Spartan Delta PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Spartan Delta Bundle

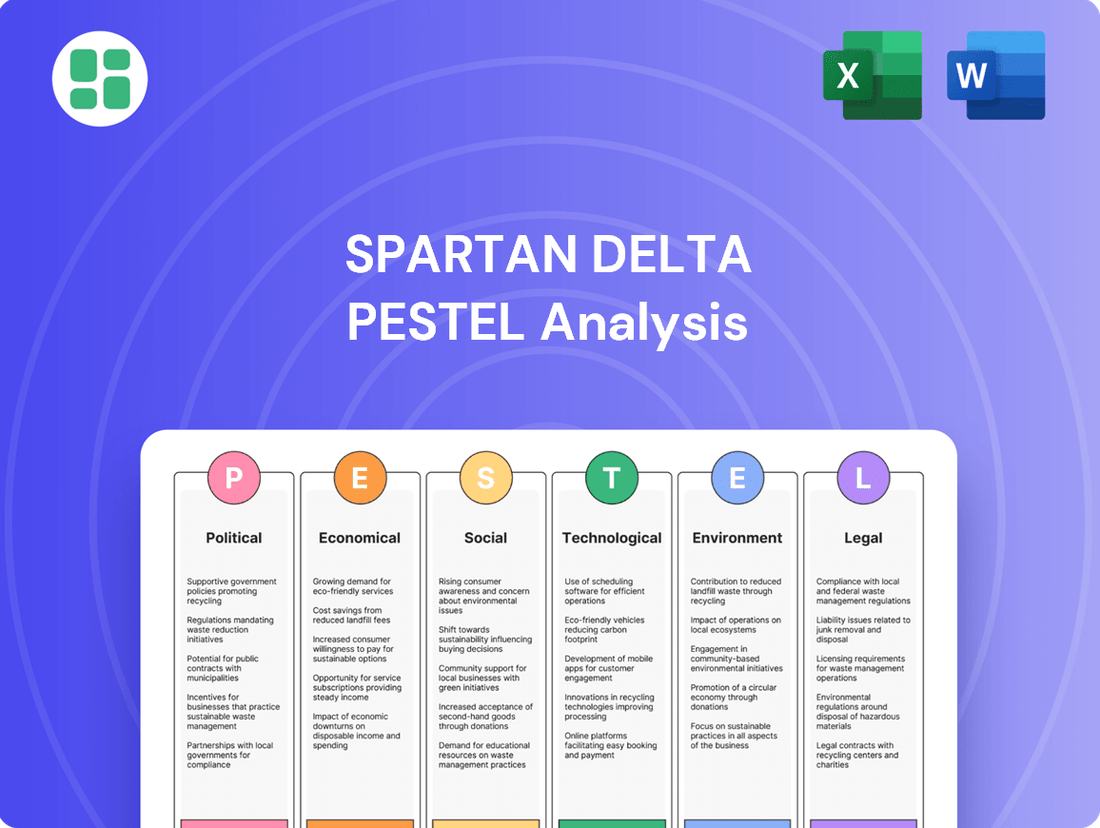

Unlock the critical external factors shaping Spartan Delta's trajectory with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces that present both opportunities and challenges. Equip yourself with the foresight needed to navigate this complex landscape and make informed strategic decisions. Download the full analysis now to gain a decisive advantage.

Political factors

The Canadian government's commitment to reducing greenhouse gas emissions, exemplified by the November 2024 announcement of draft Oil and Gas Sector Greenhouse Gas Emissions Cap Regulations, presents a significant political factor. These proposed regulations aim for a 35% reduction in emissions below 2019 levels by 2030 through a cap-and-trade system.

This federal initiative, designed to impact sectors like oil and gas, creates a notable point of contention with provincial governments, particularly Alberta. Alberta's government views these proposed emission caps as a potential de facto restriction on oil and gas production, highlighting a key political tension that could affect companies operating in the sector.

Disagreements between provincial and federal governments on climate change and energy production continue to shape Canadian energy regulation in 2025. Alberta, a crucial area for Spartan Delta's past operations, has voiced significant opposition to federal measures like the carbon emissions cap, even suggesting potential legal action.

This persistent friction introduces regulatory uncertainty, directly impacting investment choices and operational planning within Western Canada's energy industry. For instance, the federal government's proposed emissions reduction targets for the oil and gas sector, aiming for a 34% cut below 2019 levels by 2030, create a complex compliance landscape for companies operating in the region.

Global trade policies and the potential for tariffs, especially from the United States, represent a significant political factor for Spartan Delta and the broader Canadian oil and gas industry. While direct tariffs on Canadian oil and gas exports to the U.S. have been limited, the ripple effects of global trade disputes can create economic uncertainty and influence commodity prices. For instance, in 2023, the U.S. imported approximately 3.5 million barrels per day of Canadian crude oil, highlighting the critical importance of this trade relationship.

