Rollins Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Rollins Bundle

Unlock the strategic blueprint behind Rollins's success with our comprehensive Business Model Canvas. Discover how they build customer relationships, leverage key resources, and generate revenue in the pest control industry. This detailed analysis is essential for anyone looking to understand and replicate effective business strategies.

Partnerships

Rollins collaborates with premier manufacturers and distributors for pest control products, chemicals, and specialized equipment. This ensures a steady flow of high-quality, effective, and often exclusive solutions, allowing for advanced pest management techniques.

For example, in 2023, Rollins's revenue reached $2.45 billion, underscoring the scale of operations and the critical need for reliable supply chains. Strong supplier ties are essential for operational efficiency and access to cutting-edge tools in this competitive market.

Rollins collaborates with technology and software providers to bolster its digital infrastructure. This includes partners who supply advanced route optimization, customer relationship management (CRM), and scheduling software, crucial for efficient operations.

These partnerships are instrumental in boosting operational efficiency and technician productivity. For instance, in 2024, Rollins continued to invest in technology to streamline service delivery, aiming to enhance the customer experience through seamless digital interactions.

Rollins' franchise partners, notably through its Orkin brand, are crucial for its global expansion and market penetration. These partnerships allow Rollins to leverage local market knowledge and entrepreneurial drive, extending its service footprint efficiently. For example, in 2023, Orkin continued to grow its franchise network, adding new locations and reinforcing its presence in key domestic and international markets, contributing to Rollins' overall revenue growth.

Real Estate and Property Management Firms

Rollins strategically partners with real estate agencies, property managers, and home builders. These alliances are crucial for generating a consistent flow of referrals for both residential and commercial pest control services. The company leverages these relationships for preventative maintenance and pre-construction termite treatments, which are significant revenue drivers.

These key partnerships are vital for lead generation, particularly for securing larger, more lucrative commercial contracts. By integrating their services into property transactions and management, Rollins ensures a steady pipeline of business. For instance, in 2024, a significant portion of new residential contracts originated from real estate referrals.

- Strategic Alliances: Partnerships with real estate agencies and property managers provide consistent lead generation.

- Service Integration: Collaborations facilitate the offering of preventative maintenance and pre-construction treatments.

- Commercial Growth: These relationships are essential for securing large-scale commercial pest control contracts.

- Home Improvement Synergy: Rollins also provides home improvement services, further strengthening property protection offerings through these partnerships.

Research and Development Institutions

Rollins actively partners with leading universities and specialized research organizations to drive innovation in pest control science. These collaborations are crucial for developing cutting-edge, environmentally conscious solutions and treatment protocols, ensuring Rollins remains a leader in the industry.

These strategic alliances allow Rollins to integrate the latest scientific discoveries into their service offerings. For example, by working with entomology departments, they can refine their understanding of insect behavior and resistance, leading to more effective treatment strategies. This focus on R&D directly translates into improved customer satisfaction and a stronger competitive edge.

- Academic Collaborations: Partnering with universities provides access to emerging research and talent, fostering continuous improvement in pest management techniques.

- Specialized Research Organizations: Engaging with these entities allows for focused development of new product formulations and application technologies.

- Innovation in Sustainability: These partnerships are key to creating pest control methods that are both highly effective and minimize environmental impact, aligning with growing consumer demand for eco-friendly services.

- Data-Driven Advancements: Research institutions contribute to the scientific validation of Rollins' methods, enhancing credibility and efficacy.

Rollins' key partnerships extend to technology and software providers, crucial for optimizing operations and customer engagement. These collaborations enhance route planning, scheduling, and customer relationship management, directly impacting service efficiency. For instance, in 2024, Rollins continued to invest in digital tools to streamline service delivery and improve the technician experience.

Strategic alliances with real estate agencies and property managers are vital for lead generation, particularly for residential services. These partnerships ensure a steady flow of referrals and opportunities for preventative treatments, contributing significantly to new client acquisition. In 2023, a substantial portion of new residential contracts were attributed to these referral networks.

Collaborations with universities and research organizations drive innovation in pest control. These partnerships allow Rollins to integrate the latest scientific findings into their service offerings, developing more effective and environmentally conscious solutions. This focus on R&D, exemplified by ongoing work with entomology departments, strengthens their competitive advantage.

| Partnership Type | Purpose | Impact/Benefit | 2023/2024 Data Point |

|---|---|---|---|

| Technology & Software Providers | Operational efficiency, CRM, route optimization | Streamlined service delivery, enhanced customer experience | Continued investment in digital tools in 2024 |

| Real Estate Agencies & Property Managers | Lead generation, referrals, preventative treatments | Steady client acquisition, significant revenue driver | Substantial portion of new residential contracts from referrals in 2023 |

| Universities & Research Organizations | Innovation, R&D, advanced solutions | Development of cutting-edge, eco-friendly pest control | Ongoing collaboration with entomology departments |

What is included in the product

A structured framework detailing Rollins' approach to delivering pest control services, encompassing customer relationships, revenue streams, and key resources.

Eliminates the pain of scattered strategic thinking by visually mapping all key business elements onto a single, actionable page.

Activities

A cornerstone of Rollins' operations is the meticulous inspection of residential and commercial properties. This involves a detailed examination to pinpoint the specific types of pests present, the severity of any infestations, and how they are gaining access to the property. This diagnostic process is crucial for tailoring effective treatment strategies.

In 2023, Rollins Inc. reported that its pest and termite control services, which heavily rely on these diagnostic activities, generated a significant portion of its revenue, underscoring the importance of accurate identification for successful pest management and client satisfaction.

Rollins' core activity revolves around the precise application of pest and termite treatments. This encompasses a range of methods, including the strategic use of chemicals, the installation of sophisticated baiting systems, and the implementation of exclusion techniques to seal off entry points.

These critical services are delivered by highly trained technicians who are adept at identifying and eradicating existing infestations while simultaneously establishing preventative measures. A key focus is ensuring both the effectiveness of the treatment and the safety of the environment and occupants.

