Rémy Cointreau Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Rémy Cointreau Bundle

Rémy Cointreau navigates a complex landscape defined by strong brand loyalty, intense rivalry, and the ever-present threat of substitutes in the premium spirits market. Understanding these forces is crucial for any stakeholder looking to grasp the company's strategic positioning.

The complete report reveals the real forces shaping Rémy Cointreau’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of grape suppliers for Cognac, a key input for Rémy Cointreau, is significantly constrained. This limitation stems from the Cognac region's unique terroir and stringent appellation d'origine contrôlée (AOC) regulations, which dictate specific grape varietals and production methods. These factors drastically reduce the pool of eligible suppliers capable of meeting the exacting quality standards required for premium Cognac.

While individual grape farmers might possess limited leverage, the collective bargaining power of Cognac growers as a whole can be considerable. Their specialized knowledge and the indispensable nature of their product, particularly Ugni Blanc, Folle Blanche, and Colombard grapes, create a situation where Rémy Cointreau has few viable alternatives for sourcing its primary raw material. In 2023, the Cognac AOC saw a total production of approximately 75 million bottles, underscoring the scale of demand for these specific grapes.

Rémy Cointreau's reliance on specialized oak barrels for aging Cognac grants significant bargaining power to those suppliers. The unique properties of these barrels, often sourced from specific forests and requiring particular toasting, are critical for developing the characteristic flavors of Cognac, a process that can take decades. This niche market and the long-term nature of the investment in barrel production limit the number of viable suppliers, allowing them to command higher prices and favorable terms. For instance, the demand for French oak, a preferred material for Cognac aging, has seen price increases due to limited supply and high demand from the spirits industry.

The bargaining power of suppliers for specialized botanicals, particularly the bitter and sweet orange peels essential for Cointreau's distinct flavor, is moderately high. Cointreau's reliance on specific varietals from particular growing regions, like Spain and North Africa, for its signature taste profile means these niche suppliers can exert influence. In 2024, the global citrus market, while robust, faces ongoing challenges from climate variability and disease, which can further concentrate supply and bolster supplier leverage for premium quality ingredients.

High Switching Costs for Key Inputs

Rémy Cointreau faces significant supplier power due to high switching costs for critical inputs. For instance, securing specific grape varietals essential for Cognac production, or sourcing specialized oak barrels for aging, involves substantial financial investment and can lead to prolonged lead times. These dependencies are amplified by the long production cycles inherent in spirits, making abrupt supplier changes disruptive to both operations and brand consistency.

The long-term nature of Cognac production, often spanning decades from distillation to bottling, means that Rémy Cointreau has deeply integrated relationships with its key suppliers. Altering these established partnerships, built on trust and consistent quality, would likely involve considerable time and resources to re-establish equivalent supply chains, thereby reinforcing the bargaining power of these existing suppliers.

- High Capital Investment in Specialized Inputs: Acquiring specific, high-quality grape varietals or custom-made aging barrels requires significant upfront capital, making it costly to switch suppliers.

- Operational Disruption Risk: Changing suppliers for critical inputs can disrupt production schedules and impact the unique flavor profiles Rémy Cointreau is known for.

- Long-Term Contractual Obligations: Many supplier agreements for raw materials and aging infrastructure are long-term, creating inertia and making immediate shifts impractical.

- Quality and Consistency Demands: The premium nature of Rémy Cointreau's products necessitates unwavering quality and consistency from its suppliers, limiting the pool of viable alternatives.

Long-Term Supplier Relationships Mitigate Risk

Rémy Cointreau actively cultivates long-term relationships with its key suppliers, especially grape growers. This strategy is crucial for ensuring consistent quality and a dependable supply chain for its premium spirits. These established partnerships can effectively temper the immediate bargaining power of individual suppliers by fostering a sense of mutual dependence and shared commitment to upholding the high standards of Rémy Cointreau's products.

Despite these efforts, the inherent scarcity and unique characteristics of certain essential inputs, such as specific grape varietals or aged eaux-de-vie, still grant significant leverage to the overall supplier base. For instance, the production of Cognac is heavily regulated, with strict geographical and cultivation requirements, limiting the number of eligible suppliers.

