RHB Bank Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

RHB Bank Bundle

Discover how RHB Bank leverages its product offerings, competitive pricing, strategic distribution channels, and impactful promotional campaigns to capture market share. This analysis goes beyond the surface, revealing the intricate interplay of their 4Ps.

Ready to unlock the secrets behind RHB Bank's marketing success? Get the complete, editable 4Ps Marketing Mix Analysis to understand their product innovation, pricing strategies, distribution reach, and promotional effectiveness for your own strategic advantage.

Product

RHB Bank's Product strategy is built around providing comprehensive financial solutions. This means they offer a wide spectrum of products and services, covering everything from basic savings accounts for individuals to intricate financing options for large corporations. Their aim is to be a one-stop shop for all financial needs.

This extensive product range includes traditional banking services, investment products, and insurance. For instance, as of the first quarter of 2024, RHB Banking Group reported a net profit attributable to shareholders of RM720 million, demonstrating the scale and breadth of their operations across these diverse financial segments.

The bank’s approach is to create integrated solutions that cater to the varied requirements of their retail, business, and corporate clientele. This strategy ensures broad market relevance and allows them to serve a wide customer base effectively, from individuals managing personal finances to businesses seeking capital for growth.

RHB Bank is actively investing in its digital banking capabilities, focusing on making financial services smarter, faster, and more accessible through its online and mobile platforms. This commitment is evident in initiatives like the 'Banking Digitally with RHB' campaign, designed to boost customer engagement with digital channels.

Further demonstrating this push, RHB is currently alpha testing a new digital bank in collaboration with Boost. This strategic move aims to enhance transaction efficiency, elevate customer convenience, and extend financial access to previously underserved populations, reflecting a forward-looking approach to digital financial inclusion.

RHB Bank offers a comprehensive suite of Shariah-compliant Islamic banking products and services, demonstrating a dedication to catering to a wider customer base with diverse financial needs and preferences. This commitment is evident in their recent launches of new Islamic wealth management products, which complement their existing conventional financial solutions.

By integrating Islamic finance, RHB Bank broadens market accessibility, allowing a larger segment of the population to engage with financial solutions that adhere to their religious principles. For instance, as of early 2024, the Islamic finance sector in Malaysia, where RHB is a significant player, continued its steady growth, with total assets in Islamic banking reaching over RM1.1 trillion, underscoring the market demand for such offerings.

Specialized Business Banking Tools

RHB Bank’s specialized business banking tools, such as RHB Reflex Premium Plus, are designed to be a cornerstone of their Product strategy for business and SME clients. This comprehensive platform acts as an all-in-one financial management solution, automating crucial daily operations for businesses.

The integration of cash management, trade, and payment solutions within RHB Reflex Premium Plus provides businesses with real-time financial data, significantly streamlining their operational processes. This focus on efficiency and data accessibility directly supports client growth objectives.

RHB's commitment to providing these specialized tools underscores their understanding of the evolving needs of businesses. For instance, in 2024, RHB reported a 10% increase in SME client adoption of digital banking solutions, highlighting the demand for such integrated platforms.

- RHB Reflex Premium Plus: An integrated financial management solution.

- Key Features: Automates daily operations, offers real-time financial data.

- Benefits: Streamlines cash management, trade, and payment processes.

- Client Impact: Supports business growth and operational efficiency.

Sustainable Financial Services

RHB Bank's commitment to sustainable financial services is a key element of its marketing strategy, focusing on integrating Environmental, Social, and Governance (ESG) principles. The bank aims to mobilize RM50 billion by 2026, demonstrating a significant financial commitment to this area.

These services are designed to foster sustainable development and support the shift towards a greener economy. This includes a range of offerings that align with responsible finance, such as ESG-related insurance and sustainable capital market transactions.

- Mobilisation Target: RHB aims to mobilize RM50 billion in sustainable finance by 2026.

- Low-Carbon Transition: Products and services are geared towards accelerating the move to a low-carbon economy.

- Responsible Finance Offerings: This includes ESG-linked insurance policies and sustainable capital market deals.

RHB Bank's product strategy is a diversified offering catering to a broad customer base, from individuals to large corporations. This includes a comprehensive range of conventional and Islamic banking services, alongside investment and insurance products. Their digital transformation is a key product focus, with ongoing development and testing of new platforms like the digital bank in collaboration with Boost, aiming for enhanced customer experience and accessibility.

