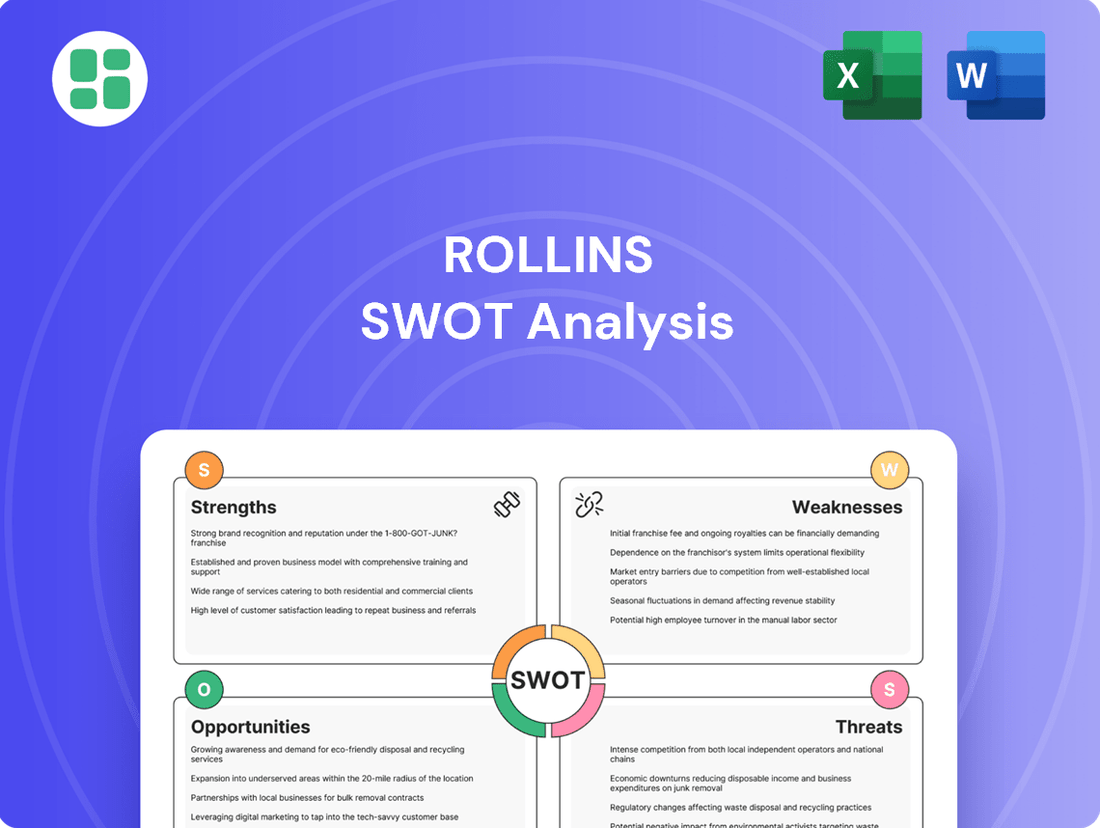

Rollins SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Rollins Bundle

Rollins' strengths lie in its diversified service offerings and strong brand recognition, but its reliance on acquisitions presents a potential risk. Understanding these dynamics is crucial for informed decision-making.

Want the full story behind Rollins' market position, potential threats, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment research.

Strengths

Rollins, Inc. stands as a titan in the pest control sector, boasting a robust collection of trusted brands including Orkin, HomeTeam Pest Defense, and Critter Control. This strong brand equity, coupled with a vast operational network, secures a commanding market presence, especially in North America where it commands a substantial 24% market share following Rentokil's acquisition of Terminix.

Rollins consistently shows impressive financial performance, marked by steady revenue growth and robust cash flow generation. This financial strength is a key advantage, enabling the company to invest in its operations and reward shareholders.

In Q2 2025, Rollins achieved a significant milestone with revenues reaching $1 billion, reflecting a healthy 12.1% year-over-year increase. Furthermore, the company saw its operating cash flow surge by 20.7% to $175 million during the same period. This consistent ability to generate cash provides a solid financial bedrock.

The company's financial stability is further underscored by its strong profit margins, with a reported gross profit margin of 52.7% in fiscal year 2023. This profitability, combined with strong cash flow, positions Rollins favorably for ongoing investment and sustained value creation for its investors.

Rollins excels through a disciplined acquisition strategy, consistently integrating new businesses to broaden its reach and service capabilities. This approach is a significant growth engine, working alongside organic expansion efforts to enter new markets and attract diverse customer bases.

