Rollins Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Rollins Bundle

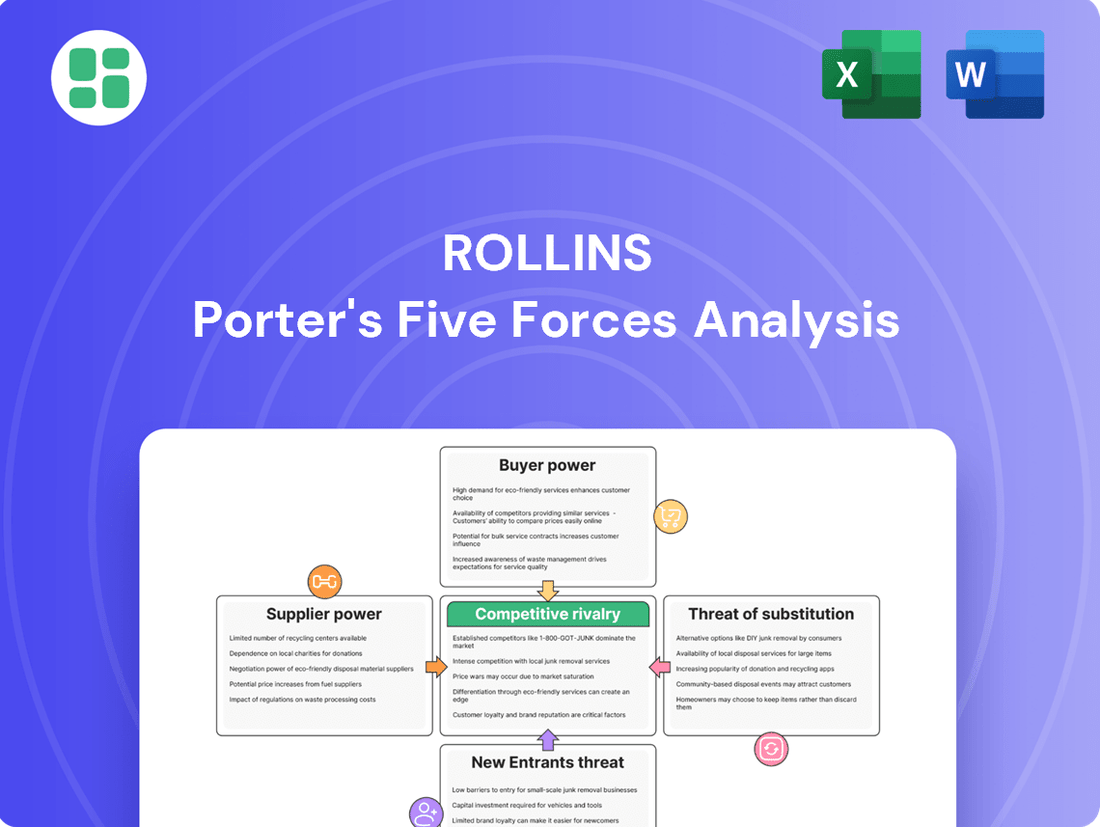

Rollins's competitive landscape is shaped by intense rivalry and the significant bargaining power of its customers. Understanding these dynamics is crucial for any stakeholder.

The full Porter's Five Forces Analysis delves into the threat of new entrants and the power of suppliers, offering a comprehensive view of Rollins's market position.

Unlock actionable insights and strategic advantages by exploring the complete report, which details the forces impacting Rollins's profitability and growth.

Suppliers Bargaining Power

The market for specialized pest control chemicals can be concentrated, with a few major manufacturers holding significant sway over pricing and availability. This concentration grants these suppliers a degree of bargaining power, potentially impacting Rollins' cost of goods. For instance, in 2024, the global pesticide market saw continued consolidation, with key players investing in R&D for advanced formulations.

However, Rollins can mitigate this supplier power through diversification. The availability of numerous generic alternatives for common pesticides and a broad base of suppliers for less specialized chemicals helps to reduce the leverage of any single supplier. This strategy ensures competitive pricing and a stable supply chain for essential pest management products.

