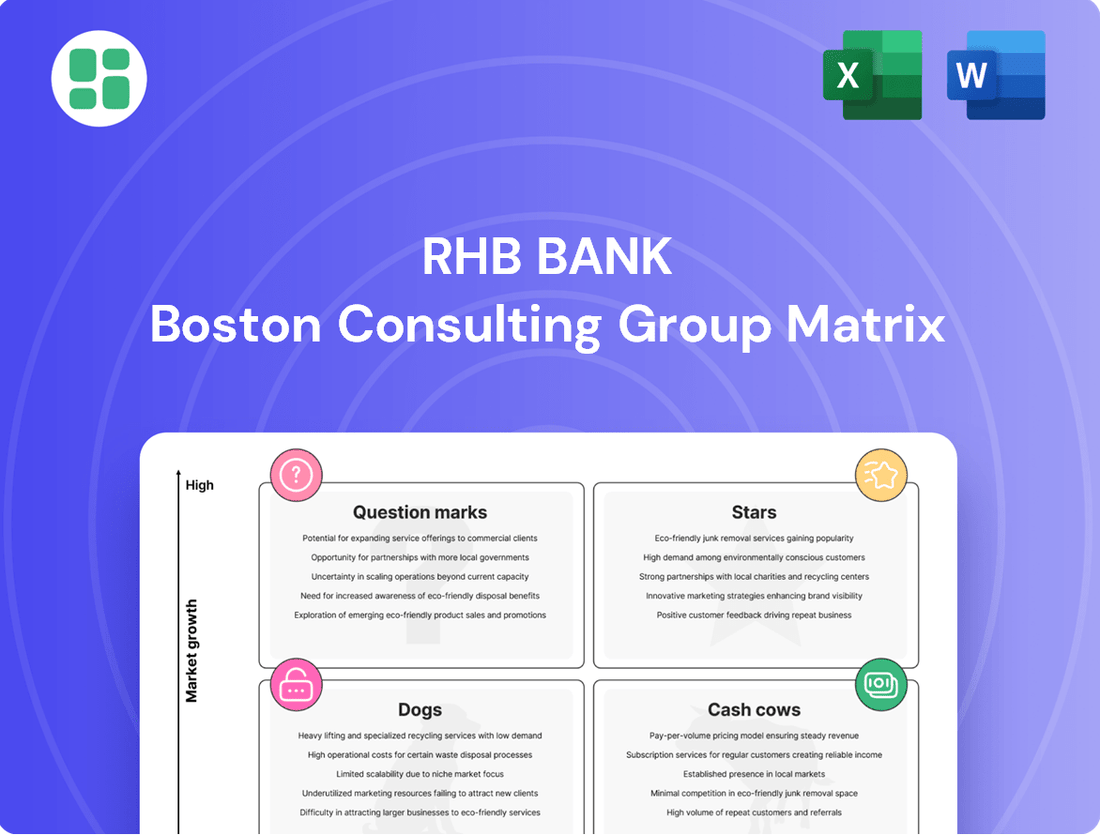

RHB Bank Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

RHB Bank Bundle

Curious about RHB Bank's strategic positioning? Our BCG Matrix analysis reveals which of their products are market leaders (Stars), which consistently generate strong returns (Cash Cows), which are underperforming (Dogs), and which hold future potential but require investment (Question Marks).

Don't miss out on the complete picture. Purchase the full RHB Bank BCG Matrix to unlock detailed quadrant breakdowns, actionable insights, and a clear roadmap for optimizing your investment and product portfolio.

Gain a competitive edge with our comprehensive report. It's your shortcut to understanding RHB Bank's market performance and making informed, data-driven strategic decisions.

Stars

RHB Bank is aggressively pursuing sustainable financial services, setting a new target of RM90 billion by 2027. This ambitious goal underscores the significant growth potential in a market increasingly shaped by Environmental, Social, and Governance (ESG) considerations. The bank’s commitment is further evidenced by its achievement of over RM40 billion in sustainable finance by December 2024, surpassing its earlier objectives and highlighting strong market traction.

