Shell Plc Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Shell Plc Bundle

Shell Plc operates in a dynamic energy landscape where intense competition, significant buyer power, and the looming threat of substitutes heavily influence its strategic decisions. Understanding these forces is crucial for navigating the complexities of the global oil and gas industry.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Shell Plc’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Shell's reliance on highly specialized equipment and technology for its complex operations, like deep-water drilling and advanced seismic imaging, means suppliers of these critical components often hold considerable sway. These suppliers frequently possess unique expertise and proprietary technology, making it difficult for Shell to find readily available alternatives.

The bargaining power of these specialized suppliers is amplified by the high switching costs associated with changing providers for such critical, bespoke solutions. For instance, in 2024, the capital expenditure for advanced offshore exploration technology can run into hundreds of millions of dollars, making a shift in suppliers a significant financial undertaking.

Shell's reliance on raw materials like crude oil and natural gas derivatives for its vast petrochemical operations means its bargaining power of suppliers is a key consideration. These suppliers, often large integrated energy firms or national oil companies, hold significant sway. For instance, in 2024, global crude oil prices experienced volatility, directly impacting Shell's feedstock costs and, consequently, its profit margins in the petrochemical segment.

As Shell pivots towards renewables like biofuels, hydrogen, and solar, its dependence on specialized component suppliers grows. For instance, the global solar panel market alone was valued at approximately $160 billion in 2023 and is projected to reach over $300 billion by 2030, indicating significant supplier leverage.

The bargaining power of these renewable energy component suppliers is shaped by their innovation in areas like solar cell efficiency and battery energy density, alongside their manufacturing scale. High demand for components like wind turbine blades and electrolyzers for hydrogen production, crucial for decarbonization efforts in 2024, further strengthens their position.

Labor and Talent Suppliers

Shell's reliance on highly skilled professionals like engineers, geologists, and data scientists gives these labor suppliers significant bargaining power. The demand for specialized talent, particularly in areas like renewable energy, is intense, meaning Shell must compete for these individuals.

A scarcity of these specialized skills, especially those critical for Shell's ongoing energy transition, can amplify the leverage of the workforce. This is particularly true in regions where unions are strong, as they can negotiate favorable terms, potentially affecting project schedules and operational expenses.

- Talent Shortages: The global shortage of skilled energy professionals, especially those with experience in offshore wind and solar, can drive up wages and recruitment costs for Shell.

- Union Influence: In certain operational hubs, strong labor unions can negotiate collective bargaining agreements that dictate pay, benefits, and working conditions, increasing labor costs.

- Project Delays: A lack of specialized personnel can lead to delays in critical projects, such as the development of new LNG facilities or offshore wind farms, impacting revenue and strategic goals.

- Operational Efficiency: The availability and cost of skilled labor directly influence the efficiency of Shell's exploration, production, and refining operations.

Logistics and Infrastructure Service Providers

Shell's extensive global operations are deeply dependent on logistics and infrastructure providers, encompassing shipping, pipelines, and storage facilities. Suppliers with significant infrastructure, like specialized LNG carriers or established pipeline networks, can wield considerable influence over Shell's operational costs and the reliability of its supply chain. For instance, the cost of chartering LNG vessels, a key component for Shell's gas business, saw significant volatility in 2024, with day rates for large LNG carriers fluctuating based on demand and vessel availability, directly impacting Shell's transportation expenses.

The bargaining power of these logistics and infrastructure service providers is amplified by the specialized nature of their assets and the high switching costs associated with changing providers. Shell's reliance on a limited number of specialized infrastructure assets, such as deep-water port facilities or extensive pipeline interconnections, means that key suppliers in these areas can negotiate favorable terms. In 2024, the ongoing global demand for energy infrastructure, coupled with supply chain constraints affecting new vessel construction, continued to support strong pricing power for established logistics providers.

- High Capital Requirements: The immense capital investment needed to build and maintain specialized logistics infrastructure, such as LNG terminals or large-scale pipeline systems, creates high barriers to entry, concentrating power among a few established players.

- Asset Specificity: Many logistics assets are highly specialized for particular types of cargo (e.g., LNG, oil tankers) or routes, making it difficult and costly for Shell to switch providers without significant disruption.

- Market Concentration: In certain regions or for specific services, the market for logistics and infrastructure providers may be concentrated, giving dominant suppliers greater leverage in price negotiations and service level agreements.

