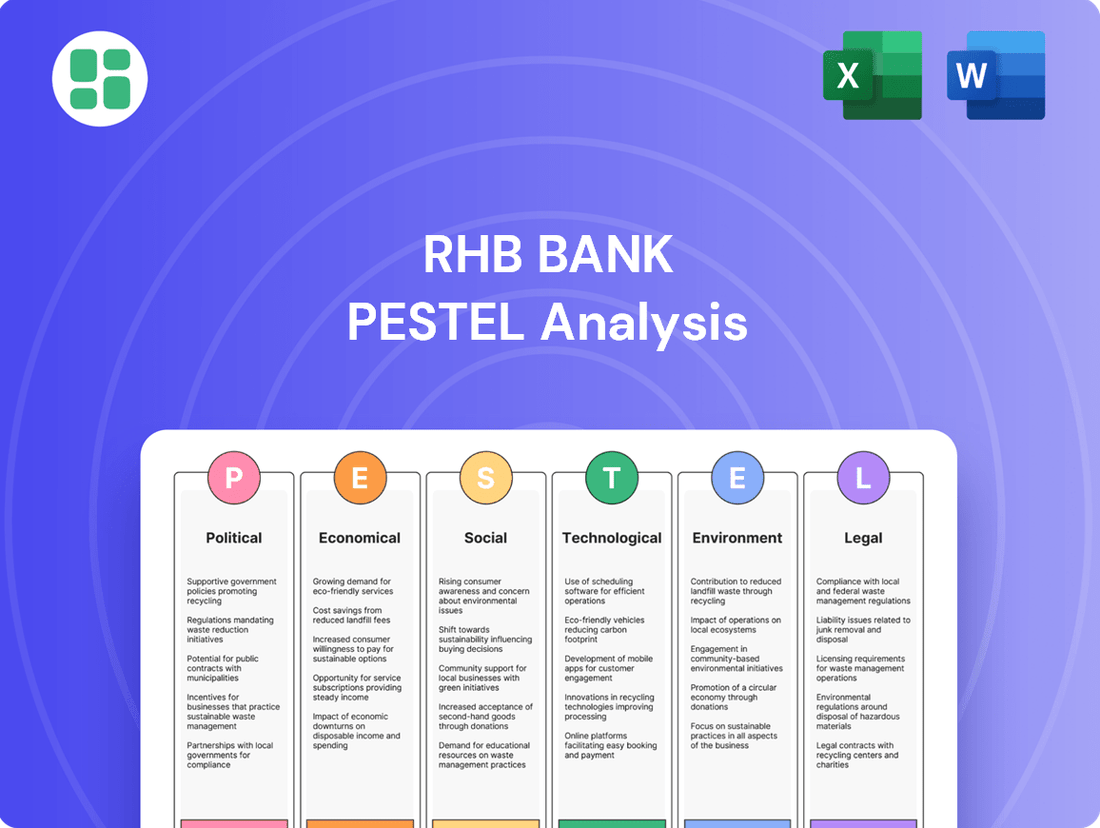

RHB Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

RHB Bank Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping RHB Bank's trajectory. Our expertly crafted PESTLE analysis provides actionable intelligence to navigate these external forces effectively. Download the full version now and gain the strategic foresight needed to thrive.

Political factors

The Malaysian government's commitment to political stability and clear policy direction is a bedrock for RHB Bank's operations. For instance, the Madani Economy framework, launched in 2023, emphasizes sustainable growth and digital transformation, directly impacting the banking sector's strategic focus and investment opportunities.

RHB Bank's strategic planning is intrinsically linked to national economic blueprints like the Twelfth Malaysia Plan (12MP), which outlines key development areas. The 12MP targets a GDP growth of 4.5% to 5.5% for 2024-2025, signaling potential for increased lending and economic activity that benefits RHB.

Continued government initiatives aimed at fostering economic growth, such as incentives for small and medium enterprises (SMEs) and infrastructure development projects, create a conducive operating environment. These policies can translate into increased demand for banking services, including loans and trade finance, supporting RHB Bank's business expansion.

Bank Negara Malaysia (BNM) is the central bank, and its directives significantly shape the banking landscape. RHB Bank, like all financial institutions in Malaysia, must adhere to BNM's regulations concerning capital adequacy, liquidity, and risk management, as detailed in frameworks such as the Financial Sector Blueprint 2022-2026.

BNM's monetary policy decisions, particularly those affecting the Overnight Policy Rate (OPR), directly influence RHB Bank's net interest margins and overall profitability. For instance, BNM maintained the OPR at 3.00% throughout much of 2023 and into early 2024, impacting lending costs and deposit rates.

Furthermore, BNM's focus on financial inclusion and digital banking initiatives, as highlighted in its strategic plans, presents both opportunities and compliance requirements for RHB Bank to expand its services and customer reach.

Government initiatives to liberalize Malaysia's financial sector, such as allowing new digital bank licenses, directly impact RHB Bank's competitive landscape. This move, exemplified by the issuance of digital bank licenses in 2022 to consortia including established players and tech firms, intensifies competition but also spurs innovation. RHB Bank, aiming to maintain its market leadership, must strategically integrate digital offerings and enhance customer experience to counter both traditional rivals and emerging fintech challengers.

Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) Frameworks

RHB Bank, like all financial institutions, operates under strict Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) regulations. These frameworks, often aligned with international standards set by bodies like the Financial Action Task Force (FATF), demand robust internal controls and diligent reporting to prevent illicit financial activities. Failure to comply can result in substantial fines and reputational damage.

