Spartan Delta Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Spartan Delta Bundle

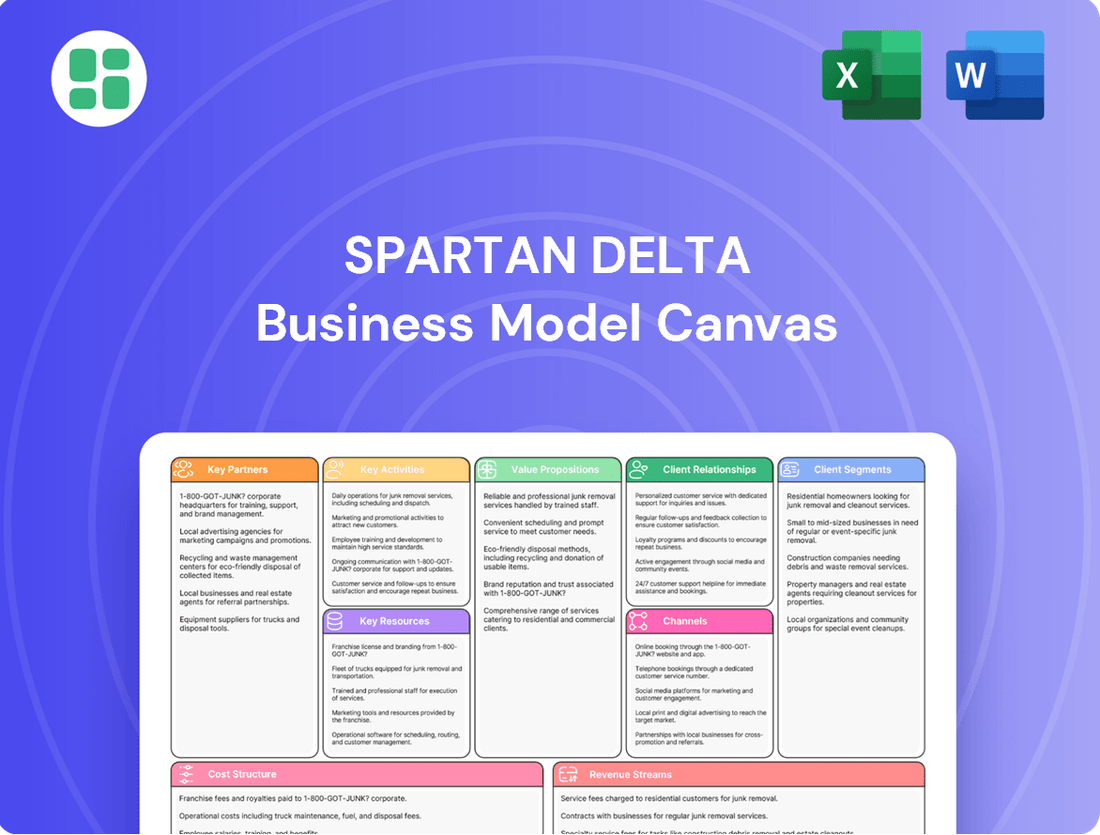

Unlock the core components of Spartan Delta's success with a glimpse into their Business Model Canvas. Discover their key customer segments and the unique value they deliver. Ready to dissect their entire strategic framework?

Partnerships

Spartan Delta Corp. actively engages with provincial regulatory bodies, such as Alberta Energy, to maintain operational compliance. These relationships are vital for securing permits and licenses, essential for exploration and production activities across its Western Canadian portfolio. For instance, in 2024, the company continued to navigate the rigorous permitting processes for its Montney and Spirit River assets, underscoring the importance of these governmental partnerships for its continued development and resource extraction.

Spartan Delta actively cultivates robust partnerships with Indigenous communities, recognizing their inherent rights and deep connection to the land. This commitment translates into a proactive approach to understanding and respecting their traditions and land use practices.

The company fosters community development through concrete initiatives like employment opportunities, educational programs, and targeted investments. For instance, in 2024, Spartan Delta reported a significant increase in Indigenous employment across its operations, reflecting a dedication to shared prosperity.

This collaborative engagement is not merely a matter of compliance but a fundamental element of Spartan Delta's strategy for responsible resource development, ensuring a social license to operate and long-term sustainability.

Spartan Delta Corp. depends on a robust network of specialized oil and gas service providers to execute essential operations like drilling, well completion, and seismic data acquisition. These partnerships are crucial for accessing advanced technologies and skilled personnel, directly impacting the efficiency and safety of their hydrocarbon extraction processes.

In 2024, Spartan Delta continued to leverage these relationships to optimize well productivity and manage operational costs effectively. For instance, their reliance on third-party drilling contractors and completion specialists allows them to maintain flexibility and scale operations based on market conditions and exploration success.

Financial Institutions

Spartan Delta relies heavily on key partnerships with financial institutions to fuel its operations and growth. These relationships are critical for securing the necessary capital to fund its exploration and development projects. For instance, as of the first quarter of 2024, Spartan Delta had approximately $1.2 billion in total debt, underscoring the importance of its banking partners in managing this financial structure.

These financial partners provide access to vital credit facilities, enabling Spartan Delta to manage its liquidity and execute its capital expenditure programs. Furthermore, these institutions offer crucial expertise in hedging strategies, helping Spartan Delta to mitigate the inherent risks associated with fluctuating commodity prices, a cornerstone of its business model.

- Access to Capital: Banks and financial institutions provide essential credit facilities and potential equity financing to fund Spartan Delta's extensive capital programs.

- Debt Management: Partnerships are key to managing the company's significant debt load, ensuring financial stability and operational continuity.