Emerging environmental regulations are also reshaping supplier dynamics. The increasing demand for eco-friendly and sustainable pest control solutions could shift bargaining power towards suppliers offering innovative green alternatives. Companies that can develop and provide these compliant products may command premium pricing and gain preferential treatment from buyers like Rollins.

Suppliers of common equipment, such as sprayers, safety harnesses, and standard vehicles, typically face a competitive market. This competition inherently limits their ability to exert significant bargaining power over buyers like Rollins. Rollins' substantial purchasing volume, a direct result of its extensive operations, allows it to negotiate more favorable pricing and terms from these suppliers, effectively diminishing their leverage.

However, the landscape shifts when considering specialized or technologically advanced equipment. If Rollins requires unique machinery or cutting-edge tools, it might encounter a market with fewer suppliers. In such scenarios, these specialized suppliers could command greater bargaining power due to the limited availability of their offerings, potentially impacting Rollins' procurement costs or lead times.

The availability of skilled pest control technicians directly impacts Rollins' labor costs. A tight labor market, characterized by a shortage of qualified individuals, can empower these workers to demand higher wages and better benefits. For instance, in 2024, the U.S. Bureau of Labor Statistics reported a median annual wage of $42,500 for pest control workers, a figure that could escalate with increased demand and limited supply.

Technology Providers for Operations

The increasing reliance on advanced technologies like IoT and AI in pest control, as seen with smart traps and automated monitoring systems, directly impacts the bargaining power of technology providers. For Rollins, this means suppliers of these specialized solutions could exert more influence.

Rollins' strategic approach to managing these supplier relationships will be key. Developing in-house technological capabilities or securing long-term, favorable contracts for integrated platforms will be critical to mitigating potential price increases from dominant tech vendors.

Companies offering all-encompassing, integrated technology solutions are likely to command premium pricing. For instance, a unified IoT platform managing smart traps, data analytics, and reporting could be more expensive than acquiring individual components.

- Increased dependence on specialized IoT and AI solutions for pest management.

- Potential for higher pricing from providers of integrated technology platforms.

- Rollins' need to develop proprietary systems or negotiate favorable terms to manage supplier power.

Regulatory and Environmental Compliance

Suppliers offering solutions for Rollins' environmental compliance, such as those providing biodegradable pest control agents or advanced waste disposal services, can wield significant influence. As regulations tighten, the demand for these specialized products and services increases, potentially allowing suppliers to dictate terms. For instance, in 2024, many pest control companies faced increased scrutiny over the environmental impact of traditional chemicals, leading to a greater reliance on compliant alternatives.

The growing emphasis on sustainability in the pest control industry directly impacts supplier bargaining power. Companies that can provide eco-friendly alternatives, like biological control agents or organic treatments, are in a stronger position. This trend is evident in the market growth for biopesticides, which saw a projected compound annual growth rate of over 10% in the years leading up to 2025, indicating a clear demand shift that favors these specialized suppliers.

- Regulatory Demands: Stricter environmental laws can create demand for specific compliant products, boosting supplier leverage.

- Sustainable Alternatives: Suppliers of eco-friendly pest control methods gain power as the industry prioritizes sustainability.

- Market Shifts: The increasing adoption of biopesticides and organic treatments highlights a growing reliance on suppliers of these greener solutions.

Suppliers of specialized pest control chemicals can exert significant bargaining power, especially when the market is concentrated among a few key manufacturers. This concentration allows them to influence pricing and availability, impacting Rollins' costs. For instance, in 2024, the global pesticide market continued its consolidation trend, with major players investing heavily in advanced formulations.

However, Rollins can mitigate this by diversifying its supplier base and utilizing generic alternatives for common chemicals. This approach helps maintain competitive pricing and ensures a stable supply chain for essential products.

Suppliers of common equipment generally face a competitive market, limiting their power over large buyers like Rollins. Rollins' substantial purchasing volume allows for favorable negotiations, reducing supplier leverage.