RHB's enhanced Mobile Banking App (MBK App) is a shining star in its digital portfolio. Recent updates have focused on making banking faster, simpler, and more secure, leading to a significant jump in its Google Play Store rating from 3.5 to 4.7. This surge in user satisfaction, coupled with innovative features like the mobile banking widget, clearly signals strong market acceptance and considerable growth potential.

The bank's commitment to digital transformation, as outlined in its PROGRESS27 strategy, underpins the continued investment in this area. This strategic focus ensures that the MBK App remains at the forefront of digital banking, poised to capture a larger share of the market and drive future growth for RHB Bank.

RHB Bank is actively driving SME green financing, having mobilized close to RM6.2 billion through its Green Product Bundling Scheme as part of a wider sustainable finance push.

This strategic focus on SMEs is yielding significant growth, fueled by increasing demand for sustainable practices and supportive government policies.

By December 2024, RHB aims to onboard over 1,000 SMEs, signaling a strong commitment to capturing market share in this rapidly expanding green finance segment.

Mortgage Lending

Mortgage lending remains a cornerstone for RHB Bank, contributing significantly to its overall loan portfolio. This segment is bolstered by consistent demand from Malaysian consumers.

The banking industry, with RHB included, is anticipating a healthy loan growth of 6-7% for 2025. Mortgages are a primary engine for this expansion, reflecting RHB's robust standing in the consumer credit landscape.

- Mortgage Contribution: Mortgage loans are a key component of RHB's gross loans and financing growth.

- Market Outlook: Steady loan growth of 6-7% is projected for the Malaysian banking sector in 2025.

- Key Driver: Household loans, especially mortgages, are expected to be a major contributor to this growth.

- RHB's Position: This highlights RHB's strong market presence and ongoing expansion within the consumer credit market.

Expansion of International Business (Singapore)

RHB's Singapore operations are a star in its BCG matrix, showing impressive expansion. In the first half of fiscal year 2024, RHB's loan growth in Singapore reached a significant 10.2%, highlighting its strong performance in this key market.

The bank strategically targets international business, with Singapore and the emerging Johor-Singapore Special Economic Zone identified as crucial drivers for future growth. This focus on a vibrant regional economy signals substantial growth potential and RHB's commitment to expanding its footprint beyond Malaysia.

- Strong Loan Growth: RHB's loan portfolio in Singapore expanded by 10.2% in H1 FY2024.

- Strategic Growth Area: Singapore is a key focus for international expansion.

- Economic Zone Potential: The Johor-Singapore Special Economic Zone presents further growth opportunities.

- Market Share Ambition: RHB aims to increase its market share in this dynamic region.

RHB Bank's Singapore operations are a star in its BCG matrix, showcasing robust expansion and strategic importance. The bank's loan growth in Singapore hit an impressive 10.2% in the first half of fiscal year 2024, underscoring its strong performance in this key regional market. This growth is further supported by the strategic focus on international business and the potential of the Johor-Singapore Special Economic Zone.

| Business Unit | Growth Rate | Market Share | Profitability | Strategic Importance |

|---|---|---|---|---|

| Singapore Operations | 10.2% (H1 FY2024 Loan Growth) | Growing | Strong | High |

| Mobile Banking App (MBK App) | Significant User Satisfaction Increase (Rating 3.5 to 4.7) | Expanding | Positive | High |

| SME Green Financing | RM6.2 billion mobilized (Green Product Bundling Scheme) | Expanding | Positive | High |

| Mortgage Lending | Key contributor to loan portfolio | Stable/Growing | Strong | Medium to High |

What is included in the product

RHB Bank's BCG Matrix offers a strategic overview of its business units, guiding investment decisions.

RHB Bank's BCG Matrix offers a clear, actionable overview of business units, relieving the pain of strategic uncertainty.

Cash Cows

RHB Bank's core retail deposits represent a significant Cash Cow, providing a stable and cost-effective funding base. As of June 30, 2024, these deposits reached RM240.3 billion, demonstrating consistent growth.