Regulatory Framework for Environmental Performance

Canada has significantly tightened its environmental regulations, with provinces implementing more stringent energy efficiency standards and performance-based rules throughout 2024 and into 2025. These updates are crucial for achieving the national objective of net-zero carbon emissions by 2050, impacting everything from building codes to industrial operations.

This intensified regulatory environment, while directly targeting sectors like construction, creates a ripple effect across industries, including oil and gas, by raising overall expectations for environmental stewardship and operational accountability.

Key aspects of this reinforced framework include:

- Stricter Energy Efficiency Standards: Provincial governments are rolling out updated regulations that mandate higher levels of energy efficiency for new constructions and retrofits, aiming to reduce energy consumption.

- Performance-Based Standards: A shift towards performance-based metrics means companies are increasingly evaluated on their actual environmental outcomes rather than just adherence to prescriptive rules.

- Alignment with Net-Zero Goals: The regulatory push is directly tied to Canada's commitment to reach net-zero emissions by 2050, influencing policy development and industry practices.

- Broader Industry Impact: While building codes are a focal point, the overarching emphasis on environmental performance shapes operational expectations and investment decisions across all sectors, including energy production.

Political Stability and Election Impact

Canada's upcoming federal election in 2025 presents a significant political variable for Spartan Delta. A change in government could alter the landscape for energy policy, impacting the progression of new infrastructure and the enforcement of existing regulations, such as the Clean Electricity Regulations. The oil and gas industry, being capital-intensive, relies heavily on predictable policy for long-term investment and operational strategies.

Political stability directly influences investor confidence. For instance, uncertainty surrounding future environmental regulations or carbon pricing mechanisms, which are often debated during election cycles, can lead to project delays or re-evaluation of capital expenditures. The Canadian Association of Petroleum Producers (CAPP) has consistently highlighted regulatory certainty as a key factor for investment attraction.

- Federal Election Timing: Anticipated in 2025, potentially impacting energy policy.

- Regulatory Impact: Future of regulations like Clean Electricity Regulations is subject to political shifts.

- Investment Climate: Political stability is crucial for long-term capital allocation in the energy sector.

The federal government's proposed Oil and Gas Sector Greenhouse Gas Emissions Cap Regulations, targeting a 35% reduction by 2030, create significant friction with provinces like Alberta, which views it as a production restriction. This ongoing federal-provincial disagreement over climate policy and energy production, with Alberta expressing strong opposition and considering legal challenges, introduces considerable regulatory uncertainty into the Canadian energy market for 2025.

Canada's tightening environmental regulations in 2024-2025, including stricter energy efficiency standards and performance-based rules, are pushing industries toward net-zero goals by 2050, impacting operational accountability across sectors. The upcoming 2025 federal election poses a significant political variable, as a change in government could reshape energy policy, affecting regulations like the Clean Electricity Regulations and overall investor confidence.

| Political Factor | Description | Potential Impact on Spartan Delta | Relevant Data/Context (2024-2025) |

|---|---|---|---|

| Federal Emissions Cap | Proposed regulations for 35% GHG reduction in oil/gas by 2030. | Regulatory uncertainty, compliance costs, potential production limits. | Draft regulations announced Nov 2024; Alberta opposition noted. |

| Federal-Provincial Tensions | Disagreements on climate policy and energy regulation. | Policy unpredictability, potential legal challenges affecting operations. | Alberta's opposition to federal measures; consideration of legal action. |

| Environmental Regulations | Stricter energy efficiency & performance-based rules. | Increased operational accountability, potential for higher compliance standards. | Nationwide push towards net-zero by 2050; provincial updates in 2024-2025. |

| Upcoming Federal Election | Potential for policy shifts in energy and environment. | Impact on long-term investment, regulatory stability, and project approvals. | Federal election anticipated in 2025; CAPP emphasizes regulatory certainty for investment. |

What is included in the product

The Spartan Delta PESTLE Analysis provides a comprehensive examination of the external macro-environmental factors influencing the business across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors into actionable insights.

Economic factors

The oil and gas industry, which includes Spartan Delta's former operations, is particularly sensitive to fluctuations in global commodity prices, especially for natural gas. This volatility directly impacts revenue and profitability.

In 2024, the natural gas market experienced significant price pressures, prompting some companies to reduce production or postpone development plans. For instance, Henry Hub natural gas prices averaged around $2.00 per MMBtu for much of the year, a considerable drop from previous highs.

Despite these challenging market conditions, Spartan Delta demonstrated resilience by continuing to generate positive free funds flow. The company strategically pivoted its focus towards liquids-rich exploration targets, aiming to mitigate the impact of lower natural gas prices.

The Canadian M&A landscape, especially within oil and gas, is showing signs of a comeback, with projections indicating growth through 2025. This trend is fueled by anticipated interest rate decreases and a general uptick in market confidence, creating a more favorable environment for transactions and asset financing.