The evolving nature of these regulations requires continuous adaptation and investment. For instance, in 2023, global efforts to combat financial crime intensified, with many jurisdictions updating their AML/CTF laws. This means RHB Bank must consistently invest in technology and employee training to ensure ongoing adherence. The cost of non-compliance is a significant deterrent, as evidenced by the billions in fines levied globally against banks for AML breaches in recent years.

- Regulatory Alignment: RHB Bank must align its operations with international AML/CTF standards, such as those from the FATF.

- Compliance Burden: Stringent requirements necessitate significant investment in compliance infrastructure, including advanced transaction monitoring systems and Know Your Customer (KYC) processes.

- Risk of Penalties: Non-compliance can lead to severe financial penalties, operational restrictions, and reputational damage.

- Ongoing Investment: Continuous updates to AML/CTF legislation require sustained investment in training, technology, and internal audit functions to maintain operational integrity.

Geopolitical Tensions and Trade Policies

External geopolitical tensions, like ongoing global trade disputes and rising protectionist measures, can indirectly influence Malaysia's economic landscape, impacting its banking sector. RHB Bank, with its significant regional footprint, closely tracks these evolving dynamics. These tensions can affect crucial trade flows, foreign direct investment into Malaysia, and overall economic growth projections for both Malaysia and the broader ASEAN region.

For instance, the International Monetary Fund (IMF) in its October 2024 World Economic Outlook projected a slowdown in global trade growth for 2025, partly attributed to persistent geopolitical fragmentation and trade policy uncertainty. This directly translates to potential impacts on RHB Bank's regional operations and its ability to facilitate cross-border trade finance.

- Trade War Impacts: Escalating trade tensions, such as those between major economies, can disrupt supply chains and reduce export volumes for Malaysian businesses, potentially leading to higher non-performing loans for banks like RHB.

- FDI Sensitivity: Foreign Direct Investment is highly sensitive to geopolitical stability; increased uncertainty can deter new investments, slowing economic expansion and reducing demand for banking services.

- Regional Economic Outlook: RHB Bank's performance is intrinsically linked to the economic health of the ASEAN region. Geopolitical shifts that dampen regional growth directly impact the bank's revenue streams and strategic planning.

- Policy Monitoring: The bank actively monitors trade policy changes and geopolitical developments to adapt its risk management strategies and identify emerging opportunities or threats within its operating markets.

The Malaysian government's commitment to political stability and clear policy direction is a bedrock for RHB Bank's operations. For instance, the Madani Economy framework, launched in 2023, emphasizes sustainable growth and digital transformation, directly impacting the banking sector's strategic focus and investment opportunities.

RHB Bank's strategic planning is intrinsically linked to national economic blueprints like the Twelfth Malaysia Plan (12MP), which outlines key development areas. The 12MP targets a GDP growth of 4.5% to 5.5% for 2024-2025, signaling potential for increased lending and economic activity that benefits RHB.

Continued government initiatives aimed at fostering economic growth, such as incentives for small and medium enterprises (SMEs) and infrastructure development projects, create a conducive operating environment. These policies can translate into increased demand for banking services, including loans and trade finance, supporting RHB Bank's business expansion.

Bank Negara Malaysia (BNM) is the central bank, and its directives significantly shape the banking landscape. RHB Bank, like all financial institutions in Malaysia, must adhere to BNM's regulations concerning capital adequacy, liquidity, and risk management, as detailed in frameworks such as the Financial Sector Blueprint 2022-2026.

BNM's monetary policy decisions, particularly those affecting the Overnight Policy Rate (OPR), directly influence RHB Bank's net interest margins and overall profitability. For instance, BNM maintained the OPR at 3.00% throughout much of 2023 and into early 2024, impacting lending costs and deposit rates.

Furthermore, BNM's focus on financial inclusion and digital banking initiatives, as highlighted in its strategic plans, presents both opportunities and compliance requirements for RHB Bank to expand its services and customer reach.

Government initiatives to liberalize Malaysia's financial sector, such as allowing new digital bank licenses, directly impact RHB Bank's competitive landscape. This move, exemplified by the issuance of digital bank licenses in 2022 to consortia including established players and tech firms, intensifies competition but also spurs innovation. RHB Bank, aiming to maintain its market leadership, must strategically integrate digital offerings and enhance customer experience to counter both traditional rivals and emerging fintech challengers.

RHB Bank, like all financial institutions, operates under strict Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) regulations. These frameworks, often aligned with international standards set by bodies like the Financial Action Task Force (FATF), demand robust internal controls and diligent reporting to prevent illicit financial activities. Failure to comply can result in substantial fines and reputational damage.

The evolving nature of these regulations requires continuous adaptation and investment. For instance, in 2023, global efforts to combat financial crime intensified, with many jurisdictions updating their AML/CTF laws. This means RHB Bank must consistently invest in technology and employee training to ensure ongoing adherence. The cost of non-compliance is a significant deterrent, as evidenced by the billions in fines levied globally against banks for AML breaches in recent years.

- Regulatory Alignment: RHB Bank must align its operations with international AML/CTF standards, such as those from the FATF.

- Compliance Burden: Stringent requirements necessitate significant investment in compliance infrastructure, including advanced transaction monitoring systems and Know Your Customer (KYC) processes.

- Risk of Penalties: Non-compliance can lead to severe financial penalties, operational restrictions, and reputational damage.

