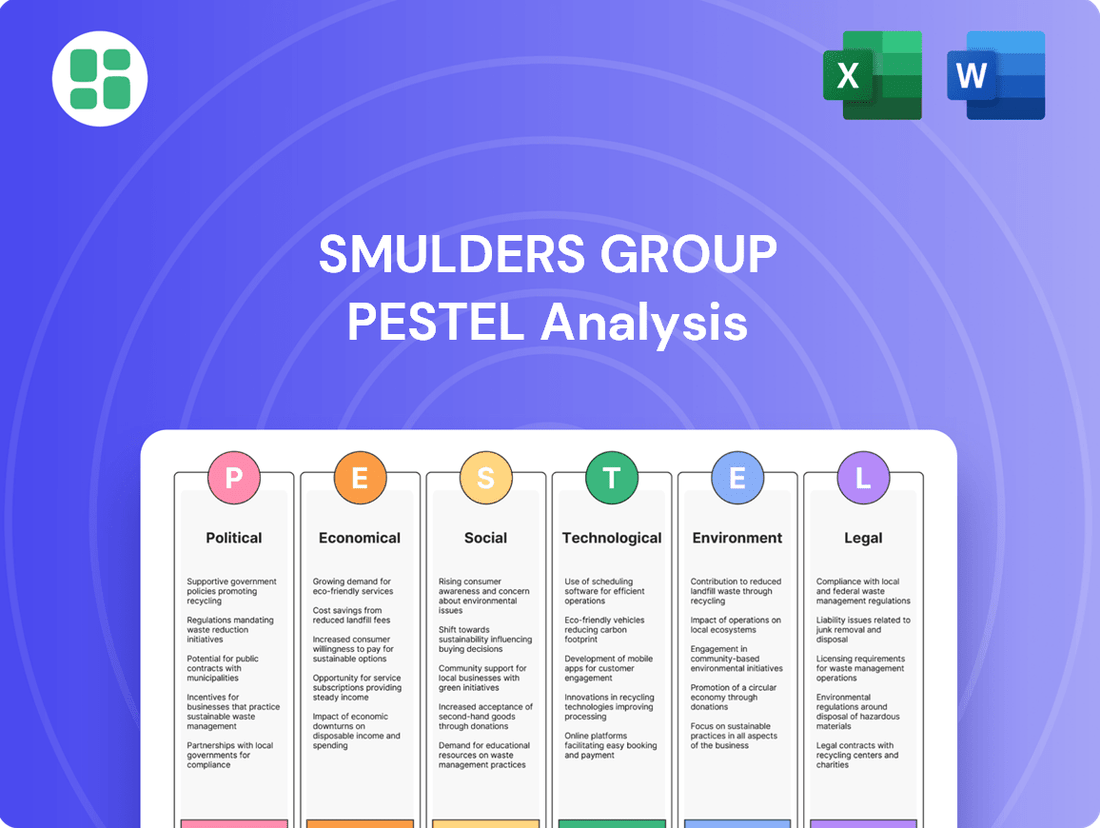

Smulders Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Smulders Group Bundle

Unlock the strategic advantage with our comprehensive PESTLE analysis of the Smulders Group. We delve into the political, economic, social, technological, legal, and environmental factors directly impacting their operations and future growth. Equip yourself with the foresight needed to navigate market complexities and identify emerging opportunities.

Gain an edge with our in-depth PESTEL Analysis—crafted specifically for Smulders Group. Discover how external forces are shaping the company’s future, and use these insights to strengthen your own market strategy. Download the full version now and get actionable intelligence at your fingertips.

Political factors

Governments in Europe and the US are heavily backing offshore wind, setting ambitious goals for expansion. For instance, the EU aims for significant offshore wind capacity by 2030, supported by initiatives like the Wind Power Package. This political momentum translates into a predictable and expanding market for Smulders Group, a key player in offshore wind infrastructure.

Policies such as the EU's Net Zero Industry Act are designed to bolster domestic manufacturing within the renewable energy sector. This focus on local production and stable tender processes directly benefits European companies like Smulders, ensuring a more secure business environment for their specialized components.

Regulatory stability and streamlined permitting are crucial for Smulders' offshore wind projects. Delays in these processes directly translate to increased costs and extended project timelines, impacting overall profitability and deployment speed. For instance, while the EU aims to expedite permitting under directives like the Renewable Energy Directive, specific national implementations can still present hurdles.

The efficiency of permitting processes is a key factor for Smulders, as it directly influences the predictability of project schedules and the associated financial commitments. Bureaucratic complexities and inconsistent regulatory application across different European nations can create significant operational challenges for a company engaged in large-scale offshore infrastructure development.