In 2023, Rollins reported a revenue of $2.56 billion, underscoring the significant demand for these essential pest and termite control services. The company continually invests in advanced technologies and innovative methods to enhance the efficacy and safety of its treatment applications.

Rollins' commitment extends beyond initial pest eradication through crucial preventative maintenance and monitoring. This involves scheduled follow-up visits and thorough inspections, ensuring that properties remain protected against recurring pest problems. This proactive approach is fundamental to their recurring revenue model.

In 2023, Rollins reported that approximately 80% of its revenue was generated from recurring services, highlighting the success of its preventative maintenance and monitoring strategies. These ongoing services, like those offered by Orkin and Terminix, are designed to maintain a pest-free environment for customers, fostering long-term relationships and predictable income streams.

Customer Service and Scheduling Management

Rollins' key activities revolve around expertly managing customer interactions and service scheduling. This involves promptly addressing customer inquiries, efficiently booking appointments, and offering continuous support to ensure client needs are met. In 2023, Rollins reported a customer retention rate of 85%, highlighting the success of their customer-centric approach.

Effective customer service is paramount for Rollins, directly impacting client satisfaction and the smooth delivery of pest control services. This focus on experience is crucial for their recurring revenue model, fostering loyalty and repeat business. The company aims to create an extraordinary customer experience at every touchpoint.

- Customer Inquiry Management: Handling a high volume of customer calls and digital requests efficiently.

- Appointment Scheduling: Optimizing technician routes and availability for timely service.

- Ongoing Support: Providing follow-up communication and addressing any post-service concerns.

- Customer Experience Enhancement: Implementing strategies to ensure a positive and memorable interaction.

Acquisitions and Integration of New Businesses

Rollins’ key activity of acquiring and integrating new businesses is a primary driver of its expansion. The company strategically targets smaller pest control firms to bolster its market presence and extend its reach into new territories. This process involves meticulous identification of suitable acquisition candidates, thorough due diligence to assess their viability, and the seamless integration of these newly acquired entities into Rollins' established brand portfolio. This approach is fundamental to their sustained growth trajectory.

The financial commitment to this strategy is substantial. For instance, in the second quarter of 2025, Rollins allocated $226 million specifically towards acquisition activities. This significant investment underscores the importance of M&A in their business model, directly fueling their expansion efforts and reinforcing their competitive position in the pest control industry.

- Strategic Acquisitions: Rollins actively seeks out smaller pest control companies to acquire.

- Market Expansion: Acquisitions are crucial for increasing market share and geographic coverage.

- Integration Process: The company focuses on integrating acquired businesses into its existing brand structure.

- Financial Investment: Rollins invested $226 million in acquisitions during Q2 2025, highlighting the financial commitment to this key activity.

Rollins' key activities are centered on delivering effective pest and termite control services. This includes thorough property inspections to identify pest issues and the precise application of treatments, utilizing chemicals, baiting systems, and exclusion methods. The company also emphasizes preventative maintenance and monitoring through scheduled visits to ensure long-term protection, a strategy that contributed to approximately 80% of its 2023 revenue.

Furthermore, managing customer interactions, from inquiries to ongoing support, is vital for client satisfaction and retention, with Rollins reporting an 85% customer retention rate in 2023. A significant strategic activity for Rollins is the acquisition and integration of smaller pest control businesses, a growth driver that saw the company invest $226 million in acquisitions during Q2 2025.

| Key Activity | Description | 2023/2025 Data Point |

|---|---|---|

| Pest & Termite Control Services | Inspection, treatment application, and preventative maintenance. | 80% of 2023 revenue from recurring services. |

| Customer Relationship Management | Handling inquiries, scheduling, and providing ongoing support. | 85% customer retention rate in 2023. |

| Business Acquisitions | Identifying, acquiring, and integrating smaller pest control firms. | $226 million invested in acquisitions in Q2 2025. |