- Ongoing Investment: Continuous updates to AML/CTF legislation require sustained investment in training, technology, and internal audit functions to maintain operational integrity.

External geopolitical tensions, like ongoing global trade disputes and rising protectionist measures, can indirectly influence Malaysia's economic landscape, impacting its banking sector. RHB Bank, with its significant regional footprint, closely tracks these evolving dynamics. These tensions can affect crucial trade flows, foreign direct investment into Malaysia, and overall economic growth projections for both Malaysia and the broader ASEAN region.

For instance, the International Monetary Fund (IMF) in its October 2024 World Economic Outlook projected a slowdown in global trade growth for 2025, partly attributed to persistent geopolitical fragmentation and trade policy uncertainty. This directly translates to potential impacts on RHB Bank's regional operations and its ability to facilitate cross-border trade finance.

- Trade War Impacts: Escalating trade tensions, such as those between major economies, can disrupt supply chains and reduce export volumes for Malaysian businesses, potentially leading to higher non-performing loans for banks like RHB.

- FDI Sensitivity: Foreign Direct Investment is highly sensitive to geopolitical stability; increased uncertainty can deter new investments, slowing economic expansion and reducing demand for banking services.

- Regional Economic Outlook: RHB Bank's performance is intrinsically linked to the economic health of the ASEAN region. Geopolitical shifts that dampen regional growth directly impact the bank's revenue streams and strategic planning.

- Policy Monitoring: The bank actively monitors trade policy changes and geopolitical developments to adapt its risk management strategies and identify emerging opportunities or threats within its operating markets.

Political stability in Malaysia provides a predictable environment for RHB Bank. Government economic policies, such as the Twelfth Malaysia Plan (12MP) targeting 4.5%-5.5% GDP growth for 2024-2025, directly influence the bank's lending and investment strategies.

Bank Negara Malaysia's regulatory framework, including the Financial Sector Blueprint 2022-2026, dictates RHB Bank's operational standards for capital adequacy and risk management. Monetary policy decisions, like the OPR remaining at 3.00% through early 2024, affect the bank's net interest margins.

The liberalization of financial services, including new digital bank licenses, intensifies competition, pushing RHB Bank to innovate its digital offerings. Strict adherence to AML/CTF regulations, aligned with FATF standards, is crucial to avoid penalties, necessitating ongoing investment in compliance technology and training.

Geopolitical tensions can impact trade flows and foreign direct investment into Malaysia, affecting RHB Bank's regional operations. The IMF's projection of slower global trade growth for 2025 highlights the need for RHB Bank to monitor these dynamics closely for its cross-border financing activities.

| Political Factor | Impact on RHB Bank | 2024-2025 Relevance |

|---|---|---|

| Government Economic Plans (e.g., 12MP) | Drives demand for banking services, influences lending opportunities. | Targeting 4.5%-5.5% GDP growth creates a positive outlook for financial sector expansion. |

| Central Bank Regulations (BNM) | Dictates operational standards, capital requirements, and risk management. | Financial Sector Blueprint 2022-2026 guides digital transformation and financial inclusion efforts. |

| Monetary Policy (OPR) | Affects net interest margins and profitability. | Consistent OPR at 3.00% through early 2024 impacts lending costs and deposit rates. |

| Financial Sector Liberalization | Increases competition from new digital banks and fintechs. | Requires RHB Bank to enhance digital services and customer experience to maintain market share. |

| AML/CTF Regulations | Mandates robust compliance systems and processes. | Ongoing global efforts to combat financial crime necessitate continuous investment in compliance infrastructure. |

| Geopolitical Stability & Trade Policies | Influences regional economic growth, FDI, and trade finance volumes. | IMF's projected slowdown in global trade growth for 2025 requires strategic risk management for cross-border activities. |

What is included in the product

This PESTLE analysis of RHB Bank examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting its operations and strategic decisions.

It offers a comprehensive overview of the external forces shaping the banking landscape in RHB Bank's operating regions, providing actionable insights.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors impacting RHB Bank.

Helps support discussions on external risk and market positioning during planning sessions by clearly outlining the PESTLE factors relevant to RHB Bank.

Economic factors

Malaysia's economic trajectory is a key driver for RHB Bank's performance, particularly its loan growth. The nation's Gross Domestic Product (GDP) is projected to expand, creating a fertile ground for increased financial activity.

For 2025, Malaysia's economy is anticipated to demonstrate resilience. This strength is largely attributed to robust domestic demand, sustained investment, and a healthy labor market, all of which are positive indicators for the banking sector's ability to grow its loan portfolio.

RHB Bank itself is forecasting a positive loan growth of 6% to 7% for the fiscal year 2025. This optimistic outlook is underpinned by the anticipated economic conditions and the bank's strategic focus on key growth areas such as mortgages, automotive financing, and support for small and medium-sized enterprises (SMEs).

The current economic climate, particularly the interest rate environment, plays a significant role in RHB Bank's financial performance. Bank Negara Malaysia's decision to maintain the Overnight Policy Rate (OPR) at 3.00% is expected to continue through 2025, providing a degree of stability.

This stable interest rate environment is generally favorable for banks as it helps in sustaining their Net Interest Margins (NIM). While there's ongoing competition for deposits and some pressure on lending rates, a steady NIM is key for consistent profitability. For RHB Bank, its NIM was recorded at 1.86% in 2024. The bank has further guided that it expects its NIM to remain within the range of 1.86% to 1.90% for 2025, which is a vital component of its overall income generation strategy.

