Shell Plc Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Shell Plc Bundle

Unlock the strategic blueprint of Shell Plc's expansive operations with our comprehensive Business Model Canvas. Discover how they connect with diverse customer segments, forge crucial partnerships, and deliver compelling value propositions across the energy spectrum. This detailed analysis is your key to understanding their market dominance and future growth.

Partnerships

Shell actively engages in joint ventures and strategic alliances with national oil companies, other international energy firms, and local businesses. These collaborations are crucial for sharing the significant risks associated with exploration, production, and the development of major infrastructure such as LNG terminals and deep-water projects.

These partnerships provide Shell with essential access to new markets and allow it to leverage specialized expertise that might not be available internally. A prime example of this strategy in action is Shell's operation of the Mina West gas field in Egypt, where it partners with KUFPEC Egypt Limited, demonstrating a commitment to shared operational success.

Shell actively partners with technology providers, research institutions, and startups to drive innovation in areas like carbon capture and hydrogen. These collaborations are vital for developing advanced energy solutions and accelerating Shell's energy transition strategy. For instance, in 2024, Shell continued its investments in R&D, with a significant portion dedicated to low-carbon technologies, aiming to maintain a competitive edge through continuous technological advancement.

Shell Plc maintains a robust network of global suppliers and contractors, crucial for its extensive upstream, midstream, and downstream operations. These partnerships are vital for procuring everything from specialized drilling equipment and services to essential IT infrastructure, ensuring operational efficiency and reliability.

In 2024, Shell continued to emphasize strategic sourcing and supplier collaboration, aiming to optimize its supply chain and mitigate risks. The company's commitment to sustainability also extends to its supplier relationships, with increasing focus on environmental and social governance (ESG) criteria in partner selection and performance evaluation.

Government and Regulatory Bodies

Shell's engagement with governments and regulatory bodies is fundamental to its operations. These collaborations are crucial for securing necessary licenses, permits, and approvals across the diverse jurisdictions where Shell conducts business. For instance, in 2024, Shell continued to navigate evolving energy transition policies and environmental regulations globally, which directly impacts its investment decisions and operational frameworks.

Adherence to stringent environmental standards and complex legal frameworks is paramount. Shell's commitment to compliance is detailed in its annual reporting, highlighting its efforts to meet international and local environmental, social, and governance (ESG) benchmarks. This includes managing emissions, ensuring safety protocols, and contributing to local economic development as stipulated by various governmental agreements.

- Securing Licenses and Permits: Essential for exploration, production, refining, and retail operations worldwide.

- Environmental Compliance: Meeting standards for emissions, waste management, and biodiversity protection in all operating regions.

- Navigating Energy Policies: Adapting to and influencing national energy strategies, including those related to renewable energy and carbon reduction targets.

- Legal Framework Adherence: Ensuring compliance with all applicable laws and regulations, from tax to labor, in over 70 countries.

Automotive and EV Charging Network Partners

Shell's strategic alliances with automotive manufacturers are crucial for seamless integration of its EV charging solutions into vehicle systems. These partnerships also help in co-marketing efforts and customer acquisition for both parties.

Collaborations with EV charging network providers and technology innovators are vital for Shell to expand its physical charging footprint and offer advanced charging features. For instance, Shell's acquisition of ubitricity in 2021 significantly boosted its street lamp charging points in Europe.

Partnerships with urban planners and local authorities are essential for securing prime locations for charging stations and navigating regulatory landscapes. Shell's objective to reach over 500,000 EV charging points globally by 2025 hinges on these collaborative efforts.

- Automotive Manufacturers: Collaborations for in-car charging integration and joint promotions.

- EV Charging Technology Providers: Partnerships to deploy advanced charging hardware and software solutions.

- Urban Planners & Municipalities: Alliances to secure strategic locations and streamline deployment processes.

Shell's key partnerships are diverse, ranging from national oil companies and technology providers to governments and automotive manufacturers. These alliances are critical for risk sharing in large-scale projects, accessing new markets, and driving innovation in energy solutions. For example, in 2024, Shell continued its focus on low-carbon technologies through collaborations with research institutions and startups, aiming to bolster its competitive edge.

Strategic collaborations with suppliers and contractors ensure operational efficiency and reliability across Shell's vast network, from upstream exploration to downstream retail. The company increasingly evaluates partners based on environmental, social, and governance (ESG) criteria, reflecting a commitment to sustainability throughout its supply chain.

Partnerships with governments are vital for securing operating licenses and navigating evolving energy policies, particularly concerning the energy transition. Shell's global presence, operating in over 70 countries, necessitates adherence to diverse legal and environmental frameworks, managed through these governmental relationships.

| Partner Type | Purpose | Example/Impact |

|---|---|---|

| National Oil Companies & International Energy Firms | Risk sharing, market access, project development | Joint ventures in LNG terminals and deep-water projects |

| Technology Providers & Research Institutions | Innovation, R&D for low-carbon solutions | Accelerating development in carbon capture and hydrogen technologies |

| Governments & Regulatory Bodies | Licenses, permits, policy navigation | Securing operational approvals and adapting to energy transition regulations |

| Automotive Manufacturers & EV Charging Providers | EV charging integration, network expansion | Co-marketing efforts and expanding charging footprint, e.g., ubitricity acquisition |

What is included in the product

Shell Plc's Business Model Canvas outlines its strategy as a global energy company, focusing on integrated operations from exploration and production to refining and marketing of oil, gas, and increasingly, lower-carbon energy solutions.

It details customer segments across industrial, commercial, and retail sectors, leveraging extensive retail networks and B2B relationships to deliver a diverse energy value proposition.

Shell Plc's Business Model Canvas offers a pain point reliever by condensing complex global energy operations into a single, actionable page.

This allows for rapid identification of key value propositions and customer segments, streamlining strategic discussions and problem-solving.