- Operational Dependencies: Shell's integrated business model means that disruptions in logistics or infrastructure services can have cascading effects, increasing the importance of reliable partners and potentially giving powerful suppliers more influence.

Suppliers of critical, specialized equipment and technology, like those for deep-water drilling, hold significant power due to unique expertise and high switching costs. In 2024, the investment for such advanced offshore technology easily reached hundreds of millions of dollars, making supplier changes a major financial hurdle.

Raw material suppliers, such as integrated energy firms and national oil companies, also possess substantial leverage, particularly impacting Shell's petrochemical segment. The price volatility of crude oil in 2024 directly affected feedstock costs and profit margins.

As Shell expands into renewables, it faces increasing dependence on component suppliers for solar, wind, and hydrogen technologies. The global solar panel market’s projected growth to over $300 billion by 2030 highlights the growing influence of these suppliers.

| Supplier Type | Key Factors Influencing Power | Impact on Shell | 2024 Data/Context |

| Specialized Technology Providers | Unique expertise, proprietary tech, high switching costs | Increased equipment costs, potential project delays | Offshore tech investments in hundreds of millions |

| Raw Material Suppliers (Oil & Gas) | Market concentration, control over essential resources | Feedstock cost volatility, margin pressure | Crude oil price fluctuations impacting petrochemicals |

| Renewable Component Suppliers | Innovation, manufacturing scale, growing demand | Component costs for energy transition projects | Solar market valued at $160B in 2023, growing rapidly |

What is included in the product

This analysis of Shell Plc's competitive landscape reveals the intensity of rivalry, the bargaining power of suppliers and buyers, and the threat of new entrants and substitutes, all crucial for understanding Shell's strategic positioning.

Instantly identify and address the key competitive pressures impacting Shell Plc's profitability with a clear, actionable breakdown of Porter's Five Forces.

Customers Bargaining Power

Individual consumers often have significant bargaining power when purchasing refined petroleum products like gasoline due to high price sensitivity and low switching costs. They can easily opt for a competitor's brand or a different fueling station, limiting Shell's pricing flexibility. For example, in 2024, average gasoline prices at the pump fluctuated significantly, directly impacting consumer purchasing decisions and forcing retailers to remain competitive.

Large industrial and commercial clients, such as airlines and manufacturers, represent a significant portion of Shell's customer base, driving substantial demand for fuels, lubricants, and chemicals. These major buyers wield considerable bargaining power due to their sheer volume of purchases. For instance, in 2023, Shell's Integrated Gas segment, which includes LNG sales to industrial customers, generated approximately $47.8 billion in revenue, highlighting the scale of these relationships.

Their ability to negotiate favorable long-term contracts and the readily available alternative suppliers in the energy market further amplify their leverage. If Shell's pricing or contractual terms are not competitive, these large clients can indeed explore switching to other energy providers, putting pressure on Shell's margins and market share.

Buyers in the chemical industry, like plastics manufacturers or agricultural firms purchasing from Shell, exhibit a fluctuating bargaining power. This power hinges on factors such as the product's specialization, the sheer volume of their orders, and the presence of competing suppliers or alternative chemical solutions. For instance, a large-volume buyer of a commodity chemical like ethylene might wield significant power due to numerous global suppliers.

Utilities and Power Grids

As Shell Plc expands its renewable electricity generation and supply operations, its customer base increasingly includes national grids and large utility companies. These significant buyers possess considerable bargaining power, driven by their massive purchasing volumes and the essential nature of electricity supply. For instance, in 2024, major utility contracts often involve competitive bidding, which intensifies pressure on suppliers like Shell to offer favorable pricing and terms.

The bargaining power of these utility customers is further amplified by regulatory oversight and the availability of alternative energy sources. This environment frequently leads to stringent contract conditions and a focus on long-term supply agreements that lock in prices and reliability. Consequently, Shell must navigate these dynamics carefully to secure profitable and stable relationships within the power grid sector.

- High Procurement Volumes: Large utility companies purchase vast quantities of electricity, giving them leverage in negotiations.

- Critical Supply Need: The essential nature of electricity means utilities often seek reliable, long-term contracts with predictable pricing.

- Regulatory Influence: Regulatory bodies can impact pricing and contract structures, indirectly increasing customer bargaining power.