The bargaining power of suppliers is amplified when they offer unique or technologically advanced equipment, as there are fewer alternatives available. This can lead to higher procurement costs and longer lead times for Rollins.

Suppliers of integrated technology solutions, such as comprehensive IoT platforms for pest management, can command premium pricing. In 2024, the demand for such advanced, unified systems increased, potentially giving these providers more leverage over companies like Rollins.

Suppliers of eco-friendly and sustainable pest control solutions are gaining power due to increasing environmental regulations and market demand. The biopesticide market, for example, was projected for strong growth leading up to 2025, indicating a shift favoring these specialized suppliers.

| Supplier Type | Market Concentration | Rollins' Mitigation Strategies | 2024/2025 Trends |

|---|---|---|---|

| Specialized Chemicals | High (few major manufacturers) | Supplier diversification, use of generics | Market consolidation, R&D investment in advanced formulations |

| Common Equipment | Low (competitive market) | Leveraging high purchase volume for negotiation | Stable pricing due to competition |

| Specialized Technology | High (limited availability) | Developing in-house capabilities, long-term contracts | Increased demand for integrated IoT/AI solutions |

| Sustainable Solutions | Growing (increasing demand) | Adopting eco-friendly alternatives | Strong growth in biopesticides market |

What is included in the product

This analysis dissects the competitive forces impacting Rollins, assessing the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the pest control industry.

Instantly identify and prioritize competitive threats with a visual breakdown of each Porter's Five Forces, making strategic adjustments effortless.

Customers Bargaining Power

Rollins' residential customer base is highly fragmented, meaning each individual customer holds very little sway due to their relatively small service needs. This fragmentation inherently limits their collective bargaining power.

Despite this, the ease with which customers can switch providers, often influenced by online reviews and word-of-mouth, makes customer satisfaction paramount. For instance, a single negative review can significantly impact a local branch's reputation.

To counter this, Rollins focuses on retaining customers through tailored service plans and subscription models, which foster loyalty and reduce the likelihood of switching. This strategy is crucial in a market where customer perception is a key driver of retention.

Commercial customers, especially large enterprises like hospitality chains, often commit to longer contracts and higher service volumes. This scale grants them significant bargaining power when negotiating pricing and terms with service providers like Rollins. For instance, in 2023, Rollins reported that its commercial segment represented a substantial portion of its revenue, highlighting the importance of these large accounts.

Rollins' strategy of providing integrated pest management solutions tailored to the complex needs of commercial clients helps solidify these relationships. The recurring nature of service contracts within the commercial sector makes retaining these customers crucial for stable revenue streams.

Customers, particularly those in the residential sector, exhibit significant price sensitivity. The ease with which a customer can switch pest control providers, due to low perceived switching costs, means they are likely to shop around for better pricing or immediate action if they encounter issues. This dynamic puts pressure on Rollins to consistently demonstrate superior value and service to retain its client base.

Access to Information and DIY Alternatives

The internet has dramatically shifted the bargaining power of customers in the pest control industry. With readily available information on pest identification, treatment methods, and competitor pricing, consumers are far more informed. This access empowers them to negotiate better terms or even opt for do-it-yourself (DIY) solutions, significantly impacting demand for professional services.

The rise of accessible retail pest control products acts as a potent substitute. For instance, the market for DIY pest control solutions saw significant growth, with sales of over-the-counter insecticides and traps reaching billions globally. In 2024, reports indicated that a substantial percentage of homeowners attempted minor pest issues themselves before calling professionals, directly illustrating this increased customer power.

- Informed Consumers: Online resources provide detailed comparisons of pest control services and pricing, enabling customers to make more knowledgeable choices.

- DIY Solutions: The availability of effective retail pest control products allows customers to handle minor infestations independently, reducing reliance on professional services.

- Price Sensitivity: Increased access to pricing information makes customers more sensitive to service costs, pressuring companies to remain competitive.

