Smulders Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Smulders Group Bundle

The Smulders Group demonstrates significant strengths in its integrated approach and specialized expertise within the offshore industry. However, understanding the nuances of its market opportunities and potential threats is crucial for strategic decision-making.

Want the full story behind the company’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Smulders Group excels in engineering, constructing, and assembling heavy, complex steel structures. This deep specialization ensures high quality and reliability, setting them apart from competitors. Their proven track record in design and build projects across civil, industrial, and offshore wind sectors highlights their capacity to tackle demanding initiatives.

Smulders Group benefits from a dominant position in the burgeoning offshore wind market, especially within Europe. They are recognized as a market leader for critical components like foundations and substations, a testament to their expertise and established reputation.

This leadership is further solidified by substantial recent contract wins, including significant projects for the Bałtyk 2 and 3 offshore wind farms. These agreements contributed to an impressive order intake exceeding €1 billion for 2024, demonstrating their strong commercial momentum and market penetration.

This strategic focus on offshore wind aligns perfectly with the global acceleration towards renewable energy sources. It positions Smulders Group for sustained growth and continued success as the demand for clean energy infrastructure intensifies.

Smulders excels in offering complete turnkey Engineering, Procurement, and Construction (EPC) solutions. This means they can handle every stage of a project, from initial design through to final commissioning, all within their own operations. This integrated capability, bolstered by ongoing investments in electrical and mechanical engineering expertise, significantly cuts down on the need for external subcontractors.

By managing the entire project lifecycle internally, Smulders gains greater control over quality, timelines, and costs. This comprehensive approach is particularly beneficial for large-scale steel projects, where efficiency and cost-effectiveness are paramount for successful delivery. For instance, in the offshore wind sector, their ability to deliver fully integrated substations and foundations demonstrates this strength.

Strong Affiliation with Eiffage Metal

Smulders' strong affiliation with Eiffage Metal, a leading European player in concessions and public works, provides significant advantages. This connection grants Smulders access to the extensive resources and operational synergies of a larger, established group, enabling them to tackle more complex and integrated projects. The backing of Eiffage Metal bolsters Smulders' financial stability and strategic reach, enhancing their capacity for substantial undertakings.

This integration into the Eiffage Group, which reported revenues of €22.4 billion in 2023, directly translates into increased credibility and a greater ability for Smulders to secure and execute large-scale international contracts. For instance, Eiffage's robust financial health and diversified portfolio offer a stable platform for Smulders' growth ambitions in sectors like offshore wind foundations.

- Access to Capital: Eiffage Metal's financial strength, evidenced by Eiffage's overall performance, provides Smulders with greater access to capital for investment in new technologies and capacity expansion.

- Project Synergies: Collaboration within the Eiffage Group allows Smulders to leverage expertise and resources across different divisions, leading to more efficient project execution.

- Market Credibility: The Eiffage brand enhances Smulders' reputation and trustworthiness in the market, particularly for high-value, complex projects.

- Risk Mitigation: Being part of a larger, diversified entity helps mitigate project-specific financial risks for Smulders.

International Presence and Production Facilities

Smulders boasts a significant international footprint with production facilities strategically located across Belgium, the Netherlands, Poland, and the UK. This expansive network allows them to effectively cater to a global customer base and streamline logistics for complex, large-scale projects. For instance, their ability to manufacture components in Poland and then conduct final assembly in Belgium or the Netherlands highlights a highly adaptable and efficient operational strategy, crucial for managing international offshore wind farm developments.

This multi-country operational model offers distinct advantages in managing diverse project requirements and optimizing supply chains. For example, in 2024, Smulders' Polish facility played a key role in fabricating components for several major European offshore wind projects, contributing to their competitive bidding and timely delivery schedules. Their facilities are equipped to handle the specialized needs of the offshore energy sector, from foundation fabrication to the assembly of transition pieces and substation components.

- Global Reach: Facilities in Belgium, Netherlands, Poland, and UK serve international clients.

- Optimized Logistics: Enables efficient management of large-scale, multi-site projects.

- Flexible Production: Components manufactured in one location, assembled in another, enhancing efficiency.

