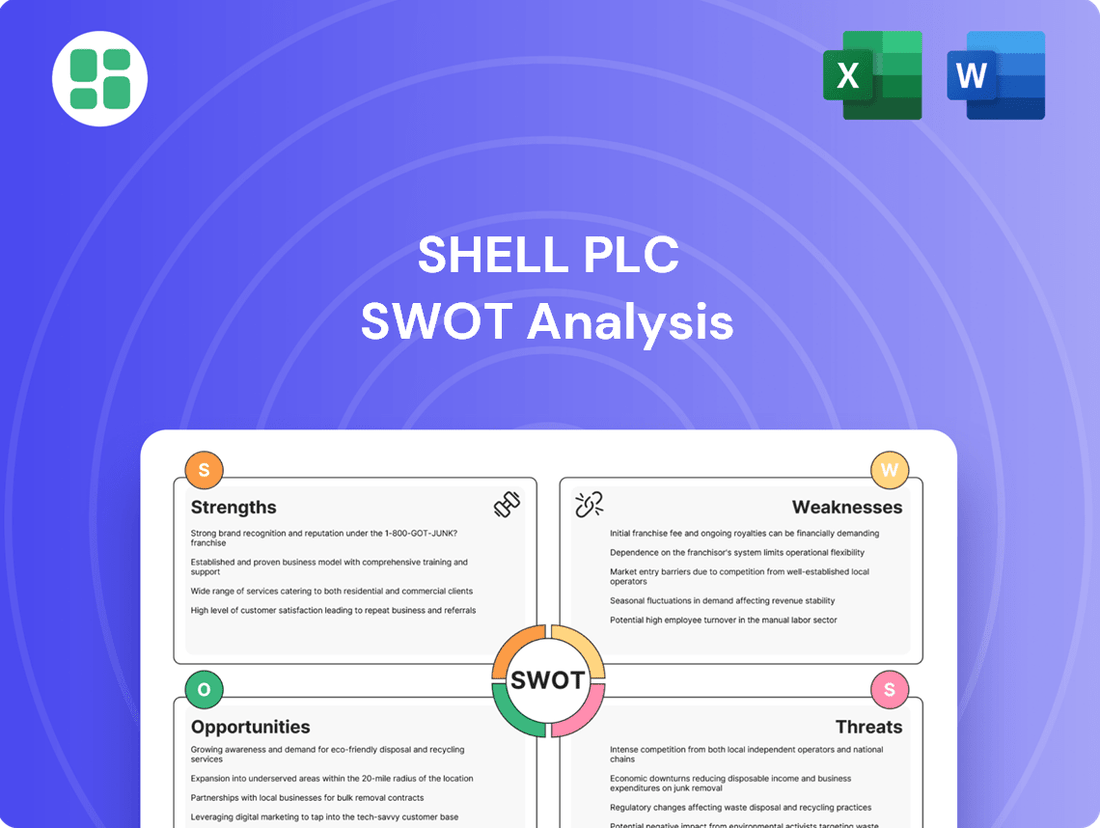

Shell Plc SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Shell Plc Bundle

Shell Plc navigates a complex energy landscape, leveraging its vast global infrastructure and established brand (Strengths) while facing intense competition and regulatory pressures (Weaknesses). The company's significant investments in renewable energy present a key opportunity for future growth, yet the ongoing transition away from fossil fuels poses a substantial threat.

Want the full story behind Shell's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Shell's global integrated operations and immense scale are significant strengths. Its presence in over 70 countries, from upstream exploration and production to downstream refining and marketing, allows for unparalleled supply chain control and cost efficiencies. This integrated model, demonstrated by their extensive network of refineries and retail stations, provides a robust buffer against volatility in any single market, contributing to their resilience.

Shell's energy portfolio is increasingly diverse, moving beyond traditional oil and gas to include significant investments in biofuels, hydrogen, and renewable electricity. This strategic shift is crucial for mitigating risks tied to hydrocarbon dependency and positions Shell to capitalize on the global energy transition. By 2024, Shell had committed billions to renewable energy projects, aiming to significantly grow its non-fossil fuel generation capacity.