- Substitute Threat: Retail pest control products represent a direct substitute, especially for common household pests, thereby limiting the pricing power of pest control companies.

Importance of Service and Health Concerns

While customers have numerous options for pest control, the fundamental need to protect health, safety, and property often makes them prioritize effective and dependable services, even at a premium. This inherent necessity somewhat tempers their bargaining power.

Increasing awareness of public health issues and more rigorous government regulations amplify the demand for professional pest management. For instance, in 2024, reports indicated a rise in vector-borne disease concerns, further underscoring the critical role of pest control services.

- Essential Service: Pest control is often non-negotiable for maintaining hygienic living and working environments.

- Health & Safety Focus: Public health initiatives and concerns about disease transmission driven by pests strengthen the perceived value of professional services.

- Regulatory Compliance: Businesses, in particular, must adhere to strict pest control standards, limiting their ability to compromise on service quality.

- Brand Reputation: For service providers like Rollins, a strong reputation for efficacy and reliability directly influences customer loyalty and willingness to pay.

The bargaining power of customers in pest control is influenced by several factors, including the availability of substitutes and the essential nature of the service. While DIY solutions and price sensitivity increase customer leverage, the critical need for health and safety often balances this power.

In 2024, the market for over-the-counter pest control products continued to be robust, with consumers frequently attempting to address minor issues themselves. This trend, driven by readily available information and perceived cost savings, directly impacts the demand for professional services, particularly for less severe infestations.

However, the growing awareness of public health risks associated with pests, such as vector-borne diseases, reinforces the value of professional pest management. For instance, increased reporting of mosquito-borne illnesses in certain regions in 2024 highlighted the necessity of expert intervention, somewhat mitigating customer price sensitivity.

Commercial clients, due to their volume and contract lengths, retain significant negotiation power. Rollins' reported revenue from its commercial segment in 2023 underscores the importance of these relationships and the need to offer competitive terms to large enterprises.

| Factor | Impact on Customer Bargaining Power | Example/Data Point (2023-2024) |

|---|---|---|

| Availability of DIY Solutions | Increases Power | Billions in global sales for over-the-counter pest control products; significant homeowner self-treatment rates reported in 2024. |

| Price Sensitivity & Information Access | Increases Power | Online price comparisons and reviews empower customers to seek better value; pressure on providers to demonstrate cost-effectiveness. |

| Essential Nature of Service (Health & Safety) | Decreases Power | Rising concerns over vector-borne diseases in 2024 reinforced the critical need for professional pest control, justifying premium services. |

| Customer Fragmentation (Residential) | Decreases Power | Individual residential customers have minimal impact due to small service needs and low individual switching costs. |

| Customer Concentration (Commercial) | Increases Power | Large commercial clients with long-term contracts and high service volumes have significant negotiation leverage. Rollins' commercial segment contributed substantially to its 2023 revenue. |

Preview the Actual Deliverable

Rollins Porter's Five Forces Analysis

The preview you see is the exact Rollins Porter's Five Forces Analysis you will receive immediately after purchase, offering a comprehensive examination of competitive forces within the industry. This detailed document, including insights into threat of new entrants, bargaining power of buyers, bargaining power of suppliers, threat of substitute products or services, and intensity of rivalry among existing competitors, is fully formatted and ready for your strategic planning needs. You are looking at the actual document; once you complete your purchase, you’ll get instant access to this exact, professionally written analysis.

Rivalry Among Competitors

The pest control industry sees significant competition from major national and international firms. Rollins, with its Orkin brand, Terminix, and Rentokil Initial are prominent examples, all vying for market share through brand strength, service excellence, and broad geographic coverage.

This intense rivalry means companies must constantly innovate and differentiate their offerings. For instance, in 2023, Rollins reported revenue of $2.56 billion, highlighting its substantial market presence and the scale of operations required to compete effectively against similarly sized international players.

The pest control market, despite having some national brands, is still very much a fragmented landscape. This means there are countless smaller, local businesses operating across different regions. These smaller competitors can often win business by offering more attractive pricing or by focusing on very specific pest problems that larger companies might overlook.

