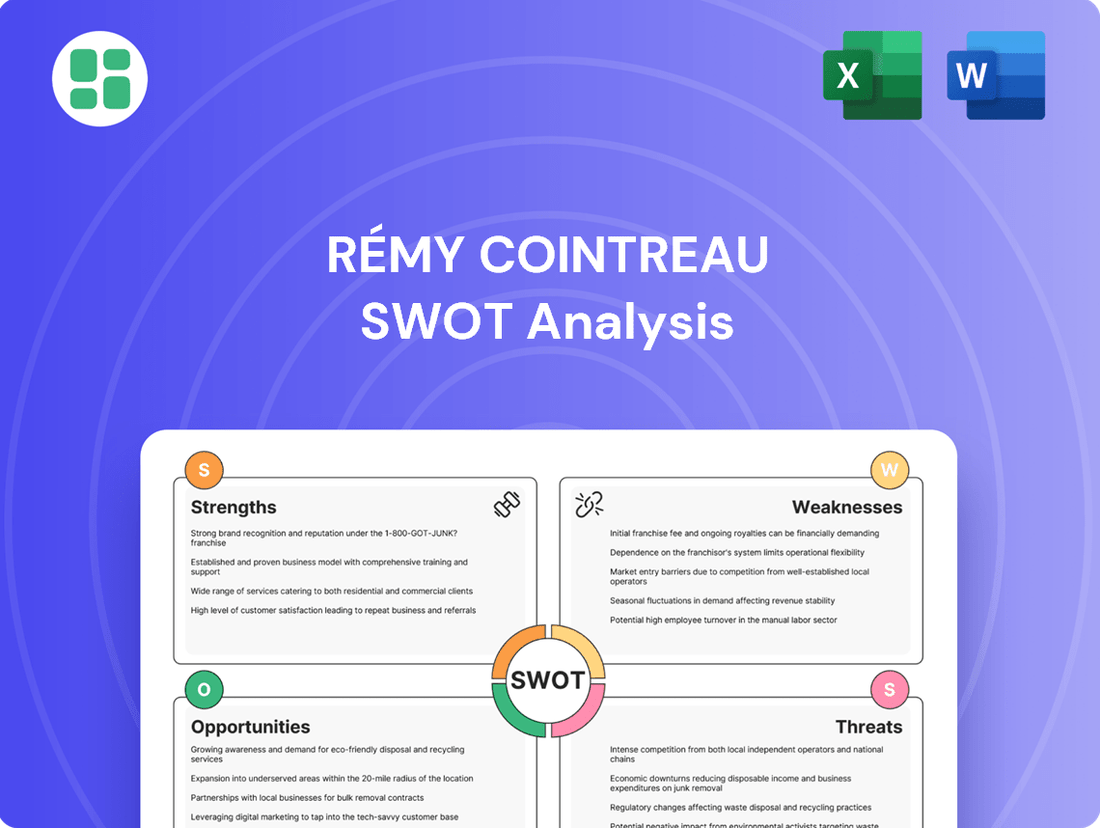

Rémy Cointreau SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Rémy Cointreau Bundle

Rémy Cointreau boasts strong brand recognition and a premium product portfolio, but faces challenges in a competitive market and evolving consumer preferences. Understanding these dynamics is crucial for navigating the luxury spirits industry.

Want the full story behind Rémy Cointreau’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Rémy Cointreau boasts a powerful collection of luxury brands, anchored by globally acclaimed names such as Rémy Martin Cognac and Cointreau liqueur. These are not just spirits; they represent decades of heritage and a commitment to unparalleled quality, resonating strongly with discerning consumers worldwide.

This strategic focus on the premium and ultra-luxury segments is a key differentiator. It enables Rémy Cointreau to achieve higher profit margins compared to mass-market producers, as affluent customers are willing to pay a premium for exclusivity and superior craftsmanship. For instance, in the fiscal year 2023-2024, the company reported robust growth in its House of Rémy Martin division, underscoring the enduring appeal of its premium offerings.

