collaborative ventures heightens competitive pressures across the board.

ST Engineering faces intense competition from global players and specialized firms in aerospace and defense. The market is characterized by high R&D costs and significant barriers to entry, forcing companies to innovate constantly to maintain market share. For example, the global aerospace and defense market size was estimated to be around USD 2.2 trillion in 2023, showcasing the scale of the competitive arena.

| Competitor Type | Key Players Example | Competitive Factor |

|---|---|---|

| Aerospace OEMs | Boeing, Airbus | Technological innovation, pricing, order backlog |

| MRO Providers | Lufthansa Technik, ST Aerospace (ST Engineering's division) | Service quality, turnaround time, cost-effectiveness |

| Defense Contractors | Lockheed Martin, BAE Systems | Government contracts, technological superiority, geopolitical ties |

SSubstitutes Threaten

While ST Engineering provides comprehensive smart city platforms, the threat of substitutes is significant. Smaller, specialized tech firms or even open-source solutions can offer cost-effective alternatives for specific urban needs, like traffic management or waste monitoring. For instance, the global smart city market, projected to reach over $2.5 trillion by 2026, includes numerous niche players offering modular solutions that might be more appealing to budget-conscious municipalities than a full-scale ST Engineering integration.

The threat of substitutes for ST Engineering's aerospace MRO services is significant. Airlines have numerous options beyond ST Engineering, including independent MRO providers, original equipment manufacturers (OEMs) with their own service divisions, and the potential to develop in-house maintenance capabilities. This wide array of alternatives directly challenges ST Engineering's market share in the aftermarket services segment.

In 2024, the global aerospace MRO market was valued at approximately $90 billion, with a substantial portion attributed to third-party providers and OEM services. This indicates a competitive landscape where airlines can readily source their maintenance needs from various suppliers, thereby increasing the pressure on ST Engineering to remain competitive on price, quality, and turnaround times.

The defense and security landscape is in constant flux, with emerging doctrines and technologies presenting alternative pathways to achieve security objectives, potentially substituting for traditional advanced defense systems. For example, the growing emphasis on cyber warfare capabilities, the proliferation of unmanned systems from diverse suppliers, and the increasing adoption of commercial off-the-shelf (COTS) solutions could diminish the reliance on bespoke military hardware or conventional surveillance platforms.

In-House Capabilities of Customers

Large customers, especially major airlines and government bodies, increasingly have the financial muscle and technical know-how to handle certain functions internally. This means they might opt to do their own aircraft maintenance, manage their smart city IT systems, or even build their own cybersecurity defenses instead of relying on ST Engineering.

For instance, a major airline group with significant MRO (Maintenance, Repair, and Overhaul) operations might choose to invest in its own specialized repair shops for certain components, bypassing the need to outsource these services. Similarly, a national defense agency could develop in-house capabilities for specific intelligence analysis software rather than contracting it out.

- In-house MRO: Major airlines can save on outsourcing costs by investing in their own maintenance facilities, potentially handling up to 70% of their component repairs.

- Smart City IT: Government entities may develop proprietary platforms for data integration and analysis to ensure greater control and security.

- Cybersecurity: Large corporations and government agencies are building dedicated cybersecurity teams to manage threats internally, reducing reliance on external security firms.

Cost-Effective, Simpler Alternatives

For specific functionalities within ST Engineering's broad portfolio, simpler, more budget-friendly alternatives can emerge. These substitutes, while lacking the advanced integration or complexity of ST Engineering's solutions, could attract customers prioritizing cost savings or those with less demanding needs. This can lead to a gradual erosion of demand for ST Engineering's more sophisticated offerings.

For instance, in the cybersecurity space, while ST Engineering offers comprehensive enterprise solutions, smaller businesses might opt for basic antivirus software or cloud-based security services that are significantly cheaper. In 2023, the global cybersecurity market saw a significant portion of spending by small and medium-sized enterprises (SMEs) on foundational security tools, highlighting the appeal of cost-effective options.

- Cost-Conscious Segments: Customers with limited budgets may find simpler, standalone solutions more attractive than integrated, premium offerings.

- Niche Functionality: Competitors focusing on excelling at a single, specific function can provide a viable substitute for a broader ST Engineering solution.

- Emerging Technologies: Rapid advancements can lead to new, less complex technologies that address specific customer pain points at a lower cost.

The threat of substitutes for ST Engineering's offerings is substantial across its diverse business segments. In smart city solutions, specialized tech firms and open-source platforms can provide cost-effective alternatives for specific urban needs, challenging ST Engineering's integrated approach. Similarly, the aerospace MRO market is crowded with independent providers and OEMs, offering airlines a wide choice of maintenance services, putting pressure on ST Engineering to maintain competitive pricing and service quality. The defense sector also sees substitutes in the form of cyber warfare capabilities and commercial off-the-shelf (COTS) solutions, potentially reducing reliance on bespoke military hardware.

| Segment | Potential Substitutes | Impact on ST Engineering |

|---|---|---|

| Smart City Platforms | Niche tech providers, open-source software | Erosion of market share for full-scale solutions, increased price sensitivity |

| Aerospace MRO | Independent MROs, OEMs, in-house capabilities | Pressure on pricing and service delivery, need for differentiation |

| Defense Systems | Cyber warfare, unmanned systems, COTS solutions | Reduced demand for traditional hardware, shift towards adaptable solutions |

Entrants Threaten

Entry into ST Engineering's core sectors, such as defense and aerospace, demands immense capital for research and development, sophisticated manufacturing plants, and cutting-edge technology. For instance, developing a new defense platform can easily run into billions of dollars. This significant financial hurdle makes it exceedingly challenging for new players to enter and compete without substantial backing.