Shell commands exceptional brand recognition, a testament to its enduring legacy and robust market standing across both oil and gas exploration (upstream) and refining and marketing (downstream). This global visibility translates into significant customer loyalty and trust, allowing for potentially higher pricing power and smoother entry into new markets with innovative offerings.

The company's vast retail network, serving approximately 33 million customers daily in over 70 countries, is a powerful asset. This widespread presence not only reinforces Shell's market dominance but also provides a critical advantage in reaching consumers and distributing its products and services effectively.

Extensive R&D and Technological Capabilities

Shell's substantial investment in research and development fuels innovation across its energy portfolio, from traditional oil and gas to emerging low-carbon technologies. This dedication to R&D is a cornerstone of its strategy to maintain operational efficiency and explore for new hydrocarbon reserves.

The company leverages its technological capabilities to pioneer advanced solutions like carbon capture, utilization, and storage (CCUS) and hydrogen production. For instance, in 2023, Shell continued to advance projects such as the Quest CCS facility in Canada, demonstrating its commitment to decarbonization technologies.

- Significant R&D Spending: Shell consistently allocates considerable resources to R&D, aiming to drive technological breakthroughs.

- Operational Optimization: Advanced technologies are employed to enhance efficiency in exploration, production, and refining processes.

- Low-Carbon Solutions: Focus on developing and scaling up technologies for CCUS and hydrogen to support its energy transition goals.

- Competitive Edge: Technological leadership provides a distinct advantage in both existing and future energy markets.

Robust Financial Performance and Cash Flow Generation

Shell consistently demonstrates robust financial performance, underpinned by substantial cash flow generation from its established oil and gas operations. This financial resilience is crucial, enabling the company to finance its ambitious energy transition strategies, pursue new investment opportunities, and reward its shareholders.

- Strong Cash Flow: In 2024, Shell reported impressive cash flow from operating activities totaling $54.7 billion.

- Free Cash Flow: The company generated $39.5 billion in free cash flow during the same period.

- Shareholder Returns: Shell distributed $22.6 billion to shareholders in 2024, highlighting its commitment to returning value.

Shell's integrated business model, spanning upstream to downstream, provides significant operational efficiencies and supply chain control. Its vast global presence, active in over 70 countries, offers resilience against regional market fluctuations. This integrated approach, coupled with a diverse energy portfolio that increasingly includes renewables, positions Shell for sustained performance.

The company's brand recognition is a powerful asset, fostering customer loyalty and market trust. This strong brand equity supports its extensive retail network, which serves millions of customers daily, reinforcing its market dominance and accessibility.

Shell's commitment to research and development fuels innovation, enhancing operational efficiency and driving the development of low-carbon technologies like CCUS and hydrogen. This technological leadership provides a competitive edge in evolving energy markets.

Financially, Shell demonstrates robust performance with substantial cash flow generation. In 2024, Shell reported $54.7 billion in cash flow from operating activities and $39.5 billion in free cash flow, enabling significant shareholder returns and investments in its energy transition strategy.

| Metric | 2024 Value (USD billions) | Significance |

|---|---|---|

| Cash Flow from Operations | 54.7 | Underpins financial resilience and investment capacity. |

| Free Cash Flow | 39.5 | Provides flexibility for shareholder returns and strategic initiatives. |

| Shareholder Distributions | 22.6 | Demonstrates commitment to returning value to investors. |

What is included in the product

Shell Plc's SWOT analysis highlights its strong brand and integrated operations as key strengths, while acknowledging potential weaknesses in its reliance on fossil fuels and the need for significant investment in renewables. The company faces opportunities in the growing demand for cleaner energy and technological advancements, but also significant threats from regulatory changes, volatile energy prices, and increasing competition from agile, lower-carbon energy providers.

Offers a clear, actionable framework to navigate Shell's complex market challenges and capitalize on emerging opportunities.

Weaknesses

Shell's significant reliance on fossil fuel revenues remains a key weakness. Despite investments in renewables, oil and gas still account for the majority of its income. This dependency creates vulnerability as global energy markets shift towards cleaner alternatives, potentially impacting long-term profitability and market perception.