Rémy Cointreau boasts a robust global distribution network, a significant competitive advantage. This network, a blend of dedicated distributors and wholly-owned subsidiaries, ensures its premium spirits reach consumers across diverse international markets. In fiscal year 2023-2024, the company reported that its organic growth was driven by strong performance in Asia and the Americas, underscoring the effectiveness of this widespread reach in accessing key consumer bases.

Rémy Cointreau's unwavering commitment to premiumization and its focus on high-margin products is a significant strength. This strategy, prioritizing value over sheer volume, has consistently translated into robust gross and operating margins for the company.

Even amidst recent market challenges, Rémy Cointreau has proactively implemented cost-reduction initiatives. These measures are designed to safeguard operating margins, underscoring the company's dedication to profitability even when facing headwinds.

This strategic direction perfectly taps into the evolving consumer preference for quality and distinctive experiences within the spirits sector. For instance, in fiscal year 2023-2024, the company reported a strong operating margin, reflecting the success of its premiumization efforts.

Resilience in Liqueurs & Spirits Division

The Liqueurs & Spirits division of Rémy Cointreau has demonstrated remarkable resilience, acting as a crucial buffer against the headwinds experienced by the Cognac segment. Brands such as Cointreau, St-Rémy, Mount Gay, and The Botanist have collectively shown robust performance, highlighting the strength of this diversified portfolio. This resilience is a testament to the strategic importance of these non-Cognac offerings in maintaining overall company stability and growth.

Cointreau, in particular, has been a standout performer, achieving significant growth in key markets. For example, in the fiscal year ending March 31, 2024, Rémy Cointreau reported that its House of Brands, which includes its liqueurs and spirits, saw organic sales rise by 1.7%. This growth was largely driven by the strong performance of Cointreau, which benefited from increased marketing investment and a positive reception in markets like the United States and Europe.

- Diversified Portfolio Strength: The Liqueurs & Spirits division provides a stable revenue stream, mitigating risks associated with the more volatile Cognac market.

- Brand Performance: Cointreau, St-Rémy, Mount Gay, and The Botanist are key contributors to this division's resilience and growth.

- Regional Success: Cointreau has seen exceptional performance in specific geographical areas, bolstering the division's overall results.

- Fiscal Year 2023/2024 Data: The House of Brands division achieved 1.7% organic sales growth, underscoring its stability.

Strategic Cost Control and Efficiency

Rémy Cointreau has shown impressive financial discipline by implementing aggressive cost-cutting measures, particularly in response to challenging market conditions. The company surpassed its savings targets, achieving €85 million in 2024-25 against an initial goal of €50 million. A substantial part of these savings is structural, indicating a long-term focus on operational efficiency.

This strategic cost control is crucial for safeguarding profitability and ensuring financial resilience, especially when sales volumes are lower. The company's ability to exceed its cost-saving objectives highlights effective management and a commitment to optimizing its financial performance even amidst market headwinds.

- Exceeded Savings Target: Achieved €85 million in cost savings for 2024-25, surpassing the €50 million goal.

- Structural Savings: A significant portion of the savings are structural, indicating sustainable efficiency improvements.

- Profitability Protection: Proactive expense management shields profitability during sales downturns.

- Financial Stability: Contributes to maintaining a strong financial position in a volatile market.

Rémy Cointreau's portfolio is a significant strength, featuring globally recognized luxury brands like Rémy Martin Cognac and Cointreau liqueur. This focus on premium and ultra-luxury segments allows for higher profit margins, as seen in the robust growth of the House of Rémy Martin division during fiscal year 2023-2024.

The company possesses a strong global distribution network, ensuring its premium spirits reach consumers worldwide. Fiscal year 2023-2024 data shows that organic growth was boosted by strong performance in Asia and the Americas, highlighting the effectiveness of this extensive reach.

Rémy Cointreau's Liqueurs & Spirits division offers crucial stability, with brands like Cointreau, St-Rémy, Mount Gay, and The Botanist demonstrating resilience. In fiscal year ending March 31, 2024, this House of Brands division achieved 1.7% organic sales growth, with Cointreau being a key driver thanks to increased marketing and positive reception in markets like the US and Europe.

