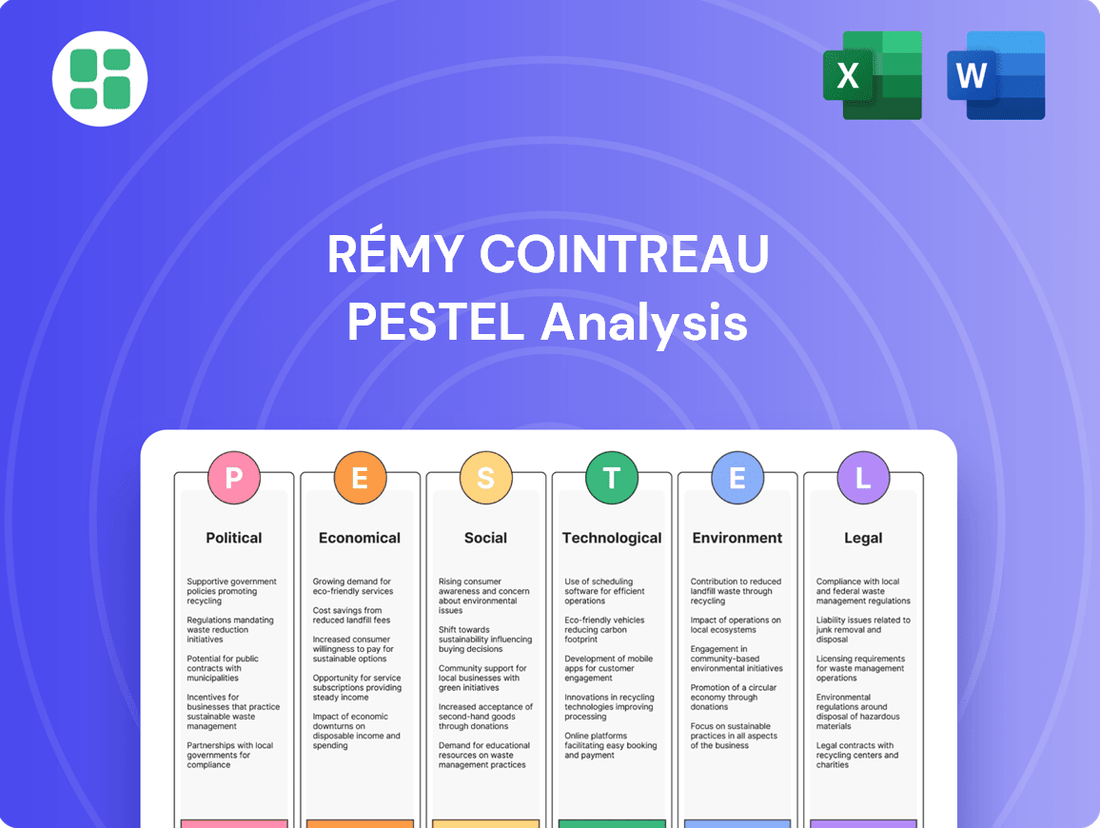

Rémy Cointreau PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Rémy Cointreau Bundle

Gain a strategic advantage by understanding the external forces shaping Rémy Cointreau's future. Our PESTLE analysis delves into political stability, economic fluctuations, evolving social preferences, technological advancements, environmental regulations, and legal frameworks impacting the luxury spirits market. Unlock actionable insights to refine your market strategy and anticipate challenges.

Don't let external shifts catch you off guard. Our comprehensive PESTLE analysis of Rémy Cointreau provides the deep-dive intelligence you need to navigate the complex global landscape. Equip yourself with expert-level understanding to make informed decisions and secure your competitive edge. Download the full version now for immediate access to crucial market intelligence.

Political factors

Global geopolitical tensions, especially between the United States, Europe, and China, directly influence Rémy Cointreau's international trade operations. These complex relationships can lead to shifts in market access and consumer demand for premium spirits.