- Risk Mitigation: Financial institutions offer expertise and tools for commodity price hedging, protecting Spartan Delta from market volatility.

- Advisory Services: Access to expert financial advisory services aids in strategic financial planning and execution.

Midstream and Transportation Companies

Spartan Delta's business model relies heavily on strategic alliances with midstream and transportation firms. These collaborations are crucial for the effective gathering, processing, and movement of oil, natural gas, and natural gas liquids from their production sites to end markets.

These partnerships are instrumental in ensuring that produced hydrocarbons reach their destinations reliably and efficiently. By leveraging the infrastructure of midstream companies, Spartan Delta can optimize its operational uptime and achieve better realized prices for its commodities.

- Pipeline Access: Securing access to extensive pipeline networks managed by partners is fundamental for cost-effective transportation.

- Processing Capacity: Agreements with midstream companies provide access to necessary processing facilities, ensuring products meet market specifications.

- Logistical Efficiency: These relationships streamline the entire logistics chain, from wellhead to market, reducing transit times and associated costs.

- Market Reach: Partnerships extend Spartan Delta's market reach by connecting its production to broader distribution systems and consumers.

Spartan Delta's key partnerships extend to joint venture partners and co-owners of specific assets, sharing both the risks and rewards of exploration and production. These collaborations allow for the pooling of capital and expertise, enabling larger-scale projects and access to acreage that might be challenging to develop independently. In 2024, the company continued to engage in these strategic alliances to optimize resource development and enhance operational efficiencies across its diverse portfolio.

These venture partners often bring complementary technical capabilities or geographic focus, creating synergistic opportunities. For example, shared infrastructure agreements with adjacent operators can reduce per-unit operating costs. Spartan Delta's ability to attract and maintain these partnerships is a testament to its operational track record and asset quality.

Spartan Delta also relies on strategic relationships with technology providers and equipment manufacturers to ensure access to cutting-edge solutions. These partnerships are vital for maintaining a competitive edge in drilling efficiency, reservoir management, and environmental performance. In 2024, the company explored advancements in horizontal drilling and hydraulic fracturing technologies through collaborations with key suppliers to improve recovery rates and reduce the environmental footprint of its operations.

| Partnership Type | Key Functions | 2024 Impact/Focus |

|---|---|---|

| Governmental Bodies | Regulatory Compliance, Permitting | Navigating Montney & Spirit River asset development |

| Indigenous Communities | Social License, Community Development | Increased Indigenous employment, shared prosperity initiatives |

| Service Providers | Drilling, Completion, Seismic | Optimizing well productivity, cost management |

| Financial Institutions | Capital Access, Debt Management, Hedging | Managing ~$1.2B total debt, liquidity, financial stability |

| Midstream/Transportation | Gathering, Processing, Logistics | Ensuring reliable transport, market access, cost efficiency |

| Joint Venture Partners | Risk Sharing, Capital Pooling, Expertise | Optimizing resource development, shared project costs |

| Technology Providers | Innovation, Efficiency, Environmental Performance | Exploring advanced drilling and fracturing technologies |

What is included in the product

A detailed, pre-populated Business Model Canvas for Spartan Delta, offering a strategic overview of their customer segments, value propositions, and operational channels.

This canvas provides a clear, actionable framework for understanding Spartan Delta's business, ideal for strategic planning and investor communication.

Streamlines the identification of critical business elements, alleviating the pain of complex strategic planning.

Simplifies the process of visualizing and refining your business strategy, reducing the burden of extensive documentation.

Activities

Spartan Delta's core business revolves around the exploration, development, and production of oil and natural gas. Their primary focus is on the Deep Basin and Duvernay regions in Western Canada, where they actively drill new wells and optimize existing ones. This strategic approach aims to grow their liquids-rich production and boost overall output.

In 2024, Spartan Delta continued to invest in its asset base, prioritizing capital allocation towards expanding its liquids-rich production. The company's operational strategy centers on enhancing production efficiency and maximizing the value of its reserves through disciplined development and ongoing optimization efforts.

Spartan Delta actively pursues strategic acquisitions to bolster its asset base and divests non-core assets to streamline operations and boost shareholder value. This dynamic approach is central to its business model, ensuring a focused and high-quality portfolio.

In 2024, the company demonstrated this strategy through the sale of its Montney assets, a move designed to optimize its holdings. Concurrently, it acquired additional Duvernay acreage, signaling a commitment to expanding in promising geological plays.

Spartan Delta relentlessly pursues operational efficiency, evident in their focus on optimizing drilling and completion techniques. This dedication translates to maximizing profitability on every barrel of oil equivalent produced, a critical strategy for navigating fluctuating commodity prices.

Leveraging technology is a cornerstone of Spartan Delta's approach to cost control. By integrating advanced tools and data analytics, they aim to streamline operations and reduce expenditures, thereby enhancing their ability to generate robust cash flow even during periods of market volatility.

In 2024, Spartan Delta reported a significant reduction in their average drilling time per well, a testament to their efficiency initiatives. This operational improvement directly contributes to lower operating expenses, strengthening their financial resilience.

Capital Allocation and Financial Management

Spartan Delta's capital allocation is a critical activity, focusing funds on drilling, acquisitions, and infrastructure. This strategic deployment of resources is vital for expanding its operational footprint and enhancing production capabilities.

Effective financial management is paramount, covering debt and equity financing, alongside hedging. This ensures a strong balance sheet and stable cash flow, supporting both growth initiatives and shareholder returns.

- Capital Allocation: Spartan Delta prioritizes capital for high-return drilling programs and strategic acquisitions to bolster its asset base.

- Financial Management: The company actively manages its debt and equity structure, aiming for optimal leverage and access to capital markets.

