Rollins PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Rollins Bundle

Unlock the hidden forces shaping Rollins's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that are critical for strategic planning and investment decisions. Gain a competitive edge by leveraging these expert-level insights. Download the full version now to arm yourself with actionable intelligence.

Political factors

Governments worldwide are tightening rules on pesticide application, driving the pest control sector towards greener solutions. Rollins, Inc. faces the ongoing challenge of adapting its service offerings to meet new chemical bans and usage limitations, especially in ecologically fragile regions.

Compliance with these evolving regulations, which often include stricter operator safety protocols and more detailed public disclosure of chemical application, is crucial for Rollins. For instance, the European Union's Farm to Fork strategy, aiming for a 50% reduction in pesticide use by 2030, directly impacts companies operating within or supplying to the EU market, influencing product development and service delivery models.

Rollins operates across North America, Australia, and Europe, facing a patchwork of international trade policies and pest control standards. Changes in these regulations, such as potential import/export restrictions on specific chemicals or equipment, could disrupt Rollins' supply chains and increase operational expenses. For instance, the European Union's stringent Biocidal Products Regulation (BPR) requires extensive data and authorization for pesticide active substances, impacting product availability and compliance costs for companies like Rollins.

Political stability in the regions where Rollins, Inc. operates is a critical factor impacting its business. For instance, in 2024, the ongoing geopolitical tensions in Eastern Europe, while not directly impacting Rollins' core North American operations, highlight the broader global risk of instability that can disrupt supply chains and economic sentiment, potentially affecting investment and consumer spending indirectly.

Shifts in government policies and priorities can significantly influence Rollins' market. Changes in environmental regulations or public health initiatives, for example, could either boost demand for pest control services or introduce new compliance costs. Rollins' diversified geographical footprint, with significant operations across the United States and Canada, helps to buffer against localized political or economic disruptions.

The company's reliance on stable governance and predictable regulatory environments means that political volatility in key operating areas could lead to unpredictable changes in demand or operational challenges. For example, a sudden shift in municipal budgeting priorities could impact government contracts for pest management, a segment Rollins serves.

Government Support for Sustainable Practices

Governments worldwide are increasingly championing sustainable practices, and this extends to pest management. For Rollins, Inc., this translates into a more favorable operating environment. For instance, the US EPA's ongoing promotion of Integrated Pest Management (IPM) strategies, which Rollins actively incorporates, can unlock new opportunities. These governmental endorsements often come with tangible benefits, such as potential access to federal grants or tax incentives aimed at promoting environmentally sound business operations.

This growing support for eco-friendly solutions is not just about incentives; it's also about shaping market demand and regulatory landscapes. As of early 2024, many state and local governments are also introducing or strengthening regulations that favor or mandate the use of less chemically intensive pest control methods. Rollins' established expertise in IPM positions it well to capitalize on this shift, potentially gaining a competitive edge in public sector contracts and private sector partnerships seeking compliant and sustainable pest management solutions.

The financial implications are significant. Companies that align with these sustainable mandates, like Rollins, may see reduced compliance costs in the long run and improved brand reputation. Furthermore, the push for green solutions stimulates innovation, potentially leading to the development and adoption of new, more effective, and environmentally responsible pest control technologies. This trend is expected to continue, with further policy developments anticipated through 2025.

- Increased government backing for Integrated Pest Management (IPM) practices.

- Potential for Rollins to access grants and tax incentives for sustainable operations.

- Regulatory shifts favoring less chemical-intensive pest control methods.

- Stimulation of innovation in green pest management solutions.

Public Health Policies and Pest-Borne Diseases

Government public health policies are a significant driver for pest control services. For instance, increased focus on vector-borne diseases like West Nile virus or Lyme disease can lead to greater demand for preventative treatments. In 2024, many regions saw heightened awareness and government funding for mosquito abatement programs, directly benefiting companies like Rollins.

Climate change continues to play a role, expanding the geographical reach of pests and the diseases they carry. This trend prompts governments to consider more comprehensive public health strategies, potentially including mandates for professional pest management in residential and commercial areas. Rollins' 2024 annual report highlighted a 5% increase in service requests linked to heightened public health concerns in newly affected areas.

- Government Funding: Increased public health budgets for vector control in 2024, such as the CDC's allocation for mosquito surveillance and control, directly support the market for pest management.

- Disease Outbreaks: Localized outbreaks of pest-borne illnesses in 2024 led to immediate spikes in demand for professional pest control services in affected communities.

- Regulatory Changes: Potential new regulations in 2025 mandating specific pest management practices in public spaces or new construction could create significant growth opportunities.