Activities

Shell's exploration and production activities are central to its business, focusing on finding and extracting oil and natural gas worldwide. They aim to maximize value from current assets while strategically investing in promising new ventures like deep-water and integrated gas projects. This approach ensures a steady and valuable supply of resources.

A prime example of this strategy is the Whale deep-water platform, which commenced production in January 2025, underscoring Shell's commitment to advancing its upstream capabilities. This ongoing investment in exploration and production is crucial for meeting global energy demand and maintaining Shell's position in the market.

Shell's key activities include refining crude oil into essential products like gasoline and diesel, alongside manufacturing a diverse portfolio of chemicals. These operations are geared towards maximizing efficiency and output, with a growing focus on developing lower-carbon chemical alternatives.

By the close of 2024, Shell operated eight refineries globally, a significant part of its infrastructure dedicated to transforming raw materials into valuable energy and chemical products.

Shell’s marketing and retail operations are centered around its extensive global network of service stations. These sites are crucial touchpoints, serving approximately 33 million customers daily with a range of products including traditional fuels, lubricants, and convenience store items.

Beyond traditional offerings, this key activity encompasses the strategic marketing of lubricants and the proactive promotion of newer energy solutions. This includes expanding its footprint in electric vehicle (EV) charging infrastructure and a growing portfolio of low-carbon fuels, reflecting a significant shift in its retail strategy.

Trading and Supply

Shell's trading operations are a cornerstone of its business, encompassing a vast global network for crude oil, refined products, natural gas, and liquefied natural gas (LNG). This extensive trading capability allows Shell to effectively manage and optimize its integrated energy portfolio. In 2023, Shell's Integrated Gas segment, which includes LNG trading, reported Adjusted Earnings of $7.9 billion, demonstrating the significant financial contribution of these activities.

Beyond traditional energy commodities, Shell is increasingly active in trading carbon credits and renewable energy. This strategic expansion reflects the company's commitment to the energy transition and its ability to adapt to evolving market demands. Shell's trading arm acts as a crucial intermediary, balancing supply and demand and capitalizing on price differentials across diverse international markets, solidifying its position as one of the world's preeminent energy traders.

- Global Reach: Shell trades a wide array of energy products, including crude oil, refined fuels, natural gas, and LNG, across numerous global markets.

- Portfolio Optimization: Trading activities are vital for managing supply, demand, and price volatility, thereby maximizing the value of Shell's integrated energy assets.

- Market Leadership: Shell is recognized as one of the largest and most influential energy trading companies worldwide.

- Transition Focus: The company is expanding its trading into newer areas like carbon credits and renewable energy, aligning with global decarbonization efforts.

Low-Carbon Energy Solutions Development

Shell's commitment to low-carbon energy solutions is a rapidly expanding core activity. This includes significant investments in developing biofuels, expanding hydrogen production capabilities, and increasing renewable electricity generation through wind and solar projects. A key component of this strategy is also the advancement of carbon capture and storage (CCS) technologies, positioning Shell to offer a more diversified portfolio of cleaner energy options.

This focus on cleaner energy is central to Shell's broader energy transition strategy. The company has outlined plans to invest between $10 billion and $15 billion in low-carbon solutions from 2023 through 2025. This substantial capital allocation underscores the growing importance of these activities within Shell's overall business model.

- Biofuels Development: Investing in advanced biofuels derived from waste and residues.

- Hydrogen Production: Expanding capacity for blue and green hydrogen.

- Renewable Electricity: Growing wind and solar power generation assets.

- Carbon Capture and Storage (CCS): Developing and deploying CCS technologies to decarbonize operations and offer solutions to others.

Shell's key activities are multifaceted, encompassing the entire energy value chain from extraction to customer delivery and the growing low-carbon sector. These operations are strategically managed to optimize resource utilization and adapt to evolving market demands, particularly the global energy transition.

The company's upstream segment focuses on exploration and production, aiming to secure and extract oil and natural gas. Downstream activities involve refining crude oil into fuels and chemicals, while marketing and retail operations serve millions of customers daily through a vast network of service stations and EV charging points. Trading is a critical function, managing a global portfolio of energy commodities and increasingly carbon credits and renewables.

Furthermore, Shell is heavily invested in developing low-carbon energy solutions, including biofuels, hydrogen, and renewable electricity, alongside carbon capture and storage technologies. This diversification reflects a strategic pivot towards a more sustainable energy future.

| Key Activity | Focus Area | 2024/2025 Data/Targets |

|---|---|---|

| Exploration & Production | Oil & Gas Extraction | Whale deep-water platform commenced production Jan 2025. |

| Refining & Chemicals | Product Manufacturing | Operated 8 refineries globally by end of 2024. |

| Marketing & Retail | Customer Service & New Energy | Serves ~33 million customers daily; expanding EV charging. |

| Trading | Commodity & Carbon Markets | 2023 Integrated Gas Adjusted Earnings: $7.9 billion. |

| Low-Carbon Energy | Biofuels, Hydrogen, Renewables, CCS | $10-15 billion investment planned for 2023-2025. |