- Competitive Bidding: Many utility contracts are awarded through competitive tender processes, forcing suppliers to offer their best terms.

Governments and Public Sector Entities

Governments and public sector entities are substantial customers for Shell, especially in sectors like defense and public transportation. Their significant purchasing volumes and the critical nature of energy supply for national interests often grant them considerable bargaining power. This is amplified by stringent regulatory demands and the typically competitive, multi-stage tender processes involved in securing large contracts.

In 2024, governments worldwide continued to exert influence through energy policy and procurement. For instance, many nations are setting ambitious targets for renewable energy integration, which can shift demand away from traditional fossil fuels, thereby altering the negotiation landscape for companies like Shell. The sheer scale of government infrastructure projects, such as developing national charging networks for electric vehicles or upgrading public transport fleets, means that Shell often engages in long-term, strategic agreements where government specifications and pricing expectations are paramount.

- High Volume Procurement: Governments often purchase energy in massive quantities, giving them leverage to negotiate favorable terms.

- Regulatory Influence: Compliance with national standards, environmental regulations, and safety protocols can be non-negotiable, impacting contract conditions.

- Strategic Importance: Energy security is a national priority, meaning governments can influence supply contracts due to their critical role in the economy and public welfare.

- Tender Processes: Complex and competitive bidding processes often favor suppliers who can meet specific technical, environmental, and cost requirements.

The bargaining power of customers for Shell Plc is a significant factor influencing its profitability and market strategy. Individual consumers, while numerous, exert influence through price sensitivity and low switching costs, as seen in the fluctuating gasoline prices during 2024. Large industrial clients, however, hold substantial sway due to their massive procurement volumes, as evidenced by Shell's $47.8 billion revenue from Integrated Gas in 2023, which includes LNG sales to these major buyers.

| Customer Segment | Bargaining Power Factors | Impact on Shell |

|---|---|---|

| Individual Consumers | Price sensitivity, low switching costs | Limits pricing flexibility, requires competitive retail strategies |

| Large Industrial/Commercial Clients | High volume purchases, alternative suppliers, long-term contracts | Demands favorable pricing and terms, potential for margin pressure |

| Chemical Industry Buyers | Product specialization, order volume, supplier competition | Varies by chemical; commodity chemicals offer more leverage to buyers |

| Utility Companies (Renewables) | High procurement volumes, critical supply need, regulatory influence, competitive bidding | Requires competitive pricing and reliable supply, contract negotiation intensity |

| Governments/Public Sector | High volume, regulatory demands, strategic importance, tender processes | Influences contract terms, pricing, and specifications; requires compliance |