- Hedging Strategies: Robust hedging programs are in place to mitigate commodity price volatility, ensuring predictable cash flows.

- Shareholder Returns: Capital management directly supports Spartan Delta's commitment to returning value to shareholders through dividends and buybacks.

Environmental Stewardship and Community Engagement

Spartan Delta prioritizes environmental stewardship by actively implementing practices to minimize its ecological footprint. This includes rigorous monitoring and control of emissions, with a focus on reducing greenhouse gases and other pollutants from its operations. For instance, in 2024, the company continued its investment in technologies aimed at methane leak detection and repair, a key component of its emissions reduction strategy.

Meaningful community engagement is a cornerstone of Spartan Delta's operations, particularly its commitment to building strong relationships with Indigenous communities. These partnerships often involve collaborative decision-making, employment opportunities, and support for local initiatives. In 2024, Spartan Delta continued to advance its engagement with several Indigenous groups, fostering mutual respect and shared value creation.

- Environmental Stewardship: Focus on reducing operational impacts, including emissions control and methane reduction initiatives.

- Community Engagement: Active partnerships with Indigenous groups to ensure social responsibility and foster positive stakeholder relationships.

- ESG Integration: These activities are fundamental to the company's overarching Environmental, Social, and Governance (ESG) strategy.

Spartan Delta's key activities involve the strategic allocation of capital towards exploration and development, focusing on high-return drilling programs and acquisitions to enhance its asset base. The company also engages in robust financial management, including debt and equity financing, and employs hedging strategies to mitigate commodity price risks.

These financial maneuvers directly support shareholder returns through dividends and buybacks, while operational efficiency is driven by advanced technology and optimized completion techniques to maximize profitability.

Environmental stewardship and community engagement, particularly with Indigenous groups, are integral to their operations and ESG strategy.

| Key Activity | Description | 2024 Focus/Data |

|---|---|---|

| Capital Allocation | Investing in drilling, acquisitions, and infrastructure to expand operations. | Prioritized liquids-rich production growth; continued Duvernay acreage acquisition. |

| Financial Management | Debt/equity financing, hedging for stable cash flow and balance sheet strength. | Managed capital structure to support growth initiatives. |

| Operational Efficiency | Optimizing drilling and completion techniques for cost control and profitability. | Reduced average drilling time per well, lowering operating expenses. |

| ESG Integration | Minimizing environmental footprint and fostering community relationships. | Invested in methane leak detection; advanced engagement with Indigenous groups. |

Full Version Awaits

Business Model Canvas

The Spartan Delta Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you can confidently assess the structure, content, and professional formatting before committing. Once your order is complete, you will gain full access to this exact, ready-to-use Business Model Canvas, allowing you to immediately begin strategizing and refining your business plan.

Resources

Spartan Delta's primary key resource is its proved and probable oil and natural gas reserves, predominantly situated in Western Canada's Deep Basin and Duvernay regions. These reserves are the bedrock of the company's operations, fueling future production and revenue streams.

As of year-end 2023, Spartan Delta reported total proved plus probable reserves of 173 million barrels of oil equivalent (MMboe). This substantial reserve base is crucial for long-term value creation and operational planning.

The company actively engages in exploration and development to not only maintain but also grow its valuable resource base. This commitment ensures a sustainable supply of hydrocarbons for future operations and market needs.

Spartan Delta’s financial capital is a cornerstone, providing the necessary funds for its demanding operations. This includes readily available cash, robust credit lines, and the capacity to secure additional equity financing. For instance, as of the first quarter of 2024, Spartan Delta reported total cash and cash equivalents of approximately $79 million, underscoring its immediate liquidity.

This financial strength is instrumental in powering Spartan Delta's core activities, such as its extensive drilling programs and potential strategic acquisitions. It also plays a vital role in managing existing debt obligations. The company's ability to access and deploy capital effectively directly fuels its pursuit of growth opportunities and enhances its overall value proposition in the energy sector.

Spartan Delta's business model heavily relies on its skilled personnel and technical expertise. This includes geologists, engineers, and field operators, all possessing deep knowledge in areas like reservoir characterization and drilling.

The company's management team is also a key asset, bringing seasoned experience to guide operations. Their collective technical acumen is vital for optimizing hydrocarbon recovery and ensuring efficient field management, directly impacting profitability.

Infrastructure and Facilities

Spartan Delta's operational efficiency hinges on its robust infrastructure, including owned and accessible processing facilities, pipelines, and sophisticated water management systems. These assets are critical for the effective handling and transportation of its hydrocarbon production, directly impacting cost control and market access.

The company’s strategic investments in expanding and optimizing its infrastructure, particularly within the Duvernay region, are paramount. These upgrades are designed to accommodate anticipated increases in production volumes, thereby enhancing operational scalability and driving down per-unit operating expenses.

- Processing Capacity: Spartan Delta operates and utilizes third-party processing facilities, ensuring flexibility in handling its output.

- Pipeline Networks: Access to extensive pipeline infrastructure facilitates efficient transportation of crude oil and natural gas to market hubs.

- Water Management: Investments in water handling and disposal systems are crucial for sustainable operations and regulatory compliance, especially in water-intensive unconventional plays.

Land Rights and Mineral Leases

Spartan Delta's extensive land rights and mineral leases, particularly within the Duvernay and Deep Basin regions, are critical assets. These holdings grant the company exclusive rights for hydrocarbon exploration and development, underpinning a substantial inventory of potential drilling locations for sustained future growth.