The ongoing global energy transition poses a direct threat to Shell's core business model. With fossil fuels still meeting around 80% of the world's primary energy needs, a rapid shift away from these sources could significantly disrupt Shell's revenue streams. This exposure can also lead to challenges in maintaining a strong sustainability image among investors and consumers.

Shell's financial performance is deeply tied to the unpredictable nature of oil and gas prices. For instance, in the first quarter of 2024, Brent crude oil prices averaged around $83 per barrel, a significant drop from the $90s seen in late 2023, directly impacting Shell's revenue streams and profitability.

Geopolitical tensions, shifts in global demand, and production decisions by major oil-producing nations can cause rapid price swings. This volatility makes it challenging for Shell to forecast earnings accurately and can disrupt long-term investment planning, affecting capital expenditure and potential shareholder returns.

The company's ongoing efforts to navigate this inherent price volatility are a constant strategic imperative. Despite diversification efforts, managing the impact of fluctuating commodity markets remains a core challenge for Shell's operational and financial stability.

Operating a global energy giant like Shell demands substantial financial outlays. Significant capital is needed for maintaining existing infrastructure, finding new oil and gas reserves, and investing in future projects. This can put a strain on finances and make it harder to quickly shift investments into newer energy areas. In 2024, Shell's cash capital expenditure reached $21.1 billion, with projections for 2025-2028 indicating an annual spend between $20 billion and $22 billion.

Environmental Liabilities and Reputational Risks

Shell continues to face significant environmental liabilities and reputational risks stemming from its historical and ongoing operations. These concerns, particularly around greenhouse gas emissions and past oil spills, attract intense scrutiny from regulators, environmental groups, and the public. For instance, in 2023, Shell was ordered by a Dutch court to accelerate its emissions reduction targets, a ruling that could have substantial financial implications and set precedents for other energy companies.

These environmental challenges translate into tangible financial risks, including substantial fines and costly legal battles. Beyond direct financial penalties, negative public perception can erode brand value and impact its social license to operate. This can make it harder to secure permits for new projects and deter investors who are increasingly focused on Environmental, Social, and Governance (ESG) performance. Attracting and retaining top talent also becomes more difficult when a company's environmental record is a point of public contention.

The company's exposure includes:

- Ongoing legal challenges and potential fines related to past environmental incidents and current emissions levels.

- Damage to corporate reputation, impacting brand loyalty and investor confidence.

- Reduced ability to secure new operating licenses and attract environmentally conscious talent.

Challenges in Fully Transitioning to a Low-Carbon Business Model

Transforming a company of Shell's magnitude from a fossil fuel focus to a low-carbon leader is a monumental undertaking. This involves significant divestments of existing oil and gas assets, which are still major revenue drivers, and simultaneously building entirely new capabilities in areas like renewable energy generation and hydrogen production. Navigating the complex and often shifting regulatory environments across various global markets adds another layer of difficulty to this strategic pivot.

Shell has set an ambitious target of achieving net-zero emissions by 2050, but the path to this goal is fraught with challenges. The sheer scale of investment required for this transition, estimated to be billions of dollars annually, needs to be balanced against shareholder expectations for returns from its traditional businesses. Furthermore, ensuring that new low-carbon ventures can scale effectively and compete economically with established energy sources remains a critical hurdle.

- Asset Divestment Pace: Shell's progress in divesting high-carbon assets needs to accelerate to align with its net-zero ambitions, with potential impacts on near-term profitability.

- New Competency Development: Building expertise in renewable energy technologies and supply chains requires significant investment in research, development, and talent acquisition.

- Regulatory Uncertainty: Evolving government policies on carbon pricing, renewable energy subsidies, and fossil fuel phase-outs create an unpredictable operating environment.

- Capital Allocation: Balancing investments between maintaining existing oil and gas operations and funding the growth of low-carbon businesses presents a complex capital allocation challenge.

Shell's substantial capital expenditure, projected between $20 billion and $22 billion annually from 2025-2028, presents a weakness by potentially limiting rapid shifts in investment towards new energy sectors. This large ongoing spend for maintaining existing infrastructure and exploring new oil and gas reserves can strain finances, making it challenging to reallocate capital quickly to burgeoning renewable energy projects.