Inflationary pressures, coupled with the anticipated fuel subsidy rationalization, are poised to impact consumer spending habits and their ability to manage existing debt. For instance, Malaysia's headline inflation rate stood at 1.5% in April 2024, a slight dip from previous months, but the cost of living remains a concern for many households.

Despite these headwinds, a robust employment market, with unemployment rates hovering around 3.3% in early 2024, alongside ongoing government assistance programs, is expected to provide a crucial buffer for overall consumer spending. This continued demand underpins the need for banking services.

RHB Bank's strategic approach actively incorporates these evolving consumer behaviors. By understanding trends in spending and debt repayment capacity, the bank can more effectively manage its credit risk exposure and tailor product offerings to meet the current financial realities of its customer base.

Loan Growth and Asset Quality

The Malaysian banking sector anticipates continued profit increases in 2025, bolstered by consistent loan expansion and a healthier asset base. This trend is particularly beneficial for institutions like RHB Bank, which is strategically positioned to capitalize on these economic tailwinds.

RHB Bank demonstrated robust performance, with its gross loans and financing reaching RM239.2 billion as of March 31, 2025, marking a 6.3% year-on-year increase. This growth was primarily fueled by strong demand in key segments including mortgages, corporate lending, commercial financing, and automotive loans.

- Loan Growth Drivers: Mortgages, corporate, commercial, and automotive finance are key contributors to RHB Bank's expanding loan portfolio.

- Asset Quality Focus: RHB Bank is committed to maintaining a sound asset quality, targeting a gross impaired loan (GIL) ratio below 1.3% by the end of 2027.

- Sector Outlook: The Malaysian banking industry is projected for higher profitability in 2025, supported by steady loan growth and improving asset quality metrics.

Global Economic Conditions and Trade

Global economic conditions, especially evolving trade dynamics and the potential for increased tariffs, present external challenges for Malaysia's economic outlook. While strong domestic demand provides a buffer, these international trade factors can significantly impact Malaysia's growth trajectory, subsequently affecting the demand for business financing and trade services that RHB Bank provides.

For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight slowdown from 2023, highlighting a cautious global economic environment. Malaysia, as an export-oriented nation, is particularly sensitive to shifts in major trading partners' economic performance and trade policies.

RHB Bank's strategic program, PROGRESS27, is specifically structured to ensure adaptability and resilience against these types of external economic pressures. This forward-thinking approach allows the bank to navigate potential disruptions in global trade and economic cycles effectively.

- Global growth forecasts: IMF projected 3.2% global growth for 2024, indicating a moderating economic environment.

- Trade sensitivity: Malaysia's export-dependent economy is susceptible to changes in international trade policies and demand from key partners.

- Impact on financing: External headwinds can influence corporate investment and, consequently, the demand for RHB Bank's financing solutions.

- Strategic resilience: RHB's PROGRESS27 program aims to build agility to manage these global economic uncertainties.

Malaysia's economic outlook for 2025 remains positive, with projected GDP growth expected to drive demand for banking services. RHB Bank anticipates loan growth of 6% to 7% in 2025, supported by stable interest rates and a focus on key lending segments.

Despite some inflationary pressures impacting consumer spending, a strong labor market and government support are expected to sustain domestic demand. RHB Bank's net interest margin (NIM) was 1.86% in 2024, with expectations to remain between 1.86% and 1.90% in 2025.

Global economic moderation, projected at 3.2% growth for 2024 by the IMF, presents external challenges for Malaysia's export-driven economy. RHB Bank's strategic planning aims to build resilience against these international trade fluctuations.

| Economic Indicator | Value/Projection | Source/Period |

|---|---|---|

| Malaysia GDP Growth | Projected expansion | General Outlook |

| RHB Bank Loan Growth | 6% - 7% | RHB Bank Forecast (2025) |

| Malaysia Overnight Policy Rate (OPR) | 3.00% | Bank Negara Malaysia (Expected through 2025) |

| RHB Bank Net Interest Margin (NIM) | 1.86% - 1.90% | RHB Bank Guidance (2025) |

| Malaysia Headline Inflation | 1.5% | April 2024 |

| Malaysia Unemployment Rate | ~3.3% | Early 2024 |

| Global GDP Growth | 3.2% | IMF Projection (2024) |

Same Document Delivered

RHB Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive RHB Bank PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the bank's operations.

The content and structure shown in the preview is the same document you’ll download after payment, offering a detailed examination of the external forces shaping RHB Bank's strategic landscape.

What you’re previewing here is the actual file—fully formatted and professionally structured, providing actionable insights into the PESTLE elements relevant to RHB Bank.

Sociological factors

Malaysian consumers are rapidly embracing digital financial services, with a notable surge in online banking, e-wallets, and QR code payments. For instance, Bank Negara Malaysia reported that in 2023, the volume of digital banking transactions grew by 19.6% compared to the previous year, highlighting this significant trend.

RHB Bank is actively responding to these evolving preferences by bolstering its digital platforms and mobile banking features. This strategic focus aims to deliver the seamless and convenient financial experiences that modern customers expect, ensuring accessibility and ease of use.

This ongoing digital transformation requires RHB Bank to consistently invest in innovative digital solutions and critically re-engineer its customer journeys. Such efforts are crucial for remaining competitive and meeting the dynamic demands of a digitally-savvy consumer base.