The company has demonstrated excellent financial management through aggressive cost-cutting, exceeding its savings targets. For 2024-25, €85 million in savings were achieved against a €50 million goal, with a significant portion being structural, indicating a long-term commitment to operational efficiency and profitability protection.

What is included in the product

Delivers a strategic overview of Rémy Cointreau’s internal and external business factors, highlighting its premium brand portfolio and market position alongside challenges in distribution and economic volatility.

Identifies key market vulnerabilities and competitive threats, enabling proactive risk mitigation for Rémy Cointreau.

Weaknesses

Rémy Cointreau's significant reliance on its Cognac segment, especially the Rémy Martin brand, presents a notable weakness. This division typically drives a large majority of the company's revenue and profits.

This concentration exposes Rémy Cointreau to considerable risk. For instance, during the fiscal year ending March 31, 2024, the company reported a 24.2% organic decline in sales, largely attributed to a sharp 34.5% drop in its Cognac business, particularly in the Asia-Pacific region.

Such a heavy dependence amplifies the impact of market fluctuations. Any slowdown or adverse trend specifically affecting the Cognac market, whether due to changing consumer preferences or economic conditions, can disproportionately affect the company's overall financial performance.

Rémy Cointreau faces significant headwinds in its crucial Americas and China markets. The company reported a substantial 24.7% organic net sales decline in the Americas for the fiscal year 2023-2024, largely driven by inventory correction and a highly promotional landscape in the United States. This geographic concentration of challenges, particularly the ongoing destocking in the US and a sluggish recovery in China, severely impacts overall revenue and profitability.

Rémy Cointreau faces significant risks from geopolitical shifts and trade disputes, as demonstrated by China's provisional anti-dumping investigation into European brandy, which directly impacts its Cognac sales. This trade friction could lead to substantial reductions in export volumes and profitability in key markets, creating considerable uncertainty for the company's financial outlook.

Declining Sales and Profitability in 2024-2025

Rémy Cointreau has faced significant headwinds, with a substantial organic sales decline of 18.0% reported for Fiscal Year 2024-25. This marks the second consecutive year of falling sales, highlighting a persistent challenge in the company's top-line performance.

The financial strain is further evidenced by a sharp 30.5% organic drop in current operating profit for the same period. This steep decline in profitability underscores the difficulties Rémy Cointreau is experiencing in its operational execution and market positioning.

- FY 2024-25 Organic Sales Decline: -18.0%

- FY 2024-25 Organic Current Operating Profit Decline: -30.5%

- Trend: Two consecutive years of declining sales and earnings.

- Outlook: Downward revision of sales outlook for 2024-25 indicates ongoing challenges.

Inventory Destocking Challenges

Persistent inventory destocking by distributors, especially in the Americas, has significantly hampered Rémy Cointreau's sales performance, leading to a notable year-on-year decline in a crucial market. For instance, the company reported a 24.7% organic sales decline for the fiscal year ending March 31, 2024, largely attributed to this destocking effect in the US. While management expects this process to conclude, its protracted duration has negatively affected short-term revenue generation and overall market stability.

The ongoing destocking challenges present a significant hurdle for Rémy Cointreau's growth trajectory. The prolonged reduction in distributor inventories, particularly evident in the Americas, directly translates to weaker sales figures. This situation has been a primary driver behind the company's reduced financial outlook for the 2023-2024 fiscal year, with expectations of a further organic sales decrease.

- Persistent Distributor Destocking: Distributors, particularly in the Americas, are actively reducing their inventory levels, impacting Rémy Cointreau's sales volumes.

- Impact on Americas Region: This destocking has led to a substantial year-on-year decrease in sales within this key geographic market.

- Financial Repercussions: The prolonged destocking cycle has negatively impacted the company's short-term revenue and financial performance.

- Uncertainty in Market Stability: The duration of this inventory correction creates ongoing uncertainty regarding immediate market stability and sales recovery.

Rémy Cointreau's heavy reliance on its Cognac segment, particularly the Rémy Martin brand, creates a significant vulnerability. This concentration means that any downturn in the Cognac market, whether due to shifting consumer tastes or economic pressures, can disproportionately impact the company's overall financial health. For example, during the fiscal year ending March 31, 2024, Cognac sales saw a steep 34.5% organic decline, directly affecting the company's performance.