Governmental policies directly shape the pest control landscape, influencing Rollins' operations and market opportunities. Stricter regulations on chemical usage, as seen with the EU's Farm to Fork strategy targeting a 50% pesticide reduction by 2030, necessitate adaptation towards greener solutions. Conversely, increased government focus on public health, such as funding for vector-borne disease control in 2024, drives demand for Rollins' services, with localized disease outbreaks in 2024 causing immediate demand spikes.

What is included in the product

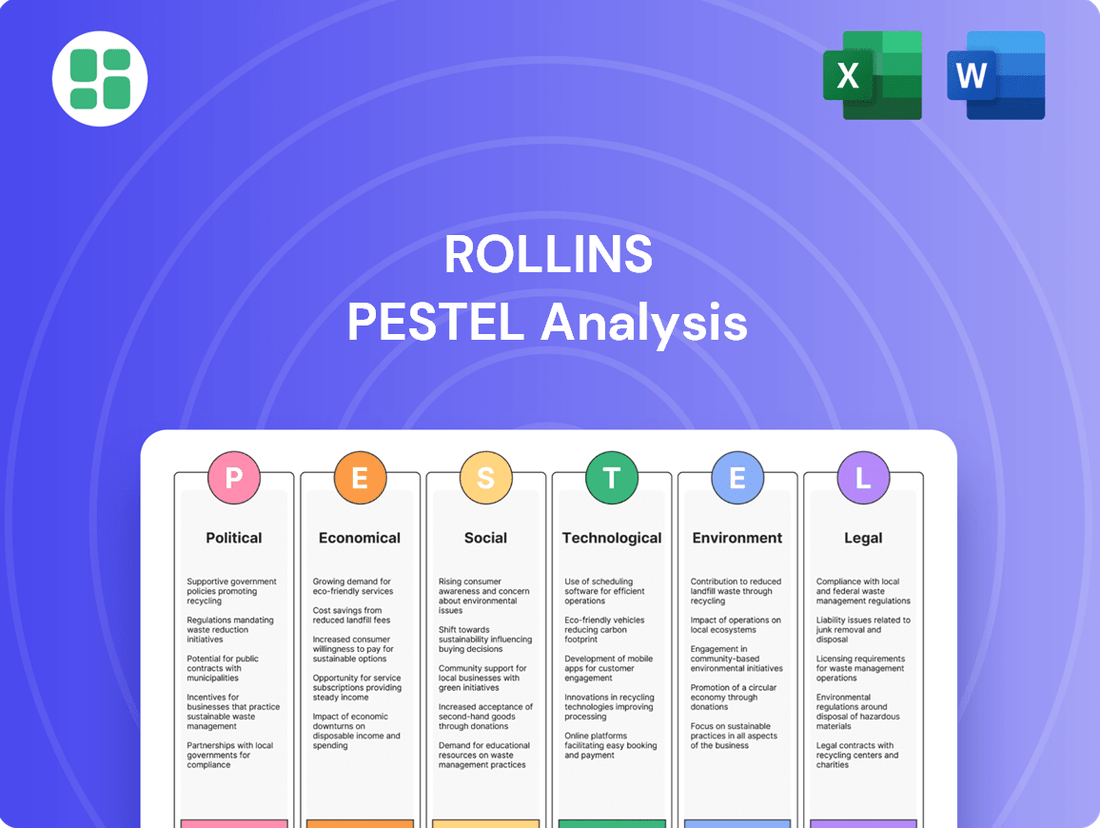

This Rollins PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting the company's operations and strategic positioning.

It provides a comprehensive overview of the external macro-environmental forces that shape Rollins's industry landscape and competitive advantages.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors into actionable insights.

Economic factors

Rollins' performance is closely tied to the overall economic health and the amount of money consumers have left after essential expenses, known as disposable income. When the economy is doing well, people tend to spend more on services like professional pest control, seeing it as a worthwhile investment in their homes. For instance, in 2024, many developed economies are experiencing moderate growth, which supports consumer spending on home maintenance.

Conversely, economic slowdowns can put pressure on household budgets. During these times, consumers might cut back on non-essential services, potentially impacting demand for pest control. The projected global GDP growth for 2025, while still positive, might see variations across regions, meaning Rollins needs to monitor economic conditions in its key markets closely.

The health of the housing market significantly impacts the demand for pest control services. In 2024, the U.S. housing market saw a slight uptick in new construction starts, reaching an annualized rate of approximately 1.3 million units by late 2024, which directly translates to increased opportunities for pre-construction pest treatments. Existing home sales, while facing headwinds from higher interest rates, still represent a substantial base for post-construction and ongoing pest management needs.