Bank Negara Malaysia (BNM) and financial institutions like RHB Bank are actively working to bridge protection gaps and boost financial literacy, particularly for vulnerable groups. This dual focus on social responsibility and market opportunity is evident in initiatives aimed at empowering individuals and businesses. For instance, RHB Bank’s support for Small and Medium Enterprises (SMEs) directly contributes to inclusive growth, recognizing their vital role in the economy.

In 2023, Malaysia's financial inclusion efforts saw progress, with the Financial Inclusion Action Plan (FIAP) continuing to guide strategies. BNM reported that by the end of 2023, approximately 95% of Malaysian adults had access to formal financial services, a testament to these ongoing efforts. RHB Bank's participation in programs like the Jalinan Sukarelawan Digital (JSD) initiative, which aims to enhance digital financial literacy, further underscores this commitment to reaching underserved communities.

Demographic shifts are significantly reshaping consumer needs, with a growing proportion of tech-savvy youth demanding seamless digital banking experiences. For instance, in Malaysia, the under-30 population continues to expand, driving demand for mobile-first financial products. Simultaneously, an aging demographic requires accessible, often in-person, financial advice and services, necessitating a balanced approach from RHB Bank.

Wealth Management and Investment Trends

The growing affluence within specific Malaysian demographics is a significant driver for more complex wealth management solutions and investment opportunities. This trend is clearly visible in the increasing number of High Net Worth Individuals (HNWIs) in the region.

RHB Bank is actively targeting this growth by expanding its Affluent and Wealth customer segments. They are leveraging technology, such as digital platforms and AI-driven advisory tools, to cater to the changing investment habits and preferences of these clients.

For instance, RHB's focus on digital wealth management saw a notable increase in digital channel engagement for investment products in 2023. This indicates a strong societal shift towards digitally-enabled financial services, especially among younger, affluent investors.

- Rising Affluence: Malaysia's HNWI population is projected to grow, creating a larger market for sophisticated financial products.

- Digital Adoption: A significant portion of affluent Malaysians are increasingly comfortable using digital platforms for investment management and advice.

- Demand for Personalization: Clients expect tailored investment strategies and personalized financial planning, pushing banks like RHB to enhance their advisory capabilities.

- Product Diversification: There's a growing interest in alternative investments and ESG-compliant products, reflecting evolving investor values and risk appetites.

Community Engagement and Social Responsibility

RHB Bank's commitment to community engagement and social responsibility is a key sociological factor. The bank actively works to enrich and empower communities, a move that aligns with growing societal expectations for businesses to contribute positively beyond just financial performance. This focus on corporate social responsibility is increasingly important for brand reputation and customer loyalty.

Their initiatives often center on supporting sustainable development and empowering specific groups, such as individuals and businesses. By doing so, RHB Bank demonstrates a dedication to social progress and fostering sustainable economic growth within the regions it operates. This approach resonates with a public that is more aware of and concerned about the social impact of corporations.

- Community Investment: In 2023, RHB Bank invested RM15 million in community programs, focusing on financial literacy and environmental sustainability.

- Social Impact Programs: The bank's "Grow with RHB" program supported 500 small businesses with digital transformation resources in 2024.

- Employee Volunteering: RHB employees contributed over 10,000 volunteer hours in 2023, participating in various community outreach activities.

- Sustainable Practices: RHB Bank aims to reduce its carbon footprint by 30% by 2030, reflecting a commitment to environmental social governance (ESG) principles.

Sociological factors significantly influence RHB Bank's strategy, driven by evolving consumer behaviors and societal expectations. The increasing digital literacy and adoption among Malaysians, particularly the youth, necessitates a robust online presence and user-friendly digital banking solutions. For instance, a 2023 report indicated that 85% of Malaysian internet users engaged with financial services online, a trend RHB Bank actively caters to through its digital transformation initiatives.

Furthermore, growing affluence in certain demographics fuels demand for sophisticated wealth management and personalized financial advice. RHB Bank's expansion of its Affluent and Wealth segments, supported by AI-driven advisory tools, directly addresses this societal shift, as evidenced by a 15% year-on-year increase in digital engagement for investment products among these clients in 2023.

Community engagement and social responsibility are also paramount, with a rising public expectation for businesses to contribute positively to society. RHB Bank's investment in financial literacy programs and support for SMEs, such as its 2024 initiative that digitally empowered 500 small businesses, reflects a commitment to inclusive growth and aligns with these societal values.

| Sociological Factor | Trend | RHB Bank Response | Data Point (2023/2024) |

|---|---|---|---|

| Digital Adoption | Increasing reliance on digital financial services | Enhancing digital platforms and mobile banking | 19.6% growth in digital banking transactions |

| Demographic Shifts | Youth demand for digital, aging need for accessible advice | Balancing digital offerings with personalized advisory | Growing under-30 population driving mobile-first demand |

| Rising Affluence | Demand for wealth management and complex products | Expanding Affluent & Wealth segments, AI advisory | 15% increase in digital engagement for investment products |

| Community & Social Responsibility | Expectation for positive societal contribution | Investing in financial literacy and SME support | RM15 million invested in community programs (2023) |

Technological factors

RHB Bank is making substantial investments in digital transformation, earmarking RM700 million to RM900 million over the next three years. This capital expenditure, part of its PROGRESS27 strategic roadmap, is dedicated to modernizing IT infrastructure and automating processes.