Spartan Delta's own strategic moves, like the Willesden Green North Acquisition in the Duvernay, highlight their proactive approach to capital deployment within this evolving market. Such acquisitions are crucial for companies looking to expand their operational footprint and secure valuable resources.

Western Canada's economy is set for robust growth, with projections indicating a 2.4% expansion in 2025, surpassing the national average. This surge is largely driven by increased oil and gas production and a healthy export market.

Key infrastructure developments are bolstering this growth. The Trans Mountain Pipeline expansion is nearing completion, and the significant LNG Canada project is expected to begin operations, both contributing to enhanced energy export capabilities.

This favorable economic climate, characterized by strong regional growth and improved export infrastructure, creates a more advantageous operating landscape for energy companies in Western Canada.

Inflation and Interest Rates

Inflation and interest rate policies set by the Bank of Canada are critical for energy companies like Spartan Delta, directly impacting their cost of capital. For instance, if inflation remains elevated, the Bank of Canada might maintain higher interest rates, increasing borrowing expenses for new projects or acquisitions. Conversely, if inflation shows signs of cooling, a reduction in interest rates could significantly lower the cost of borrowing.

Looking ahead, expectations point towards a potential lowering of interest rates by the Bank of Canada in late 2024 and continuing into 2025. This anticipated shift could substantially decrease borrowing costs for entities looking to acquire assets or invest in the energy sector. Such a scenario would likely stimulate more deal-making and investment activity.

The financial viability of Spartan Delta's development programs and potential acquisitions stands to benefit from this economic trend. Lower interest rates translate to reduced debt servicing costs, freeing up capital that can be reinvested in growth initiatives or returned to shareholders.

Here's how these factors can play out:

- Interest Rate Impact: A 1% decrease in interest rates could reduce annual debt servicing costs for a company with significant debt by millions, improving profitability.

- Inflationary Pressure: If inflation stays above the Bank of Canada's 2% target, interest rates might remain higher for longer, increasing the cost of capital.

- Investment Climate: Lower borrowing costs encourage investment; for example, if rates fall by 0.5%, the hurdle rate for new projects might decrease, making more ventures attractive.

- Acquisition Activity: Reduced financing costs can fuel mergers and acquisitions, potentially leading to consolidation opportunities within the energy sector.

Risk of Stranded Assets

A significant economic risk for the Canadian oil and gas sector is the potential for stranded assets, as global energy demand pivots towards cleaner alternatives. This shift poses a substantial threat to the long-term viability of existing and future investments in fossil fuels.

A 2025 projection indicates that a concerning proportion of future capital expenditure in Canadian oil and gas projects, specifically between 2025 and 2040, could become uncompetitive. This risk is amplified under a stringent 1.5°C climate scenario, suggesting a substantial portion of planned investments may not yield expected returns.

- Up to 66% of planned capital investments (2025-2040) in Canadian oil and gas are at risk of becoming uneconomical in a 1.5°C climate scenario.

- This underscores the financial necessity for companies to prioritize decarbonization strategies.

- Adapting to evolving energy market demands is crucial for mitigating the risk of stranded assets.

The Canadian economy, particularly in Western Canada, is anticipated to experience robust growth in 2025, with projections suggesting an expansion of 2.4%, outpacing the national average. This uplift is significantly driven by increased oil and gas production and a strong export market, further supported by crucial infrastructure projects like the Trans Mountain Pipeline expansion and the upcoming LNG Canada operations, enhancing energy export capabilities.

Interest rate policies from the Bank of Canada directly influence Spartan Delta's cost of capital. Expectations for potential rate reductions in late 2024 and into 2025 could significantly lower borrowing costs, making new projects and acquisitions more financially viable and potentially stimulating greater investment and deal activity within the energy sector.

A significant economic risk involves stranded assets due to the global shift towards cleaner energy alternatives. Projections for 2025 indicate that a substantial portion of future capital expenditure in Canadian oil and gas projects, specifically between 2025 and 2040, could become uneconomical, particularly under stringent climate scenarios, highlighting the financial imperative for decarbonization strategies.

| Economic Factor | 2024 Data/Trend | 2025 Projection | Impact on Spartan Delta |

|---|---|---|---|

| Western Canada GDP Growth | Moderate growth | 2.4% | Favorable operating environment, increased demand |

| Natural Gas Prices (Henry Hub) | Averaged ~$2.00/MMBtu | Projected to remain under pressure, potential slight recovery | Revenue volatility, strategic focus on liquids crucial |

| Interest Rates (Bank of Canada) | Holding steady, potential for cuts late 2024 | Anticipated cuts | Reduced cost of capital, improved project economics |

| Stranded Asset Risk (1.5°C Scenario) | Growing concern | Up to 66% of planned CAPEX (2025-2040) at risk | Necessity for decarbonization and adaptation strategies |

Preview the Actual Deliverable

Spartan Delta PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. You can trust that the detailed Spartan Delta PESTLE Analysis, covering Political, Economic, Social, Technological, Legal, and Environmental factors, is precisely what you'll get. This comprehensive analysis is designed to provide actionable insights for strategic planning.