Global geopolitical tensions, particularly conflicts in Eastern Europe and the Middle East, continue to disrupt international supply chains and impact raw material costs for the steel industry. For Smulders, this translates to potential volatility in the prices of iron ore, coking coal, and other essential inputs, as well as challenges in securing timely deliveries. For example, the ongoing conflict has significantly impacted energy markets, with Brent crude oil prices fluctuating around $80-$90 per barrel in early 2024, directly affecting the energy-intensive steel production process.

Shifting trade policies and protectionist measures implemented by major economies can also create barriers and increase costs for companies like Smulders operating on a global scale. Tariffs on steel imports or exports can alter competitive landscapes and necessitate adjustments to sourcing and sales strategies. The European Union's Carbon Border Adjustment Mechanism (CBAM), fully phased in from 2026, will also influence trade flows and production costs for imported steel, potentially impacting Smulders' international procurement and sales.

Energy Security Initiatives

The increasing focus on energy security, especially within Europe, is a significant political driver propelling the expansion of renewable energy, particularly offshore wind. This political push directly benefits Smulders Group by bolstering the long-term demand for their specialized skills in building critical infrastructure for these green energy projects.

Government policies aimed at diversifying energy supplies and reducing reliance on volatile fossil fuel markets are a key factor. For example, the European Union's REPowerEU plan, launched in 2022, targets a rapid exit from Russian fossil fuels and significantly elevates investments in renewable energy sources. This initiative underscores the political commitment to a cleaner energy future, which translates into sustained opportunities for companies like Smulders.

- Energy Security as a Political Imperative: Governments worldwide, particularly in Europe, are prioritizing energy security, leading to increased support for domestic renewable energy production.

- REPowerEU's Impact: The EU's REPowerEU plan aims to accelerate the transition away from fossil fuels, with a substantial portion of its €300 billion investment earmarked for renewable energy projects, including offshore wind.

- Demand for Infrastructure: This policy shift directly enhances the demand for Smulders' expertise in fabricating and installing offshore wind farm components, such as foundations and substations.

- Long-Term Growth Potential: The sustained political will to achieve energy independence through renewables suggests a robust and enduring market for Smulders' services in the coming years.

Local Content Requirements and Industrial Policy

Local content requirements are becoming a significant factor in the offshore wind industry. For instance, in 2024, several European nations are implementing or strengthening policies that mandate a certain percentage of components or labor be sourced domestically. This could mean Smulders may need to adapt its supply chain and manufacturing processes to comply with these regulations, potentially increasing operational costs but also opening avenues for local partnerships and job creation within those specific markets.

Industrial policies aimed at boosting national economies are also shaping the sector. Governments are actively investing in vocational training programs to build a skilled workforce for offshore wind projects. By 2025, it's anticipated that investments in training infrastructure and international standard alignment will reach several billion euros across key markets like Germany and France, directly impacting companies like Smulders by ensuring a qualified labor pool but also potentially increasing competition for talent.

- Increased focus on domestic supply chains: Countries are prioritizing local manufacturing and assembly for offshore wind components.

- Government investment in workforce development: Significant funding is being allocated to vocational training and upskilling for the offshore wind sector.

- Potential for localized partnerships: Smulders may need to forge strategic alliances with local businesses to meet content requirements.

- Impact on operational costs and strategy: Compliance with local content rules could necessitate adjustments to Smulders' global operational and sourcing strategies.

Governmental support for offshore wind continues to strengthen, with the EU aiming for 111 GW of offshore wind capacity by 2030, a significant increase from the approximately 32 GW operational in early 2024. Policies like the Net Zero Industry Act are designed to foster domestic manufacturing, benefiting companies like Smulders by ensuring stable tender processes and a predictable market for their specialized components.

Energy security is a paramount political concern, driving initiatives like the EU's REPowerEU plan, which allocates substantial investment to renewable energy to reduce reliance on fossil fuels. This political commitment translates into sustained demand for Smulders' expertise in building offshore wind infrastructure, ensuring long-term growth potential.

Local content requirements are increasingly shaping project development, with several European nations implementing or strengthening rules for domestic sourcing of components and labor. Smulders must adapt its supply chain to comply, potentially increasing costs but also creating opportunities for local partnerships and job creation.

Industrial policies are also focusing on workforce development, with significant investments in vocational training expected across key markets by 2025. This ensures a qualified labor pool for offshore wind projects, benefiting companies like Smulders, though it may also intensify competition for talent.

| Policy/Initiative | Target/Goal | Impact on Smulders | Relevant Data (as of early 2024) |

|---|---|---|---|

| EU Offshore Wind Target | 111 GW by 2030 | Expands market and demand for infrastructure | Approx. 32 GW operational capacity |

| EU Net Zero Industry Act | Boost domestic manufacturing | Creates stable tender processes and predictable market | Aims to increase EU manufacturing capacity |

| EU REPowerEU Plan | Reduce fossil fuel reliance, boost renewables | Sustains demand for offshore wind services | €300 billion total investment |

| Local Content Requirements | Mandate domestic sourcing | Requires supply chain adaptation, potential cost increase, local partnership opportunities | Strengthening in multiple European nations |

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting the Smulders Group across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to aid strategic decision-making and identify opportunities within the Smulders Group's operating landscape.