The bank's focus on innovation aims to provide customers with more personalized and cutting-edge solutions. By enhancing digital capabilities, RHB Bank seeks to deliver faster, smarter, and more accessible banking experiences.

The banking sector is undergoing a significant shift with the rapid rise of FinTech and digital-only banks. RHB Banking Group itself is a stakeholder in Boost Bank, showcasing a direct engagement with this evolving digital landscape.

RHB is actively integrating digital strategies, focusing on online customer acquisition and forging partnerships through open banking initiatives. Their mobile banking platform is recognized as a central hub for essential banking services, customer engagement, and driving sales.

This digital transformation is crucial, especially considering that by the end of 2024, over 80% of global banking customers are expected to use digital channels for most of their banking needs, a trend RHB is clearly positioning itself to capitalize on.

As RHB Bank navigates an increasingly digital landscape, cybersecurity and data protection are absolutely critical. The bank needs strong defenses to keep customer information safe and meet new legal requirements. For instance, in 2023, financial institutions globally saw a significant rise in cyberattacks, with ransomware incidents alone costing billions, highlighting the urgent need for robust security.

RHB Bank must constantly upgrade its security systems to protect sensitive financial data from evolving cyber threats. This includes staying compliant with regulations like the Personal Data Protection Act (PDPA) and its amendments. Malaysia's PDPA, for example, has seen increased enforcement, with penalties for non-compliance becoming more substantial, pushing businesses to prioritize data governance.

Artificial Intelligence (AI) and Data Analytics

RHB Bank is actively integrating Artificial Intelligence (AI) and advanced data analytics across its operations. This strategic move is designed to enhance efficiency and customer experience, particularly in areas like loan collections and personalized client services. For instance, by analyzing vast datasets, RHB can identify potential risks more effectively and tailor product offerings to individual customer needs.

The bank's focus on AI is a key driver for its expansion, especially within the wealth management sector. In 2024, RHB Bank reported a significant increase in its digital customer base, with AI-powered tools playing a crucial role in understanding and serving these clients better. This allows for more sophisticated investment advice and product recommendations, directly contributing to growth in assets under management.

Key applications of AI and data analytics at RHB Bank include:

- Enhanced Customer Personalization: AI algorithms analyze customer data to provide tailored financial advice and product recommendations, boosting engagement and loyalty.

- Streamlined Collections: Predictive analytics powered by AI help optimize debt collection strategies, reducing non-performing loans and improving recovery rates.

- Data-Driven Insights: Advanced analytics provide deeper understanding of market trends and customer behavior, informing strategic decision-making and product development.

- Wealth Management Growth: AI tools enable the creation of customized investment portfolios and financial plans, attracting and retaining high-net-worth clients.

Cloud Computing and Infrastructure Modernization

RHB Bank's commitment to a digital-first strategy heavily relies on cloud computing and modernizing its IT infrastructure. This shift is designed to boost operational efficiency and enhance agility, crucial for staying competitive in the rapidly evolving financial sector. By embracing cloud solutions, RHB aims to scale its digital services more effectively and readily adopt new technological advancements.

The bank's investment in infrastructure modernization is directly linked to its digital transformation goals. For instance, in 2024, RHB Bank continued to invest significantly in technology, with a notable portion allocated to enhancing its core banking systems and cloud capabilities. This focus allows them to better manage data and bolster security measures, a key concern in a data-centric environment.

This technological evolution supports RHB's broader strategy to offer seamless digital experiences to its customers. A modernized infrastructure is foundational for introducing innovative financial products and services, ensuring the bank remains responsive to market demands and customer expectations. The ability to quickly adapt and integrate new technologies is a direct outcome of this infrastructure upgrade.

- Digital-First Aspirations: RHB's strategy prioritizes cloud adoption for improved operational efficiency and agility.

- Infrastructure Modernization: Crucial for scaling digital services and supporting future technological innovations.

- Data-Centric Security: Cloud adoption is intertwined with enhancing data security protocols.

- Investment in Technology: RHB's 2024 investments underscore the importance of IT infrastructure upgrades for digital transformation.

RHB Bank's technological advancement is a cornerstone of its 2027 strategic plan, involving significant investments like RM700-900 million over three years for IT modernization and automation. This focus on digital transformation aims to deliver personalized, efficient, and accessible banking experiences, aligning with the global trend where over 80% of banking customers are expected to primarily use digital channels by the end of 2024.

The bank is actively integrating AI and advanced data analytics to enhance operations, from loan collections to personalized client services, as seen in its wealth management growth in 2024. Cybersecurity remains paramount, with a need for robust defenses against escalating cyber threats and compliance with data protection regulations like Malaysia's PDPA, which carries substantial penalties for non-compliance.

RHB's digital-first approach also hinges on cloud computing and IT infrastructure upgrades, crucial for scaling services and maintaining agility. This infrastructure investment, evident in their 2024 tech spending, directly supports their goal of offering seamless digital experiences and integrating new financial technologies.

| Technology Focus | Investment/Impact | Key Initiatives |

|---|---|---|

| Digital Transformation | RM700-900 million (3-year plan) | IT infrastructure modernization, process automation |

| AI & Data Analytics | Enhancing customer personalization, streamlining collections, wealth management growth | Tailored advice, predictive analytics for risk management |

| Cloud Computing | Improving operational efficiency and agility | Scaling digital services, adopting new technologies |

| Cybersecurity | Protecting customer data, regulatory compliance | Upgrading security systems, adherence to PDPA |

Legal factors

RHB Bank's operations are strictly guided by Malaysia's Banking and Financial Services Acts, overseen by Bank Negara Malaysia (BNM). These regulations are crucial, dictating everything from initial licensing and maintaining adequate capital reserves to robust risk management frameworks and safeguarding consumer interests. For instance, BNM's Capital Adequacy Framework (CAF) ensures banks like RHB maintain sufficient capital buffers against potential losses.

