RHB Bank Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

RHB Bank Bundle

RHB Bank operates within a dynamic financial landscape, where the intensity of competition is shaped by several key forces. Understanding the bargaining power of buyers, the threat of new entrants, and the influence of suppliers is crucial for navigating this market.

The complete report reveals the real forces shaping RHB Bank’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Depositors, the primary source of capital for RHB Bank, hold significant bargaining power. This power is amplified in a competitive market where multiple financial institutions actively seek deposits. For instance, as of early 2024, deposit growth across Malaysian banks remained robust, indicating a healthy competition for customer funds, which directly impacts RHB's cost of capital.

The ease with which depositors can move their funds to institutions offering more attractive rates or better services directly influences their leverage. Large corporate and institutional depositors, in particular, can command higher interest rates, thereby increasing their bargaining power and the cost of funding for RHB Bank.

RHB Bank's reliance on technology and software providers for critical functions like core banking, digital interfaces, and cybersecurity means these suppliers can hold considerable sway. Specialized or proprietary software, particularly if it's complex to integrate with existing systems, amplifies this supplier power.

The significant costs and operational disruptions associated with switching technology vendors further bolster the bargaining position of these software and technology providers. In 2024, the global IT spending for financial services was projected to reach over $600 billion, highlighting the substantial market for these essential services.

Skilled employees, especially in digital banking, data science, cybersecurity, and financial advisory, are key suppliers of expertise for RHB Bank. A market shortage or high demand for these specialized skills significantly boosts their bargaining power. This can translate into increased salary expectations and more challenging recruitment processes for the bank.

Regulatory Bodies

Regulatory bodies, such as Bank Negara Malaysia (BNM), act as powerful forces influencing RHB Bank's operations. While not direct suppliers of goods, they dictate the rules of engagement, including capital adequacy ratios and compliance standards. For instance, BNM's ongoing efforts to strengthen financial sector resilience through enhanced capital requirements can increase the cost of doing business for banks like RHB.

These regulations significantly impact RHB Bank's strategic flexibility and profitability. BNM’s focus on digital banking and cybersecurity, for example, necessitates substantial investment in technology, directly affecting operational costs and business model evolution. Failure to comply can result in penalties, further underscoring the bargaining power of these regulatory entities.

- Capital Requirements: BNM mandates specific capital adequacy ratios, influencing how much capital RHB Bank must hold, thereby impacting its lending capacity and profitability.

- Compliance Standards: Adherence to evolving compliance rules, such as those related to Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, adds operational complexity and cost.

- Operational Guidelines: BNM's directives on risk management, consumer protection, and operational resilience shape RHB Bank's business practices and investment priorities.

- Monetary Policy: BNM's decisions on interest rates and liquidity directly affect RHB Bank's net interest margins and funding costs.

Interbank Market and Capital Markets

RHB Bank, like many financial institutions, relies on the interbank market and capital market instruments such as bonds to secure funding and liquidity. The cost and availability of these crucial resources are directly shaped by broader economic factors, central bank interest rate decisions, and RHB Bank's own perceived creditworthiness.

Suppliers in these markets, which include other banks and large institutional investors, wield considerable bargaining power. This power is amplified when market liquidity is scarce or when there's a heightened perception of risk associated with the banking sector. For instance, during periods of economic uncertainty, the cost of borrowing for banks can surge as lenders demand higher premiums for perceived risk.

- Interbank Market Dependence: RHB Bank sources significant funding from interbank markets, making it susceptible to the pricing power of other financial institutions.

- Capital Market Access: Issuing bonds and other debt instruments means RHB Bank must contend with the demands of institutional investors who set terms based on market conditions and the bank's financial health.

- Macroeconomic Influence: Interest rate policies set by central banks directly impact the cost of funds, giving policymakers indirect bargaining power over RHB Bank's funding expenses.

- Creditworthiness as Leverage: A strong credit rating enhances RHB Bank's ability to secure favorable terms, while a weaker rating increases its borrowing costs, demonstrating the suppliers' leverage.