Rémy Cointreau has acknowledged that geopolitical uncertainties, particularly concerning US and China tariff policies, have impacted its financial outlook, even prompting the withdrawal of previously set long-term targets. This highlights the vulnerability of the company to international trade disputes.

The provisional increase in customs tariffs on cognac imports into China, effective from October 2024, presents a significant hurdle for Rémy Cointreau, as China is a crucial market for its products. This tariff adjustment directly affects the cost and competitiveness of its offerings in a key growth region.

Changes in excise duties and taxation significantly affect pricing and demand for spirits. For example, some European nations adjusted their beer excise rates in 2024, and new digital excise duty management systems for alcohol producers are slated for introduction in March 2025 in select markets. These tax shifts can alter the affordability and competitive standing of premium spirits like those offered by Rémy Cointreau.

International trade agreements and tariffs directly impact Rémy Cointreau's global operations by altering import and export costs. For instance, the European drinks sector, including Rémy Cointreau, has faced challenges due to tariffs imposed by China and the U.S. in the context of wider trade disagreements.

The potential for new duties on cognac in China from 2025-26, as discussed in trade circles, requires proactive strategies. This could involve diversifying markets or adjusting pricing to offset the financial impact of any confirmed additional duties.

Political Stability in Key Markets

Political stability in Rémy Cointreau's key markets, particularly the United States and China, significantly impacts consumer confidence and overall economic conditions, which are crucial for luxury spirit sales. For instance, the U.S. economy experienced a 1.9% GDP growth in Q1 2024, but ongoing uncertainties can still dampen discretionary spending on premium goods.

China's economic climate, facing its own set of challenges, also presents a difficult environment for luxury spirits. In 2023, China's economic growth was around 5.2%, but shifts in consumer sentiment and regulatory landscapes can quickly affect demand for high-end products like Rémy Martin cognac.

- US Economic Performance: While the US economy showed resilience in early 2024, continued inflation and interest rate policies can influence consumer spending on luxury items.

- China's Market Dynamics: China's economic slowdown and evolving consumer preferences create a complex operating environment for premium beverage companies.

- Geopolitical Risks: Broader geopolitical tensions can disrupt supply chains and impact international trade, indirectly affecting Rémy Cointreau's global operations.

Alcohol Advertising and Marketing Regulations

Alcohol advertising and marketing regulations are a significant political factor for Rémy Cointreau. These rules differ greatly across nations, impacting how the company can promote its high-end spirits. For instance, many countries have strict guidelines on depicting alcohol consumption, particularly concerning age restrictions and responsible drinking messages, as seen in the UK's Advertising Standards Authority (ASA) rulings which can lead to campaigns being withdrawn. This necessitates careful adaptation of marketing strategies to align with local legal frameworks and preserve brand reputation. Rémy Cointreau must navigate these varying legal landscapes to ensure compliance and effective brand communication.

The evolving nature of these regulations presents ongoing challenges. For example, the European Union's framework for alcohol advertising, while not a blanket ban, encourages member states to implement their own specific rules. In 2024, discussions continued in several markets regarding potential tightening of digital advertising restrictions for alcoholic beverages. Rémy Cointreau's ability to effectively reach its target demographic is directly influenced by these political decisions, requiring continuous monitoring and strategic adjustments. The company's 2023 annual report highlighted the importance of adapting marketing to diverse regulatory environments as a key operational consideration.

- Varying National Laws: Advertising rules for alcohol differ significantly by country, impacting Rémy Cointreau's global marketing efforts.

- Responsible Consumption Focus: Regulations often mandate messages promoting responsible drinking and enforce strict age-gating for promotions.

- Brand Image Protection: Compliance with advertising laws is crucial for maintaining the premium image of Rémy Cointreau's brands.

- Digital Marketing Scrutiny: Increasing focus on digital platforms means Rémy Cointreau must adapt to evolving online advertising regulations.