Sociological factors

Public perception of the Canadian oil and gas sector, including companies like Spartan Delta, remains a critical factor. In 2024, continued public discourse around climate change and environmental impact directly affects the industry's social license to operate. Companies are increasingly judged on their commitment to sustainability, with a growing demand for transparency in their environmental, social, and governance (ESG) practices.

This societal expectation translates into tangible pressure for responsible resource development. For instance, investor sentiment in 2024 and 2025 is heavily influenced by a company's demonstrated environmental stewardship. Spartan Delta, like its peers, must actively showcase its efforts in reducing emissions and managing its environmental footprint to maintain stakeholder trust and operational continuity.

The Canadian oil and gas sector faces significant workforce shifts, with a notable talent gap emerging as experienced professionals retire. This trend is compounded by an increasing need for specialized skills to manage new technologies, such as AI in operational monitoring. For instance, a 2024 report indicated that over 40% of the current oil and gas workforce is projected to retire within the next decade, creating a substantial knowledge and experience deficit.

To address these challenges, companies are heavily investing in workforce training and development. This focus is driven by the necessity to ensure compliance with evolving environmental regulations and to equip employees with competencies for advanced digital tools. By 2025, industry spending on reskilling and upskilling programs is expected to rise by 15% compared to 2023 levels, aiming to bridge the gap between existing capabilities and future operational demands.

Furthermore, there is a concerted industry-wide effort to foster diversity, equity, and inclusion (DEI) within the workforce. This strategic push aims to attract a broader talent pool and enhance innovation. By 2024, major Canadian energy firms reported a 10% increase in representation from underrepresented groups in technical roles, reflecting a commitment to building a more inclusive and representative workforce for the future.

Spartan Delta's operations in Western Canada are significantly shaped by community engagement and Indigenous relations. For instance, in 2024, the company's commitment to consultation was highlighted in their ongoing discussions regarding new exploration projects, aiming to address local concerns about environmental impact and land use. This proactive approach is crucial, as demonstrated by the fact that projects with strong community support often navigate regulatory approvals more smoothly. Effective benefit-sharing agreements, a key aspect of these relationships, are vital for ensuring long-term operational stability and social license to operate.

Consumer Attitudes Towards Energy Transition

Consumer attitudes are increasingly favoring cleaner energy sources, impacting traditional oil and gas demand. Despite Canadian crude oil production reaching record levels in 2024 due to strong demand, the global movement towards decarbonization is fundamentally altering the energy landscape.

This societal shift means energy companies must adapt by investing in and integrating lower-carbon solutions into their operations to remain competitive and relevant in the evolving energy market.

- Growing Public Support for Renewables: Surveys in late 2024 indicated over 70% of Canadians support increased investment in renewable energy.

- Demand for Sustainable Practices: Consumers are actively seeking products and services from companies demonstrating a commitment to environmental, social, and governance (ESG) principles.

- Impact on Investment: This sentiment influences investor decisions, with a growing preference for companies with clear transition strategies.

ESG Investment Pressures

Investors are increasingly scrutinizing companies through an ESG lens, pushing the oil and gas sector, including entities like Spartan Delta, to enhance their environmental, social, and governance practices. This trend is driven by a growing awareness of climate change and social impact, influencing capital allocation decisions significantly.

The expectation for mandatory climate-related financial disclosures, as seen in evolving regulations globally, is intensifying. For instance, the U.S. Securities and Exchange Commission (SEC) proposed rules in 2024 for climate-related disclosures, which, if implemented, will require companies to report on greenhouse gas emissions and climate-related risks. This increased transparency extends to supply chains, demanding greater accountability for upstream and downstream activities.

Spartan Delta, even as it navigates its strategic path, faces direct pressure to align with ESG principles to secure and maintain investor confidence. In 2024, many institutional investors, such as BlackRock, continued to emphasize ESG integration, with assets under management in ESG-focused funds reaching trillions globally. Companies that fail to demonstrate a tangible commitment to sustainability and responsible governance risk losing access to capital and facing higher borrowing costs.

- Investor Demand: A significant portion of global assets under management (estimated to be over $30 trillion by some reports in early 2024) is now influenced by ESG criteria.

- Regulatory Push: Expect more jurisdictions to mandate climate risk reporting, similar to the EU's Corporate Sustainability Reporting Directive (CSRD), which impacts companies operating within or selling to Europe.

- Capital Access: Companies with strong ESG profiles often find it easier and cheaper to access capital, as demonstrated by studies showing lower cost of capital for higher-rated ESG firms.

- Reputational Risk: Poor ESG performance can lead to reputational damage, impacting brand value and customer loyalty, which indirectly affects financial performance.