RHB Bank faces significant bargaining power from its depositors, who are the primary source of its capital. This is especially true in a competitive banking landscape where institutions vie for customer funds, as evidenced by continued robust deposit growth across Malaysian banks in early 2024. Large corporate and institutional depositors, in particular, can leverage their substantial balances to negotiate higher interest rates, directly impacting RHB's funding costs.

Technology and software providers also exert considerable influence due to RHB Bank's reliance on specialized systems for core operations, digital services, and cybersecurity. The cost and complexity of switching vendors, coupled with substantial global IT spending in financial services projected to exceed $600 billion in 2024, reinforce the bargaining power of these essential suppliers.

Skilled human capital, particularly in areas like digital banking, data science, and cybersecurity, acts as another critical supplier. High demand and market shortages for these specialized skills empower employees to negotiate higher salaries and better working conditions, increasing recruitment and retention costs for RHB Bank.

Regulatory bodies like Bank Negara Malaysia (BNM) wield significant power by dictating operational frameworks, capital requirements, and compliance standards. BNM's directives, such as those aimed at strengthening financial sector resilience through enhanced capital adequacy ratios, directly influence RHB Bank's operational costs and strategic flexibility.

| Supplier Type | Key Influence | Example Impact on RHB Bank (2024 Context) |

|---|---|---|

| Depositors | Interest rate demands, ease of fund transfer | Increased cost of funds due to competition for deposits |

| Technology Providers | Specialized software, switching costs | Higher IT expenditure, potential for vendor lock-in |

| Skilled Employees | Demand for specialized skills, market shortages | Increased salary costs, recruitment challenges |

| Regulatory Bodies (BNM) | Capital requirements, compliance standards | Higher operational costs, need for strategic adaptation |