Smulders Group's primary strength lies in its specialized expertise in engineering, constructing, and assembling heavy, complex steel structures, particularly for the offshore wind sector. Their proven track record in delivering high-quality, reliable components like foundations and substations solidifies their market leadership. Recent contract wins, including for the Bałtyk 2 and 3 offshore wind farms, contributed to over €1 billion in order intake for 2024, underscoring their commercial momentum and deep market penetration.

What is included in the product

Delivers a strategic overview of Smulders Group’s internal and external business factors, highlighting its strengths in offshore wind and project execution, while identifying potential weaknesses in diversification and opportunities in emerging markets.

Uncovers hidden opportunities and mitigates risks by clearly outlining Smulders Group's strategic landscape.

Weaknesses

Smulders Group's significant reliance on steel as a primary input exposes it to the inherent volatility of raw material prices, such as iron ore and scrap metal. For instance, global steel prices saw considerable fluctuations throughout 2024, with benchmarks like the TSI North European Hot Rolled Coil Index experiencing periods of sharp ascent and descent, directly impacting Smulders' cost of goods sold.

These price swings directly affect production costs and can compress profitability margins if higher expenses cannot be effectively passed on to clients in project bids. The ability to manage this price volatility through strategic procurement and hedging mechanisms is therefore crucial for maintaining financial stability and predictable earnings.

Smulders Group operates in heavy steel construction and fabrication, sectors inherently demanding significant capital outlay for state-of-the-art production facilities, advanced machinery, and cutting-edge technologies. This high capital expenditure (CapEx) can place a considerable strain on the company's financial resources, necessitating meticulous strategic planning to ensure efficient resource allocation and a strong return on investment.

Smulders' reliance on winning substantial project tenders, especially within the offshore wind and oil & gas industries, exposes it to significant revenue fluctuations. A missed bid or a postponed award for a major contract directly impacts its ability to keep its substantial fabrication facilities operating at full capacity.

The intense competition for these large-scale offshore projects means that Smulders faces constant pressure to secure new business, with a single lost tender capable of creating substantial gaps in its order book. This vulnerability was highlighted in early 2024 when several key offshore wind projects experienced delays, impacting the pipeline for fabrication companies like Smulders.

Potential Over-reliance on Offshore Wind Sector

While Smulders Group's expertise in offshore wind is a significant asset, it also creates a vulnerability. A concentrated focus on this sector means the company is heavily exposed to shifts in government policies, evolving regulations, and broader economic conditions that can affect renewable energy projects.

The offshore wind industry has faced headwinds recently. For instance, in late 2023 and early 2024, several major offshore wind projects in the US and Europe experienced delays or cancellations. These setbacks were often attributed to rising inflation, increased material costs, and higher interest rates, which directly impact project economics and financing. Such global project challenges can directly affect Smulders' order book and revenue streams, highlighting the risk of over-dependence.

- Sector Concentration Risk: Smulders' deep involvement in offshore wind makes it susceptible to sector-specific downturns.

- Policy and Regulatory Sensitivity: Changes in government subsidies, permitting processes, or environmental regulations can significantly alter project viability.

- Economic Headwinds Impact: Inflationary pressures and rising interest rates, as seen in 2023-2024, can lead to project cancellations or postponements, directly affecting Smulders' pipeline.

- Project Pipeline Volatility: Global project cancellations, such as those impacting some US offshore wind developments in late 2023, underscore the potential for instability in Smulders' future workload.

Vulnerability to Supply Chain Disruptions

Smulders Group's extensive global operations and reliance on intricate supply chains for critical materials, such as steel, make it highly susceptible to disruptions. These can stem from worldwide events, geopolitical friction, and logistical hurdles. For instance, the ongoing global shipping container shortage, which saw rates surge by over 400% from pre-pandemic levels in late 2023, directly impacts the cost and availability of raw materials for offshore wind components.

Such disruptions can manifest as material scarcity, escalating costs, and significant project delays. This directly affects Smulders' ability to meet contractual timelines and stay within budget. In 2024, the energy sector, including offshore wind, has continued to grapple with inflationary pressures and supply chain bottlenecks, with some projects experiencing cost overruns of 10-20% due to these factors.