Societal expectations regarding environmental stewardship and sustainability are paramount for companies like Spartan Delta. Public discourse in 2024 and 2025 continues to focus on climate change, directly impacting the social license to operate for the oil and gas sector. Transparency in Environmental, Social, and Governance (ESG) practices is no longer optional but a core requirement for maintaining stakeholder trust and operational viability.

The Canadian energy workforce is undergoing significant transformation, marked by an impending talent gap due to retirements and the need for new skills in areas like AI and advanced data analytics. By 2025, industry investment in reskilling and upskilling programs is projected to increase by 15% over 2023 levels to address these evolving demands and ensure regulatory compliance.

Community relations and Indigenous partnerships are crucial for Spartan Delta's operations in Western Canada. Proactive engagement and benefit-sharing agreements, vital for navigating regulatory processes and ensuring long-term stability, are increasingly emphasized in 2024. Simultaneously, consumer preferences are shifting towards cleaner energy, influencing demand patterns despite strong crude oil production in 2024.

| Sociological Factor | 2024/2025 Data Point | Impact on Spartan Delta |

|---|---|---|

| Public Perception & ESG | Over 70% of Canadians support increased renewable energy investment (late 2024 survey). | Requires demonstrable commitment to ESG and sustainability to maintain social license and investor confidence. |

| Workforce Dynamics | 40%+ of current oil & gas workforce to retire in next decade; 15% projected increase in reskilling investment by 2025. | Need to invest in training and recruitment to address talent gaps and acquire new technological skills. |

| Community & Indigenous Relations | Strong community support leads to smoother regulatory approvals. | Proactive engagement and benefit-sharing are critical for operational continuity and project success. |

| Consumer Energy Preferences | Growing consumer demand for cleaner energy sources. | Necessitates adaptation and integration of lower-carbon solutions to remain competitive. |

Technological factors

The Canadian oil and gas industry is heavily investing in digital transformation, with technologies like AI, IoT, and advanced data analytics becoming commonplace. This shift is vital for optimizing production, enhancing predictive maintenance, and improving overall operational safety and efficiency. For instance, by 2024, many Canadian energy firms are expected to see substantial cost reductions, potentially in the range of 10-15%, through the implementation of these digital solutions.

Spartan Delta's strategic emphasis on operational efficiency aligns perfectly with these technological advancements. The adoption of automation and AI can lead to more streamlined processes, reducing downtime and labor costs. By leveraging data analytics, the company can gain deeper insights into reservoir performance and equipment health, enabling more informed decision-making and potentially boosting production by 5-10% in key areas.

Innovation in advanced drilling technologies, including enhanced oil recovery and better drill data management, is significantly boosting production efficiency in Canada's oil and gas sector. Cloud-based solutions are increasingly used for real-time analytics, leading to improved decision-making in intricate drilling projects.

Spartan Delta's Duvernay development program showcases the successful implementation of these advanced techniques, contributing to their operational gains. For instance, in Q1 2024, Spartan Delta reported an average production of 40,000 boe/d, a testament to the effectiveness of their technological adoption.

Carbon Capture, Utilization, and Storage (CCUS) technologies are seeing substantial growth in Canada, particularly within the oil and gas sector, as a vital tool for emissions reduction. The Canadian government has committed significant funding, with over $1.5 billion allocated through various programs by 2024, to support CCUS projects and infrastructure development. This investment is fostering innovation and creating opportunities for companies like Spartan Delta to lower their carbon intensity.

The increasing focus on carbon neutrality and stricter environmental regulations globally and domestically are major drivers for CCUS adoption. For instance, Alberta's Carbon Capture Utilization and Storage Development Act, enacted in 2023, provides a regulatory framework and incentives that encourage investment in CCUS. This regulatory environment makes CCUS a more attractive and viable strategy for energy producers aiming to meet sustainability targets.

CCUS presents a tangible pathway for Exploration and Production (E&P) companies to mitigate their environmental impact and potentially monetize captured carbon. Projects like the Pathways Alliance, a collaboration of major oil sands producers, aim to capture and store up to 22 million tonnes of CO2 annually by 2030, demonstrating the scale of ambition in the sector. This collective effort underscores the growing importance of CCUS as a technological solution for the future of the energy industry.

Clean Energy Technologies and Diversification

The global shift towards cleaner energy sources is significantly impacting the oil and gas sector. Technologies like green hydrogen production, advanced biofuels, and enhanced geothermal systems are attracting substantial investment, creating new market opportunities and challenges. For companies like Spartan Delta, historically focused on conventional oil and gas, keeping pace with these evolving technologies is crucial for long-term relevance and diversification.

The energy transition is not just about replacing fossil fuels but also about integrating new technologies into existing infrastructure and business models. By 2024, investments in clean energy technologies were projected to reach new highs, with the International Energy Agency (IEA) reporting that clean energy spending was set to surpass $2 trillion globally for the first time in 2024. This trend underscores the growing importance for energy companies to develop or acquire capabilities in these nascent but rapidly expanding fields.