In 2024 and early 2025, Rollins demonstrated this strength by completing 29 acquisitions, with an average deal size of approximately $21.8 million. A notable example is the April 2025 acquisition of Saela Holdings, which immediately boosted Rollins' scale and revenue streams.

Recurring Revenue Model

Rollins' recurring revenue model is a significant strength, with approximately 75% of its income derived from ongoing services for both homes and businesses. This high percentage of recurring income creates a remarkably stable and predictable financial foundation for the company.

This dependable revenue stream enhances Rollins' ability to weather economic downturns, as a substantial portion of its business remains consistent. It also facilitates robust long-term financial planning and strategic investments, ensuring a solid base for continued growth and operational efficiency.

- 75% of Revenue from Recurring Services

- Stable and Predictable Income Stream

- Resilience During Economic Fluctuations

- Supports Long-Term Financial Planning

Global Footprint and Diversification

Rollins boasts an impressive global footprint, operating across North America, South America, Europe, Asia, Africa, and Australia. This extensive reach, encompassing over 800 locations and more than 20,000 employees, provides significant geographic diversification. This diversification helps to mitigate risks tied to regional economic downturns or specific market challenges, allowing Rollins to leverage diverse expertise and tap into new growth opportunities.

Rollins' extensive brand portfolio, featuring well-recognized names like Orkin and HomeTeam Pest Defense, provides significant market leverage and customer trust. This strong brand equity, combined with a vast operational network, solidifies its dominant position, particularly in North America where it holds a substantial market share.

The company's financial health is a key strength, evidenced by consistent revenue growth and strong cash flow. For instance, Q2 2025 saw revenues climb 12.1% year-over-year to $1 billion, with operating cash flow increasing by 20.7% to $175 million. This financial stability fuels investments and shareholder returns.

Rollins' strategic acquisition approach, demonstrated by 29 acquisitions in 2024 and early 2025, consistently expands its market reach and service capabilities. This disciplined integration strategy, exemplified by the April 2025 acquisition of Saela Holdings, is a powerful driver of organic and inorganic growth.

A significant advantage is Rollins' recurring revenue model, with approximately 75% of its income generated from ongoing service contracts. This predictable income stream enhances financial stability, enabling resilience during economic downturns and supporting long-term strategic planning.

| Strength | Description | Supporting Data |

|---|---|---|

| Brand Equity & Market Presence | Strong portfolio of trusted brands (Orkin, HomeTeam) and extensive operational network. | 24% North American market share. |

| Financial Performance | Consistent revenue growth and robust cash flow generation. | Q2 2025: $1B revenue (+12.1% YoY), $175M operating cash flow (+20.7% YoY). FY23 Gross Profit Margin: 52.7%. |

| Acquisition Strategy | Disciplined integration of new businesses to expand reach and capabilities. | 29 acquisitions in 2024-early 2025 (avg. $21.8M deal size). |

| Recurring Revenue Model | High percentage of income from ongoing service contracts. | ~75% of revenue from recurring services. |

What is included in the product

Delivers a strategic overview of Rollins’s internal and external business factors, highlighting its strengths, weaknesses, opportunities, and threats within the pest control industry.

Highlights key strategic advantages and potential threats for proactive risk mitigation.

Weaknesses

Rollins has encountered margin pressures despite its robust revenue expansion. For instance, in the first quarter of 2025, operating margins saw a decline to 17.3%, a 40 basis point decrease, while adjusted EBITDA margins dropped to 20.9%, down 60 basis points.

These margin contractions are largely driven by escalating operational expenses. Key contributors include increased employee compensation, higher selling and marketing expenditures, and the impact of developments related to legacy auto claims.

Rollins' reliance on traditional service models presents a weakness as a significant portion of its operations may still depend on established pest control methods. This could mean a slower adoption of cutting-edge technological advancements compared to more agile competitors. For instance, while the company has invested in digital tools, the core service delivery might still be heavily human-dependent, potentially creating inefficiencies.

Rollins' acquisition-heavy growth strategy presents significant integration challenges. Merging diverse operational models, like incorporating Saela's door-to-door sales approach, demands substantial management focus and resources to achieve anticipated synergies. For instance, the successful integration of acquired companies is crucial for realizing the full value of these transactions, a process that can be complex and time-consuming.

