Rémy Cointreau Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Rémy Cointreau Bundle

Curious about how Rémy Cointreau masterfully blends heritage with innovation? This Business Model Canvas breaks down their premium brand positioning, exclusive distribution channels, and strong customer relationships, revealing the core drivers of their success.

Unlock the complete strategic blueprint behind Rémy Cointreau’s enduring appeal. This in-depth Business Model Canvas details their value propositions, key resources, and revenue streams, offering a clear roadmap to their market dominance. Ideal for anyone seeking to understand luxury brand strategy.

Dive deeper into the sophisticated operations of Rémy Cointreau with our comprehensive Business Model Canvas. From their meticulously crafted products to their targeted marketing efforts, discover what makes this iconic company a leader in the spirits industry. Download the full version to gain actionable insights.

Partnerships

Rémy Cointreau cultivates strategic alliances with key global and regional distributors, a vital component of its business model. For instance, its partnership with Southern Glazer's Wine & Spirits in California exemplifies this approach, ensuring extensive market reach and streamlined product delivery across diverse retail and on-premise establishments.

Rémy Cointreau actively seeks out key partnerships with suppliers and innovators committed to sustainability. A prime example is their collaboration with INTACT, a company developing low-carbon alcohol derived from legumes, specifically for use in Cointreau. This initiative directly supports their goal of reducing the carbon footprint associated with a flagship product.

Another crucial partnership is with Verallia, a leading glass manufacturer. Together, they are focused on integrating electric furnaces into glass production. This move is a significant step towards decarbonizing the packaging component of their supply chain, aligning with Rémy Cointreau's broader environmental objectives.

These collaborations are not merely transactional; they are fundamental to Rémy Cointreau's 'Sustainable Exception' roadmap. This strategic approach emphasizes a deep commitment to minimizing environmental impact throughout their entire production and supply chain, from raw materials to finished goods.

Rémy Cointreau cultivates strong ties with on-trade establishments like premium bars and restaurants, alongside off-trade retailers such as specialized liquor stores. This ensures their prestigious brands are accessible in locations where discerning consumers shop and socialize.

These partnerships are crucial for brand presence and driving sales, particularly in significant markets. For instance, in the fiscal year 2023-2024, Rémy Cointreau saw continued strength in the US market, a key territory where on-trade and retail relationships are paramount to their success.

Eco-packaging Technology Providers

Rémy Cointreau's strategic alliance with eco-packaging technology providers is a cornerstone of its sustainability efforts. A significant investment in EcoSpirits, coupled with a four-year global licensing agreement, underscores this commitment. This partnership is specifically geared towards implementing circular packaging solutions for key brands, including Cointreau and Mount Gay.

This collaboration directly addresses the growing consumer demand for environmentally responsible products. By focusing on reducing single-use glass bottles, Rémy Cointreau is proactively aligning its operations with sustainability goals. This move is crucial for maintaining brand reputation and market share in an increasingly eco-conscious global market.

- Investment in EcoSpirits: This partnership signifies a financial commitment to innovative, sustainable packaging solutions.

- Global Licensing Agreement: A four-year deal enables the widespread adoption of circular packaging technologies across Rémy Cointreau's portfolio.

- Brand Impact: Cointreau and Mount Gay are early beneficiaries, showcasing the practical application of these eco-friendly initiatives.

- Environmental Focus: The primary objective is to drastically reduce reliance on single-use glass bottles, contributing to a circular economy model.

Agricultural and Terroir Stakeholders

Rémy Cointreau cultivates deep-rooted partnerships with winemakers and farmers, especially within the Cognac region. These collaborations are crucial for guaranteeing the exceptional quality and long-term sustainability of their essential raw materials.

The company actively promotes agroecological farming practices. This focus not only enhances soil resilience but also plays a vital role in developing the distinct character of their renowned spirits, ensuring a consistent and superior product.

- Vineyard Partnerships: Rémy Cointreau works closely with over 1,000 winegrowers in the Cognac appellation, many of whom have been supplying the house for generations.

- Sustainable Practices: In 2023, the group announced its commitment to having 100% of its wine suppliers committed to sustainable development by 2025, with a significant portion already engaged in eco-friendly methods.

- Terroir Preservation: These alliances are instrumental in safeguarding the unique terroir of Cognac, ensuring the continued availability of high-quality Ugni Blanc grapes, the primary varietal used.

- Innovation in Viticulture: The partnerships foster the adoption of innovative techniques, such as cover cropping and reduced pesticide use, contributing to biodiversity and the overall health of the vineyards.

Rémy Cointreau's key partnerships extend to its distribution network, including major players like Southern Glazer's Wine & Spirits in California, ensuring broad market access. They also collaborate with suppliers focused on sustainability, such as INTACT for low-carbon alcohol, and Verallia for electric furnace glass production, aiming to decarbonize packaging.

Furthermore, Rémy Cointreau has invested in and formed a global licensing agreement with EcoSpirits to implement circular packaging solutions for brands like Cointreau and Mount Gay, reducing single-use glass. In 2023, they committed to having 100% of their wine suppliers engaged in sustainable development by 2025, working with over 1,000 Cognac winegrowers.

| Partnership Type | Key Partner Example | Strategic Focus | Impact/Data Point |

|---|---|---|---|

| Distribution | Southern Glazer's Wine & Spirits | Market Reach & Delivery | Ensures extensive retail and on-premise presence. |

| Sustainable Suppliers | INTACT | Low-Carbon Ingredients | Developing low-carbon alcohol for Cointreau. |

| Packaging Innovation | Verallia | Decarbonization | Integrating electric furnaces for glass production. |

| Circular Packaging | EcoSpirits | Waste Reduction | Global licensing for circular packaging of Cointreau & Mount Gay. |

| Viticulture | Cognac Winegrowers (1,000+) | Quality & Sustainability | Aiming for 100% sustainable suppliers by 2025. |

What is included in the product

A comprehensive, pre-written business model tailored to Rémy Cointreau’s strategy of focusing on premium spirits, detailing customer segments, channels, and value propositions.

