Rollins Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Rollins Bundle

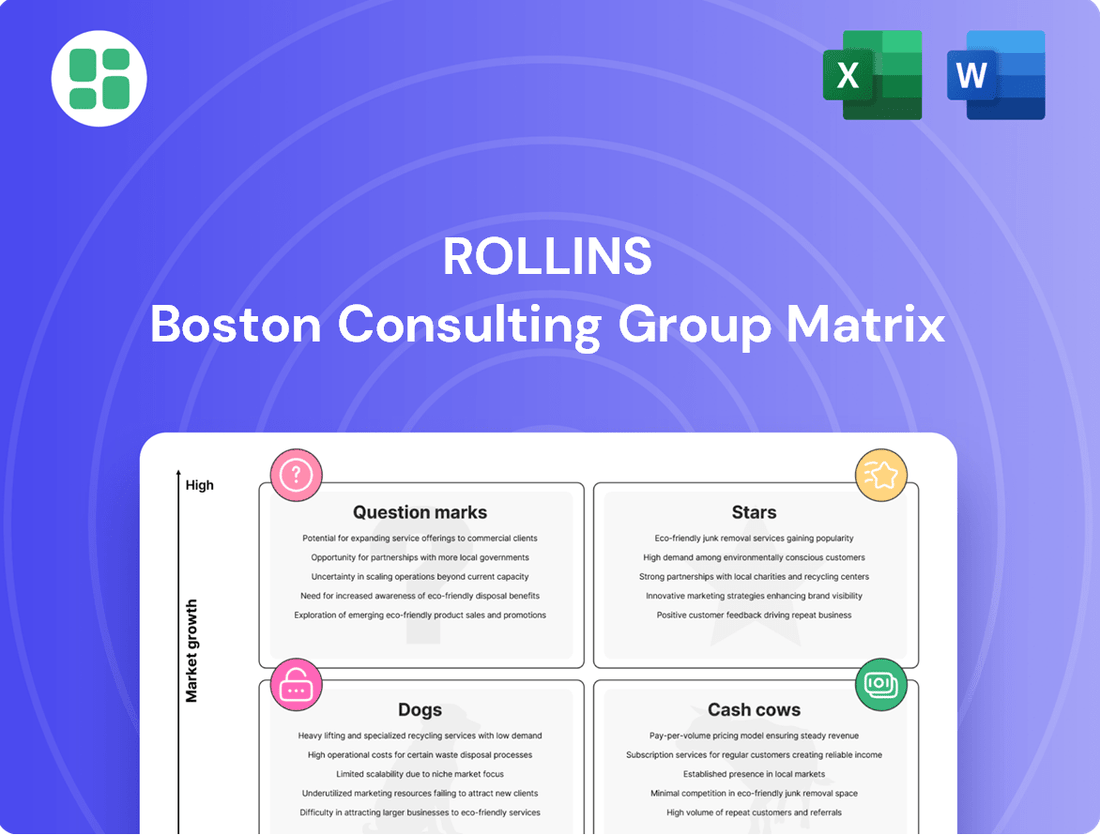

The Rollins BCG Matrix offers a powerful framework for understanding your product portfolio's market share and growth potential. See where your offerings fit as Stars, Cash Cows, Dogs, or Question Marks, and unlock the secrets to optimizing your business strategy. Purchase the full BCG Matrix for a comprehensive analysis and actionable insights to drive your company's success.

Stars

Rollins' investment in digital pest monitoring and smart solutions, such as IoT-enabled traps, places this segment firmly in the "Stars" category of the BCG Matrix. This strategic focus aligns with the pest control industry's significant growth in technology-driven offerings.

These smart solutions provide crucial real-time monitoring and predictive analytics, directly addressing the escalating market need for more efficient and proactive pest management strategies. This technological advancement is key to capturing market share in a rapidly evolving sector.

As of early 2024, the global smart pest control market is projected to experience substantial growth, with some estimates suggesting a compound annual growth rate exceeding 15% through the end of the decade. Rollins' early and substantial investment in these areas positions it to capitalize on this expansion, solidifying its leadership in a high-potential market segment.

