Shell Plc Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Shell Plc Bundle

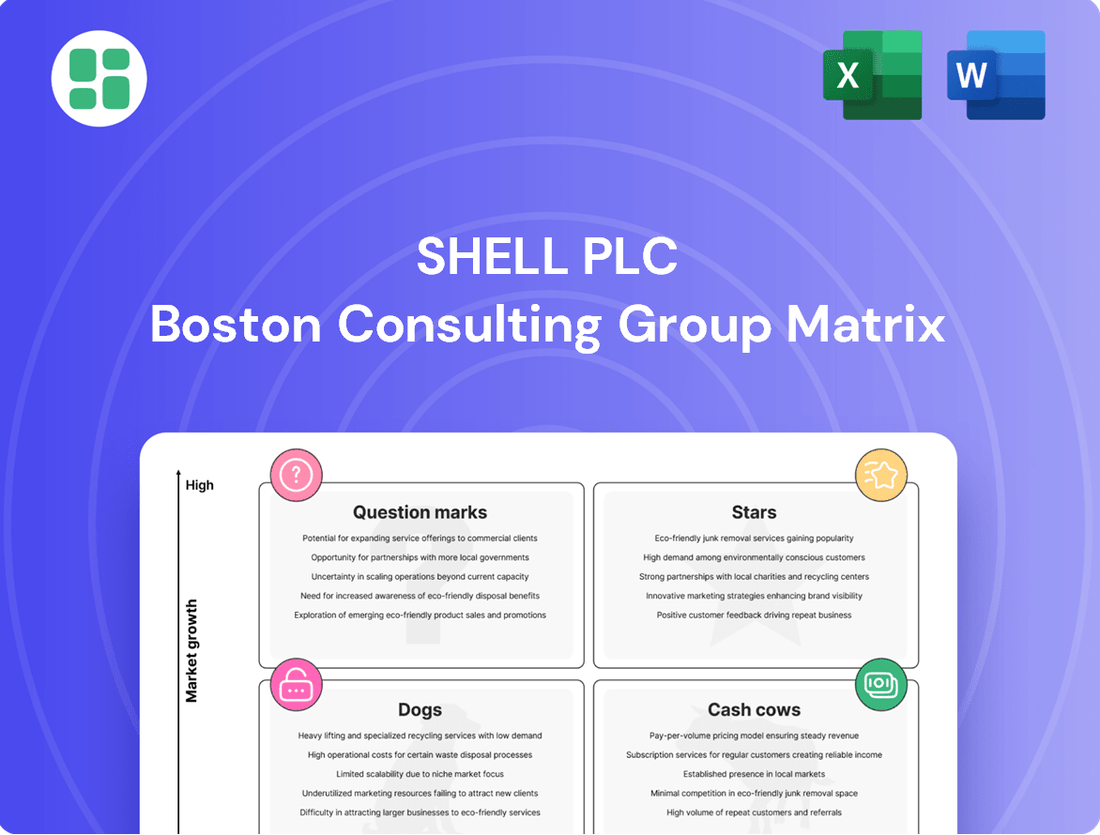

Explore the strategic positioning of Shell Plc's diverse portfolio through its BCG Matrix. Understand which of their ventures are market leaders, which are generating consistent profits, and which require careful evaluation. This snapshot offers a glimpse into their product lifecycle and market share dynamics.

Dive deeper into Shell Plc's BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Shell's EV Charging Network is a key growth engine, positioned as a Star in the BCG Matrix. The company is aggressively expanding its public charging infrastructure, targeting 200,000 charge points globally by 2030, a substantial leap from 54,000 in 2023.

This expansion is strategically focused on lucrative markets such as China and Europe, where EV adoption is high. Shell benefits from its extensive existing retail footprint, creating a synergistic advantage for its charging business.

The EV charging segment is demonstrating impressive financial performance, with Shell anticipating an internal rate of return of 12% or more. This strong profitability outlook underscores its status as a high-growth, high-share business.