Same Document Delivered

Shell Plc SWOT Analysis

You're previewing the actual analysis document for Shell Plc's SWOT. Buy now to access the full, detailed report, which includes a comprehensive breakdown of its Strengths, Weaknesses, Opportunities, and Threats.

Opportunities

The global shift towards cleaner energy sources offers Shell a prime opportunity to grow its renewable energy portfolio. This includes expanding investments in wind, solar, and other sustainable power generation technologies.

Shell is actively channeling significant capital into this area, earmarking $10 billion to $15 billion for low-carbon solutions from 2023 through 2025. This strategic allocation supports growth in electric vehicle charging infrastructure, biofuel production, and renewable power generation.

This strategic pivot not only opens up new avenues for revenue but also positions Shell to align with and capitalize on international climate objectives and growing market demand for sustainable energy.

The burgeoning hydrogen and advanced biofuels markets represent significant opportunities for Shell. These cleaner fuel alternatives are vital for decarbonizing sectors like heavy-duty transport and heavy industry, areas where electrification is challenging. Shell's strategic investments, including up to $1 billion annually in hydrogen and carbon capture and storage (CCS) for 2024-2025, underscore its commitment to this transition.

Shell can significantly boost its performance by embracing digital tools like AI and advanced data analytics. These technologies can streamline everything from finding new oil and gas reserves to getting products to customers, making operations smoother and more cost-effective. This focus on digital transformation is key to unlocking greater efficiency across the entire business.

By implementing these digital solutions, Shell aims to achieve substantial cost savings and make smarter, faster decisions. The company has already demonstrated its commitment to this strategy, reporting over $3 billion in structural cost reductions since 2022, highlighting the tangible benefits of operational efficiency improvements.

Strategic Partnerships and Acquisitions in New Energy Sectors

Strategic partnerships and acquisitions are key to Shell's expansion into new energy. By teaming up with innovative tech startups, renewable energy developers, and other industry leaders, Shell can speed up its transition away from fossil fuels. These collaborations offer access to cutting-edge technologies and specialized knowledge, helping to bring new energy solutions to market faster and share the financial burden.

Shell's acquisition of Pavilion Energy in the first quarter of 2025 for approximately $2.6 billion is a prime example of this strategy in action. This move significantly bolsters Shell's liquefied natural gas (LNG) business, a crucial component of its lower-carbon energy portfolio. The integration of Pavilion Energy's assets and expertise is expected to enhance Shell's position in the global gas market and support its energy transition goals.

- Access to New Technologies: Partnerships can provide Shell with early access to emerging technologies in areas like hydrogen, carbon capture, and advanced battery storage, crucial for its 2030 and 2035 emissions reduction targets.

- Risk Mitigation: Joint ventures and acquisitions allow Shell to share the substantial capital investment required for new energy infrastructure, reducing its individual financial exposure.

- Market Penetration: Acquiring or partnering with established players in nascent energy sectors can accelerate Shell's entry and growth in these markets, leveraging existing customer bases and distribution networks.

Growing Demand for Energy in Emerging Economies

The burgeoning industrialization and population expansion in emerging economies are creating a significant surge in energy consumption. Shell is well-positioned to meet this escalating demand by offering a diverse portfolio of energy solutions, encompassing both conventional and sustainable options, specifically designed for these dynamic markets. This strategic focus on high-growth regions presents substantial long-term revenue potential, especially as global energy needs are anticipated to climb. For instance, the International Energy Agency (IEA) projected in its 2024 outlook that emerging and developing economies, excluding China, will account for the majority of the projected increase in global oil demand through 2030.

Shell can leverage this opportunity by:

- Expanding its downstream infrastructure and retail networks in rapidly developing nations.

- Investing in and promoting a broader range of lower-carbon energy solutions, such as LNG and biofuels, to meet evolving market preferences.

- Forming strategic partnerships with local governments and businesses to navigate regulatory landscapes and ensure reliable energy supply.