A clear, actionable summary of the Smulders Group's PESTLE analysis, designed to quickly identify and address external challenges, thereby relieving strategic planning pain points.

Economic factors

The offshore wind sector is a major growth engine, with Europe alone expected to install significant new capacity in 2025 and subsequent years. This expansion translates directly into increased demand for specialized components and services.

Smulders Group is capitalizing on this trend, having already secured over €1 billion in offshore wind contracts during 2024. Key wins include substantial projects like the Bałtyk 2 and 3 wind farms, demonstrating their strong market position.

This robust investment environment provides a direct and substantial boost to Smulders Group's order book, underpinning their revenue and growth prospects in the renewable energy market.

The global steel market is navigating a period of adjustment, with demand anticipated to dip in 2024 before a projected modest rebound in 2025, largely fueled by increased investment in green infrastructure projects. Smulders' financial performance is closely tied to the volatility of steel prices and the cost of crucial raw materials like nickel and chromium, both of which are expected to see upward price pressure.

To mitigate the impact of escalating production expenses, Smulders is increasingly integrating energy-efficient technologies into its operations. For instance, advancements in electric arc furnace (EAF) technology, which can reduce energy consumption by up to 30% compared to traditional blast furnaces, are becoming more prevalent in the industry.

The offshore wind sector, including key players like Smulders, is grappling with persistent supply chain disruptions and inflationary pressures. These issues are driving up costs for materials and components, impacting project economics. For instance, the cost of steel, a primary input for wind turbine foundations, saw significant increases throughout 2023 and into early 2024, driven by global demand and geopolitical factors.

Despite these headwinds, confidence in the long-term growth of offshore wind remains robust, with ambitious targets set by many nations. However, Smulders and its peers require clearer visibility into future project pipelines and proactive strategies to address critical skills shortages. Reports from industry bodies in late 2024 highlighted a projected deficit of tens of thousands of skilled workers needed to meet 2030 deployment goals.

Navigating these complex supply chain dynamics is crucial for Smulders to maintain its competitive edge and ensure the efficient, cost-effective delivery of offshore wind projects. Successful management of these challenges will directly influence the group's ability to capitalize on the expanding offshore wind market.

Impact of Interest Rates and Financing Costs

Higher interest rates and restrictive monetary policies significantly influence investment in major projects, particularly within steel construction and renewable energy. This environment can make developers hesitant to start new ventures or scale up existing ones, directly impacting Smulders' future project opportunities. For instance, in late 2024, many central banks maintained elevated interest rates to combat persistent inflation, leading to increased borrowing costs for large capital expenditures.

The cost of financing is a critical determinant for Smulders' clients undertaking substantial infrastructure developments. When borrowing becomes more expensive, the economic viability of new projects is scrutinized more closely, potentially delaying or canceling commitments. This can create a more challenging environment for securing new contracts, especially for projects with long lead times and significant upfront investment.

- Financing Costs: In Q4 2024, benchmark interest rates in key European markets remained elevated, with the European Central Bank's main refinancing operations rate standing at 4.50%.

- Investment Decisions: Increased financing costs can push the hurdle rate for new projects higher, making fewer projects financially attractive.

- Project Pipeline: A slowdown in new project initiations due to high financing costs directly translates to a leaner project pipeline for companies like Smulders.

- 2025 Outlook: Projections for 2025 suggest a potential easing of monetary policy, which could lower financing costs and stimulate investment, improving Smulders' market outlook.

Diversification into General Steel Construction and Oil & Gas

Smulders Group's strategic diversification beyond its core offshore wind focus into general steel construction and the oil & gas sector offers a crucial hedge against market volatility. This dual approach provides alternative revenue streams, enhancing overall business resilience.

The global oil and gas industry, despite the energy transition, continues to require significant steel infrastructure for exploration, production, and refining. For instance, capital expenditure in the oil and gas sector was projected to reach over $500 billion globally in 2024, according to industry analyses, highlighting sustained demand for heavy steel fabrication services. This presents a stable, albeit cyclical, market for Smulders.

Furthermore, the broader construction industry's need for structural steel is robust. In 2024, global construction output was estimated to grow by approximately 2.5%, driven by infrastructure projects and commercial building. Smulders' expertise in large-scale steel structures positions it to capitalize on this demand, complementing its renewable energy activities.

