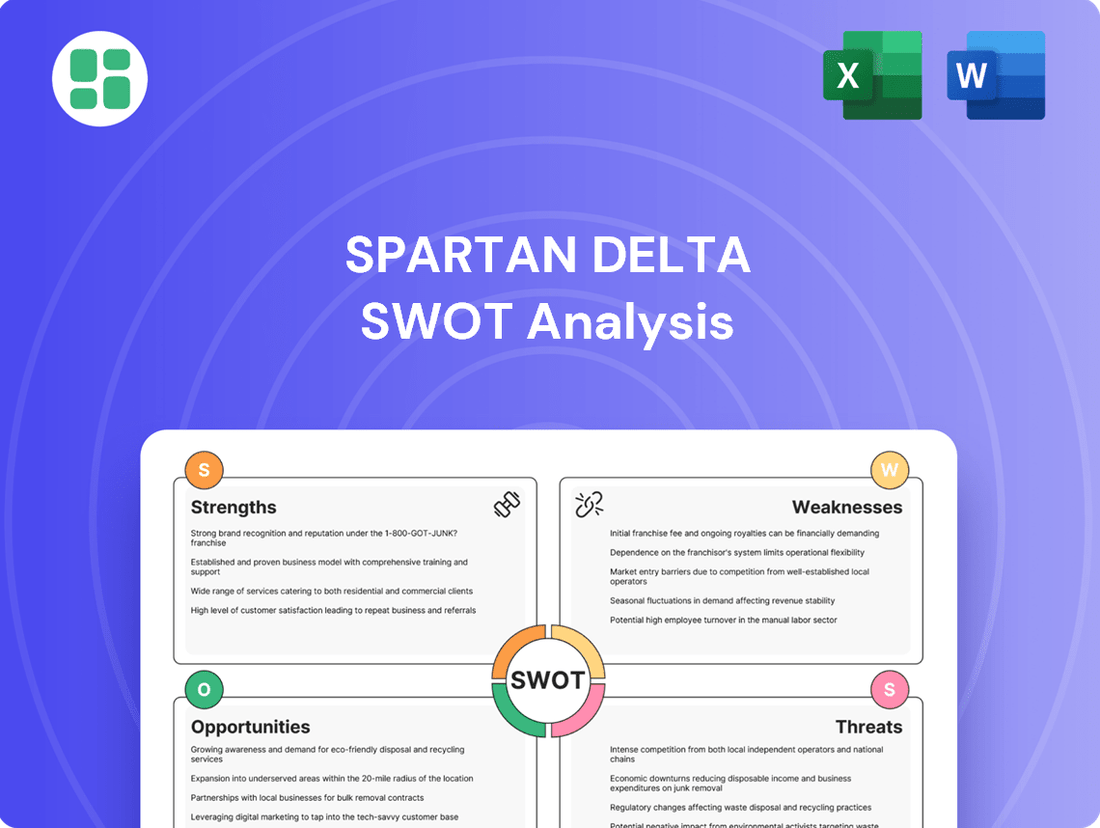

Spartan Delta SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Spartan Delta Bundle

Spartan Delta's unique approach to [mention a key strength] positions them strongly in the market, but understanding their full competitive landscape requires a deeper dive. Our comprehensive SWOT analysis reveals critical insights into their vulnerabilities and untapped opportunities.

Want the full story behind Spartan Delta's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Spartan Delta Corp. showcased impressive operational strength in 2024, reporting substantial oil and gas sales and achieving robust Adjusted Funds Flow. This financial health stems from exceeding production guidance, notably in crude oil and condensate volumes, underscoring efficient operational execution.

Spartan Delta has strategically concentrated on developing its liquids-rich Duvernay assets, securing a substantial footprint of over 250,000 net acres in this prolific basin. This focus is a key strength, as the company's Duvernay wells are consistently exceeding initial production forecasts, showcasing impressive volumes of valuable crude oil and condensate. This concentration on high-value liquids directly boosts profitability and positions Spartan Delta favorably within a market increasingly prioritizing these commodities.