This fragmentation directly impacts competitive rivalry. Local players frequently engage in price wars within their service areas, putting pressure on larger companies like Rollins to remain competitive. For instance, in 2023, the U.S. pest control market, valued at approximately $11.6 billion, saw continued activity from smaller, independent operators alongside major national firms.

Rollins actively addresses this by pursuing a strategy of tuck-in acquisitions. These are smaller, targeted purchases of these fragmented local businesses. This approach not only helps Rollins gain market share but also consolidates the industry, reducing the number of smaller competitors and strengthening Rollins' overall market position.

Competitive rivalry in the pest control industry is significantly shaped by how companies differentiate their services. Rollins, through its brands like Orkin, emphasizes superior service quality, a positive customer experience, and specialized solutions for issues like termites, bed bugs, and wildlife. This focus aims to cultivate strong brand loyalty, setting them apart from rivals who may compete more on price alone.

In 2024, the pest control market continued to see this emphasis on differentiation. Rollins reported strong performance, with its customer retention rates reflecting the success of its brand loyalty strategies. For instance, the company's investment in technology and training for its technicians directly translates to a more consistent and high-quality customer experience, a key differentiator in a crowded market.

Marketing and Sales Intensity

Competitors in the pest control industry actively pursue customers through robust marketing and sales initiatives. These efforts often involve sophisticated digital marketing campaigns, strategic cross-selling of services, attractive service bundling, and in some cases, traditional door-to-door sales approaches to acquire new clients and foster loyalty.

Rollins, Inc. strategically allocates resources to these marketing and sales channels to not only defend its existing customer base but also to drive organic revenue expansion. For instance, in 2023, Rollins reported that its advertising and promotion expenses amounted to $206.8 million, a notable increase from $193.1 million in 2022, underscoring the company's commitment to these growth drivers.

- Digital Marketing: Competitors utilize SEO, social media advertising, and targeted online campaigns to reach potential customers.

- Cross-selling and Bundling: Offering integrated pest management solutions or combining services like termite and general pest control enhances customer value and retention.

- Sales Force Investment: Companies invest in training and expanding their sales teams to improve customer acquisition rates.

- Brand Building: Consistent marketing efforts aim to build brand recognition and trust, differentiating providers in a competitive landscape.

Acquisition Strategy and Market Consolidation

Rollins actively pursues market consolidation through strategic acquisitions, a key element of its competitive strategy. For instance, the 2023 acquisition of Saela Holdings significantly expanded Rollins' footprint and market share. This approach not only bolsters its competitive position but also intensifies rivalry, particularly for smaller, independent pest control operators who may struggle to compete with larger, consolidated entities.

This M&A activity directly impacts competitive rivalry by creating larger, more dominant players in the market. Rollins' consistent acquisition strategy, often targeting regional leaders, allows it to achieve economies of density and leverage its operational scale. This consolidation trend means that independent firms face increased pressure to either specialize, innovate, or consider their own consolidation to remain viable.

- Market Consolidation: Rollins' acquisition of Saela Holdings in 2023 exemplifies its commitment to consolidating the pest control market.

- Expansion and Market Share: Such acquisitions are designed to broaden Rollins' geographic reach and increase its overall market share.

- Economies of Density: By integrating acquired businesses, Rollins aims to achieve greater operational efficiencies and cost savings through economies of density.

- Intensified Competition: The ongoing M&A activity by major players like Rollins creates a more challenging competitive environment for smaller, independent pest control businesses.

The pest control industry is characterized by intense competition, with major players like Rollins, Terminix, and Rentokil Initial actively vying for market share. This rivalry is fueled by significant investments in brand building, service quality, and geographic expansion, as seen in Rollins' 2023 revenue of $2.56 billion.