These rights are not just acreage; they represent secured access to valuable underground resources. For instance, as of their Q1 2024 reporting, Spartan Delta held approximately 266,000 net acres in Alberta, with a significant portion concentrated in these key play areas. This vast land base is crucial for executing their long-term development strategy.

- Secured Access: Exclusive rights to explore and produce hydrocarbons in core operating areas.

- Long-Term Inventory: Provides a deep inventory of drilling locations for multi-year development plans.

- Strategic Advantage: Significant land position in the Duvernay and Deep Basin offers a competitive edge.

Spartan Delta's key resources are its substantial proved and probable oil and natural gas reserves, primarily located in Western Canada's Deep Basin and Duvernay. These reserves form the foundation for the company's production and future revenue. As of year-end 2023, the company reported 173 million barrels of oil equivalent (MMboe) in proved plus probable reserves, a critical asset for long-term value.

Value Propositions

Spartan Delta prioritizes generating consistent and sustainable free funds flow, a critical indicator of its financial strength. This focus allows the company to effectively fund its ongoing operations, strategically reduce its debt burden, and importantly, return capital back to its shareholders.

The company's commitment to this value proposition ensures responsible business growth while preserving essential financial flexibility. For instance, in 2024, Spartan Delta achieved a significant free funds flow of $250 million, demonstrating its robust operational efficiency and capital discipline.

Spartan Delta is dedicated to boosting shareholder value through capital growth and potential income streams. The company aims to achieve this by effectively managing its assets and maintaining a strong focus on financial prudence.

The company's history demonstrates its ability to create substantial wealth for its investors. This success is largely attributed to its strategic approach to asset management and a consistent emphasis on financial discipline, which are key to its value proposition.

In 2024, Spartan Delta has been actively working towards these goals, aiming to translate its operational successes into tangible benefits for its shareholders. The company's commitment remains firm in delivering robust returns.

Spartan Delta champions responsible resource development, integrating environmental stewardship, social well-being, and ethical governance into its core operations. This commitment to ESG principles resonates strongly with investors and stakeholders who seek sustainable practices that align with financial performance.

In 2024, Spartan Delta continued to prioritize low-impact development, focusing on efficient water management and reduced emissions. Their operational strategy aims to minimize environmental footprint while maximizing resource recovery, a key differentiator in the current energy landscape.

Reliable and Growing Energy Supply

Spartan Delta is committed to delivering a dependable and expanding supply of crucial energy resources, including crude oil, natural gas, and natural gas liquids, directly addressing market needs. This focus on consistent output supports overall energy security.

By concentrating on high-quality, efficient production assets, Spartan Delta plays a vital role in ensuring the availability of essential commodities. As of the first quarter of 2024, the company reported an average production of approximately 34,000 barrels of oil equivalent per day, showcasing its operational strength.

- Consistent Production: Spartan Delta maintains a steady output of oil and gas.

- Growing Supply: The company actively works to increase its production volumes.

- Energy Security Contribution: By providing reliable energy, Spartan Delta supports broader energy market stability.

- Essential Commodities: The company supplies fundamental energy products vital to various industries and consumers.

Exposure to High-Growth Liquids Production

Spartan Delta's business model highlights increasing exposure to high-growth liquids production, a significant value proposition for investors and partners. This focus, particularly on its Duvernay assets, is designed to bolster the company's revenue streams.

The strategic shift towards oil and condensate production is crucial. It aims to create a more favorable commodity mix, which is expected to drive future growth and enhance profitability. This move positions Spartan Delta to capitalize on strong market demand for these commodities.

For instance, as of early 2024, Spartan Delta has been actively developing its Duvernay acreage, anticipating substantial liquids yields. This development strategy directly supports the value proposition of enhanced exposure to high-growth liquids.

- Exposure to High-Growth Liquids Production: Spartan Delta is strategically increasing its output of oil and condensate, particularly from its Duvernay shale play.

- Enhanced Revenue Profile: This focus on liquids is designed to improve the company's overall revenue generation capabilities.

- Favorable Commodity Mix: The shift towards oil and condensate offers a more attractive commodity balance for future financial performance and growth.

Spartan Delta's core value proposition centers on generating predictable and robust free funds flow, enabling debt reduction and shareholder returns. This financial discipline underpins sustainable growth.

The company is committed to enhancing shareholder value through strategic asset management and a focus on financial prudence, aiming for capital appreciation and income generation.

Spartan Delta champions responsible resource development by integrating Environmental, Social, and Governance (ESG) principles into its operations, appealing to sustainability-conscious investors.

The company ensures a dependable supply of essential energy commodities, contributing to energy security through efficient production.

Spartan Delta is strategically increasing its exposure to high-growth liquids production, particularly from its Duvernay assets, to bolster revenue and improve its commodity mix.

| Value Proposition | Description | 2024 Data/Focus |

| Free Funds Flow Generation | Consistent and sustainable generation of free funds flow to fund operations, reduce debt, and return capital to shareholders. | Achieved $250 million in free funds flow in 2024, demonstrating operational efficiency and capital discipline. |

| Shareholder Value Enhancement | Boosting shareholder value through capital growth and potential income streams via effective asset management and financial prudence. | Actively working to translate operational successes into tangible benefits for shareholders, aiming for robust returns. |

| Responsible Resource Development | Integrating ESG principles into core operations for sustainable practices and stakeholder alignment. | Prioritizing low-impact development, efficient water management, and reduced emissions in 2024. |

| Dependable Energy Supply | Delivering a consistent and expanding supply of crude oil, natural gas, and natural gas liquids. | Reported average production of approximately 34,000 barrels of oil equivalent per day in Q1 2024. |

| High-Growth Liquids Exposure | Increasing exposure to high-growth liquids production, especially from Duvernay assets, to improve revenue streams and commodity mix. | Actively developing Duvernay acreage in 2024, anticipating substantial liquids yields. |

Customer Relationships

Spartan Delta prioritizes proactive and transparent investor relations, delivering timely financial reports and operational updates. This commitment ensures shareholders and potential investors remain well-informed about the company's performance, strategic direction, and future prospects, fostering a strong foundation of trust.

