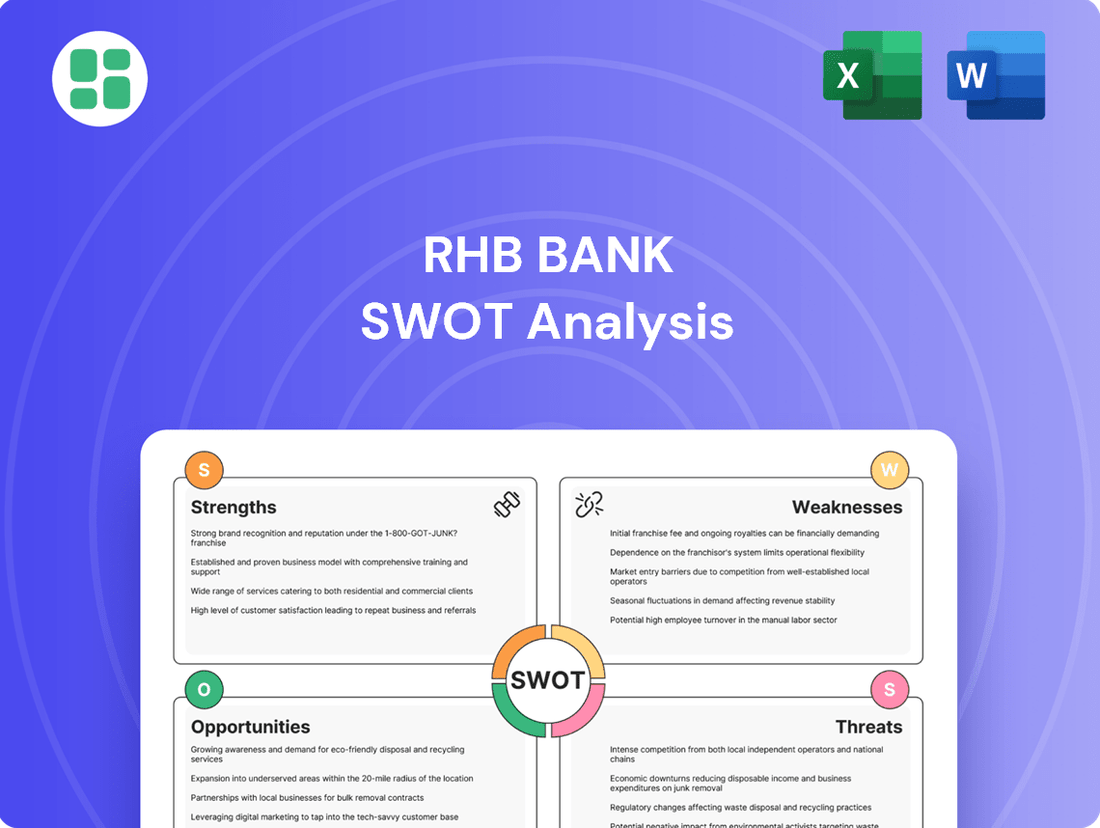

RHB Bank SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

RHB Bank Bundle

RHB Bank demonstrates significant strengths in its digital transformation and established regional presence, but faces challenges from intense competition and evolving regulatory landscapes. Understanding these dynamics is crucial for any stakeholder looking to navigate the Malaysian financial sector.

Want the full story behind RHB Bank's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

RHB Bank has shown impressive financial strength, with its net profit climbing 11.2% to RM3.1 billion in fiscal year 2024. This growth was fueled by increased revenue and significant expansion in both its fund-based and non-fund-based income streams. This robust financial performance establishes a solid base for the bank's future endeavors.

The bank's improved Return on Equity (ROE) also highlights its efficiency and profitability, reaching 10.04% in FY2024. Such a strong financial position allows RHB Bank to confidently pursue new investment opportunities and strategic initiatives, reinforcing its market standing.