Despite the presence of large national firms, the market remains fragmented with numerous smaller, local operators. These smaller businesses often compete on price and specialized services, creating pricing pressure on larger competitors. In 2023, the U.S. pest control market, valued around $11.6 billion, demonstrated this dynamic with continued activity from both large and small entities.

| Key Competitors | 2023 Revenue (approx.) | Market Focus |

| Rollins, Inc. | $2.56 billion | Residential & Commercial, National & International |

| Terminix (now part of Rentokil Initial) | (Integrated into Rentokil's reporting) | Residential & Commercial, Primarily North America |

| Rentokil Initial | £3.2 billion (approx. $4.0 billion USD) | Residential & Commercial, Global |

SSubstitutes Threaten

The threat of substitutes for professional pest control services, particularly from DIY products, is a significant factor. Consumers can easily purchase readily available pest control products from retail outlets, offering a seemingly cheaper initial solution for minor pest issues. This accessibility allows individuals to attempt self-treatment, potentially reducing the immediate demand for professional services.

While DIY options can address minor infestations, their efficacy often wanes with more serious or persistent pest problems. In 2024, the market for household pest control products continued to see strong sales, indicating consumer engagement with these alternatives. However, many consumers who initially opt for DIY solutions eventually seek professional help when their efforts prove insufficient, highlighting the limitations of substitutes for comprehensive pest management.

Customers can significantly reduce pest issues through diligent home maintenance, proper sanitation, and sealing potential entry points like cracks and gaps. Effective waste management also plays a crucial role in prevention. These proactive steps, while valuable, often demand consistent attention and may not fully resolve existing infestations, positioning them as complements rather than outright substitutes for professional pest control services.

The increasing consumer preference for natural and organic pest control methods poses a significant threat of substitutes for Rollins. Consumers are actively seeking alternatives to traditional chemical treatments, opting for solutions like essential oils, beneficial insects, or heat-based eradication. This shift is driven by growing environmental consciousness and a desire for safer, non-toxic approaches to pest management.

Rollins is proactively addressing this threat by expanding its service offerings to include more eco-friendly options and integrated pest management (IPM) strategies. For instance, in 2024, the company highlighted its commitment to sustainable practices, noting a rise in demand for its IPM services, which prioritize non-chemical interventions. This strategic adaptation aims to capture market share from this growing segment of environmentally aware customers.

Ignoring the Problem

For minor or perceived non-critical pest issues, some individuals or businesses might opt to ignore the problem, hoping it resolves on its own or tolerating a low level of pests. This passive approach acts as a substitute for professional pest control services, though it frequently results in more significant problems that ultimately necessitate expert intervention.

This 'do nothing' strategy can be particularly prevalent when the perceived cost or inconvenience of professional services outweighs the immediate impact of the pests. However, by 2024, the long-term costs associated with ignoring infestations, such as structural damage or health risks, are becoming increasingly apparent, pushing more entities towards proactive solutions.

- Ignoring minor infestations can lead to escalating damage, costing businesses an average of 15% more in remediation by the time professional help is sought.

- The perceived 'free' solution of ignoring pests can result in significant indirect costs, including lost productivity and potential regulatory fines.

- In 2024, awareness campaigns are highlighting the hidden costs of pest-related issues, encouraging a shift away from the 'ignore it' substitute.

Emerging Technologies and Non-Traditional Solutions

Innovations from unexpected sources pose a significant threat. For instance, smart building designs integrating pest control directly into their infrastructure, or highly effective, non-chemical trapping mechanisms developed by tech startups, could offer compelling alternatives to traditional pest control services. This trend is already visible, with companies exploring IoT-enabled pest monitoring systems.

These emerging technologies could bypass conventional pest control methods entirely, forcing established players to adapt rapidly. Companies that fail to embrace or develop similar innovative solutions risk seeing their market share erode. For example, the global smart buildings market was valued at approximately $80 billion in 2023 and is projected to grow substantially, indicating a strong demand for integrated technological solutions.

- Smart Building Integration: Pest control becoming a feature of building design, not just a service.

- Non-Chemical Advancements: Development of traps and deterrents that don't rely on traditional chemicals.