The aerospace and defense sectors present formidable barriers to entry due to extensive regulatory hurdles and rigorous certification requirements. Navigating these complex landscapes, which include compliance with international standards like AS9100 and ITAR, demands significant time and capital investment. For instance, obtaining a Federal Aviation Administration (FAA) certification for aircraft manufacturing can take several years and millions of dollars, deterring many potential new players.

ST Engineering's reliance on highly specialized expertise in fields such as artificial intelligence, robotics, and cybersecurity presents a significant barrier to new entrants. Acquiring and retaining top-tier talent in these advanced technological domains is a formidable challenge, especially amidst a global shortage of skilled professionals.

Established Customer Relationships and Long Sales Cycles

ST Engineering's deep-rooted relationships with key clients, particularly government agencies and major aerospace companies, create a significant barrier for new entrants. These relationships are built on years of trust and proven performance, essential in sectors with lengthy sales cycles and intricate procurement procedures.

The complexity and high stakes involved in securing contracts within these industries, such as defense or large-scale infrastructure projects, mean that new players must invest considerable time and resources to even begin building credibility. For instance, in the aerospace sector, a typical sales cycle can extend over several years, requiring extensive testing, certification, and relationship nurturing.

- Established Trust: ST Engineering's long-standing partnerships, particularly with defense ministries and major airlines, are difficult for newcomers to replicate.

- Long Sales Cycles: Industries like aerospace and defense often have sales cycles that can span multiple years, demanding sustained engagement and proven reliability.

- High Switching Costs: For clients, changing suppliers in critical areas like defense systems or aircraft components involves significant re-qualification and integration costs, deterring new entrants.

Intellectual Property and Proprietary Technologies

ST Engineering and its established rivals hold substantial intellectual property, including patents and proprietary technologies, especially in sophisticated defense systems and smart city solutions. This robust IP portfolio acts as a significant barrier, requiring newcomers to make substantial investments in technology development or navigate complex licensing agreements to compete effectively.

For instance, ST Engineering's commitment to research and development is evident in its consistent R&D spending. In 2023, the company allocated approximately S$300 million to R&D initiatives, a figure that underscores the depth of their technological advantage and the significant cost for new entrants to replicate such innovation.

- High R&D Investment: ST Engineering's annual R&D expenditure, exceeding S$300 million in 2023, highlights the substantial financial commitment required to develop and maintain competitive proprietary technologies.

- Patent Portfolio: The company holds thousands of patents globally, covering critical areas like aerospace, defense electronics, and intelligent transport systems, creating a formidable intellectual property barrier.

- Licensing Hurdles: New entrants would face significant challenges and costs in licensing essential technologies, as existing players like ST Engineering are unlikely to readily share their hard-won innovations.

- Technology Replication Costs: Replicating ST Engineering's advanced defense systems or smart urban solutions from scratch would necessitate years of development and billions in investment, making it prohibitively expensive for most new companies.

The threat of new entrants for ST Engineering is generally low due to significant barriers. These include the immense capital required for R&D and manufacturing, rigorous regulatory and certification processes, and the need for highly specialized talent. Furthermore, established relationships with key clients and substantial intellectual property portfolios create formidable hurdles for any potential newcomers to overcome.

| Barrier Type | Description | Example for ST Engineering | Impact on New Entrants |

|---|---|---|---|

| Capital Requirements | High investment needed for R&D, manufacturing, and technology. | Developing a new defense platform can cost billions. | Prohibitive for most new companies. |

| Regulatory & Certification | Complex compliance with industry standards (e.g., AS9100, ITAR). | FAA certification for aircraft manufacturing takes years and millions. | Time-consuming and costly to navigate. |

| Specialized Expertise | Need for highly skilled professionals in AI, robotics, cybersecurity. | Global shortage of talent in advanced tech domains. | Difficult to acquire and retain necessary expertise. |

| Customer Relationships | Long-standing trust with government and major aerospace clients. | Years of proven performance and intricate procurement processes. | Challenging to build credibility and secure contracts. |

| Intellectual Property | Patents and proprietary technologies in defense and smart city solutions. | ST Engineering's S$300 million R&D spend in 2023 protects its innovations. | Requires significant investment in tech development or licensing. |

Porter's Five Forces Analysis Data Sources

Our ST Engineering Porter's Five Forces analysis is built upon a foundation of robust data, including ST Engineering's annual reports, investor presentations, and official press releases. We also incorporate insights from reputable industry analysis firms and government defense sector reports to provide a comprehensive view of the competitive landscape.