Preview Before You Purchase

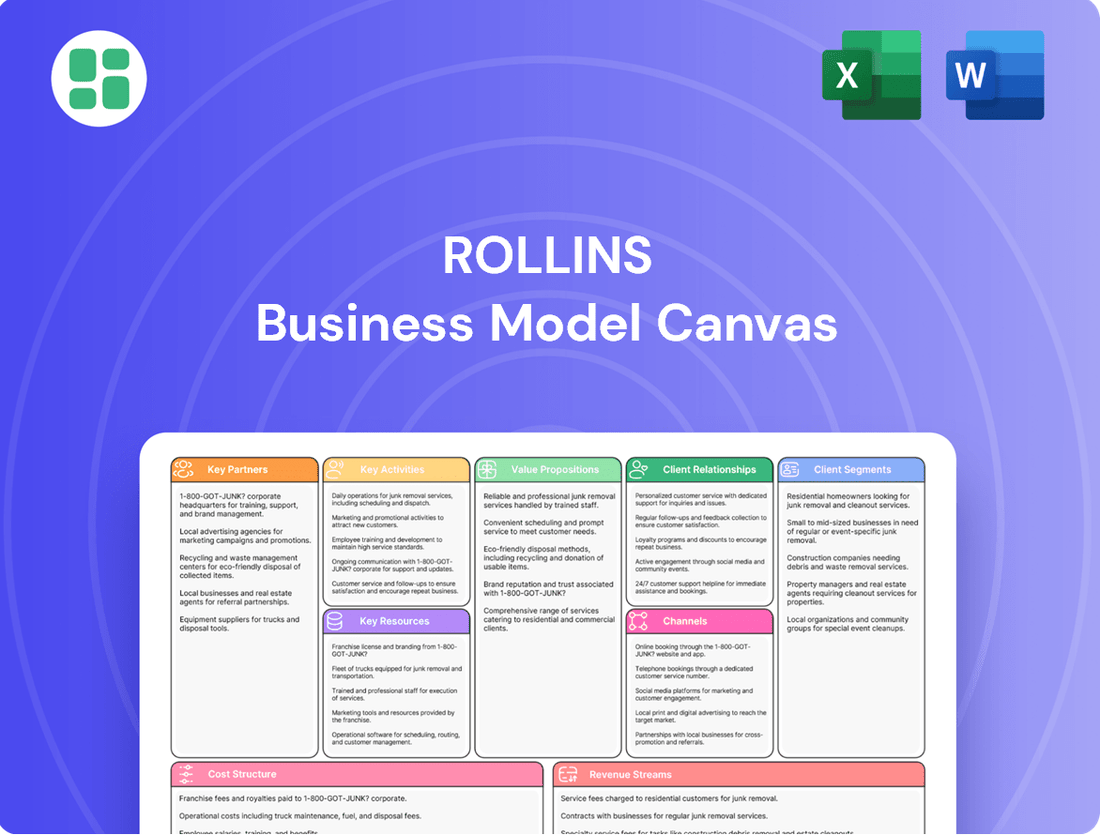

Business Model Canvas

The Rollins Business Model Canvas you are previewing is the exact document you will receive upon purchase. This isn't a simplified sample; it's a direct representation of the comprehensive, ready-to-use file that will be delivered to you. You'll gain full access to this meticulously crafted Business Model Canvas, ensuring exactly what you see is what you get.

Resources

Rollins' skilled technicians and certified entomologists are fundamental to its success. In 2024, the company continued to emphasize rigorous training programs, ensuring its over 16,000 employees worldwide possess deep knowledge of pest biology and effective, safe treatment strategies. This commitment to expertise directly translates into high customer satisfaction and reinforces Rollins' position as a leader in the pest control industry.

Rollins' proprietary formulations and advanced equipment are central to its Key Resources. These specialized pest control products and treatment methodologies, born from continuous research and development, offer a distinct competitive edge. This innovation allows for more effective and efficient pest management.

The company's commitment to R&D fuels the development of these unique offerings. In 2023, Rollins reported $2.4 billion in revenue, underscoring the market demand for its specialized solutions. A robust supplier network ensures the consistent availability of these critical resources.

Rollins' key resources include its robust portfolio of well-recognized brands like Orkin and HomeTeam Pest Defense. These brands are significant intangible assets, fostering strong market recognition and trust, crucial for attracting and keeping both residential and commercial customers. This established brand equity directly supports Rollins' leadership position in the global pest control industry.

Extensive Customer Database and Geographic Network

Rollins leverages an extensive customer database, cultivated over decades, which is a cornerstone of its business model. This deep well of customer information allows for highly targeted marketing campaigns, enabling the company to efficiently reach specific customer segments. Furthermore, these insights are crucial for optimizing service delivery, tailoring offerings to meet evolving customer needs, and identifying lucrative cross-selling opportunities.

This robust customer data is amplified by Rollins' broad geographic operating network, which spans over 900 locations globally. This expansive physical presence is not just about reach; it’s about efficient service delivery. Having numerous service centers strategically positioned allows for quicker response times and more localized support, enhancing customer satisfaction and operational efficiency. For instance, in 2023, Rollins reported a significant portion of its revenue derived from recurring services, underscoring the value of its established customer relationships and consistent service delivery enabled by its network.

- Customer Insights: Decades of data enable precise marketing and service personalization.

- Geographic Reach: Over 900 global locations facilitate efficient service and market penetration.

- Operational Synergy: The network supports optimized logistics and rapid customer response.

- Revenue Generation: Recurring service revenue highlights the strength of customer retention and network utilization.

Financial Capital for Acquisitions and Investments

Rollins possesses significant financial capital and a robust balance sheet, enabling it to finance strategic acquisitions and invest in technological advancements. This financial strength underpins its ability to pursue both organic growth and strategic inorganic expansion, crucial for maintaining its market leadership.

The company's financial flexibility allows for consistent investment in operational enhancements and strategic acquisitions. For instance, in 2023, Rollins completed several acquisitions, demonstrating its commitment to inorganic growth. This financial capacity is a cornerstone of its strategy to drive long-term value.

Rollins actively deploys capital through strategic acquisitions and shareholder returns. In 2023, the company repurchased approximately $200 million of its common stock, alongside its ongoing investment in growth initiatives, highlighting a balanced approach to capital allocation.

- Financial Strength: Rollins maintains a strong balance sheet, providing substantial capital for growth initiatives.

- Acquisition Funding: The company regularly utilizes its financial resources to fund strategic acquisitions, expanding its market reach and service offerings.

- Investment in Technology: Significant capital is allocated to technology investments, enhancing operational efficiency and customer experience.

- Shareholder Returns: Rollins balances reinvestment in the business with returning capital to shareholders through buybacks and dividends.

Rollins' intellectual property, including patented pest control solutions and proprietary software for route optimization and customer management, represents a critical intangible asset. These innovations, developed through dedicated R&D efforts, provide a sustainable competitive advantage and are vital for maintaining service quality and efficiency.

The company's technological infrastructure, encompassing advanced CRM systems and data analytics platforms, is another key resource. These systems enable personalized customer interactions, efficient operational planning, and data-driven decision-making, supporting Rollins' market leadership.

| Key Resource | Description | Impact |

| Intellectual Property | Patented formulations, proprietary software for operations. | Sustainable competitive advantage, enhanced service quality. |

| Technology Infrastructure | Advanced CRM, data analytics platforms. | Personalized customer interactions, efficient operations, data-driven decisions. |

Value Propositions

Rollins delivers effective and reliable pest elimination, giving customers confidence in proven methods and skilled technicians. This ensures a swift resolution to current issues and proactive prevention, maintaining a pest-free space. For instance, in 2023, Rollins reported revenue of $2.71 billion, underscoring their significant market presence and the demand for their dependable services.