This model reflects the real-world operations and plans of the featured company, organized into 9 classic BMC blocks with full narrative and insights.

The Rémy Cointreau Business Model Canvas offers a pain point reliever by providing a clear, one-page snapshot of their complex global operations, simplifying the identification of key value propositions and customer segments.

This structured approach allows for rapid analysis of their premium spirits strategy, alleviating the pain of deciphering intricate market dynamics and distribution channels.

Activities

Rémy Cointreau's core activity revolves around the artful creation and patient maturation of its premium spirits. This includes the renowned Rémy Martin and LOUIS XIII Cognacs, alongside a portfolio of fine liqueurs and whiskies. This dedication to quality, honed over generations, defines the unique character and luxury appeal of their offerings.

The aging process is particularly crucial. For instance, Rémy Martin's Fine Champagne Cognac requires a minimum of four years of aging in French oak barrels, with many expressions, like LOUIS XIII, aging for decades, even a century, to develop their complex flavor profiles. This long-term investment in time and oak is fundamental to their brand value and premium pricing.

Rémy Cointreau orchestrates a sophisticated global distribution network, leveraging both wholly-owned subsidiaries and a robust cadre of third-party distributors. This intricate web ensures its premium spirits reach consumers across diverse international markets.

Key activities focus on optimizing supply chain performance, a critical element given the company's premium positioning. This includes managing inventory, transportation, and warehousing to maintain product quality and timely delivery, adapting to the unique demands of each market.

In 2023, Rémy Cointreau reported that its distribution network was instrumental in achieving a 19.1% organic growth in net sales, highlighting the direct impact of efficient logistics on its financial performance and market penetration.

Rémy Cointreau consistently invests in marketing and communications to solidify its luxury image and foster deep customer connections. This strategic approach involves carefully chosen campaigns, robust digital marketing efforts, and engaging experiential events designed to boost brand recognition and sales in crucial global markets.

For the fiscal year 2023-2024, Rémy Cointreau reported a notable increase in marketing expenditure, reflecting its commitment to brand building. This investment is crucial for maintaining its premium positioning against competitors, as seen in its continued focus on heritage and craftsmanship in advertising.

Innovation and Product Development

Rémy Cointreau's innovation engine is fueled by a commitment to continuous product development, evident in recent launches like Cointreau Cocktail Twists, catering to the growing demand for convenient, high-quality ready-to-drink options. This focus extends to enhancing the sustainability of its packaging, aligning with evolving consumer preferences and environmental consciousness.

The company actively invests in exploring novel distillation techniques to refine its spirits and create unique flavor profiles. Furthermore, Rémy Cointreau strategically aims to cultivate new consumption occasions for its established brands, broadening their appeal across different demographics and social settings.

- Product Innovation: Development of ready-to-drink (RTD) cocktails, such as Cointreau Cocktail Twists, to capture evolving consumer preferences for convenience and quality.

- Sustainability Focus: Advancements in sustainable packaging solutions to reduce environmental impact and appeal to eco-conscious consumers.

- Process Enhancement: Exploration of new distillation techniques to refine product quality and create distinctive flavor profiles for its portfolio.

- Market Expansion: Strategic efforts to create new consumption occasions for its brands, thereby increasing market penetration and brand relevance.

Implementing Sustainability Initiatives

Rémy Cointreau's key activities include the rigorous implementation of its 'Sustainable Exception' Corporate Social Responsibility (CSR) roadmap. This involves actively pursuing projects aimed at reducing the company's environmental footprint.

Central to this is responsible sourcing of raw materials, enhancing energy efficiency across all facilities, and championing circular economy principles. For instance, in fiscal year 2023-2024, the company continued its efforts to decarbonize its supply chain, targeting a 25% reduction in Scope 1 and 2 emissions by 2030 compared to a 2021 baseline.

These initiatives are crucial for long-term value creation and mitigating risks associated with climate change and resource scarcity. The company also focuses on reducing water consumption, a vital resource for spirits production, with specific targets set for its distilleries.

- Responsible Sourcing: Ensuring ethical and sustainable procurement of grapes, sugarcane, and other agricultural inputs.

- Energy Efficiency: Investing in renewable energy sources and optimizing energy consumption in distillation and bottling processes.

- Circular Economy: Implementing waste reduction programs and exploring innovative uses for by-products.

- Water Management: Reducing water usage and improving water quality in and around its production sites.

Rémy Cointreau's key activities encompass the meticulous creation and patient aging of its premium spirits, a process central to its luxury brand identity. This includes managing the intricate supply chain and distribution networks necessary to deliver these high-value products globally. Furthermore, significant investment is directed towards marketing and communications to reinforce brand prestige and foster consumer engagement.

Innovation is also a vital activity, focusing on developing new product formats, like ready-to-drink options, and enhancing the sustainability of its operations and packaging. The company is committed to its CSR roadmap, emphasizing responsible sourcing, energy efficiency, and water management across its production sites.

| Activity Area | Key Actions | Impact/Focus |

|---|---|---|

| Spirit Creation & Maturation | Artisanal distillation, long-term barrel aging (e.g., LOUIS XIII aging for decades) | Developing complex flavor profiles, brand heritage, premium quality |

| Distribution & Supply Chain | Managing global network (owned subsidiaries, third-party distributors), inventory, logistics | Market penetration, product quality maintenance, sales performance |

| Marketing & Communications | Brand building campaigns, digital marketing, experiential events | Luxury image reinforcement, customer connection, sales growth |

| Innovation & Sustainability | New product development (RTDs), sustainable packaging, process enhancement, CSR roadmap implementation | Meeting evolving consumer needs, environmental responsibility, operational efficiency |