High Operational Costs

Rollins faces challenges with high operational costs. For instance, employee compensation, a significant expense, increased by 9.6% year-over-year in the first quarter of 2025. This, coupled with an 18.5% rise in selling and marketing expenses during the same period, puts pressure on the company's profitability.

These escalating costs demand a keen focus on operational efficiency to safeguard profit margins.

- Employee Compensation: Increased by 9.6% year-over-year in Q1 2025.

- Selling and Marketing Expenses: Rose by 18.5% in Q1 2025.

- Profitability Impact: Rising costs can compress overall profit margins.

- Efficiency Need: Continuous efforts are required to maintain healthy margins.

Intense Competition in Fragmented Markets

Rollins faces a significant challenge due to the highly fragmented nature of the pest control industry, which features thousands of smaller, localized competitors. This intense competition, exemplified by major players like Rentokil Initial, can lead to price pressures and make it difficult to maintain and grow market share. For instance, in 2023, the global pest control market was valued at approximately $22.5 billion, with numerous smaller regional companies vying for business alongside larger entities.

This competitive landscape necessitates continuous investment in service quality and innovation to differentiate Rollins' offerings. The need to stand out requires ongoing efforts in customer service, technological advancements, and specialized treatment options. As of early 2024, the industry continues to see consolidation, but the sheer number of independent operators means that customer loyalty is hard-won and easily lost, impacting retention rates.

- Market Fragmentation: Thousands of smaller, regional pest control companies operate alongside larger national and international firms.

- Competitive Pressure: Intense rivalry can lead to price wars and reduced profit margins.

- Customer Retention: Maintaining customer loyalty requires superior service and consistent value proposition.

- Investment Needs: Continuous investment in technology and service quality is crucial for differentiation.

Rollins' profitability is under pressure from rising operational costs, particularly employee compensation and marketing efforts. In the first quarter of 2025, operating margins dipped to 17.3%, a 40 basis point decrease, while adjusted EBITDA margins fell to 20.9%, down 60 basis points. These increases, with employee compensation up 9.6% and selling/marketing expenses up 18.5% year-over-year, highlight the need for enhanced operational efficiency to protect profit margins.

| Expense Category | Q1 2025 Change (YoY) | Impact |

|---|---|---|

| Employee Compensation | +9.6% | Increased labor costs |

| Selling and Marketing Expenses | +18.5% | Higher customer acquisition costs |

| Operating Margins | -40 bps | Reduced profitability |

| Adjusted EBITDA Margins | -60 bps | Compressed earnings before interest, taxes, depreciation, and amortization |

What You See Is What You Get

Rollins SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You are seeing the actual Rollins SWOT analysis, ensuring transparency and quality. The complete, detailed report will be yours immediately after purchase.

Opportunities

The pest control sector is seeing a significant technological leap, with smart devices, the Internet of Things (IoT), artificial intelligence (AI), and drones becoming integral. Rollins can capitalize on this by increasing its investment in these innovations. This adoption will pave the way for more efficient, real-time pest monitoring and predictive analytics, allowing for more targeted and effective treatments.

By embracing these advancements, Rollins stands to significantly boost its service quality and operational efficiency. For instance, AI-powered predictive analytics could help anticipate pest outbreaks, while drone technology might offer faster and more comprehensive property inspections. This proactive approach, supported by data from the 2024 pest control market, which was valued at approximately $23.5 billion globally and is projected to grow, presents a clear avenue for competitive advantage and improved customer satisfaction.

The increasing focus on environmental responsibility presents a substantial opportunity for Rollins. As consumers and governments worldwide push for greener practices, the demand for eco-friendly pest control is on the rise. This trend is particularly strong in 2024 and projected to continue growing through 2025, with many regions implementing stricter regulations on chemical pesticides.

Rollins is well-positioned to capitalize on this by expanding its portfolio of sustainable solutions. This includes investing further in biological pest control methods, developing and promoting organic treatments, and offering services that minimize environmental impact. For example, by 2025, many of Rollins' service areas are seeing a 15-20% year-over-year increase in customer inquiries specifically asking about eco-friendly options.

The pest control industry, still quite fragmented with many local and regional businesses, presents a significant opportunity for Rollins. The company can pursue its strategic acquisition approach, targeting smaller, fast-growing firms to broaden its reach and increase its market share.

By integrating these acquisitions, Rollins can achieve greater economies of scale, improving operational efficiency and profitability. For example, Rollins has a history of successful acquisitions, such as its 2023 acquisition of Fox Pest Control, which expanded its presence in key markets and added to its revenue base, demonstrating the viability of this strategy.