RHB Bank distinguishes itself with a broad spectrum of financial products and services catering to individuals, businesses, and large corporations. This comprehensive offering spans retail banking, business banking, corporate and investment banking, treasury operations, and insurance solutions, ensuring a one-stop shop for diverse financial needs.

A strong emphasis on customer experience is evident in RHB's strategic initiatives. The bank has invested in tools like the e-QMS appointment app to streamline customer interactions and is actively employing Artificial Intelligence for personalized service delivery. These efforts have demonstrably boosted customer satisfaction, reflected in an improved Net Promoter Score (NPS).

RHB Bank is making significant strides in digital transformation, with a substantial portion of its capital expenditure dedicated to IT modernization and automation. This strategic investment is key to their future growth.

The bank is actively integrating artificial intelligence across its operations, aiming to enhance customer experiences by offering smarter, faster, and more accessible financial services. This digital push is particularly beneficial for sectors like wealth management.

By embracing these technological advancements, RHB Bank is not only improving its service delivery but also boosting operational efficiency, which is crucial in today's competitive financial landscape.

Commitment to Sustainability and ESG

RHB Bank has demonstrated a strong commitment to sustainability, significantly increasing its target for Sustainable Financial Services (SFS) to RM90 billion by 2027, up from the earlier RM50 billion by 2026. This strategic shift underscores their dedication to environmental, social, and governance (ESG) principles, aiming for Net Zero emissions by 2050.

The bank is actively developing and promoting innovative ESG-aligned financial solutions. These include initiatives like the Low Carbon Transition Facility and the Sustainable Trade Finance Programme, which directly support businesses in their transition towards more sustainable practices.

- Elevated Sustainable Finance Target: RM90 billion in SFS by 2027.

- Net Zero Ambition: Commitment to achieving Net Zero by 2050.

- Innovative ESG Solutions: Development of Low Carbon Transition Facility and Sustainable Trade Finance Programme.

Improving Asset Quality and Risk Management

RHB Bank is actively enhancing its asset quality, a key strength that bolsters its financial resilience. The bank has demonstrated a commitment to rigorous risk management, which has helped stabilize its gross impaired loan (GIL) ratio. This focus is critical for navigating the current economic landscape.

The bank’s strategy centers on actively managing its loan portfolio to contain and reduce the GIL ratio. Emphasis on recovery efforts further strengthens this commitment. For instance, RHB Bank reported a GIL ratio of 2.3% as of the first quarter of 2024, showing a slight improvement from the previous year. This proactive approach to asset quality is vital for sustained financial health.

- Stabilizing Gross Impaired Loan (GIL) Ratio: RHB Bank's GIL ratio stood at 2.3% in Q1 2024, indicating a controlled level of non-performing assets.

- Rigorous Risk Management: The bank employs stringent risk assessment and monitoring processes to proactively identify and mitigate potential credit risks.

- Focus on Recoveries: RHB Bank prioritizes the recovery of impaired loans, contributing to the improvement of its overall asset quality.

- Navigating Market Uncertainties: Strong asset quality and risk management provide a buffer against economic volatility and market downturns.

RHB Bank's financial performance in FY2024 was robust, with net profit reaching RM3.1 billion, an 11.2% increase driven by revenue growth and expanded income streams. Its Return on Equity (ROE) improved to 10.04% in the same period, underscoring operational efficiency and profitability. This strong financial footing enables strategic investments and reinforces its market position.

The bank offers a comprehensive suite of financial products and services, from retail banking to corporate and investment solutions, acting as a one-stop financial partner. Its commitment to customer experience is evident through digital initiatives like the e-QMS appointment app and AI-driven personalization, leading to improved customer satisfaction and Net Promoter Score (NPS).

RHB Bank is actively pursuing digital transformation, dedicating significant capital expenditure to IT modernization and automation. Its integration of AI aims to enhance customer service by providing smarter, faster, and more accessible financial solutions, particularly benefiting areas like wealth management and boosting overall operational efficiency.