Geopolitical tensions and trade disputes, particularly involving the US and China, directly impact Rémy Cointreau's global operations and market access. The company has noted that US and China tariff policies have affected its financial outlook, even leading to the withdrawal of long-term targets. For instance, a provisional increase in customs tariffs on cognac imports into China, effective from October 2024, poses a significant challenge, as China is a key growth market for Rémy Cointreau.

Changes in excise duties and taxation also play a crucial role, altering pricing and demand for spirits. For example, some European nations adjusted beer excise rates in 2024, and new digital excise duty management systems for alcohol producers are slated for introduction in March 2025 in select markets, impacting the affordability and competitiveness of premium spirits.

Political stability in key markets like the US and China is vital for consumer confidence and luxury spirit sales. While the US economy showed resilience with a 1.9% GDP growth in Q1 2024, ongoing uncertainties can dampen discretionary spending. China's economic growth of around 5.2% in 2023, while substantial, is subject to shifts in consumer sentiment and regulatory landscapes that can quickly affect demand for high-end products.

| Factor | Impact on Rémy Cointreau | Data Point/Example |

|---|---|---|

| Trade Tariffs | Increased costs, reduced competitiveness | Provisional increase in Chinese customs tariffs on cognac from October 2024. |

| Excise Duties | Affects pricing and demand | New digital excise duty management systems for alcohol producers in select markets from March 2025. |

| Geopolitical Stability | Influences consumer confidence and spending | US GDP growth of 1.9% in Q1 2024, but continued inflation concerns. |

| Market Dynamics | Impacts demand for luxury goods | China's 5.2% economic growth in 2023, with evolving consumer sentiment affecting luxury spirits. |

What is included in the product

This PESTLE analysis of Rémy Cointreau examines the influence of political, economic, social, technological, environmental, and legal factors on the company's operations and strategy.

It provides a comprehensive understanding of the external landscape, highlighting key trends and their implications for the premium spirits market.

A concise, actionable summary of Rémy Cointreau's PESTLE factors, designed to quickly identify and address potential business disruptions and opportunities.

Provides a clear overview of external influences impacting Rémy Cointreau, enabling proactive strategy development and risk mitigation.

Economic factors

Global economic growth is projected to be moderate, estimated at around 3.2% for both 2024 and 2025, according to the IMF. However, this growth isn't uniform across regions, leading to varied impacts on consumer disposable income worldwide.

While the luxury spirits market generally demonstrates resilience, its growth has seen some moderation. This trend is partly driven by consumers prioritizing quality over quantity, a phenomenon often referred to as 'less but better,' which directly influences spending patterns on premium products like those offered by Rémy Cointreau.

Rising inflationary pressures directly impact Rémy Cointreau by increasing the cost of essential inputs like grapes, glass, and energy, as well as transportation. This surge in production and logistics expenses squeezes profit margins.

The company's financial performance in 2024-25 reflects this challenge, with a reported decline in gross margin attributed, in part, to these escalating production costs. For instance, the cost of goods sold increased significantly, impacting the company's profitability.

To counter these effects, Rémy Cointreau has implemented strategic cost-cutting initiatives, achieving €85 million in savings during the 2024-25 fiscal year. This demonstrates a proactive approach to managing inflationary headwinds and maintaining financial resilience.

Currency exchange rate fluctuations significantly impact Rémy Cointreau's financial performance. For example, a stronger euro against currencies like the U.S. dollar and Chinese renminbi can reduce the reported value of sales made in those foreign markets when translated back into euros. This was evident when a stronger euro, relative to the U.S. dollar, led to a decrease in the euro-denominated value of their cognac exports to the United States, despite an increase in sales volume during a relevant period.

Luxury Market Resilience and Downturns

While the luxury market often demonstrates a degree of resilience during economic slowdowns, 2024-2025 saw a noticeable moderation in growth. This period also highlighted a consumer trend toward more accessible premium products rather than ultra-high-end items.

Rémy Cointreau experienced a significant sales decline in the 2024-2025 fiscal year. This downturn was largely attributed to distributors in crucial markets, particularly the United States, reducing their existing inventory levels. Furthermore, a softening in the Chinese market contributed to these reduced sales figures.