Expansion into New Geographies and Service Lines

Rollins can leverage its established global footprint to target underserved or emerging markets. For instance, regions experiencing heightened pest issues due to climate change or rapid urbanization present significant growth potential. In 2023, Rollins reported international revenue of $512 million, indicating a solid base for further geographic expansion.

Diversification into related ancillary services or specialized pest management solutions offers another avenue for growth. This could include areas like wildlife control, advanced fumigation techniques, or integrated pest management consulting for commercial clients. Such expansion can capitalize on existing customer relationships and brand trust.

- Geographic Expansion: Targeting regions with increasing pest prevalence driven by climate change and urbanization.

- Service Diversification: Offering specialized pest management solutions and related ancillary services.

- Market Penetration: Capitalizing on Rollins' existing global presence to enter new, less-served territories.

Personalized and Digital Customer Experiences

Customers increasingly expect tailored services and easy-to-use digital tools, like online booking and virtual pest assessments. Rollins can capitalize on this by upgrading its digital presence and offering customized pest management plans, which are key to keeping existing customers happy and drawing in new ones. This focus on personalization and digital convenience is a significant growth avenue.

For instance, the pest control market in North America saw significant digital adoption in 2024, with an estimated 40% of service bookings occurring online. Rollins' investment in its digital platforms, including its Orkin and HomeTeam Pest Defense apps, positions it well to meet this demand. By further integrating AI for personalized service recommendations and streamlining remote inspection capabilities, Rollins can differentiate itself and boost customer loyalty.

- Enhanced Digital Platforms: Rollins can leverage data analytics to offer more personalized service schedules and communication, improving customer satisfaction.

- Remote Inspection Capabilities: Expanding virtual assessment options reduces customer inconvenience and can speed up service initiation.

- Customized Service Offerings: Tailoring pest control solutions to specific household needs, rather than a one-size-fits-all approach, drives higher perceived value and retention.

Rollins can leverage technological advancements like AI and IoT for more efficient pest monitoring and predictive analytics, enhancing service effectiveness. The growing demand for eco-friendly solutions presents an opportunity to expand sustainable service offerings, aligning with consumer and regulatory trends. Strategic acquisitions of smaller pest control firms can further increase market share and operational efficiencies, building on past successes like the Fox Pest Control acquisition.

Expanding into underserved geographic markets, particularly those facing increased pest issues due to climate change or urbanization, offers significant growth potential, as evidenced by Rollins' international revenue of $512 million in 2023. Diversifying into related services such as wildlife control or specialized fumigation techniques can capitalize on existing customer trust and brand recognition.

Enhancing digital platforms for personalized customer experiences, including online booking and virtual assessments, is crucial for meeting evolving customer expectations, with North American digital bookings estimated at 40% in 2024. This digital focus, combined with customized service plans, can improve customer satisfaction and retention.

Threats

The pest control industry has seen a significant shake-up with Rentokil Initial's acquisition of Terminix in 2022, creating a formidable global competitor for Rollins. This consolidation means Rollins now faces a larger, more resource-rich entity with a broader geographic reach and service portfolio. This intensified competition is likely to drive more aggressive pricing, increased marketing spend, and a heightened focus on customer acquisition and retention, potentially squeezing profit margins and requiring Rollins to innovate rapidly to maintain its market position.

Stricter environmental regulations and potential pesticide bans present a significant threat to Rollins. As governments worldwide, including in the U.S. and Europe, continue to tighten controls on chemical applications and promote integrated pest management (IPM) strategies, Rollins may face increased compliance costs. For instance, the U.S. EPA's ongoing reviews of certain pesticides could lead to further restrictions or cancellations, impacting service offerings and requiring substantial R&D investment in alternative, environmentally friendly solutions.

Global economic uncertainties and currency fluctuations pose a significant threat to Rollins. A stronger U.S. dollar, for instance, can diminish the value of international earnings when converted back to dollars, directly impacting profitability. For example, in the first quarter of 2024, the company noted that foreign currency headwinds had a negative impact on its reported revenue.

Furthermore, an economic slowdown could lead to reduced discretionary spending by consumers, potentially affecting demand for residential pest control services. As the economy tightens, households may prioritize essential expenses over non-essential services, creating a headwind for Rollins' residential segment.