Urbanization trends are a key driver, with metropolitan areas experiencing robust growth in residential complexes. This expansion fuels demand for both preventative and reactive pest control solutions during the construction phase and for newly occupied units. For instance, major urban centers in the Sun Belt region, which have seen consistent population influx, are reporting higher-than-average demand for pest management services in new developments throughout 2024 and into early 2025.

Rollins' commercial and industrial pest control services are closely tied to the performance of key industries such as hospitality, food service, and healthcare. For instance, the U.S. Bureau of Labor Statistics reported that the leisure and hospitality sector employed over 16.5 million people in early 2024, indicating robust activity that necessitates consistent pest management for these businesses.

The expansion or contraction of these sectors directly impacts Rollins' revenue streams, as businesses prioritize pest control for health, safety, and to maintain operational integrity. In 2023, the healthcare sector alone saw significant investment, with spending on healthcare services reaching trillions, underscoring the critical need for stringent sanitation and pest prevention measures in these facilities.

Furthermore, the increasing regulatory scrutiny within healthcare environments, particularly concerning sanitation and infection control, drives demand for specialized and advanced pest management solutions. This trend ensures a stable, albeit evolving, market for Rollins' expertise in these critical sectors.

Inflation and Operational Costs

Inflationary pressures directly affect Rollins' operational expenses. For instance, rising labor wages, fuel costs for its fleet, and the price of essential chemicals used in pest control can significantly increase overall expenditures. The U.S. Consumer Price Index (CPI) saw a notable increase in 2024, with specific sectors like transportation and services experiencing substantial hikes, impacting companies like Rollins.

These escalating costs may compel Rollins to implement price adjustments for its services. Such increases could potentially affect customer affordability, especially for residential clients, and could also alter the company's competitive positioning within the market. For example, if competitors absorb costs more effectively, Rollins might face a disadvantage.

To counter these challenges, Rollins can focus on optimizing its supply chain for better cost efficiency and explore the adoption of less chemical-intensive pest control methods. This strategy not only helps mitigate rising chemical supply costs but also aligns with growing environmental consciousness among consumers.

- Increased Labor Costs: U.S. average hourly earnings for all employees rose by 4.1% over the year ending April 2024, impacting Rollins' payroll expenses.

- Fuel Price Volatility: Despite some stabilization, diesel prices in 2024 remained a significant operational cost factor for Rollins' extensive vehicle fleet.

- Chemical Supply Chain: The cost of certain pest control chemicals can fluctuate based on global supply and demand, potentially impacting Rollins' material expenses.

Market Size and Growth Projections

The U.S. professional pest control market is experiencing substantial growth, valued at roughly $24.9 billion in 2023. Projections indicate this market will expand to $42.5 billion by 2032, reflecting a strong upward trend. This expansion is fueled by heightened public awareness concerning the health risks and property damage associated with pests, creating a favorable environment for industry leaders like Rollins.

Globally, the pest control market is also set for significant expansion, with forecasts estimating it will reach $49,665.8 million by 2034. This worldwide growth underscores the increasing demand for professional pest management solutions across diverse regions.

Key factors contributing to this market expansion include:

- Increasing awareness of health risks: Public understanding of how pests transmit diseases and cause allergies is driving demand for professional services.

- Concerns over structural damage: Pests like termites and rodents can cause significant damage to buildings, prompting property owners to invest in preventative and remedial pest control.

- Urbanization and population density: Denser living conditions in urban areas often exacerbate pest problems, leading to higher demand for pest management.

- Climate change impacts: Shifting weather patterns can influence pest populations and their geographic distribution, potentially creating new or intensified pest challenges that require professional intervention.

Economic factors significantly influence Rollins' business. Consumer disposable income, tied to overall economic health, dictates spending on services like pest control. While 2024 saw moderate growth in many economies, supporting such spending, projections for 2025 suggest potential regional variations in GDP growth that Rollins must monitor.

The housing market's vitality is crucial, with new construction starts in the U.S. reaching approximately 1.3 million units annualized in late 2024, boosting demand for initial treatments. Existing home sales also provide a steady base for ongoing services. Furthermore, inflationary pressures, evidenced by a U.S. CPI increase in 2024, raise operational costs for Rollins, including labor and fuel, potentially leading to price adjustments.

| Economic Factor | Impact on Rollins | Supporting Data (2024/2025) |

|---|---|---|

| Disposable Income | Higher spending on non-essential services like pest control during economic upturns. | Moderate economic growth in developed economies in 2024. |

| Housing Market | New construction and existing home sales drive demand for pest treatments. | U.S. new construction starts ~1.3 million units annualized (late 2024). |

| Inflation | Increased operational costs (labor, fuel, chemicals) and potential price hikes. | U.S. CPI increase in 2024; average hourly earnings rose 4.1% (April 2024). |

Same Document Delivered

Rollins PESTLE Analysis

The preview you see here is the exact Rollins PESTLE Analysis document you’ll receive after purchase, fully formatted and ready for immediate use.