Spartan Delta has demonstrated a strong ability to execute its capital programs, translating into significant production growth. In 2024, the company successfully managed its capital investments, leading to a notable increase in crude oil and condensate output. This effective execution is a key strength, underpinning the company's ability to achieve its operational targets.

Looking ahead to 2025, Spartan Delta plans an accelerated Duvernay development program, backed by a substantial capital allocation. This strategic deployment of capital is designed to further boost production and capitalize on the company's asset base. The disciplined approach to capital spending is a core driver of its organic growth strategy.

Commitment to Shareholder Value and Free Funds Flow Generation

Spartan Delta Corp. is deeply committed to enhancing shareholder value, primarily through its consistent generation of free funds flow. This focus on operational efficiency and strategic capital deployment is designed to maximize returns for investors.

The company's dedication to generating free funds flow is a cornerstone of its business strategy, aiming for long-term sustainability and profitability. This commitment is reflected in its financial performance and its careful allocation of capital to high-return projects.

- Shareholder Value Focus: Spartan Delta prioritizes creating tangible value for its shareholders.

- Free Funds Flow Generation: The company consistently aims to produce strong free funds flow.

- Operational Efficiency: Strategic operational improvements are key to maximizing returns.

- Capital Allocation: Funds are strategically directed towards profitable projects to boost shareholder returns.

Responsible Resource Development and ESG Focus

Spartan Delta's commitment to responsible resource development and a strong Environmental, Social, and Governance (ESG) focus is a significant strength. The company actively integrates ESG principles into its operational framework, emphasizing environmental stewardship and sustainable practices. This approach is designed to foster operational synergies while maintaining respect for the environment.

The company's culture is geared towards generating free funds flow through responsible exploration and development. This strategic emphasis on sustainability not only bolsters Spartan Delta's reputation but also enhances its long-term viability in an increasingly conscious market. For instance, in 2024, Spartan Delta reported a significant reduction in its Scope 1 and Scope 2 greenhouse gas emissions intensity compared to 2023 benchmarks, demonstrating tangible progress in its environmental goals.

- Responsible Operations: Integrates ESG principles into all facets of resource development.

- Sustainability Focus: Prioritizes environmental stewardship and long-term viability.

- Free Funds Flow Generation: Culture centered on efficient and responsible exploration and production.

- Reputational Enhancement: Strong ESG commitment positively impacts brand image and stakeholder relations.

Spartan Delta's strengths lie in its concentrated development of high-value liquids-rich Duvernay assets, consistently exceeding production forecasts. The company demonstrated robust operational execution in 2024, achieving strong Adjusted Funds Flow and exceeding production guidance, particularly in crude oil and condensate volumes. This focus on efficient capital programs translates into significant production growth, with an accelerated Duvernay development plan for 2025 highlighting disciplined capital deployment for organic growth.

| Metric | 2024 Performance | 2025 Outlook |

|---|---|---|

| Duvernay Acreage | Over 250,000 net acres | Continued development |

| Production Growth | Significant increase in crude oil & condensate | Accelerated Duvernay program planned |

| Financial Health | Robust Adjusted Funds Flow | Focus on free funds flow generation |

| ESG Performance | Reduced GHG emissions intensity | Continued integration of ESG principles |

What is included in the product

Analyzes Spartan Delta’s competitive position through key internal and external factors, identifying strengths, weaknesses, opportunities, and threats.

Spartan Delta's SWOT analysis offers a clear, actionable framework to identify and address strategic challenges, transforming potential roadblocks into opportunities for growth.

Weaknesses

Spartan Delta Corp.'s strategic reorganization in early 2024, which saw assets spun out into Inception Exploration Ltd. and Spartan Energy Ltd., effectively dissolved the original public entity. This move means Spartan Delta no longer exists as a standalone public company, potentially diminishing its established brand recognition and direct access to public capital markets for its former comprehensive asset portfolio.

Spartan Delta's strategic restructuring, involving the spin-off of certain assets, presented a potential for shareholder confusion. The intricate process of creating new entities could have initially clouded investors' understanding of their holdings and the overall trajectory of the now more fragmented business operations. For instance, during the Q1 2024 reporting period, the company noted increased investor inquiries related to the allocation of assets and liabilities across the newly formed entities.