Shell is significantly ramping up its biofuel production, with a keen eye on Sustainable Aviation Fuel (SAF). They are investing in expanding capacity, particularly utilizing waste materials as feedstocks. This strategic move positions them to capitalize on the growing demand for cleaner aviation fuels.

The Rotterdam biofuels facility is a cornerstone of this strategy. Although temporarily paused for upgrades, it's slated to become one of Europe's largest, projected to produce substantial volumes of renewable diesel and SAF. This facility is crucial for Shell's ambition to be a top global SAF supplier.

This expansion directly supports the aviation industry's push for decarbonization, a market experiencing rapid growth. Shell's commitment to SAF production, evidenced by these investments, aligns with global environmental goals and offers a pathway to reduce the carbon footprint of air travel.

Hydrogen Energy Solutions represents a significant growth opportunity for Shell, aligning with its strategy to transition towards cleaner energy. The company is channeling substantial capital into this sector, with plans to invest up to $1 billion annually in hydrogen and carbon capture and storage (CCS) from 2024 to 2025. This commitment underscores the perceived potential of hydrogen as a key component of the future energy mix.

Shell's strategic investments are evident in projects such as the REFHYNE II renewable hydrogen electrolyzer in Germany, which aims for substantial green hydrogen production by 2027. By leveraging its existing infrastructure and capitalizing on supportive government policies, Shell is positioning itself to be a major player in this emerging market. The company's proactive approach reflects a belief in hydrogen's long-term viability and its role in decarbonization efforts.

Integrated Power for Commercial Customers

Shell's commercial power segment is a key growth driver, moving away from broad retail supply to targeted sales in lucrative markets such as Australia, Europe, India, and the USA. This strategic pivot emphasizes value creation by leveraging Shell's established strengths in power trading and renewable energy generation to cater specifically to the needs of commercial clients.

By the beginning of 2025, Shell had already deployed approximately 3.4 gigawatts of renewable power generation capacity. This figure is set to increase significantly as the company continues to invest in and construct additional renewable projects, underscoring its commitment to this evolving energy landscape.

- Focus on High-Growth Markets: Shell is concentrating its commercial power efforts in regions like Australia, Europe, India, and the USA, identifying these as key areas for expansion.

- Value Over Volume Strategy: The company is prioritizing profitable sales to commercial customers rather than simply increasing overall power supply volume.

- Leveraging Core Competencies: Shell is utilizing its existing expertise in power trading and its growing renewable generation portfolio to serve commercial demand effectively.

- Significant Renewable Capacity: As of early 2025, Shell operated 3.4 GW of renewable power generation capacity, with ongoing development of further projects.

Carbon Capture and Storage (CCS)

Shell is actively developing Carbon Capture and Storage (CCS) capabilities, viewing it as a vital technology for reducing emissions in challenging industries. The company is channeling a portion of its substantial low-carbon investments, projected between $10 billion and $15 billion from 2023 to 2025, into these initiatives.

- Polaris Project: Shell is a partner in the Polaris carbon capture project in Alberta, Canada, which aims to capture and permanently store significant quantities of CO2 annually.

- Decarbonization Role: CCS is considered essential for decarbonizing sectors that are difficult to abate, aligning with Shell's broader energy transition goals.

- Strategic Investment: The allocation of funds towards CCS underscores Shell's recognition of its potential for future growth and its role in achieving emissions reduction targets.

Shell's EV Charging Network is a prime example of a Star in the BCG matrix, demonstrating high growth and a strong market position. The company is aggressively expanding its global charging points, aiming for 200,000 by 2030, up from 54,000 in 2023.