- Capitalizing on the projected 20% increase in global energy demand by 2050, with a significant portion attributed to emerging economies.

Shell's strategic investments in renewable energy are substantial, with $10 billion to $15 billion allocated for low-carbon solutions between 2023 and 2025, targeting growth in EV charging and biofuels.

The company sees significant potential in hydrogen and advanced biofuels, earmarking up to $1 billion annually for these areas in 2024-2025 to decarbonize challenging sectors.

Digital transformation, including AI and data analytics, is a key opportunity for Shell to boost efficiency and achieve cost savings, building on over $3 billion in structural cost reductions since 2022.

Strategic partnerships and acquisitions, like the $2.6 billion Pavilion Energy deal in early 2025, are crucial for Shell to access new technologies and accelerate its energy transition.

| Opportunity Area | Shell's Strategic Focus | Financial Commitment/Impact |

|---|---|---|

| Renewable Energy Growth | Expanding wind, solar, and EV charging infrastructure | $10-15 billion (2023-2025) for low-carbon solutions |

| Hydrogen & Biofuels | Developing cleaner fuels for hard-to-abate sectors | Up to $1 billion annually (2024-2025) for hydrogen and CCS |

| Digital Transformation | Leveraging AI and data analytics for efficiency | Over $3 billion in structural cost reductions achieved since 2022 |

| Partnerships & Acquisitions | Acquiring Pavilion Energy for $2.6 billion (Q1 2025) | Strengthens LNG portfolio and accelerates energy transition |

Threats

Governments globally are intensifying efforts to combat climate change, translating into more rigorous environmental policies and carbon pricing. For Shell, this means facing increased operational expenses and a potential downturn in demand for its core fossil fuel products. The European Union's Emissions Trading System, for instance, saw its carbon price hit €86.28 per ton in January 2024, a clear indicator of rising compliance costs.

These escalating regulatory pressures pose a significant threat by potentially devaluing Shell's existing assets, creating the risk of stranded assets as the world shifts away from carbon-intensive energy sources. Adapting to these stricter regulations will require substantial investment in cleaner technologies and a strategic pivot to more sustainable business models to mitigate financial and operational risks.

Global geopolitical tensions, including ongoing conflicts and escalating trade disputes, pose a significant threat to Shell's operations. These events can severely disrupt critical supply chains, impacting everything from raw material sourcing to product distribution, and can also directly affect production facilities in volatile regions.

The direct consequences of such instability include increased operational costs due to logistical challenges and security measures. Furthermore, market uncertainties can arise, making it harder to predict demand and pricing, while access to key markets might be restricted, directly impacting Shell's revenue streams.

For instance, the ongoing conflict in Eastern Europe has led to significant price volatility in oil and gas markets, affecting Shell's profitability and strategic planning throughout 2024. The company's efforts to maintain operational resilience are crucial to navigate these complex and unpredictable geopolitical landscapes.

Shell's pivot into renewables means it's now directly confronting specialized companies like Ørsted and Iberdrola, which have built their entire operations around clean energy. These pure-play firms often benefit from leaner structures and a singular focus, potentially allowing them to operate with greater cost efficiencies than a diversified energy giant like Shell.

This intensified competition poses a challenge for Shell to capture substantial market share and achieve the profit margins it targets in the renewable sector. For instance, while Shell invested $3.3 billion in renewables and low-carbon energy solutions in 2023, pure-play companies are solely dedicated to this growth, often with more streamlined operations and potentially lower overheads.

To succeed, Shell must effectively differentiate its renewable offerings and maintain a sharp strategic focus. The ability to innovate and adapt quickly will be crucial in a market where agility and specialized expertise are significant competitive advantages, especially as the global renewable energy market is projected to reach $1,977.6 billion by 2030.

Fluctuations in Oil and Gas Prices

Fluctuations in oil and gas prices represent a significant external threat to Shell. Extreme volatility or a prolonged slump in crude oil and natural gas prices directly impacts Shell's profitability and its ability to fund future investments. For instance, during periods of low oil prices, such as those seen in early 2020, margins shrink, cash flow diminishes, and the company often has to postpone or cancel planned projects. This economic sensitivity highlights the ongoing imperative for Shell to diversify its energy portfolio beyond traditional fossil fuels.