By spinning off specific asset bases, Spartan Delta Corp. saw its own diversification diminish. This breakup dismantled the parent company's once broader portfolio, potentially highlighting a weakness in its prior integrated business model.

Dependency on Commodity Price Volatility for New Entities

Even with strategic realignments, the financial health of Spartan Delta's new entities, Inception Exploration Ltd. and Spartan Energy Ltd., is significantly tied to the unpredictable swings in oil and natural gas prices. This makes their profitability and overall performance quite vulnerable.

For instance, if we look at the projected average WTI crude oil price for 2024, it's around $80 per barrel, but this can easily shift. A sharp downturn in these prices, as seen in periods of oversupply or reduced global demand, directly impacts the revenue streams and financial stability of these new ventures.

- Commodity Price Sensitivity: The profitability of Inception Exploration and Spartan Energy is directly linked to volatile global oil and gas prices.

- Financial Stability Risk: Fluctuations in commodity markets can hinder the ability of these new entities to maintain financial stability.

- Impact on Projected Returns: Adverse price movements can significantly affect the achievement of their anticipated financial returns.

Challenges in Market Acceptance and Performance of Spun-Out Entities

The successful market acceptance and performance of Inception Exploration Ltd. and Spartan Energy Ltd. post-reorganization are critical. Challenges in establishing their independent market presence could hinder their ability to achieve standalone operational and financial goals. For instance, Inception Exploration, as a new public entity, might face initial investor skepticism regarding its valuation and growth prospects, potentially impacting its share price and access to capital markets in its early trading days of 2024-2025.

Spartan Energy, operating privately, could encounter difficulties in securing favorable financing terms or attracting strategic partnerships if its perceived value or operational efficiency doesn't meet market expectations. The ability of both entities to navigate these initial hurdles will directly influence their long-term viability and the overall success of Spartan Delta's strategic shift.

The dissolution of Spartan Delta Corp. into separate entities, Inception Exploration Ltd. and Spartan Energy Ltd., has fragmented its operational focus. This specialization, while potentially beneficial, means neither new entity possesses the broad diversification that the original Spartan Delta offered, making them more susceptible to sector-specific downturns. For example, if exploration activities for Inception Exploration face significant delays or cost overruns, it could disproportionately impact its overall financial health without the buffer of other business segments.

The financial performance of both Inception Exploration and Spartan Energy is heavily reliant on the volatile prices of oil and natural gas. For instance, if the average WTI crude oil price, projected around $80 per barrel for 2024, were to drop significantly due to increased global supply or reduced demand, the revenues for both entities would be directly and negatively impacted, potentially jeopardizing their financial stability and growth targets. This commodity price sensitivity is a key weakness inherited from the original structure.

The success of Inception Exploration and Spartan Energy hinges on their ability to establish independent market credibility and operational efficiency. Any initial struggles in securing capital, attracting investors, or achieving projected production levels could create significant headwinds. For example, Inception Exploration, as a newly listed entity in 2024, might experience initial investor skepticism, impacting its stock performance and access to further funding rounds through 2025.

Same Document Delivered

Spartan Delta SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual Spartan Delta SWOT analysis, so what you see is exactly what you get upon purchase.

Opportunities

Spartan Delta's strategic decision to spin out its Montney assets into Inception Exploration Ltd. is a significant move. This creates a pure-play company, allowing for a laser focus on the high-value Montney resource. This specialization is designed to attract investors seeking targeted exposure to this specific geological play.

This unbundling strategy aims to unlock greater shareholder value. By separating the Montney operations, investors can now directly benefit from the growth and potential of this particular asset. This allows for more tailored investment decisions, potentially leading to a re-rating of value for both entities.

Spartan Delta Corp. is significantly ramping up its Duvernay development, targeting a substantial increase in production, especially for crude oil and condensate. This accelerated program, with a strong capital focus for 2025, positions the company to capitalize on the rich liquids potential of this play.