Specialized business solutions like RHB Reflex Premium Plus are central to their product mix, providing integrated financial management for SMEs. Furthermore, RHB is actively developing and promoting sustainable finance products, aligning with ESG principles and aiming to mobilize significant capital for green initiatives. This multifaceted approach ensures RHB remains competitive and relevant across various market segments.

| Product Category | Key Offerings/Focus | Recent Developments/Data (2024/2025) |

| Retail Banking | Savings, Current Accounts, Loans, Credit Cards | Continued focus on digital onboarding and personalized offerings. |

| Business & SME Banking | RHB Reflex Premium Plus, Cash Management, Trade Finance | 10% increase in SME digital adoption (2024); RHB Reflex Premium Plus enhances operational efficiency. |

| Digital Banking | Mobile App, Online Banking, New Digital Bank (with Boost) | Alpha testing of new digital bank; campaign to boost digital channel engagement. |

| Islamic Banking | Shariah-compliant accounts, wealth management | Expansion of Islamic wealth management products; steady growth in Malaysia's Islamic finance sector (over RM1.1 trillion in assets, early 2024). |

| Sustainable Finance | ESG-linked products, Sustainable Capital Markets | Target to mobilize RM50 billion by 2026; focus on low-carbon transition. |

What is included in the product

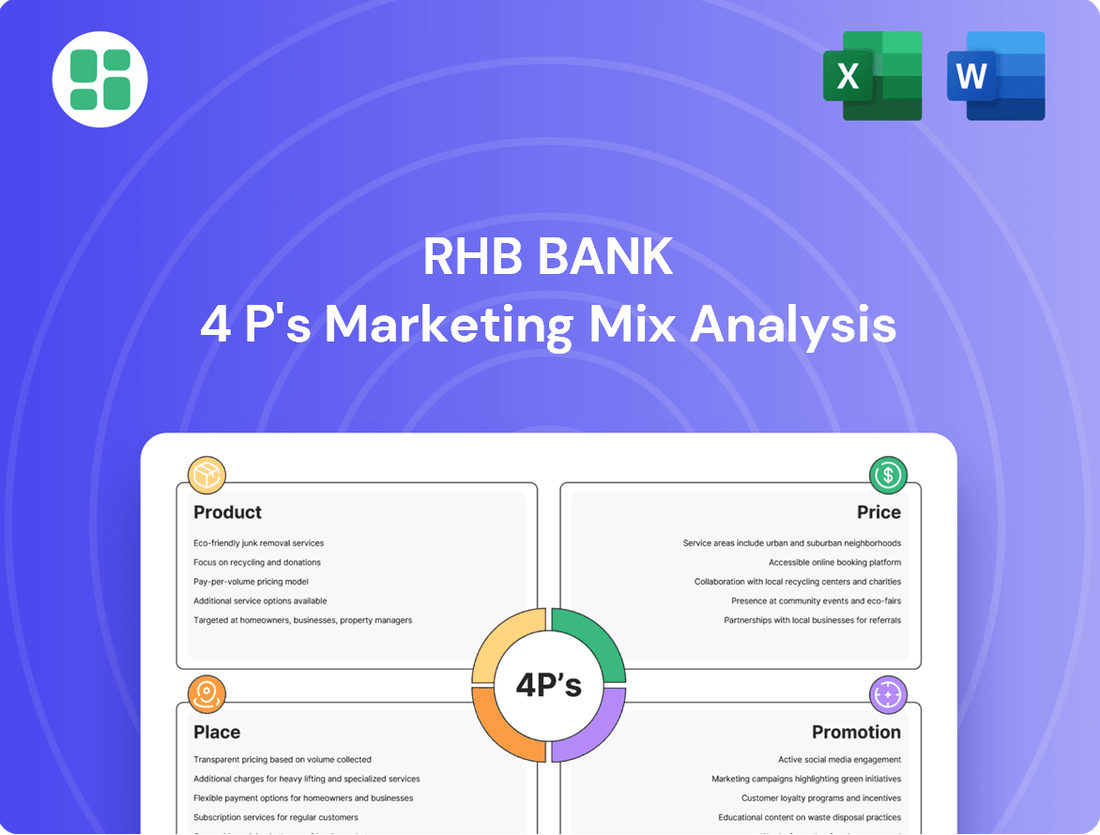

This analysis offers a comprehensive examination of RHB Bank's marketing strategies across Product, Price, Place, and Promotion, providing actionable insights for strategic decision-making.