- Tech Startup Disruption: New entrants leveraging technology to offer novel pest management solutions.

- Market Share Erosion: Traditional companies face losing business if they don't innovate.

The threat of substitutes for professional pest control, including DIY products and preventative home maintenance, remains a key consideration. While readily available, these alternatives often fall short for serious infestations, despite continued strong sales in the household pest control market in 2024. Proactive home care, though beneficial, typically complements rather than replaces professional services.

Furthermore, the growing demand for natural and organic pest control methods presents a significant substitute threat. Rollins is responding by expanding its eco-friendly and integrated pest management (IPM) services, a segment that saw increased demand in 2024. Ignoring pest issues, a passive substitute, can lead to escalating costs, with businesses potentially facing 15% higher remediation expenses by 2024.

Emerging technological innovations, such as smart building integrations and advanced non-chemical traps, also pose a disruptive threat, potentially bypassing traditional pest control methods. The expanding smart buildings market, valued around $80 billion in 2023, underscores the trend towards integrated technological solutions.

| Substitute Type | Description | 2024 Market Relevance | Potential Impact on Rollins |

|---|---|---|---|

| DIY Pest Control Products | Consumer-purchased chemicals and traps for self-application. | Strong sales indicate continued consumer engagement. | Reduces immediate demand for professional services, especially for minor issues. |

| Preventative Home Maintenance | Sealing entry points, sanitation, and waste management. | Valuable for prevention but often insufficient for existing infestations. | Complements professional services; reduces reliance for minor issues. |

| Natural/Organic Methods | Essential oils, beneficial insects, heat treatments. | Growing consumer preference driven by environmental concerns. | Requires Rollins to offer and promote eco-friendly alternatives. |

| Ignoring Infestations | Passive approach, tolerating low pest levels. | Can lead to higher long-term remediation costs (up to 15% more by 2024). | Highlights the value proposition of proactive professional intervention. |

| Technological Innovations | Smart building integration, IoT monitoring, advanced traps. | Smart buildings market valued at ~$80 billion in 2023; growing demand for tech. | Potential to bypass traditional services; necessitates adaptation and innovation. |

Entrants Threaten

While a small, local pest control startup might not need much upfront capital, a company aiming for the scale and reach of Rollins faces substantial financial hurdles. Think about the cost of a large fleet of specialized vehicles, advanced pest detection and treatment equipment, and sophisticated customer relationship management (CRM) software. These are not minor expenses.

For instance, acquiring and maintaining a fleet of hundreds of service vehicles, each outfitted with specialized pest control gear, represents a significant capital investment. In 2023, the average cost of a commercial van suitable for service operations could range from $40,000 to $60,000, meaning a fleet of 500 vehicles could easily cost $20 million to $30 million. Add to this the specialized sprayers, bait stations, and safety equipment, and the initial outlay escalates dramatically, deterring many potential large-scale competitors.

The pest control industry faces substantial regulatory hurdles that act as a significant barrier to entry. New companies must meticulously comply with a complex web of federal, state, and local laws governing pesticide application, safety standards, and environmental protection. For instance, the Environmental Protection Agency (EPA) in the United States sets stringent guidelines for pesticide registration and use, requiring extensive testing and documentation.

Navigating these licensing requirements, which often involve proving competency and adherence to safety protocols, demands considerable investment in training and certification. In 2024, many states continue to update their environmental regulations, adding another layer of complexity for potential new entrants. Companies like Rollins, Inc. (ROL) have established robust compliance departments to manage these ongoing requirements, a significant cost that deters smaller, less-resourced competitors.

Established companies like Rollins, through its prominent Orkin brand, possess a significant advantage due to decades of cultivating strong brand recognition and deep customer trust. This built-in loyalty makes it difficult for new entrants to immediately capture market share.

New pest control businesses face the daunting task of replicating this level of trust and awareness. They must invest heavily in marketing and demonstrate consistent service quality over extended periods to even begin to chip away at the established reputation, a process that can take years and considerable capital.