The bank's Current Account and Savings Account (CASA) deposits, making up 28.1% of the total, are particularly valuable. This segment ensures a reliable source of liquidity and contributes steadily to net interest income with minimal promotional expenditure.

RHB Bank's established corporate and commercial banking relationships are a clear Cash Cow. This segment boasts a robust client portfolio, providing a wide array of banking solutions that consistently bolster the bank's net funding income and gross loans.

The commercial segment, in particular, demonstrated impressive growth, expanding by 10.1% in the first half of fiscal year 2024. These enduring partnerships within a mature market environment are instrumental in generating stable, high-margin cash flows.

The strength of these relationships translates into predictable revenue streams, reducing the necessity for substantial investments in aggressive market share expansion. This stability is a hallmark of a strong Cash Cow in the BCG matrix.

The auto finance portfolio at RHB Bank is a classic cash cow, demonstrating consistent and reliable contribution to the bank's overall loan growth. In the first half of fiscal year 2024, this segment saw a healthy 6.7% increase within the group's community banking operations, highlighting its steady performance.

This market segment is mature, meaning RHB Bank already holds a significant and established share. This strong position translates into predictable income streams, as demand for auto financing tends to be stable, even in slower economic periods. The bank can leverage its existing infrastructure and customer base to maintain profitability without needing substantial new investments.

Because auto finance operates in a low-growth environment, it requires less aggressive capital deployment to sustain its strong market standing. This allows RHB Bank to extract consistent cash flow from this business unit, which can then be reinvested in other areas of the bank with higher growth potential or used to return value to shareholders.

Traditional Fee-Based Services

RHB Bank's traditional fee-based services, like trade finance and wealth management advisory for its existing clientele, are considered cash cows. These services benefit from a large, established customer base, generating consistent transactional fees and contributing to stable, non-fund-based income.

These mature market offerings require relatively low investment to maintain their strong market share and profitability. For instance, RHB's focus on digitalizing trade finance processes in 2023 aimed to enhance efficiency rather than requiring substantial new capital expenditure.

- Stable Income Source: Traditional fee-based services provide a predictable revenue stream for RHB Bank.

- Low Investment Needs: These mature services require minimal additional capital to sustain their market position.

- Profitability: High market share in these established areas ensures consistent profitability.

- Customer Base Leverage: RHB leverages its extensive customer network for transactional fees and advisory services.

Islamic Banking Segment

RHB Bank's Islamic banking segment is a clear cash cow. It already accounts for a significant 44.3% of the bank's total domestic loans and financing as of the first half of fiscal year 2024.

This segment is on track to meet its target of 50% contribution, demonstrating its robust growth and strong market position.

The substantial and stable income generated from its large, established customer base in a market with consistent demand solidifies its cash cow status within RHB's portfolio.

- Significant Contribution: 44.3% of total domestic loans and financing in H1 FY2024.

- Growth Trajectory: Aiming to reach 50% contribution to domestic loans and financing.

- Stable Income Generation: Benefits from a large customer base and consistent demand in the Islamic finance market.

RHB Bank's core retail deposits, particularly its Current Account and Savings Account (CASA) balances, represent a significant Cash Cow. As of June 30, 2024, total retail deposits stood at RM240.3 billion, with CASA making up a substantial 28.1% of this. This segment provides a stable, low-cost funding base, generating consistent net interest income with minimal investment required for growth.

The bank's established corporate and commercial banking relationships are also a key Cash Cow. The commercial segment, for example, saw a 10.1% expansion in the first half of fiscal year 2024, showcasing strong client retention and consistent revenue generation in a mature market. This allows RHB to leverage existing infrastructure for predictable, high-margin cash flows.

RHB Bank's auto finance portfolio is another prime example of a Cash Cow. In the first half of fiscal year 2024, this segment grew by 6.7% within community banking. Operating in a mature market with stable demand, it requires limited new capital to maintain its strong position, ensuring consistent cash extraction for reinvestment or shareholder returns.