What You See Is What You Get

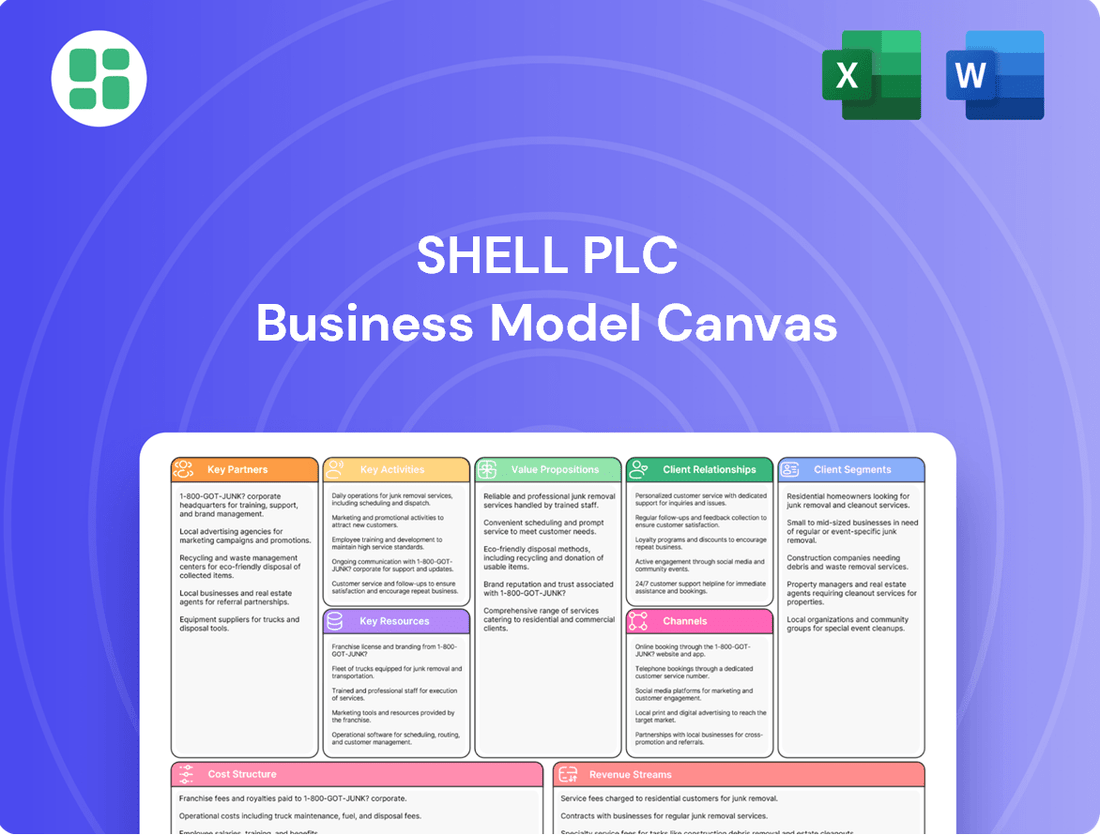

Business Model Canvas

The Shell Plc Business Model Canvas you are currently previewing is the exact document you will receive upon purchase. This comprehensive overview, meticulously detailing Shell's customer segments, value propositions, channels, customer relationships, revenue streams, key resources, key activities, key partnerships, and cost structure, is not a mockup but a direct representation of the final deliverable. You can be assured that upon completing your transaction, you will gain full access to this same, professionally structured and informative Business Model Canvas.

Resources

Shell's extensive global oil and gas reserves are a cornerstone of its business, providing the raw materials for its operations. These reserves, both proven and unproven, are spread across various regions, ensuring a diversified supply base.

As of 2023, Shell reported proven oil and gas reserves amounting to 8.5 billion barrels of oil equivalent. This substantial resource base directly fuels its exploration and production segment, guaranteeing a consistent hydrocarbon supply for the foreseeable future.

Shell's global infrastructure and assets are the backbone of its operations, encompassing a massive network of refineries, petrochemical plants, LNG terminals, and pipelines. This physical footprint also includes offshore platforms vital for oil and gas extraction. In 2024, Shell continued to leverage its extensive reach, operating in over 70 countries.

The company's retail presence is equally significant, with over 46,000 service stations worldwide. These stations are not just points of sale but also crucial touchpoints for customer engagement and brand visibility. These assets are fundamental to Shell's ability to produce, process, transport, and distribute its diverse range of energy and chemical products efficiently across the globe.

Shell's advanced technology and intellectual property are cornerstones of its business model, particularly evident in its proprietary techniques for deep-water exploration and enhanced oil recovery. These capabilities allow the company to access and maximize output from challenging reserves. In 2023, Shell held over 4,000 active technology patents, underscoring its commitment to innovation and its significant investment in research and development.

Furthermore, Shell leverages advanced intellectual property in gas liquefaction and refining processes, optimizing efficiency and product quality. This technological edge extends to its burgeoning low-carbon solutions, including carbon capture and storage (CCS) and hydrogen technologies, positioning the company for future energy transitions.

Human Capital and Expertise

Shell's business model relies heavily on its highly skilled global workforce, a crucial asset for its complex operations. This team includes engineers, scientists, traders, and operational staff, all possessing specialized knowledge.

Their collective expertise is vital for managing intricate energy projects, overseeing large-scale operations safely, and navigating volatile market dynamics. This human capital is fundamental to Shell's ability to deliver on its diverse business objectives.

As of 2025, Shell employed approximately 90,000 individuals worldwide, underscoring the scale of its human resource investment.

- Global Workforce: A team of 90,000 employees in 2025.

- Key Roles: Engineers, scientists, traders, and operational staff.

- Expertise Areas: Complex energy operations, project management, market analysis.

- Business Impact: Enables efficient and safe execution of diverse activities.

Strong Brand and Customer Relationships

Shell's brand is a cornerstone of its business model, recognized globally for over a century and synonymous with quality and dependability. This deep-rooted brand equity translates into significant market presence and customer loyalty, a truly invaluable intangible asset.

The company fosters strong customer relationships through its extensive retail network, serving millions of individuals daily, and through dedicated business-to-business (B2B) engagements. These established connections are critical for maintaining market share and driving repeat business.

- Globally Recognized Brand: Shell's brand has been built over 100+ years, associating it with quality and reliability.

- Extensive Retail Network: Millions of customers interact with Shell daily at its numerous service stations.

- B2B Engagements: Strong relationships are maintained with commercial clients, ensuring consistent demand for products and services.

Shell's financial resources are critical, enabling large-scale investments in exploration, production, and new energy ventures. Access to substantial capital allows the company to undertake complex projects and weather market volatility.

In 2024, Shell reported significant financial strength, with operating cash flow reaching approximately $30 billion. This robust financial position supports its ongoing operations and strategic investments in both traditional and low-carbon energy solutions.