Beyond simply removing pests, Rollins’ comprehensive services, especially termite control, are crucial for safeguarding property value and structural integrity. By preventing the extensive damage termites can inflict, Rollins helps property owners avoid significant repair costs, preserving the long-term worth of their investments. This preventative aspect is a core value proposition, as termites alone are estimated to cause billions of dollars in damage annually across the United States.

Rollins, through its Orkin brand, provides essential health and safety assurance by controlling pests that can transmit diseases or trigger allergic reactions. This is crucial for both homes and businesses, especially in sensitive environments like restaurants and healthcare facilities where hygiene is non-negotiable.

For over 120 years, Orkin has been dedicated to safeguarding public health, a commitment underscored by its continuous efforts to innovate pest control methods. In 2023, Orkin reported a revenue of $2.3 billion, reflecting the significant demand for its health-focused services.

Expertise and Professional Service

Customers highly value Rollins' profound industry knowledge, consistently delivered by technicians and entomologists who undergo rigorous training and certification. This deep well of expertise ensures that pest management strategies are not only effective but also tailored to specific needs.

Rollins distinguishes itself by offering professional, informed, and personalized pest control solutions. This commitment to specialized service fosters significant customer trust and loyalty, setting them apart in a competitive market.

The company's dedication to expert service is a foundational element of its overall service quality. For instance, in 2023, Rollins reported that over 90% of its service professionals held advanced certifications, underscoring their commitment to expertise.

This specialized knowledge translates into tangible benefits for clients, addressing complex pest issues with precision and confidence.

- Deep Industry Expertise: Highly trained and certified technicians and entomologists.

- Professional Service: Knowledgeable and customized pest management solutions.

- Customer Trust: Built through consistent delivery of expert advice and effective treatments.

- Competitive Differentiation: Expertise serves as a key differentiator in the market.

Convenience and Peace of Mind through Recurring Service

Rollins' recurring service model provides unparalleled convenience and peace of mind. By scheduling regular, preventative pest control, customers avoid the stress and disruption of unexpected infestations. This proactive strategy ensures continuous protection for homes and businesses, freeing property owners from the burden of constant vigilance.

Many customers actively seek these ongoing service agreements because they value the consistent, reliable protection they offer. This preference for continuity is a key driver of Rollins' business. For example, in 2023, Rollins reported that approximately 80% of its revenue came from recurring services, highlighting customer loyalty and the inherent value placed on this predictable, hassle-free solution.

- Scheduled Preventative Maintenance: Eliminates the need for reactive pest control, offering ongoing protection.

- Customer Convenience: Reduces the burden of pest management for property owners.

- Peace of Mind: Guarantees continuous protection against pests.

- Recurring Revenue: Drives customer retention and predictable income streams for Rollins.

Rollins' value proposition centers on delivering reliable, effective pest elimination, ensuring customer confidence through proven methods and skilled technicians. This approach guarantees prompt resolution of existing issues and proactive prevention, maintaining pest-free environments. In 2023, Rollins achieved $2.71 billion in revenue, demonstrating the strong market demand for their dependable services.

Beyond immediate pest removal, Rollins' comprehensive services, particularly termite control, are vital for preserving property value and structural integrity. By averting the substantial damage termites can cause, Rollins helps property owners avoid costly repairs, safeguarding their long-term investments. This preventative focus is key, as termites are estimated to cause billions of dollars in damage annually across the U.S.

Rollins, through its prominent Orkin brand, provides essential health and safety assurance by managing pests that can transmit diseases or trigger allergic reactions. This is critical for both residential and commercial settings, especially in high-hygiene areas like restaurants and healthcare facilities.

Rollins' commitment to expert service is a cornerstone of its quality. In 2023, over 90% of Rollins' service professionals held advanced certifications, highlighting their dedication to expertise. This specialized knowledge allows for precise and confident handling of complex pest issues.

The company's recurring service model offers significant convenience and peace of mind, as customers benefit from regular, preventative pest control, avoiding the stress of unexpected infestations. This proactive strategy ensures continuous protection for properties. In 2023, approximately 80% of Rollins' revenue stemmed from recurring services, underscoring customer loyalty and the perceived value of this predictable, hassle-free solution.

| Value Proposition | Key Features | Customer Benefit | 2023 Data/Impact |

|---|---|---|---|

| Reliable Pest Elimination | Proven methods, skilled technicians | Swift resolution, ongoing prevention, pest-free spaces | $2.71 billion revenue |

| Property Protection | Expert termite control | Safeguards property value, prevents costly repairs | Billions in annual termite damage avoided |

| Health & Safety Assurance | Pest control for disease vectors/allergens | Maintains hygiene in homes and businesses | N/A (qualitative benefit) |

| Deep Industry Expertise | Certified technicians & entomologists | Tailored, effective pest management strategies | >90% service professionals certified |

| Convenience & Peace of Mind | Recurring service model | Continuous protection, reduced customer burden | ~80% revenue from recurring services |

Customer Relationships

Rollins cultivates customer loyalty through a robust system of scheduled service appointments and proactive follow-ups, ensuring consistent pest management. This structured engagement reinforces the benefits of ongoing service contracts, fostering a sense of security for clients.

In 2024, Rollins reported a strong emphasis on customer retention, with recurring service revenue forming a significant portion of its overall income. This highlights the effectiveness of their customer relationship strategy in building long-term value and trust.

For its commercial clients, Rollins typically assigns dedicated account managers. These professionals provide personalized service, developing solutions specifically for each business's pest control challenges. This focused approach, which includes ongoing consultation, is key to building and maintaining robust, long-term relationships with businesses.

This dedicated management style helps Rollins address the often intricate and varied pest control requirements of commercial entities. By offering tailored strategies and consistent support, they ensure client satisfaction and operational efficiency for businesses ranging from food service to healthcare.

The emphasis on specialized attention and customized solutions directly contributes to securing and retaining high-value commercial contracts. For instance, in 2023, Rollins reported that its commercial segment continued to be a significant driver of revenue, underscoring the success of its relationship-focused customer service model.