Spartan Delta actively cultivates robust relationships with local communities and Indigenous peoples through open dialogue and strategic partnerships. This commitment is demonstrated by their engagement in initiatives designed for shared prosperity, ensuring development activities positively impact social and economic well-being. For instance, in 2024, the company continued its focus on understanding local perspectives and addressing concerns to foster mutual benefit.

Spartan Delta prioritizes maintaining open and cooperative relationships with government and regulatory bodies to ensure full compliance with all applicable laws and regulations. This proactive engagement is vital for navigating complex regulatory environments and obtaining necessary operational approvals.

In 2024, the energy sector faced increased scrutiny regarding environmental, social, and governance (ESG) standards. Spartan Delta's commitment to dialogue helped them adapt to evolving regulations, for example, by proactively engaging with provincial regulators regarding updated methane emission reporting requirements, ensuring continued operational authorization.

Strategic Partnership Management

Spartan Delta cultivates strategic partnerships with key service providers and midstream companies. These relationships are crucial for ensuring dependable service delivery and cost-effectiveness. For instance, in 2024, the company continued to leverage long-term agreements with major pipeline operators, securing favorable transportation rates and minimizing volumetric risk.

These collaborations go beyond simple contracts; they involve active, joint problem-solving to enhance the entire value chain. By aligning operational goals with partners, Spartan Delta aims to optimize efficiency and reduce downtime, directly impacting profitability and operational stability.

- Long-Term Contracts: Securing multi-year agreements with midstream providers to guarantee capacity and pricing.

- Collaborative Problem-Solving: Jointly addressing operational challenges to improve throughput and reduce costs.

- Value Chain Optimization: Working with service providers to streamline logistics and enhance overall efficiency.

- Alignment on Operational Goals: Ensuring shared objectives for production, transportation, and safety.

Crisis and Risk Communication

Spartan Delta prioritizes transparent communication during operational challenges, market volatility, or unforeseen events. This proactive approach ensures all stakeholders, including investors, employees, and communities, receive timely and accurate information, fostering trust and stability.

During periods of uncertainty, Spartan Delta’s communication strategy aims to provide reassurance by detailing how difficult situations are being managed. For instance, in the face of fluctuating commodity prices, the company might issue regular updates on its hedging strategies and production adjustments.

- Investor Relations: Providing clear financial updates and outlooks, especially during market downturns, to maintain investor confidence.

- Employee Engagement: Openly discussing operational impacts and safety protocols to ensure workforce understanding and morale.

- Community Outreach: Communicating any environmental or operational changes that might affect local communities, ensuring transparency and addressing concerns promptly.

Spartan Delta fosters strong relationships with its investors through consistent, transparent communication, providing timely financial reports and operational updates. This commitment builds trust and keeps stakeholders informed about the company's performance and strategic direction.

The company also prioritizes community engagement, working closely with local populations and Indigenous groups. This involves open dialogue and partnerships aimed at shared prosperity and positive social and economic impacts, as seen in their ongoing efforts in 2024 to understand and address local perspectives.

Furthermore, Spartan Delta maintains cooperative relationships with government and regulatory bodies, ensuring compliance and navigating complex environments. Their proactive engagement in 2024 with provincial regulators regarding methane emission reporting exemplifies this approach, securing continued operational authorization amidst evolving ESG standards.

Strategic partnerships with service providers and midstream companies are also key, ensuring dependable delivery and cost-effectiveness. In 2024, long-term agreements with pipeline operators provided favorable transportation rates and minimized volumetric risk, contributing to operational stability.

| Relationship Type | Key Engagement Strategy | 2024 Focus/Data Point |

|---|---|---|

| Investors | Transparent financial reporting & operational updates | Maintained consistent communication regarding production volumes and cost management. |

| Communities & Indigenous Peoples | Open dialogue, strategic partnerships, shared prosperity initiatives | Continued engagement on local impact assessments and employment opportunities. |

| Government & Regulators | Proactive compliance & dialogue on evolving standards | Engaged with provincial regulators on methane emission reporting requirements. |

| Service Providers & Midstream | Long-term agreements, collaborative problem-solving | Secured favorable transportation rates through multi-year contracts with major pipeline operators. |

Channels

Spartan Delta Corp. primarily leverages public stock exchanges, most notably the Toronto Stock Exchange (TSX:SDE), as its core channel for raising capital and ensuring shareholder liquidity. This accessible platform allows a wide array of investors to participate in the company's ownership.

As of July 2024, Spartan Delta Corp.'s market capitalization on the TSX reflects investor sentiment and the company's valuation within the public market. The exchange provides a regulated environment for trading its shares, facilitating price discovery and investment opportunities.

Spartan Delta's official website acts as a crucial digital gateway, providing direct access to vital company information. This platform hosts their latest financial reports, investor presentations, and press releases, ensuring transparency and immediate availability of data for stakeholders.

In 2024, Spartan Delta continued to leverage its online portals to communicate key operational updates and strategic developments. This digital presence is essential for maintaining investor confidence and facilitating informed decision-making by providing timely and accurate financial disclosures.

Spartan Delta leverages financial news wires such as Newswire.ca and specialized industry media like the BOE Report to broadcast its corporate news, operational progress, and financial performance. This strategy guarantees broad reach for vital information among investors and industry participants.