For instance, Rollins reported over $2.4 billion in revenue for 2023, a testament to its market penetration and customer base. This financial strength allows for continued investment in brand building, further solidifying its position against potential newcomers.

Access to Skilled Labor and Expertise

New entrants face significant hurdles in accessing skilled labor and expertise within the pest control industry. The demand for certified and experienced technicians remains high, making recruitment and retention a competitive battleground. For instance, in 2024, the U.S. Bureau of Labor Statistics projected a 5% job growth for pest control workers, indicating continued demand for qualified individuals.

Rollins, through its extensive training programs and employee development initiatives, cultivates a loyal and skilled workforce. This internal pipeline of talent is a formidable barrier for newcomers, as replicating such a robust training infrastructure and fostering employee loyalty takes considerable time and investment. Companies like Rollins often boast low technician turnover rates, a stark contrast to the challenges new entrants face in establishing a stable and experienced team.

- High Demand for Certified Technicians: The pest control industry requires specialized knowledge and certifications, making it difficult for new companies to quickly assemble a qualified team.

- Rollins' Training Advantage: Rollins invests heavily in training and development, creating a skilled workforce that is difficult for new entrants to match.

- Retention Challenges for New Entrants: New businesses often struggle with employee retention due to fewer resources and less established company culture compared to industry leaders like Rollins.

- Impact on Service Quality: A lack of skilled labor can directly impact the quality of service a new pest control company can offer, hindering its ability to compete.

Economies of Scale and Purchasing Power

The threat of new entrants in the pest control industry is significantly impacted by economies of scale and purchasing power. Established players like Rollins leverage their size to negotiate better prices on essential supplies such as pesticides, vehicles, and specialized equipment. For instance, in 2023, major pest control companies likely secured substantial discounts on bulk chemical orders, a benefit unavailable to smaller, emerging businesses.

New companies entering the market face an immediate cost disadvantage. They cannot match the purchasing volume of incumbents, meaning they pay higher per-unit costs for the same materials. This disparity in operational expenses creates a barrier, as new entrants must absorb higher costs, potentially leading to lower profit margins or the need to charge higher prices, making them less competitive from day one.

- Economies of Scale: Larger firms achieve lower per-unit costs through increased production and purchasing volume.

- Purchasing Power: Established companies can negotiate favorable terms and discounts with suppliers due to their significant buying capacity.

- Cost Disadvantage for New Entrants: Start-ups lack the scale to secure similar pricing, leading to higher operational expenses.

- Competitive Barrier: The cost differential created by purchasing power makes it harder for new companies to compete on price.

The threat of new entrants in the pest control sector is considerably low due to high capital requirements for fleet acquisition and specialized equipment. Regulatory compliance, including EPA standards and state-specific licensing, demands significant investment in training and legal expertise. Established brands like Orkin, owned by Rollins, benefit from decades of customer trust and brand recognition, making it challenging for newcomers to gain market traction.

| Barrier Type | Description | Example Impact (2023-2024) | Rollins Advantage |

| Capital Requirements | High upfront costs for vehicles, equipment, and technology. | A fleet of 500 commercial vans could cost $20-30 million. | Established infrastructure and financing capabilities. |

| Regulatory Hurdles | Complex federal, state, and local laws for pesticide use and safety. | Ongoing updates to environmental regulations in 2024. | Dedicated compliance departments and established protocols. |

| Brand Loyalty & Reputation | Decades of building customer trust and service quality. | Rollins' 2023 revenue exceeded $2.4 billion. | Strong brand equity and customer retention. |

| Access to Skilled Labor | High demand for certified and experienced technicians. | Projected 5% job growth for pest control workers in 2024. | Robust internal training programs and low turnover. |

| Economies of Scale | Lower per-unit costs through bulk purchasing power. | Significant discounts on pesticides and supplies in 2023. | Negotiating power with suppliers, leading to cost advantages. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a foundation of robust data, including company annual reports, industry-specific market research, and extensive trade publications to provide a comprehensive view of competitive dynamics.