It delves into RHB Bank's actual marketing practices and competitive positioning, serving as a valuable resource for marketers and consultants seeking a detailed understanding.

Simplifies RHB Bank's marketing strategy by clearly outlining how Product, Price, Place, and Promotion address customer pain points, making it easy to identify and communicate solutions.

Place

RHB Bank boasts a substantial physical presence with a widespread network of branches throughout Malaysia and in key regional markets. This extensive footprint ensures traditional banking services and direct customer support remain readily available, catering to a significant portion of their clientele. As of early 2024, RHB operates over 180 branches across Malaysia, underscoring their commitment to physical accessibility.

These branches are undergoing strategic re-engineering to optimize customer experience, focusing on seamless, straight-through processing for those who prefer face-to-face interactions. This initiative aims to enhance efficiency and convenience within the physical banking environment. For instance, the bank has been investing in digitalizing branch operations to speed up common transactions like account opening and loan applications.

This robust physical infrastructure is crucial for maintaining accessibility, particularly for customers who may not be fully comfortable or equipped to rely solely on digital banking channels. It provides a vital touchpoint for a diverse customer base, reinforcing RHB's commitment to inclusive banking services in 2024 and beyond.

RHB Bank's digital channels are a cornerstone of its marketing strategy, with RHB Online and Mobile Banking apps experiencing significant growth in user adoption and transaction volume. By the end of 2024, the bank reported that over 70% of its customer transactions were conducted digitally, a testament to the convenience and effectiveness of these platforms.

These digital touchpoints are not just for basic banking; they are crucial for communication, driving sales through targeted offers, and providing seamless customer service. This focus aligns with RHB's commitment to accelerating its digital transformation, a key pillar of its corporate strategy moving into 2025.

RHB Bank complements its branch and digital offerings with an extensive network of ATMs and CDMs, ensuring customers have convenient access to cash transactions and essential banking services anytime. This physical presence is crucial for customers who prefer or require in-person interactions, especially outside of traditional banking hours. For instance, as of early 2024, RHB maintained a significant ATM network across Malaysia, facilitating millions of transactions monthly, underscoring its commitment to accessibility.

Partnerships and Ecosystem Expansion

RHB Bank actively cultivates strategic alliances with fintech innovators and other key players to broaden its service scope and customer base. A prime example is its involvement in the Boost-RHB Digital Bank consortium, which is designed to tap into previously unreached market segments, particularly those in unserved and underserved communities. This approach leverages technological advancements and expanded networks to enhance financial inclusion.

These collaborations are instrumental in extending RHB's market footprint beyond its conventional banking channels, fostering growth and innovation. By partnering, RHB can offer more specialized and accessible financial solutions. For instance, in 2024, RHB announced a collaboration with a leading digital payments provider to enhance its mobile banking experience, aiming to onboard an additional 500,000 new users by the end of 2025. This strategy directly addresses the need to serve a wider demographic, including youth and small business owners who may not be fully integrated into traditional banking systems.

- Strategic Fintech Alliances: RHB partners with fintech firms to integrate cutting-edge technology into its offerings.

- Digital Bank Consortiums: Participation in initiatives like the Boost-RHB Digital Bank consortium aims to serve unbanked populations.

- Market Reach Expansion: Collaborations extend RHB's presence into new customer segments and geographical areas.

- Financial Inclusion Goals: Partnerships are key to achieving greater financial inclusion, especially for underserved communities.

Regional and International Presence

RHB Bank’s regional and international presence extends beyond Malaysia, with significant operations in key Southeast Asian markets including Singapore, Cambodia, Indonesia, and Thailand. This strategic expansion allows RHB to cater to a broader base of international clients by offering specialized commercial and investment banking solutions. The bank’s commitment to regional growth is exemplified by its Singapore unit, which actively promotes a unified Malaysia-Singapore hub for major corporate clients, leveraging the strengths of both markets.