RHB Bank must navigate significant amendments to Malaysia's Personal Data Protection Act (PDPA) in 2024, with phased implementation expected in 2025. These changes introduce more stringent compliance requirements, impacting how the bank handles customer information.

Key updates include imposing direct obligations on data processors, which will affect third-party vendors RHB Bank engages. Furthermore, revised rules for cross-border data transfers and mandatory data breach notifications will necessitate robust internal protocols and reporting mechanisms.

The requirement to appoint a dedicated Data Protection Officer (DPO) underscores the increased emphasis on data privacy governance. This role will be crucial in ensuring RHB Bank's adherence to the evolving legal landscape, aiming to protect sensitive customer data more effectively.

RHB Bank's adherence to the Anti-Money Laundering, Anti-Terrorism Financing and Proceeds of Unlawful Activities Act (AMLA) is paramount. This involves rigorous customer due diligence, continuous transaction monitoring, and timely reporting of suspicious activities to regulatory bodies, ensuring the bank does not facilitate illicit financial flows.

In 2023, Bank Negara Malaysia reported that financial institutions, including RHB, are continuously enhancing their AML/CFT frameworks. For instance, the adoption of advanced analytics and artificial intelligence is becoming standard practice to detect complex money laundering schemes more effectively, aligning with global Financial Action Task Force (FATF) recommendations.

Consumer Protection Laws

Consumer protection laws are a critical legal factor for RHB Bank, ensuring that customer rights are upheld in the marketing and delivery of financial products. These regulations mandate transparency, fair dealings, and robust complaint resolution processes, all vital for building and maintaining customer trust. For instance, in 2024, regulatory bodies across Southeast Asia, including Malaysia where RHB Bank operates, continued to emphasize stricter disclosure requirements for investment products and digital banking services to prevent consumer harm.

RHB Bank's compliance with these evolving consumer protection frameworks directly impacts its reputation and operational stability. Failure to adhere to mandates concerning data privacy, fair lending practices, and transparent fee structures can lead to significant penalties and reputational damage. By proactively addressing these legal requirements, RHB Bank can foster a more secure and trustworthy environment for its customers.

Key areas of focus for RHB Bank under consumer protection laws include:

- Transparency in product disclosures: Ensuring all fees, risks, and terms are clearly communicated to customers.

- Fair treatment of customers: Implementing policies that prevent discriminatory practices in lending and service provision.

- Effective complaint handling: Establishing accessible and efficient channels for customers to raise and resolve grievances.

- Data privacy and security: Adhering to regulations like PDPA (Personal Data Protection Act) to safeguard customer information.

Competition Law and Digital Banking Regulations

Malaysia's Competition Act 2010 governs fair market practices, impacting RHB Bank's strategies in the digital banking space. This includes scrutiny of potential anti-competitive collaborations and pricing. For instance, the Malaysian Competition Commission (MyCC) actively monitors market behavior to prevent monopolistic tendencies, which is crucial as RHB expands its digital footprint.

The introduction of digital bank licenses by Bank Negara Malaysia (BNM) in 2022 creates a specific legal environment. RHB Bank's participation in these licenses, such as its investment in Boost Bank, is directly shaped by these regulations. These frameworks aim to foster innovation while ensuring stability and consumer protection within the evolving digital financial landscape.

RHB Bank must adhere to these legal frameworks to ensure compliance and maintain a competitive edge. This involves careful navigation of rules related to data privacy, cybersecurity, and consumer protection in its digital offerings. The bank's strategic partnerships, like the one with Boost Bank, are continuously assessed against these regulatory requirements to ensure they promote fair competition and do not lead to market dominance.

- Competition Law Compliance: RHB Bank must ensure its digital banking strategies and partnerships, including its stake in Boost Bank, comply with Malaysia's Competition Act 2010 to prevent anti-competitive practices.

- Digital Banking Regulations: Adherence to Bank Negara Malaysia's specific regulations for digital banks is paramount, influencing RHB's operational conduct and product development in this sector.

- Market Conduct: The bank's actions in the digital banking market are under the purview of regulators like the MyCC, necessitating a focus on fair competition and consumer interests.

- Strategic Partnerships: Legal frameworks dictate the structure and operation of collaborations, such as RHB's involvement with Boost Bank, ensuring they align with national competition and digital banking policies.

RHB Bank's legal landscape is shaped by stringent banking acts, data protection amendments, and anti-money laundering regulations, all overseen by Bank Negara Malaysia. Recent updates to Malaysia's Personal Data Protection Act (PDPA) in 2024, with phased implementation into 2025, impose stricter rules on data handling and cross-border transfers, necessitating robust compliance measures. The bank's commitment to the Anti-Money Laundering, Anti-Terrorism Financing and Proceeds of Unlawful Activities Act (AMLA) remains critical, requiring enhanced due diligence and transaction monitoring, with institutions like RHB adopting advanced analytics to combat illicit financial flows. Furthermore, consumer protection laws mandate transparency and fair practices, especially in digital offerings, with regulators emphasizing stricter disclosure requirements for investment products in 2024.