What You See Is What You Get

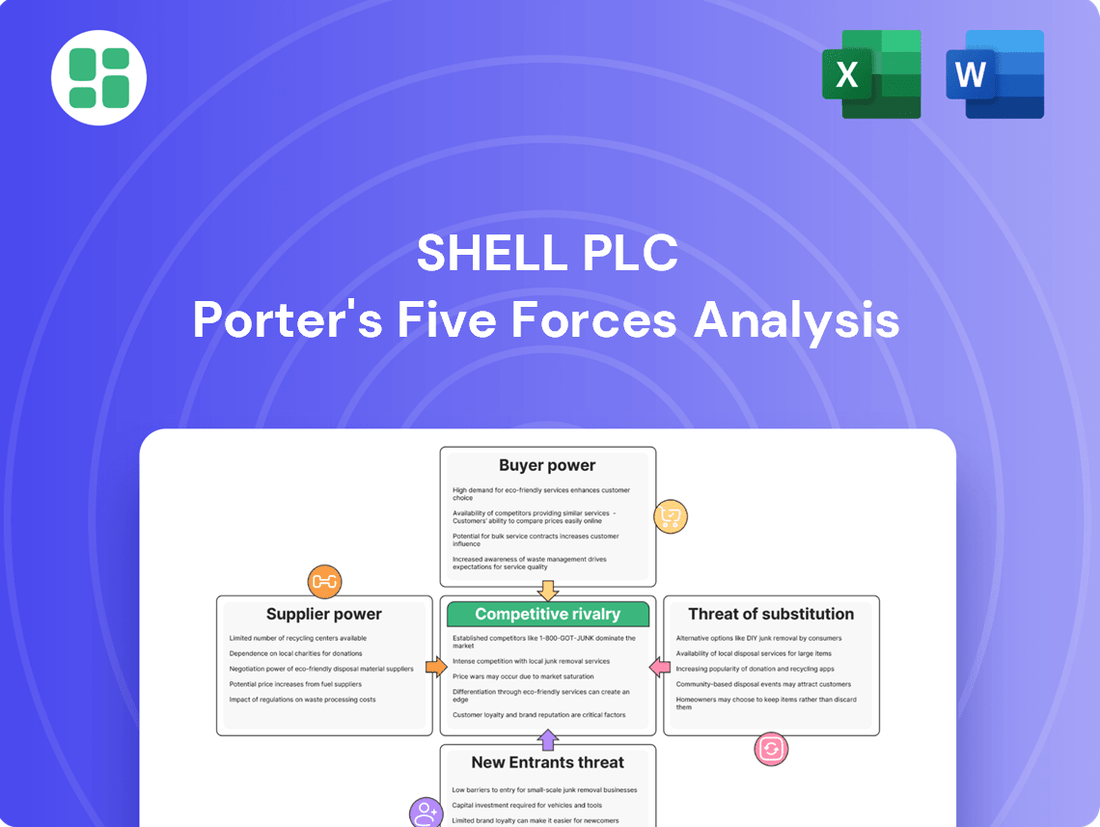

Shell Plc Porter's Five Forces Analysis

This preview showcases a comprehensive Porter's Five Forces analysis of Shell Plc, detailing the competitive landscape within the oil and gas industry, and the exact document you'll receive immediately after purchase—no surprises, no placeholders.

You're looking at the actual, professionally written analysis. Once you complete your purchase, you’ll get instant access to this exact file, providing deep insights into buyer power, supplier power, threat of new entrants, threat of substitutes, and industry rivalry for Shell Plc.

Rivalry Among Competitors

Shell operates in a highly competitive landscape with other global integrated energy majors such as ExxonMobil, Chevron, BP, and TotalEnergies. These companies vie for market dominance across the entire energy value chain, from upstream exploration and production to downstream refining and marketing, and are increasingly investing in low-carbon energy solutions.

The intensity of this rivalry is underscored by substantial capital investments, a relentless pursuit of technological advancements, and aggressive competition for market share in both established fossil fuel markets and the burgeoning renewable energy sector. For instance, in 2024, major integrated energy companies continued to report significant investments in oil and gas exploration, alongside growing commitments to renewable energy projects, reflecting this dual focus.

National Oil Companies (NOCs) represent a significant competitive force, often holding dominant positions due to their control over vast domestic reserves and strong governmental backing. For instance, Saudi Aramco, a prime example of an NOC, consistently leads global oil production, demonstrating the scale of influence these entities wield. Their strategic objectives frequently extend beyond profit, encompassing national energy security and economic development, which can shape market dynamics in ways distinct from purely commercial enterprises.

The energy transition is fostering a new breed of agile, specialized competitors in renewables. These pure-play companies, focusing exclusively on areas like large-scale solar and wind development, battery storage, and green hydrogen, often boast leaner cost structures and innovative business models. This dynamic intensifies competition for Shell as it pivots towards low-carbon energy solutions.

Chemical Industry Competitors

Shell's chemicals division faces intense competition from a wide array of global and regional players. Many rivals specialize in particular chemical product lines or leverage cost advantages from secured feedstock access, creating a dynamic competitive landscape. This necessitates constant innovation in product development, highly efficient manufacturing operations, and robust customer partnerships to thrive amidst volatile commodity prices.

The competitive rivalry in the chemical sector is a significant force for Shell. For instance, in 2023, the global chemicals market size was estimated to be around $5.7 trillion, with projections indicating continued growth, driven by demand across various industries. Shell's competitors include giants like Dow Inc., BASF SE, and Sinopec, many of whom have extensive global reach and integrated value chains.

- Global & Regional Competitors: Shell competes with major international chemical companies and specialized regional producers.

- Specialization & Cost Advantages: Competitors often focus on specific product niches or benefit from lower feedstock costs.

- Key Success Factors: Innovation, production efficiency, and strong customer relationships are crucial for market position.

- Market Dynamics: Fluctuating commodity prices and evolving demand patterns shape the competitive environment.