- Global Reliance: Smulders' international project footprint necessitates a complex, multi-country supply chain for key components and raw materials.

- Material Volatility: Dependence on materials like steel exposes the company to price fluctuations and availability issues influenced by global demand and geopolitical events.

- Logistical Bottlenecks: Port congestion and transportation disruptions, like those seen in 2023-2024, can impede the timely delivery of essential supplies, impacting project schedules.

- Cost and Timeline Impacts: Supply chain interruptions directly translate to increased operational costs and potential delays in project execution, affecting profitability and client satisfaction.

Smulders Group's substantial reliance on steel exposes it to price volatility, as seen with iron ore and scrap metal markets. For example, global steel prices saw considerable fluctuations throughout 2024, directly impacting the company's cost of goods sold and potentially compressing profit margins if these increased expenses cannot be passed on to clients.

The company's operations in heavy steel construction demand significant capital expenditure for advanced facilities and machinery. This high CapEx can strain financial resources, requiring meticulous planning for efficient resource allocation and a strong return on investment.

Smulders is vulnerable to revenue fluctuations due to its dependence on winning large project tenders, particularly in the offshore wind and oil & gas sectors. A missed or delayed major contract can lead to underutilization of its fabrication facilities, with intense competition for these projects adding pressure to secure new business.

The company's concentrated focus on the offshore wind sector makes it susceptible to sector-specific downturns, policy changes, and economic headwinds. For instance, project delays and cancellations in the US and Europe during late 2023 and early 2024, attributed to inflation and rising interest rates, directly impacted the order pipeline for companies like Smulders.