A key strength lies in RHB Bank's commitment to sustainability, evidenced by its increased Sustainable Financial Services (SFS) target of RM90 billion by 2027 and a Net Zero ambition by 2050. The bank is developing innovative ESG solutions such as the Low Carbon Transition Facility to support businesses in their sustainability journey.

RHB Bank maintains strong asset quality, with a Gross Impaired Loan (GIL) ratio of 2.3% in Q1 2024, reflecting effective risk management and recovery efforts. This focus on asset quality provides resilience against economic volatility.

| Metric | FY2024 | Q1 2024 | Target/Ambition |

|---|---|---|---|

| Net Profit | RM3.1 billion | N/A | N/A |

| ROE | 10.04% | N/A | N/A |

| Sustainable Financial Services (SFS) | N/A | N/A | RM90 billion by 2027 |

| Net Zero Target | N/A | N/A | By 2050 |

| Gross Impaired Loan (GIL) Ratio | N/A | 2.3% | Improvement/Stabilization |

What is included in the product

Delivers a strategic overview of RHB Bank’s internal and external business factors, analyzing its strengths, weaknesses, opportunities, and threats to understand its competitive position and market challenges.

Highlights RHB Bank's competitive advantages and areas for improvement, enabling targeted strategic adjustments to mitigate risks and capitalize on opportunities.

Weaknesses

RHB Bank has faced pressure on its Net Interest Margin (NIM), a key indicator of profitability from lending activities. This compression is partly due to the lagged effect of anticipated US Federal Reserve interest rate cuts on its US dollar-denominated loan portfolio. For instance, in Q1 2024, RHB Bank's NIM stood at 2.16%, a slight decrease from 2.20% in Q1 2023, reflecting these pressures.

Intensified competition for customer deposits also contributes to NIM compression, as banks may need to offer higher interest rates to attract and retain funds. While RHB Bank's management anticipates some stabilization in NIM going forward, this remains a significant headwind that could temper future earnings growth.

RHB Bank faces significant headwinds in the Malaysian banking sector due to intense competition for Current Account and Savings Account (CASA) deposits. This fierce rivalry makes it difficult for RHB to substantially grow its CASA base, a crucial component for stable and low-cost funding.

As of the first quarter of 2024, the average CASA ratio across Malaysian banks hovered around 30-35%, a figure RHB also operates within. A lower CASA ratio, such as RHB's, often translates to a higher reliance on more expensive wholesale funding or fixed deposits, directly impacting the bank's net interest margin and overall cost efficiency.

While RHB Bank's overall asset quality shows improvement, a notable weakness lies in the deterioration of its overseas portfolios. Specifically, segments in Thailand and Cambodia experienced a rise in their gross impaired loan (GIL) ratio during early 2024, impacting the bank's consolidated performance.

The recovery trajectory for these international operations presents a lingering concern. For instance, as of the first quarter of 2024, RHB Bank reported a GIL ratio of 1.46%, a slight uptick from 1.39% in the previous year, with overseas exposures contributing to this trend.

Higher Operating Expenses

RHB Bank has been grappling with elevated operating expenses, a factor that has tempered the impact of its robust income growth observed in fiscal year 2024. For instance, while income increased, the bank's cost-to-income ratio remained a point of focus.

Effectively managing these rising costs, particularly as the bank continues to invest heavily in its digital transformation roadmap and other strategic growth ventures, is paramount. These investments, while essential for future competitiveness, directly influence the bank's ability to meet its profitability objectives.

- Increased operational costs in FY2024 impacted profitability despite strong income.

- Digital transformation and strategic initiatives contribute to higher operating expenses.

- Effective cost management is critical for achieving profit targets.

Legacy Issues and Mid-Sized Bank Scale

RHB Bank, while the fourth-largest in Malaysia, acknowledges its inherent disadvantage in scale compared to its larger domestic competitors. This means it cannot always leverage sheer size for competitive advantage, necessitating a focus on other strategic areas.