In 2023, RHB Bank reported its international operations contributed a notable portion to its overall performance, underscoring the importance of its regional footprint. For instance, the bank’s efforts in Singapore are geared towards capturing opportunities from cross-border trade and investment flows within ASEAN. This focus on building a cohesive regional platform aims to enhance service delivery and product offerings for multinational corporations and sophisticated investors operating across these diverse economies.

- Regional Footprint: Operations in Singapore, Cambodia, Indonesia, and Thailand.

- Targeted Offerings: Commercial and investment banking products tailored for international clients.

- Strategic Hub: Singapore unit promoting a Malaysia-Singapore hub for large corporate clients.

- Performance Contribution: International business segment is a key driver of RHB's overall financial results.

RHB Bank's Place strategy encompasses a multi-channel approach, blending a robust physical branch network with advanced digital platforms and strategic partnerships. This ensures accessibility for a diverse customer base, catering to both traditional and modern banking preferences. The bank's commitment to physical presence is evident in its extensive Malaysian branch network, which is actively being optimized for enhanced customer experience and efficiency.

Digital channels, including the RHB Online and Mobile Banking apps, are central to the bank's growth, with a significant majority of transactions now occurring digitally. This digital focus is further amplified by a widespread ATM and CDM network, guaranteeing 24/7 access to essential banking services. Strategic alliances with fintech firms and participation in digital bank consortiums, such as Boost-RHB, are expanding RHB's reach and promoting financial inclusion.

Furthermore, RHB's regional presence in key Southeast Asian markets like Singapore, Cambodia, Indonesia, and Thailand allows it to serve international clients with tailored commercial and investment banking solutions, reinforcing its position as a significant regional player. This comprehensive 'Place' strategy ensures RHB remains a convenient and accessible banking partner across multiple touchpoints.

| Channel | Description | Key Data/Initiative (as of early 2024/2025) |

|---|---|---|

| Physical Branches | Extensive network for traditional banking and direct support. | Over 180 branches in Malaysia; strategic re-engineering for digital integration and efficiency. |

| Digital Platforms | RHB Online and Mobile Banking apps for seamless transactions and service. | Over 70% of customer transactions conducted digitally by end of 2024; focus on user adoption and growth. |

| ATMs & CDMs | 24/7 access to cash transactions and essential banking services. | Significant ATM network across Malaysia facilitating millions of transactions monthly. |

| Strategic Alliances | Partnerships with fintechs and participation in digital bank consortia. | Boost-RHB Digital Bank consortium; collaboration with digital payments provider targeting 500,000 new users by end of 2025. |

| Regional Presence | Operations in Singapore, Cambodia, Indonesia, and Thailand. | Promoting Malaysia-Singapore hub for corporate clients; international operations contributed notably to performance in 2023. |

What You Preview Is What You Download

RHB Bank 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive RHB Bank 4P's Marketing Mix Analysis covers Product, Price, Place, and Promotion strategies in detail. You'll gain immediate access to this ready-to-use analysis upon completing your order.

Promotion

RHB Bank's 'Together We Progress' branding directly reflects its corporate strategy, 'Together We Progress 2024' (TWP24), and the forward-looking 'PROGRESS27' roadmap. This consistent messaging highlights the bank's dedication to service excellence and empowering its customers to achieve their financial goals. RHB aims to build significant brand awareness and equity through campaigns that demonstrate this commitment to progress for all stakeholders.

RHB Bank leverages digital marketing extensively, utilizing platforms like Facebook, YouTube, Twitter, and Instagram for promotions. Their festive advertisements and social media campaigns garner significant viewership, demonstrating strong digital reach.

These channels are vital for fostering customer engagement and interaction, enabling direct feedback and dialogue. For instance, in 2024, RHB's social media engagement saw a notable increase in user-generated content during key campaigns.

The bank's digital strategy emphasizes authentic, believable, and humble communication. This approach aims to build a deeper, more meaningful connection with their customer base, resonating with their values.

RHB Bank leverages content-driven storytelling, particularly through heartwarming short films, to forge strong connections with Malaysian audiences, especially during key festive periods. These narratives often draw inspiration from true stories, fostering an emotional resonance that goes beyond typical product advertising.

A prime example is the 2024 Raya campaign, 'Lembaran Baharu,' which aimed to inspire viewers and subtly underscore RHB's dedication to community development and sustainable progress. This approach strategically positions the bank as a values-driven institution.