Shell's intellectual property, particularly in areas like liquefied natural gas (LNG) technology and advanced refining processes, provides a competitive edge. These proprietary technologies enhance operational efficiency and product value across its diverse energy portfolio.

| Key Resource | Description | 2024 Data/Significance |

|---|---|---|

| Financial Resources | Capital for investments, operations, and R&D. | Operating cash flow of ~$30 billion in 2024. |

| Intellectual Property | Proprietary technologies in LNG, refining, and low-carbon solutions. | Enhances efficiency and competitive positioning in energy markets. |

| Global Workforce | Highly skilled employees across diverse operational and technical roles. | Approximately 90,000 employees in 2025, essential for complex project execution. |

| Brand Reputation | Over a century of brand building, associated with quality and reliability. | Drives customer loyalty and market presence across retail and B2B segments. |

Value Propositions

Shell ensures a steady and dependable flow of crucial energy resources like oil, natural gas, and lubricants, catering to worldwide needs across numerous industries. This reliability is underpinned by its extensive, integrated operations, from exploration and production to refining and marketing, guaranteeing energy security for its diverse customer base.

In 2024, Shell continued to be a significant provider of the energy the world requires, even as the global transition to cleaner sources progresses. The company’s commitment to supplying essential fuels and lubricants remains a core part of its value proposition, supporting economic activity and daily life.

Shell's extensive global network of over 45,000 retail sites provides unparalleled convenience, offering readily available fuels, electric vehicle charging, and a wide array of convenience items and services. This widespread accessibility caters to the daily needs of individual drivers and the operational demands of commercial fleets, ensuring mobility and convenience wherever they are.

By 2025, Shell is targeting the operation of 15,000 convenience stores worldwide, a significant expansion aimed at further enhancing customer accessibility and offering a more comprehensive retail experience beyond fuel. This strategic move underscores their commitment to providing convenient, one-stop solutions for a broad customer base.

Shell is actively expanding its portfolio of lower-carbon energy solutions, including biofuels, hydrogen, and renewable electricity. This directly addresses increasing customer demand for environmentally friendly options and supports their efforts to lower carbon footprints.

The company is making substantial investments in these low-carbon technologies. For instance, Shell's 2024 capital expenditure plans include significant allocations towards developing and scaling up these offerings, reflecting a strategic shift towards a more sustainable energy future.

Shell's commitment to carbon capture solutions also forms a key part of this value proposition. By offering these technologies, Shell enables industrial partners to mitigate their emissions, aligning with global decarbonization goals and creating new revenue streams.

High-Performance Products and Services

Shell's commitment to high-performance products and services is a cornerstone of its value proposition. This is evident in offerings like Shell V-Power, a premium fuel designed to enhance engine efficiency and power, and Shell Helix, a range of advanced lubricants for automotive and industrial machinery. These products cater to customers who prioritize optimal performance and longevity for their vehicles and equipment.

The company actively expands its premium lubricants portfolio, recognizing the growing demand for specialized solutions. For instance, in 2024, Shell continued to innovate in this space, introducing new formulations aimed at specific engine types and operating conditions. This strategic focus on product excellence drives customer loyalty and justifies premium pricing.

- Shell V-Power: Premium fuel offering enhanced engine performance and protection.

- Shell Helix: Advanced lubricants for automotive and industrial applications, focusing on efficiency and durability.

- Portfolio Growth: Ongoing investment in developing and expanding premium lubricant offerings.

- Customer Appeal: Attracts customers seeking superior quality and performance benefits.

Integrated Energy Management for Businesses

Shell offers large industrial and commercial clients integrated energy management, combining traditional fuels, lubricants, and power with expert guidance on energy efficiency and decarbonization. This allows businesses to manage their energy needs comprehensively.

Shell is a significant player in the power market, actively selling electricity to commercial customers. In 2023, Shell Energy’s global power trading volumes increased significantly, reflecting growing demand for flexible and integrated energy solutions from businesses looking to optimize their operations and reduce their carbon footprint.

- Holistic Energy Solutions: Shell provides a full spectrum of energy products and services, from fuels and lubricants to electricity and advisory services, enabling businesses to manage their energy portfolio efficiently.

- Decarbonization Support: The company actively advises clients on pathways to reduce emissions, integrating sustainability into their energy management strategies.

- Growing Power Sales: Shell is increasing its sales of power to commercial customers, demonstrating its commitment to becoming a broader energy provider beyond traditional oil and gas.

- Market Position: Shell’s extensive reach and diverse energy offerings position it as a key partner for businesses navigating the complexities of energy transition and cost management.

Shell provides a reliable supply of essential energy, including oil, natural gas, and lubricants, to meet global demand. Its integrated operations ensure energy security for a wide range of customers.

In 2024, Shell remained a vital energy supplier, supporting economic activity with fuels and lubricants amidst the ongoing energy transition. The company's extensive retail network, with over 45,000 sites globally, offers convenience through fuels, EV charging, and retail services, catering to both individual and commercial needs.

Shell is actively expanding its lower-carbon energy portfolio, including biofuels and hydrogen, supported by significant capital investments in 2024. This strategic shift addresses customer demand for greener options and aims to reduce carbon footprints.

Shell's value proposition also includes high-performance products like Shell V-Power and Shell Helix lubricants, which enhance efficiency and longevity. The company continues to innovate in premium lubricants, with new formulations introduced in 2024 to meet specific customer needs and drive loyalty.

Customer Relationships

Shell primarily engages individual consumers through self-service at its vast network of retail fueling stations. This direct interaction is enhanced by digital touchpoints, including their mobile app and online portals, which facilitate loyalty program management, streamlined payments, and access to product information, offering both convenience and efficiency to customers.