What You See Is What You Get

Smulders Group SWOT Analysis

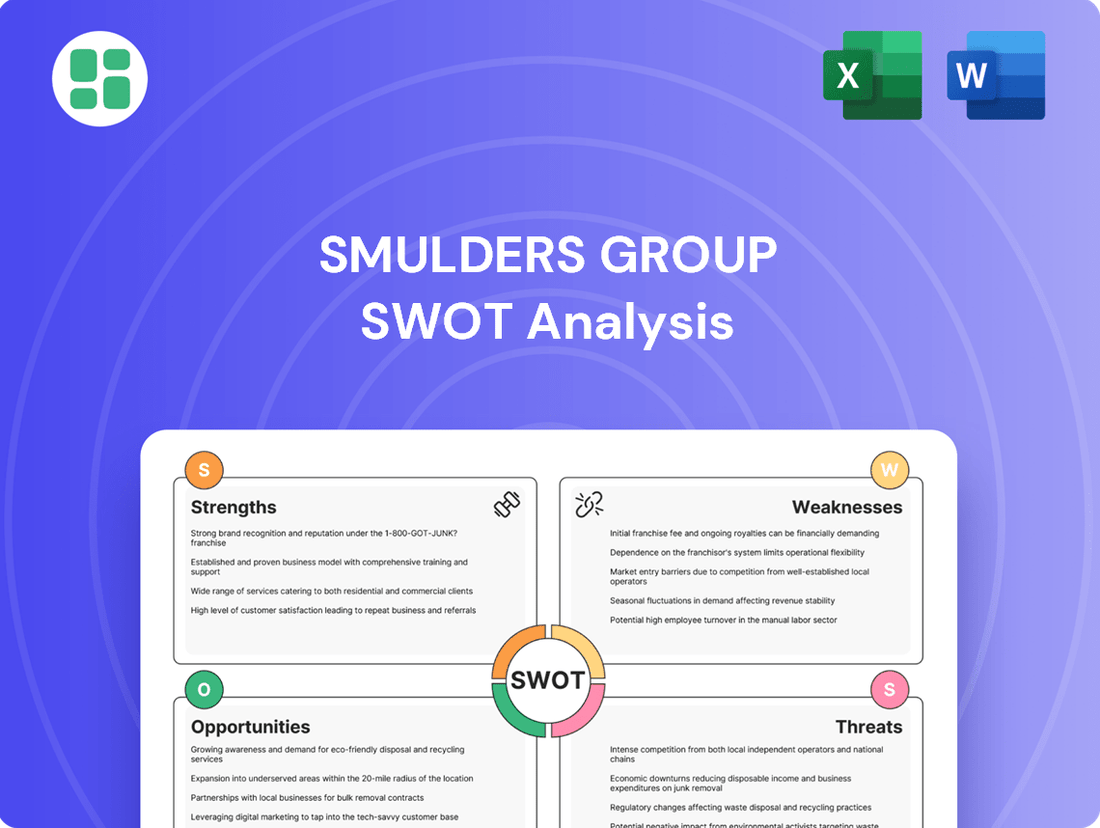

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering a comprehensive look at the Smulders Group's strategic positioning. This detailed analysis will equip you with actionable insights for future planning.

Opportunities

The global offshore wind power market is experiencing robust expansion, with projections indicating a compound annual growth rate (CAGR) of around 15% through 2030, reaching an estimated value of over $100 billion. This sustained demand, fueled by ambitious government renewable energy targets and the overarching drive towards decarbonization, presents a significant opportunity for Smulders to broaden its market presence and secure a larger share of upcoming projects.

Smulders can capitalize on this by leveraging its expertise in fabricating foundations and substations for offshore wind farms. The increasing scale of turbines and the development of floating offshore wind technologies, which are expected to see substantial investment in the coming years, offer new avenues for Smulders to innovate and supply critical components, further solidifying its position in this dynamic sector.

Smulders has a significant opportunity to expand beyond its established offshore wind foundation and substation work. Leveraging its deep expertise in fabricating large, complex steel structures, the company can target emerging areas within the renewable energy sector.

This strategic pivot includes pursuing projects in green hydrogen production facilities, where large-scale electrolyzer support structures and storage solutions are needed. Furthermore, the burgeoning market for floating offshore wind farms presents a natural extension, requiring specialized floating platforms and mooring systems that align with Smulders' core competencies.

The global investment in the energy transition is substantial, with the International Energy Agency (IEA) projecting that renewable energy capacity additions will reach nearly 500 GW in 2024, a new record. This growth trajectory, coupled with increasing demand for hydrogen infrastructure, estimated to grow significantly by 2030, offers Smulders a robust avenue for diversification and revenue growth.

Smulders can leverage innovations like robotics and IoT sensors to boost efficiency and precision in steel production. These technologies, already transforming the industry, promise faster cycles and better quality, helping Smulders stay ahead.

Adopting advanced manufacturing techniques, including 3D/2D technologies, presents an opportunity for Smulders to create more complex and customized steel components. This can lead to significant cost reductions and a smaller environmental impact, aligning with sustainability goals. For instance, the global industrial automation market, which includes robotics and IoT, was projected to reach over $300 billion in 2024, highlighting the widespread adoption and potential benefits.

Geographic Expansion into Emerging Markets

Smulders can capitalize on opportunities for geographic expansion, targeting emerging offshore wind markets outside of Europe, including North America and Asia. As these regions increase their offshore wind investments, Smulders can utilize its global experience to secure new contracts and expand its client portfolio.

For instance, the U.S. offshore wind market is projected to install approximately 30 gigawatts (GW) by 2030, presenting a significant growth avenue. Similarly, Asian markets like Taiwan and South Korea are actively developing their offshore wind sectors, with ambitious deployment targets.

- North America: The U.S. aims for 30 GW of offshore wind by 2030, creating substantial project opportunities.

- Asia: Taiwan and South Korea are rapidly expanding their offshore wind capacity, offering new markets.

- Leveraging Expertise: Smulders' established international track record in complex offshore projects is a key asset for market entry.

Strategic Partnerships and Collaborations

Smulders Group can significantly expand its project scope by forming strategic partnerships and joint ventures. These collaborations, much like their existing relationship with Eiffage Metal and recent project-specific alliances, can unlock access to larger, more intricate, and integrated projects. For instance, a joint venture could allow Smulders to bid on offshore wind farm foundations requiring a broader range of specialized services than they currently offer independently.