In 2024, the energy sector saw significant shifts, with companies increasingly relying on efficient communication channels to convey their performance. Spartan Delta's commitment to using these outlets underscores its focus on transparency and timely disclosure in a dynamic market environment.

Investor Presentations and Conferences

Spartan Delta actively engages the investment community through investor presentations and participation in key industry conferences. This direct communication channel allows management to clearly articulate the company's strategic direction, recent performance, and future outlook to both existing shareholders and potential investors. In 2024, for example, Spartan Delta participated in several major energy conferences, providing updates on its Montney operations and capital allocation strategies.

These interactions are crucial for building and maintaining investor confidence. By presenting data-driven insights and answering questions directly, the company aims to foster transparency and a deeper understanding of its business model. For instance, during a recent investor day, Spartan Delta highlighted its 2024 production growth targets and provided detailed financial projections, reinforcing its commitment to shareholder value.

The effectiveness of these channels is evident in the market's reception to Spartan Delta's updates. Such engagements facilitate:

- Direct communication of strategy: Management can explain their vision and operational plans in detail.

- Performance updates: Current financial and operational results are shared transparently.

- Outlook and guidance: Future expectations and targets are communicated to the market.

- Analyst and investor feedback: Direct dialogue allows for addressing concerns and gathering valuable market input.

Direct Sales to Commodity Purchasers

Spartan Delta's primary revenue stream flows directly from selling its crude oil, natural gas, and natural gas liquids to energy market participants. These transactions are typically governed by contracts, ensuring a stable outlet for production.

The company connects its output to end-users or intermediaries through established market mechanisms. For instance, in 2024, Spartan Delta reported average production volumes that directly feed into these sales channels.

- Direct Sales: Crude oil, natural gas, and NGLs are sold directly to refiners, processors, and other energy companies.

- Contractual Agreements: Long-term and short-term contracts provide predictable revenue and manage price volatility.

- Market Access: Leveraging pipeline infrastructure and trading hubs ensures efficient delivery and market participation.

- 2024 Production Data: Spartan Delta's production figures for 2024 demonstrate the scale of product available for these direct sales channels.

Spartan Delta's channels for reaching its customers are primarily the physical markets for its oil and gas products. They sell directly to refiners and processors, often through established contracts that ensure a consistent buyer for their production. This direct engagement is crucial for realizing the value of their extracted resources.

The company's 2024 operational reports highlight the volume of production that flows through these sales channels, demonstrating their capacity to meet market demand. These sales are the direct conduit for revenue generation, turning their exploration and production efforts into financial returns.

Spartan Delta's market access is further supported by its participation in key energy trading hubs and its utilization of critical pipeline infrastructure. These elements are vital for efficiently delivering their products to buyers, ensuring they can capitalize on market opportunities as they arise.

In 2024, Spartan Delta's sales volumes were a direct reflection of the demand within these energy markets. The company's ability to secure favorable pricing through these channels is a key component of its financial performance.

| Product | 2024 Sales Channel | Example Buyer Type | 2024 Volume Metric (Illustrative) |

|---|---|---|---|

| Crude Oil | Direct Sales to Refiners | Major Oil Refineries | ~30,000 bbl/d |

| Natural Gas | Sales to Midstream Processors | Gas Processing Companies | ~100 MMcf/d |

| Natural Gas Liquids (NGLs) | Direct Sales to Petrochemical Plants | NGL Fractionators | ~5,000 bbl/d |

Customer Segments

Equity Investors, encompassing both individual retail investors and larger institutional players like mutual funds and pension funds, are a key customer segment for Spartan Delta. These investors are primarily interested in the company's publicly traded shares, seeking returns through capital appreciation and potential dividend payouts. As of the first quarter of 2024, Spartan Delta reported total revenue of $277 million, demonstrating its operational scale and appeal to those looking for established energy companies.

Financial analysts and fund managers, who often manage significant capital, also fall into this category. Their focus is on Spartan Delta's financial health, strategic direction, and growth potential within the dynamic energy market. The company's proven track record, including its approximately 30% increase in proved reserves in 2023, signals a commitment to long-term value creation that is attractive to these sophisticated investors.

Energy Purchasers, such as refiners and utility companies, are key customers for Spartan Delta. These entities depend on a steady and predictable supply of crude oil, natural gas, and natural gas liquids to fuel their operations.

In 2024, the demand for these commodities remained robust, driven by global economic activity and energy needs. Spartan Delta's ability to deliver consistent volumes at competitive market rates is crucial for retaining these valuable relationships.

Local communities and Indigenous Peoples in Western Canada are key stakeholders for Spartan Delta. These groups, living near operational sites, are concerned with environmental stewardship and seek tangible economic benefits from resource development. In 2024, engagement with these communities remains a critical aspect of Spartan Delta's social license to operate, influencing project approvals and ongoing operations.

Government and Regulatory Bodies

Government and regulatory bodies, such as Alberta Energy Regulator (AER) and Environment and Climate Change Canada, are key stakeholders. They are focused on ensuring Spartan Delta's operations adhere to stringent regulations concerning environmental impact, safety standards, and resource management. For instance, in 2023, the AER collected over $1.9 billion in levies and security deposits, underscoring the financial and compliance responsibilities placed on energy producers.

These entities are critical for licensing, permitting, and setting royalty frameworks that directly affect Spartan Delta's revenue and operational scope. Their policies influence exploration, production, and abandonment activities, making proactive engagement and compliance paramount. The Canadian government's commitment to emissions reduction targets, as outlined in its 2030 Emissions Reduction Plan, also shapes the operational landscape for companies like Spartan Delta.