Traditional fee-based services, such as trade finance and wealth management advisory, also function as Cash Cows. These mature offerings benefit from RHB's extensive customer base, generating consistent transactional fees and non-fund-based income. The bank's 2023 focus on digitalizing trade finance aimed at efficiency, not significant new capital outlay, reinforcing their low-investment, high-return nature.

The Islamic banking segment is a strong Cash Cow, accounting for 44.3% of RHB's total domestic loans and financing in the first half of fiscal year 2024, with a target of 50%. This segment benefits from a large, loyal customer base and consistent market demand, providing stable and substantial income without requiring aggressive new investments.

| Business Segment | BCG Category | H1 FY2024 Data Point | Key Characteristics |

| Retail Deposits (CASA) | Cash Cow | RM240.3 billion total retail deposits (as of June 30, 2024), 28.1% CASA | Stable, low-cost funding, consistent net interest income |

| Corporate & Commercial Banking | Cash Cow | 10.1% growth in commercial segment (H1 FY2024) | Established relationships, predictable high-margin cash flows |

| Auto Finance | Cash Cow | 6.7% growth in auto finance (H1 FY2024) | Mature market, stable demand, low capital requirement |

| Fee-Based Services (Trade Finance, Wealth Management) | Cash Cow | Digitalization focus in 2023 for efficiency | Leverages existing customer base, consistent fee income |

| Islamic Banking | Cash Cow | 44.3% of domestic loans & financing (H1 FY2024) | Large customer base, consistent demand, stable income |

Preview = Final Product

RHB Bank BCG Matrix

The RHB Bank BCG Matrix preview you are currently viewing is the identical, fully comprehensive document you will receive immediately after your purchase. This means you’ll gain access to the complete, unwatermarked analysis, ready for immediate strategic application without any further modifications or hidden content. It's a professionally formatted report, designed to provide clear insights into RHB Bank's product portfolio and market positioning, enabling informed decision-making for your business planning and presentations.

Dogs

RHB Bank, like many established financial institutions, likely operates older, less efficient legacy IT systems. These systems are costly to maintain and difficult to integrate with newer technologies, offering low growth potential and minimal competitive advantage in a rapidly digitalizing banking landscape. They often act as cash traps, consuming resources without significant returns.

The bank's strategic focus on allocating significant capital expenditure towards IT modernization and automation, with plans to invest RM2 billion in digital transformation by 2026, indirectly points to the existence and impact of these underperforming legacy systems. This investment highlights the need to replace or upgrade these older technologies to improve efficiency and competitiveness.

RHB Bank's operations in markets like Thailand, Laos, and Cambodia, which experienced slow recovery in 2023, could be categorized as Dogs within the BCG Matrix. These smaller international presences often contend with low market share in economies exhibiting sluggish growth, leading to minimal profitability or even outright losses.

Such entities can strain resources that might otherwise be allocated to more promising ventures, lacking a clear path to substantial improvement. For instance, while specific 2024 figures for these individual operations are not yet fully consolidated, the broader trend of cautious economic recovery in some Southeast Asian markets in late 2023 suggests ongoing challenges.

Certain niche investment banking advisory services at RHB Bank might fall into the "Question Mark" category of the BCG Matrix. These could include highly specialized areas like advising on niche technology mergers or specific types of distressed debt restructuring. For instance, if RHB's advisory on, say, rare earth mining M&A is a small part of their overall deal flow, and the market for such deals is projected to grow only moderately, it fits this profile. In 2024, such niche advisory teams might be investing heavily in talent and research to build expertise, but their current fee generation could be below the bank's average for more established services.

Outdated Physical Branch Locations

As digital banking gains traction, some RHB Bank physical branches in areas with reduced economic activity or low customer traffic might become less productive. These locations often struggle with a small share of the shrinking physical banking market, leading to high operating expenses like rent and staffing that outweigh the revenue they generate. For instance, in 2024, the trend of branch consolidation continued across the banking sector, with many institutions evaluating their physical footprint based on digital engagement metrics and cost-efficiency ratios. RHB Bank, like its peers, would likely analyze these underperforming branches for potential optimization or closure to reallocate resources more effectively.

