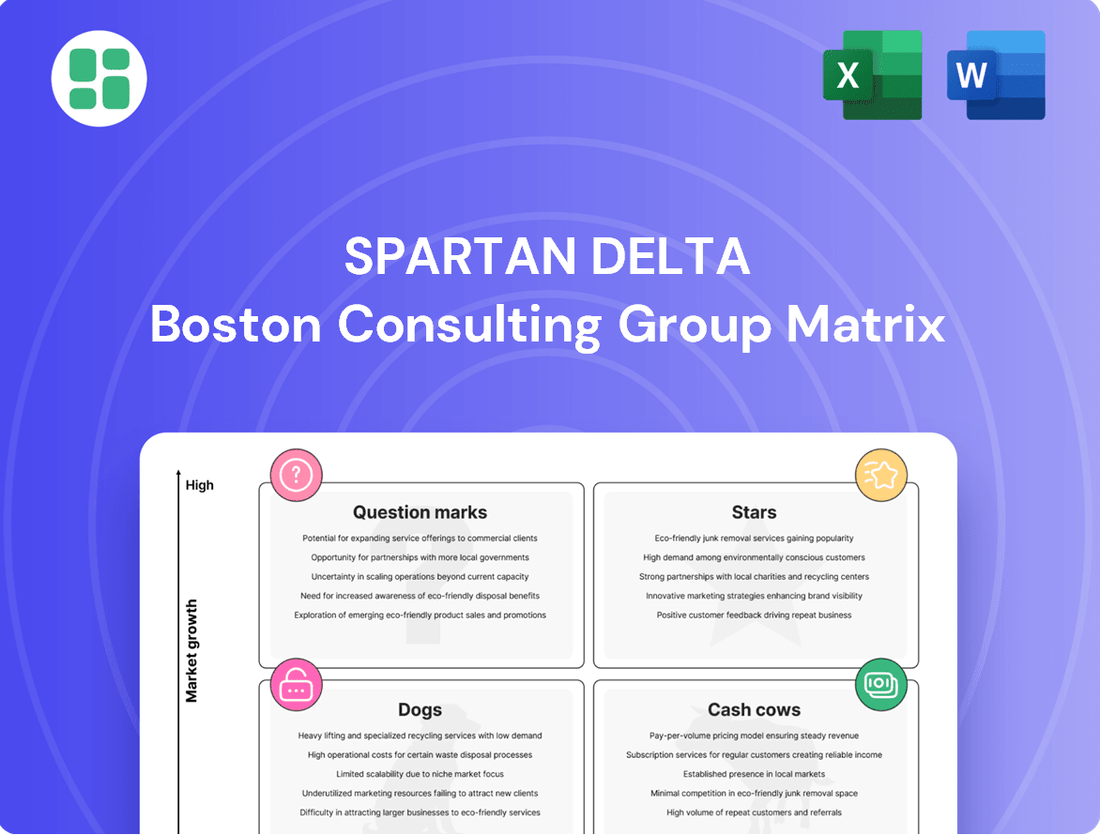

Spartan Delta Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Spartan Delta Bundle

Uncover the strategic positioning of Spartan Delta's product portfolio with our insightful BCG Matrix. This powerful tool categorizes their offerings into Stars, Cash Cows, Dogs, and Question Marks, offering a crucial snapshot of their market performance and potential.

Don't settle for a glimpse; dive into the full BCG Matrix to gain a comprehensive understanding of each product's trajectory and unlock actionable strategies for growth and resource allocation. Purchase the complete report for a detailed breakdown and the insights you need to drive Spartan Delta's success.

Stars

Spartan Delta Corp. holds a commanding presence in the Duvernay, boasting over 250,000 net acres. By the close of 2024, their production in this region surpassed 5,000 BOE/d, with a notable 77% of that being liquids.

The company is significantly ramping up its Duvernay development in 2025, earmarking $200 million to $215 million in capital. This investment aims to catapult their Duvernay production to an impressive 25,000 BOE/d.

Early well results from the Duvernay have been exceptionally strong, consistently outperforming internal forecasts. These wells exhibit a high liquids content, ranging from 87% to 90%, and impressive average IP30 rates, signaling a robust growth trajectory and expanding market share in this valuable liquids-rich area.

Spartan Delta's 2025 capital allocation heavily favors the Duvernay, with $200 million to $215 million of its $300 million to $325 million budget earmarked for this play. This aggressive stance underscores the company's conviction in the Duvernay's substantial growth prospects and its ability to capture significant market share.