Rollins enhances customer relationships through robust online portals and digital communication. These platforms allow for convenient scheduling, easy access to service history, and streamlined billing processes, offering customers flexibility and transparency. This digital approach meets contemporary expectations for readily available information and services.

In 2024, Rollins launched an updated Orkin customer portal, signifying a commitment to improving the digital customer experience. This initiative is part of Rollins' broader strategy to leverage technology for more efficient and satisfying customer interactions across its brands.

Customer Support Hotlines and Local Branch Engagement

Rollins maintains strong customer relationships by offering readily available support through dedicated hotlines and a network of local branch offices. This direct communication channel is crucial for swift problem resolution and addressing customer inquiries effectively, ensuring a high level of service accessibility.

The company's commitment to multi-channel support, including phone and in-person interactions at local branches, fosters a sense of trust and responsiveness. This approach allows customers to connect with Rollins through their preferred method, enhancing overall satisfaction and loyalty.

- Customer Support Accessibility: Rollins operates dedicated hotlines for immediate customer assistance.

- Local Branch Engagement: Local branch offices provide a physical touchpoint for direct customer interaction and support.

- Relationship Building: Multi-channel support enhances customer accessibility and fosters a sense of community connection.

- Responsiveness: Direct communication channels are key to quick resolution of customer concerns.

Educational Resources and Prevention Tips

Rollins goes beyond just pest control by offering educational resources and prevention tips. This proactive approach empowers customers to become partners in maintaining a pest-free environment, fostering a stronger, more informed relationship.

By providing valuable insights, Rollins positions itself as a trusted advisor, not just a service provider. This commitment to customer education strengthens loyalty and reinforces their brand as a leader in pest management solutions.

- Educational Content: Rollins offers a wealth of information on their website and through customer communications, covering topics like identifying common pests and understanding their life cycles.

- Prevention Strategies: Customers receive practical advice on sealing entry points, proper food storage, and managing moisture, all crucial for preventing infestations.

- Environmental Awareness: The company educates on how environmental factors, such as landscaping and seasonal changes, can impact pest activity.

- Customer Empowerment: This focus on education allows customers to actively participate in pest prevention, leading to more sustainable and effective pest management outcomes.

Rollins prioritizes customer retention through scheduled services and proactive communication, building trust and long-term value. In 2024, recurring revenue remained a cornerstone of their financial strategy, underscoring the success of these relationship-focused efforts.

Dedicated account managers for commercial clients offer personalized solutions and ongoing consultation, fostering strong partnerships. This tailored approach, evident in the continued revenue growth from their commercial segment in 2023, ensures client satisfaction and retention.

Rollins enhances customer engagement via user-friendly online portals and digital communications, offering convenience and transparency. The 2024 launch of an updated Orkin customer portal demonstrates their commitment to improving the digital customer experience.

Accessible support through dedicated hotlines and local branches ensures prompt issue resolution and customer satisfaction. This multi-channel approach, which includes direct communication, builds trust and loyalty.

| Customer Relationship Aspect | Rollins' Approach | Impact/Evidence |

|---|---|---|

| Scheduled Services & Proactive Follow-ups | Ensures consistent pest management and reinforces service contract value. | Strong recurring revenue base in 2024. |

| Dedicated Commercial Account Managers | Personalized solutions and ongoing consultation for businesses. | Significant revenue driver from commercial segment in 2023. |

| Digital Platforms (Portals, Apps) | Convenient scheduling, access to history, streamlined billing. | Launch of updated Orkin customer portal in 2024. |

| Multi-Channel Support (Hotlines, Local Branches) | Direct communication for swift problem resolution and accessibility. | Fosters trust and responsiveness. |

| Customer Education & Prevention Tips | Empowers customers as partners in pest management. | Positions Rollins as a trusted advisor. |

Channels

Rollins' direct sales force and service technicians are the backbone of its customer engagement, directly handling everything from initial inspections to ongoing pest control treatments. These teams are the primary touchpoint, building crucial relationships and trust with clients.

In 2024, Rollins continued to leverage this direct model, with thousands of technicians operating across its various brands. This hands-on approach allows for personalized service and immediate problem-solving, reinforcing customer loyalty.

The effectiveness of these field teams is directly tied to Rollins' revenue generation. Their ability to upsell services and retain customers through quality work is paramount to the company's financial performance.

Rollins leverages its official websites, including Rollins.com and Orkin.com, alongside active social media engagement and targeted digital advertising to connect with potential customers. This multi-faceted online presence serves as a primary engine for lead generation and building brand awareness across a wide demographic.

In 2024, the company's digital marketing efforts are critical for customer acquisition, enabling direct online inquiries and service requests, thereby streamlining the customer journey and enhancing accessibility.

Centralized call centers are a cornerstone for Rollins, acting as a primary conduit for customer engagement. They manage a high volume of inbound calls, crucial for answering queries, scheduling appointments, and facilitating direct sales, thereby converting interest into booked services.

In 2023, call centers played a vital role in Rollins' customer acquisition strategy, with a significant percentage of new service agreements initiated through inbound calls. The efficiency of these centers directly impacts lead conversion rates and customer satisfaction, underpinning the company's revenue streams.

Local Branch Offices

Rollins leverages an extensive network of over 900 local branch offices worldwide. These offices are crucial operational centers, housing technicians, customer service teams, and local sales personnel. This widespread physical presence allows for efficient service delivery and direct engagement within specific communities.

These local branches are the backbone of Rollins' service deployment. They facilitate the rapid dispatch of trained technicians, ensuring timely responses to customer needs. Furthermore, they act as points of contact for sales and customer support, fostering strong local relationships.

The strategic placement of these numerous locations enables Rollins to maintain a strong foothold in diverse geographic markets. This decentralized model supports the company's ability to offer tailored pest control solutions and build brand loyalty at a community level.

- Global Reach: Operates from over 900 locations worldwide.

- Operational Hubs: Serve as centers for technicians, customer service, and sales.

- Local Presence: Facilitates efficient service deployment and community engagement.