- Diversification Strategy: Smulders Group leverages its steel fabrication capabilities across offshore wind, oil & gas, and general construction to mitigate sector-specific risks.

- Oil & Gas Market: Sustained global capital expenditure in oil & gas, projected to exceed $500 billion in 2024, provides a consistent demand for heavy steel construction.

- General Construction Growth: An estimated 2.5% growth in global construction output for 2024, fueled by infrastructure and commercial projects, offers additional market opportunities.

- Synergistic Demand: The increasing demand for precision metals in both renewable energy and traditional construction sectors creates cross-sectoral growth potential for Smulders.

Economic factors significantly shape Smulders Group's operational landscape, particularly through commodity price fluctuations and interest rate environments. The global steel market, a key input for Smulders, is expected to see a modest rebound in 2025 after a dip in 2024, driven by green infrastructure investments. However, upward price pressure on essential raw materials like nickel and chromium is anticipated, directly impacting production costs.

The cost of financing remains a critical consideration, with elevated interest rates in late 2024 increasing borrowing costs for large capital expenditures. This can lead to project delays or cancellations by clients, directly affecting Smulders' future contract opportunities. For instance, the European Central Bank's main refinancing operations rate was 4.50% in Q4 2024, highlighting the prevailing cost of capital.

Smulders' strategic diversification into oil & gas and general construction provides a buffer against the volatility inherent in the offshore wind sector. The oil and gas industry's capital expenditure was projected to exceed $500 billion globally in 2024, ensuring sustained demand for heavy steel fabrication, while global construction output was estimated to grow by 2.5% in the same year.

| Economic Factor | 2024 Data/Projection | 2025 Outlook | Impact on Smulders |

|---|---|---|---|

| Steel Market Demand | Dip expected | Modest rebound projected | Potential for increased orders, but raw material costs are a concern |

| Raw Material Prices (Nickel, Chromium) | Upward pressure | Continued upward pressure | Increased production expenses |

| Interest Rates (ECB Refinancing Rate) | 4.50% (Q4 2024) | Potential easing | Higher financing costs can deter client investment; easing could stimulate projects |

| Oil & Gas Capex | >$500 billion (Global) | Sustained | Consistent demand for steel fabrication services |

| Global Construction Output | ~2.5% growth | Growth expected | Additional market opportunities for steel structures |

Preview Before You Purchase

Smulders Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of the Smulders Group delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting their operations. Gain valuable insights into the strategic landscape for Smulders Group.

Sociological factors

The burgeoning offshore wind sector, a key growth area for Smulders, is experiencing a pronounced skills gap. Projections indicate a need for tens of thousands of specialized technicians by 2028, a demand that directly impacts workforce availability. This shortage necessitates proactive strategies for Smulders to develop its own talent pool.

To counter this, Smulders must invest heavily in internal training programs and apprenticeships, ensuring its workforce possesses the necessary expertise in specialized steel construction for offshore wind projects. Collaborating with vocational schools and universities is also vital to attract new talent and bridge the gap between academic learning and industry requirements.

Effectively attracting and retaining skilled personnel is paramount for Smulders to meet the increasing demands of offshore wind projects and maintain its competitive edge. The ability to secure and keep qualified engineers, welders, and technicians will directly influence project timelines and overall operational success in this rapidly expanding market.

Smulders operates in an industry where rigorous health and safety standards are non-negotiable, especially given the complexities of steel construction and offshore environments. A commitment to safety directly impacts employee well-being and bolsters the company's reputation, ensuring compliance with evolving international regulations.

The offshore wind sector, a key area for Smulders, places a significant emphasis on specialized safety training for personnel, ensuring they are equipped for the unique challenges of working at sea. For instance, in 2024, the Global Wind Organisation (GWO) reported a continued increase in the number of technicians completing safety training modules, reflecting the industry's proactive approach to risk mitigation.

Smulders' large-scale offshore wind projects necessitate robust community engagement to gain a social license to operate. This involves addressing local concerns about visual impact, environmental changes, and economic benefits, as seen with the Ørsted Hornsea 2 project, which involved extensive stakeholder consultations across the UK coast. Positive community relations are crucial for smoother project execution and mitigating potential opposition, as demonstrated by the successful integration of offshore wind farms in regions with strong local support.

Public Perception of Renewable Energy

Public acceptance and support for renewable energy, particularly offshore wind, are vital for continued expansion. A favorable public view can translate into stronger policy backing and increased investment, which is a significant advantage for companies like Smulders. For instance, recent surveys in 2024 indicated that over 70% of the public in key European markets support the development of new wind farms.