What You See Is What You Get

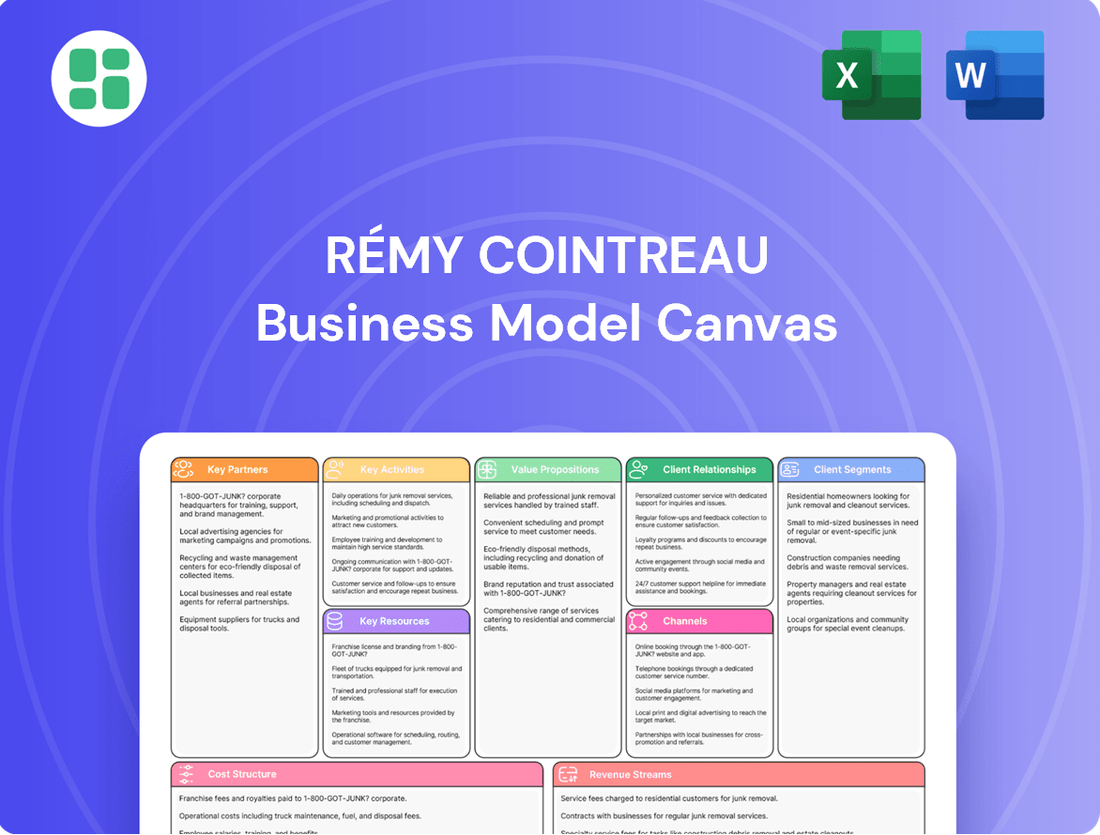

Business Model Canvas

The Rémy Cointreau Business Model Canvas you are previewing is the actual, complete document you will receive upon purchase. This is not a sample or a mockup; it's a direct glimpse into the professional, ready-to-use file that will be yours. You'll gain full access to this exact same document, allowing you to immediately leverage its insights for your strategic planning.

Resources

Rémy Cointreau's core strength lies in its prestigious portfolio of iconic luxury spirits. This includes globally recognized names like Rémy Martin Cognac, the ultra-premium LOUIS XIII, and the distinctive Cointreau liqueur. These brands represent a significant portion of the company's value, embodying heritage and commanding premium pricing in the market.

Beyond its flagship brands, the portfolio extends to other esteemed spirits such as Metaxa Greek spirit, Mount Gay rum, and Bruichladdich Scotch whisky. This diversification across different spirit categories strengthens Rémy Cointreau's market presence and appeal to a wider range of discerning consumers. In fiscal year 2023-2024, the company reported a revenue of €1.46 billion, with its House of Rémy Martin and House of Cointreau brands driving significant growth.

Rémy Cointreau's considerable inventory of aging eaux-de-vie, especially for its signature Cognac, is a cornerstone of its business. This vast stock is not just an asset but a crucial element in crafting the exceptional quality and aged expressions that define its luxury brand. For instance, the company's commitment to aging is evident in its extensive cellars, holding many years' worth of production, a key differentiator in the premium spirits market.

Rémy Cointreau leverages a robust global distribution network, a cornerstone of its business model. This network includes directly-owned subsidiaries in key markets, ensuring control over brand presentation and consumer engagement. For instance, in fiscal year 2023-2024, the company continued to strengthen its direct-to-consumer capabilities.

Complementing its owned subsidiaries, Rémy Cointreau partners with major distributors worldwide. These partnerships are crucial for reaching a broader consumer base and navigating diverse market complexities. This dual approach allows for efficient market penetration and a direct connection with consumers across various geographies.

The company’s infrastructure is designed for efficient logistics and market access. This allows Rémy Cointreau to effectively introduce and promote its premium spirits, such as Rémy Martin cognac and Cointreau liqueur, to a global audience. Their commitment to this network underpins their strategy for sustained growth in the premium spirits sector.

Human Capital and Expertise

The deep expertise of Rémy Cointreau's employees is a cornerstone of its business model. This includes highly skilled master blenders, distillers, and brand ambassadors who ensure the exceptional quality and heritage of their spirits. A dedicated management team further guides the company's strategic direction.

This collective knowledge is critical for maintaining the premium quality of products like Cognac and Champagne, fostering innovation in new offerings, and effectively executing the company's global business strategies. The commitment of this human capital directly translates into brand equity and customer loyalty.

- Master Blenders and Distillers: Their artisanal skills are paramount to the unique taste profiles of Rémy Cointreau's portfolio.

- Brand Ambassadors: These individuals are crucial for communicating brand heritage and engaging consumers globally, a key part of their marketing strategy.

- Management Team: Their strategic vision and operational oversight drive growth and ensure the long-term success of the business.