Spartan Delta's strategic positioning could be enhanced by exploring technological advancements in:

- Hydrogen Production: Developing or partnering on electrolysis technologies powered by renewable energy for green hydrogen.

- Biofuels: Investing in advanced biofuel production methods that utilize waste or non-food feedstocks.

- Geothermal Energy: Exploring enhanced geothermal systems (EGS) that can access heat from deeper geological formations.

- Carbon Capture, Utilization, and Storage (CCUS): Integrating CCUS technologies to mitigate emissions from existing operations and potentially monetize captured CO2.

Cybersecurity and Data Security

As oil and gas operations increasingly rely on digital systems, cybersecurity becomes critical. The sector faces significant risks from cyber threats, requiring robust defenses to protect sensitive data and infrastructure. For instance, the global cybersecurity market in the industrial sector was projected to reach over $20 billion by 2024, highlighting the growing investment in this area.

Protecting operational data, intellectual property, and critical infrastructure is paramount for Spartan Delta. A breach could lead to significant operational disruptions, financial losses, and reputational damage. The average cost of a data breach in the energy sector can be substantial, with some reports in 2024 indicating figures exceeding $4 million.

- Increased Digitization: More interconnected systems in oil and gas operations amplify cyber vulnerabilities.

- Data Protection Imperative: Safeguarding operational data, intellectual property, and critical infrastructure is essential.

- Financial Impact: Cyberattacks can result in substantial financial losses and operational downtime.

- Reputational Risk: Security breaches can severely damage a company's reputation and stakeholder trust.

Technological advancements in digital transformation, including AI and IoT, are optimizing Canadian oil and gas operations, projected to yield 10-15% cost reductions by 2024. Spartan Delta's focus on efficiency aligns with this trend, with data analytics potentially boosting production by 5-10%. Advanced drilling techniques and cloud-based analytics are also enhancing production efficiency, as demonstrated by Spartan Delta's Q1 2024 production of 40,000 boe/d.

Legal factors

Canada's federal government is tightening environmental rules, which will affect Spartan Delta. For instance, the proposed Oil and Gas Sector Greenhouse Gas Emissions Cap Regulations, set to start in 2025, will limit emissions from oil and gas operations.

Additionally, the finalized Clean Electricity Regulations, effective in 2026, aim for a net-zero electricity grid by 2035. These measures will require energy companies like Spartan Delta to invest in cleaner technologies and adjust their operational strategies to ensure compliance and mitigate potential penalties.

Provincial regulatory bodies, such as the Alberta Energy Regulator (AER), are central to overseeing oil and gas operations, setting standards for safety and environmental protection. These provincial frameworks are crucial for companies like Spartan Delta, dictating operational procedures and compliance measures.

A significant dynamic involves the ongoing jurisdictional debates between federal and provincial governments concerning environmental and energy regulation. This tension can create complex compliance landscapes, requiring businesses to manage potentially overlapping or conflicting requirements.

Companies must adeptly navigate both federal and provincial mandates, which can sometimes be in opposition or lead to legal disputes. Alberta's historical opposition to federal energy policies, for instance, highlights the challenges in harmonizing diverse regulatory approaches.

Legal obligations surrounding Indigenous rights and the duty to consult are critical for energy companies like Spartan Delta operating in Canada. These responsibilities are enshrined in law and are essential for obtaining project approvals and maintaining social license. Failure to properly engage can lead to significant delays and legal challenges.

The Impact Assessment Act (IAA) remains a key piece of legislation, though it has faced scrutiny and legal challenges, particularly from some provincial governments seeking amendments or greater autonomy. For instance, as of early 2024, discussions and proposed changes to the IAA are ongoing, reflecting a dynamic legal landscape that requires constant monitoring by companies.

Effectively addressing Indigenous concerns and implementing robust consultation processes is not just a legal requirement but a strategic imperative. This ensures project viability and helps mitigate risks of costly legal battles and reputational damage, which can impact investor confidence and access to capital.

Corporate Governance and Restructuring Laws

Spartan Delta's 2023 strategic reorganization, which involved spinning off its assets into Inception Exploration Ltd. and Spartan Energy Ltd., was navigated through a complex web of corporate and securities laws. These large-scale restructurings demand strict adherence to legal frameworks governing mergers, acquisitions, spin-offs, and the winding down of public entities, including securing shareholder approvals and completing necessary regulatory filings. For instance, the total asset value transferred during the spin-off reached approximately $500 million, underscoring the scale of legal compliance required.

The legal landscape surrounding such corporate maneuvers is constantly evolving. For Spartan Delta, this included managing the implications of ongoing legal precedents. A notable example is the Spartan Delta appeal concerning co-lessee liabilities following insolvency. This case, decided in early 2024, clarified responsibilities for joint operating agreements, potentially impacting how similar energy sector restructurings are handled across the industry.