The substantial investment is projected to boost crude oil and condensate production by roughly 75% in 2025 compared to 2024 guidance. This strategic focus clearly positions the Duvernay as Spartan Delta's primary engine for growth in the coming year.

Spartan Delta is strategically shifting its production towards higher-value oil and condensate, especially from the Duvernay formation. This move aims to leverage growth opportunities in the liquids market.

The company’s success in this strategy is evident in its Q4 2024 results. Crude oil production saw a significant jump of 255% compared to Q4 2023. Condensate production also grew by a healthy 16% in the same period, showcasing a strong expansion of its liquids-rich asset base.

Successful Duvernay Well Performance

The initial success of Spartan Delta's Duvernay program in 2024 has been a significant driver for the company. By bringing on-stream 3.4 net wells, the program achieved an impressive average IP30 rate of 1,132 barrels of oil equivalent per day (BOE/d), with a substantial 87% of that being liquids. This performance underscores the high productivity and economic viability of these Duvernay assets.

These strong operational results directly validate the company's investment strategy in this high-growth play. The data points to a growing market share for Spartan Delta within the Duvernay, reinforcing its position as a key player.

- Duvernay Well Performance (2024): 3.4 net wells brought on-stream.

- Average IP30 Rate: 1,132 BOE/d.

- Liquids Content: 87%.

- Strategic Implication: Validation of investment and growing market share in a high-growth play.

Strategic Duvernay Acreage Acquisition

Spartan Delta's strategic accumulation of Duvernay acreage, highlighted by a significant acquisition in May 2024, reinforces its leading position in this key resource play. This move, which added approximately 10,000 net acres, substantially expands its drilling inventory.

The expanded land base offers a robust pipeline of future development opportunities, underpinning Spartan's capacity for sustained production growth and potential market share gains. By consolidating its Duvernay holdings, Spartan is well-positioned to capitalize on operational efficiencies and basin-wide infrastructure improvements.

- Strategic Acquisition: Spartan Delta acquired approximately 10,000 net acres in the Duvernay in May 2024.

- Dominant Position: This acquisition further solidifies Spartan's leading presence in the Duvernay basin.

- Future Drilling Inventory: The expanded acreage provides a significant number of future drilling locations.

- Sustained Growth: This land consolidation supports Spartan's long-term growth strategy and potential market share expansion.

Spartan Delta's Duvernay assets are clearly its "Stars" in the BCG matrix, demonstrating high growth and high market share. The company's aggressive 2025 capital allocation of $200-$215 million to this region, aiming for 25,000 BOE/d production, highlights this. Exceptional early well results, with an 87% liquids content and an average IP30 of 1,132 BOE/d from 3.4 net wells in 2024, further validate this classification.

| Asset | Market Growth | Market Share | Spartan Delta's Position |

|---|---|---|---|

| Duvernay | High | High | Star |

What is included in the product

Spartan Delta's BCG Matrix offers a strategic overview of its assets, categorizing them as Stars, Cash Cows, Question Marks, or Dogs to guide investment decisions.

Provides a clear, visual assessment of your portfolio's strengths and weaknesses, simplifying complex strategic decisions.

Cash Cows

Spartan Delta's Deep Basin assets, despite a shift in capital focus towards the Duvernay, remain a stable contributor. These holdings are characterized by liquids-rich natural gas production, ensuring consistent cash flow generation.

Management is actively optimizing these assets to sustain production levels and maximize free funds flow. This strategic approach ensures the Deep Basin continues to act as a reliable cash generator for the company.

Spartan Delta demonstrated robust financial performance in 2024, generating $2.7 million in Free Funds Flow. This consistent cash generation, even with fluctuating natural gas prices, highlights the strength of its assets.

The company's Q4 2024 results were particularly strong, with Free Funds Flow reaching $10.7 million. This ability to produce cash after accounting for capital expenditures is a hallmark of a cash cow, providing vital capital for other business initiatives.

Spartan Delta's Deep Basin operations exemplify a classic Cash Cow. The company is laser-focused on squeezing every drop of efficiency from this mature asset base, prioritizing cost control and operational discipline. This strategy is crucial for maintaining healthy profit margins and consistent cash flow, especially as new growth investments become less critical.

In 2024, Spartan Delta reported that its Deep Basin segment continued to be a significant contributor to its overall financial health, generating substantial free cash flow. This performance underscores the effectiveness of their optimization efforts, allowing them to generate reliable returns from established production.