- Innovation and Quality Control: Employee expertise underpins both the consistent quality of existing products and the development of new, market-relevant offerings.

Terroirs and Agricultural Holdings

Rémy Cointreau’s access to and careful management of exceptional terroirs, especially in the Cognac region, are absolutely critical. These prime agricultural lands are the bedrock for the unparalleled quality and authenticity of their renowned spirits, like Cognac and Scotch whisky.

These agricultural holdings are not just land; they are vital for securing premium raw materials. Rémy Cointreau places a strong emphasis on sustainable practices in managing these lands, ensuring long-term quality and environmental responsibility. This commitment is reflected in their approach to viticulture and grain sourcing.

- Exceptional Terroirs: Ownership and access to prime vineyards in the Grande Champagne and Petite Champagne crus of Cognac, areas renowned for producing the finest eaux-de-vie.

- Sustainable Agriculture: Implementation of eco-friendly farming methods, including reduced pesticide use and biodiversity promotion, across their vineyards and distilleries. For instance, by 2025, they aim to have 100% of their vineyards certified High Environmental Value (HVE) Level 3.

- Raw Material Sourcing: Direct control over a significant portion of their grape and grain supply, guaranteeing the quality and traceability essential for their premium spirits.

Rémy Cointreau's intellectual property, particularly its renowned brand names and proprietary aging techniques, forms a significant resource. The company actively protects its trademarks and patents, ensuring the exclusive use of its iconic brands like Rémy Martin and Cointreau. This intellectual capital is crucial for maintaining brand value and market differentiation.

The company's deep-seated knowledge of distillation, blending, and maturation processes is invaluable. This expertise, passed down through generations and continuously refined, allows Rémy Cointreau to produce spirits of unparalleled quality and consistency. For example, the specific oak used for aging Cointreau contributes to its distinctive flavor profile.

Rémy Cointreau's financial resources are substantial, enabling significant investments in inventory, brand building, and distribution. The company's strong balance sheet and access to capital markets support its long-term growth strategy. In fiscal year 2023-2024, Rémy Cointreau reported €1.46 billion in revenue, demonstrating its robust financial standing.

These financial assets allow for the acquisition of premium raw materials and the maintenance of extensive aging inventories, which are critical for producing aged spirits. Furthermore, capital is allocated to marketing campaigns that reinforce the luxury positioning of its brands, such as Rémy Martin Cognac.

| Key Resource Category | Specific Assets/Capabilities | Financial Year 2023-2024 Data |

|---|---|---|

| Intellectual Property | Brand Names (Rémy Martin, Cointreau, LOUIS XIII) | High brand equity and premium pricing power. |

| Intellectual Property | Proprietary Aging Techniques & Blending Expertise | Key differentiator for product quality and consistency. |

| Financial Resources | Revenue | €1.46 billion |

| Financial Resources | Investment Capacity | Supports inventory, brand building, and distribution expansion. |

Value Propositions

Rémy Cointreau’s commitment to uncompromising quality is evident in its premium spirits, a direct result of centuries of dedicated craftsmanship. This rich heritage, passed down through generations, ensures meticulous production processes that consumers value for their authenticity and time-tested expertise.

For the fiscal year ending March 31, 2024, Rémy Cointreau reported net sales of €1.35 billion, underscoring the market's consistent demand for its high-quality, heritage-rich products. This financial performance reflects the enduring appeal of brands built on a foundation of tradition and exceptional savoir-faire.

Rémy Cointreau crafts an exclusive luxury experience, positioning itself as a purveyor of exceptional spirits. This goes beyond just the liquid, weaving in rich brand storytelling and offering consumers a sense of prestige and high-end indulgence. For instance, their limited-edition releases and immersive brand events cater directly to discerning customers who value exclusivity and status.

Rémy Cointreau's value proposition centers on authenticity and terroir expression, where each brand, like Louis XIII cognac or Cointreau liqueur, meticulously showcases its unique origin. This commitment allows consumers to experience distinct flavors and sensory profiles directly tied to specific geographical and climatic conditions, offering a truly authentic taste of place that connoisseurs highly appreciate.

Commitment to Sustainability and Responsible Practices

Rémy Cointreau's 'Sustainable Exception' roadmap deeply resonates with consumers prioritizing environmental and social responsibility. This commitment is not just about marketing; it translates into tangible actions across their operations, attracting a growing segment of the market that actively seeks out brands with ethical practices.

The company’s focus on environmental protection, responsible sourcing, and circular economy initiatives directly addresses rising consumer expectations. For instance, their efforts in biodiversity preservation and reducing their carbon footprint are key components of this value proposition. In 2024, Rémy Cointreau continued to invest in renewable energy sources for its production sites, aiming to further decrease its environmental impact.

- Environmental Stewardship: Rémy Cointreau actively works to protect ecosystems and reduce its carbon emissions, aligning with global climate goals.

- Responsible Sourcing: The company emphasizes ethical and sustainable sourcing of its raw materials, ensuring fair practices throughout its supply chain.

- Circular Economy: Initiatives promoting waste reduction, recycling, and the reuse of materials are central to minimizing the brand's environmental footprint.

- Consumer Alignment: This commitment directly appeals to eco-conscious consumers who increasingly factor sustainability into their purchasing decisions, driving brand loyalty and market share.

Innovation and Modern Relevance

Rémy Cointreau balances its rich heritage with a forward-looking approach, ensuring its premium brands resonate with contemporary consumers. This is evident in their embrace of innovation, such as the development of new product formats like ready-to-drink cocktails, which cater to convenience-seeking demographics.

The company also leverages modern technology to enhance the customer experience and brand integrity. For instance, their exploration and adoption of technologies like blockchain for provenance tracking directly address consumer demand for transparency and authenticity in premium spirits.

- Innovation in Product Formats: Rémy Cointreau is expanding into ready-to-drink (RTD) offerings, tapping into a growing market segment.