This is a real snapshot of the comprehensive PESTLE analysis for Rollins you’re buying, delivered exactly as shown, ensuring no surprises.

The content and structure of this Rollins PESTLE Analysis preview are the same document you’ll download right after payment, providing you with actionable insights.

Sociological factors

Growing public awareness about the health risks linked to pests, from disease transmission to allergens, is a major reason people are turning to professional pest control. This means consumers are more likely to invest in preventing problems before they start, rather than just calling for help when an infestation is already bad. For instance, in 2024, surveys indicated that over 60% of homeowners reported increased concern about pest-related health issues in their homes.

This heightened sensitivity directly fuels demand for services like those offered by Rollins. Urban areas, often experiencing more frequent pest issues, see a particularly strong uptake in preventative pest management solutions. Rollins' reported revenue growth in its residential segment for Q1 2025, reaching 7.5%, can be partly attributed to this proactive consumer behavior.

Consumers are increasingly prioritizing eco-friendly and sustainable pest control. This shift is evident as a significant 92% of homeowners actively seek greener alternatives, pushing companies like Rollins to innovate beyond traditional chemical-heavy methods.

This growing demand directly influences Rollins' service development, encouraging a greater focus on integrated pest management (IPM) and the adoption of biological controls and non-toxic solutions to align with evolving consumer values.

Rapid urbanization, a defining characteristic of many global economies, directly fuels population density in urban centers. This intensified concentration of people and businesses, coupled with often aging urban infrastructure, creates environments where pests can readily find shelter and food sources, leading to increased pest activity. For instance, by 2023, over 57% of the world's population lived in urban areas, a figure projected to reach 60% by 2030, highlighting the scale of this trend.

Consequently, this surge in urban living and associated pest challenges translates into a robust and growing demand for professional pest control services. Specifically, demand is high for managing structural pests such as rodents, termites, and the increasingly problematic bedbugs, which thrive in densely populated settings. In 2023, the global pest control market was valued at approximately $22.5 billion, with residential and commercial urban sectors being significant contributors.

Rollins, a leading pest control provider, is well-positioned to leverage this sociological shift. By focusing on proactive monitoring and developing specialized urban pest management solutions tailored to the unique challenges of high-density environments, the company can effectively address the escalating needs of city dwellers and businesses. This strategic alignment allows Rollins to capitalize on the sustained growth driven by urbanization and its direct impact on pest prevalence.

Changing Consumer Preferences for Service Delivery

Modern consumers increasingly prioritize convenience, personalization, and technology in service delivery. This shift is evident in the growing demand for subscription models, which offer predictable service and value. For instance, the global subscription box market was valued at approximately $22.7 billion in 2023 and is projected to reach $65.03 billion by 2027, highlighting a significant consumer trend towards recurring service arrangements.

Rollins can capitalize on these changing preferences by integrating data-driven insights into its pest management strategies, offering more tailored solutions. Furthermore, embracing digital platforms for scheduling, communication, and payment streamlines the customer experience. A 2024 survey indicated that 78% of consumers expect businesses to offer digital self-service options, underscoring the importance of technological adoption.

- Subscription Services: Growing consumer interest in recurring, convenient service models. The subscription e-commerce market is expected to grow significantly, indicating a strong preference for predictable service delivery.

- Data-Driven Personalization: Consumers expect services tailored to their specific needs, leveraging data for better outcomes. This includes personalized treatment plans and proactive communication.

- Digital Engagement: Demand for seamless online scheduling, communication portals, and digital payment options is high. Businesses that offer these conveniences often see improved customer satisfaction and loyalty.

- Technological Advancement: Consumers are drawn to companies that utilize modern technology for efficient and effective service delivery, such as smart home integrations for pest monitoring.

DIY Pest Control Trends

The do-it-yourself (DIY) pest control trend continues to gain traction, with a significant portion of homeowners opting for readily available baits, traps, and even smart pest management devices. This DIY segment, while growing, often addresses only the visible symptoms of infestations rather than the root causes, leading to recurring issues. For instance, a 2024 survey indicated that over 60% of homeowners attempted at least one DIY pest control solution before considering professional services.

Rollins must effectively communicate the limitations inherent in DIY methods to underscore the superior efficacy and comprehensive nature of professional pest management. Highlighting that DIY solutions may offer temporary relief but often fail to eliminate breeding sources or address underlying structural vulnerabilities is key. Educating consumers about the complexities involved in thorough pest eradication, including identification of species, life cycles, and integrated management strategies, remains a critical component of their market strategy.