- Declining Foot Traffic: Branches in economically stagnant regions see fewer customers, impacting transaction volumes.

- High Operational Costs: Maintaining physical locations incurs significant expenses for rent, utilities, and staff.

- Low Market Share: These branches represent a small portion of RHB Bank's overall customer base in a contracting physical banking segment.

- Digital Shift Impact: Increased reliance on mobile and online banking reduces the need for traditional branch services.

Low-Uptake Traditional Insurance Products

Within RHB Bank's insurance segment, certain traditional products are experiencing low uptake. These offerings, often undifferentiated, are caught in a highly competitive landscape and have struggled to gain substantial market share. For instance, in 2023, the general insurance sector in Malaysia, where RHB operates, saw a modest growth of 4.5%, indicating a mature market.

These products operate in a mature market with limited organic growth potential for RHB. Consequently, they demand considerable marketing investment for relatively small returns. This scenario makes them less appealing for continued strategic investment and resource allocation within the bank's portfolio.

- Low Market Share: Products with less than 5% market share in their respective segments.

- Mature Market Dynamics: Operating in sectors with growth rates below the industry average.

- High Marketing Spend to Revenue Ratio: Indicating inefficient customer acquisition for these specific products.

- Limited Differentiation: Products that do not offer unique value propositions compared to competitors.

Certain operations or products within RHB Bank's portfolio likely fit the 'Dog' category in the BCG Matrix. These are typically characterized by low market share in low-growth markets, meaning they don't generate significant returns and consume resources without much prospect for future improvement. For example, RHB's smaller international subsidiaries in markets with subdued economic activity, such as Laos or Cambodia, might fall into this quadrant, especially if their market penetration remains minimal amidst slow regional recovery.

These 'Dog' segments often require substantial investment to maintain their current, albeit limited, market position. The bank's strategic allocation of RM2 billion towards digital transformation by 2026 indirectly suggests a need to divest or minimize resources from less productive areas to fund growth initiatives. In 2024, the ongoing evaluation of underperforming assets and a focus on operational efficiency would likely lead RHB to scrutinize these 'Dog' units.

Physical branches in areas experiencing economic decline also represent potential 'Dogs'. With declining foot traffic and high operational costs, these branches struggle to justify their existence in an increasingly digital banking environment. The broader banking trend in 2024 of branch consolidation further supports the idea that RHB would identify and address such underperforming physical locations.

Similarly, certain traditional insurance products with low uptake and high marketing spend relative to revenue are prime candidates for the 'Dog' classification. Operating in mature markets with limited differentiation, these products offer minimal competitive advantage and are unlikely to see significant growth. The modest 4.5% growth in Malaysia's general insurance sector in 2023 highlights the competitive and mature nature of these markets.

Question Marks

RHB Bank is strategically integrating Artificial Intelligence across its operations, particularly in customer service and wealth management. This focus on AI for personalization and advanced data analytics places the bank firmly on a high-growth technological frontier. For instance, by mid-2024, many leading financial institutions reported significant increases in customer engagement through AI-powered chatbots and personalized recommendations, with some seeing up to a 20% uplift in query resolution speed.

While RHB's investment in AI signifies a commitment to future growth, its current market share in specific AI-driven financial solutions is likely nascent. This positions AI integration as a Question Mark within the BCG matrix. For example, in 2024, the global AI in finance market was projected to reach over $30 billion, but the penetration of advanced AI applications within individual banking segments is still developing, meaning RHB is likely capturing a small fraction of this burgeoning market.

To move AI integration from a Question Mark to a Star, RHB Bank needs sustained and substantial investment. This is crucial for scaling these AI capabilities, capturing a larger market share, and ultimately demonstrating profitability. The high cost of developing and maintaining sophisticated AI systems, coupled with the need for continuous innovation to stay competitive, underscores the investment required to solidify its position in this rapidly evolving space.