- Technological Integration: The use of blockchain for provenance tracking underscores a commitment to transparency and combating counterfeits.

- Brand Relevance: This blend of tradition and modernity keeps iconic brands like Louis XIII and Cointreau appealing to both established and new generations of discerning consumers.

- Market Adaptation: By innovating in product and technology, Rémy Cointreau actively adapts to evolving consumer preferences and market trends.

Rémy Cointreau's value proposition is built on delivering an authentic luxury experience through its exceptional spirits. This is achieved through a deep respect for heritage, meticulous craftsmanship, and a commitment to expressing the unique terroir of its products, offering consumers a taste of genuine quality and prestige.

Customer Relationships

Rémy Cointreau is actively strengthening its direct-to-consumer (DTC) engagement, especially via online channels. This strategy aims to forge a more personal connection with customers, fostering deeper relationships and enabling the gathering of crucial insights into consumer tastes and buying habits.

Rémy Cointreau utilizes sophisticated data analytics to deeply understand its discerning clientele, driving highly personalized marketing initiatives. This focus on consumer preferences allows for the creation of tailored communications and exclusive offers, strengthening customer loyalty.

The company's investment in robust Customer Relationship Management (CRM) systems is key to this strategy. By leveraging data, Rémy Cointreau aims to forge deeper emotional connections with its customers, moving beyond transactional relationships to build lasting brand affinity.

Rémy Cointreau deeply engages its customers through immersive experiential and educational events. These gatherings, often guided by knowledgeable brand ambassadors, offer a unique window into the heritage and meticulous craftsmanship behind their renowned spirits.

Hospitality initiatives at their historic Maisons further enhance these connections, providing memorable interactions that go beyond simple product sampling. For instance, in fiscal year 2023-2024, Rémy Cointreau reported a significant increase in visitor numbers at its estates, underscoring the success of these relationship-building strategies.

Community Building and Loyalty Programs

Rémy Cointreau actively cultivates strong customer connections through dedicated community building and loyalty initiatives. These programs are designed to create lasting bonds, encouraging customers to become brand advocates and repeat purchasers.

The company focuses on building vibrant communities around its premium brands, fostering a sense of belonging and shared appreciation among consumers. This approach aims to enhance brand loyalty and drive sustained engagement.

- Brand Communities: Rémy Cointreau develops online and offline platforms where enthusiasts can connect, share experiences, and learn more about their favorite spirits, such as exclusive virtual tastings or distillery tours.

- Loyalty Programs: Implementing tiered loyalty programs rewards repeat customers with exclusive benefits, early access to new products, and personalized offers, reinforcing their commitment to the brands.

- Customer Engagement: By fostering these relationships, the company aims to increase customer lifetime value and generate positive word-of-mouth marketing, crucial for a luxury goods market.

Dedicated Customer Service

Rémy Cointreau places significant emphasis on dedicated customer service, recognizing its importance in catering to a discerning, high-end clientele. This commitment involves offering personalized experiences that directly address the unique needs and expectations of luxury consumers, thereby reinforcing the premium image of its esteemed brands.

- Personalized Engagement: Tailoring interactions to individual preferences for a bespoke luxury experience.

- High-Touch Support: Providing responsive and knowledgeable assistance to meet demanding standards.

- Brand Reinforcement: Ensuring every customer touchpoint reflects the exclusivity and quality of Rémy Cointreau's portfolio.

- Clientele Retention: Cultivating loyalty through exceptional service that fosters long-term relationships.

Rémy Cointreau prioritizes building strong, lasting relationships with its customers, particularly through digital channels and exclusive experiences. The company leverages data analytics and CRM systems to personalize interactions, fostering loyalty and brand advocacy. This focus on high-touch support and community building reinforces the premium image of its brands.

| Customer Relationship Strategy | Key Initiatives | Impact/Focus |

|---|---|---|

| Direct-to-Consumer (DTC) Engagement | Online sales platforms, personalized digital content | Fostering personal connections, gathering consumer insights |

| Data-Driven Personalization | Sophisticated analytics, tailored marketing, exclusive offers | Enhancing customer loyalty, driving repeat purchases |

| Experiential Marketing | Immersive events, distillery tours, brand ambassador guidance | Deepening brand heritage understanding, creating memorable interactions |

| Community Building & Loyalty | Online/offline platforms for enthusiasts, tiered loyalty programs | Cultivating brand advocates, increasing customer lifetime value |

| Exceptional Customer Service | Personalized support, high-touch assistance | Reinforcing brand exclusivity, ensuring clientele retention |

Channels

Wholesale distributors are the backbone of Rémy Cointreau's global market penetration. This established network ensures that brands like Rémy Martin and Cointreau reach diverse markets efficiently. In 2024, this channel remains critical for maintaining broad availability across numerous countries and territories.

These distributors manage the complex logistics of transporting and storing premium spirits, ensuring they reach retailers and hospitality venues in optimal condition. Their expertise in local markets allows Rémy Cointreau to tailor its distribution strategies. This traditional approach continues to be a reliable method for sales growth.

Rémy Cointreau leverages its directly-owned subsidiaries in crucial markets like the United States, China, and the UK. This direct management of distribution, pricing, and sales ensures meticulous control over brand presentation and market strategies.

For the fiscal year ending March 31, 2024, Rémy Cointreau reported organic growth in its key markets, with the United States remaining its largest market, contributing significantly to overall revenue. This direct subsidiary model allows the company to adapt quickly to local consumer preferences and regulatory landscapes.

E-commerce platforms are increasingly vital for Rémy Cointreau, facilitating direct-to-consumer (DTC) engagement and expanding reach, especially in burgeoning markets like Asia-Pacific. This digital channel is key to tapping into a wider, digitally-savvy consumer base, allowing for more personalized marketing and sales efforts.