Increased Competition in Downstream and New Energy Ventures

Shell faces intensifying rivalry in its traditional downstream operations, particularly at retail fuel stations and in the lubricants market. Success here hinges on robust brand recognition, extensive distribution networks, and unique service offerings, making it a challenging arena. For instance, in 2024, the global lubricants market is projected to reach over $170 billion, with numerous players vying for market share through product innovation and customer loyalty programs.

The company's strategic pivot into new energy sectors, including electric vehicle (EV) charging infrastructure, hydrogen production, and carbon capture technologies, is also met with fierce competition. This emerging landscape sees participation from established automotive manufacturers, agile technology startups, and major industrial gas suppliers, all seeking to capitalize on the energy transition.

Key competitive dynamics include:

- Retail Fuel Stations: Competition is based on price, convenience, and ancillary services like convenience stores and car washes.

- Lubricants Market: Differentiation through performance, specialized formulations, and strong brand endorsements drives competition.

- EV Charging: Major automakers, dedicated charging network providers, and energy utilities are rapidly expanding their presence.

- Hydrogen Production: Industrial gas giants and new energy ventures are investing heavily in production and distribution infrastructure.

- Carbon Capture: A mix of technology providers, oil and gas majors, and industrial conglomerates are developing and deploying solutions.

Shell faces intense competition from global energy giants like ExxonMobil and BP, who are also investing heavily in both traditional and low-carbon energy. This rivalry is evident in their substantial capital expenditures; for example, many integrated majors reported multi-billion dollar investments in exploration and renewables throughout 2024.

National Oil Companies, such as Saudi Aramco, also exert significant competitive pressure due to their vast resource control and government backing, often influencing global supply dynamics. Furthermore, specialized renewable energy firms are emerging as agile competitors, challenging Shell's pivot into areas like solar and hydrogen.

In chemicals, Shell contends with giants like BASF and Dow, who leverage economies of scale and feedstock advantages. The global chemicals market, valued at approximately $5.7 trillion in 2023, demands constant innovation and operational efficiency from all players.

The downstream sector, including retail fuel and lubricants, is characterized by fierce competition driven by brand loyalty and distribution networks. The lubricants market alone, projected to exceed $170 billion in 2024, sees numerous companies vying for market share through product differentiation and customer programs.

SSubstitutes Threaten

The increasing global adoption of electric vehicles (EVs) poses a substantial long-term threat to Shell's traditional fuel sales. By the end of 2023, global EV sales surpassed 13.6 million units, a significant jump from previous years, indicating a clear shift in consumer preference and a direct reduction in demand for gasoline and diesel.

As battery technology improves, leading to lower costs and increased driving ranges, and as charging infrastructure continues to expand, this trend is expected to accelerate. For instance, in 2024, major automotive manufacturers are projected to introduce numerous new EV models, further intensifying this competitive pressure.

This necessitates Shell's strategic pivot towards investments in EV charging networks and the development of alternative low-carbon transport fuels to mitigate the impact on its core business. Shell's own investments in charging infrastructure, such as its acquisition of ubitricity in 2021, highlight this adaptation strategy.

The increasing global adoption of renewable electricity sources like solar and wind directly challenges Shell's traditional fossil fuel power generation, particularly its natural gas segment. This shift is a major reason Shell is investing heavily in renewable energy development, aiming to become a key player in this growing market and diversify its energy portfolio.

The rise of biofuels and Sustainable Aviation Fuels (SAFs) presents a notable threat of substitution for Shell's core petroleum-based products. While Shell is actively involved in biofuel production, the increasing market adoption of these alternatives, especially in sectors like aviation and heavy transport, directly challenges its traditional fuel sales. By 2023, the global SAF market was valued at approximately $2.8 billion, with projections indicating significant growth, potentially impacting Shell's refining margins as demand shifts.

Hydrogen as an Energy Carrier

Hydrogen, particularly green hydrogen, is becoming a significant substitute for traditional fossil fuels across multiple sectors. Its ability to serve as an energy carrier for industrial processes, heavy-duty transportation, and even heating presents a direct challenge to Shell's existing business models. For instance, the International Energy Agency (IEA) reported in 2024 that global hydrogen production capacity from renewables is on the rise, with many countries setting ambitious targets for its adoption.