This positive sentiment directly impacts the market landscape. When communities embrace renewable projects, it often streamlines permitting processes and reduces local opposition, accelerating project timelines. Smulders, as a key player in offshore wind infrastructure, benefits directly from this societal buy-in, as it fosters a more predictable and supportive operating environment.

The data consistently shows a growing trend in public approval:

- High Support: Public opinion polls in 2024 consistently show a majority favoring the expansion of wind energy capacity across North America and Europe.

- Environmental Awareness: Increased awareness of climate change is a primary driver of this positive public perception.

- Economic Benefits: Local communities often see job creation and economic development opportunities associated with renewable projects, further boosting acceptance.

- Policy Alignment: Government targets for renewable energy adoption, often reflecting public demand, create a favorable climate for companies in the sector.

Corporate Social Responsibility (CSR) Initiatives

Smulders Group demonstrates a strong commitment to corporate social responsibility (CSR), actively engaging in initiatives that resonate with societal expectations for positive social and environmental impact. For instance, their tree-planting programs and sponsorship of clean water projects directly address environmental sustainability and community well-being, bolstering their public image and fostering employee pride. In 2024, Smulders reported planting over 10,000 trees as part of their ongoing reforestation efforts.

These CSR activities are strategically designed to align with broader societal trends that increasingly demand businesses contribute positively beyond profit generation. This focus on social well-being and environmental stewardship is crucial for maintaining a favorable reputation and attracting talent. Smulders' employees are encouraged to adopt healthy lifestyles and participate in charitable events, fostering a culture of giving back.

The company's CSR strategy also aims to motivate employees by connecting their work to meaningful social contributions. This includes promoting employee participation in sponsored events, such as the 2024 "Clean Seas" campaign where Smulders employees collected over 500 kilograms of plastic waste from coastal areas. Such engagement not only enhances employee morale but also reinforces the company's dedication to social responsibility.

- Environmental Stewardship: Smulders' tree-planting initiatives, with over 10,000 trees planted in 2024, underscore a commitment to ecological balance.

- Community Engagement: Sponsorship of clean water projects directly benefits communities, addressing essential social needs.

- Employee Motivation: Encouraging healthy lifestyles and charity participation fosters a positive work environment and civic responsibility.

- Public Image Enhancement: Visible CSR efforts contribute to a stronger brand reputation and stakeholder trust.

Sociological factors significantly influence Smulders Group's operations, particularly concerning workforce development and public perception in the offshore wind sector. The demand for skilled labor is high, with tens of thousands of specialized technicians needed by 2028, making internal training and partnerships with educational institutions crucial for talent acquisition and retention.

Public support for renewable energy, especially offshore wind, remains strong, with over 70% favoring expansion in key European markets in 2024. This positive sentiment streamlines project approvals and reduces opposition, benefiting companies like Smulders. Furthermore, Smulders' commitment to Corporate Social Responsibility (CSR), including planting over 10,000 trees in 2024 and supporting community projects, enhances its public image and employee engagement.

| Sociological Factor | Impact on Smulders | Supporting Data (2024/2025) |

|---|---|---|

| Skills Gap in Offshore Wind | Need for proactive talent development and training | Tens of thousands of specialized technicians needed by 2028 |

| Public Support for Renewables | Facilitates project approvals and reduces opposition | Over 70% public support for offshore wind expansion in key European markets |

| Corporate Social Responsibility (CSR) | Enhances reputation, attracts talent, and boosts employee morale | Over 10,000 trees planted; employee participation in community initiatives |

Technological factors

The steel fabrication sector is rapidly evolving with technologies like advanced 3D modeling and robotic welding. These advancements are crucial for industries like offshore wind, where precision and consistency are paramount. For instance, the adoption of automated welding systems can boost productivity by up to 30% and significantly improve weld quality, directly impacting the structural integrity of components.

Smulders can capitalize on these technological shifts to enhance its operational efficiency and product quality. By integrating sophisticated automation, the company can achieve greater accuracy in fabricating complex offshore wind foundations and other structures, leading to reduced material waste and faster project turnaround times. This technological edge is vital for maintaining competitiveness in a demanding global market.

Modular construction and prefabrication are significantly reshaping the steel industry. This trend allows for components to be built off-site in controlled factory settings, leading to faster project completion and improved quality. For Smulders Group, this means leveraging their fabrication expertise to deliver projects more efficiently. The global modular construction market was valued at approximately USD 150 billion in 2023 and is projected to reach over USD 250 billion by 2030, highlighting a substantial growth opportunity.

While Smulders has a strong foundation in fixed-bottom offshore wind, the burgeoning field of floating offshore wind presents a significant future growth avenue. This evolving technology is poised to unlock new markets for steel structures in deeper waters, necessitating adaptation and innovation from companies like Smulders.