The company has set ambitious targets for digital sales, aiming for them to represent a substantial percentage of overall revenue in the near future. For instance, in fiscal year 2023-2024, Rémy Cointreau reported a notable increase in its online sales performance, underscoring the growing importance of this channel. This strategic push reflects a broader industry trend where brands are investing heavily in their digital infrastructure to capture market share and build stronger customer relationships.

On-Premise Outlets

On-premise channels, including bars, restaurants, and hotels, are essential for Rémy Cointreau, driving brand visibility and offering consumers a direct, engaging experience. The company actively works to enhance its footprint in these crucial locations, recognizing their impact on brand perception and trial. For instance, in 2024, Rémy Cointreau continued its strategic partnerships with premium hospitality venues globally.

These partnerships are particularly vital in high-volume markets, acting as key drivers for sales and brand advocacy. Las Vegas, a prime example of such a market, sees significant focus from Rémy Cointreau in 2024, with targeted activations and premium placements within top-tier establishments. This strategy aims to capture consumer attention at the point of decision.

- Brand Visibility: On-premise venues serve as prime stages for brand exposure, allowing direct interaction with potential customers.

- Consumer Experience: These channels offer curated tasting experiences and expert recommendations, enhancing brand appreciation.

- Sales Driver: Premium on-premise placements, especially in high-traffic areas, directly contribute to sales volume and market share.

- Market Penetration: Strengthening presence in key markets like Las Vegas in 2024 allows Rémy Cointreau to capture a larger share of the luxury spirits market.

Global Travel Retail

Global Travel Retail is a vital sales channel for Rémy Cointreau, connecting with a significant portion of international consumers. This segment, encompassing duty-free shops in airports and on cruise lines, serves as a prime location for brand exposure and direct engagement with travelers. Rémy Cointreau actively invests in this channel through targeted brand activations and the introduction of exclusive or new product offerings, aiming to capture the attention of a global audience.

In 2024, the travel retail sector continued its recovery trajectory, with airport passenger traffic showing robust growth. For instance, by early 2024, many major international airports had surpassed pre-pandemic passenger volumes, creating a fertile ground for luxury goods sales. Rémy Cointreau leverages this resurgence by:

- Targeted Promotions: Implementing specific campaigns and limited editions tailored for the travel retail environment to drive impulse purchases.

- Brand Experience: Creating engaging in-store experiences and tastings to enhance brand perception among discerning travelers.

- Product Innovation: Launching travel-exclusive sizes or gift sets that appeal to the gifting occasion common in duty-free shopping.

- Strategic Partnerships: Collaborating with airport retailers and travel operators to maximize visibility and sales opportunities.

Rémy Cointreau utilizes a multi-channel strategy, with wholesale distributors forming the core for broad market access, complemented by directly-owned subsidiaries in key regions for enhanced control. E-commerce is a growing focus, enabling direct consumer engagement and personalized marketing, while on-premise channels like bars and restaurants drive brand visibility and trial through curated experiences.

Customer Segments

Rémy Cointreau's customer base prominently features the affluent middle class and high-net-worth individuals. These consumers possess substantial disposable income, allowing them to indulge in premium and luxury spirits, aligning perfectly with Rémy Cointreau's brand positioning.

This segment spans across global markets, encompassing both newly affluent individuals and long-established wealthy households. For instance, in 2024, the global luxury goods market, which includes premium spirits, continued its robust growth, with reports indicating a significant portion of this growth driven by spending from these high-income demographics.

Rémy Cointreau recognizes the growing influence of Millennials and Gen Z, who are actively seeking premium spirits that offer more than just taste. These consumers, often digitally savvy, are drawn to brands with a clear narrative about their heritage and production methods. In 2024, the company's marketing efforts are increasingly tailored to resonate with these values, highlighting the craftsmanship and authenticity behind their portfolio, which is crucial for capturing future market share.

Discerning connoisseurs and collectors represent a crucial customer segment for Rémy Cointreau, particularly those drawn to ultra-premium and prestige spirits like LOUIS XIII Cognac. These individuals value rarity, heritage, and the distinctive qualities that set these products apart. Their purchasing decisions are driven by a desire for exclusivity and uncompromising quality.

Eco-Conscious and Socially Responsible Consumers

Eco-conscious consumers are increasingly influential, seeking brands that align with their values. Rémy Cointreau’s dedication to its Sustainable Exception roadmap, focusing on biodiversity, climate action, and responsible sourcing, resonates strongly with this demographic.

This segment is willing to support companies demonstrating tangible environmental and social commitments. For instance, Rémy Cointreau’s efforts in reducing carbon emissions and promoting sustainable agriculture in its vineyards directly appeal to these buyers.

- Growing Market Share: Reports indicate a significant rise in consumer preference for sustainable products, with market research suggesting this trend will continue to accelerate through 2025 and beyond.

- Brand Loyalty: Consumers prioritizing sustainability often exhibit higher brand loyalty, driven by a shared commitment to ethical practices.

- Premium Pricing: This segment is often willing to pay a premium for products that meet stringent environmental and social standards.

- Rémy Cointreau's Initiatives: The company's investments in renewable energy and water stewardship projects are key selling points for these discerning customers.

International Travelers

International travelers represent a key customer segment for Rémy Cointreau, particularly within the global travel retail channel. This channel provides a unique environment to reach consumers during their journeys, offering them premium spirits like Rémy Martin cognac and Cointreau liqueur.

Brand activations and exclusive travel retail offerings are crucial for engaging this segment. For instance, in 2024, airports and duty-free shops continue to be significant touchpoints. Rémy Cointreau often leverages these locations for special promotions and limited-edition products, aiming to capture impulse purchases and enhance brand visibility among a global audience. The travel retail market itself is a substantial contributor to premium spirit sales, with many travelers seeking unique or travel-exclusive items.

- Global Reach: International travelers provide access to a diverse, affluent customer base across numerous geographic locations.

- Premiumization Focus: This segment is often receptive to high-end and exclusive products, aligning with Rémy Cointreau's brand positioning.