What is included in the product

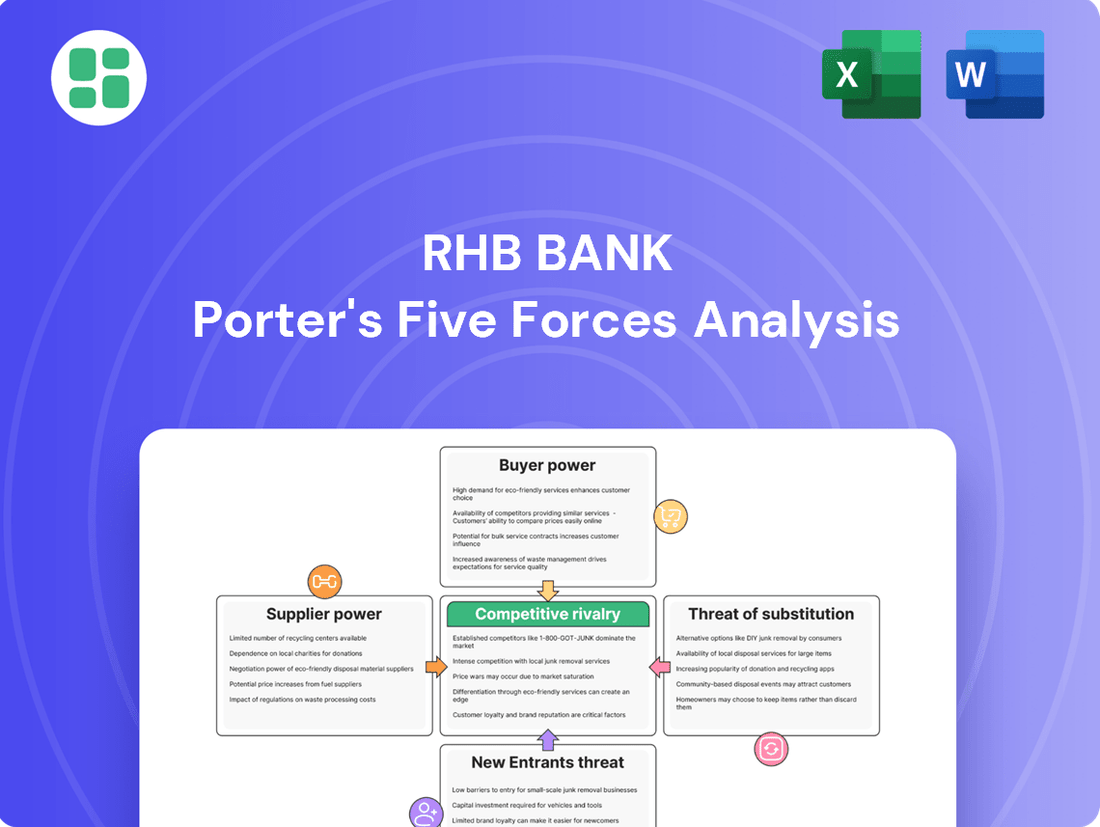

This Porter's Five Forces analysis for RHB Bank dissects the competitive intensity, buyer and supplier power, threat of new entrants, and the risk of substitutes within the Malaysian banking sector.

Effortlessly identify and address competitive threats by visualizing the intensity of each of Porter's Five Forces, enabling RHB Bank to proactively mitigate risks and capitalize on opportunities.

Customers Bargaining Power

Retail customer mobility significantly influences bargaining power. With low switching costs for everyday banking, customers can easily move between institutions, especially with the rise of digital platforms facilitating product comparisons. For instance, in 2023, the average customer held accounts at 2.5 different financial institutions, highlighting a degree of dispersion.

While banks implement loyalty programs and bundle services to retain customers, the sheer number of competitors, including neobanks and fintech firms, means customers retain considerable choice. This competitive landscape, evident in the over 4,500 commercial banks operating in the US as of early 2024, ensures that customer preferences and pricing demands are key considerations.

Small and Medium Enterprises (SMEs) and other business clients wield considerable bargaining power, often exceeding that of individual retail customers. This is particularly true for businesses with substantial transaction volumes or intricate financing requirements.

These clients actively pursue competitive lending rates and tailored financial solutions. For instance, in 2024, the average SME loan rate in Malaysia hovered around 5-7%, creating a competitive landscape where banks must offer attractive terms to retain these valuable customers.

Their willingness to switch banks for superior terms or enhanced service quality means financial institutions must prioritize relationship management and offer differentiated products to maintain loyalty and market share.

Large corporate and institutional clients hold considerable sway with banks like RHB due to the sheer scale of their business. These clients often manage vast sums, giving them the leverage to demand tailored financial solutions and competitive pricing. For instance, a major corporation seeking a syndicated loan or complex treasury services can negotiate terms that might not be available to smaller clients.

Their ability to switch banking partners also amplifies their bargaining power. Many institutional clients maintain relationships with several financial institutions, allowing them to pit banks against each other to secure the best rates and service packages. This competitive dynamic pressures banks to offer concessions, whether it's on fees for investment banking services or interest rates for large credit facilities, ultimately impacting RHB's profitability.

Digital Empowerment and Information Asymmetry Reduction

The rise of digital banking and financial comparison sites has significantly boosted customer power. These platforms offer unprecedented transparency into product features, interest rates, and fees across various financial institutions, including RHB Bank. This leveling of the information playing field means customers can easily identify the best deals, forcing banks to compete more aggressively on price and service.

- Increased Transparency: Digital tools allow customers to compare loans, deposits, and other financial products from multiple providers side-by-side.

- Informed Decision-Making: Access to comprehensive data empowers consumers to select offerings that best suit their needs and financial goals.

- Competitive Pressure: Banks are compelled to offer more attractive rates and innovative digital solutions to retain and attract customers in this transparent environment.

- Digital Experience Demand: Customers now expect seamless, user-friendly digital interfaces, pushing banks to invest heavily in their online and mobile platforms.

Product Complexity and Customization Needs

For highly complex financial products like bespoke corporate finance or intricate wealth management, customers often have limited direct bargaining power. This is because these services demand specialized knowledge and a deep understanding of financial markets, which not all clients possess. For instance, a small business owner might not have the expertise to negotiate terms for a complex syndicated loan as effectively as a large multinational corporation. In 2024, the demand for specialized financial advice remained strong, with many clients relying on the expertise of institutions like RHB Bank for navigating intricate financial landscapes.