These alliances offer a powerful mechanism for sharing project risks, gaining access to cutting-edge technologies, and entering new geographical markets. By pooling resources and expertise, Smulders can enhance its ability to deliver comprehensive, turnkey solutions, thereby increasing its competitive edge. In 2023, the offshore wind sector alone saw significant investment, with global offshore wind capacity additions reaching approximately 13.4 GW, highlighting the potential for growth through strategic alliances in this burgeoning market.

- Access to Larger Projects: Collaborations enable Smulders to pursue mega-projects, such as entire offshore wind farm installations, which might be beyond their individual capacity.

- Risk Mitigation: Joint ventures allow for the distribution of financial and operational risks associated with large-scale, complex engineering projects.

- Technological Advancement: Partnerships can provide access to novel construction techniques, advanced materials, or digital integration solutions, boosting Smulders' innovative capabilities.

- Market Expansion: Strategic alliances can be instrumental in penetrating new international markets where local partnerships are often a prerequisite for entry.

Smulders can capitalize on the expanding global offshore wind market, which is projected to grow significantly, with new capacity additions expected to break records. The increasing demand for renewable energy, driven by decarbonization efforts, fuels this expansion. Smulders is well-positioned to benefit from this trend by supplying critical components like foundations and substations.

The company has an opportunity to diversify its offerings within the renewable energy sector by targeting green hydrogen production facilities and floating offshore wind technologies. These emerging areas require specialized steel structures that align with Smulders' core competencies, offering new revenue streams and market penetration.

Leveraging advanced manufacturing techniques and digital innovations, such as robotics and IoT, can enhance Smulders' production efficiency and product quality. This strategic adoption of technology can lead to cost reductions and a smaller environmental footprint, improving competitiveness and aligning with sustainability goals.

Geographic expansion into burgeoning offshore wind markets in North America and Asia presents a substantial growth opportunity. As these regions ramp up their renewable energy investments, Smulders can leverage its international experience to secure new contracts and broaden its client base.

Threats

Smulders operates within the specialized steel construction sector, a field characterized by significant competition from both direct rivals in steel fabrication and other manufacturers supplying components for offshore wind projects. This crowded market means constant pressure on pricing and profitability.

The intense competition necessitates substantial ongoing investment in advanced technologies and operational efficiencies. For instance, in 2023, the offshore wind sector alone saw significant investments in new manufacturing facilities by various players, highlighting the drive for scale and technological advantage.

Smulders Group's steel fabrication operations are highly dependent on energy, particularly electricity and natural gas. This reliance makes the company susceptible to significant cost increases if energy prices surge. For example, in early 2024, European natural gas prices saw considerable volatility, driven by geopolitical tensions and supply concerns, directly impacting industrial energy costs.

Rising energy expenses directly translate to higher operational costs for Smulders. If these increases aren't offset by efficiency gains or passed on to clients, they can squeeze profit margins. This pressure might force Smulders to increase its pricing, potentially making its bids less competitive in the global market for offshore wind and other heavy fabrication projects.

Changes in government policies, subsidies, and regulatory frameworks within the offshore wind and oil & gas sectors represent a substantial threat to Smulders Group. For instance, a shift towards less supportive renewable energy policies or a sudden reduction in oil and gas exploration budgets, which saw a global decline in upstream investment in 2023 compared to prior years, could directly impact the demand for Smulders' services.

Unfavorable policy shifts, such as stricter environmental regulations or extended consenting processes for offshore wind farms, can significantly hinder project viability. The UK's offshore wind sector, for example, has faced challenges with consenting timelines, potentially delaying projects that Smulders relies on for revenue. This can lead to project cancellations or a diminished attractiveness for new investments, directly affecting Smulders' order book.

Poorly designed auction mechanisms, common in renewable energy procurement, can also pose a threat by driving down prices to unsustainable levels. If Smulders is unable to secure projects at profitable margins due to intense price competition driven by auction design, it could negatively impact financial performance. The European offshore wind market, a key area for Smulders, has seen fluctuating auction results, highlighting this risk.