- Impulse and Gifting: Travel retail environments often drive impulse purchases and gifting occasions, which Rémy Cointreau products are well-suited for.

- Brand Experience: Targeted activations in travel hubs can create memorable brand interactions, fostering loyalty among transient consumers.

Rémy Cointreau targets affluent consumers, including high-net-worth individuals, who appreciate premium and luxury spirits. This segment is global, encompassing both emerging and established wealthy demographics, with luxury goods spending showing continued strength in 2024.

The company also focuses on younger generations like Millennials and Gen Z, who seek brands with authentic stories and craftsmanship. Marketing in 2024 emphasizes heritage and production methods to connect with these digitally savvy consumers.

Discerning connoisseurs and collectors are key, especially for ultra-premium offerings like LOUIS XIII Cognac, valuing rarity and exclusivity. Furthermore, eco-conscious consumers are increasingly important, drawn to Rémy Cointreau's sustainability initiatives, such as carbon emission reduction and responsible sourcing, which saw continued market growth in 2024.

International travelers are a significant segment, reached through global travel retail. Rémy Cointreau leverages airport and duty-free promotions in 2024 to capture impulse purchases and enhance brand visibility among this diverse, affluent customer base.

| Customer Segment | Key Characteristics | 2024 Relevance/Data Point |

|---|---|---|

| Affluent Consumers | High disposable income, appreciation for luxury | Global luxury goods market continued robust growth in 2024. |

| Millennials & Gen Z | Value heritage, authenticity, digital engagement | Marketing in 2024 increasingly tailored to these values. |

| Connoisseurs & Collectors | Seek rarity, exclusivity, uncompromising quality | Demand for ultra-premium spirits remains strong. |

| Eco-Conscious Consumers | Prioritize sustainability, ethical practices | Consumer preference for sustainable products continues to accelerate. |

| International Travelers | Global reach, impulse/gifting occasions | Travel retail remains a significant touchpoint for premium spirit sales. |

Cost Structure

Rémy Cointreau's production and raw material costs are substantial, driven by the high-quality grapes for its Cognacs and the specific botanicals used in liqueurs like Cointreau. These agricultural inputs are directly affected by harvest quality and availability, impacting overall expenses.

The intricate production processes, including lengthy aging periods for Cognac, which can span decades, and meticulous blending techniques, represent significant cost drivers. For instance, the aging process requires substantial investment in oak barrels and climate-controlled cellars, contributing to the premium pricing of their products.

In fiscal year 2023-2024, Rémy Cointreau highlighted the impact of inflation on raw material and energy costs, which put pressure on their margins, even as they focused on managing these expenses through strategic sourcing and operational efficiencies.

Rémy Cointreau dedicates significant resources to marketing and communication, essential for nurturing its premium brand image and connecting with affluent consumers worldwide. These expenditures encompass a broad range, from high-profile advertising campaigns and sophisticated digital marketing strategies to in-person promotional events and public relations efforts.

For the fiscal year ending March 31, 2024, Rémy Cointreau reported that its marketing and distribution expenses, which include these communication costs, amounted to €383.6 million. This figure represents a notable portion of their overall operational spending, underscoring the company's commitment to maintaining brand visibility and desirability in a competitive luxury spirits market.

Rémy Cointreau's extensive global presence demands substantial investment in its distribution and logistics infrastructure. This includes the costs associated with warehousing products across various regions, the transportation of goods via sea, air, and land, and the ongoing management of relationships with a wide array of wholesale and retail partners.

For fiscal year 2023-2024, optimizing these operational expenditures is paramount to maintaining cost efficiency and ensuring timely delivery of premium spirits to consumers worldwide. The company continually seeks ways to streamline its supply chain, from sourcing raw materials to the final point of sale, to mitigate these significant costs.

Overhead and Administrative Costs

Rémy Cointreau's cost structure includes significant overhead and administrative expenses. These encompass general overheads, salaries for administrative and non-production personnel, and the operational costs associated with its various subsidiaries and global offices. For instance, the company's fiscal year 2023-2024 saw continued focus on managing these operational expenditures.

To address these costs, the company has actively implemented cost-cutting and efficiency improvement plans. These initiatives are designed to optimize resource allocation and streamline operations across its global footprint.

- General Overheads: Includes administrative expenses, salaries for non-production staff, and operational costs of subsidiaries and offices.

- Cost Management Initiatives: The company has implemented cost-cutting plans to manage these expenses effectively.

- Fiscal Year 2023-2024 Focus: Continued emphasis on operational expenditure control and efficiency improvements.

Research and Development (R&D) and Innovation Investment

Rémy Cointreau's commitment to Research and Development (R&D) and innovation is a cornerstone of its cost structure, directly fueling its ability to offer premium spirits. This investment is crucial for developing new product lines, refining existing ones, and exploring advanced distillation and aging processes. For instance, the company consistently invests in enhancing its savoir-faire, which is vital for maintaining the quality and exclusivity of brands like Rémy Martin and Cointreau.

This dedication to innovation extends to sustainable practices, a growing priority in the spirits industry. Investments in R&D support the exploration of environmentally friendly production methods, from sourcing raw materials to packaging. While exact R&D spending figures are often embedded within broader operational costs, the company's sustained market position and brand equity are testaments to the effectiveness of these investments in driving long-term growth and differentiation.

- Product Innovation: Funding for the creation of new cognac expressions and liqueurs, ensuring a pipeline of premium offerings.

- Process Improvement: Investment in advanced distillation techniques and aging methods to enhance product quality and character.

- Sustainability Initiatives: Allocation of resources towards developing eco-friendly production processes and sustainable sourcing practices.

- Market Differentiation: R&D spending is key to maintaining a competitive edge and reinforcing the premium positioning of Rémy Cointreau's brands.