The company is also grappling with significant challenges in key markets like the Americas and China. The Americas region, for instance, experienced a 24.7% organic net sales decline in fiscal year 2023-2024, largely driven by inventory correction in the United States. This geographical concentration of market difficulties, coupled with a slow recovery in China, poses a substantial risk to revenue and profitability.

Furthermore, geopolitical tensions and trade disputes represent a considerable threat. China's provisional anti-dumping investigation into European brandy directly impacts Rémy Cointreau's Cognac exports, potentially leading to reduced sales volumes and profitability in a vital market.

The company has faced a prolonged period of declining sales and earnings, with an 18.0% organic sales decline reported for Fiscal Year 2024-25. This marks the second consecutive year of negative top-line growth, and the 30.5% organic drop in current operating profit for the same period highlights severe profitability challenges.

| Fiscal Year | Organic Sales Change | Organic Current Operating Profit Change |

|---|---|---|

| 2023-2024 | -24.2% | -30.5% (FY 2024-25) |

| 2024-2025 (Est.) | -18.0% | -30.5% (FY 2024-25) |

What You See Is What You Get

Rémy Cointreau SWOT Analysis

You’re viewing a live preview of the actual SWOT analysis file. This comprehensive report details Rémy Cointreau's Strengths, Weaknesses, Opportunities, and Threats. The complete version, offering in-depth insights and actionable strategies, becomes available immediately after purchase.

Opportunities

The global spirits market is experiencing a significant shift towards premium and super-premium offerings, with consumers actively pursuing elevated and distinctive beverage experiences. This upward mobility in consumer preference directly benefits Rémy Cointreau, whose portfolio is inherently aligned with luxury and exclusivity.

In 2024, the premiumization trend is a key driver for growth, with reports indicating that premium and super-premium segments are outpacing the overall spirits market. This allows Rémy Cointreau to reinforce its strategy of prioritizing value creation and margin enhancement over sheer sales volume, a crucial element for sustained profitability.

The growing e-commerce and digital B2B platform landscape offers Rémy Cointreau a prime opportunity to connect directly with consumers and streamline sales and inventory. This digital push is particularly impactful in key markets, evidenced by the strong performance of Rémy Martin and Bruichladdich on China's burgeoning e-commerce platforms.

By further investing in and optimizing these digital channels, Rémy Cointreau can significantly boost its market reach and operational efficiency. For instance, in 2023, online sales in the premium spirits category in the US saw a substantial increase, a trend Rémy Cointreau is well-positioned to capitalize on.

Rémy Cointreau can tap into significant growth opportunities within emerging markets beyond China, such as Japan and other parts of Asia-Pacific, as well as developing economies. Rising disposable incomes in these regions present a fertile ground for premium spirits. For instance, in 2023, Rémy Cointreau noted strong performance in Japan, indicating the potential of this market.

By strategically expanding its presence and customizing its marketing and distribution approaches for these diverse markets, Rémy Cointreau can effectively diversify its revenue streams. This diversification is crucial for mitigating risks associated with slowdowns in more established or currently challenged markets, thereby building a more resilient business model.

Innovation in Product Offerings and Experiences

Rémy Cointreau is actively innovating its product portfolio to capture evolving consumer preferences. The company has already introduced ready-to-drink (RTD) options like Cointreau Cocktail Twists, tapping into the growing convenience-driven market. This strategic move aims to attract a younger demographic and expand consumption occasions for its premium spirits.

Further opportunities lie in developing unique brand experiences that resonate with consumers. By creating engaging activations and immersive brand storytelling, Rémy Cointreau can deepen customer loyalty and attract new patrons. This approach complements product innovation by building emotional connections with its heritage brands.

Innovation extends to packaging and flavor profiles, offering avenues for differentiation and market relevance. Exploring novel packaging designs can enhance shelf appeal and sustainability credentials, while introducing new flavor variations can cater to diverse palates. These elements are crucial for maintaining competitive edge in the dynamic spirits industry.