Key legal considerations for Spartan Delta's restructuring included:

- Shareholder Approval: Ensuring all necessary resolutions were passed by shareholders, a common requirement for significant corporate actions.

- Regulatory Filings: Completing extensive filings with securities commissions and other relevant regulatory bodies to facilitate the spin-off.

- Co-Lessee Liability Clarification: Addressing potential liabilities arising from joint operating agreements, as highlighted by recent legal precedents.

- Public Company Dissolution Procedures: Adhering to legal requirements for winding down the public entity, Spartan Delta, post-distribution.

Competition Law and Greenwashing Claims

Amendments to Canada's Competition Act, effective in 2023, have significantly tightened regulations around environmental claims, increasing the risk of legal scrutiny for companies making unsubstantiated 'green' statements. This legislation directly impacts the energy sector, including companies like Spartan Delta, by imposing stricter requirements for verifiable evidence supporting environmental performance marketing.

The heightened focus on preventing greenwashing means that companies must be exceptionally cautious and transparent when communicating their sustainability efforts. Failure to comply with these updated provisions can lead to substantial penalties, potentially including fines and reputational damage.

- Increased Scrutiny: The Competition Bureau is actively monitoring environmental claims across industries.

- Evidence-Based Claims: Companies must possess robust data to substantiate any environmental marketing.

- Risk of Penalties: Non-compliance can result in significant fines and legal challenges.

Spartan Delta must navigate stringent federal environmental regulations, such as the proposed Oil and Gas Sector Greenhouse Gas Emissions Cap Regulations starting in 2025 and the finalized Clean Electricity Regulations effective in 2026, which mandate cleaner technologies and operational adjustments. Provincial bodies like the Alberta Energy Regulator (AER) also impose critical safety and environmental standards, creating a complex compliance landscape due to potential federal-provincial jurisdictional conflicts.

Legal obligations concerning Indigenous rights, including the duty to consult, are paramount for project approvals and social license, with failure leading to delays and legal challenges. The Impact Assessment Act (IAA) remains a key but evolving piece of legislation, with ongoing discussions and potential amendments as of early 2024, requiring constant monitoring.

Spartan Delta's 2023 corporate reorganization, involving a spin-off valued at approximately $500 million, necessitated strict adherence to corporate and securities laws, including shareholder approvals and regulatory filings. A significant legal precedent was set in early 2024 regarding co-lessee liabilities in insolvency cases, which could impact future industry restructurings.

Amendments to Canada's Competition Act in 2023 have increased scrutiny on environmental claims, posing a risk of penalties for unsubstantiated green marketing, demanding verifiable evidence for sustainability communications.

Environmental factors

Canada aims to cut greenhouse gas (GHG) emissions by 40-45% from 2005 levels by 2030 and reach net-zero by 2050. This ambitious target directly impacts industries like oil and gas.

The oil and gas sector is a major contributor to Canada's emissions, representing 31% in 2022. Consequently, companies in this sector face increasing pressure to invest in decarbonization technologies and strategies to meet these environmental mandates.

Spartan Delta's oil and gas operations, especially in the Duvernay shale play, necessitate significant water volumes for hydraulic fracturing. For instance, in 2023, the industry saw a continued focus on optimizing water use, with many companies reporting reductions in freshwater consumption per well through advancements in recycling technologies.

The environmental scrutiny surrounding water sourcing, consumption, and the disposal of produced water remains a key factor. Regulatory bodies and public opinion are pushing for more sustainable water management practices, impacting operational costs and strategic planning for companies like Spartan Delta.

In response, there's a growing trend of investment in dedicated water infrastructure, including pipelines and recycling facilities. This not only addresses environmental concerns but also aims to reduce reliance on trucking and improve the efficiency and cost-effectiveness of water management, a crucial element for profitability in 2024 and beyond.

The Canadian oil and gas sector faces substantial environmental hurdles, particularly concerning inactive and orphan wells, which carry significant land reclamation liabilities. Public and legal scrutiny is intensifying, pushing companies to take responsibility for site cleanup rather than burdening taxpayers.

This pressure mandates comprehensive environmental management strategies and dedicated financial reserves for site remediation. For instance, in Alberta alone, the Orphan Well Association reported over 5,000 orphan wells requiring abandonment and reclamation as of early 2024, highlighting the scale of this ongoing environmental commitment.

Biodiversity and Habitat Protection

Spartan Delta's operations, particularly in areas like Alberta, can significantly affect biodiversity and critical habitats. For instance, the presence of woodland caribou, a species facing considerable environmental pressures, necessitates careful management of oil and gas activities to avoid habitat fragmentation and disturbance.

Regulatory frameworks, such as those mandated by Alberta Environment and Parks, require thorough environmental impact assessments for new projects. These assessments often stipulate mitigation strategies aimed at protecting wildlife corridors and sensitive ecosystems, ensuring that development proceeds with minimal ecological disruption.