Rémy Cointreau's cost structure is significantly influenced by its premium raw materials, intricate production processes including long aging periods, and substantial marketing and distribution efforts. The company also incurs general overheads and invests in research and development to maintain its brand's exclusivity and drive innovation.

| Cost Category | Description | Fiscal Year 2023-2024 Impact |

| Production & Raw Materials | High-quality grapes for Cognac, specific botanicals for liqueurs. Affected by harvest quality. | Inflationary pressures on raw materials and energy. |

| Production Processes | Lengthy aging (decades), meticulous blending, oak barrels, climate-controlled cellars. | Significant investment required, contributing to premium pricing. |

| Marketing & Communication | Advertising, digital marketing, promotional events, public relations to nurture premium brand image. | €383.6 million in marketing and distribution expenses. |

| Distribution & Logistics | Warehousing, transportation (sea, air, land), managing retail and wholesale partner relationships. | Optimization is paramount for cost efficiency and timely delivery. |

| Overheads & Administration | General overheads, salaries for non-production staff, operational costs of subsidiaries and offices. | Continued focus on managing operational expenditures and efficiency improvements. |

| Research & Development | New product lines, refining existing products, advanced distillation and aging processes, sustainability. | Crucial for developing new offerings and maintaining market differentiation. |

Revenue Streams

The core of Rémy Cointreau's revenue generation is firmly rooted in the sales of its prestigious Cognac products, with Rémy Martin and LOUIS XIII leading the charge. This segment consistently represents the largest portion of the company's consolidated sales, underscoring its critical importance to the business.

For the fiscal year ending March 31, 2024, the Cognac division reported a revenue of €1.25 billion. This demonstrates its enduring strength even amidst shifting market dynamics, solidifying its position as the primary revenue engine for the group.

Rémy Cointreau's Sales of Liqueurs & Spirits Division Products is a significant revenue driver, encompassing iconic brands like Cointreau, Metaxa, Mount Gay rum, Bruichladdich whiskies, and The Botanist gin. This diversification across various spirit categories allows the company to tap into different consumer preferences and market trends.

In the fiscal year 2023-2024, the House of Rémy Martin experienced robust growth, with its Cognac sales contributing significantly to the overall performance. This highlights the continued strength and appeal of their flagship brand within the spirits portfolio.

Rémy Cointreau is increasingly leveraging direct-to-consumer (DTC) sales, especially via e-commerce, to boost revenue. This strategy aims to capture higher profit margins by cutting out intermediaries and fostering direct engagement with customers. The company has a clear objective to substantially grow its digital sales in the coming years.

Global Travel Retail Sales

Global Travel Retail Sales represent a significant revenue stream for Rémy Cointreau, tapping into the flow of international travelers through duty-free shops and other travel points. This channel is crucial for reaching a global audience and often features exclusive product launches or special editions, enhancing brand visibility and driving sales.

In the fiscal year 2023-2024, Rémy Cointreau reported that its Travel Retail segment saw a notable increase, reflecting a strong recovery in international travel. This channel is particularly important for premium and super-premium brands, where travelers are often seeking luxury goods.

- Airport Boutiques: Sales within airport duty-free stores are a primary component.

- Cruise Ships and Ferries: Revenue generated from onboard retail outlets.

- Diplomatic and Military Channels: Sales to specific exempt entities.

- Exclusive Product Offerings: Limited editions and travel-exclusive sets drive higher value.

Sales through Wholesale and Retail Partnerships

Revenue streams for Rémy Cointreau significantly rely on sales to a network of wholesale distributors and direct relationships with retail partners. These channels encompass both on-premise establishments, like bars and restaurants, and off-premise retailers, such as liquor stores and supermarkets. This dual approach forms the bedrock of the company's global distribution strategy.

In the fiscal year 2023-2024, Rémy Cointreau's performance illustrated the strength of these channels. The company reported a 1.9% organic decrease in sales to €1.17 billion for the fiscal year ending March 31, 2024, with a notable impact from the U.S. market. Despite this, the foundational wholesale and retail partnerships remain critical for market penetration and brand visibility.

- Wholesale Distribution: Sales to a broad network of independent and consolidated distributors worldwide, ensuring product availability across diverse markets.

- Direct Retail Partnerships: Engaging directly with on-premise (bars, restaurants) and off-premise (liquor stores, supermarkets) retailers to manage product placement and promotional activities.

- Global Reach: These channels facilitate the company's presence in key international markets, driving brand awareness and sales volume for its premium spirits portfolio.

Rémy Cointreau's revenue is primarily driven by its premium Cognac sales, notably from the Rémy Martin and LOUIS XIII brands. For the fiscal year ending March 31, 2024, the Cognac division generated €1.25 billion in revenue, highlighting its consistent dominance. The company also diversifies its income through its Liqueurs & Spirits division, featuring brands like Cointreau and Mount Gay, which further broadens its market reach and taps into varied consumer preferences.

Direct-to-consumer (DTC) sales, particularly through e-commerce, are a growing focus for Rémy Cointreau, aiming to enhance profit margins and customer engagement. Global Travel Retail is another vital revenue stream, capitalizing on international travelers, with notable increases reported in fiscal year 2023-2024 following the recovery in global travel.

| Revenue Stream | Primary Brands/Activities | FY 2023-2024 Performance |

| Cognac Sales | Rémy Martin, LOUIS XIII | €1.25 billion revenue |

| Liqueurs & Spirits Sales | Cointreau, Metaxa, Mount Gay, Bruichladdich, The Botanist | Significant contributor |

| Global Travel Retail | Airport duty-free, cruise ships, exclusive sets | Notable increase |

| Wholesale & Retail Distribution | Distributors, bars, restaurants, liquor stores | 1.9% organic decrease in sales to €1.17 billion (overall group) |

| Direct-to-Consumer (DTC) | E-commerce, digital sales | Strategic growth area |

Business Model Canvas Data Sources

The Rémy Cointreau Business Model Canvas is informed by a blend of internal financial reports, market research on luxury spirits consumption, and competitive analysis of key players. These sources provide a comprehensive view of the company's operations and strategic positioning.