RHB Bank's commitment to Boost Bank, a new digital-only player, highlights its strategic move into the dynamic digital banking sector. This investment, evidenced by RHB's subscription to additional shares, positions Boost Bank as a nascent entity with a currently low market share but significant growth potential. RHB's capital infusion and strategic backing are crucial for Boost Bank's journey from a Question Mark to a potential Star in the competitive digital finance landscape.

RHB Bank is actively participating in the burgeoning digital payment ecosystem through strategic partnerships, notably with Payments Network Malaysia (PayNet) for DuitNow QR. This initiative aims to boost cashless transactions across the nation.

The digital payment market is experiencing rapid expansion, yet it remains highly fragmented with numerous competitors vying for market share. RHB's involvement here is a strategic move to capture a more significant presence in this dynamic sector.

These efforts position RHB's digital payment initiatives as a Question Mark in the BCG matrix. Significant investment is required to overcome the fragmented landscape and establish a stronger market position, aiming to convert this into a future Star.

Specific Innovative ESG-Linked Financing Solutions

RHB Bank is actively expanding its sustainable finance offerings by introducing innovative ESG-linked financing solutions. These new products are designed to cater to the evolving needs of the market and support the transition to a lower-carbon economy.

Among these innovations is Malaysia's first Low Carbon Transition Facility, a significant step in providing targeted financial support for companies committed to reducing their carbon footprint. Additionally, the Sustainable Trade Finance Programme aims to integrate ESG principles into trade transactions, promoting responsible business practices across supply chains.

- Low Carbon Transition Facility: This facility is specifically designed to assist businesses in their journey towards decarbonization, offering financial incentives for adopting greener technologies and processes.

- Sustainable Trade Finance Programme: This initiative encourages environmentally and socially responsible trade activities by integrating ESG criteria into financing decisions, fostering sustainability throughout the trade lifecycle.

- Targeted Sectors: These new solutions are strategically focused on emerging green sectors that exhibit high growth potential, even in areas where RHB's current market share is still building.

- Market Development Focus: Scaling these offerings necessitates substantial investment in market education and proactive client acquisition strategies to ensure widespread adoption and impact.

Strategic Expansion in Emerging Economic Corridors (e.g., Sarawak, Penang)

RHB Bank is actively targeting emerging economic corridors like Sarawak and Penang, recognizing their significant growth potential driven by substantial infrastructure development. For instance, the Sarawak Corridor of Renewable Energy (SCORE) initiative and Penang's ongoing infrastructure upgrades are creating fertile ground for new banking services and customer acquisition.

While these regions represent high-growth areas, RHB's current market share within these specific emerging pockets may be nascent. This positions them as potential Stars or Question Marks within the BCG framework, necessitating strategic investment to build a stronger presence and capture market share.

- Strategic Focus: RHB is prioritizing growth in regions like Sarawak and Penang, anticipating economic expansion fueled by infrastructure projects.

- Market Potential: These corridors offer substantial opportunities for new business due to ongoing development and increasing economic activity.

- Market Share Consideration: RHB's market share in these specific emerging segments might be low, indicating a need for targeted investment and market penetration efforts.

- Investment Required: Significant investment will be crucial for RHB to establish a strong foothold and convert these emerging opportunities into substantial revenue streams.

RHB Bank's foray into advanced AI applications and the digital banking sector through Boost Bank places these initiatives in the Question Mark category. While holding potential for high growth, their current market share is likely small, requiring substantial investment to mature into Stars.

Similarly, RHB's engagement in the digital payment landscape, particularly with DuitNow QR, is a Question Mark. The market is competitive and fragmented, meaning significant capital and strategic effort are needed to gain a dominant position.

The bank's expansion into sustainable finance and its focus on emerging economic corridors like Sarawak and Penang also represent Question Marks. These areas offer high growth prospects, but RHB's current market penetration is still developing, necessitating targeted investments to capitalize on these opportunities.

BCG Matrix Data Sources

Our RHB Bank BCG Matrix is built on robust financial data from annual reports, market share analysis from industry publications, and growth forecasts from reputable financial institutions.