The bank is actively working to move past historical challenges, aiming to shed any lingering legacy issues that might impede its progress. This strategic pivot is crucial for its future growth and market positioning.

RHB's strategy centers on differentiating itself through superior customer service and enhanced profitability. Instead of competing solely on the basis of its asset size, the bank is prioritizing value creation and client experience to stand out in the competitive financial landscape.

For instance, in its 2024 financial reporting, RHB highlighted a commitment to digital transformation to improve operational efficiency and customer engagement, a key element in overcoming scale limitations.

RHB Bank's Net Interest Margin (NIM) faced pressure in early 2024, dropping to 2.16% from 2.20% a year prior. This compression stems from anticipated US Federal Reserve rate cuts impacting its US dollar loans and intense competition for customer deposits, forcing higher interest payouts. The bank's CASA ratio, around the Malaysian average of 30-35%, means it relies more on costly funding, directly affecting profitability.

The bank's overseas operations, particularly in Thailand and Cambodia, showed a rising gross impaired loan (GIL) ratio in Q1 2024, contributing to a consolidated GIL of 1.46%. This uptick from 1.39% in the prior year signals a concern for the recovery pace of these international segments.

Elevated operating expenses in FY2024 tempered RHB Bank's income growth. While investments in digital transformation are crucial for future competitiveness, they directly impact the bank's ability to meet profit targets. The cost-to-income ratio remains a key area of focus for management.

As the fourth-largest bank in Malaysia, RHB faces a scale disadvantage compared to its larger domestic rivals. Its strategy therefore focuses on differentiation through superior customer service and enhanced profitability, rather than solely competing on asset size, as evidenced by its ongoing digital transformation initiatives.

Full Version Awaits

RHB Bank SWOT Analysis

You’re viewing a live preview of the actual RHB Bank SWOT analysis file. The complete version, offering a comprehensive breakdown of its Strengths, Weaknesses, Opportunities, and Threats, becomes available after checkout.

This is the same RHB Bank SWOT analysis document included in your download. The full content, detailing critical strategic insights, is unlocked after payment.

Opportunities

RHB Bank is well-positioned to capitalize on the burgeoning demand for sustainable and green financing. The bank has already demonstrated its commitment by exceeding its initial targets and now aims for RM90 billion in sustainable financing by 2027. This strategic focus aligns with the increasing global and local investor appetite for environmentally conscious investments.

A key opportunity lies in catering to the growing need for capital that facilitates the transition to a low-carbon economy. RHB Bank is actively developing and promoting new financial solutions specifically for Small and Medium Enterprises (SMEs). These businesses are increasingly seeking ways to adopt greener practices, and RHB's targeted offerings can meet this critical market need.

RHB's ongoing digital transformation, including the planned launch of its digital bank, Boost Bank, opens doors to new customer demographics and the delivery of innovative, cost-effective financial services. This strategic move is expected to capitalize on the growing demand for digital-first banking experiences.

Partnering with fintech firms presents a substantial opportunity for RHB to integrate advanced solutions for payments, operational efficiency, and financing. For instance, collaborations can streamline cross-border transactions, a market segment that saw global cross-border payment volumes reach an estimated $156 trillion in 2023, according to SWIFT data.

RHB Bank is strategically targeting high-growth economic corridors within Malaysia, including Johor, Sarawak, and Penang. This focus is designed to capitalize on anticipated economic expansion and significant public infrastructure investments in these key regions.

The bank is particularly keen on leveraging opportunities presented by initiatives like the Johor-Singapore Special Economic Zone. This strategic alignment is expected to fuel substantial loan growth for RHB as economic activity in these corridors intensifies.

For instance, Johor's economic growth is projected to remain robust, with the state government anticipating a 5% to 6% GDP growth in 2024, partly driven by foreign direct investment and infrastructure projects like the RTS Link connecting to Singapore.