Loyalty programs are a cornerstone of Shell's customer relationship strategy. For instance, the Shell GO+ program rewards frequent customers with points for fuel and in-store purchases, redeemable for discounts and exclusive offers. In 2024, Shell continued to invest in these digital platforms to personalize offers and improve the overall customer experience.

Shell's loyalty programs, like Shell Go+, are a cornerstone of their customer relationship strategy, designed to foster repeat business and strengthen customer bonds. These initiatives offer tangible benefits, such as discounts on fuel and in-store purchases, encouraging customers to choose Shell consistently. In 2024, Shell continued to refine these programs, focusing on personalized offers based on purchasing behavior to maximize customer engagement and loyalty.

Shell's approach to key account management for its B2B clients is highly personalized. Dedicated account managers work closely with large industrial, commercial, and aviation customers, offering bespoke solutions and expert technical support. These relationships are built on a foundation of trust and long-term partnership, often involving strategic energy advice to help businesses navigate their specific needs and energy transition objectives.

This consultative approach is crucial for fostering deep, lasting relationships. Shell's commitment to understanding individual business requirements ensures that clients receive energy solutions precisely tailored to their operations. This includes assisting them in achieving their sustainability and energy transition goals, a key focus for many of Shell's B2B partners.

The scale of Shell's B2B operations is significant, serving approximately 1 million business customers across more than 70 countries. This widespread reach underscores the importance of effective key account management in maintaining and growing its diverse customer base. The company's ability to cater to such a broad spectrum of businesses highlights its robust infrastructure and dedicated client support systems.

Community Engagement and CSR Initiatives

Shell actively fosters community relationships through diverse corporate social responsibility (CSR) programs and consistent dialogue. These efforts are crucial for maintaining trust and securing its social license to operate, allowing Shell to effectively address community concerns arising from its widespread operations.

In 2024, Shell continued to invest in community development projects, focusing on areas such as education, environmental conservation, and economic empowerment. For instance, its global "Skills for Success" program aims to equip young people with employable skills, with over 150,000 individuals having benefited from such initiatives by the end of 2023, and continued expansion planned for 2024.

- Community Investment: Shell's total community investment globally reached approximately $50 million in 2023, with a significant portion allocated to programs designed to enhance local livelihoods and environmental stewardship, continuing this trend in 2024.

- Social Performance Reporting: The company's annual Sustainability Report provides detailed insights into its social performance, including metrics on community engagement, stakeholder feedback, and the impact of its CSR activities.

- Dialogue Platforms: Shell maintains numerous local dialogue forums and stakeholder engagement platforms worldwide to ensure transparent communication and responsiveness to community needs and operational impacts.

- Sponsorships: Strategic sponsorships of local events and initiatives further solidify Shell's presence and commitment within the communities where it operates, fostering goodwill and mutual benefit.

Customer Feedback and Support

Shell actively gathers customer insights through various channels, including dedicated customer service centers and digital platforms. This commitment ensures prompt resolution of issues and provides valuable feedback for enhancing its offerings.

- Customer Feedback Channels: Shell operates customer service centers and online portals to facilitate feedback and support.

- Issue Resolution: These channels are designed to address customer inquiries and resolve problems efficiently.

- Service Improvement: Feedback collected is crucial for Shell's continuous improvement of its products and services.

- Customer Satisfaction Focus: A strong emphasis on customer relationships aims to foster high levels of satisfaction.

Shell cultivates customer relationships through a multi-faceted approach, blending self-service convenience at its extensive retail network with personalized digital engagement via its mobile app and online platforms. Loyalty programs, such as Shell GO+, are central to fostering repeat business, offering rewards and discounts that incentivize continued patronage. In 2024, Shell focused on enhancing these digital touchpoints to deliver more personalized experiences and streamline customer interactions.

For its business-to-business clients, Shell employs a dedicated key account management strategy, providing tailored energy solutions and expert technical support. This consultative approach, focused on understanding unique operational needs and sustainability goals, builds long-term partnerships. Shell serves approximately 1 million business customers globally, underscoring the importance of these personalized relationships.

Community engagement is also a vital aspect of Shell's customer relationship strategy. Through corporate social responsibility programs, including educational and environmental initiatives, Shell aims to build trust and maintain its social license to operate. In 2023, Shell's global community investment reached approximately $50 million, with continued investment planned for 2024 to support local development and environmental stewardship.

| Customer Segment | Relationship Type | Key Engagement Channels | 2024 Focus Areas |

|---|---|---|---|

| Individual Consumers | Self-Service, Loyalty Programs | Retail Stations, Mobile App, Online Portals | Personalized Offers, Enhanced Digital Experience |

| Business Customers (B2B) | Key Account Management, Consultative Support | Dedicated Account Managers, Technical Support | Tailored Energy Solutions, Sustainability Partnerships |

| Communities | Corporate Social Responsibility (CSR), Dialogue | Community Development Projects, Dialogue Forums | Local Livelihood Enhancement, Environmental Stewardship |

Channels

Shell's global retail service station network, exceeding 46,000 locations, is its most prominent channel. This vast infrastructure acts as the primary touchpoint for customers, facilitating sales of fuels, lubricants, and convenience goods. As the world's largest mobility retailer, Shell leverages these stations for traditional offerings and is rapidly expanding electric vehicle (EV) charging capabilities.

Shell's direct sales channel is crucial for its commercial and industrial clients, involving the sale of petroleum products, natural gas, lubricants, and chemicals. This segment focuses on large-scale customers like industrial complexes, power generators, and aviation companies, often through customized supply agreements.

In 2024, Shell continued to leverage these direct relationships, serving a substantial base of business customers. For instance, its lubricants business, a key component of direct sales, reported significant revenue streams, underscoring the importance of these bespoke solutions for industrial operations.

Shell leverages a robust network of wholesalers, distributors, and resellers to ensure its lubricants, specialty chemicals, and bulk fuels reach a broad customer base. This strategy is crucial for tapping into smaller businesses and expanding its footprint across varied geographic regions where direct operations might be less feasible.