- Supplier Relationship Management: Rémy Cointreau's focus on long-term contracts with grape growers helps secure supply and quality, reducing reliance on the spot market.

- Input Specificity: The unique terroir and specific grape varietals required for Cognac production inherently limit the pool of available suppliers, increasing their bargaining power.

- Quality Control: Maintaining the premium quality of its products means Rémy Cointreau must work closely with suppliers who meet stringent standards, reinforcing supplier influence.

- Market Dynamics: Fluctuations in agricultural yields due to weather or disease can further amplify the bargaining power of suppliers by creating supply shortages.

The bargaining power of Rémy Cointreau's suppliers for key inputs like Cognac grapes and aging barrels is a significant factor. While the company cultivates strong relationships, the specialized nature and limited availability of these inputs, coupled with high switching costs, often empower suppliers.

For example, the stringent appellation d'origine contrôlée (AOC) regulations for Cognac mean that only specific grape varietals grown in designated regions can be used. This inherent limitation on supply, combined with the decades-long aging process requiring specialized oak barrels, grants considerable leverage to these niche suppliers.

In 2023, the global demand for premium spirits continued to rise, putting further pressure on the supply of high-quality raw materials and aging components. This market dynamic, where Rémy Cointreau relies on a select group of suppliers for its signature products, underscores the substantial bargaining power they hold.

| Input Category | Key Factors Influencing Supplier Power | Impact on Rémy Cointreau |

|---|---|---|

| Cognac Grapes | Strict AOC regulations, specific varietals (e.g., Ugni Blanc), limited growing regions, specialized cultivation knowledge. | High; limits supplier options and dictates quality, influencing raw material costs. |

| Oak Barrels | Specific wood types (e.g., French oak), particular toasting processes, long aging cycles, limited specialized cooperages. | High; critical for flavor development, leading to higher costs and long lead times. |

| Botanicals (e.g., Orange Peels for Cointreau) | Reliance on specific varietals from particular regions, climate variability impacting yields, disease risks. | Moderate to High; quality and consistency are paramount, concentrating power with premium suppliers. |