Low Capital Intensity for Maintenance

Spartan Delta's Deep Basin assets function as cash cows due to their low capital intensity for maintenance. Investments here are focused on sustaining current production and optimizing existing infrastructure, not on rapid expansion. This contrasts with higher-growth areas, allowing the Deep Basin to consistently generate reliable cash flow.

This operational approach translates into significant financial benefits. For instance, in 2024, Spartan Delta's capital expenditures for maintenance and optimization in the Deep Basin were notably lower per barrel of oil equivalent compared to their development activities elsewhere. This efficiency directly contributes to their robust free cash flow generation.

- Focus on Optimization: Investments are geared towards enhancing efficiency and maintaining output from established wells and facilities.

- Reduced Capital Outlay: Lower expenditure requirements compared to exploration or aggressive development projects.

- Consistent Cash Generation: The stable production profile and lower investment needs ensure a predictable and reliable cash inflow.

- Financial Stability: These assets provide a strong foundation for funding other strategic initiatives or returning capital to shareholders.

Hedging Program for Stability

Spartan Delta's hedging program is a key component of its strategy for its cash cow assets. For 2025, the company has hedged approximately 45% of its oil and condensate production and 50% of its natural gas production. This proactive approach significantly reduces the impact of fluctuating commodity prices on its revenue streams.

This hedging strategy directly contributes to the stability and predictability of cash flows generated by Spartan's mature assets. By locking in prices for a substantial portion of its production, the company creates a more reliable income stream, reinforcing the cash cow status of these operations. This financial predictability is crucial for planning and reinvestment.

- Hedging Coverage for 2025: Approximately 45% of oil/condensate and 50% of natural gas production.

- Objective: Mitigate commodity price volatility and ensure stable cash flow.

- Impact on Assets: Enhances the predictable and stable nature of mature asset cash generation.

- Strategic Benefit: Reinforces the cash cow status through reliable revenue streams.

Spartan Delta's Deep Basin assets are quintessential cash cows, characterized by mature, stable production that reliably generates free funds flow with minimal new capital investment. The company's strategy centers on optimizing existing infrastructure and controlling costs, ensuring these assets continue to provide a steady income stream.

In 2024, these operations were instrumental in Spartan Delta's financial performance, contributing significantly to overall cash generation. The focus on efficiency means that capital expenditures are primarily for maintenance, directly translating into higher free funds flow.

This consistent cash generation provides a crucial financial foundation, enabling the company to fund growth initiatives in other areas or return capital to shareholders. The Deep Basin's role as a cash cow is further solidified by its low operational risk and predictable output.

Spartan Delta's hedging program for 2025, covering roughly 45% of oil and 50% of gas production, further enhances the stability of these cash cow assets by mitigating commodity price volatility.

| Asset Segment | 2024 Free Funds Flow (Millions USD) | Capital Expenditures (Millions USD) | Production (boe/d) |

|---|---|---|---|

| Deep Basin (Cash Cow) | $2.7 (Annual) / $10.7 (Q4) | Lower per boe for maintenance | Stable, liquids-rich NG |

What You’re Viewing Is Included

Spartan Delta BCG Matrix

The Spartan Delta BCG Matrix preview you are viewing is the exact, fully formatted document you will receive upon purchase. This means no watermarks, no demo content, and no missing sections—just the complete, analysis-ready strategic tool ready for immediate application in your business planning.

Dogs

The Gold Creek and Karr Montney assets, which Spartan Delta sold to Crescent Point Energy for $1.7 billion in 2023, were a substantial part of their Montney holdings. This divestiture, though substantial in value, indicates these assets might have been viewed as mature or not central to Spartan's forward-looking strategy.

In the context of a BCG matrix, these assets, while generating revenue, could be classified as dogs if they required high capital investment for diminishing returns or if Spartan identified more promising growth opportunities elsewhere. The significant sale price of $1.7 billion in 2023 highlights their existing value but also suggests a strategic decision to reallocate capital.

Spartan Delta's legacy North-East British Columbia production, specifically the 500 BOE/d portion, was spun out into Logan Energy Corp. This move effectively categorizes this asset as a 'dog' within the BCG matrix framework.

By divesting this smaller, potentially declining, and less strategic production, Spartan Delta aimed to streamline its operations and focus on its core, higher-growth assets. This separation allows Logan Energy to manage or further divest these assets, potentially unlocking value or mitigating ongoing operational costs for Spartan Delta.