By focusing on emotional engagement and showcasing its core values, RHB Bank effectively builds brand loyalty and trust, demonstrating a commitment to societal well-being that aligns with its long-term business objectives.

Public Relations and CSR Initiatives

RHB Bank actively cultivates its brand reputation and community presence through strategic public relations and Corporate Social Responsibility (CSR) efforts. These initiatives are designed to showcase the bank's commitment to positive societal impact, fostering trust and goodwill among stakeholders.

The bank's dedication to environmental, social, and governance (ESG) principles is clearly articulated in its sustainability reporting. For instance, RHB's 2023 Sustainability Report highlighted a 15% reduction in its operational carbon footprint compared to 2022, underscoring its proactive approach to environmental stewardship.

These CSR activities go beyond mere philanthropy, aiming to build enduring relationships and demonstrate RHB's value as a responsible corporate citizen. Examples include their financial literacy programs, which reached over 50,000 participants in 2024, and their community development projects, contributing to local infrastructure improvements.

- Brand Enhancement: PR and CSR activities bolster RHB's image as a trustworthy and community-focused financial institution.

- ESG Commitment: The bank's sustainability reports, like the 2023 edition detailing a 15% carbon footprint reduction, showcase its dedication to ESG performance.

- Community Impact: Initiatives such as financial literacy programs, which engaged 50,000 individuals in 2024, demonstrate tangible positive effects beyond core banking services.

- Stakeholder Trust: By highlighting its responsible practices and community contributions, RHB aims to build and maintain strong trust with customers, investors, and the wider public.

Product-Specific Campaigns and Incentives

RHB Bank actively employs product-specific campaigns and incentives to boost customer engagement and drive the adoption of its digital services. For instance, the 'Banking Digitally with RHB' campaign in late 2024 offered attractive cashback rewards for performing digital transactions, directly encouraging the use of services like DuitNow QR payments and online banking logins.

These targeted promotions are crucial for increasing sales volumes for specific products and deepening customer relationships with particular banking solutions. For example, a 2024 campaign focused on increasing RHB's credit card sign-ups saw a 15% uplift in new accounts during the promotion period.

- Digital Transaction Incentives: Campaigns like 'Banking Digitally with RHB' provide cashback for using digital channels.

- Service Adoption Focus: Promotions aim to increase usage of services such as DuitNow QR and online banking.

- Sales and Engagement Goals: These tactics are designed to directly boost sales and deepen customer interaction with specific RHB offerings.

RHB Bank's promotional efforts are deeply integrated with its digital-first strategy, using platforms like social media and content marketing to connect with audiences. Their campaigns, such as the 2024 Raya initiative 'Lembaran Baharu,' focus on emotional storytelling and community values to build brand loyalty.

The bank also employs targeted product promotions, like the 'Banking Digitally with RHB' campaign in late 2024, offering cashback incentives to drive digital transaction adoption. This strategic approach aims to boost sales for specific offerings and deepen customer engagement with RHB's digital services.

Furthermore, RHB leverages public relations and CSR activities, including financial literacy programs that reached over 50,000 participants in 2024, to enhance its reputation as a responsible corporate citizen. These efforts reinforce brand trust and showcase a commitment to societal well-being, aligning with their ESG principles, as evidenced by a 15% reduction in operational carbon footprint reported in 2023.

Price

RHB Bank is actively positioning itself with competitive interest rates on loans and deposits, aiming to capture a larger market share. For instance, as of early 2024, their fixed deposit rates for a 12-month term were observed to be around 3.50% p.a., which is competitive within the Malaysian banking sector.

The bank also emphasizes transparent fee structures for its diverse banking services, ensuring customers understand the costs associated with transactions and account management. This transparency is crucial for building trust and retaining clients in a competitive financial landscape.

RHB's pricing strategy is carefully calibrated to maintain a healthy net interest margin, projected to be in the range of 2.0% to 2.2% for 2024, while simultaneously ensuring its offerings remain attractive against rivals. This balance between profitability and market competitiveness is key to their sustained growth.

RHB Bank employs a tailored pricing strategy to cater to its diverse customer base. This approach recognizes that different segments, from individual premier clients to small and medium enterprises (SMEs) and large corporations, have distinct financial needs and sensitivities. For example, premium banking clients might benefit from preferential rates or bundled service packages, while SME financing options are structured to support business growth with competitive interest rates and flexible repayment terms.