What is included in the product

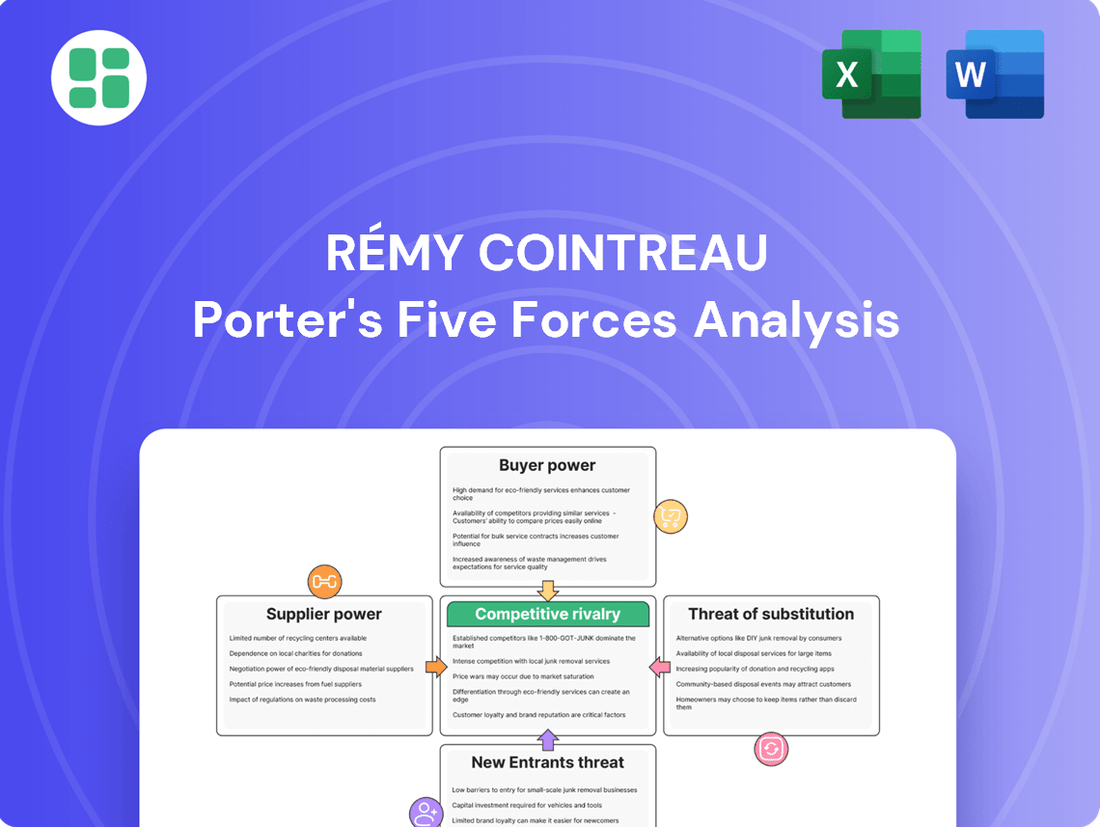

Analyzes the competitive intensity within the premium spirits market, examining buyer power, supplier leverage, threat of substitutes, and barriers to entry for Rémy Cointreau.

Instantly assess competitive intensity and identify strategic vulnerabilities with a dynamic, interactive Porter's Five Forces model for Rémy Cointreau.

Customers Bargaining Power

Rémy Cointreau serves a vast and dispersed global customer base, comprising countless distributors, retailers, and individual consumers. This extensive reach means that no single customer or small cluster of customers holds significant sway over the company's sales volume.

The sheer number of entities purchasing Rémy Cointreau products globally limits the bargaining power of any one buyer. For instance, in fiscal year 2023-2024, Rémy Cointreau reported net sales of €1.32 billion, spread across numerous markets and customer segments, preventing any single entity from representing a dominant share of this revenue.

Customers in the premium and luxury spirits segment, like those who favor Rémy Cointreau's offerings, often display significant brand loyalty. This is particularly true for established names such as Rémy Martin and Cointreau, whose reputations are built on heritage and perceived quality.

This strong brand allegiance means consumers are less likely to switch to competitors based purely on price. For instance, a 2024 report indicated that over 60% of luxury spirits consumers prioritize brand reputation and taste over cost, underscoring the diminished price sensitivity driven by emotional connections to these premium brands.

Rémy Cointreau's commitment to the premium and luxury spirits market means its clientele is typically less swayed by price fluctuations. These consumers prioritize the brand's heritage, craftsmanship, and the overall sophisticated experience associated with products like Louis XIII Cognac or Cointreau liqueur.

This focus on quality and exclusivity significantly diminishes the bargaining power of customers. When customers are seeking prestige and a unique sensory journey, the price becomes a less critical factor in their decision-making process, thereby strengthening Rémy Cointreau's position.

High Switching Costs for Retailers/Distributors

For Rémy Cointreau, while individual consumers might easily switch between premium spirits, the company's direct customers – retailers and distributors – face more substantial hurdles. These intermediaries often invest heavily in promoting specific brands, securing prime shelf placement, and managing complex inventory systems. For example, a major European distributor might dedicate significant resources to marketing a particular Rémy Martin cognac expression, including in-store promotions and staff training.

The cost and risk associated with reconfiguring these established relationships and operational processes to accommodate a new supplier or brand can be considerable. This discourages frequent switching, thereby limiting the bargaining power of these crucial intermediaries. In 2024, the global beverage distribution market saw consolidation, meaning fewer, larger players can command more influence, but their existing investments in brands like Rémy Cointreau still tie them to the supplier.

- Retailer/Distributor Investments: Significant capital is tied up in marketing, inventory management, and relationship-building for established brands.

- Supply Chain Disruption Costs: Altering established logistics and supplier networks incurs financial penalties and operational inefficiencies.

- Risk of New Brand Introduction: Retailers and distributors face uncertainty regarding the sales performance and consumer acceptance of unfamiliar products.