Economic Downturns and Project Delays

Global economic slowdowns, particularly those impacting construction and energy sectors, pose a significant threat to Smulders Group. For instance, the International Monetary Fund (IMF) projected global growth to slow to 2.9% in 2024, down from 3.1% in 2023, indicating a challenging environment for capital-intensive projects. This economic uncertainty can lead to postponed or canceled infrastructure investments, directly impacting Smulders' order pipeline and revenue streams.

Project delays are a common consequence of economic instability. Reduced government spending on infrastructure or private sector hesitancy to commit capital can stall projects that Smulders is involved in. This can result in increased costs due to extended timelines and potentially lower profitability on secured contracts. For example, a 2024 report by S&P Global highlighted that rising interest rates and inflation were causing delays in several major European infrastructure projects.

- Economic Slowdown Impact: Reduced demand for large-scale steel construction and energy projects due to global or regional economic instability.

- Project Cancellations: Increased risk of project cancellations or deferrals as clients face financial constraints.

- Revenue Uncertainty: Direct negative effect on Smulders' order book and revenue projections stemming from economic headwinds.

- Inflationary Pressures: Rising material and labor costs due to inflation can further squeeze project margins if not adequately passed on.

Supply Chain Bottlenecks and Labor Shortages

Smulders Group faces ongoing threats from persistent global supply chain disruptions. These include shortages of critical materials and significant delays in transportation, which directly impact production efficiency. For instance, the global shipping container shortage experienced throughout 2023 and into early 2024 continued to inflate freight costs by an average of 15-20% compared to pre-pandemic levels for key components.

Furthermore, potential labor shortages in skilled trades pose another significant challenge. This scarcity can hinder the ability to maintain optimal production schedules and manage project timelines effectively. Reports from the European construction sector in late 2023 indicated a deficit of approximately 1.5 million skilled workers, a trend likely to persist into 2024 and 2025, affecting companies like Smulders Group that rely on specialized labor.

These combined bottlenecks can lead to substantial project cost overruns and difficulties in meeting contractual delivery dates. For example, a delay in a major offshore wind farm project due to component unavailability could result in penalties and reputational damage, impacting Smulders Group's financial performance and client relationships.

- Material Shortages: Continued scarcity of steel, specialized alloys, and electronic components.

- Transportation Delays: Ongoing congestion at ports and increased lead times for critical equipment.

- Skilled Labor Deficit: Difficulty in recruiting and retaining qualified welders, engineers, and technicians.

- Cost Inflation: Rising prices for raw materials and logistics, squeezing profit margins.

Smulders faces threats from intense competition, especially in the offshore wind sector, where players are investing heavily in technology and scale. For instance, in 2023, significant capital was poured into new manufacturing facilities across the industry. This competitive landscape puts pressure on pricing and profitability for Smulders.

Rising energy costs, driven by market volatility and geopolitical factors, directly impact Smulders’ operational expenses. For example, European natural gas prices saw considerable fluctuations in early 2024. These increased costs can erode profit margins if they cannot be passed on to clients, potentially making Smulders less competitive.

Changes in government policies and regulations within the renewable energy and oil & gas sectors represent a substantial risk. For example, a slowdown in upstream investment in 2023 compared to previous years, or stricter consenting processes for offshore wind projects, could reduce demand for Smulders' services. The UK's offshore wind sector has experienced delays due to consenting timelines, illustrating this risk.

Global economic slowdowns, as indicated by the IMF's projected slower global growth for 2024, threaten demand for large-scale projects. Project delays, exacerbated by inflation and rising interest rates, as noted by S&P Global in early 2024, can lead to cost overruns and reduced profitability for Smulders.

Persistent supply chain disruptions, including material shortages and transportation delays, continue to affect Smulders. The global shipping container shortage in 2023-2024 inflated freight costs by 15-20%. Furthermore, a deficit of skilled labor, estimated at 1.5 million in the European construction sector by late 2023, hinders production and project timelines, potentially leading to cost overruns and penalties.

SWOT Analysis Data Sources

This Smulders Group SWOT analysis is built upon a robust foundation of data, drawing from official financial reports, comprehensive market intelligence, and expert industry analyses to provide a clear and actionable strategic overview.