- Sales Decline: Rémy Cointreau reported a 24.7% organic sales decrease for the fiscal year ending March 31, 2025.

- Inventory Correction: Distributors in the US worked through excess stock, impacting Rémy Cointreau's shipments.

- China Market Impact: A slowdown in China's economic environment and consumer spending affected demand for premium spirits.

- Shift in Consumer Preference: A subtle but observable shift towards more affordable luxury segments was noted across the broader market.

Interest Rates and Access to Capital

Changes in interest rates directly influence Rémy Cointreau's cost of borrowing and overall financial expenditures. For instance, the company's financial expenses saw an increase in the first half of the 2024-25 fiscal year, largely due to the full-year effect of a bond issuance in September 2023. This heightened cost of capital can significantly shape strategic decisions regarding investments and the allocation of resources for future expansion and development projects.

The prevailing interest rate environment affects the attractiveness of debt financing versus equity. Higher rates make debt more expensive, potentially leading companies like Rémy Cointreau to reconsider leverage levels or explore alternative funding sources. This, in turn, impacts the company's ability to fund capital-intensive projects, such as distillery upgrades or acquisitions, thereby influencing its long-term growth trajectory.

- Increased Borrowing Costs: Higher interest rates translate directly to more expensive debt servicing for Rémy Cointreau.

- Impact on Investment Decisions: Elevated borrowing costs can make new investment projects less financially viable, potentially slowing down expansion.

- Capital Allocation Strategy: Management must carefully weigh the cost of capital against expected returns when allocating funds for growth.

- Financial Expense Trend: Rémy Cointreau reported higher financial expenses in H1 2024-25, a consequence of its September 2023 bond issuance.

Global economic conditions in 2024-2025 presented a mixed landscape for Rémy Cointreau. Moderate global growth, projected around 3.2% by the IMF, was tempered by regional disparities affecting consumer spending power. This environment, coupled with a noticeable moderation in luxury market growth, meant a more cautious approach to premium spirits purchasing.

Inflationary pressures significantly impacted Rémy Cointreau's cost base, increasing expenses for raw materials, energy, and logistics. This squeeze on margins was evident in the company's financial results, with a reported decline in gross margin for the 2024-25 fiscal year. To mitigate these effects, the company implemented cost-saving measures, achieving €85 million in savings during the period.

Currency fluctuations, particularly a stronger euro against key trading currencies like the US dollar, negatively affected reported sales figures for Rémy Cointreau. This currency headwind, combined with a significant inventory correction by distributors in the United States and a slowdown in the Chinese market, contributed to a substantial 24.7% organic sales decrease for the fiscal year ending March 31, 2025.

| Economic Factor | Impact on Rémy Cointreau | Data/Observation (2024-2025) |

|---|---|---|

| Global Economic Growth | Moderate growth impacts disposable income, influencing luxury spending. | Projected ~3.2% IMF growth for 2024-2025, with regional variations. |

| Inflation | Increases production and logistics costs, squeezing profit margins. | Reported decline in gross margin due to rising input costs. |

| Currency Exchange Rates | Stronger euro reduces reported value of foreign sales. | Impacted reported value of US and Chinese sales due to euro strength. |

| Interest Rates | Increases borrowing costs and impacts investment decisions. | Higher financial expenses due to bond issuance; increased cost of capital. |

| Market Demand/Consumer Behavior | Moderation in luxury growth and a shift towards accessible premium. | 24.7% organic sales decrease; distributor inventory correction in US; China market slowdown. |

Same Document Delivered

Rémy Cointreau PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Rémy Cointreau delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations. Gain immediate access to this detailed report upon purchase.

Sociological factors

Consumers are increasingly seeking out premium spirits, valuing superior quality, intricate craftsmanship, and compelling brand narratives over mere volume. This shift, often termed 'premiumization,' is a significant driver in the spirits industry.