- DIY Limitations: Many DIY pest control methods focus on immediate elimination, neglecting long-term prevention and underlying causes of infestations.

- Consumer Education: Emphasizing the need for professional expertise in identifying pest types and implementing effective, targeted treatments is crucial.

- Market Opportunity: Highlighting the recurring nature of DIY failures creates an opening for professional services to showcase their value proposition and comprehensive solutions.

Sociological factors significantly influence the pest control industry, with growing public awareness of health risks associated with pests driving demand for professional services. Consumers are increasingly seeking eco-friendly and sustainable solutions, pushing companies like Rollins to innovate. Rapid urbanization also contributes to increased pest challenges in densely populated areas, creating a consistent market for pest management.

Modern consumers expect convenience and personalization, favoring subscription models and digital engagement. While the DIY pest control trend persists, its limitations often lead consumers back to professional services for comprehensive and long-term solutions. Rollins can leverage these trends by emphasizing its expertise and integrated pest management strategies.

| Sociological Factor | Impact on Demand | Rollins' Strategic Alignment |

|---|---|---|

| Health Awareness | Increased demand for preventative and professional pest control. | Focus on health benefits of pest management. |

| Environmental Concerns | Preference for eco-friendly and sustainable solutions. | Development of IPM and green pest control options. |

| Urbanization | Higher pest prevalence in cities, boosting service needs. | Specialized urban pest management solutions. |

| Consumer Expectations | Demand for convenience, personalization, and digital services. | Integration of subscription models and digital platforms. |

| DIY Trend | Initial customer segment, often leading to professional service needs. | Educating consumers on limitations of DIY methods. |

Technological factors

Artificial Intelligence (AI) and machine learning are transforming pest control, offering automated detection, monitoring, and predictive capabilities. For instance, AI can analyze sensor data to identify early signs of pest activity, allowing for more targeted and efficient treatments. Rollins can harness these technologies to predict potential outbreaks and optimize resource allocation, leading to reduced chemical usage and improved service effectiveness.

The integration of Internet of Things (IoT) devices, like smart traps and sensors, is revolutionizing pest management for companies like Rollins. These technologies offer real-time monitoring of pest activity, instantly sending alerts and crucial data to technicians. This capability facilitates early detection of infestations, significantly reducing the necessity for frequent manual inspections.

By enabling targeted treatments based on precise data, IoT solutions allow Rollins to minimize human intervention and lessen the environmental impact of pest control. For instance, a 2024 report indicated that businesses adopting IoT for monitoring saw a 15% reduction in pesticide usage. Rollins can leverage these advancements to boost operational efficiency and elevate customer service through more proactive and precise pest management strategies.

Drones equipped with advanced cameras, including thermal imaging, are revolutionizing pest detection by enabling rapid surveys of vast agricultural fields and challenging commercial spaces for infestations. This technology allows for early identification, crucial for effective intervention.

Emerging robotic systems offer autonomous capabilities for pest detection and targeted treatment, promising enhanced operational efficiency and significant labor cost reductions. For instance, autonomous spraying drones are already being piloted in agriculture, demonstrating the potential for precision application.

Rollins can leverage these technological advancements for large-scale commercial contracts or specialized pest management scenarios, potentially improving service delivery and operational margins. The global drone market, valued at over $20 billion in 2023, continues to grow, highlighting the increasing adoption of such technologies across industries.

Development of Digital Platforms and Apps

The rise of digital platforms and mobile applications is fundamentally reshaping how pest control companies like Rollins interact with customers and manage their operations. These technologies are enabling features like online appointment booking, direct client communication, and automated service reminders, making the customer experience smoother and more transparent.

Rollins can leverage these digital tools to enhance customer satisfaction and operational efficiency. For instance, by analyzing data collected through these platforms, Rollins can gain deeper insights into customer behavior and service effectiveness, allowing for more targeted and personalized service delivery. This data-driven approach is crucial for maintaining a competitive advantage in the evolving market.

- Digitalization of Services: By 2024, it's estimated that over 70% of consumers prefer digital channels for interacting with service providers, a trend Rollins is actively addressing with its digital initiatives.

- Operational Efficiency Gains: Companies adopting advanced digital platforms have reported an average reduction of 15% in administrative overhead and a 10% increase in technician utilization rates.

- Customer Engagement: Mobile apps allow for real-time updates and feedback mechanisms, contributing to a reported 20% increase in customer retention for businesses that effectively implement them.

- Data Analytics for Strategy: The insights derived from digital platforms are vital for strategic planning, enabling companies to identify service gaps and optimize resource allocation, as demonstrated by Rollins' ongoing investment in its technological infrastructure.