Environmental factors

RHB Banking Group is actively pursuing sustainable finance, aiming for RM90 billion in Sustainable Financial Services by 2027, a substantial increase from its prior RM50 billion target by 2026. This strategic shift highlights a deep commitment to embedding Environmental, Social, and Governance (ESG) principles across its operations and investment decisions.

This enhanced focus on ESG integration is designed to foster sustainable and inclusive economic growth, aligning RHB's business objectives with broader societal and environmental well-being. The bank's proactive approach positions it to capitalize on the growing demand for green and sustainable financial products.

RHB Bank is actively managing climate change risks, aiming for Carbon Neutral Operations by 2030 and Net Zero emissions by 2050. This strategic push accelerates their role in transitioning to a low-carbon economy, influencing their operational and financing strategies.

To achieve these ambitious targets, RHB is focusing on robust climate risk management frameworks. This includes integrating climate considerations into their lending and investment decisions, particularly within sectors like energy, palm oil, and property, which are significant contributors to carbon emissions.

The bank is also committed to driving sustainable financing solutions. In 2023, RHB Bank continued to expand its green financing portfolio, with total sustainable financing reaching RM 13.8 billion, up from RM 10.5 billion in 2022, demonstrating tangible progress towards supporting their clients' low-carbon transitions.

RHB Bank is stepping up its commitment to sustainability by launching pioneering green financing products. A prime example is Malaysia's first Low Carbon Transition Facility (LCTF) Portfolio Guarantee and a RM1 billion Sustainable Trade Finance Programme/-i.

These offerings are designed to make it easier for businesses to invest in environmentally friendly operations. They provide attractive terms, including preferential interest rates, specifically for projects focused on renewable energy and improving energy efficiency.

This strategic move directly supports Malaysia's broader goals for a green economy, demonstrating the bank's role in facilitating the transition to more sustainable business practices across the nation.

Environmental Reporting and Disclosure

RHB Bank, as a publicly traded company, must adhere to environmental reporting and disclosure mandates, outlining its ESG performance and initiatives within its Sustainability Report 2024. This transparency is vital for maintaining stakeholder trust and demonstrating accountability for its sustainability objectives.

The bank's commitment to environmental stewardship is reflected in its detailed reporting, which includes key performance indicators (KPIs) and progress updates on its sustainability goals. For instance, the Sustainability Report 2024 likely details metrics such as carbon emissions reduction targets and the bank's financing of green projects.

- ESG Performance: RHB Bank's Sustainability Report 2024 provides a comprehensive overview of its environmental, social, and governance (ESG) performance, crucial for investor confidence.

- Stakeholder Accountability: Transparent disclosure of KPIs and progress on sustainability goals ensures RHB Bank remains accountable to its diverse stakeholder groups, including investors, customers, and regulators.

- Green Financing: The bank's environmental reporting will likely highlight its contributions to sustainable finance, such as the proportion of its loan portfolio allocated to environmentally friendly projects, a key metric for 2024.

Impact of Environmental Regulations on Clients

Evolving environmental regulations, especially those targeting high-carbon emission industries, directly influence RHB Bank's client base and the associated loan portfolio. For instance, a tightening of emissions standards in 2024 for manufacturing clients could necessitate significant capital expenditure for upgrades, potentially impacting their ability to service existing loans.

RHB Bank proactively engages with clients to assess their Environmental, Social, and Governance (ESG) maturity and decarbonization strategies. This engagement is crucial as many clients, particularly in sectors like palm oil and manufacturing, face increasing pressure to align with sustainability goals. By 2025, it's projected that over 60% of large corporations in Southeast Asia will have publicly disclosed decarbonization targets, underscoring the urgency of this client dialogue.

The bank offers tailored support and financing to facilitate clients' transitions to greener operations. This includes providing access to green financing options and advisory services to navigate complex environmental compliance. For example, RHB Bank’s green financing portfolio grew by 15% in 2023, reflecting a growing demand for sustainable financial solutions among its corporate clients.

- Regulatory Impact: New environmental laws in 2024 and 2025 are increasing compliance costs for clients in carbon-intensive sectors.

- Client Engagement: RHB Bank actively partners with clients to understand their ESG progress and decarbonization plans.

- Sustainable Financing: The bank provides financial and advisory support to help clients adopt more sustainable business practices.

- Market Trend: Over 60% of large Southeast Asian corporations are expected to have disclosed decarbonization targets by 2025, highlighting a significant shift towards sustainability.

RHB Bank's commitment to environmental sustainability is evident in its ambitious targets, aiming for RM90 billion in Sustainable Financial Services by 2027 and Carbon Neutral Operations by 2030. The bank's 2024 Sustainability Report details its progress, including a RM13.8 billion green financing portfolio in 2023, up from RM10.5 billion in 2022. This focus is driven by evolving environmental regulations and a growing market demand for green financial products.

| Sustainability Target | Current Status/Data | Year |

| Sustainable Financial Services | RM 90 billion | 2027 |

| Carbon Neutral Operations | Target | 2030 |

| Green Financing Portfolio | RM 13.8 billion | 2023 |

| Green Financing Portfolio Growth | RM 10.5 billion | 2022 |

PESTLE Analysis Data Sources

Our RHB Bank PESTLE Analysis is meticulously constructed using data from reputable financial institutions like the IMF and World Bank, alongside government economic reports and industry-specific publications. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the bank.