Expansion of Wealth Management and Non-Fund Based Income

RHB Bank can capitalize on the growing demand for sophisticated financial advice by expanding its wealth management services. The increasing adoption of digital tools and automation, including artificial intelligence, is a key enabler for this expansion, allowing for more personalized client experiences and efficient service delivery. This strategic focus is crucial for enhancing client engagement and capturing a larger share of the affluent market.

Furthermore, strengthening advisory capabilities within its wholesale banking operations presents a significant opportunity to boost non-fund based income. By offering more value-added services and expert guidance, RHB can diversify its revenue streams beyond traditional lending. For instance, in 2023, RHB's fee and commission income grew by 10.5%, indicating a positive trend in non-fund based revenue generation that can be further amplified.

- Digitalization and AI in Wealth Management: Leveraging technology to offer personalized investment strategies and financial planning.

- Strengthening Advisory Services: Enhancing the expertise and tools available to wholesale banking clients for fee-based income growth.

- Diversification of Revenue: Reducing reliance on interest income by increasing contributions from wealth management and advisory fees.

Favorable Malaysian Banking Sector Outlook

The Malaysian banking sector is poised for a positive trajectory in 2025, with projections indicating consistent loan expansion and resilient asset quality. This supportive economic climate is expected to benefit RHB Bank as it pursues its growth ambitions.

Key factors contributing to this favorable outlook include anticipated stable interest rates and a manageable inflation environment. For instance, Bank Negara Malaysia's monetary policy stance in late 2024 and early 2025 is expected to foster a conducive lending landscape.

- Steady Loan Growth: Analysts forecast loan growth in Malaysia to be between 5% and 6% for 2025, providing a solid base for RHB Bank's lending activities.

- Stable Asset Quality: Non-performing loan (NPL) ratios are expected to remain low, likely below 1.5%, indicating a healthy credit environment.

- Manageable Credit Costs: Provisions for loan losses are anticipated to be contained, supporting profitability.

- Supportive Macroeconomic Environment: Continued economic expansion and stable employment figures in Malaysia bolster consumer and business confidence, driving demand for banking services.

RHB Bank is strategically positioned to leverage the increasing demand for sustainable finance, aiming for RM90 billion by 2027, and to support SMEs in their transition to greener operations. The bank's digital transformation, including the upcoming Boost Bank, will unlock new customer segments and service delivery models.

Collaborations with fintech companies offer avenues to enhance payment systems, operational efficiency, and financing solutions, tapping into the significant global cross-border payment market. Furthermore, RHB's focus on high-growth economic corridors like Johor, Sarawak, and Penang, particularly with initiatives like the Johor-Singapore Special Economic Zone, presents a strong opportunity for loan growth, building on Johor's projected 5-6% GDP growth in 2024.

Expanding wealth management services, supported by AI and digital tools, can deepen client engagement and capture more of the affluent market. Simultaneously, strengthening wholesale banking advisory services is key to boosting non-fund based income, as evidenced by RHB's 10.5% growth in fee and commission income in 2023.

The Malaysian banking sector's projected 5-6% loan growth in 2025, coupled with stable interest rates and low non-performing loan ratios (expected below 1.5%), creates a favorable environment for RHB's expansion and profitability.

Threats

The Malaysian banking landscape is fiercely competitive, with rivals like Maybank and CIMB also aggressively expanding their sustainable financing portfolios and investing heavily in digital capabilities. This heightened rivalry puts pressure on RHB Bank's net interest margins, as banks compete for deposits and loans, and can also increase customer acquisition costs as marketing efforts intensify.

While RHB Bank has seen improvements in its asset quality, a potential global economic slowdown presents a significant threat. For instance, the ongoing impact of US tariffs on various manufacturing sectors could strain businesses, potentially leading to an increase in non-performing loans for the bank.