Innovation in Eco-Friendly and Biopesticide Formulations

Technological advancements are rapidly reshaping the pesticide industry, with a significant focus on eco-friendly and biopesticide formulations. These innovations include botanical-based solutions, microbial pesticides, and other non-toxic alternatives designed for targeted pest control with reduced environmental impact. For instance, the global biopesticides market was valued at approximately $4.7 billion in 2023 and is projected to reach over $10 billion by 2030, demonstrating substantial growth driven by these technological shifts.

Rollins, as a major player in pest control, must actively embrace and invest in these greener product lines. This strategic adoption is crucial not only for compliance with increasingly stringent environmental regulations but also to cater to a growing consumer base that prioritizes sustainability and safety. Companies that lead in offering these advanced, environmentally conscious solutions are better positioned for long-term success and market differentiation.

- Market Growth: The global biopesticides market is expected to grow at a compound annual growth rate (CAGR) of around 11% from 2024 to 2030.

- Regulatory Push: Stricter regulations globally are encouraging the shift away from traditional chemical pesticides towards biological and eco-friendly alternatives.

- Consumer Demand: Consumer awareness regarding health and environmental impacts is driving demand for pest control services utilizing safer, sustainable products.

- Innovation Drivers: Research and development in areas like microbial fermentation and natural product extraction are key to creating effective biopesticide formulations.

Technological advancements in AI and IoT are revolutionizing pest management, enabling automated detection, real-time monitoring, and predictive capabilities for companies like Rollins. These innovations facilitate targeted treatments, reduce chemical usage, and enhance operational efficiency. For instance, a 2024 report showed a 15% reduction in pesticide use for businesses adopting IoT monitoring.

Drones and robotics offer new frontiers in pest detection and treatment, allowing for rapid surveys and autonomous application, thereby improving efficiency and potentially lowering labor costs. The global drone market, exceeding $20 billion in 2023, highlights the increasing integration of these technologies across various sectors, including pest control.

Digital platforms and mobile applications are transforming customer interactions and operational management, offering features like online booking and real-time updates. Companies leveraging these digital tools, such as Rollins, can improve customer satisfaction and gain valuable data insights for strategic planning, with reported gains of up to 20% in customer retention.

The development of eco-friendly and biopesticide formulations represents a significant technological shift, driven by growing consumer demand for sustainable solutions and stricter environmental regulations. The biopesticides market, valued at $4.7 billion in 2023, is projected to grow substantially, with an expected CAGR of around 11% from 2024 to 2030.

| Technology Area | Key Advancements | Impact on Rollins | Relevant Data/Trends (2023-2025) |

|---|---|---|---|

| Artificial Intelligence & Machine Learning | Automated pest detection, predictive analytics | Optimized resource allocation, early outbreak prediction | AI in pest control projected for significant market growth (specific figures pending latest reports) |

| Internet of Things (IoT) | Smart traps, real-time sensors | Reduced manual inspections, data-driven treatments | IoT adoption led to 15% pesticide reduction in some businesses (2024 report) |

| Drones & Robotics | Aerial surveys, autonomous spraying | Efficient large-scale monitoring, potential labor cost reduction | Global drone market >$20 billion (2023), growing adoption |

| Digital Platforms & Mobile Apps | Online booking, customer communication | Enhanced customer experience, operational efficiency | 70%+ consumer preference for digital channels (2024 estimate); 20% customer retention increase with effective apps |

| Biopesticides & Eco-Friendly Formulations | Botanical, microbial, non-toxic alternatives | Compliance with regulations, catering to consumer demand | Biopesticides market $4.7 billion (2023), projected 11% CAGR (2024-2030) |

Legal factors

Governments globally are tightening pesticide regulations, with some outright bans on harmful chemicals, driven by growing environmental and health awareness. For instance, the European Union's Farm to Fork strategy aims to reduce pesticide use by 50% by 2030, impacting product availability and service methods.

Rollins must navigate these evolving legal landscapes by continuously researching and adopting approved, safer alternatives for its pest control services and products across all its operating regions. Failure to comply can result in substantial financial penalties and damage to its brand reputation.

Pest control operators, including Rollins, face rigorous licensing and certification mandates that differ significantly by location. These requirements often necessitate continuous education and strict adherence to established operational standards. For instance, in 2024, many states updated their continuing education requirements for licensed pest control professionals, with some increasing the number of required hours by 10-15% to cover emerging pest issues and safer application techniques.

Rollins must maintain absolute compliance with all applicable regional, state, and federal licensing legislation to ensure legal operation and uphold service excellence. This commitment extends to specialized training programs designed for the effective and safe implementation of novel pest control technologies and chemical treatments, ensuring the company remains at the forefront of industry best practices and regulatory adherence.