This expansion, particularly in high-EV adoption markets like China and Europe, leverages Shell's existing retail network for a competitive edge. The segment is projected to deliver an internal rate of return of 12% or more, signaling robust profitability.

| Business Unit | BCG Category | Key Metrics/Developments |

| EV Charging Network | Star | Target: 200,000 charge points globally by 2030 (vs. 54,000 in 2023). Projected IRR: 12%+. |

| Biofuels (SAF) | Star | Investing in capacity expansion, particularly using waste feedstocks. Rotterdam facility to be one of Europe's largest SAF producers. |

| Hydrogen Energy Solutions | Star | Investing up to $1 billion annually (2024-2025) in hydrogen and CCS. REFHYNE II electrolyzer in Germany targeting substantial green hydrogen by 2027. |

| Commercial Power | Star | Focus on high-growth markets (Australia, Europe, India, USA). Deployed 3.4 GW renewable capacity by early 2025, with ongoing project development. |

| Carbon Capture and Storage (CCS) | Question Mark / Star (Emerging) | Investing between $10-15 billion (2023-2025) in low-carbon solutions including CCS. Partner in Polaris project in Alberta, Canada. |

What is included in the product

Shell Plc's BCG Matrix analysis categorizes its diverse energy portfolio, identifying which units offer high growth and market share (Stars) versus those with strong cash flow but low growth (Cash Cows).

The matrix guides strategic decisions, highlighting areas for investment (Stars, Question Marks) and potential divestment (Dogs).

A clear BCG Matrix for Shell Plc's business units simplifies complex portfolio decisions, acting as a pain point reliever for strategic planning.

Cash Cows

Shell's Liquefied Natural Gas (LNG) business is a significant Cash Cow, consistently generating substantial profits and reinforcing its market leadership. The company anticipates its LNG sales to grow by 4-5% annually through 2030, underscoring its robust performance and strategic focus.

Global demand for LNG is projected to surge by 2040, primarily fueled by economic expansion in Asian markets. This sustained demand ensures that Shell's LNG operations will continue to be a strong source of cash generation for the foreseeable future.

The recent acquisition of Pavilion Energy's LNG assets is a key strategic move that enhances Shell's trading and optimization capabilities. This acquisition further solidifies Shell's dominant position in the global LNG market, ensuring continued profitability.

Shell's upstream oil and gas production remains a robust cash cow, fueling its energy transition initiatives. This segment consistently delivers substantial profits, underscoring its importance to the company's financial health.

The newly operational Whale platform in the Gulf of Mexico, commencing production in January 2025, is a prime example of this segment's cash-generating power. It's projected to reach a peak production of approximately 100,000 barrels of oil equivalent per day, directly boosting Shell's cash flow.

Shell's strategic focus on maintaining liquids production at around 1.4 million barrels per day through 2030 further solidifies the upstream segment's role as a reliable cash generator. This commitment highlights the company's dedication to ensuring cash flow resilience during its ongoing energy transformation.

Shell's traditional refining and marketing of petroleum products, encompassing its vast global retail network, acts as a significant Cash Cow. This segment consistently delivers robust profit margins, underscoring its stable and high-performing nature within the company's portfolio. In 2024, Shell's retail sites catered to an impressive average of 33 million customers each day, highlighting its substantial market reach and deep-rooted brand loyalty.

The Products segment's financial performance in Q1 2025 further solidified its Cash Cow status. Adjusted earnings experienced a notable uplift, primarily driven by enhanced margins derived from trading activities and effective optimization strategies. This demonstrates the segment's ability to capitalize on market dynamics and operational efficiencies to generate substantial, consistent returns.

Chemicals Business

Shell's Chemicals business is a significant contributor to its overall cash flow. In the first quarter of 2025, this segment demonstrated improved margins and utilization rates, underscoring its role as a reliable revenue generator.

Despite inherent market volatility, Shell maintains robust operations within its chemicals manufacturing plants. These facilities are supported by dedicated marketing networks and are strategically integrated into the company's larger energy and chemicals parks, optimizing operational synergies.

- Revenue Stream: Provides a consistent, albeit lower-growth, source of revenue for Shell.

- Profitability: Contributes steadily to the company's profits, benefiting from operational efficiencies.

- Q1 2025 Performance: Saw improved margins and higher utilization rates, indicating operational strength.

- Strategic Integration: Operates with its own marketing networks and is integrated into broader energy and chemicals parks.