However, a customer's bargaining power can significantly increase when dealing with complex offerings if they represent a substantial client base or have the capacity to demand highly customized solutions. This is particularly true if there are several other financial institutions capable of providing similar sophisticated services. For example, a large institutional investor seeking tailored derivatives strategies might have considerable leverage if multiple investment banks can meet their specific needs. The global investment banking sector, valued at hundreds of billions of dollars annually, often sees sophisticated clients dictating terms due to the competitive landscape.

- Customer Bargaining Power in Complex Financial Products: For specialized services like corporate finance or wealth management, customers typically have less direct bargaining power due to the high level of expertise required.

- Factors Increasing Customer Power: Bargaining power rises for large, sophisticated clients who can demand tailored solutions or when multiple providers can offer similar complex services.

- Market Dynamics in 2024: The demand for specialized financial expertise remained robust in 2024, with sophisticated clients leveraging competitive markets to negotiate terms for complex financial instruments.

The bargaining power of customers for RHB Bank is generally high, driven by low switching costs for retail banking and increasing transparency through digital platforms. This allows customers to easily compare offerings and move between institutions, forcing banks to compete on price and service.

While individual retail customers have significant power due to ease of switching, business clients, especially SMEs and large corporations, wield even greater influence. They can negotiate better rates and tailored solutions due to their transaction volumes and the competitive nature of the market for these services.

However, for highly complex financial products, direct customer bargaining power can be limited due to the specialized knowledge required. Yet, for large, sophisticated clients or when multiple providers offer similar complex services, this power can increase significantly.

| Customer Segment | Bargaining Power Factors | Impact on RHB Bank |

|---|---|---|

| Retail Customers | Low switching costs, digital comparison tools | Pressure on pricing, need for user-friendly digital services |

| SMEs | Transaction volume, need for tailored solutions | Competition on lending rates (e.g., 5-7% in Malaysia 2024), relationship management |

| Large Corporations | Scale of business, ability to switch partners | Negotiation of terms for syndicated loans, treasury services, and investment banking fees |

| Sophisticated Clients (Complex Products) | Specialized knowledge, multiple provider options | Leverage in negotiating bespoke financial strategies, derivatives |

Same Document Delivered

RHB Bank Porter's Five Forces Analysis

This preview showcases the complete RHB Bank Porter's Five Forces Analysis, offering a thorough examination of competitive forces within the banking sector. The document you see here is precisely what you will receive immediately after purchase, ensuring full transparency and immediate access to this professionally formatted strategic tool.

Rivalry Among Competitors

The Malaysian banking landscape is dominated by major players like Maybank, CIMB, and Public Bank, creating a highly competitive arena. RHB Bank faces intense rivalry from these established institutions, which possess significant brand recognition and customer loyalty. This forces RHB to continuously enhance its services and digital offerings to stand out.

The banking sector is experiencing an aggressive digital transformation race, intensifying competitive rivalry. Banks are pouring significant resources into improving their mobile apps, online services, and digital payment capabilities to attract and retain customers. This focus on digital innovation means banks are constantly vying to offer smoother user experiences, cutting-edge features, and tailored services, making digital prowess a crucial differentiator.

RHB Bank faces intense competition on both price and product offerings. Banks frequently adjust interest rates on loans and deposits to attract customers, and their fee structures for services are also a key battleground. For instance, in 2024, the average personal loan interest rate in Malaysia, RHB's primary market, hovered around 4.9% to 15.5%, creating a dynamic pricing environment.

Beyond just pricing, the competition extends to the sheer variety and quality of products. RHB strives to offer a comprehensive suite of financial solutions, from basic savings accounts for individuals to complex trade finance and investment banking services for corporations. This breadth ensures they can cater to a wide spectrum of customer needs, aiming to be a one-stop shop for financial services.

Customer Acquisition and Retention Efforts

RHB Bank, like its peers, faces intense competition in acquiring and retaining customers. This is evident in the aggressive marketing campaigns and loyalty programs banks deploy to attract new clients and keep existing ones engaged. The ease with which customers can switch between financial institutions for many standard services means banks must constantly innovate their offerings and enhance customer experience to maintain market share.