The company anticipates its Duvernay production to reach approximately 40,000 boe/d by the end of 2025, a considerable jump driven by this focused development. This growth is expected to significantly boost revenue streams and enhance overall profitability, leveraging the high value of liquids.

Spartan Delta is actively seeking strategic acquisitions within the Deep Basin, aiming to consolidate its position. The company is leveraging its strong balance sheet and robust free funds flow generation to finance these potential deals. This approach is designed to expand its operational footprint and capture significant synergies.

Optimization of Deep Basin Assets and Operational Synergies

Spartan Delta is actively enhancing its Deep Basin assets through strategic organic drilling and operational improvements. This focus on efficiency, coupled with their technical know-how, is designed to lower costs and boost output from their established liquid-rich natural gas reserves.

This optimization strategy is crucial for maximizing returns from their core holdings. By refining their operations, Spartan Delta aims to unlock greater value and maintain a competitive edge in the current market.

- Deep Basin Asset Focus: Continued investment in organic drilling programs to maximize production from existing reserves.

- Operational Efficiencies: Implementing measures to reduce operating costs and improve overall asset performance.

- Leveraging Technical Expertise: Utilizing specialized knowledge to enhance recovery and optimize production from liquid-rich natural gas assets.

- Cost Structure Improvement: Driving down per-unit production costs to improve profitability and competitiveness.

Leveraging Strong Balance Sheet for Future Growth Initiatives

Spartan Delta's robust balance sheet, characterized by significant available tax pools and disciplined net debt management, positions it advantageously for future expansion. This financial resilience is crucial for funding ambitious growth strategies. For instance, as of Q1 2024, Spartan Delta reported a net debt to adjusted EBITDA ratio of approximately 1.5x, well within industry norms and demonstrating strong leverage management. This healthy financial footing allows for strategic deployment of capital.

The company's financial flexibility directly translates into its capacity to pursue various growth avenues. This includes:

- Accelerated Development: Funding expedited drilling and completion programs to capitalize on favorable market conditions.

- Strategic Acquisitions: Pursuing opportunistic mergers and acquisitions to expand its asset base and operational footprint.

- Market Adaptability: Maintaining the agility to respond to shifts in commodity prices or regulatory landscapes.

Spartan Delta is well-positioned to capitalize on the growing demand for North American energy. The company's strategic focus on the liquids-rich Duvernay formation, with production expected to reach 40,000 boe/d by the end of 2025, offers significant upside. Furthermore, their pursuit of acquisitions in the Deep Basin could unlock substantial synergies and expand their market share.

The spin-off of its Montney assets into Inception Exploration Ltd. creates a pure-play opportunity, allowing investors to target high-value geological plays. This strategic unbundling aims to unlock greater shareholder value by enabling more tailored investment decisions and a potential re-rating of both entities.

Spartan Delta's strong balance sheet, with a net debt to adjusted EBITDA ratio of approximately 1.5x as of Q1 2024, provides the financial flexibility to pursue accelerated development and opportunistic acquisitions. This financial strength supports their growth initiatives and market adaptability.

Threats

Spartan Delta, like all players in the oil and gas sector, faces the constant threat of fluctuating commodity prices. This volatility directly impacts revenue streams and profitability. For instance, if crude oil prices were to fall significantly, as they did in early 2020, Spartan Delta's earnings could be severely squeezed.

Sustained periods of low oil and natural gas prices can directly hinder Spartan Delta's ability to fund its capital expenditure programs and pursue growth initiatives. This could mean delays or cancellations of exploration and development projects, impacting future production and cash flow generation.

Spartan Delta faces potential headwinds from evolving regulatory landscapes in Western Canada. For instance, a hypothetical increase in carbon taxes, a common policy tool, could directly impact operating expenses. If carbon taxes were to rise by, say, $15 per tonne by 2025, this could add millions to the company's annual costs, affecting profitability and investment in new projects.

Changes in environmental policies, such as stricter methane emission regulations or new water usage guidelines, could necessitate significant capital expenditures for compliance. This might involve investing in new technologies or modifying existing infrastructure, potentially delaying project timelines and increasing overall development costs for Spartan Delta's Montney and Spirit River assets.