Global Convenience Retail Network

Shell's extensive global convenience retail network, encompassing numerous service stations and integrated convenience stores, acts as a significant cash cow. This network consistently generates substantial revenue from millions of daily transactions, benefiting from high-margin sales of everyday consumables.

Shell is actively investing in modernizing this network. By incorporating electric vehicle (EV) charging infrastructure and enhancing convenience offerings, the company is adapting to evolving consumer preferences and reinforcing its market position. This strategic upgrade aims to ensure continued profitability and competitive strength in the face of changing energy landscapes.

The established infrastructure and strong brand recognition associated with Shell's retail outlets provide a reliable foundation for consistent cash flow. Everyday consumer purchases at these locations contribute significantly to the company's financial stability, underscoring the cash cow status of this business segment.

- Global Reach: Shell operates over 40,000 retail sites worldwide as of 2023, with a significant portion including convenience stores.

- Revenue Contribution: Convenience retail and broader mobility services contributed approximately $1.5 billion to Shell's operational earnings in 2023.

- EV Integration: By the end of 2023, Shell had installed over 12,000 EV charging points across its global network, with plans for significant expansion.

- Customer Focus: The company aims to capture a larger share of the growing convenience market, which is projected to reach over $1.1 trillion globally by 2025.

Shell's Liquefied Natural Gas (LNG) business is a significant Cash Cow, consistently generating substantial profits and reinforcing its market leadership. The company anticipates its LNG sales to grow by 4-5% annually through 2030, underscoring its robust performance and strategic focus.

Global demand for LNG is projected to surge by 2040, primarily fueled by economic expansion in Asian markets. This sustained demand ensures that Shell's LNG operations will continue to be a strong source of cash generation for the foreseeable future.

The recent acquisition of Pavilion Energy's LNG assets is a key strategic move that enhances Shell's trading and optimization capabilities. This acquisition further solidifies Shell's dominant position in the global LNG market, ensuring continued profitability.

Shell's upstream oil and gas production remains a robust cash cow, fueling its energy transition initiatives. This segment consistently delivers substantial profits, underscoring its importance to the company's financial health.

The newly operational Whale platform in the Gulf of Mexico, commencing production in January 2025, is a prime example of this segment's cash-generating power. It's projected to reach a peak production of approximately 100,000 barrels of oil equivalent per day, directly boosting Shell's cash flow.

Shell's strategic focus on maintaining liquids production at around 1.4 million barrels per day through 2030 further solidifies the upstream segment's role as a reliable cash generator. This commitment highlights the company's dedication to ensuring cash flow resilience during its ongoing energy transformation.

Shell's traditional refining and marketing of petroleum products, encompassing its vast global retail network, acts as a significant Cash Cow. This segment consistently delivers robust profit margins, underscoring its stable and high-performing nature within the company's portfolio. In 2024, Shell's retail sites catered to an impressive average of 33 million customers each day, highlighting its substantial market reach and deep-rooted brand loyalty.

The Products segment's financial performance in Q1 2025 further solidified its Cash Cow status. Adjusted earnings experienced a notable uplift, primarily driven by enhanced margins derived from trading activities and effective optimization strategies. This demonstrates the segment's ability to capitalize on market dynamics and operational efficiencies to generate substantial, consistent returns.

Shell's Chemicals business is a significant contributor to its overall cash flow. In the first quarter of 2025, this segment demonstrated improved margins and utilization rates, underscoring its role as a reliable revenue generator.

Despite inherent market volatility, Shell maintains robust operations within its chemicals manufacturing plants. These facilities are supported by dedicated marketing networks and are strategically integrated into the company's larger energy and chemicals parks, optimizing operational synergies.

Shell's extensive global convenience retail network, encompassing numerous service stations and integrated convenience stores, acts as a significant cash cow. This network consistently generates substantial revenue from millions of daily transactions, benefiting from high-margin sales of everyday consumables.