Shell's strategic response includes substantial investments in hydrogen production facilities and distribution networks. This proactive approach aims to position the company as a leader in this burgeoning market, mitigating the threat of substitutes by becoming a provider of the alternative energy source itself. By 2024, Shell had announced several major green hydrogen projects, underscoring its commitment to this transition.

- Growing Demand: The global demand for hydrogen is projected to grow significantly, driven by decarbonization efforts in hard-to-abate sectors like steel and chemicals.

- Investment Trends: Major energy companies, including Shell, are channeling billions into hydrogen projects, signaling a strong belief in its future as a key energy carrier.

- Policy Support: Government incentives and policies worldwide are increasingly favoring hydrogen as a clean energy solution, further accelerating its development and adoption.

Advanced Materials and Circular Economy

The rise of advanced materials and the circular economy presents a significant threat of substitution for Shell's traditional petrochemical products. Bio-based plastics and recycled materials offer alternatives that reduce reliance on fossil fuels, impacting demand for Shell's core chemical offerings. For instance, by 2024, the global bioplastics market is projected to reach over $11.5 billion, indicating a growing appetite for these substitutes.

This shift necessitates Shell's strategic adaptation to integrate sustainable solutions. The company's investment in chemical recycling technologies, such as its joint venture withước, aims to process difficult-to-recycle plastics back into feedstock. Shell's commitment to developing circular solutions is crucial to mitigating the substitution threat and maintaining market relevance in an evolving chemical landscape.

- Growing Bioplastics Market: The global bioplastics market is expected to exceed $11.5 billion by 2024, directly competing with conventional plastics.

- Circular Economy Initiatives: Increased adoption of recycling and reuse models reduces the demand for virgin petrochemicals.

- Shell's Response: Shell is investing in chemical recycling and sustainable material development to counter this substitution threat.

The increasing adoption of electric vehicles (EVs) directly challenges Shell's gasoline and diesel sales, with global EV sales surpassing 13.6 million units by the end of 2023. This trend is amplified by improving battery technology and expanding charging infrastructure, with numerous new EV models expected in 2024. Shell's strategic pivot includes significant investments in EV charging networks and alternative fuels, such as its acquisition of ubitricity.

Renewable electricity sources like solar and wind are increasingly substituting fossil fuels for power generation, impacting Shell's natural gas segment. This is a primary driver for Shell's substantial investments in renewable energy development to diversify its portfolio. Furthermore, biofuels and Sustainable Aviation Fuels (SAFs) are emerging as notable substitutes for Shell's petroleum-based products, particularly in aviation and heavy transport, with the SAF market valued at approximately $2.8 billion in 2023.

Hydrogen, especially green hydrogen, poses a significant threat to traditional fossil fuels across various sectors, including industrial processes and heavy-duty transportation. Global hydrogen production capacity from renewables is rising, with many countries setting ambitious adoption targets, as noted by the IEA in 2024. Shell is responding by investing heavily in hydrogen production and distribution, aiming to lead in this growing market and mitigate substitution risks.

Advanced materials and the circular economy present a substitution threat to Shell's petrochemical products. Bio-based plastics and recycled materials are gaining traction, reducing reliance on fossil fuels. The global bioplastics market was projected to exceed $11.5 billion by 2024, highlighting the demand for these alternatives. Shell is actively investing in chemical recycling technologies and developing circular solutions to maintain its market position.

| Substitute | Impact on Shell | Shell's Response/Investment | Market Data (2023/2024 Projections) |

|---|---|---|---|

| Electric Vehicles (EVs) | Reduced demand for gasoline/diesel | Investment in EV charging infrastructure (e.g., ubitricity acquisition) | Global EV sales > 13.6 million units (2023) |

| Renewable Electricity | Challenges fossil fuel power generation | Significant investment in renewable energy development | N/A (Ongoing trend) |

| Biofuels & SAFs | Threatens traditional fuel sales | Involvement in biofuel production | Global SAF market value ~$2.8 billion (2023) |

| Hydrogen (Green) | Substitute for fossil fuels in various sectors | Investment in hydrogen production and distribution | Rising renewable hydrogen capacity (IEA 2024) |

| Bioplastics & Recycled Materials | Threatens petrochemical product demand | Investment in chemical recycling technologies | Global bioplastics market > $11.5 billion (2024 proj.) |

Entrants Threaten

The energy sector, especially oil and gas exploration and production, requires massive upfront capital. For instance, developing a single offshore oil field can cost billions of dollars, a sum that most new companies cannot readily access.