In 2024, Shell's marketing sales volumes reached an impressive 2,843 thousand barrels per day (kb/d). This significant volume underscores the effectiveness of its extensive distribution channels in penetrating diverse markets and serving a wide array of customers.

Digital Platforms and E-commerce

Shell leverages digital platforms and e-commerce to streamline customer interactions and enhance convenience. Online portals and mobile applications provide access to product information, manage loyalty programs, and facilitate digital payments, simplifying transactions for consumers.

These digital channels are crucial for boosting customer engagement. For instance, Shell's loyalty program, Shell GO+, is accessible via their app, allowing customers to track rewards and access exclusive offers, thereby fostering repeat business.

Shell is actively investing in digital innovation to optimize its operations and customer experience. By 2024, the company aims to further integrate its digital offerings, potentially enabling direct ordering and delivery for select products and services through its e-commerce capabilities.

- Online Presence: Shell's digital platforms serve as a primary touchpoint for customers seeking information and managing their relationship with the brand.

- Customer Convenience: Mobile apps and e-commerce portals simplify loyalty program management and digital payments, making interactions more efficient.

- Digital Engagement: Shell GO+ loyalty program, accessible via mobile, drives customer retention through personalized offers and rewards.

- Future Growth: Continued investment in digital innovation signals a strategic focus on expanding e-commerce functionalities for product ordering and delivery.

Joint Venture Operations and Partnerships

Shell frequently leverages joint ventures and strategic partnerships to bring complex and capital-intensive projects to fruition, particularly in areas like Liquefied Natural Gas (LNG) and deep-water oil exploration. These collaborations serve as crucial channels for both production and distribution, allowing Shell to share risks and access specialized expertise. For instance, Shell's involvement in the Manatee gas field in Trinidad and Tobago, which will feed the Atlantic LNG facility, exemplifies this strategy.

These partnerships are vital for accessing new markets and technologies. They enable Shell to participate in projects that might otherwise be too large or too risky to undertake alone. By sharing the financial burden and operational responsibilities, Shell can maintain a competitive edge in the global energy landscape.

- Joint Venture Model: Shell utilizes joint ventures for large-scale projects, sharing capital expenditure and operational risk.

- Strategic Alliances: Partnerships provide access to specialized technology and market entry, particularly in deep-water and LNG sectors.

- Example: Manatee Gas Field: Shell's final investment decision for the Manatee gas field in Trinidad and Tobago will supply the Atlantic LNG facility, showcasing operational partnerships.

- Risk Mitigation: Collaborations help mitigate the significant financial and technical risks associated with major energy infrastructure development.

Shell's channels are diverse, ranging from its extensive global retail network of over 46,000 service stations to direct sales for industrial clients and a robust wholesale distribution system. Digital platforms and e-commerce are increasingly important for customer engagement and convenience, while joint ventures and strategic partnerships facilitate complex, capital-intensive projects.

In 2024, Shell's marketing sales volumes reached 2,843 thousand barrels per day (kb/d), highlighting the reach of its distribution strategies. The company's digital loyalty program, Shell GO+, accessible via its app, is a key driver of customer retention.

| Channel Type | Key Activities | 2024 Data/Examples |

|---|---|---|

| Retail Network | Fuel, lubricants, convenience goods, EV charging | >46,000 global locations; World's largest mobility retailer |

| Direct Sales | Petroleum products, natural gas, lubricants, chemicals for commercial/industrial clients | Significant revenue from lubricants business |

| Wholesalers/Distributors | Reaching smaller businesses and diverse geographic regions | Facilitated 2,843 kb/d marketing sales volumes |

| Digital Platforms | Customer information, loyalty programs, digital payments, e-commerce | Shell GO+ loyalty program via mobile app |

| Joint Ventures/Partnerships | LNG, deep-water exploration, risk sharing, market access | Manatee gas field supplying Atlantic LNG |

Customer Segments

Individual consumers, the everyday drivers and vehicle owners, represent a core customer segment for Shell. These individuals rely on Shell for essential automotive fuels like gasoline and diesel, as well as lubricants and a variety of convenience items purchased at their retail service stations. They are drawn to Shell's brand recognition and the trust it inspires, often participating in loyalty programs to gain rewards and discounts.

The sheer scale of this segment is remarkable, with Shell serving approximately 33 million customers daily at its retail locations worldwide. This constant flow of individual consumers highlights the critical importance of convenience and a positive customer experience in maintaining brand loyalty and driving consistent sales for Shell's downstream operations.

Commercial and Industrial Businesses represent a significant customer segment for Shell, encompassing diverse sectors like manufacturing, transportation, construction, and agriculture. These businesses rely on Shell for bulk fuels, lubricants, and specialized chemical products essential for their operations. They prioritize dependable supply chains, expert technical assistance, and cost-efficient solutions to maintain their competitive edge.

Shell actively serves around 1 million business customers within this broad category. For instance, in 2024, the demand for heavy-duty fuels for trucking and shipping remained robust, with Shell's supply network playing a crucial role in keeping these industries moving. Furthermore, the construction sector's need for specialized lubricants and fuels for heavy machinery continued to be a key area of focus.

Power generators and utilities are key customers for Shell, buying natural gas, including Liquefied Natural Gas (LNG), and a growing amount of renewable electricity. These entities rely on Shell for fuel to power national grids and industrial facilities.

Their primary concerns are consistent supply, cost-effectiveness, and a rising demand for cleaner energy alternatives. Shell is actively pursuing opportunities to increase its power sales to commercial clients within this sector.

Chemical and Petrochemical Industries

The chemical and petrochemical industries represent a significant customer segment for Shell. These businesses procure a wide array of base chemicals and derivatives, essential for manufacturing everyday products like plastics, detergents, and various other industrial goods.

These customers prioritize consistent product quality and dependable supply chains. They also frequently look to Shell for innovative chemical solutions that can enhance their own product offerings and manufacturing processes.