Shell is actively investing in modernizing this network. By incorporating electric vehicle (EV) charging infrastructure and enhancing convenience offerings, the company is adapting to evolving consumer preferences and reinforcing its market position. This strategic upgrade aims to ensure continued profitability and competitive strength in the face of changing energy landscapes.

The established infrastructure and strong brand recognition associated with Shell's retail outlets provide a reliable foundation for consistent cash flow. Everyday consumer purchases at these locations contribute significantly to the company's financial stability, underscoring the cash cow status of this business segment.

| Business Segment | BCG Category | Key Characteristics | 2024/2025 Performance Highlights | Future Outlook |

|---|---|---|---|---|

| Liquefied Natural Gas (LNG) | Cash Cow | High market share, strong demand growth | Anticipated 4-5% annual sales growth through 2030; Acquisition of Pavilion Energy assets | Continued strong cash generation driven by global demand, especially in Asia |

| Upstream Oil & Gas Production | Cash Cow | Consistent profitability, supports energy transition | Whale platform commenced production Jan 2025 (peak ~100 kboepd); Maintaining liquids production around 1.4 million bpd through 2030 | Reliable cash generator for ongoing business and investments |

| Refining & Marketing (Products) | Cash Cow | Stable high margins, vast retail network | Served ~33 million customers daily in 2024; Q1 2025 saw uplift in adjusted earnings from trading and optimization | Continued robust profit margins from established operations and market reach |

| Chemicals | Cash Cow | Reliable revenue generator, operational synergies | Q1 2025 showed improved margins and utilization rates; Robust operations in integrated parks | Steady contribution to cash flow, benefiting from integrated infrastructure |

| Convenience Retail & Mobility | Cash Cow | High-margin sales, strong brand loyalty | Operates over 40,000 global retail sites; Contributed ~$1.5 billion to operational earnings in 2023; Over 12,000 EV charging points by end of 2023 | Capturing growing convenience market share; Modernization and EV integration to ensure continued profitability |

What You See Is What You Get

Shell Plc BCG Matrix

The Shell Plc BCG Matrix preview you are viewing is the identical, fully-formatted document you will receive upon purchase, ensuring no surprises and immediate usability for your strategic planning.

This preview accurately represents the comprehensive Shell Plc BCG Matrix you'll download, offering an unwatermarked, analysis-ready report designed for professional application and decision-making.

What you see is the actual Shell Plc BCG Matrix file you’ll get upon purchase, providing you with a complete, professionally crafted strategic tool ready for immediate integration into your business analysis.

You're previewing the real Shell Plc BCG Matrix document that becomes yours after a one-time purchase; it's a professionally designed, analysis-ready file that’s instantly downloadable for immediate use.

Dogs

Shell's strategic move to divest around 1,000 company-owned retail sites in 2024 and 2025 places these locations squarely in the 'Dog' quadrant of the BCG Matrix. These sites are characterized by low growth potential and a small market share within Shell's broader retail operations.

The divestment strategy indicates these locations are not meeting performance expectations or aligning with Shell's future growth ambitions, potentially representing a drain on capital and management attention. By shedding these underperformers, Shell can reallocate resources to more promising ventures.

This action supports Shell's broader objective of optimizing its retail network, focusing on high-return areas such as expanding electric vehicle (EV) charging infrastructure and enhancing premium convenience offerings at its remaining, more strategic locations.

Shell's divestment of its onshore oil and gas assets in Nigeria, including the Shell Petroleum Development Company (SPDC), marks a strategic move to refine its portfolio. This transition, completed in 2024, signals a shift away from mature, challenging operational environments. These legacy assets, while once cornerstones of Shell's operations, often grappled with significant security concerns and operational complexities, impacting their growth trajectory.

The decision to divest from these onshore Nigerian assets aligns with Shell's broader strategy to exit segments characterized by lower growth potential and market share. By doing so, the company can free up capital and management focus, enabling reinvestment into more promising, higher-growth areas within its global portfolio. This strategic reallocation is crucial for adapting to evolving energy landscapes and enhancing overall shareholder value.