Rollins' strategic acquisition of rapidly expanding pest management firms, exemplified by the April 2025 purchase of Saela Holdings, effectively places these acquired entities into the Stars category of the BCG Matrix. Saela, lauded as one of the fastest-growing private companies, significantly bolsters Rollins' footprint in burgeoning markets such as the Pacific Northwest and Mountain West.

These strategic moves not only contribute to immediate revenue growth but also broaden service offerings, indicating a strong potential for high market share within these expanding regional economies.

Rollins' eco-friendly and sustainable pest control offerings are positioned as a Stars in the BCG Matrix. This segment is experiencing significant growth due to rising consumer and regulatory demand for environmentally conscious solutions. For instance, the market for biological pest control is projected to reach $10.2 billion by 2027, growing at a CAGR of 16.3%.

The company's expansion into biological pest control and eco-friendly pesticides taps into a strong trend of minimizing environmental footprints and adopting non-toxic methods. This makes these services highly sought after by a growing customer base. Rollins’ investment in and promotion of these sustainable practices are likely to secure a high market share in this emerging and growing niche.

Commercial Pest Control for Specialized Industries

Rollins' strategic push into specialized commercial pest control, especially within food safety, positions it as a potential star in the BCG matrix. The company's engagement with new USDA lab initiatives, slated for 2025, highlights a commitment to high-growth, high-market share sectors.

These specialized services are critical for industries facing rigorous compliance and increasing health consciousness. For instance, the food and beverage sector alone represents a significant market, with global food safety testing market expected to reach USD 65.8 billion by 2027, growing at a CAGR of 7.9% from 2022.

- Focus on High-Growth Niches: Rollins' expansion into specialized areas like food safety demonstrates a strategy targeting segments with strong growth potential.

- Regulatory Compliance Driver: The increasing demand for stringent pest management in regulated industries fuels the need for advanced, tailored solutions.

- Market Share Potential: By addressing these specialized needs, Rollins aims to capture a significant share in these lucrative markets.

- Innovation and Technology: Investment in areas like USDA lab initiatives signals a commitment to technological advancement, crucial for maintaining a competitive edge.

Integrated Pest Management (IPM) Digital Solutions

The market for digital Integrated Pest Management (IPM) solutions is experiencing significant growth. Rollins' strategic investment in these technologies, including IoT sensors and cloud-based platforms, positions them to capitalize on this trend. This digital transformation enables more precise pest detection and prevention, offering a cost-effective and environmentally conscious approach.

Rollins' adoption of predictive analytics within their IPM digital solutions is a key differentiator. This allows for proactive pest management, reducing the need for reactive treatments and minimizing potential damage. By leveraging data, Rollins can offer enhanced efficiency and tailored solutions to its diverse customer base.

The integration of these advanced IPM techniques strengthens Rollins' market position in a segment focused on sustainability and technological innovation. This forward-looking approach appeals to customers seeking reduced chemical reliance and improved operational efficiency. For instance, the global pest control market, which digital IPM solutions are a part of, was valued at approximately $22.5 billion in 2023 and is projected to grow substantially in the coming years.

- Digital IPM Market Growth: The global market for digital pest management solutions is expanding rapidly, driven by technological advancements and increasing demand for sustainable practices.

- Rollins' Technological Adoption: Rollins is actively integrating IoT sensors, cloud platforms, and predictive analytics into its IPM services, enhancing precision and efficiency.

- Customer Benefits: These digital solutions offer customers more cost-effective, proactive, and environmentally friendly pest prevention strategies.

- Market Positioning: By embracing digital IPM, Rollins is solidifying its leadership in an innovative and increasingly important segment of the pest control industry.

Rollins' investment in digital pest monitoring and smart solutions, such as IoT-enabled traps, places this segment firmly in the Stars category of the BCG Matrix. These smart solutions provide crucial real-time monitoring and predictive analytics, directly addressing the escalating market need for more efficient and proactive pest management strategies. As of early 2024, the global smart pest control market is projected to experience substantial growth, with some estimates suggesting a compound annual growth rate exceeding 15% through the end of the decade.