The drive for customer acquisition and retention is a significant factor in the competitive rivalry within the banking sector. Banks are investing heavily in digital transformation and personalized services to differentiate themselves. For instance, many banks in 2024 are focusing on seamless onboarding processes and proactive customer support to build stronger relationships.

- Customer Acquisition Costs: Banks often spend considerable amounts on advertising, promotions, and referral bonuses to attract new customers, impacting profitability.

- Customer Lifetime Value: Retaining customers is crucial as it significantly reduces the need for costly acquisition efforts and builds a stable revenue stream.

- Digital Channels: The shift towards digital banking has intensified rivalry, with banks competing on the user-friendliness and feature richness of their mobile apps and online platforms.

- Personalization: Tailoring financial products and advice based on individual customer data is becoming a key differentiator in retaining clients.

Regulatory and Market Share Dynamics

The regulatory landscape for banks like RHB in Malaysia, while generally stable, significantly shapes competitive rivalry. Regulations often dictate capital requirements, lending practices, and operational standards, influencing how banks compete and potentially encouraging consolidation. For instance, Bank Negara Malaysia’s prudential framework ensures financial stability but also sets the playing field for all players.

Banks are locked in intense competition for market share across a diverse range of financial products. This includes vying for dominance in areas such as retail banking, mortgages, auto financing, and especially the lucrative SME and corporate lending segments. RHB Bank, like its peers, constantly strategizes to attract and retain customers, with market share gains serving as a critical metric for success and a testament to its competitive prowess.

- Market Share Focus: Banks actively compete for market share across various segments, making gains a key indicator of competitive success.

- Regulatory Influence: The stable regulatory environment sets standards and can encourage consolidation or specific market behaviors.

- Segment Competition: Competition is fierce in areas like mortgages, auto loans, SME financing, and corporate lending.

Competitive rivalry is a defining characteristic of the Malaysian banking sector, with RHB Bank facing formidable opposition from established giants like Maybank, CIMB, and Public Bank. This intense competition is fueled by a relentless pursuit of market share across all financial product segments, from retail banking and mortgages to corporate lending. Banks are actively engaged in a digital transformation race, pouring resources into mobile apps and online services to enhance customer experience and offer seamless digital solutions, making digital prowess a critical differentiator.

| Metric | RHB Bank Peers (Approximate 2024 Data) | Significance for RHB |

|---|---|---|

| Market Share (Retail Deposits) | Maybank: ~20-25%, CIMB: ~15-20%, Public Bank: ~15-20% | RHB needs to innovate to capture share from larger players. |

| Digital Transaction Growth | Industry average: ~30-40% YoY | RHB must match or exceed this to remain competitive. |

| Personal Loan Interest Rates | Range: 4.9% - 15.5% | Pricing strategies are crucial for customer acquisition. |

SSubstitutes Threaten

The most potent threat of substitution for RHB Bank originates from non-bank fintech firms providing digital payment solutions, e-wallets, and peer-to-peer lending. These platforms increasingly allow consumers to bypass traditional banking channels for everyday transactions, diminishing reliance on conventional bank accounts. For instance, the global digital payments market was valued at over $2.5 trillion in 2023 and is projected to grow significantly, indicating a substantial shift in how consumers manage their money.

Non-bank financial institutions and independent asset managers present a significant threat of substitution for traditional banking services. These entities, like insurance companies offering investment-linked products or specialized wealth management firms, can cater to specific customer needs, such as investment growth or retirement planning, without requiring a full banking relationship. For instance, the global asset management industry saw significant growth, with assets under management reaching an estimated $135.5 trillion in 2023, indicating a strong market for alternative investment vehicles.

Large corporations increasingly bypass traditional banking channels by accessing capital markets directly. For instance, in 2024, global bond issuance by corporations reached significant levels, offering an alternative to bank loans for major fundraising needs. This trend is particularly pronounced for companies with strong credit profiles, allowing them to secure capital more efficiently and often at lower costs.

Emergence of Blockchain and Cryptocurrency Solutions

The emergence of blockchain and cryptocurrency solutions poses a nascent but growing threat of substitutes for traditional banking services. While widespread adoption for daily transactions remains limited, these decentralized technologies offer potential alternatives for remittances, cross-border payments, and lending, often at lower costs. As of early 2024, the global cryptocurrency market capitalization fluctuated, but the underlying technology continues to mature, indicating a long-term disruptive potential.