- Reduced Bargaining Power: These high switching costs effectively diminish the leverage retailers and distributors have over Rémy Cointreau.

Influence of On-Trade Channels

The on-trade channel, encompassing bars, restaurants, and hotels, is crucial for shaping consumer tastes and driving sales for premium spirits like those from Rémy Cointreau. While individual outlets have minimal leverage, larger entities such as major restaurant groups or hotel chains can wield more influence due to their significant purchasing volumes.

However, the bargaining power of these on-trade customers is often tempered by the brand equity and desirability of Rémy Cointreau's portfolio. The prestige of featuring brands like Louis XIII or Cointreau in their establishments frequently gives Rémy Cointreau a stronger negotiating position.

- Brand Prestige: Rémy Cointreau's premium brands enhance the appeal of on-trade venues, reducing customer reliance on price concessions.

- Limited Concentration: While some groups are large, the overall on-trade sector remains fragmented, limiting the collective bargaining power of individual customers.

- Supplier Relationships: Rémy Cointreau cultivates strong relationships with key on-trade partners, often prioritizing brand placement and marketing support over aggressive price negotiations.

The bargaining power of customers for Rémy Cointreau is generally low due to the company's strong brand loyalty in the luxury spirits market and the high switching costs for distributors and retailers. Consumers are often driven by brand prestige and heritage rather than price, limiting their leverage. For example, in fiscal year 2023-2024, Rémy Cointreau's net sales reached €1.32 billion, distributed across a wide global customer base, preventing any single buyer from dictating terms.

Distributors and retailers invest significantly in marketing and stocking premium brands like Rémy Martin, creating inertia that discourages them from switching suppliers. This is further supported by data from 2024 indicating that over 60% of luxury spirits consumers prioritize brand reputation and taste, making price less of a deciding factor.

The on-trade channel, while important, also sees its bargaining power diminished by the desirability of Rémy Cointreau's premium portfolio, as featuring these brands enhances the appeal of establishments. This dynamic reinforces Rémy Cointreau's strong market position.

| Customer Segment | Bargaining Power Factor | Impact on Rémy Cointreau |

|---|---|---|

| Individual Consumers | Brand Loyalty & Prestige | Low; prioritize quality and experience over price. |

| Distributors & Retailers | Switching Costs & Brand Investment | Low to Moderate; significant investment in Rémy Cointreau brands limits leverage. |

| On-Trade (Bars, Restaurants, Hotels) | Brand Desirability & Venue Appeal | Low; premium brands enhance venue appeal, reducing reliance on price concessions. |

Preview the Actual Deliverable

Rémy Cointreau Porter's Five Forces Analysis

This preview showcases the exact Rémy Cointreau Porter's Five Forces Analysis you'll receive immediately after purchase, offering a comprehensive breakdown of competitive forces within the premium spirits industry. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors. This detailed analysis is fully formatted and ready for your immediate use, ensuring no surprises or placeholders.

Rivalry Among Competitors

The premium spirits sector, especially Cognac, sees fierce competition from established global brands like LVMH's Hennessy, Pernod Ricard's Martell, and Beam Suntory's Courvoisier. These companies, alongside Rémy Cointreau, battle for dominance through powerful brand legacies, vast distribution networks, and substantial marketing investments. For instance, in fiscal year 2023-2024, the global spirits market continued to see aggressive promotional activities from major players seeking to capture consumer attention and loyalty.

The spirits industry, particularly for premium and aged products like Cognac, is characterized by significant fixed costs. These include investments in distilleries, extensive aging warehouses, and the capital tied up in inventory that matures over years. For instance, Rémy Cointreau's aging process for its Cognac brands requires substantial, long-term inventory investment, impacting cash flow and operational flexibility.

These high fixed costs create a strong incentive for companies to maximize production and sales volumes to achieve economies of scale and cover their overheads. This dynamic fuels intense competition among players like Rémy Cointreau, as they strive to capture market share and ensure efficient utilization of their production capacity. The prolonged aging period further exacerbates this, as capital remains locked for extended durations, intensifying the pressure to perform in the market.