Shell's decision to exit large-scale onshore wind and solar projects in Brazil, announced in March 2025, signals a strategic pivot. This move highlights a focus on projects that meet stringent profitability metrics, especially in capital-intensive renewable sectors.

The termination reflects a broader trend of portfolio optimization within Shell's energy transition strategy. While the company remains committed to renewables, it's increasingly selective about where it deploys capital, prioritizing regions and project types offering more attractive returns.

Non-Core or Less Profitable Chemical Product Lines

Within Shell's extensive chemicals portfolio, certain product lines might be classified as Dogs if they exhibit persistently low profitability or a shrinking market presence. This is particularly relevant given Shell's strategic emphasis on high-return ventures, which often necessitates divesting or de-emphasizing underperforming segments.

Shell's Q4 2024 financial disclosures highlighted a challenging period, with management specifically mentioning a weak chemicals margin environment. This suggests that some chemical sub-segments were indeed struggling to generate adequate returns, potentially fitting the profile of a Dog category.

The company's ongoing portfolio review process is designed to identify and address these less profitable areas. Decisions regarding these chemical product lines will likely be informed by their long-term growth prospects and alignment with Shell's overall strategic objectives.

- Underperforming Margins: Specific chemical product lines may show consistently lower profit margins compared to industry benchmarks or other Shell business units.

- Low Market Share: These products might operate in niche or declining markets where Shell holds a minimal competitive position.

- Strategic Re-evaluation: Shell's focus on optimizing its chemicals business for higher returns implies a continuous assessment of all product lines, potentially leading to the divestment or restructuring of those identified as Dogs.

Outdated Refining Assets with Low Efficiency

Shell Plc, as part of its ongoing strategic portfolio management, may classify certain outdated refining assets with low efficiency as Dogs within the BCG Matrix. These facilities often face challenges such as low utilization rates and elevated operating expenditures, particularly in saturated markets. While specific divestment plans for 2024-2025 are not publicly detailed, the company's consistent emphasis on 'high-grading' its assets and enhancing overall efficiency strongly indicates a strategic move towards divesting less competitive refining units.

The company's objective is to achieve improved refining margins, which are largely influenced by asset utilization and prevailing global supply-demand dynamics. This focus naturally leads to a de-prioritization and potential exit from facilities that are unable to compete effectively. For instance, in 2023, Shell announced plans to divest its 50% stake in the Marathon Petroleum Garyville refinery, a move that aligns with optimizing its refining footprint for greater efficiency and profitability.

- Low Utilization: Assets that consistently operate below optimal capacity due to market conditions or internal inefficiencies.

- High Operating Costs: Older facilities may incur higher maintenance and energy expenses compared to newer, more advanced refineries.

- Strategic Divestment: Shell’s portfolio optimization strategy prioritizes assets contributing to higher refining margins and competitive advantage.

Shell's divestment of approximately 1,000 retail sites in 2024-2025, along with its exit from onshore Nigerian oil assets and certain Brazilian renewable projects, highlights a strategic pruning of underperforming businesses. These actions classify these ventures as 'Dogs' in the BCG Matrix due to their low growth and market share.

The company's Q4 2024 financial reports indicated weak chemicals margins, suggesting some product lines also fall into the Dog category. This proactive portfolio management allows Shell to reallocate capital and focus on higher-return opportunities, such as EV charging infrastructure and premium convenience stores.

By shedding these less profitable segments, Shell aims to enhance overall efficiency and shareholder value, aligning with its broader strategy of optimizing its global asset base for future growth in a dynamic energy market.

Question Marks

Shell's exploration into emerging hydrogen production technologies, particularly green hydrogen, positions them in a high-growth sector with significant future potential. However, these ventures are currently in their early stages, characterized by substantial capital investment needs and a relatively low market share compared to established methods.

The commercial viability and widespread adoption of these nascent technologies are still unfolding, making them characteristic of a question mark in the BCG matrix. For instance, while the global green hydrogen market was valued at approximately USD 3.1 billion in 2023 and is projected to grow substantially, Shell's specific investments are still building scale.