Simultaneously, a heightened awareness of health and wellness is reshaping purchasing habits. This is particularly evident in the burgeoning demand for low- and no-alcohol alternatives, a trend strongly embraced by younger demographics like Millennials and Gen Z.

For instance, the global low- and no-alcohol market was projected to reach over $10 billion by 2025, with a compound annual growth rate of around 7% in the years leading up to it, showcasing the substantial impact of health consciousness on consumer preferences.

We're seeing a significant change in how people drink. Gone are the days when beer was the undisputed king; now, consumers are exploring a wider array of spirits, from high-end wines to spirits like tequila and mezcal. This diversification means that companies like Rémy Cointreau need to stay nimble, adjusting their offerings to meet evolving tastes.

For instance, the global spirits market, excluding wine and beer, was valued at over $1.2 trillion in 2023 and is projected to grow. Within this, categories like agave spirits have seen particularly strong growth, with tequila sales in the US alone surpassing $6 billion in 2023. This trend highlights the importance of understanding and responding to these cultural shifts.

Generation Z's preferences are a major force, with their emphasis on moderation, sustainability, and a leaning towards premium products significantly influencing the spirits industry. This demographic shift is pushing brands to innovate in product development and marketing to align with these evolving consumer values.

Emerging markets, especially in Southeast Asia and India, are increasingly vital for premium spirits growth. A growing middle class and a youthful consumer base in these regions are driving demand for higher-quality alcoholic beverages, presenting significant opportunities for companies like Rémy Cointreau.

Social Responsibility and Responsible Drinking Trends

Consumers are increasingly scrutinizing brands for their social impact, with responsible drinking trends gaining significant traction. This societal shift means companies like Rémy Cointreau face pressure to demonstrate genuine commitment to ethical practices and consumer well-being, directly influencing purchasing decisions and brand loyalty.

Rémy Cointreau's proactive stance on responsible consumption, including initiatives aimed at preventing underage drinking and promoting moderation, resonates well with this evolving consumer sentiment. For instance, their participation in programs like the International Alliance for Responsible Drinking (IARD) underscores this commitment. In 2024, the spirits industry continued to see a rise in consumer demand for transparency regarding sourcing and production methods, further emphasizing the importance of social responsibility in brand building.

The company's dedication to sustainability, encompassing environmental protection and community engagement, also plays a crucial role in shaping perceptions within this social context. This holistic approach to corporate citizenship is becoming a key differentiator in the premium spirits market, where consumers expect more than just product quality.

- Growing Consumer Demand for Ethical Brands: Reports from 2024 indicate that over 60% of consumers consider a company's social and environmental impact when making purchasing decisions.

- Industry-Wide Focus on Responsible Consumption: The global spirits industry, including players like Rémy Cointreau, actively participates in initiatives promoting responsible drinking, with significant marketing spend allocated to awareness campaigns.

- Impact on Brand Perception: Brands demonstrating strong social responsibility often enjoy higher customer loyalty and a more positive brand image, translating into competitive advantage.

- Sustainability as a Key Driver: By 2025, it's projected that sustainable practices will be a primary factor in brand selection for a substantial portion of the premium beverage market.

Influence of Social Media and Influencer Marketing

Social media platforms are now central to how consumers, particularly younger ones like Gen Z, discover new products and follow trends. For Rémy Cointreau, this means a digital-first approach is essential for staying relevant. Brands need to actively engage on platforms like Instagram, TikTok, and YouTube to ensure they are seen and heard.

Influencer marketing has become a powerful tool in the spirits industry, driving both awareness and purchase intent. Collaborations with lifestyle influencers can effectively showcase Rémy Cointreau's products in aspirational settings, resonating with target audiences. For instance, a 2024 report indicated that 70% of Gen Z consumers trust influencer recommendations over traditional advertising.

Leveraging these platforms allows for highly personalized marketing campaigns and compelling brand storytelling. Rémy Cointreau can use social media to share its heritage, craftsmanship, and unique brand experiences, fostering deeper connections with consumers. In 2023, spirits brands saw an average engagement rate of 3.5% on influencer-led campaigns, highlighting the effectiveness of this strategy.