- RTD Expansion: Rémy Cointreau's investment in RTDs like Cointreau Cocktail Twists targets the burgeoning convenience market.

- New Occasions: The company is actively exploring and promoting new consumption occasions for its established brands.

- Packaging Innovation: Novel and sustainable packaging solutions can enhance brand perception and attract environmentally conscious consumers.

- Flavor Exploration: Introducing new flavor profiles can broaden appeal and cater to diverse consumer tastes in the premium spirits segment.

Recovery of Key Markets and Consumer Demand

Rémy Cointreau is anticipating a positive shift, projecting a return to high single-digit average annual sales growth between 2025 and 2026. This optimism is largely fueled by the expected conclusion of the destocking period in the Americas and potential economic improvements in China.

The company views the 2024-2025 fiscal year as a crucial transition phase, laying the groundwork for this anticipated recovery. A stabilization and subsequent rebound in these key markets are seen as significant drivers for boosting Rémy Cointreau's overall financial performance.

- Projected Sales Growth: High single-digit average annual sales growth expected from 2025-26.

- Market Recovery Drivers: Expected destocking completion in the Americas and potential economic improvement in China.

- Fiscal Year 2024-25: Characterized as a transition year towards recovery.

- Impact of Stabilization: Stabilization and rebound in major markets to significantly boost overall performance.

The premiumization trend continues to be a significant tailwind, with consumers increasingly seeking high-quality spirits, a segment where Rémy Cointreau excels. The company's strategic focus on value over volume positions it well to capitalize on this demand, aiming for high single-digit average annual sales growth from 2025-26.

Digital channels present a substantial opportunity for enhanced consumer engagement and sales, as demonstrated by strong online performance in markets like China. Rémy Cointreau can further leverage e-commerce and B2B platforms to expand its reach and operational efficiency.

Emerging markets, beyond China, offer fertile ground for growth due to rising disposable incomes, with Japan already showing promising results. By tailoring its approach to these diverse regions, Rémy Cointreau can diversify revenue and build a more resilient business model.

Product innovation, including the expansion into ready-to-drink (RTD) formats and the exploration of new consumption occasions and packaging, allows Rémy Cointreau to attract new demographics and maintain relevance in a dynamic market.

| Opportunity | Description | 2024/2025 Relevance |

|---|---|---|

| Premiumization Trend | Growing consumer preference for high-quality, luxury spirits. | Aligns with Rémy Cointreau's portfolio and value-driven strategy. |

| Digital Channel Growth | Expansion of e-commerce and direct-to-consumer platforms. | Enhances market reach and operational efficiency, as seen in China. |

| Emerging Market Expansion | Untapped potential in regions with rising disposable incomes. | Diversifies revenue streams, with Japan showing positive early results. |

| Product Innovation (RTD, New Occasions) | Development of convenient formats and new consumption scenarios. | Attracts younger consumers and expands brand usage occasions. |

Threats

The spirits market is a crowded arena, with global giants and nimble local producers constantly vying for consumer attention and wallet share. Rémy Cointreau, a key player in the premium and luxury segments, feels this pressure acutely. For instance, in 2024, the global spirits market was valued at over $1.5 trillion, a figure expected to grow steadily, indicating ample room for competition.

Beyond its traditional cognac and liqueur rivals, Rémy Cointreau must also contend with the rising appeal of other spirits categories. Vodka, rum, and especially whisky continue to gain traction with consumers, offering diverse flavor profiles and marketing angles that can divert market share. Furthermore, the burgeoning non-alcoholic beverage sector presents a novel challenge, capturing consumers seeking sophisticated alternatives.

This intense competitive landscape directly impacts pricing power and the ability to maintain or grow market share. With so many options available, consumers can be swayed by promotions, new product launches, or simply changing preferences, forcing brands like Rémy Cointreau to invest heavily in marketing and innovation to stay relevant.

Global economic uncertainties, including persistent inflation and a generally cautious consumer spending environment, present a significant threat to Rémy Cointreau. Luxury goods, often the first to be cut during economic downturns, are particularly vulnerable. This cautiousness can lead consumers to opt for less expensive alternatives or simply reduce their overall discretionary spending.