While the premium spirits market is undeniably competitive, Rémy Cointreau benefits from significant differentiation. Brands like Rémy Martin and Cointreau leverage unique heritage, distinct taste profiles, and compelling brand narratives to stand out. This strong brand equity is a key advantage, though rivals also boast formidable and well-recognized brands.

Competition in this segment often hinges on factors beyond price, such as sophisticated marketing campaigns, the perception of exclusivity, and overall brand prestige. For instance, in 2023, the global premium spirits market was valued at over $200 billion, highlighting the substantial investment in brand building and marketing by all major players.

Global Distribution Network Importance

Success in the premium spirits market hinges on robust global distribution networks. Competitors constantly battle for prime retail shelf space and cultivate strong ties with distributors internationally. Rémy Cointreau's established network is a significant asset, but rivals are actively investing in expanding their reach, escalating competition at the distribution level.

The intensity of this rivalry is underscored by the strategic importance of market access. For instance, in 2023, the global spirits market was valued at over $1.5 trillion, with distribution channels playing a critical role in capturing market share. Companies are pouring resources into securing better placement and more efficient logistics.

- Distribution Network Investment: Competitors are increasing their spending on logistics and sales forces to gain an edge.

- Retailer Relationships: Strong partnerships with key retailers are crucial for visibility and sales volume.

- Emerging Market Penetration: Expanding into new geographic territories requires significant investment in building distribution infrastructure.

- Brand Visibility: Effective distribution directly impacts how easily consumers can find and purchase premium spirits.

Strategic Acquisitions and Partnerships

Competitive rivalry at Rémy Cointreau is intensified by strategic acquisitions and partnerships. These moves are designed to solidify market standing, broaden product offerings, and enter new regions. For instance, in 2023, Pernod Ricard acquired a majority stake in a premium tequila brand, demonstrating the trend of consolidation.

While Rémy Cointreau focuses on its core brands, larger rivals can use their financial muscle for these strategic maneuvers. This creates ongoing pressure and keeps the competitive environment dynamic.

- Strategic Acquisitions: Competitors like LVMH and Diageo frequently engage in acquisitions to expand their spirits portfolios and market reach.

- Partnership Dynamics: Collaborative ventures, such as distribution agreements or joint marketing campaigns, are common tactics to enhance competitive positioning.

- Market Consolidation: The spirits industry has seen significant consolidation, with larger players acquiring smaller, niche brands to gain market share and diversify offerings.

The competitive landscape for Rémy Cointreau is intensely shaped by major global players like LVMH, Pernod Ricard, and Beam Suntory, who vie for market share through significant brand investments and extensive distribution. These rivals, much like Rémy Cointreau, are locked in a perpetual battle for consumer attention and loyalty, often employing aggressive marketing tactics. For example, in fiscal year 2023-2024, the premium spirits sector saw continued high levels of promotional activity across the board, underscoring the fierce rivalry.

The premium spirits market, particularly for Cognac, is characterized by substantial fixed costs, including distillery operations, warehousing, and long-term inventory aging. This necessitates high production volumes to achieve economies of scale, intensifying competition as companies like Rémy Cointreau strive to optimize capacity utilization. The capital tied up in aged inventory for years further amplifies the pressure to perform and capture market share.

While Rémy Cointreau leverages strong brand equity with names like Rémy Martin, its competitors also boast formidable and well-recognized brands, making differentiation a constant challenge. Success hinges on more than just product quality; it involves sophisticated marketing, the cultivation of exclusivity, and overall brand prestige. In 2023, the global premium spirits market, valued at over $200 billion, reflects the immense marketing spend by all major participants to build and maintain brand perception.