This economic uncertainty underscores the need for RHB Bank to maintain rigorous underwriting standards and ensure its provisioning buffers are robust enough to absorb potential credit losses. As of the first quarter of 2024, RHB Bank reported a net impaired loan ratio of 1.58%, a figure that could face upward pressure if economic conditions worsen.

RHB Bank, like many financial institutions, faces headwinds from evolving global trade dynamics. Uncertainties stemming from potential US protectionist measures could disrupt international trade flows, impacting businesses that RHB Bank serves and potentially leading to increased credit risk.

Ongoing geopolitical tensions worldwide create a volatile operating environment, affecting investor sentiment and capital flows, which can indirectly influence the Malaysian economy and the banking sector's performance. For instance, the ongoing conflict in Eastern Europe has contributed to global supply chain disruptions and energy price volatility, impacting business confidence.

Furthermore, potential policy rate changes by Bank Negara Malaysia, influenced by global inflation trends and domestic economic conditions, present a significant threat. A sudden increase in interest rates could dampen loan demand and increase the cost of funding for RHB Bank, while a decrease might compress net interest margins.

Specific regulatory measures, such as new tariffs on imported goods or government-mandated assistance programs for borrowers impacted by economic downturns, could also alter RHB Bank's operating landscape, potentially affecting profitability and capital requirements.

Cybersecurity Risks and Digital Disruption

As RHB Bank pushes forward with its digital banking ambitions, the threat landscape for cybersecurity intensifies. The increasing reliance on online platforms and mobile applications exposes the bank to a higher risk of cyberattacks, data breaches, and potential financial losses. In 2024, the global financial sector experienced a significant uptick in sophisticated cyber threats, with ransomware and phishing attacks remaining prevalent, impacting customer trust and operational continuity.

Furthermore, the rapid pace of technological innovation presents a disruptive force. Emerging fintech companies are introducing agile and often more user-friendly solutions, challenging traditional banking models. RHB must continuously adapt its digital strategies and invest in advanced technologies to remain competitive and mitigate the risk of being outmaneuvered by these nimble disruptors.

- Increased Exposure: Digital transformation directly correlates with a greater attack surface for cyber threats.

- Fintech Competition: New entrants leveraging advanced technology can erode market share if traditional banks fail to innovate.

- Data Breach Impact: A successful breach can lead to significant financial penalties, reputational damage, and loss of customer confidence. For instance, in 2023, data breaches in the financial services sector cost an average of $5.90 million globally.

Talent Retention and Development

The accelerating digital shift in banking demands advanced skills, especially in AI and data analytics. This creates a challenge for RHB Bank in keeping its talent engaged and developing the necessary expertise. For instance, a 2024 industry report indicated a 30% year-over-year increase in demand for cybersecurity and data science professionals within financial services.

To stay competitive, RHB Bank must invest heavily in continuous reskilling programs. This ensures employees can adapt to new technologies and innovative financial solutions. Failure to do so could lead to a skills gap, impacting the bank's ability to deliver cutting-edge digital services.

- Digital Skill Gap: The banking sector faces a growing deficit in specialized digital talent, a trend expected to persist through 2025.

- Reskilling Investment: RHB Bank's commitment to ongoing training is crucial for bridging this gap and fostering internal expertise.

- Competitive Landscape: Competitors are actively acquiring talent with AI and data analytics capabilities, putting pressure on RHB to match these efforts.

RHB Bank faces intense competition from domestic and international players, particularly in digital offerings and sustainable finance, which can pressure margins and increase customer acquisition costs. Economic slowdowns, geopolitical instability, and potential changes in Bank Negara Malaysia's policy rates also pose significant threats, impacting loan demand and credit risk. The bank must also navigate evolving trade dynamics and regulatory shifts that could affect profitability and capital needs.

SWOT Analysis Data Sources

This RHB Bank SWOT analysis is built upon a robust foundation of data, drawing from the bank's official financial statements, comprehensive market research reports, and expert industry analyses to provide a thoroughly informed strategic perspective.