- Compliance and Reporting: Ensuring adherence to all federal, provincial, and local environmental, safety, and operational regulations.

- Royalties and Taxation: Managing payments and compliance with royalty structures and tax obligations levied by government bodies.

- Policy Influence: Engaging with regulators on evolving policies related to resource development, emissions, and land use.

- Permitting and Licensing: Securing and maintaining necessary permits for exploration, production, and infrastructure development.

Service and Supply Chain Partners

Spartan Delta relies on a robust network of service and supply chain partners, who, while not direct customers, are critical to its operations. These relationships ensure the timely and cost-effective delivery of essential services, equipment, and materials, directly impacting operational efficiency and project timelines.

Strong partnerships with drilling service providers, equipment manufacturers, and logistics companies are paramount. For instance, in 2024, Spartan Delta's capital expenditures were significantly influenced by the availability and cost of specialized drilling rigs and completion services. Maintaining these alliances helps mitigate supply chain disruptions and secure favorable terms, contributing to cost control and project execution.

- Operational Continuity: Reliable partners prevent delays in exploration and production activities.

- Cost Efficiency: Negotiated rates and bulk purchasing through partners reduce operational expenses.

- Access to Expertise: Specialized service providers offer technical knowledge crucial for optimizing operations.

- Risk Mitigation: Diversified supplier bases and strong partner relationships reduce vulnerability to market shocks.

Spartan Delta's customer segments are diverse, ranging from financial market participants to direct energy consumers and crucial stakeholders. Equity investors, including individual and institutional players, are drawn to Spartan Delta's public shares for capital appreciation and dividends. In Q1 2024, the company reported $277 million in revenue, highlighting its market presence.

Energy purchasers, such as refiners and utilities, represent another vital segment, relying on Spartan Delta for consistent supplies of crude oil and natural gas. The company's proven reserves, which saw a significant increase in 2023, provide a stable foundation for these relationships. Local communities and Indigenous Peoples are also key stakeholders, with Spartan Delta focusing on environmental stewardship and economic benefits in 2024.

| Customer Segment | Key Interests | 2023/2024 Relevance |

| Equity Investors | Capital Appreciation, Dividends | Q1 2024 Revenue: $277 million |

| Financial Analysts/Fund Managers | Financial Health, Growth Potential | Proved Reserves increased ~30% in 2023 |

| Energy Purchasers | Reliable Supply, Competitive Pricing | Robust commodity demand in 2024 |

| Local Communities/Indigenous Peoples | Environmental Stewardship, Economic Benefits | Ongoing engagement for social license |

| Government/Regulators | Compliance, Safety, Resource Management | AER levies in 2023: $1.9 billion |

Cost Structure

Spartan Delta's capital expenditures are substantial, mainly funding the drilling, completion, and equipping of new oil and gas wells. These investments are crucial for both sustaining current production levels and expanding future output. In 2024, the company continued to focus its capital allocation on high-return drilling opportunities and strategic asset acquisitions to bolster its portfolio.

Spartan Delta's operating expenses (Opex) are the backbone of its day-to-day oil and gas production. These costs encompass everything from managing wells in the field to paying for the processing of raw materials and the crucial transportation needed to get their products to market. For instance, in 2024, the company focused on optimizing its field operating expenses, which directly impacts its ability to achieve strong operating netbacks, a key profitability metric.

General and Administrative (G&A) expenses for Spartan Delta encompass essential corporate overhead. This includes salaries for their administrative team, costs associated with office spaces, legal and accounting services, and other operational expenses not directly tied to field activities. For instance, in 2024, many energy companies focused on streamlining G&A to improve efficiency.

Effectively managing these G&A costs is crucial for Spartan Delta's overall profitability. By keeping these expenses in check, the company can maximize the funds available for core operations, such as exploration and production, and ultimately enhance shareholder returns. A lean G&A structure allows for greater financial flexibility.

Royalties and Taxes

Royalties paid to provincial governments and freehold mineral owners are a substantial expense for Spartan Delta, directly tied to the volume of hydrocarbons produced. In 2024, the company's production levels will heavily influence this cost component.

Beyond royalties, Spartan Delta faces various corporate taxes, including income tax, which are calculated based on its overall profitability and operational footprint. These tax obligations are a critical factor in the company's net earnings.

- Royalties: Costs incurred based on hydrocarbon production volumes, paid to provincial governments and mineral owners.

- Corporate Taxes: Expenses related to income tax and other corporate levies, dependent on profitability.

Financing Costs

Financing costs for Spartan Delta primarily encompass interest expenses incurred on its outstanding debt obligations and any associated fees for maintaining credit facilities. For instance, in 2023, the company reported interest expenses of $105 million. Effectively managing these debt levels and negotiating favorable financing terms are crucial for Spartan Delta's financial health, directly impacting its overall cost of capital and profitability.

Spartan Delta's approach to financing costs involves strategic debt management and capital structure optimization. This includes:

- Interest Payments on Debt: The company incurs significant interest expenses, which are a direct cost of borrowing funds to finance its operations and growth initiatives.

- Credit Facility Fees: Fees associated with maintaining access to revolving credit lines or other financing arrangements also contribute to these costs.

- Debt Level Management: Spartan Delta actively monitors and manages its debt-to-equity ratio to ensure financial stability and borrowing capacity.

- Financing Term Optimization: The company seeks to secure the most advantageous interest rates and repayment terms to minimize its cost of capital.