The battle for prime shelf space and strong international distribution networks is a critical battleground for Rémy Cointreau and its rivals. Competitors are actively expanding their global reach and investing heavily in logistics and sales forces to gain an advantage. In 2023, the global spirits market, valued at over $1.5 trillion, saw companies pouring resources into securing better placement and more efficient distribution channels to capture market share.

| Competitor | Key Brands | Estimated Market Share (Global Premium Spirits) | Recent Strategic Move (Illustrative) |

|---|---|---|---|

| LVMH | Hennessy | Significant share, particularly in Cognac | Continued investment in brand building and premium experiences. |

| Pernod Ricard | Martell, Absolut, Malibu | Broad portfolio, strong global presence | Acquisition of a majority stake in a premium tequila brand in 2023 to diversify. |

| Beam Suntory | Courvoisier, Jim Beam, Maker's Mark | Strong presence in Bourbon and Scotch | Focus on premiumization and expansion in emerging markets. |

SSubstitutes Threaten

The primary threat of substitutes for Rémy Cointreau's premium spirits, like Cognac and Cointreau, stems from the sheer breadth of other alcoholic beverages available. Consumers have a vast selection, ranging from diverse whiskies such as Scotch, Bourbon, and Irish, to rums, gins, vodkas, and an extensive world of wines.

While Cognac and Cointreau are positioned in distinct premium segments, consumers can readily opt for an alternative drink for social gatherings or personal enjoyment. This ease of substitution is amplified by the low switching costs for consumers, making it a persistent and significant challenge for Rémy Cointreau.

For instance, in 2024, the global spirits market continued to see strong performance from categories like whiskey, which holds a substantial market share, presenting a direct alternative to Cognac for many consumers seeking aged spirits. Similarly, the wine market, with its diverse price points and varietals, offers another readily accessible substitute.

The burgeoning trend of health and wellness is fueling a significant rise in sophisticated non-alcoholic beverage options. These include premium mocktails, artisanal sodas, and even alcohol-free spirits that mimic the complexity of traditional liquors.

While not a direct replacement for the sensory experience of enjoying Cognac, these alternatives can capture consumer spending and occupy occasions where spirits might have previously been the default choice. This growing segment presents an emerging, yet notable, threat to the broader spirits market.

For instance, the global non-alcoholic beverage market was valued at over $1 trillion in 2023 and is projected to continue robust growth, indicating a substantial shift in consumer preferences that could impact premium spirit sales.

Consumer preferences are always on the move, with tastes shifting between various spirit categories. For instance, if premium gin or tequila sees a significant rise in popularity, it could pull consumers away from established products like Cognac or liqueurs.

Rémy Cointreau faces a real substitution risk here. To stay competitive and counter these potential shifts in consumer tastes towards other alcoholic beverages, the company needs to consistently innovate and strategically market its brands.

For example, in 2024, the global spirits market saw continued growth in categories beyond traditional ones, with ready-to-drink (RTD) cocktails and non-alcoholic spirits gaining significant traction, representing a direct substitute threat for established spirits like those in Rémy Cointreau's portfolio.

Price-Performance of Other Premium Spirits

Consumers looking for a premium drinking experience often explore alternatives to Cognac, such as high-end Scotch whiskies or aged rums. These spirits can offer distinct flavor profiles and perceived value, directly competing with Rémy Cointreau's offerings. For example, a well-aged single malt Scotch might appeal to a consumer seeking complexity and tradition, presenting a viable substitute.

The price-performance ratio of these substitute premium spirits is a critical factor in consumer decision-making. If a premium Scotch is perceived to offer comparable or superior quality for a similar or lower price point, it can divert demand from Cognac. This dynamic is particularly relevant in markets where consumers are price-sensitive, even within the premium segment.

Rémy Cointreau faces competition not only from other Cognac houses but also from a broad spectrum of premium spirits. The availability and marketing of alternatives like high-quality gin, artisanal vodkas, and premium tequilas further broaden the competitive landscape.

- Premium Scotch Whisky Market: The global Scotch whisky market is projected to reach approximately $14.5 billion by 2027, indicating strong consumer demand for premium spirits.

- Aged Rum Market: The premium aged rum segment is also experiencing growth, with market forecasts suggesting continued expansion due to increasing consumer interest in complex flavor profiles.

- Consumer Preference Shifts: Surveys indicate that a significant portion of premium spirit consumers are open to exploring different categories based on occasion, price, and perceived quality.