Underperforming non-core assets in Spartan Delta's portfolio, by definition, are those operations outside their strategic Duvernay focus and Deep Basin optimization efforts. These assets likely exhibit low market share and limited growth potential, consuming valuable capital and management attention without delivering commensurate returns.

For instance, if Spartan Delta had legacy natural gas assets in a region with declining production and high operating costs, these would fit the underperforming non-core category. In 2024, such assets might be characterized by a negative net present value (NPV) under current market conditions, or a return on capital employed (ROCE) significantly below the company's hurdle rate.

Inefficient Corporate Structure (Pre-reorganization)

Spartan Delta Corp.'s strategic repositioning, beginning in late 2022 with asset sales and spin-offs, indicated that its prior structure and asset portfolio weren't optimally reflecting their inherent value. This implies that before these significant changes, the company, as a whole, exhibited characteristics of a 'dog' in terms of market perception and how effectively it utilized its capital. For instance, by Q3 2022, Spartan Delta reported a significant debt-to-equity ratio, highlighting potential capital inefficiencies.

The decision to divest certain assets and create separate entities suggests that these previously integrated parts were not performing as strongly as desired, potentially dragging down overall valuation and investor sentiment. This move aimed to unlock value by allowing individual business units to operate with greater focus and potentially attract different investor bases. The market's reaction to these strategic shifts, particularly the spin-off of certain natural gas assets, will be a key indicator of whether the 'dog' status is being shed.

- Pre-reorganization inefficiencies: Spartan Delta's prior structure likely contained underperforming assets or business segments that did not align with the company's core strengths, leading to capital misallocation.

- Market perception: The market may have undervalued the company due to the complexity of its diverse asset base or concerns about the performance of specific divisions.

- Asset sales as a solution: The divestiture of assets in late 2022 and early 2023, such as the sale of certain Montney assets, aimed to streamline operations and improve financial flexibility.

- Focus on core competencies: By shedding non-core or underperforming assets, Spartan Delta sought to concentrate resources on areas with higher growth potential and better returns.

Deep Basin Natural Gas (Low Price Environment)

While the Deep Basin often acts as a cash cow for Spartan Delta, its significant natural gas exposure, particularly in the challenging price environment of 2024, can present 'dog-like' characteristics. This is primarily due to the lower profitability of natural gas when prices are depressed, although the valuable liquids content helps mitigate this. For instance, average natural gas prices in North America dipped significantly in early 2024 compared to previous years, impacting margins for gas-heavy producers.

Spartan Delta's strategic pivot to increase oil and condensate production in the Duvernay formation directly addresses the headwinds faced by natural gas in certain market conditions. This shift acknowledges that while the Deep Basin is a mature asset, focusing on its higher-value liquid components is crucial for maintaining profitability and growth when natural gas markets are weak.

- Deep Basin Natural Gas (Low Price Environment): Despite being a cash cow, the natural gas-heavy nature of the Deep Basin, especially with 2024's lower natural gas prices, can lead to dog-like characteristics due to reduced profitability.

- Liquids Content and Efficiencies: The profitability of the Deep Basin is significantly bolstered by its liquids production and the company's operational efficiencies, which help offset the impact of low natural gas prices.

- Strategic Shift to Liquids: Spartan Delta's focus on increasing oil and condensate production in the Duvernay highlights a strategic response to the lower growth and profitability potential of natural gas in certain market scenarios.

- 2024 Market Context: The average spot price for natural gas in key North American markets during the first half of 2024 saw a notable decline from the highs of previous years, underscoring the challenges faced by gas-focused assets.

Spartan Delta's legacy North-East British Columbia production, spun out into Logan Energy Corp., is a clear example of a 'dog' in the BCG matrix. This segment likely has low market share and limited growth prospects, requiring significant capital for diminishing returns.

By divesting these assets, Spartan Delta aimed to streamline operations and focus on higher-growth areas. This strategic move allows Logan Energy to manage these assets, potentially unlocking value or mitigating ongoing costs for Spartan Delta, effectively shedding a 'dog' from its core portfolio.

Underperforming non-core assets are those outside Spartan Delta's strategic focus, such as the Duvernay and Deep Basin optimization. These assets typically exhibit low growth potential and market share, consuming capital without delivering commensurate returns, fitting the 'dog' profile.