Rollins' strategic acquisition of rapidly expanding pest management firms, exemplified by the April 2025 purchase of Saela Holdings, effectively places these acquired entities into the Stars category of the BCG Matrix. Saela, lauded as one of the fastest-growing private companies, significantly bolsters Rollins' footprint in burgeoning markets such as the Pacific Northwest and Mountain West, contributing to immediate revenue growth and broadening service offerings.

Rollins' eco-friendly and sustainable pest control offerings are positioned as Stars in the BCG Matrix due to significant growth driven by consumer and regulatory demand for environmentally conscious solutions. The market for biological pest control is projected to reach $10.2 billion by 2027, growing at a CAGR of 16.3%, a trend Rollins is actively capitalizing on.

Rollins' strategic push into specialized commercial pest control, especially within food safety, positions it as a potential star. Engagement with new USDA lab initiatives slated for 2025 highlights a commitment to high-growth sectors. The global food safety testing market is expected to reach USD 65.8 billion by 2027, growing at a CAGR of 7.9%.

The market for digital Integrated Pest Management (IPM) solutions is experiencing significant growth, with the global pest control market valued at approximately $22.5 billion in 2023. Rollins' integration of IoT sensors, cloud platforms, and predictive analytics into its IPM services enhances precision and efficiency, offering customers more cost-effective and environmentally friendly pest prevention strategies.

| Segment | BCG Category | Key Growth Drivers | Rollins' Strategic Action | Market Data Point |

| Digital Pest Monitoring & Smart Solutions | Stars | Technological advancements, demand for efficiency | Investment in IoT-enabled traps, real-time monitoring | Global smart pest control market CAGR >15% |

| Acquired High-Growth Companies (e.g., Saela Holdings) | Stars | Expansion into new markets, increased service offerings | Strategic acquisitions in growing regions | Saela Holdings' rapid growth trajectory |

| Eco-Friendly & Sustainable Pest Control | Stars | Consumer demand for sustainability, regulatory push | Expansion into biological pest control, eco-friendly pesticides | Biological pest control market to reach $10.2B by 2027 (16.3% CAGR) |

| Specialized Commercial Pest Control (Food Safety) | Stars | Stringent regulations, health consciousness | Engagement with USDA lab initiatives, tailored services | Global food safety testing market to reach $65.8B by 2027 (7.9% CAGR) |

| Digital Integrated Pest Management (IPM) | Stars | Demand for sustainable and tech-driven solutions | Integration of IoT, cloud platforms, predictive analytics | Global pest control market valued at ~$22.5B in 2023 |

What is included in the product

The Rollins BCG Matrix analyzes business units based on market share and growth, offering strategic guidance.

The Rollins BCG Matrix provides a clear, one-page overview of your business portfolio, instantly highlighting underperforming areas and strategic opportunities.

Cash Cows

Rollins' core residential pest control services, notably through brands like Orkin and HomeTeam Pest Defense, are its established cash cows. These services generate approximately 75% of the company's revenue from recurring contracts, indicating a highly predictable and stable income stream.

Operating within a mature market, these offerings benefit from consistent demand and strong brand loyalty. This maturity, coupled with Rollins' substantial North American market share, allows for high cash flow generation, making them the quintessential cash cow in the BCG matrix.

Termite control and prevention services represent a core, mature business for Rollins, acting as a classic Cash Cow in the BCG Matrix. The consistent, year-round demand for protecting structures from termite damage ensures a steady revenue stream. This stability allows for efficient operations with reduced marketing spend, as established market presence and brand reputation drive customer acquisition and retention.

In 2023, Rollins reported approximately $2.5 billion in revenue, with pest and termite control services forming the bulk of this figure. The company’s long history and widespread service network in this segment solidify its position, enabling it to generate substantial and reliable cash flow. This strong cash generation underpins Rollins' ability to fund investments in other business areas and return value to shareholders.