Usage Occasions and Versatility

The versatility of substitute beverages presents a significant threat to Rémy Cointreau. While Cognac is often enjoyed as a post-dinner drink, spirits like vodka and gin are far more adaptable for a wider variety of cocktails, appealing to a broader consumer base and more consumption occasions. This versatility allows competitors to capture market share across different drinking experiences.

Rémy Cointreau is actively working to counter this by promoting cocktail applications for its Cointreau brand. However, the inherent nature of Cognac often positions it within more specific, traditional usage occasions. For example, in 2023, the global spirits market saw continued growth in ready-to-drink (RTD) cocktails, a category where vodka and gin are dominant players due to their mixability.

Consider the impact on market penetration. Brands with broader cocktail applications can attract consumers who might not traditionally seek out Cognac. This is particularly relevant as younger demographics often explore spirits through mixed drinks. The ease with which vodka or gin can be incorporated into popular cocktails, compared to the more nuanced appreciation of Cognac, gives these substitutes an edge in capturing everyday consumption moments.

- Versatility Advantage: Vodka and gin are more adaptable to a wider range of cocktails than Cognac, potentially capturing more consumption occasions.

- Market Share Capture: Competitors leveraging versatile spirits can attract consumers seeking diverse drinking experiences.

- Rémy Cointreau's Mitigation: The company promotes cocktail uses for Cointreau to broaden its appeal.

- Cognac's Niche Positioning: Cognac traditionally remains associated with more specific, often less frequent, drinking occasions.

The threat of substitutes for Rémy Cointreau's premium spirits is substantial, as consumers have a wide array of alcoholic and non-alcoholic beverages to choose from. While Cognac and Cointreau occupy premium niches, alternatives like Scotch whisky, aged rum, and even premium wines offer comparable experiences and can readily capture consumer spending. The growth of sophisticated non-alcoholic options further diversifies choices, presenting an emerging challenge.

In 2024, the global spirits market continued to see strong performance from whiskey, a direct substitute for Cognac, with its market share remaining significant. Similarly, the wine market offers diverse price points and varietals, acting as an accessible alternative. The non-alcoholic beverage market, valued at over $1 trillion in 2023, is also expanding, indicating a potential shift in consumer preferences away from traditional spirits.

| Substitute Category | Key Characteristics | Relevance to Rémy Cointreau |

| Premium Scotch Whisky | Aged, complex flavor profiles, strong tradition | Direct competitor for consumers seeking premium aged spirits, often with comparable pricing. |

| Aged Rum | Diverse origins, evolving premium segment, unique flavor profiles | Appeals to consumers exploring complex spirits, offering an alternative to Cognac's traditional appeal. |

| High-End Gin & Vodka | Versatile for cocktails, broad appeal, growing premiumization | Captures a wider range of consumption occasions due to mixability, potentially diverting consumers from spirits like Cognac. |

| Premium Non-Alcoholic Beverages | Health-conscious appeal, sophisticated options, mimicry of spirits | Addresses growing wellness trends, potentially reducing overall alcohol consumption occasions. |

Entrants Threaten

Entering the premium spirits market, especially for aged products like Cognac, requires immense capital. Think about the cost of building distilleries, maintaining extensive aging warehouses, and stocking inventory that needs years, even decades, to mature. This is a huge financial hurdle.

For instance, the lengthy aging process for Cognac, often 10 years or more for even entry-level expressions, means that a significant amount of money is locked up for a very long time before any revenue can be generated. This capital tie-up is one of the steepest barriers to entry in the entire beverage sector, making it incredibly difficult for newcomers to compete.

Established players like Rémy Cointreau leverage centuries of brand building, a rich heritage, and deep consumer trust. This creates a formidable barrier for new entrants. In 2024, the premium spirits market continues to value provenance and perceived quality, making it incredibly difficult for newcomers to replicate this established brand equity. Building comparable brand recognition and consumer loyalty requires substantial investment and time, often decades.

The threat of new entrants for Rémy Cointreau, specifically concerning its Cognac business, is significantly mitigated by the limited access to crucial raw materials and the unique terroir of the Cognac region. These elements are not easily replicable.