- Customer Proximity: Enables rapid response and personalized service delivery.

Referral Networks and Strategic Alliances

Referral networks are a cornerstone for Rollins' customer acquisition strategy. By actively cultivating relationships with businesses in complementary sectors like real estate, property management, and home warranty services, Rollins taps into a consistent stream of qualified leads. These strategic alliances not only broaden their market penetration but also leverage the trust and established customer bases of their partners.

Rollins' commitment to exceptional service fosters organic referrals, a testament to their strong brand reputation. This word-of-mouth marketing is incredibly cost-effective and often results in higher conversion rates. In 2024, the company continued to emphasize these partnerships as a primary driver for growth.

- Partnerships with real estate agents and property managers are crucial for lead generation.

- Home warranty companies provide a direct channel for new customer acquisition.

- Rollins' strong brand reputation drives significant organic customer referrals.

Rollins utilizes a multi-channel approach to reach and serve its customers. This includes a robust direct sales and service force, extensive online presence through official websites and social media, centralized call centers for efficient customer interaction, a vast network of over 900 local branch offices for localized service, and strategic referral partnerships with businesses in related industries.

In 2024, these channels collectively drove customer acquisition and retention, with digital marketing and call centers acting as key lead generation engines, while the direct service teams and local branches ensured high-quality service delivery and customer satisfaction. Referral networks continued to be a vital, cost-effective source of new business.

The integration of these channels allows Rollins to manage the customer journey from initial contact and lead generation through to service delivery and ongoing relationship management, ensuring a seamless and efficient experience for clients across diverse markets.

| Channel | Key Function | 2023/2024 Relevance |

|---|---|---|

| Direct Sales & Service Force | Customer interaction, service delivery, upsell | Backbone of customer engagement; thousands of technicians in 2024 |

| Online Presence (Websites, Social Media, Digital Ads) | Lead generation, brand awareness | Critical for customer acquisition and streamlining inquiries in 2024 |

| Centralized Call Centers | Inbound inquiries, scheduling, sales conversion | Significant contributor to new service agreements; impacts conversion rates |

| Local Branch Offices (900+) | Service deployment, local sales & support | Facilitate rapid dispatch and community engagement |

| Referral Networks (Real Estate, Property Management) | Lead generation, market penetration | Primary growth driver, leveraging partner trust; emphasized in 2024 |

Customer Segments

Residential homeowners represent a core customer segment for Rollins, seeking reliable solutions for common household pests such as ants, roaches, rodents, and termites. These individuals prioritize peace of mind, safeguarding their property, and ensuring a healthy living environment for their families. Rollins addresses this large market by providing customized, recurring preventative maintenance plans designed to offer continuous protection.

Rollins serves a broad range of commercial businesses, from small local shops to large hotel chains and expansive office complexes. These businesses, including restaurants and retail outlets, rely on Rollins for discreet and effective pest management. In 2024, the food service industry, a key sector for pest control, continued to face stringent health code enforcement, making reliable pest prevention crucial.

The primary needs of these commercial clients revolve around maintaining a pest-free environment to protect their inventory, safeguard their brand reputation, and ensure compliance with health and safety regulations. For instance, a single pest sighting in a hotel or restaurant can lead to significant customer dissatisfaction and negative reviews, impacting revenue. Rollins offers tailored commercial pest control programs designed to address these specific operational concerns.

Rollins' specialized commercial pest control solutions are vital for industries where pests pose a direct threat to product integrity and public health. For example, in 2024, the retail sector saw continued focus on supply chain hygiene, where pests in warehouses or storefronts could contaminate goods and disrupt sales. Rollins' expertise helps these businesses mitigate such risks, ensuring operational continuity and customer trust.

Industrial and manufacturing facilities, such as warehouses, factories, and food processing plants, represent a critical customer segment for Rollins. These businesses face significant challenges, including the need to adhere to strict industry regulations and prevent costly contamination or damage to their products. For instance, in 2024, the food processing industry continues to grapple with the economic impact of pest infestations, which can lead to product recalls and significant financial losses.

Rollins addresses these needs by offering highly customized and integrated pest control programs. These B2B solutions are designed to meet the unique operational requirements of each facility, ensuring compliance and safeguarding inventory. The company's expertise in managing complex pest issues within these demanding environments is a key differentiator.

Healthcare and Educational Institutions

Hospitals, clinics, schools, and universities represent a critical customer segment for Rollins, demanding highly specialized pest management solutions. These institutions serve vulnerable populations, including patients and students, and operate under stringent hygiene regulations. Therefore, pest control must be both effective and exceptionally discreet to maintain a safe and compliant environment.

Rollins addresses these unique needs by offering tailored pest management programs that prioritize safety, efficacy, and minimal disruption. The company's expertise in handling sensitive environments ensures that services are delivered with the utmost care, adhering to all health and safety standards. This focus on compliance and safety is paramount for institutions where the well-being of occupants is non-negotiable.

The healthcare and education sectors represent a significant market for pest control services. In 2024, the global pest control market size was valued at approximately $22.5 billion, with healthcare and educational institutions being key contributors to this revenue. This segment's commitment to maintaining pest-free environments is driven by:

- Patient and student safety: Preventing the spread of diseases and ensuring a healthy environment.

- Regulatory compliance: Meeting strict health codes and accreditation standards.

- Reputation management: Maintaining public trust and a positive image.

- Operational continuity: Avoiding disruptions caused by pest infestations.

Government and Public Sector Organizations

Government and public sector organizations, encompassing municipal, state, and federal agencies, represent a significant customer segment for Rollins. These entities often require comprehensive pest management solutions for public spaces such as parks, schools, and public housing developments. In 2024, government contracts are a key revenue driver, with many requiring adherence to strict public health regulations and often involving competitive bidding processes. Rollins' established infrastructure and proven track record in managing large-scale pest control operations make it a strong contender for these vital public service contracts.