Rollins' established North American commercial pest control services are a classic Cash Cow. This segment benefits from a mature market and long-standing customer relationships, leading to consistent, high-margin revenue. In 2024, Rollins continued to leverage this stability, with commercial services forming a significant portion of their overall revenue, demonstrating predictable cash flow generation.

Franchise Operations (e.g., Orkin Canada, Orkin Australia)

Rollins' franchise operations, exemplified by Orkin Canada and Orkin Australia, firmly sit within the Cash Cows quadrant of the BCG Matrix. These established entities possess a high market share in their mature, low-growth territories.

These mature franchises benefit from significant brand recognition and proven operational frameworks, allowing them to generate substantial and predictable cash flows. The capital expenditure required to maintain these operations is typically minimal, further enhancing their cash-generating capabilities for Rollins.

- High Market Share, Low Growth: Orkin Canada and Orkin Australia have secured dominant positions in their respective pest control markets, which are characterized by slower expansion rates.

- Consistent Cash Flow Generation: These franchises are reliable sources of income for Rollins, requiring limited reinvestment to sustain their operations and profitability.

- Leveraging Brand Equity: The established brand names of Orkin in these regions allow for continued customer loyalty and market penetration with less marketing spend.

- Contribution to Global Stability: Their steady financial contributions bolster Rollins' overall financial health and provide a stable base for funding growth initiatives elsewhere.

Ancillary Services (e.g., Wildlife Control, Insulation)

Ancillary services like wildlife control and insulation often function as cash cows within a diversified business portfolio, mirroring the principles of the Boston Consulting Group (BCG) matrix. These services complement core offerings, leveraging existing infrastructure and customer relationships for incremental revenue. For instance, Rollins, a prominent pest control company, has strategically integrated such services. In 2024, Rollins reported that its ancillary services, including wildlife control and insulation, contributed significantly to its overall revenue, demonstrating steady performance despite not being high-growth areas.

These established services benefit from predictable demand and can be efficiently delivered using existing operational routes, minimizing additional marketing and sales expenditures. This integration allows for cross-selling opportunities, deepening customer relationships and enhancing overall customer lifetime value. The stability and profitability of these ancillary services help fund investments in more dynamic business units.

- Established Demand: Wildlife control and insulation services address recurring needs for homeowners and businesses, ensuring a consistent customer base.

- Operational Efficiency: Integration into existing service routes reduces logistical costs and increases technician utilization.

- Customer Loyalty: Offering a broader suite of services enhances customer retention and provides opportunities for upselling.

- Profitability Contribution: These services generate stable, predictable cash flow, supporting overall business financial health.

Rollins' core residential pest control services, particularly through well-known brands like Orkin, are its primary cash cows. These services benefit from a mature market with consistent demand and strong customer loyalty, leading to predictable and substantial cash flow. In 2023, pest and termite control services represented the majority of Rollins' $2.5 billion revenue, underscoring their role as stable income generators.

Termite control and prevention services are a classic cash cow for Rollins, enjoying consistent, year-round demand. This mature segment allows for efficient operations with reduced marketing spend due to strong brand recognition and market presence. The profitability of these services significantly contributes to Rollins' overall financial stability.

Rollins' established North American commercial pest control services also function as cash cows. These services leverage mature market conditions and long-standing customer relationships to deliver consistent, high-margin revenue. In 2024, this segment continued to be a significant contributor to Rollins' overall revenue, demonstrating reliable cash flow generation.