Shell's involvement in manufacturing and marketing chemicals directly serves this segment. In 2024, Shell Chemicals reported substantial sales, reflecting the ongoing demand from these industrial partners. For example, their integrated refining and chemical sites are crucial for meeting the volume and specification requirements of these large-scale buyers.

- Key Purchases: Base chemicals and derivatives for plastics, detergents, and industrial products.

- Customer Needs: Consistent quality, reliable supply, and innovative chemical solutions.

- Shell's Role: Manufacturer and marketer of chemicals, leveraging integrated refining and chemical operations.

Governments and Public Sector Entities

Shell provides essential energy products to governments and public sector entities worldwide, supporting critical public services, transportation networks, and vital infrastructure development. These partnerships are often characterized by long-term agreements and strict adherence to established procurement processes, reflecting the scale and importance of these energy needs. In 2024, Shell continued to be a significant supplier to numerous government bodies across its extensive operational footprint, which covers more than 99 countries.

- Public Services: Supplying fuel for emergency vehicles, public transportation fleets, and government facilities.

- Infrastructure Projects: Providing energy for construction, maintenance, and operation of public works.

- Long-Term Contracts: Engaging in multi-year agreements for reliable energy supply to government entities.

- Global Reach: Serving public sector clients in over 99 countries where Shell operates.

Aviation and Marine sectors represent specialized, high-volume customer segments for Shell. Airlines and shipping companies require reliable, high-quality jet fuel and marine fuels, respectively, often under complex logistical arrangements. These industries depend on Shell for consistent supply, adherence to stringent safety and environmental standards, and global refueling capabilities.

In 2024, Shell remained a leading supplier in both aviation and marine fuels. The aviation sector saw a significant rebound in travel, increasing demand for jet fuel, with Shell serving major international carriers. Similarly, the maritime industry's transition towards lower-sulfur fuels and the exploration of alternative marine fuels presented ongoing opportunities and challenges for Shell's supply and product development.

| Customer Segment | Key Products/Services | Customer Needs | Shell's Role/Focus |

|---|---|---|---|

| Aviation | Jet fuel, Avgas | Reliable supply, quality, global network, safety | Major global supplier, investing in sustainable aviation fuel (SAF) initiatives. |

| Marine | Marine fuels (VLSFO, MGO), lubricants | Consistent supply, regulatory compliance, cost-effectiveness, decarbonization solutions | Leading supplier of marine fuels, developing lower-carbon solutions and biofuels. |

Cost Structure

Shell's capital expenditure is substantial, funding the exploration and development of new oil and gas fields. This also covers the construction and upkeep of its extensive network of refineries and petrochemical plants. Furthermore, significant investments are directed towards its growing renewable energy projects.

In 2024, Shell's cash capital expenditure reached $21.1 billion. Looking ahead, the company anticipates maintaining this investment level, projecting annual spending between $20 billion and $22 billion for the period of 2025 through 2028.

Shell's operating expenses, or OPEX, encompass the essential day-to-day costs of running its vast global operations. This includes significant outlays for employee compensation, the ongoing maintenance of its extensive infrastructure like refineries and retail stations, utility costs, and the complex logistics involved in transporting oil and gas. Managing this cost base is crucial for profitability.

Shell has been actively pursuing structural cost reductions, demonstrating a commitment to efficiency. As of their latest reports, the company has achieved substantial savings, totaling $3.1 billion in reductions since the beginning of 2022. This focus on streamlining OPEX is a key element in their strategy to maintain competitiveness and enhance shareholder returns.

Shell's exploration and production costs are substantial, encompassing the high-risk ventures of finding and extracting oil and gas. These expenses include critical activities like seismic surveys to identify potential reserves, the costly process of drilling wells, ongoing maintenance to ensure operational efficiency, and sophisticated reservoir management to maximize recovery.

These investments, while significant, are fundamental to Shell's core business. The company reported a 2% increase in its oil and gas production for 2024, underscoring the ongoing commitment and expenditure in this segment. Such growth often necessitates continued investment in exploration and the upkeep of existing production facilities.

Research and Development (R&D) and Technology Costs

Shell's commitment to innovation is evident in its significant investment in Research and Development (R&D) and Technology Costs. This includes substantial funding for developing cutting-edge technologies aimed at enhancing exploration and production efficiency, optimizing refining processes, and crucially, advancing low-carbon energy solutions. The company's strategic focus on areas like biofuels, hydrogen, carbon capture and storage (CCS), and electric vehicle (EV) charging infrastructure underscores its dedication to a sustainable energy future.

In 2023 alone, Shell allocated $5.6 billion towards low-carbon solutions, a figure that represented 23% of its total capital spending. This financial commitment highlights the growing importance of these initiatives within Shell's overall business strategy. The company is actively pursuing technological advancements to reduce its environmental impact and capitalize on emerging market opportunities in the clean energy sector.

- Investment Focus: Developing new technologies for exploration, production efficiency, refining, and low-carbon energy solutions (biofuels, hydrogen, CCS, EV charging).

- 2023 Low-Carbon Investment: Shell invested $5.6 billion in low-carbon solutions, constituting 23% of its total capital expenditure for the year.

- Strategic Importance: These R&D and technology costs are vital for Shell's transition to becoming a net-zero emissions energy business.

Environmental Compliance and Decarbonization Costs

Shell incurs significant expenses to comply with evolving environmental regulations and achieve its net-zero ambitions. These costs encompass investments in emissions reduction technologies, carbon capture projects, and the development of lower-carbon energy solutions. For instance, Shell has committed to reducing its net carbon intensity by 15-20% by 2030, a target that necessitates substantial capital allocation towards sustainable practices.

The company's cost structure is also impacted by carbon pricing mechanisms, which directly affect the profitability of its fossil fuel operations. Shell's investments in renewable energy, such as offshore wind and solar power, and its efforts to decarbonize its existing infrastructure represent a considerable portion of its expenditures. These strategic investments are crucial for aligning its business with global climate goals.