This segmentation allows RHB to optimize its product offerings and ensure competitive attractiveness across the board. A prime example is the RHB Reflex Premium Plus, a business banking solution designed to provide enhanced value through advanced automation and seamless integration, reflecting a pricing model that aligns with the sophisticated needs of its corporate clientele.

RHB Bank actively uses promotional pricing to drive customer engagement. For instance, in 2024, they ran campaigns offering cashback on digital transactions, directly incentivizing the use of their online platforms. These short-term price adjustments are a key tactic to attract new customers and boost the adoption of specific banking services.

Value-Based Pricing for Integrated Solutions

RHB Bank employs value-based pricing for its integrated solutions, particularly in the business and corporate banking sectors. This strategy centers on the overall benefits and efficiencies these solutions deliver to clients, rather than focusing solely on individual transaction costs. For instance, the RHB Reflex platform, a suite of integrated financial management tools, aims to generate substantial operational savings and provide valuable business insights.

This approach highlights the long-term value proposition, aligning pricing with the tangible advantages clients receive.

- Focus on Total Benefits: Pricing reflects the collective advantages of integrated financial management tools.

- Operational Efficiency Gains: Solutions like RHB Reflex are designed to reduce operational costs for businesses.

- Long-Term Value Proposition: The strategy emphasizes sustained client value over short-term transaction fees.

- Client-Centric Approach: Pricing is directly linked to the efficiencies and insights the platform provides to the client's business.

Consideration of Market and Economic Factors

RHB Bank's pricing strategy is deeply intertwined with external market and economic forces. They actively monitor competitor pricing and shifts in market demand to ensure their product offerings remain competitive and appealing. For instance, during periods of anticipated economic slowdown, RHB might adjust interest rates on loans or savings products to remain attractive to customers seeking stability or value.

The bank's financial reports and strategic outlooks consistently highlight how projected economic growth and prevailing market trends directly inform their pricing decisions. This proactive stance allows RHB to remain agile, adapting its pricing structures to navigate the dynamic financial landscape effectively. For example, if forecasts indicate a rise in inflation, RHB might adjust its deposit rates to better reflect the changing cost of money.

RHB's pricing policies are designed to be both competitive and accessible, a balancing act influenced by several key factors:

- Competitor Pricing: RHB analyzes the pricing of similar financial products offered by its rivals to maintain market share and attract new customers.

- Market Demand: The bank assesses the current demand for its services, adjusting prices to reflect consumer needs and willingness to pay.

- Economic Conditions: RHB considers broader economic factors like inflation, interest rate movements, and GDP growth when setting prices for its various financial products and services.

RHB Bank's pricing strategy is multifaceted, aiming for competitiveness and value across its offerings. They leverage promotional pricing, such as cashback on digital transactions in early 2024, to drive adoption of specific services.

Value-based pricing is applied to integrated solutions, with platforms like RHB Reflex designed to deliver operational efficiencies and insights, justifying their cost through tangible client benefits.

The bank strategically calibrates pricing to maintain healthy net interest margins, targeting a 2.0% to 2.2% range for 2024, while ensuring its deposit and loan rates, like a 3.50% p.a. for 12-month fixed deposits in early 2024, remain attractive.

RHB Bank's pricing is dynamic, influenced by competitor actions, market demand, and economic conditions, ensuring their financial products remain appealing and accessible in a fluctuating market.

| Pricing Tactic | Example/Observation (2024) | Objective |

|---|---|---|

| Competitive Interest Rates | ~3.50% p.a. on 12-month fixed deposits | Market share capture, customer attraction |

| Promotional Pricing | Cashback on digital transactions | Drive digital platform usage, acquire new customers |

| Value-Based Pricing | RHB Reflex integrated solutions | Highlight operational efficiencies and client insights |

| Transparent Fee Structures | Clear cost disclosure for services | Build trust, client retention |

4P's Marketing Mix Analysis Data Sources

Our RHB Bank 4P's Marketing Mix Analysis is meticulously constructed using official financial disclosures, annual reports, investor presentations, and press releases. We also incorporate data from RHB Bank's official website, customer reviews, and reputable financial news outlets to ensure a comprehensive understanding of their strategies.