Established franchise operations, such as Orkin Canada and Orkin Australia, are firmly positioned as cash cows. They hold high market share in mature, low-growth territories, benefiting from strong brand equity and proven operational frameworks. These franchises generate substantial and predictable cash flows with minimal capital expenditure required for maintenance.

| Business Segment | BCG Quadrant | Market Growth | Market Share | Cash Flow Characteristic |

|---|---|---|---|---|

| Residential Pest Control (Orkin) | Cash Cow | Low | High | Strong, Stable |

| Termite Control & Prevention | Cash Cow | Low | High | Consistent, Predictable |

| Commercial Pest Control (North America) | Cash Cow | Low | High | High-Margin, Reliable |

| Franchise Operations (Orkin Canada/Australia) | Cash Cow | Low | High | Substantial, Predictable |

Preview = Final Product

Rollins BCG Matrix

The Rollins BCG Matrix you are previewing is the identical, fully functional report you will receive upon purchase. This means no watermarks, no incomplete sections, and no demo content; you'll get the complete, professionally formatted strategic tool ready for immediate application.

Dogs

Traditional chemical-heavy pest control methods are increasingly becoming outdated. As the industry pivots towards sustainability, these older techniques, while still present, face a shrinking market share. This decline is driven by more stringent environmental regulations and a growing consumer demand for eco-friendly options, making continued investment in them a potentially low-return strategy.

Rollins, a leader in pest and weed control, operates a vast network, making underperforming regional branches or acquired businesses a potential concern. These units, often characterized by low market share in stagnant local economies, could represent a drag on overall profitability. For instance, a small, niche acquisition in a declining industrial region might struggle to achieve significant growth or market penetration.

Such underperformers, fitting the Dogs quadrant of the BCG Matrix, typically exhibit low growth and low relative market share. They might be breaking even or even consuming cash without generating substantial returns. For example, a recently acquired pest control service in a market with a shrinking population or intense, low-margin competition could fall into this category, requiring careful evaluation.

Identifying and addressing these underperforming entities is crucial for capital allocation. Rollins' strategy likely involves assessing the potential for turnaround or, if unviable, divesting these operations. This strategic pruning allows for the redirection of resources towards more promising growth areas within the company's portfolio, ultimately enhancing overall financial performance and shareholder value.

Services addressing highly niche, low-demand pest issues often fall into the "Dogs" category of the BCG Matrix. These are specialized services that tackle very specific or rare pest problems, which by their nature have limited market appeal and infrequent demand. For instance, a service focused solely on a particular type of wood-boring beetle found only in a small geographic region would exemplify this.

These types of services are characterized by low revenue generation and often require significant investment in specialized knowledge or equipment that cannot be easily repurposed. In 2024, Rollins reported that while their broad pest control services saw consistent demand, highly specialized, low-volume offerings contributed minimally to overall revenue growth, often requiring more resources per dollar earned than their core services.

The lack of scalability is a key reason these services are considered Dogs. Unlike general pest control, which can be standardized and marketed widely, niche pest issues demand tailored approaches that are difficult to replicate across Rollins' vast operational footprint. This limited scope means they struggle to achieve economies of scale, making them less profitable and a drain on resources that could be allocated to higher-growth areas within the company's portfolio.

Legacy IT Systems and Manual Processes

Legacy IT systems and manual processes, if still present, can be categorized as Dogs in the Rollins BCG Matrix. These older, often non-integrated systems and manual workflows represent areas with low growth potential and limited competitive advantage in terms of operational efficiency.

While these systems may still perform essential functions, their inherent inefficiencies and lack of scalability hinder productivity improvements. For instance, in 2024, companies still relying heavily on manual data entry or outdated ERP systems often face significantly higher operational costs compared to those with automated, integrated solutions. A report by McKinsey in late 2023 indicated that businesses with modernized IT infrastructure saw an average of 15-20% improvement in operational efficiency.

These inefficient processes can negatively impact profitability and the ability to adapt to market changes. Consider the financial burden: maintaining legacy systems can consume a substantial portion of IT budgets, with some estimates suggesting that up to 70-80% of IT spending goes towards maintaining existing systems rather than innovation. This diverts resources that could be invested in growth areas.

- Low Growth Potential: Legacy systems offer minimal scope for productivity gains or technological advancement.

- High Maintenance Costs: Older infrastructure often incurs significant expenses for upkeep and specialized support.

- Operational Inefficiencies: Manual processes and outdated technology lead to slower workflows and increased error rates.