- Environmental Compliance: Costs associated with adhering to regulations on emissions, waste management, and biodiversity protection.

- Decarbonization Initiatives: Investments in renewable energy sources, carbon capture utilization and storage (CCUS), and hydrogen production.

- Carbon Pricing: Expenses related to carbon taxes and emissions trading schemes in various operating regions.

- Sustainable Projects: Funding for research and development in low-carbon technologies and nature-based solutions.

Shell's cost structure is heavily influenced by substantial capital expenditures, particularly in exploration and production, alongside significant operating expenses for its global infrastructure. The company also dedicates considerable resources to research and development, especially in low-carbon technologies, and incurs costs related to environmental compliance and decarbonization efforts.

In 2024, Shell's cash capital expenditure was $21.1 billion, with projections for 2025-2028 remaining between $20 billion and $22 billion annually. Operating expenses cover essential day-to-day costs, and the company achieved $3.1 billion in structural cost reductions since early 2022. Investment in low-carbon solutions was $5.6 billion in 2023, representing 23% of total capital spending.

| Cost Category | 2024 Data/Recent Trend | Key Components |

|---|---|---|

| Capital Expenditure (CAPEX) | $21.1 billion (2024) | Exploration, new fields, refineries, petrochemicals, renewables |

| Operating Expenses (OPEX) | Ongoing reduction efforts, $3.1 billion saved since early 2022 | Employee compensation, infrastructure maintenance, utilities, logistics |

| R&D and Technology Costs | $5.6 billion in low-carbon solutions (2023) | Low-carbon tech (biofuels, hydrogen, CCS, EV charging), efficiency |

| Environmental Compliance & Decarbonization | Commitment to 15-20% net carbon intensity reduction by 2030 | Emissions reduction tech, carbon capture, renewable energy projects |

Revenue Streams

Shell's primary revenue stream is generated from the sale of refined petroleum products. This includes everyday items like gasoline and diesel for consumers, as well as jet fuel for airlines and lubricants for industrial use, serving a global customer base of both individuals and businesses.

In 2024, the marketing segment of Shell's operations, which encompasses the sale of these petroleum products, represented a significant portion of their business, accounting for 42.2% of net sales.

Shell generates significant revenue from the sale of natural gas and liquefied natural gas (LNG). This includes revenue from producing, liquefying, and trading these products to a global customer base, encompassing utilities, industrial clients, and other energy firms.

In 2024, the production of liquefied natural gas represented 13.1% of Shell's net sales. Looking ahead, the company has ambitious plans to expand its LNG sales, targeting an annual growth rate of 4-5% between now and 2030.

Shell generates significant revenue from selling a broad spectrum of chemicals and petrochemicals. These products are essential building blocks for numerous industries, finding applications in everything from plastics and packaging to detergents and synthetic textiles.

In 2024, Shell's chemicals segment continued to be a vital contributor to its overall financial performance. The company's integrated refining and chemicals operations allow for efficient production, feeding into a global market hungry for these essential materials.

Sales of Renewable Electricity and Biofuels

Shell's revenue from selling electricity generated by renewables like wind and solar is a rapidly expanding area. This segment also includes their production and sale of biofuels and other cleaner energy options, reflecting a strategic shift towards lower-carbon solutions.

In 2024, sales of electricity from renewable sources alone represented a significant 10.3% of Shell's total net sales. This highlights the increasing importance of these cleaner energy products within their overall business portfolio.

- Growing Renewable Electricity Sales: Revenue generated from electricity produced by wind and solar farms.

- Biofuel and Low-Carbon Solutions: Income from the production and sale of biofuels and other alternative, cleaner energy sources.

- 2024 Contribution: Renewable electricity sales accounted for 10.3% of Shell's net sales in 2024, demonstrating substantial growth.

Trading and Optimization Activities

Shell generates significant revenue through its global trading operations, buying and selling crude oil, refined products, natural gas, and Liquefied Natural Gas (LNG). These activities capitalize on market price differentials and supply-demand dynamics.

Leveraging its vast logistics network, including tankers and terminals, Shell optimizes the movement and storage of these commodities. This integrated approach allows them to capture value across the entire supply chain, from production to end-user delivery.

- Revenue Source: Global trading of crude oil, refined products, natural gas, and LNG.

- Key Capability: Exploiting market fluctuations through extensive supply chain and logistics.

- Strategic Benefit: Optimizing the value of Shell's integrated energy portfolio.

- 2024 Insight: While specific trading revenue figures are often embedded within broader segment reporting, Shell's Integrated Gas segment, which includes LNG trading, reported strong performance in early 2024, reflecting robust demand and favorable market conditions. For instance, in Q1 2024, the Integrated Gas business saw Adjusted Earnings of $4.2 billion, partly driven by trading outcomes.

Shell's revenue streams are diverse, spanning the sale of refined petroleum products, natural gas and LNG, chemicals, and increasingly, electricity from renewable sources. Trading operations also play a crucial role in capitalizing on market dynamics.

| Revenue Stream | Description | 2024 Contribution (Net Sales) |

| Refined Petroleum Products | Gasoline, diesel, jet fuel, lubricants | 42.2% |

| Natural Gas & LNG | Production, liquefaction, and trading | 13.1% (LNG production) |

| Chemicals | Petrochemicals for various industries | Integral to refining operations |

| Renewable Electricity & Biofuels | Wind, solar power, biofuels | 10.3% (Renewable electricity sales) |

| Trading Operations | Global buying and selling of commodities | Supports Integrated Gas segment performance |

Business Model Canvas Data Sources

The Shell Plc Business Model Canvas is informed by a comprehensive blend of internal financial disclosures, extensive market research reports, and strategic analyses of global energy trends. These diverse data streams ensure a robust and accurate representation of Shell's operational and strategic landscape.