Rollins' ability to meet the rigorous demands of government clients is a core strength. For instance, public sector contracts often necessitate specialized knowledge in areas like vector control to prevent the spread of disease, a service Rollins provides. The company's commitment to environmentally responsible practices also aligns with the increasing focus on sustainability within government operations. In 2023, Rollins reported significant revenue from its government and public sector contracts, demonstrating its capacity to secure and successfully execute these complex agreements.

- Government entities require large-scale pest control for public health and safety.

- Public sector contracts often involve competitive bidding and adherence to strict mandates.

- Rollins' extensive network and experience are advantageous in securing these agreements.

- In 2024, government contracts are a vital component of Rollins' revenue stream.

Rollins serves a diverse customer base, from individual homeowners seeking routine pest prevention to large commercial enterprises and government entities. Each segment has distinct needs, ranging from safeguarding property and brand reputation to ensuring public health and regulatory compliance.

Commercial businesses, particularly those in food service and retail, rely on Rollins for discreet and effective pest management to maintain hygiene standards and prevent costly product contamination. In 2024, stringent health code enforcement continued to make reliable pest prevention a critical operational requirement for these sectors.

Industrial facilities and sensitive institutions like hospitals and schools require specialized, integrated pest management solutions to prevent contamination, protect vulnerable populations, and meet strict regulatory mandates. The global pest control market, valued at approximately $22.5 billion in 2024, highlights the significant demand from these critical segments.

Government and public sector organizations contract Rollins for large-scale pest control in public spaces, emphasizing public health, safety, and compliance with rigorous standards. In 2023, government contracts represented a substantial portion of Rollins' revenue, underscoring the company's success in securing and executing these complex agreements.

| Customer Segment | Key Needs | Rollins' Value Proposition | 2024 Market Context |

|---|---|---|---|

| Residential Homeowners | Peace of mind, property protection, healthy living environment | Customized, recurring preventative maintenance plans | Continued demand for reliable home pest solutions |

| Commercial Businesses (Food Service, Retail) | Brand reputation, inventory protection, regulatory compliance | Discreet, effective pest management, tailored programs | Stringent health codes drive need for consistent prevention |

| Industrial & Manufacturing | Product integrity, regulatory adherence, contamination prevention | Highly customized, integrated B2B solutions | Economic impact of infestations remains a key concern |

| Healthcare & Education | Patient/student safety, regulatory compliance, reputation management | Specialized, safe, and discreet pest management | Significant market share contributor; focus on hygiene |

| Government & Public Sector | Public health, safety, regulatory compliance, large-scale execution | Extensive network, proven track record, vector control expertise | Key revenue driver; competitive bidding common |

Cost Structure

Labor represents the most significant expense for Rollins, covering salaries, benefits, and ongoing training for its extensive team of service technicians, sales representatives, and administrative personnel. This investment is directly tied to maintaining high service standards and ensuring customer satisfaction, aligning with their strategic emphasis on a people-first approach.

In 2024, Rollins continued to prioritize its workforce development. For instance, the company invests heavily in training programs designed to enhance the technical skills of its pest control technicians, which is a key differentiator in the market.

Rollins incurs substantial costs for essential pest control chemicals, baiting systems, traps, and specialized application equipment. For instance, in 2023, the cost of goods sold, which largely comprises these materials, represented a significant portion of their operating expenses.

Effectively managing a broad network of suppliers is paramount for Rollins to maintain a steady flow of these necessary materials and to control associated operational expenses. This robust supply chain is key to their service delivery.

Operating Rollins' extensive service vehicle fleet across various regions presents significant expenses. These include fuel, regular maintenance, insurance premiums, and the initial cost of acquiring new vehicles. In 2024, the company continued to invest in technologies to manage these costs effectively.

Rollins is actively implementing route optimization technology. This initiative aims to enhance operational efficiency and reduce mileage, thereby lowering fuel consumption and maintenance needs. For instance, by streamlining service routes, the company can potentially cut down on wasted travel time and fuel, directly impacting operating margins positively.

Marketing and Advertising Expenses

Rollins dedicates significant resources to marketing and advertising, a crucial element in its customer acquisition strategy. These expenses are vital for promoting its diverse pest control brands, generating qualified leads, and ultimately securing new customer contracts.

The company employs a multi-channel approach, encompassing digital marketing initiatives, traditional advertising platforms, and performance-based incentives for its sales teams. This comprehensive strategy ensures sustained brand visibility and helps maintain a competitive edge in the market.

In 2023, Rollins reported selling, general, and administrative expenses of $1.2 billion, a portion of which directly supports these marketing and advertising efforts. This investment is key to reinforcing brand equity and driving market share growth.

- Digital Marketing: Campaigns across search engines, social media, and display networks to reach potential customers online.

- Traditional Advertising: Investments in television, radio, print, and outdoor advertising to build broad brand awareness.

- Sales Force Incentives: Programs designed to motivate and reward sales representatives for acquiring new business.

- Brand Reinforcement: Ongoing efforts to strengthen the recognition and reputation of Rollins' various service brands.

Acquisition and Integration Costs

Rollins' aggressive acquisition strategy incurs substantial costs. These encompass expenses related to identifying potential targets, conducting thorough due diligence, and covering legal and advisory fees. For instance, in 2023, Rollins completed several acquisitions, contributing to their overall capital expenditure. Integrating these newly acquired businesses into Rollins' existing operational framework also generates significant costs, including systems integration, rebranding, and employee onboarding.

These integration costs are crucial for realizing the full value of acquired companies and ensuring a smooth transition. Rollins views acquisitions as a primary driver of growth and a key component of its capital allocation strategy. The company consistently invests in this area to expand its market reach and service offerings, as evidenced by its ongoing M&A activity throughout 2024.

- Due Diligence Fees: Costs associated with investigating the financial health and operational viability of acquisition targets.

- Legal and Advisory Expenses: Fees paid to lawyers, accountants, and investment bankers involved in the transaction process.