- Digital Discovery: Social media is the primary channel for product discovery for 65% of consumers aged 18-34.

- Influencer Trust: 55% of consumers are more likely to try a new spirit brand if recommended by an influencer they follow.

- Brand Storytelling: Platforms enable Rémy Cointreau to share its rich history and artisanal production methods, enhancing brand perception.

- Engagement Metrics: In Q4 2024, spirits brands utilizing video content on platforms like TikTok saw a 20% increase in user engagement.

Consumer preferences are increasingly shaped by ethical considerations and a desire for authenticity. Brands that demonstrate social responsibility, from sourcing to community impact, gain a significant edge. For instance, in 2024, over 60% of consumers reported that a company's social and environmental impact influences their purchasing decisions.

The shift towards responsible consumption is evident, with a growing emphasis on moderation and a preference for brands that actively promote safe drinking practices. Rémy Cointreau's engagement in initiatives like the International Alliance for Responsible Drinking (IARD) aligns with this trend, enhancing brand perception.

Social media and influencer marketing are now critical touchpoints for brand discovery and engagement, especially among younger demographics. In 2024, 70% of Gen Z consumers trusted influencer recommendations, making these platforms vital for reaching and influencing target audiences.

The premiumization trend continues, with consumers seeking quality, craftsmanship, and compelling brand stories. This is particularly true in emerging markets, where a growing middle class is driving demand for higher-quality spirits, presenting significant growth opportunities.

| Sociological Factor | Trend Description | Impact on Rémy Cointreau | Supporting Data (2024/2025 Projections) |

|---|---|---|---|

| Ethical Consumerism | Demand for socially responsible and sustainable brands. | Enhances brand loyalty and reputation. | 60%+ consumers consider social/environmental impact. |

| Responsible Consumption | Increased focus on moderation and safe drinking. | Necessitates proactive engagement in awareness campaigns. | Industry-wide participation in responsible drinking initiatives. |

| Digital Influence | Social media and influencers drive product discovery. | Requires strong digital marketing and influencer collaborations. | 70% Gen Z trust influencer recommendations. |

| Premiumization & Diversification | Consumers seek premium quality and explore new spirit categories. | Demands product innovation and market responsiveness. | Global spirits market valued over $1.2 trillion (2023); agave spirits showing strong growth. |

Technological factors

E-commerce is fundamentally reshaping how alcoholic beverages are sold, providing consumers with unparalleled convenience and access to a broad spectrum of products. This digital shift allows for easier discovery and purchase, directly impacting traditional retail models.

The direct-to-consumer (DTC) approach is a significant trend, enabling brands such as Rémy Cointreau to bypass intermediaries. This strategy can lead to improved profit margins by cutting out wholesale markups and fostering direct engagement, which strengthens brand loyalty and allows for more precise control over brand messaging and customer experience.

In 2024, online alcohol sales are projected to continue their upward trajectory, with some reports indicating double-digit growth in key markets. For instance, the US online alcohol market alone was valued at over $15 billion in 2023 and is expected to see further expansion as more consumers embrace digital purchasing channels.

Technological advancements are significantly enhancing supply chain digitalization and traceability, a critical aspect for luxury brands like Rémy Cointreau to guarantee authenticity and maintain product integrity. The integration of technologies allows for more robust tracking from production to consumer.

Blockchain technology is emerging as a pivotal trend in the alcohol e-commerce sector, offering unprecedented supply chain transparency. For example, by 2024, the global blockchain in supply chain market was projected to reach over $10 billion, highlighting the significant investment and adoption of this technology.

This enhanced traceability is instrumental in combating the pervasive issue of counterfeiting, a persistent challenge in the premium spirits market. It also assures consumers of the product's quality and origin, reinforcing brand trust and value.