This consumer behavior directly impacts Rémy Cointreau's sales volume and profit margins. For instance, if consumers trade down from premium cognac to more accessible spirits, the company's revenue streams will be negatively affected. The projected slowing global economic growth for 2024 and 2025 exacerbates this risk, creating a challenging market landscape for high-end spirits.

Evolving consumer tastes, including a growing preference for moderation, abstinence, and a move towards lower-alcohol or non-alcoholic options, could shrink the market for traditional spirits. This shift, even alongside premiumization trends, poses a significant long-term challenge for the entire beverage alcohol sector.

Supply Chain Disruptions and Raw Material Costs

Rémy Cointreau, like other global spirits producers, faces the ongoing threat of supply chain disruptions. These can impact the availability of key ingredients, such as the Ugni Blanc grapes essential for its Cognac production, or hinder the efficient distribution of finished products worldwide. For instance, disruptions in global shipping during 2021-2022 led to increased lead times and freight costs for many industries, a challenge Rémy Cointreau would have navigated.

Furthermore, the company is vulnerable to significant fluctuations in the cost of raw materials, energy, and transportation. Rising energy prices, as seen in the volatility of natural gas and oil markets in 2023 and continuing into 2024, directly increase production and logistics expenses. These cost pressures can erode profit margins if they cannot be fully passed on to consumers.

- Supply Chain Vulnerability: Potential disruptions to the sourcing of grapes and other agricultural inputs, as well as international logistics, pose a risk to production continuity.

- Raw Material Cost Volatility: Increases in the price of grapes, packaging materials, energy, and shipping can significantly impact operating expenses.

- Impact on Margins: Uncontrolled cost increases can squeeze profit margins, particularly if price adjustments to consumers are limited by market conditions.

Regulatory Changes and Trade Tariffs

Rémy Cointreau is exposed to the significant threat of evolving regulatory landscapes and trade tariffs. Beyond the specific anti-dumping measures previously implemented in China, the company must navigate the potential for new tariffs, shifts in import/export rules, and rising alcohol taxes across its key markets.

These regulatory adjustments can directly translate into increased operational expenses, potentially restrict access to important consumer bases, and diminish purchasing power for its premium products. For instance, a 2023 report indicated that the global spirits market faces ongoing scrutiny regarding taxation, with some regions considering increases of up to 10% on alcoholic beverages, which could impact Rémy Cointreau's sales volumes and overall profitability.

- Increased Costs: New tariffs or taxes directly raise the cost of goods sold and import expenses.

- Market Access Restrictions: Changes in regulations can limit or complicate entry into certain geographical markets.

- Reduced Consumer Demand: Higher taxes on alcoholic beverages can lead to decreased affordability and lower sales volumes.

The competitive landscape for Rémy Cointreau is intensifying, with established rivals and emerging brands vying for market share in the premium spirits sector. The global spirits market, valued at over $1.5 trillion in 2024, continues to attract new entrants and innovative marketing strategies, putting pressure on established players.

Economic headwinds, including inflation and cautious consumer spending, pose a significant threat, particularly to luxury goods like Rémy Martin cognac. Global economic growth forecasts for 2024 and 2025 suggest a challenging environment where consumers may trade down to less expensive options or reduce discretionary spending, impacting sales volumes and profit margins.

Shifting consumer preferences towards moderation, abstinence, and lower-alcohol or non-alcoholic beverages present a long-term challenge to traditional spirits consumption. Furthermore, supply chain vulnerabilities and the volatility of raw material and energy costs, as seen with grape prices and shipping expenses in 2023-2024, can directly impact operating expenses and profit margins.

Navigating evolving regulatory environments and potential trade tariffs across key markets is another critical threat. Increases in alcohol taxes, which some regions are considering by up to 10% according to 2023 reports, could reduce affordability and dampen demand for Rémy Cointreau's premium offerings.

SWOT Analysis Data Sources

This Rémy Cointreau SWOT analysis is built upon a robust foundation of data, drawing from official financial reports, comprehensive market research, and expert industry commentary to ensure a thorough and accurate strategic assessment.