Europe is anticipated to lead the charge in developing and deploying floating wind technologies. By 2030, the EU aims for 11 GW of offshore wind capacity from floating installations, indicating substantial demand for the specialized steel structures Smulders could provide.

Digitalization and Data Analytics in Construction

The construction industry's embrace of digitalization and data analytics is reshaping project execution. Smulders can leverage these advancements for enhanced project oversight, proactive maintenance strategies, and streamlined operations across its global sites. This technological shift is crucial for maintaining a competitive edge.

By integrating sophisticated data analytics, Smulders can gain deeper insights into project performance, identify potential bottlenecks early, and optimize resource allocation. This data-driven approach supports more informed strategic decisions, leading to improved efficiency and profitability.

Specific applications include using AI for predictive maintenance of heavy machinery and implementing digital twins for real-time monitoring of complex offshore wind farm installations. For example, the adoption of digital tools in construction projects is projected to increase project efficiency by an average of 15% by 2025, according to industry reports.

- Enhanced Project Management: Digital platforms allow for real-time tracking of progress, budget adherence, and risk assessment, improving Smulders' ability to deliver projects on time and within budget.

- Operational Optimization: Data analytics can identify inefficiencies in workflows and supply chains, enabling Smulders to reduce costs and improve resource utilization.

- Predictive Maintenance: By analyzing sensor data from equipment, Smulders can anticipate potential failures, minimizing downtime and associated repair costs.

- AI in Operations: Companies like Beam are demonstrating the power of AI and autonomous systems in revolutionizing wind farm operations, a sector relevant to Smulders' activities.

Integration of Auxiliary and High Voltage Equipment

Smulders' strategic acquisition of HSM Offshore Energy in early 2024 signals a significant advancement in their ability to offer integrated solutions for offshore wind projects. This move directly addresses the growing demand for turnkey services, encompassing the crucial integration of auxiliary and high voltage equipment.

This integration is vital for the efficient and reliable operation of offshore wind farms, as it ensures seamless functionality between power generation components and the grid connection infrastructure. Smulders' enhanced EPCIC capabilities, bolstered by HSM Offshore Energy's expertise, position them to deliver more comprehensive packages, reducing complexity for clients.

The acquisition reinforces the Eiffage Group's commitment to expanding its footprint in the European sustainable energy sector. By consolidating capabilities in high-voltage equipment integration, Smulders is better equipped to capitalize on the projected growth in offshore wind development across Europe, a market expected to see substantial investment in the coming years.

Key benefits of this integration include:

- Enhanced Turnkey Solutions: Smulders can now offer more complete project delivery, from initial design to final commissioning, including critical high-voltage systems.

- Improved Project Efficiency: Streamlined integration of auxiliary and high voltage equipment can lead to faster project timelines and reduced on-site coordination challenges.

- Strengthened Market Position: The acquisition solidifies Smulders' and Eiffage Group's competitive edge in the rapidly expanding offshore wind market.

Technological advancements are reshaping the steel fabrication sector, with innovations like advanced 3D modeling and robotic welding enhancing precision and efficiency. Smulders can leverage these technologies to improve its operational capabilities, especially in complex projects like offshore wind foundations. The integration of digital tools and data analytics is also crucial for optimizing project management and enabling predictive maintenance, with industry reports suggesting a potential 15% increase in project efficiency by 2025 through digital adoption.

The growing adoption of modular construction techniques, with the global market valued around USD 150 billion in 2023 and projected to exceed USD 250 billion by 2030, offers Smulders opportunities to streamline production and improve project delivery times. Furthermore, the expansion into floating offshore wind, a sector where Europe aims for 11 GW of capacity by 2030, presents new avenues for specialized steel structures. Smulders' 2024 acquisition of HSM Offshore Energy strengthens its ability to provide integrated turnkey solutions, including high-voltage equipment, positioning it favorably in the expanding offshore wind market.

Legal factors

The European Union's Renewable Energy Directive sets ambitious targets for renewable energy consumption by 2030, aiming for at least 42.5% of its energy to come from renewable sources, with a further aspiration to reach 45%. This includes specific goals for offshore wind capacity, which directly fuels demand for Smulders' expertise in offshore wind farm construction.

These directives establish a legally binding framework across member states, creating a predictable and consistent market for renewable energy infrastructure. This legal certainty is crucial for companies like Smulders, enabling long-term investment and strategic planning in the offshore wind sector.

Furthermore, member states have committed to revised regional offshore wind targets, reinforcing the legal impetus for growth. For instance, North Sea countries have set collective targets, underscoring a unified push towards expanding offshore wind power generation.