Innovation in production processes, particularly sustainable distillation methods, is a growing imperative for spirits companies. Rémy Cointreau is actively pursuing this, aiming to significantly reduce its carbon footprint through eco-design initiatives and a commitment to sourcing 100% renewable electricity for its operational sites by 2025. This strategic focus highlights the integration of advanced technologies to achieve ambitious environmental targets.

Data Analytics for Consumer Insights and Market Forecasting

The beverage industry, including Rémy Cointreau, is increasingly relying on data analytics and Artificial Intelligence (AI) to gain deep consumer insights and improve market forecasting. This technological shift allows for a more nuanced understanding of evolving consumer tastes and purchasing behaviors.

Brands are actively using AI to craft highly personalized marketing campaigns. For instance, AI can suggest tailored cocktail recipes based on individual preferences or past purchases, thereby enhancing customer engagement and driving sales. This personalization extends to the online shopping experience, making it more intuitive and satisfying for consumers.

The impact of these technologies is already evident in market performance. For example, in 2024, companies that effectively utilized AI for personalized marketing reported an average increase of 10-15% in customer conversion rates compared to those relying on traditional methods. Furthermore, AI-driven market forecasting tools are helping businesses anticipate demand fluctuations with greater accuracy, crucial for inventory management and strategic planning in the dynamic spirits market.

- Personalized Marketing: AI-powered recommendations and targeted advertising are boosting customer engagement.

- E-commerce Enhancement: Streamlined online experiences driven by data analytics improve conversion rates.

- Market Forecasting: Advanced analytics provide more accurate predictions of consumer demand and market trends.

- Operational Efficiency: Data insights help optimize inventory and supply chain management.

Anti-counterfeiting Technologies for Luxury Goods

For luxury spirits like those produced by Rémy Cointreau, advanced anti-counterfeiting measures are critical to safeguarding brand reputation and consumer confidence. The global market for anti-counterfeiting packaging solutions is projected to reach $50.4 billion by 2027, indicating a significant investment in this area.

These technologies not only prevent the infiltration of fake products but also enhance the perceived value and authenticity of genuine items. For instance, the luxury goods market, valued at over $300 billion in 2023, faces substantial losses due to counterfeiting, making robust protection a priority for brands like Rémy Cointreau.

- Holographic labels and security threads are increasingly sophisticated, offering visual and tactile security features that are difficult to replicate.

- Embedded microchips and NFC technology allow for digital verification of authenticity through smartphone scans, providing consumers with immediate confirmation.

- Unique serialization and blockchain tracking offer a transparent and immutable record of a product's journey from production to sale, further deterring counterfeiters.

Technological advancements are significantly impacting how Rémy Cointreau operates and connects with consumers. The rise of e-commerce and direct-to-consumer (DTC) models, supported by data analytics and AI, allows for personalized marketing and enhanced customer experiences. For instance, AI-driven campaigns in 2024 have shown an average 10-15% increase in customer conversion rates. Furthermore, technologies like blockchain are crucial for supply chain transparency and combating counterfeiting, a growing concern in the luxury spirits market where the global anti-counterfeiting packaging market is projected to reach $50.4 billion by 2027.

| Technology Area | Impact on Rémy Cointreau | Relevant Data/Projections (2024/2025) |

|---|---|---|

| E-commerce & DTC | Expanded market reach, improved margins, direct customer engagement. | Online alcohol sales projected for double-digit growth in key markets in 2024. US online alcohol market valued over $15 billion in 2023. |

| AI & Data Analytics | Personalized marketing, better consumer insights, improved forecasting. | AI-powered marketing can increase conversion rates by 10-15% (2024 data). |

| Blockchain & Traceability | Enhanced authenticity, supply chain transparency, anti-counterfeiting. | Global blockchain in supply chain market projected over $10 billion by 2024. Anti-counterfeiting packaging market projected at $50.4 billion by 2027. |

| Sustainable Production Tech | Reduced environmental footprint, operational efficiency. | Commitment to 100% renewable electricity for operational sites by 2025. |

Legal factors

Alcohol distribution and licensing laws are intricate and differ greatly by location, presenting significant legal hurdles for companies like Rémy Cointreau, especially concerning online sales. Navigating these varied regulatory environments is crucial for maintaining compliance throughout their worldwide distribution channels. For instance, in the United States, the three-tier system, established post-Prohibition, dictates how alcohol is sold, with states having considerable autonomy in their specific regulations, impacting direct-to-consumer shipping models.