Cognac production is governed by strict appellation laws, which legally protect specific grape varietals and the geographical origin, known as terroir. This means new players cannot simply set up shop and produce authentic Cognac; they are bound by these regulations, making it a formidable barrier.

The scarcity and protected nature of these essential resources create an almost insurmountable hurdle for any new company wishing to enter the authentic Cognac market. This exclusivity inherently limits competition and protects Rémy Cointreau's established position.

Complex Global Distribution Channels

The complexity and cost of establishing a global distribution network for premium spirits present a significant barrier for new entrants. Building relationships with distributors, securing retail placement, and accessing on-trade venues worldwide demands substantial investment and time. Incumbents like Rémy Cointreau benefit from existing, well-established networks and economies of scale in logistics, making it difficult for newcomers to gain comparable market access.

New players face considerable hurdles in replicating the extensive reach and influence that established brands possess. For instance, in 2024, the global alcoholic beverage market is valued at hundreds of billions of dollars, with distribution being a critical component of market share. Gaining entry into established channels requires overcoming the entrenched relationships and logistical advantages held by companies with decades of experience.

- High Capital Investment: Securing distribution agreements and prime retail shelf space often necessitates significant upfront payments or volume commitments.

- Established Relationships: Incumbents have cultivated long-standing partnerships with key distributors and retailers, creating a closed ecosystem.

- Logistical Expertise: Managing a global supply chain, including warehousing, transportation, and compliance, requires specialized knowledge and infrastructure that new entrants may lack.

- Brand Recognition and Demand: Existing brands benefit from consumer awareness and loyalty, which distributors are more likely to support, further marginalizing new entrants.

Regulatory Hurdles and Marketing Restrictions

The spirits industry is a minefield of regulations, with licensing, production standards, and marketing rules differing wildly across the globe. This complex web creates significant barriers for newcomers, demanding substantial investment in time and resources to achieve compliance, particularly for those aspiring to international markets.

These compliance burdens hit smaller, newer companies harder than established players who have the infrastructure and expertise to manage them. For instance, in 2024, the average cost for a new craft distillery to obtain all necessary federal and state permits in the United States could range from $10,000 to $50,000, not including ongoing compliance fees.

- Licensing Complexity: Obtaining federal, state, and local licenses can be a lengthy and costly process, often taking over a year and requiring detailed business plans and financial projections.

- Marketing Restrictions: Many countries impose strict rules on alcohol advertising, including limitations on direct-to-consumer marketing, sponsorships, and content, impacting brand building efforts for new entrants.

- Production Standards: Adhering to specific production methods, ingredient sourcing, and labeling requirements, such as those for "cognac" or "scotch whisky," adds another layer of complexity and cost.

The threat of new entrants for Rémy Cointreau is considerably low due to the substantial capital required for production, aging, and global distribution. These high initial costs, coupled with stringent regulatory frameworks and the need for established brand equity, create significant barriers.

The protected appellation laws for Cognac, requiring specific grapes and a defined geographical origin, further limit new players. This exclusivity, combined with the long maturation periods for spirits like Cognac, ties up capital for years, deterring potential entrants.

In 2024, the premium spirits market continues to favor established brands with proven heritage and consumer trust. Replicating this brand loyalty and global distribution network demands immense investment and time, making direct competition extremely challenging for newcomers.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High costs for land, distilleries, aging warehouses, and inventory. | Significant financial hurdle, requiring substantial upfront investment. |

| Brand Equity & Heritage | Centuries of brand building and consumer trust. | Difficult for new entrants to replicate, requiring extensive marketing and time. |

| Appellation Laws & Terroir | Strict regulations on grape varietals and geographic origin for Cognac. | Limits authentic production to specific regions, preventing replication. |

| Distribution Networks | Established global relationships with distributors and retailers. | New entrants struggle to gain market access and shelf space. |

| Regulatory Compliance | Complex licensing, production, and marketing rules worldwide. | Demands significant investment in time and resources for compliance. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Rémy Cointreau is built upon a foundation of comprehensive data, including the company's annual reports, investor presentations, and SEC filings. We also incorporate insights from reputable industry research firms and market intelligence platforms to provide a robust understanding of the competitive landscape.