Smulders' offshore wind ventures face stringent environmental impact assessments and permitting laws, covering crucial areas like species protection, habitat preservation, noise pollution, and visual aesthetics. Failure to comply with these regulations, which are often enforced through legal avenues such as the National Environmental Policy Act (NEPA) in the US, can result in significant project delays. For instance, the Vineyard Wind 1 project, a major offshore wind farm, experienced delays due to environmental reviews and legal challenges, highlighting the critical need for thorough legal navigation.

International trade laws and potential tariffs significantly influence Smulders' global operations. For instance, the EU's Carbon Border Adjustment Mechanism (CBAM), implemented in October 2023 and set to fully apply from 2026, could increase costs for imported steel products based on their embodied carbon emissions, potentially affecting Smulders' procurement of raw materials and the competitiveness of its exports.

Navigating these evolving trade regulations, including tariffs on steel imports or exports, is crucial for Smulders' procurement and sales strategies. Compliance with international trade agreements and customs regulations is paramount for maintaining smooth cross-border operations and avoiding penalties.

Anti-Corruption and Compliance Regulations

As a subsidiary of Eiffage Metal, Smulders operates under stringent anti-corruption and compliance frameworks. This includes adherence to national and European Union regulations, such as those mandating vigilance duties for companies. Eiffage’s commitment to ethical conduct is reinforced by a robust compliance system, which features a detailed code of conduct and a confidential whistleblower hotline to encourage reporting of any irregularities.

These measures are crucial for maintaining trust and ensuring legal operational integrity, particularly given Eiffage's extensive international presence. For instance, in 2023, Eiffage reported a significant increase in its focus on compliance training, with over 90% of its employees having completed mandatory ethics modules. This proactive approach aims to mitigate risks associated with bribery and corruption, a critical concern in the global construction and infrastructure sectors where Smulders is active.

- Regulatory Adherence: Smulders, as part of Eiffage, must comply with all anti-corruption laws and vigilance duties mandated by national and EU authorities.

- Ethical Framework: Eiffage maintains a comprehensive compliance program, including a code of conduct and a whistleblower system, to promote ethical business practices.

- Risk Mitigation: The company's focus on compliance, evidenced by extensive employee training, aims to prevent and address potential corruption risks across its operations.

- Global Standards: These regulations and internal policies ensure that Smulders upholds high ethical standards in all its international dealings.

Labor Laws and Employment Regulations

Smulders, operating in Belgium, the Netherlands, Poland, the UK, and India, navigates a complex web of labor laws and employment regulations. These vary significantly across jurisdictions, impacting everything from minimum wage and working hours to safety standards and employee rights. For instance, in 2024, the UK's National Living Wage increased to £11.44 per hour for those aged 21 and over, a key consideration for Smulders' UK operations.

Compliance is paramount to prevent legal challenges and ensure a stable international workforce. Smulders' commitment to adhering to these diverse regulations is crucial for maintaining operational integrity. The company actively promotes workforce development initiatives, recognizing the need to address skill shortages prevalent in the manufacturing and offshore sectors across its operating regions.

- Diverse Labor Laws: Smulders must comply with varying regulations on working conditions, wages, and safety in Belgium, Netherlands, Poland, UK, and India.

- Legal Compliance Importance: Adherence to these laws is essential for managing an international workforce and avoiding costly legal disputes.

- Workforce Development Focus: Smulders is actively engaged in strategies to combat skill shortages within its operational countries.

- Wage Standards: For example, the UK's National Living Wage of £11.44 per hour (as of April 2024) impacts employment costs in that region.

Smulders operates within a framework of evolving environmental regulations, particularly concerning emissions and waste management. For instance, the EU's Industrial Emissions Directive (IED) sets strict limits on pollutants from industrial activities, requiring significant investment in abatement technologies. Companies like Smulders must ensure their manufacturing processes comply with these legally binding standards to avoid penalties and maintain operational licenses.

The company's commitment to sustainability is also shaped by product-specific regulations, such as those governing the materials used in wind turbine components and their end-of-life disposal. For example, the EU's Waste Framework Directive mandates increased recycling rates and responsible waste management, influencing Smulders' material sourcing and production lifecycle planning.

Navigating intellectual property laws is crucial for protecting Smulders' innovative designs and manufacturing techniques. Protecting patents and proprietary information safeguards their competitive advantage in the renewable energy sector.

Smulders must adhere to various national and international safety regulations, including those related to heavy machinery operation and construction site safety. In 2024, the Health and Safety Executive (HSE) in the UK continued to enforce strict guidelines, with a focus on preventing fatalities and major injuries in industrial settings, directly impacting Smulders' operational procedures.