For instance, legacy natural gas assets with declining production and high operating costs would be categorized as dogs. In 2024, such assets might show a negative net present value or a return on capital employed significantly below the company's hurdle rate, indicating poor performance.

| Asset Category | BCG Matrix Classification | Spartan Delta Example | Rationale |

|---|---|---|---|

| Legacy NE BC Production | Dog | Spun out into Logan Energy Corp. | Low growth, low market share, potentially high costs. |

| Underperforming Non-Core Assets | Dog | Legacy gas assets with declining production | Negative NPV or ROCE below hurdle rate in 2024. |

Question Marks

Spartan Delta's early-stage Duvernay acreage, comprising over 350,000 net acres as of mid-2025, positions it as a potential 'Question Mark' in the BCG matrix. While this undeveloped land offers considerable growth prospects, its current low market share and the significant capital required for exploration and development mean its future success is uncertain.

Exploration and appraisal programs in emerging or less certain territories fall under the question mark category within the Spartan Delta BCG Matrix. These ventures demand substantial investment, and their profitability remains uncertain until reserves are confirmed and production commences.

For instance, in 2024, many energy companies are dedicating significant portions of their capital expenditure to exploring new frontiers, particularly in deepwater or unconventional resource plays. These investments, while carrying inherent risk, are crucial for future growth and reserve replacement.

Spartan Delta's Deep Basin assets are generally considered cash cows, but emerging or deeper drilling prospects within this prolific region represent potential question marks. These targets, not yet fully de-risked, carry uncertainty regarding their economic viability and necessitate further capital investment for thorough assessment.

New Technology Adoption

Spartan Delta's investments in novel drilling or completion technologies that haven't achieved broad commercial validation across their operations would be categorized as question marks. These ventures represent a calculated gamble, offering the possibility of substantial rewards but also carrying a considerable degree of uncertainty.

For instance, if Spartan Delta were to invest in a pilot program for a new hydraulic fracturing technique in 2024, this would fall into the question mark category. Such a technology might promise increased oil recovery rates, but its effectiveness and cost-efficiency at scale are still unproven.

- Potential for High Returns: Successful adoption of a disruptive technology could significantly lower production costs or boost output, leading to higher profitability.

- Significant Risk: Early-stage technologies may fail to deliver expected results, leading to capital losses and operational setbacks.

- Strategic Importance: Investing in question marks allows Spartan Delta to stay ahead of the technological curve and identify future competitive advantages.

Future Strategic Acquisitions

Spartan Delta's strategy emphasizes opportunistic consolidation of undercapitalized assets, a key driver for future acquisitions. These potential targets, especially in nascent or developing resource plays, would initially be categorized as question marks within the BCG framework.

Until their operational integration and subsequent development demonstrate a clear path to significant market share and sustained growth potential, these acquisitions represent a strategic gamble. For instance, if Spartan Delta were to acquire a smaller, promising shale play with unproven infrastructure in late 2024, it would likely begin as a question mark.

- Strategic Focus: Opportunistic consolidation of underdeveloped or undercapitalized assets.

- Initial BCG Classification: Question Marks for new or emerging plays pending integration and development.

- Data Point: In 2024, the North American oil and gas sector saw numerous smaller asset trades, many in emerging plays, highlighting the potential for such question mark acquisitions.

- Future Potential: Successful integration and development could shift these assets to Stars, driving future growth.

Question Marks represent Spartan Delta's ventures into new territories or technologies where success is not guaranteed but the potential for high returns exists. These are areas requiring significant investment and strategic evaluation to determine their future market position. The company's approach involves carefully assessing these opportunities to transform them into future Stars or divest if they fail to meet expectations.

| Category | Description | Spartan Delta Example (2024/2025) | Potential Outcome |

|---|---|---|---|

| Question Mark | Low market share, high growth potential, uncertain future. Requires significant investment. | Undeveloped Duvernay acreage (350,000+ net acres) | Star (if successful development) or Dog (if unsuccessful) |

| Question Mark | Exploration in new or less certain resource plays. | Deep Basin deeper drilling prospects | Star (if economic viability confirmed) or Divestment |

| Question Mark | Investment in unproven technologies or innovative processes. | Pilot program for new hydraulic fracturing technique | Star (if cost-effective at scale) or write-off |

| Question Mark | Acquisition of undercapitalized assets in nascent plays. | Acquisition of a promising shale play with unproven infrastructure (late 2024) | Star (post-integration and development) or write-down |

BCG Matrix Data Sources

Our Spartan Delta BCG Matrix is built on robust market data, integrating financial performance, industry growth rates, and competitive landscape analysis for strategic decision-making.