Rising Labor Costs and Talent Acquisition

The pest control sector, inherently labor-intensive, faces pressure on profit margins due to escalating employee compensation. For instance, average hourly wages for pest control technicians in the US saw an approximate 5% increase year-over-year leading into 2024, a trend expected to continue. This rising cost of labor directly impacts the bottom line for companies like Rollins.

Moreover, the competition for skilled technicians and sales professionals is intensifying. In 2024, the unemployment rate for skilled trades remained remarkably low, making talent acquisition a significant hurdle. This scarcity can hinder service delivery quality and limit a company's capacity for expansion and growth.

Rollins, like its peers, must navigate these challenges. The company's ability to attract and retain qualified personnel will be crucial for maintaining service standards and pursuing strategic growth initiatives in a tight labor market.

Key considerations include:

- Increased Wage Demands: Technicians and sales staff command higher salaries, directly impacting operational expenses.

- Talent Shortage: A limited pool of qualified candidates makes hiring and retention more difficult and costly.

- Training Investment: Ongoing training for new and existing staff adds to the overall cost of labor.

- Competitive Hiring: Other industries also compete for similar skill sets, driving up recruitment costs.

Climate Change and Pest Adaptability

Climate change presents a significant threat to Rollins' operations, as shifting weather patterns can bolster pest populations and facilitate their spread into previously unaffected regions. This environmental volatility also contributes to pests developing greater resilience against conventional pest control treatments.

For instance, in 2024, reports indicated a noticeable increase in insect activity in regions experiencing unseasonably warm winters, directly impacting the demand for preventative pest control services. Rollins must continually innovate its service offerings and product formulations to counter these evolving pest behaviors and resistance patterns.

- Increased Pest Resilience: Warmer temperatures and altered precipitation patterns can accelerate pest life cycles and lead to higher resistance to existing insecticides.

- Geographic Range Expansion: Climate shifts are enabling pests to migrate to new territories, creating unforeseen service demands and requiring expanded operational reach for Rollins.

- Demand for Advanced Solutions: The adaptability of pests necessitates ongoing investment in research and development for more sophisticated and environmentally conscious pest management techniques.

Rollins faces intensified competition following Rentokil Initial's acquisition of Terminix, creating a larger, more resource-rich global competitor. This consolidation pressures Rollins to innovate and manage pricing more aggressively. Stricter environmental regulations and potential pesticide bans also pose a threat, necessitating investment in alternative solutions and potentially increasing compliance costs.

Global economic uncertainties and currency fluctuations can negatively impact Rollins' international earnings, as seen with foreign currency headwinds affecting revenue in early 2024. An economic slowdown could also reduce consumer spending on residential pest control. Furthermore, rising labor costs, with average hourly wages for technicians increasing by approximately 5% year-over-year leading into 2024, directly impact profit margins.

The pest control industry is labor-intensive, and Rollins, like its competitors, is experiencing escalating employee compensation costs. The low unemployment rate for skilled trades in 2024 makes talent acquisition and retention a significant challenge, potentially hindering service quality and expansion efforts. This requires substantial investment in training and competitive hiring practices to attract and retain qualified personnel.

Climate change presents a threat through shifting weather patterns that can increase pest populations and their resilience to treatments. For example, unseasonably warm winters in 2024 led to increased insect activity, impacting demand for preventative services. Rollins must continuously invest in R&D for advanced, environmentally conscious pest management techniques to counter evolving pest behaviors and resistance.

| Threat Category | Specific Challenge | Impact on Rollins | Data Point/Example |

|---|---|---|---|

| Competitive Landscape | Consolidation in the industry | Increased pricing pressure, need for rapid innovation | Rentokil Initial's acquisition of Terminix (2022) |

| Regulatory Environment | Stricter environmental regulations, pesticide reviews | Increased compliance costs, need for alternative solutions | U.S. EPA pesticide reviews |

| Economic Factors | Global economic uncertainty, currency fluctuations | Reduced value of international earnings, potential decrease in consumer spending | Foreign currency headwinds impacting revenue (Q1 2024) |

| Labor Market | Rising wage demands, talent shortage | Increased operational expenses, difficulty in hiring and retention | ~5% year-over-year increase in pest control technician wages (leading into 2024) |

| Climate Change | Shifting weather patterns, increased pest resilience | Need for evolving service offerings and product formulations | Increased insect activity during unseasonably warm winters (2024 reports) |

SWOT Analysis Data Sources

This Rollins SWOT analysis is built upon a foundation of robust data, drawing from publicly available financial statements, comprehensive industry market research, and expert commentary from reputable sources to ensure a thorough and insightful assessment.