Environmental factors

Smulders Group is a key player in the global shift towards decarbonization, supplying essential infrastructure for offshore wind farms, a critical element in achieving net-zero targets. This involvement directly aligns with ambitious climate goals, such as the European Union's Green Deal and Clean Industrial Deal, which are targeting climate neutrality by 2050.

The company’s commitment extends to its own operations, with Smulders utilizing 100% green and locally sourced electricity for its production processes, demonstrating a proactive approach to sustainable manufacturing. This focus on internal sustainability reinforces its position as a facilitator of the broader energy transition.

Smulders' Sustainable Procurement Policy targets suppliers committed to sustainability, aiming to cut Scope 3 emissions from transport, installation, packaging, and waste. This strategy is particularly focused on reducing the environmental impact associated with steel and paint, key materials in their operations.

In 2024, the global steel industry accounted for approximately 7% of total CO2 emissions, highlighting the significance of Smulders' focus on steel procurement. By partnering with sustainable suppliers, Smulders aims to mitigate these upstream emissions and enhance its overall environmental performance.

Smulders Group's involvement in constructing offshore wind farms necessitates stringent environmental protocols. For instance, the fabrication and installation of steel structures, vital for wind turbines, demand meticulous planning to safeguard marine ecosystems and wildlife. Adherence to regulations like the EU's Environmental Impact Assessment Directive is paramount, ensuring minimal disturbance to marine mammals and their habitats during these operations.

Waste Management and Circular Economy Principles

Smulders Group is actively integrating circular economy principles by prioritizing high-quality waste treatment and reducing packaging materials. This focus on waste reduction and recycling is a key component of their broader sustainability agenda.

The company's efforts align with a growing trend where recycled materials are increasingly vital for industry. For instance, in 2023, over 50% of the EU's steel, iron, zinc, and platinum originated from recycled sources, highlighting the economic and environmental benefits of such practices.

- Waste Reduction: Smulders aims to minimize waste generation through efficient operational processes.

- Circular Economy: The group's strategy includes adopting principles of reuse, repair, and recycling.

- Recycled Material Usage: Over 50% of key EU metals (steel, iron, zinc, platinum) are sourced from recycling, indicating a strong market for recycled inputs.

- Sustainability Commitment: Waste management and circularity are integral to Smulders' overall environmental, social, and governance (ESG) performance.

Climate Change Adaptation and Resilience

Smulders, as a key player in offshore wind and infrastructure, must navigate the increasing physical risks posed by climate change. Extreme weather events, such as intensified storms, directly threaten offshore construction and maintenance activities, potentially causing project delays and increased operational costs. By 2025, the global cost of climate-related disasters is projected to escalate, underscoring the need for robust adaptation strategies.

Building resilience into Smulders' operations and supply chains is paramount. This includes investing in weather-resilient technologies and diversifying operational locations to mitigate the impact of localized extreme weather. For instance, the company's commitment to a sustainable future, as stated in its mission, necessitates proactive measures against sea-level rise affecting coastal fabrication yards and logistics hubs.

- Increased operational costs due to extreme weather events impacting offshore projects.

- Need for investment in weather-resilient infrastructure and technologies for coastal facilities.

- Strategic adaptation to mitigate risks from sea-level rise and intensified storm seasons.

Smulders Group's environmental strategy is deeply intertwined with the global push for decarbonization, particularly through its role in offshore wind infrastructure. The company's operations are significantly influenced by environmental regulations and the increasing demand for sustainable practices. For example, the EU's target of climate neutrality by 2050, as part of the Green Deal, directly shapes Smulders' market opportunities and operational requirements.

The company actively manages its environmental footprint by focusing on waste reduction and embracing circular economy principles, aiming to minimize waste generation and maximize the use of recycled materials. This aligns with industry trends, as seen in 2023, where over 50% of key metals in the EU were sourced from recycled materials, underscoring the growing importance of sustainable sourcing for companies like Smulders.

| Environmental Focus | Smulders' Action | Industry Context/Data (2023-2025) |

|---|---|---|

| Decarbonization & Offshore Wind | Supplying infrastructure for offshore wind farms | EU Green Deal targets climate neutrality by 2050. Offshore wind capacity is projected to grow significantly by 2030. |

| Sustainable Operations | Using 100% green electricity; Sustainable Procurement Policy | Global steel industry CO2 emissions were ~7% in 2024. Smulders aims to cut Scope 3 emissions. |

| Circular Economy & Waste | Prioritizing waste treatment, reducing packaging, increasing recycled material use | Over 50% of EU steel, iron, zinc, and platinum sourced from recycling in 2023. |

PESTLE Analysis Data Sources

Our Smulders Group PESTLE Analysis is meticulously crafted using a blend of public and proprietary data. We draw insights from official government publications, reputable market research firms, and leading industry associations to ensure a comprehensive and accurate macro-environmental assessment.