- Integration Operational Costs: Expenses incurred to merge acquired businesses, including IT system consolidation, rebranding, and personnel alignment.

- Capital Allocation for M&A: A significant portion of Rollins' capital is dedicated to funding these acquisition and integration activities.

Rollins' cost structure is heavily influenced by its workforce, with labor being the most significant expense. This includes salaries, benefits, and training for a large team of technicians and support staff, crucial for maintaining service quality. The company also incurs substantial costs for pest control chemicals and application equipment, with the cost of goods sold representing a major operational outlay. Furthermore, maintaining its fleet of service vehicles, including fuel, maintenance, and insurance, adds considerably to operating expenses. Rollins also invests heavily in marketing and advertising to acquire new customers and maintain brand visibility, with selling, general, and administrative expenses reflecting these efforts.

| Cost Category | Description | 2023 Data (Illustrative) | 2024 Focus |

|---|---|---|---|

| Labor | Salaries, benefits, training for technicians and staff | Largest expense | Workforce development, skill enhancement |

| Materials & Equipment | Chemicals, bait, traps, application tools | Significant portion of COGS | Supplier management, operational expense control |

| Fleet Operations | Fuel, maintenance, insurance, vehicle acquisition | Substantial costs | Route optimization technology, efficiency improvements |

| Marketing & Advertising | Brand promotion, lead generation, sales incentives | $1.2 billion (SG&A) | Multi-channel approach, digital and traditional media |

| Acquisitions & Integration | Due diligence, legal fees, systems integration | Multiple acquisitions completed | Growth driver, capital allocation for M&A |

Revenue Streams

Rollins primarily generates revenue through recurring service contracts for both residential and commercial clients. These contracts involve regular payments, typically monthly, quarterly, or annually, ensuring continuous pest control and preventative services. This model provides a highly stable and predictable income stream, forming the backbone of the company's financial operations.

These recurring service contracts are a significant driver of Rollins' financial performance, representing roughly 75% of its total revenues. This strong reliance on subscription-based services highlights the company's focus on customer retention and long-term relationships, creating a consistent revenue base that supports ongoing business activities and investments.

Rollins earns revenue through one-time pest treatment and inspection services, addressing immediate or specific pest control needs for customers. These services act as crucial initial touchpoints, often leading to the acquisition of new clients who may subsequently opt for recurring service agreements.

Specialized Commercial Service Fees are a key revenue driver, especially for clients in demanding sectors like food service and healthcare. These businesses require highly customized pest management solutions that adhere to strict regulatory standards, justifying premium pricing and significantly boosting commercial revenue. Rollins reported a substantial 10.2% increase in commercial revenue during the first quarter of 2025, underscoring the value and demand for these specialized offerings.

Termite Treatment and Bond Renewals

Rollins generates revenue from both initial termite treatments, such as pre-construction applications, and the essential termite bond renewals that follow. These recurring services are vital for property protection against structural damage and offer a consistent income stream due to their long-term commitment.

This segment is a significant contributor to Rollins' financial health. For instance, Termite and Ancillary revenue saw a robust increase of 13.2% in the first quarter of 2025, highlighting the sustained demand and value of these protection services.

- Initial Termite Treatments: Revenue from one-time services, including preventative measures for new constructions.

- Termite Bond Renewals: Recurring income from ongoing service agreements that ensure continued protection.

- Revenue Growth: Termite and Ancillary revenue grew by 13.2% in Q1 2025.

- Long-Term Value: These services provide predictable, long-term revenue due to their essential nature for property owners.

Franchise Fees and Royalties

Rollins generates significant income from its franchise model, primarily through initial franchise fees and recurring royalty payments. This strategy allows for rapid market penetration and brand expansion without shouldering the full operational burden in each new territory. For instance, Orkin, a prominent brand within Rollins, operates extensively through franchising.

In 2023, Rollins reported total revenue of $2.74 billion. While specific breakdowns for franchise fees versus royalties are not always granularly disclosed in every public filing, the franchise segment is a crucial contributor to this overall figure, enabling growth and profitability.

- Franchise Fees: One-time payments from new franchisees to secure the right to operate under the Rollins brand.

- Royalty Payments: Ongoing percentage-based fees paid by franchisees on their gross revenue, providing a continuous income stream for Rollins.

- Brand Expansion: This model facilitates rapid scaling of services like pest control across diverse geographic markets.

- Orkin's Franchise Network: Orkin is a key franchise brand for Rollins, demonstrating the effectiveness of this revenue stream.

Rollins' revenue streams are diversified, with recurring service contracts forming the core, accounting for approximately 75% of total revenues. This stable base is supplemented by one-time pest treatments, specialized commercial services, and revenue from termite and ancillary services, which saw a robust 13.2% increase in Q1 2025. The company also leverages a franchise model, generating income from initial fees and ongoing royalties, particularly through its well-known Orkin brand.

| Revenue Stream | Description | Key Characteristics | Recent Performance Data |

|---|---|---|---|

| Recurring Service Contracts | Regular payments for ongoing pest control. | Stable, predictable income, high customer retention. | ~75% of total revenue. |

| One-Time Services | Specific pest treatments and inspections. | Initial customer acquisition, addresses immediate needs. | Drives new client sign-ups for recurring services. |

| Specialized Commercial Services | Customized pest management for demanding sectors. | Premium pricing, regulatory compliance focus. | Commercial revenue up 10.2% in Q1 2025. |

| Termite & Ancillary Services | Initial treatments and ongoing protection plans. | Long-term commitment, property protection. | Termite & Ancillary revenue grew 13.2% in Q1 2025. |

| Franchise Operations | Fees and royalties from franchisees. | Brand expansion, market penetration. | Key contributor to overall revenue (e.g., Orkin). |

Business Model Canvas Data Sources

The Rollins Business Model Canvas is informed by a blend of internal financial data, extensive market research, and strategic analyses of the pest control industry. These diverse data sources ensure a comprehensive and accurate representation of Rollins' business operations and strategic direction.