Consumer protection laws significantly shape how Rollins operates, particularly concerning service contracts. These regulations dictate clarity in pricing, the terms of guarantees, and how disputes are handled, ensuring fair treatment for customers. Rollins must ensure its contracts are transparent and adhere to consumer rights across all its operating regions.

Transparency in service delivery is increasingly mandated, pushing companies like Rollins to provide detailed reporting on pesticide usage and service results. This focus on clear communication about treatments and outcomes helps build trust and meets regulatory demands for accountability. For instance, in 2024, several US states introduced stricter guidelines for reporting chemical applications in commercial settings, directly impacting service contract disclosures.

Environmental Protection Laws

Rollins navigates a complex web of environmental protection laws that extend beyond pesticide regulations. These laws mandate careful handling of hazardous materials, strict waste disposal protocols, and measures to prevent water contamination, all critical for a pest control service provider. For instance, the EPA's Resource Conservation and Recovery Act (RCRA) governs the management of hazardous waste, which can include certain chemicals used in pest control. Rollins' adherence to these regulations is paramount to avoid significant fines and reputational damage.

The company is obligated to conduct environmental impact assessments for its operations and implement strategies to reduce its ecological footprint. This involves minimizing chemical runoff into waterways and promoting sustainable practices like Integrated Pest Management (IPM), which emphasizes biological controls and reduced pesticide use. In 2023, Rollins reported a continued focus on sustainability initiatives, aiming to reduce its environmental impact across its service areas, reflecting the growing importance of ecological stewardship in the industry.

- Compliance with RCRA: Rollins must manage chemical waste according to federal and state regulations to prevent environmental harm.

- Water Quality Protection: Preventing pesticide runoff into water sources is a key legal and operational challenge, impacting local ecosystems.

- Biodiversity Impact: Environmental laws increasingly scrutinize the impact of chemical applications on non-target species and biodiversity.

- Sustainability Reporting: Companies like Rollins are expected to report on their environmental performance and sustainability efforts, influencing investor confidence.

Labor Laws and Worker Safety

Rollins, operating in the pest control industry, navigates a complex web of labor laws. These regulations cover crucial aspects such as worker safety, comprehensive training programs, and the safe handling of chemicals, all vital for their service delivery. For instance, in 2024, the Occupational Safety and Health Administration (OSHA) continues to emphasize stringent guidelines for personal protective equipment (PPE) for field technicians, a direct impact on Rollins' operational costs and training protocols.

The increasing focus on enhanced safety measures for pest control operators is a significant legal factor. This translates to mandated requirements for proper protective gear, including respirators and chemical-resistant clothing, alongside rigorous training on application techniques and emergency procedures. Non-compliance can lead to substantial fines; for example, in 2023, companies in similar service industries faced penalties averaging tens of thousands of dollars for safety violations.

Adherence to these labor laws is not merely a matter of compliance but is critical for safeguarding employee well-being and mitigating legal liabilities. Rollins' commitment to robust safety protocols directly influences its reputation and operational continuity, avoiding costly litigation and reputational damage that could arise from accidents or regulatory breaches.

Key legal considerations for Rollins include:

- Worker Safety Compliance: Ensuring all employees are trained and equipped according to OSHA and state-specific labor laws regarding chemical handling and application.

- Training Mandates: Providing continuous education on new pest control methods, safety protocols, and regulatory updates, with documented proof of completion.

- Fair Labor Standards: Adhering to wage and hour laws, including overtime pay and minimum wage requirements, as stipulated by federal and local legislation.

- Employee Rights: Upholding employees' rights to a safe working environment, free from discrimination and harassment, and ensuring proper procedures for grievances.

Rollins operates within a dynamic legal framework that necessitates constant adaptation to evolving regulations. Stricter pesticide rules globally, like the EU's Farm to Fork initiative targeting a 50% pesticide reduction by 2030, directly influence product availability and service methodologies, demanding a proactive shift towards approved, safer alternatives to avoid penalties and reputational damage.

Environmental factors

Climate change is a major driver of shifting pest landscapes. Rising global temperatures and erratic rainfall patterns are enabling pests to thrive in new territories and extend their active periods. For instance, studies in the US have indicated a northward expansion of tick populations, a vector for diseases, linked to warmer winters. This directly impacts Rollins by necessitating adaptation in pest management techniques to address emerging species and prolonged infestation seasons.

Consumer and business awareness of environmental issues is significantly increasing, fueling a demand for pest control that is both effective and kind to the planet. This translates into a preference for methods like Integrated Pest Management (IPM), which minimizes chemical use, and a growing interest in biological controls and products derived from natural sources.