Strategic investment is crucial for Shell to capture market leadership in these developing areas. Without aggressive scaling and cost reduction efforts, these promising technologies risk remaining niche players rather than becoming dominant forces in the future energy landscape.

Shell is actively developing advanced biofuels feedstocks, exemplified by its acquisition of waste recycling firm EcoOils and investment in agroforestry company Investancia Group for pongamia oil. These initiatives target high-growth potential areas for sustainable aviation fuel (SAF) and renewable diesel. For instance, pongamia oil is projected to yield significantly more oil per hectare compared to traditional oil crops.

While these novel feedstocks represent promising avenues for sustainable energy, their current market penetration is likely minimal. Significant investment in research, development, and the establishment of robust supply chains is crucial for their widespread adoption. The long-term profitability and scalability remain subject to technological advancements and market acceptance, positioning them as potential Stars or Question Marks within a BCG matrix framework.

Shell is actively investing in grid-scale battery storage and flexible gas-fired power plants to address the inherent intermittency of renewable energy sources. This strategic move positions Shell to capitalize on the rapidly expanding energy storage market, which is a crucial component for a stable and decarbonized power grid.

The global grid-scale battery storage market is experiencing robust growth, projected to reach over $100 billion by 2030, driven by the increasing adoption of solar and wind power. While Shell's market share in this burgeoning segment is still in its formative stages, the company's commitment signifies its ambition to become a key player.

Significant capital expenditure and ongoing technological innovation are paramount for these grid-scale solutions to achieve widespread market dominance. Shell's investments in 2024 reflect this understanding, aiming to build a competitive advantage in a sector vital for the energy transition.

Integrated Energy Hubs Development

Shell's development of integrated energy hubs represents a strategic move into the 'Question Marks' category of the BCG Matrix. These hubs, planned for locations with anticipated high future demand, aim to blend existing energy sources with emerging technologies.

The company is investing significantly in these early-stage ventures, with capital expenditure expected to be substantial. For example, Shell's 2024 financial reports indicate continued investment in low-carbon energy solutions, though specific figures for these hubs are still materializing as projects advance.

- Focus on High-Demand Growth Locations: Targeting areas with projected future energy needs.

- Integration of Traditional and New Energy: Combining existing infrastructure with renewables and other low-carbon solutions.

- Early Stage Development & High Capital Expenditure: Requiring significant upfront investment and strategic planning.

- Uncertainty and Future Market Adoption: Success depends on technological integration and market acceptance, characteristic of question mark ventures.

Carbon Capture Utilization and Storage (CCUS) Beyond Own Operations

Shell's ambition to offer Carbon Capture Utilization and Storage (CCUS) services to external industrial emitters positions it in a burgeoning market. This expansion beyond its own operational needs taps into a significant growth avenue, as industries worldwide seek decarbonization solutions.

The company's participation in projects like Polaris demonstrates a nascent capability in CCUS infrastructure. However, transforming this into a dominant, standalone business requires substantial capital infusion and dedicated market cultivation to compete with emerging players.

- Market Opportunity: The global CCUS market is projected to grow significantly, with estimates suggesting it could reach hundreds of billions of dollars by 2030, driven by net-zero targets.

- Shell's Position: Shell's existing CCUS projects, such as the Quest facility in Canada which captured 1 million tonnes of CO2 in 2023, provide a technological and operational base.

- Investment Needs: Developing third-party CCUS services involves considerable investment in capture technology, transportation infrastructure, and storage sites, potentially running into billions of dollars for large-scale projects.

- Competitive Landscape: Emerging competitors and national initiatives are rapidly developing CCUS capabilities, intensifying the need for Shell to scale quickly to capture significant market share.

Shell's exploration into emerging hydrogen production technologies, particularly green hydrogen, positions them in a high-growth sector with significant future potential. However, these ventures are currently in their early stages, characterized by substantial capital investment needs and a relatively low market share compared to established methods.