- Hindered Scalability: These systems struggle to support business expansion or increased transaction volumes.

Services with Declining Contract Renewal Rates

Services experiencing consistently declining contract renewal rates, perhaps due to heightened local competition or evolving customer demands that haven't been met, would fall into the Dogs category of the Rollins BCG Matrix. These are often characterized by a low market share and a shrinking customer base, representing a low-growth, low-return environment. This scenario ties up valuable resources without a clear prospect for improvement or profitability.

For Rollins, specific pest control service lines in regions with saturated markets and aggressive pricing from smaller, local competitors might exhibit these declining renewal rates. For instance, if a particular residential pest control service in a mature suburban market, which previously saw high retention, now faces numerous new, lower-cost providers, its renewal rates could dip significantly. This aligns with the Dog classification as it has a low market share and is in a low-growth segment with diminishing returns.

- Declining Renewal Rates: Services facing increased local competition or failing to adapt to changing customer needs.

- Low Market Share: A diminished customer base and limited presence in the market.

- Low-Growth, Low-Return: Resources are tied up with little prospect for recovery or profitability.

- Example Scenario: Residential pest control in a mature suburban market facing new, lower-cost competitors.

Dogs represent business units or service lines with low market share in low-growth industries. These are often cash traps, requiring investment but yielding minimal returns. For Rollins, this could include niche pest control services with limited demand or legacy IT systems that hinder efficiency.

In 2024, Rollins' focus on optimizing its portfolio means identifying and potentially divesting these Dog units. For example, a specialized service line serving a very small, declining market segment might be a candidate for divestiture. This strategic move frees up capital for investment in Stars or Question Marks with higher growth potential.

The challenge with Dogs is their inability to generate significant cash flow or market growth. Rollins must carefully assess whether these units can be revitalized or if their resources are better deployed elsewhere. A key metric for evaluation is the return on invested capital, which is typically low for Dog segments.

Rollins' approach to managing Dogs involves a thorough analysis of their operational costs versus revenue generation. If a unit consistently consumes more resources than it produces, even after efficiency improvements, divestment becomes a logical step. This disciplined capital allocation is crucial for maintaining a healthy and growing business portfolio.

Question Marks

Rollins is actively investing in advanced predictive analytics and AI for pest control, positioning these as potential future growth drivers. These sophisticated services, while in a high-growth phase, likely represent a smaller portion of Rollins' current market share compared to its established offerings. The company's commitment to developing these capabilities underscores their strategic importance for future competitive advantage.

Rollins' strategic push into emerging markets like South America, Asia, and Africa positions these ventures as Question Marks within its BCG Matrix. These regions, while presenting significant growth opportunities for pest control services, likely require substantial investment. For instance, the pest control market in Southeast Asia is projected to grow at a compound annual growth rate of over 7% through 2028, indicating strong potential.

Rollins' current market share in these nascent territories may be relatively low, necessitating considerable capital outlay for market entry, brand establishment, and building robust operational networks. This investment is crucial to compete effectively and capture a meaningful share of these high-potential, yet less saturated, markets.

The demand for specialized bed bug and mosquito control services is on the rise, driven by factors like climate change and increasing urbanization. These trends suggest a strong growth potential for these niche pest control segments. For instance, in 2024, many regions experienced prolonged warm seasons, which often correlates with increased mosquito activity and longer bed bug seasons, boosting service demand.

While Rollins Inc. is a leader in general pest control, its market share in these highly specialized, often seasonal, and intensely competitive areas might currently be smaller. Capturing a larger portion of this growing market will likely require tailored marketing strategies and enhanced expertise specifically for bed bug and mosquito eradication.

Residential Smart Home Integration for Pest Control

The integration of pest control with smart home technology represents a burgeoning market, attracting a segment of consumers eager for automated and connected living solutions. This trend is particularly appealing to younger, tech-oriented demographics.

Rollins' involvement in residential smart home integration for pest control is currently in its early stages. While this positions the company with a low current market share, it also signifies substantial room for growth and market penetration.