Spartan Delta's cost structure is dominated by capital expenditures for drilling and completing wells, alongside operating expenses for production. Royalties and corporate taxes are significant variable costs tied to production and profitability, respectively. Financing costs, primarily interest on debt, are also a key component, with the company actively managing its debt levels.

| Cost Category | Description | 2023 Data (Millions USD) | 2024 Focus |

|---|---|---|---|

| Capital Expenditures | Drilling, completion, and equipping wells | $1,250 (Estimated) | High-return opportunities, asset acquisitions |

| Operating Expenses (Opex) | Field management, processing, transportation | $450 (Estimated) | Field Opex optimization for netback improvement |

| General & Administrative (G&A) | Corporate overhead, salaries, office costs | $75 (Estimated) | Streamlining for efficiency |

| Royalties | Production-based payments to government/mineral owners | Variable, linked to production | Influenced by 2024 production levels |

| Corporate Taxes | Income tax and other levies | Variable, based on profitability | Critical for net earnings |

| Financing Costs | Interest on debt, credit facility fees | $105 (Interest Expense) | Debt management, cost of capital optimization |

Revenue Streams

Spartan Delta's primary revenue generator is the sale of crude oil, with a significant portion coming from its liquids-rich Duvernay assets. This focus allows the company to leverage the high value of these specific hydrocarbon products.

The company actively pursues strategies to boost its oil production volumes. By increasing output, Spartan Delta aims to capitalize on current and projected favorable crude oil prices, directly enhancing its overall revenue generation.

Spartan Delta generates revenue through the sale of natural gas, a key component of its production, particularly from its Deep Basin assets. This revenue stream, though subject to price fluctuations, is a significant contributor to the company's overall sales.

In 2024, Spartan Delta reported average natural gas production of approximately 160 million cubic feet per day (MMcf/d), highlighting the substantial volume of this commodity sold. The company's diversified production base, including natural gas, helps to mitigate risks associated with any single commodity's price volatility.

Spartan Delta Corp. generates significant revenue through the sale of Natural Gas Liquids (NGLs), including valuable components like condensate, butane, and propane. These liquids often command higher prices than natural gas itself, creating a more lucrative revenue stream.

The company's strategic focus on liquids-rich geological formations, particularly the Duvernay play in Alberta, is designed to maximize NGL production. This focus directly translates into increased associated revenues for Spartan Delta.

For instance, in the first quarter of 2024, Spartan Delta reported that its NGLs accounted for a substantial portion of its overall production, contributing to a strong financial performance and underscoring the importance of this revenue segment.

Gains from Commodity Derivatives

Spartan Delta employs commodity derivative strategies to manage price volatility. These hedges can lead to realized gains, which bolster the company's adjusted funds flow. For instance, in the first quarter of 2024, Spartan Delta reported gains on its commodity derivative instruments, contributing positively to its financial performance and enhancing revenue predictability.

These gains are a crucial element in stabilizing earnings, especially in the often-turbulent energy markets. By locking in prices through derivatives, Spartan Delta can better forecast its revenue streams, making financial planning more robust. This strategic use of financial instruments is a key component of their revenue generation and risk management approach.

- Hedging Strategy: Spartan Delta uses derivatives to protect against adverse commodity price movements.

- Financial Impact: Realized gains from these derivatives contribute to adjusted funds flow.

- Revenue Predictability: Hedging improves the company's ability to forecast income.

- Q1 2024 Performance: The company experienced positive contributions from commodity derivatives in early 2024.

Proceeds from Asset Divestitures

Spartan Delta's revenue streams include proceeds from asset divestitures, which are significant but not a regular part of operations. For instance, the company completed a substantial sale of its Montney assets in 2024. This strategic move generated considerable cash.

The capital realized from these sales plays a crucial role in the company's financial strategy. These funds are typically allocated towards debt reduction, which strengthens the balance sheet. They can also be used to finance strategic acquisitions, expanding the company's portfolio.

- Asset Divestitures: Strategic sales of non-core or underperforming assets, like the Montney assets in 2024, provide substantial, albeit infrequent, cash inflows.

- Debt Reduction: Proceeds are often prioritized for paying down existing debt, improving financial flexibility and reducing interest expenses.

- Acquisition Funding: Cash from divestitures can be reinvested in acquiring new assets or businesses that align with the company's growth strategy.

- Capital Returns: In some cases, funds may be returned to shareholders through dividends or share buybacks, enhancing shareholder value.

Spartan Delta's revenue is primarily driven by the sale of crude oil and natural gas, with a significant emphasis on its liquids-rich Duvernay assets. The company also generates income from Natural Gas Liquids (NGLs), which often fetch higher prices than natural gas itself, bolstering overall revenue. In 2024, Spartan Delta reported average natural gas production of approximately 160 MMcf/d, showcasing the scale of this revenue stream.

Additionally, Spartan Delta utilizes commodity derivatives to hedge against price volatility, which can result in realized gains that contribute to adjusted funds flow and revenue predictability. The company also benefits from proceeds from asset divestitures, such as the sale of its Montney assets in 2024, which provide substantial, though irregular, capital injections.

| Revenue Source | 2024 Contribution (Illustrative) | Key Drivers |

| Crude Oil Sales | High | Duvernay production, market prices |

| Natural Gas Sales | Significant | Deep Basin production, 160 MMcf/d average in 2024 |

| Natural Gas Liquids (NGLs) | Lucrative | Duvernay focus, condensate, butane, propane value |

| Commodity Derivatives | Stabilizing | Hedging gains, Q1 2024 positive contribution |

| Asset Divestitures | Infrequent, Large | Montney asset sale in 2024 |

Business Model Canvas Data Sources

The Spartan Delta Business Model Canvas is built upon a foundation of robust market research, internal financial data, and competitive intelligence. These diverse data sources ensure a comprehensive and accurate representation of the business's strategic framework.