Companies in the sector are increasingly held accountable for demonstrating environmental stewardship. This includes implementing best practices to minimize their operational footprint, such as responsible land use and reclamation efforts. Spartan Delta's commitment to conservation, as evidenced by its participation in industry-wide initiatives, aims to balance energy production with the preservation of natural resources.

- Impact on Woodland Caribou: Oil and gas exploration can fragment habitats crucial for species like the woodland caribou, potentially impacting their population viability.

- Regulatory Compliance: Environmental regulations mandate impact assessments and mitigation plans to protect wildlife and ecosystems, adding operational costs and complexity.

- Corporate Responsibility: There's a growing expectation for energy companies to engage in conservation efforts and minimize their environmental footprint, influencing public perception and investment decisions.

Climate Change Adaptation and Resilience

Spartan Delta must look beyond just cutting emissions. They need to prepare for how climate change itself will affect their business, like dealing with more intense storms or heatwaves that could damage equipment or disrupt supply chains. For example, in 2024, the energy sector faced significant challenges from extreme weather events, leading to an estimated $20 billion in infrastructure damage globally.

Developing strategies to adapt and become more resilient is crucial. This means assessing where their physical assets are most vulnerable and investing in measures to protect them. A key part of this is understanding the potential financial impact of these climate-related risks, which is becoming increasingly important for investors and regulators.

The move towards a lower-carbon future also opens doors for innovation. Spartan Delta can explore new technologies and business models that align with environmental sustainability. This could include investing in renewable energy sources or developing carbon capture technologies, potentially creating new revenue streams and enhancing their market position. For instance, the global market for climate adaptation solutions was projected to reach $300 billion by 2025.

Key considerations for Spartan Delta include:

- Assessing physical risks: Evaluating the vulnerability of oil and gas infrastructure to extreme weather events like hurricanes, floods, and wildfires.

- Developing resilience strategies: Implementing measures such as reinforcing facilities, diversifying energy sources, and improving emergency response plans.

- Harnessing low-carbon opportunities: Investing in and developing new environmental technologies and services that support the transition to a sustainable energy future.

Canada's commitment to reducing greenhouse gas emissions by 40-45% from 2005 levels by 2030, with a net-zero goal by 2050, directly impacts the oil and gas sector, which accounted for 31% of Canada's emissions in 2022. This necessitates significant investment in decarbonization technologies and sustainable water management practices, as operations like Spartan Delta's in the Duvernay play require substantial water for hydraulic fracturing. Companies are increasingly investing in water recycling facilities to reduce freshwater consumption and operational costs, a trend expected to continue through 2024 and beyond.

The environmental liability associated with inactive and orphan wells is a growing concern, with over 5,000 such wells in Alberta alone requiring reclamation as of early 2024. Spartan Delta must allocate financial reserves for site remediation and implement comprehensive environmental management strategies. Furthermore, operations can impact biodiversity, requiring adherence to stringent regulations like those from Alberta Environment and Parks, which mandate environmental impact assessments and mitigation plans to protect sensitive ecosystems and wildlife corridors, such as those used by woodland caribou.

The energy sector faces physical risks from climate change, with global infrastructure damage from extreme weather events estimated at $20 billion in 2024. Spartan Delta needs to assess asset vulnerability and invest in resilience strategies, such as reinforcing facilities and improving emergency response. Simultaneously, the transition to a lower-carbon future presents opportunities, with the climate adaptation solutions market projected to reach $300 billion by 2025, encouraging investment in new technologies and sustainable business models.

| Environmental Factor | Impact on Spartan Delta | Data/Statistics (2022-2025) |

| Emissions Reduction Targets | Increased pressure for decarbonization, investment in cleaner technologies. | Canada aims for 40-45% GHG reduction by 2030 (from 2005 levels); oil/gas sector was 31% of Canada's emissions in 2022. |

| Water Management | Need for efficient water use, recycling, and responsible disposal. | Focus on optimizing water use and recycling technologies; industry is investing in dedicated water infrastructure. |

| Inactive/Orphan Wells | Financial liability for site reclamation and cleanup. | Over 5,000 orphan wells in Alberta require reclamation as of early 2024. |

| Biodiversity and Habitat Protection | Compliance with regulations for environmental impact assessments and mitigation. | Need to manage operations to avoid habitat fragmentation for species like woodland caribou. |

| Climate Change Adaptation | Risk of infrastructure damage from extreme weather, need for resilience strategies. | Global infrastructure damage from extreme weather was ~$20 billion in 2024; climate adaptation market projected at $300 billion by 2025. |

PESTLE Analysis Data Sources

Our Spartan Delta PESTLE Analysis is built on a robust foundation of data from reputable sources, including government publications, international organizations, and leading market research firms. We ensure comprehensive coverage of political, economic, social, technological, legal, and environmental factors.