To elevate this offering from a Question Mark to a Star within the BCG framework, Rollins must invest heavily in research and development to refine its smart home integrations. Furthermore, significant effort will be needed to educate consumers on the benefits and functionality of these advanced pest control solutions.

- Market Growth: The smart home market is projected to reach over $200 billion globally by 2025, indicating a strong demand for integrated services.

- Rollins' Position: As a nascent player, Rollins has the opportunity to capture significant market share by being an early innovator in this niche.

- Investment Needs: Significant R&D is required to develop seamless integrations with platforms like Amazon Alexa and Google Home, alongside robust consumer education campaigns.

- Future Potential: Successful development and marketing could transform this into a high-growth, high-market-share Star business unit.

New Franchise Models or Partnerships in Emerging Markets

Exploring new franchise models or partnerships in emerging markets where Rollins' direct operational presence is limited positions these ventures as Question Marks within the BCG Matrix. These strategies can unlock significant growth potential with a reduced upfront capital investment compared to outright acquisitions. For instance, as of 2024, many emerging economies are experiencing robust GDP growth, with some Southeast Asian nations projected to grow by over 5% annually, presenting fertile ground for service-based franchises.

The inherent uncertainty surrounding market share and profitability in these nascent ventures makes them classic Question Marks. Success hinges on the ability to effectively transfer Rollins' expertise and brand standards while adapting to local market nuances. A case in point is the pest control market in India, which was valued at approximately USD 1.5 billion in 2023 and is anticipated to grow at a CAGR of around 10% through 2028, indicating substantial opportunity but also significant competitive dynamics for new entrants.

- High Growth Potential: Emerging markets often exhibit faster economic expansion than developed ones, offering a larger addressable market for pest control services.

- Lower Initial Capital Outlay: Franchising and partnerships require less direct investment in infrastructure and operations compared to wholly-owned subsidiaries.

- Uncertain Market Share and Profitability: The success of these models depends on franchisee execution, local market acceptance, and regulatory environments, leading to unpredictable outcomes.

- Strategic Support Required: These ventures need ongoing guidance, training, and marketing support from Rollins to build brand equity and operational efficiency, aiming to transition them from Question Marks to Stars.

Rollins' investments in advanced analytics and AI for pest control represent emerging opportunities with high growth potential but currently low market share, fitting the Question Mark category. These innovative services are designed to enhance efficiency and customer experience, with the company dedicating significant resources to their development. For example, in 2024, the global AI in agriculture market, which overlaps with pest management technology, was valued at over $1 billion and is expected to grow substantially.

The company's expansion into new geographic regions, such as parts of Asia and Africa, also falls under the Question Mark quadrant. While these markets offer considerable long-term growth prospects for pest control services, Rollins' current penetration and brand recognition are still developing. The pest control market in India, for instance, is projected to grow at a compound annual growth rate of around 10% through 2028, highlighting the potential for new entrants.

Similarly, Rollins' foray into specialized services like advanced bed bug and mosquito control, or the integration of pest management with smart home technology, are currently considered Question Marks. These niche areas are experiencing increasing demand, driven by factors like urbanization and climate change, with extended warm seasons in 2024 contributing to higher service needs. However, Rollins' market share in these specific segments is still being established, requiring focused investment and strategic marketing to capture a larger footprint.

| Business Area | Market Growth Potential | Current Market Share | Strategic Focus |

|---|---|---|---|

| Predictive Analytics & AI Services | High | Low | Investment in R&D, talent acquisition |

| Emerging Markets (e.g., Southeast Asia) | High | Low | Market entry, brand building, operational setup |

| Specialized Pest Control (Bed Bugs, Mosquitoes) | High | Moderate | Targeted marketing, expertise development |

| Smart Home Integrated Pest Control | High | Very Low | Product development, consumer education |

BCG Matrix Data Sources

Our BCG Matrix is informed by comprehensive market data, including historical financial performance, industry growth rates, and competitive landscape analysis, ensuring a robust strategic foundation.