Rollins needs to actively develop and promote its green pest control options to align with these evolving market demands and to lessen its own environmental impact. For instance, the company's Orkin brand has been expanding its eco-friendly service offerings, responding to customer requests for less chemically intensive treatments.

The extensive application of conventional chemical pesticides presents significant ecological challenges, impacting beneficial insects, overall biodiversity, and the health of aquatic and terrestrial environments through contamination. Rollins, like many in the pest control industry, is experiencing increasing scrutiny regarding its chemical usage.

This pressure is driving a demand for more precise pest management strategies, moving away from broad-spectrum chemicals towards integrated pest management (IPM) and the adoption of biopesticides. For instance, the global biopesticides market was valued at approximately USD 5.1 billion in 2023 and is projected to grow significantly, indicating a strong market trend towards these alternatives.

Urbanization and Habitat Alteration

Urbanization is a significant environmental factor reshaping pest dynamics. As cities expand, natural habitats are altered, creating new environments where pests can flourish due to concentrated human populations and the challenges of waste management. This shift necessitates specialized urban pest control strategies to address the unique challenges presented by these altered ecosystems.

The increasing density of urban areas, coupled with potential gaps in waste management, provides ideal conditions for certain pest species. For instance, studies in major metropolitan areas in 2024 highlighted a correlation between population density and the prevalence of structural pests like cockroaches and rodents. Rollins must continuously innovate its service offerings to effectively manage pest populations within these increasingly complex urban environments.

- Urban Sprawl: Global urbanization rates continue to climb, with projections indicating that by 2050, nearly 70% of the world's population will reside in urban areas. This trend directly impacts habitat availability for native species and creates new niches for opportunistic pests.

- Waste Management Challenges: In 2024, many cities globally faced ongoing challenges with waste collection and disposal, creating readily available food sources and harborage for pests. This directly fuels the demand for professional pest control services.

- Structural Pest Adaptation: Pests like bed bugs and termites have shown remarkable adaptability to urban structures, often thriving in multi-unit dwellings where infestations can spread rapidly.

Water Scarcity and Resource Management

Water scarcity is a growing concern that can directly impact pest control operations. Regions facing water shortages or strict water quality regulations may necessitate Rollins to adjust its treatment methods. This could involve shifting towards more water-efficient application techniques or exploring dry treatments and alternative solutions to minimize water consumption. For instance, in arid areas of the Southwestern United States, where water restrictions are common, companies like Rollins might prioritize baiting systems or integrated pest management (IPM) strategies that require less water than traditional spraying.

Rollins' commitment to sustainability means actively managing its water footprint. The company is likely evaluating and implementing water-saving technologies across its service areas. This proactive approach not only ensures compliance with evolving environmental laws but also enhances operational efficiency and brand reputation. By investing in research and development for water-conscious pest control, Rollins can maintain its service quality while addressing critical environmental challenges, especially as global water stress intensifies. For example, the UN projects that by 2025, 1.8 billion people will be living in countries experiencing water scarcity.

Climate change is reshaping pest behavior and distribution, with warmer temperatures expanding the range and season for many species. This necessitates adaptive strategies for pest control providers like Rollins. Growing consumer and regulatory demand for environmentally friendly solutions is pushing the industry towards Integrated Pest Management (IPM) and reduced chemical reliance, a trend supported by the biopesticides market, which was valued at approximately USD 5.1 billion in 2023.

Urbanization creates complex pest challenges, with dense populations and waste management issues providing ideal conditions for infestations. Pests are also adapting to urban structures, increasing the need for specialized urban pest control. Water scarcity is another growing concern, requiring Rollins to develop more water-efficient treatment methods, a critical consideration as the UN projects 1.8 billion people will face water scarcity by 2025.

| Environmental Factor | Impact on Rollins | Industry Trend/Data (2023-2025) |

|---|---|---|

| Climate Change | Requires adaptation to new pest species and extended seasons. | Northward expansion of tick populations observed in US. |

| Environmental Awareness | Drives demand for green pest control and IPM. | Biopesticides market valued at USD 5.1 billion in 2023. |

| Urbanization | Creates demand for specialized urban pest management. | Nearly 70% of world population projected to live in urban areas by 2050. |

| Water Scarcity | Necessitates water-efficient treatment methods. | 1.8 billion people projected to face water scarcity by 2025. |

PESTLE Analysis Data Sources

Our Rollins PESTLE Analysis is meticulously constructed using a comprehensive blend of data. This includes official government publications, reports from reputable international organizations, and in-depth industry-specific research to ensure a robust understanding of the macro-environment.