The impact of price swings is substantial:

- Eroded Margins: Lower commodity prices directly reduce the profit margin on each barrel of oil or cubic foot of gas sold.

- Reduced Cash Flow: This squeeze on margins translates into less cash available for operations, debt repayment, and shareholder returns.

- Project Deferrals: Unfavorable price environments can make new exploration and production projects economically unviable, leading to delays or outright cancellations.

- Investment Uncertainty: Volatility creates uncertainty, making it harder for Shell to plan long-term capital expenditures with confidence.

Potential for Disruptive Technologies in the Energy Sector

The energy sector is a hotbed for innovation, and emerging technologies pose a significant threat to established players like Shell. Breakthroughs in areas such as advanced battery storage, small modular nuclear reactors, and next-generation biofuels could quickly make current energy infrastructure and business models obsolete. For instance, by 2024, global investment in clean energy technologies was projected to exceed $2 trillion, signaling a rapid shift away from traditional fossil fuels.

These disruptive forces could fundamentally alter demand for Shell's core products. For example, widespread adoption of electric vehicles, powered by increasingly efficient and cheaper battery technology, directly impacts gasoline and diesel consumption. Similarly, advancements in green hydrogen production and distribution could offer a cleaner alternative for industrial and transportation sectors, challenging Shell's existing natural gas and refining operations.

To counter this, Shell must actively monitor and invest in these nascent technologies. Their 2024 R&D budget, which saw a notable increase to support low-carbon solutions, reflects this understanding. Failing to adapt could lead to a significant competitive disadvantage and erosion of market share as newer, more agile companies leverage these disruptive innovations.

- Technological Disruption: New energy technologies can rapidly displace existing solutions, impacting Shell's business model.

- Market Shifts: Advancements in areas like battery storage and green hydrogen challenge traditional fossil fuel demand.

- Investment Imperative: Shell's 2024 R&D focus on low-carbon solutions highlights the need to invest in innovation to mitigate this threat.

- Competitive Landscape: Failure to adapt to technological change risks ceding market share to innovative competitors.

The increasing global focus on climate change translates into stricter environmental regulations and carbon pricing mechanisms for energy companies like Shell. This poses a threat of higher operational costs and potentially reduced demand for its traditional fossil fuel products, as evidenced by the EU's carbon price reaching €86.28 per ton in January 2024.

Geopolitical instability, including conflicts and trade disputes, can disrupt Shell's supply chains, affect production in volatile regions, and create market uncertainty. The ongoing conflict in Eastern Europe, for example, has contributed to significant oil and gas price volatility throughout 2024, impacting the company's profitability.

Shell faces intense competition in the growing renewables sector from specialized companies like Ørsted and Iberdrola, which may have leaner structures and a singular focus. While Shell invested $3.3 billion in renewables in 2023, these pure-play competitors are solely dedicated to this growth, potentially offering greater cost efficiencies.

Emerging technologies such as advanced battery storage and green hydrogen present a significant threat by potentially making current energy infrastructure and business models obsolete. Global investment in clean energy technologies was projected to exceed $2 trillion by 2024, signaling a rapid shift that could impact demand for Shell's core products.

| Threat Category | Specific Example/Impact | Relevant Data Point (2024/2025 Focus) |

|---|---|---|

| Regulatory Pressure | Stricter environmental policies, carbon pricing | EU Carbon Price: €86.28/ton (Jan 2024) |

| Geopolitical Instability | Supply chain disruption, price volatility | Impact of Eastern European conflict on oil/gas prices (ongoing 2024) |

| Competition in Renewables | Specialized clean energy firms | Shell's 2023 renewables investment: $3.3 billion |

| Technological Disruption | Advancements in battery storage, green hydrogen | Global clean energy tech investment projected >$2 trillion (by 2024) |

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of robust data, drawing from Shell's official financial reports, comprehensive market intelligence, and expert industry analysis. These sources provide a detailed understanding of the company's performance, competitive landscape, and future outlook.