The evolving regulatory landscape for digital assets is a key factor in assessing this threat. Countries are actively developing frameworks, which could either legitimize or restrict these alternatives. For instance, El Salvador's adoption of Bitcoin as legal tender in 2021 highlights the varying approaches to cryptocurrency integration, signaling a dynamic environment that banks must monitor.

- Decentralized Finance (DeFi): DeFi platforms offer lending, borrowing, and trading services without traditional intermediaries, potentially capturing market share from banks.

- Cryptocurrency Remittances: Services like Ripple aim to facilitate faster and cheaper cross-border payments compared to traditional wire transfers, impacting a core banking revenue stream.

- Stablecoins: These cryptocurrencies pegged to stable assets could become viable alternatives for digital transactions and store of value, challenging traditional deposit services.

- Regulatory Uncertainty: The lack of uniform global regulation creates both opportunities and risks for crypto solutions, influencing their adoption rate as substitutes.

Informal Financial Channels

Informal financial channels, such as peer-to-peer lending or community savings groups, can act as substitutes for traditional banking services, especially in segments requiring micro-financing or rapid personal loans. While these alternatives may not directly challenge RHB Bank's primary operations, they offer viable options for specific customer demographics seeking quick, accessible funding.

For instance, in Malaysia, the prevalence of informal credit providers, while difficult to quantify precisely, caters to a significant portion of the population, particularly small businesses and individuals without extensive credit histories. These channels often bypass the stringent requirements of formal institutions, making them an attractive alternative for immediate needs.

- Informal lending in Southeast Asia, including Malaysia, often fills gaps left by formal financial institutions, providing accessible credit to underserved populations.

- The reliance on informal channels can be higher in regions with lower financial inclusion rates, impacting the demand for traditional banking products.

- While direct competition is limited, these informal networks represent a behavioral substitute, influencing customer choices for certain financial transactions.

The threat of substitutes for RHB Bank is multifaceted, with fintech innovations and alternative financial channels posing significant challenges. Digital payment platforms and peer-to-peer lending services allow consumers to bypass traditional banking for everyday transactions. For example, the global digital payments market exceeded $2.5 trillion in 2023, highlighting a substantial shift in consumer financial behavior.

Non-bank financial institutions and direct access to capital markets by corporations also present viable alternatives. In 2024, corporate bond issuance remained robust, providing companies with efficient fundraising options outside of traditional bank loans. Furthermore, decentralized finance (DeFi) and cryptocurrency solutions, while still evolving, offer potential for cheaper and faster cross-border payments and lending, impacting core banking revenue streams.

| Substitute Area | Example | Market Size/Growth Indicator (2023/2024 Data) | Impact on RHB Bank |

|---|---|---|---|

| Digital Payments & Wallets | Fintech payment apps | Global digital payments market >$2.5 trillion (2023) | Reduced reliance on traditional accounts for transactions |

| Alternative Investment | Asset managers, insurance products | Global asset management AUM ~$135.5 trillion (2023) | Competition for wealth management and savings |

| Corporate Capital Markets | Direct bond issuance | Significant global corporate bond issuance (2024) | Reduced demand for corporate lending |

| Decentralized Finance (DeFi) | Lending, borrowing platforms | Nascent but growing, potential for lower-cost cross-border payments | Disruption of payment and lending services |

Entrants Threaten

The Malaysian banking sector presents a formidable threat of new entrants due to significant regulatory barriers and substantial capital requirements. Bank Negara Malaysia (BNM) enforces rigorous licensing procedures, demanding considerable financial resources and adherence to strict compliance standards. For instance, as of late 2023, the minimum capital fund requirement for a commercial bank in Malaysia was RM100 million, a figure that can deter many aspiring players.

Establishing a full-service banking operation necessitates enormous capital for physical branches, ATM networks, and sophisticated IT systems. This significant barrier deters many potential new entrants.

While digital banks can reduce some infrastructure costs, building widespread trust and customer reach is a persistent hurdle. For instance, in 2024, the average cost to open a new bank branch can range from $2 million to $5 million, not including ongoing operational expenses.