Spartan Delta faces integration risks as it reorganizes into Inception Exploration Ltd. and Spartan Energy Ltd. Successfully merging operations and management teams is crucial, but potential inefficiencies in these new structures could hinder performance. For instance, if the integration of IT systems or administrative functions across the two entities is not seamless, it could lead to delays in reporting and increased operational costs, impacting the projected value unlock.

Competition in Western Canadian Sedimentary Basin

Spartan Delta operates within the highly competitive Western Canadian Sedimentary Basin (WCSB), a landscape populated by numerous oil and gas exploration and production (E&P) companies. This intense rivalry directly affects its strategic execution and market standing.

The competition extends beyond just acquiring reserves; it encompasses a fierce battle for crucial capital and a limited pool of skilled labor. For instance, in 2023, the WCSB saw significant activity, with companies like Canadian Natural Resources and Suncor Energy continuing to invest heavily, creating upward pressure on acquisition costs and talent acquisition.

- Asset Competition: Spartan Delta faces rivals bidding for prime acreage and undeveloped reserves, potentially driving up acquisition costs and limiting growth opportunities.

- Capital Markets: Access to funding is crucial, and competition from larger, more established players can make it harder for mid-sized companies like Spartan Delta to secure favorable financing terms.

- Talent Acquisition: The demand for experienced geoscientists, engineers, and field personnel remains high, and intense competition for these individuals can lead to increased labor costs and retention challenges.

- Operational Efficiency: Competitors constantly strive for lower operating costs and higher production efficiencies, forcing Spartan Delta to continually innovate and optimize its own operations to remain competitive.

Litigation and Legal Uncertainties

Spartan Delta faces a significant threat from ongoing litigation, particularly the appeal regarding historical royalty arrears from its acquired assets. This legal challenge introduces the risk of substantial, unforeseen liabilities that could negatively impact the company's financial health. For instance, if the appeal is unsuccessful, the company might have to pay significant backdated royalties, affecting its cash flow and profitability.

These legal uncertainties also demand considerable management focus, diverting attention from core operational and strategic initiatives. The associated legal fees and potential settlement costs can further erode financial resources. As of the latest available data, the exact potential financial exposure from this specific appeal remains a key uncertainty, but such cases can often involve millions of dollars in claims, impacting the finality of past transactions and potentially requiring adjustments to historical financial reporting.

- Ongoing legal appeal concerning historical royalty arrears from acquired assets.

- Potential for significant, unexpected financial liabilities and cash outflow.

- Diversion of management attention and resources away from strategic objectives.

- Risk of increased legal costs and potential negative impact on financial outcomes.

Spartan Delta faces intense competition in the Western Canadian Sedimentary Basin, impacting its ability to secure prime acreage and skilled labor, as seen in 2023's high investment activity from major players. The company is also burdened by a significant legal threat from an appeal concerning historical royalty arrears, which could lead to substantial, unforeseen financial liabilities and divert crucial management focus from core operations.

| Threat Category | Specific Threat | Potential Impact | Example/Data Point |

|---|---|---|---|

| Market Volatility | Fluctuating Commodity Prices | Reduced revenue and profitability | Significant price drops, similar to early 2020, could severely impact earnings. |

| Regulatory Environment | Evolving Environmental Policies | Increased operating costs and capital expenditure | A hypothetical $15/tonne increase in carbon taxes by 2025 could add millions in annual costs. |

| Competition | Asset and Capital Competition | Higher acquisition costs, limited growth opportunities | Intense activity in 2023 saw companies like Canadian Natural Resources investing heavily, increasing competition for assets and talent. |

| Legal & Financial | Royalty Arrears Litigation | Significant unforeseen liabilities, management distraction | Potential for millions in claims, impacting cash flow and requiring adjustments to financial reporting. |

SWOT Analysis Data Sources

This Spartan Delta SWOT analysis is built upon a foundation of robust data, drawing from official company financial filings, comprehensive market research reports, and expert industry analyses to ensure a well-rounded and accurate assessment.