The commercial viability and widespread adoption of these nascent technologies are still unfolding, making them characteristic of a question mark in the BCG matrix. For instance, while the global green hydrogen market was valued at approximately USD 3.1 billion in 2023 and is projected to grow substantially, Shell's specific investments are still building scale.

Strategic investment is crucial for Shell to capture market leadership in these developing areas. Without aggressive scaling and cost reduction efforts, these promising technologies risk remaining niche players rather than becoming dominant forces in the future energy landscape.

Shell is actively developing advanced biofuels feedstocks, exemplified by its acquisition of waste recycling firm EcoOils and investment in agroforestry company Investancia Group for pongamia oil. These initiatives target high-growth potential areas for sustainable aviation fuel (SAF) and renewable diesel. For instance, pongamia oil is projected to yield significantly more oil per hectare compared to traditional oil crops.

While these novel feedstocks represent promising avenues for sustainable energy, their current market penetration is likely minimal. Significant investment in research, development, and the establishment of robust supply chains is crucial for their widespread adoption. The long-term profitability and scalability remain subject to technological advancements and market acceptance, positioning them as potential Stars or Question Marks within a BCG matrix framework.

Shell is actively investing in grid-scale battery storage and flexible gas-fired power plants to address the inherent intermittency of renewable energy sources. This strategic move positions Shell to capitalize on the rapidly expanding energy storage market, which is a crucial component for a stable and decarbonized power grid.

The global grid-scale battery storage market is experiencing robust growth, projected to reach over $100 billion by 2030, driven by the increasing adoption of solar and wind power. While Shell's market share in this burgeoning segment is still in its formative stages, the company's commitment signifies its ambition to become a key player.

Significant capital expenditure and ongoing technological innovation are paramount for these grid-scale solutions to achieve widespread market dominance. Shell's investments in 2024 reflect this understanding, aiming to build a competitive advantage in a sector vital for the energy transition.

Shell's development of integrated energy hubs represents a strategic move into the 'Question Marks' category of the BCG Matrix. These hubs, planned for locations with anticipated high future demand, aim to blend existing energy sources with emerging technologies.

The company is investing significantly in these early-stage ventures, with capital expenditure expected to be substantial. For example, Shell's 2024 financial reports indicate continued investment in low-carbon energy solutions, though specific figures for these hubs are still materializing as projects advance.

- Focus on High-Demand Growth Locations: Targeting areas with projected future energy needs.

- Integration of Traditional and New Energy: Combining existing infrastructure with renewables and other low-carbon solutions.

- Early Stage Development & High Capital Expenditure: Requiring significant upfront investment and strategic planning.

- Uncertainty and Future Market Adoption: Success depends on technological integration and market acceptance, characteristic of question mark ventures.

Shell's ambition to offer Carbon Capture Utilization and Storage (CCUS) services to external industrial emitters positions it in a burgeoning market. This expansion beyond its own operational needs taps into a significant growth avenue, as industries worldwide seek decarbonization solutions.

The company's participation in projects like Polaris demonstrates a nascent capability in CCUS infrastructure. However, transforming this into a dominant, standalone business requires substantial capital infusion and dedicated market cultivation to compete with emerging players.

- Market Opportunity: The global CCUS market is projected to grow significantly, with estimates suggesting it could reach hundreds of billions of dollars by 2030, driven by net-zero targets.

- Shell's Position: Shell's existing CCUS projects, such as the Quest facility in Canada which captured 1 million tonnes of CO2 in 2023, provide a technological and operational base.

- Investment Needs: Developing third-party CCUS services involves considerable investment in capture technology, transportation infrastructure, and storage sites, potentially running into billions of dollars for large-scale projects.

- Competitive Landscape: Emerging competitors and national initiatives are rapidly developing CCUS capabilities, intensifying the need for Shell to scale quickly to capture significant market share.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from Shell's internal financial statements, market research reports on the energy sector, and global economic growth forecasts to provide a strategic overview.