Existing banks like RHB Bank have cultivated significant brand loyalty and customer trust, a major barrier for new entrants. For instance, RHB's long-standing presence in Malaysia, dating back to 1886, has allowed it to build a deep reservoir of customer confidence, making it difficult for newcomers to attract and retain clients. This established reputation means potential new players must invest heavily in marketing and service to even begin chipping away at existing relationships.

Economies of Scale and Experience Curve

Established banks like RHB Bank leverage substantial economies of scale, particularly in technology investment and operational efficiency, which new entrants find challenging to replicate. For instance, in 2024, major banking groups continued to invest billions in digital transformation and cybersecurity, creating a high barrier to entry for smaller, less capitalized firms.

The experience curve also plays a critical role; incumbent banks have honed their risk management and customer service processes over decades, leading to lower operating costs per transaction. A new bank would need considerable time and capital to build a comparable level of expertise and efficiency, making it difficult to compete on price or service quality from the outset.

- Economies of Scale: Incumbent banks benefit from massive scale in IT infrastructure, marketing, and compliance, leading to lower per-unit costs.

- Experience Curve: Decades of operational experience allow established banks to optimize processes and reduce errors, enhancing profitability.

- Capital Requirements: The sheer capital needed to build a comparable operational and technological infrastructure is a significant deterrent for new market entrants.

- Brand Loyalty and Trust: Long-standing institutions often enjoy higher levels of customer trust and loyalty, which are difficult for new players to quickly establish.

Emergence of Digital Bank Licenses

While traditional banking faces significant hurdles for new competitors, the recent introduction of digital bank licenses by Bank Negara Malaysia (BNM) presents a distinct pathway for entry. These licenses, though carefully regulated, allow for the establishment of specialized banking operations.

These digital banks, even with their limited initial numbers, are a tangible threat. They often target specific customer segments that may be underserved by conventional banks, employing technology to deliver innovative and cost-effective financial solutions. For instance, by operating with a leaner cost structure, they can offer more competitive pricing on services.

- Digital Bank Licenses: BNM's framework allows for new, technology-focused banking entrants.

- Targeted Segments: Digital banks often focus on niche markets or specific customer needs.

- Innovation & Cost: Leverage technology to offer novel services and potentially lower fees compared to incumbents.

- Disruptive Potential: Can challenge traditional banking models by offering alternative, more agile solutions.

The threat of new entrants into the Malaysian banking sector, including for institutions like RHB Bank, remains moderate to low due to substantial barriers. Significant capital requirements, stringent regulatory approvals from Bank Negara Malaysia (BNM), and the need for extensive technological infrastructure are major deterrents. For example, as of 2024, the capital base requirements for digital banks are RM100 million, while full-fledged commercial banks require a much higher threshold, making it difficult for new players to enter without substantial backing.

| Barrier Type | Description | Impact on New Entrants | Example Data (2024) |

|---|---|---|---|

| Capital Requirements | Substantial funds needed to establish operations, technology, and meet regulatory capital adequacy ratios. | High deterrent, limits the pool of potential entrants. | Digital Bank License: RM100 million minimum capital fund. |

| Regulatory Hurdles | Rigorous licensing, compliance, and ongoing supervision by BNM. | Time-consuming and costly, requires deep understanding of financial regulations. | Licensing process can take 12-18 months for digital banks. |

| Economies of Scale | Existing banks benefit from lower per-unit costs in IT, marketing, and operations. | New entrants struggle to compete on cost efficiency initially. | Large banks invest billions annually in technology upgrades. |

| Brand Loyalty & Trust | Established banks have built long-term customer relationships and reputation. | Difficult for new entrants to attract and retain customers. | RHB Bank's history dates back to 1886, fostering deep customer trust. |

Porter's Five Forces Analysis Data Sources

Our RHB Bank Porter's Five Forces analysis is built upon a robust foundation of data, including the bank's annual reports, financial statements, and investor relations disclosures. We also incorporate insights from industry-specific research from reputable market analysis firms and macroeconomic data from reliable economic databases.