These substantial financial barriers significantly deter potential new entrants from challenging established players like Shell in the traditional energy markets. This high cost of entry acts as a powerful protective moat.

In 2024, major oil and gas projects continue to demand investments in the tens of billions, reinforcing the capital-intensive nature of the industry and limiting the threat of new, smaller competitors.

New entrants into the oil and gas sector, like Shell plc, face formidable regulatory and environmental hurdles. These include obtaining numerous permits and approvals for exploration, production, and transportation, often requiring extensive environmental impact studies. For instance, in 2024, the average time for securing offshore drilling permits in some regions could extend over several years, involving detailed assessments of potential ecological damage and mitigation strategies.

Shell benefits from decades of investment in vast, integrated global infrastructure, including extensive pipelines, sophisticated refineries, large shipping fleets, and widespread retail distribution networks. This established infrastructure represents a significant barrier to entry for potential new competitors.

Replicating Shell's asset-heavy and interconnected supply chain is incredibly costly and time-consuming. For instance, building a new refinery can cost billions of dollars, a prohibitive expense for most new entrants. This provides Shell with a considerable competitive advantage, making it difficult for newcomers to match its operational scale and efficiency.

Technological Expertise and R&D Investment

The energy and petrochemical industries demand significant technological expertise, from deep-water exploration and intricate refining to advanced chemical manufacturing and novel renewable energy technologies. Shell's substantial and ongoing investments in research and development, coupled with its developed proprietary technologies, establish a formidable knowledge barrier for potential new entrants. This makes it challenging for newcomers to replicate Shell's operational efficiency and innovative capacity.

For instance, in 2023, Shell reported capital expenditure of $23 billion, with a significant portion allocated to growth projects and R&D, including advancements in lower-carbon solutions. This sustained investment creates a high hurdle for new companies aiming to compete on technological prowess and innovation.

- High R&D Spending: Shell consistently invests billions annually in research and development to maintain its technological edge.

- Proprietary Technologies: The company possesses a portfolio of unique technologies in areas like LNG liquefaction and advanced refining catalysts.

- Operational Complexity: New entrants face immense challenges in acquiring the specialized knowledge and infrastructure needed for complex energy operations.

Brand Recognition and Customer Loyalty

Shell's brand recognition and customer loyalty present a significant barrier to new entrants. For over a century, Shell has built a globally recognized brand, fostering deep customer loyalty, especially in its retail fuel and lubricants sectors. New companies face the daunting task of replicating this trust and brand equity, which demands substantial marketing investment and a considerable timeframe.

This deep-rooted loyalty means new players must offer compelling value propositions to even begin chipping away at Shell's market share. Consider that in 2023, Shell's brand value was estimated to be in the tens of billions of dollars globally, a testament to its long-standing presence and marketing prowess.

- Established Brand Equity: Shell's global brand recognition, built over decades, instills trust and familiarity among consumers.

- Customer Loyalty Programs: Extensive loyalty programs and customer engagement initiatives further solidify existing customer relationships, making it difficult for new entrants to attract and retain customers.

- High Marketing Investment: New entrants would need to invest heavily in marketing and advertising to build comparable brand awareness and overcome Shell's established market presence.

The threat of new entrants for Shell plc is generally low due to several significant barriers. The sheer capital required for exploration, production, and infrastructure development, often in the billions of dollars for major projects, effectively deters most potential newcomers. For example, in 2024, the cost of developing new offshore fields continues to be a major deterrent.

Furthermore, stringent regulatory environments and the need for extensive environmental impact assessments, which can take years to navigate as seen with offshore permit approvals in 2024, add considerable complexity and cost. Shell's established, integrated global infrastructure, including vast pipeline networks and refining capabilities, represents another formidable obstacle that is prohibitively expensive for new companies to replicate.

The company's strong brand recognition and customer loyalty, built over decades and valued in the tens of billions of dollars as of 2023, also make it challenging for new entrants to gain market traction. Combined with significant investments in R&D and proprietary technologies, these factors create a high barrier to entry, protecting Shell's market position.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Shell Plc is built upon a robust foundation of publicly available information. This includes Shell's annual reports and investor presentations, alongside data from reputable industry analysis firms and financial news outlets, to capture the competitive landscape.