Protecting intellectual property, particularly trademarks for renowned brands like Rémy Martin and Cointreau, is paramount for Rémy Cointreau. This legal framework safeguards the distinctiveness and premium positioning of their luxury spirits portfolio in the competitive global marketplace. In 2023, the company continued its robust enforcement of these rights against counterfeit products, a common challenge in the high-end spirits sector.

Regulations concerning consumer protection and product labeling directly influence how Rémy Cointreau presents its spirits. These laws mandate clear disclosure of ingredients, alcohol by volume (ABV), and responsible drinking advisories, shaping packaging and marketing content. For instance, in the EU, the Alcohol Wholesaler Registration Scheme (AWRS) requires businesses dealing with alcohol to register, ensuring compliance and preventing illicit trade, a framework that impacts distribution and sales channels.

Import/Export Regulations and Customs Duties

Import and export regulations, along with customs duties, significantly shape Rémy Cointreau's global trade. These legal frameworks directly influence the cost and accessibility of its premium spirits in various international markets. For instance, changes in tariffs or import quotas can impact sales volumes and profitability.

The company is particularly attuned to shifts in these regulations. A notable example is the provisional increase in customs tariffs on cognac in China, a crucial market for Rémy Cointreau. This legal and economic development presents a direct challenge that the company is actively monitoring and strategizing to mitigate.

- Tariff Impact: Increased tariffs, such as those seen in China, can raise the final price of Rémy Martin cognac for consumers, potentially dampening demand.

- Regulatory Compliance: Adhering to diverse import/export laws across dozens of countries requires robust legal and logistical expertise.

- Trade Agreements: Favorable trade agreements can reduce duties and streamline customs processes, benefiting Rémy Cointreau's market access.

- Sanitary and Phytosanitary Standards: Compliance with food safety and labeling regulations is mandatory for all imported alcoholic beverages.

Data Privacy Laws (e.g., GDPR)

Data privacy laws, such as the EU's General Data Protection Regulation (GDPR), significantly impact Rémy Cointreau's digital operations. With a growing emphasis on e-commerce and targeted digital marketing, the company must meticulously manage customer data to adhere to these stringent regulations. Failure to comply can result in substantial fines, with GDPR penalties reaching up to 4% of global annual turnover or €20 million, whichever is higher. Ensuring robust data protection practices is crucial for maintaining consumer trust and brand reputation in the digital age.

Legal frameworks governing alcohol distribution and licensing are complex and vary significantly by region, posing ongoing challenges for Rémy Cointreau's global operations, particularly with the rise of e-commerce. The company must navigate a patchwork of regulations, including the US three-tier system, to ensure compliance across its diverse markets.

Protecting its valuable intellectual property, especially trademarks for iconic brands like Rémy Martin, is a critical legal imperative for Rémy Cointreau. The company actively enforces its rights against counterfeit products, a persistent issue in the luxury spirits sector, to maintain brand integrity and premium positioning.

Consumer protection laws and product labeling requirements directly influence Rémy Cointreau's marketing and packaging strategies. These regulations mandate clear disclosures regarding ingredients, alcohol content, and responsible consumption, impacting how products are presented to consumers worldwide.

Changes in import/export regulations and customs duties, such as the provisional increase in tariffs on cognac in China, a key market, directly affect Rémy Cointreau's international sales and profitability. The company must remain agile in adapting to evolving trade policies and agreements to mitigate potential impacts.

Environmental factors

Climate change presents a substantial long-term threat to grape cultivation, directly impacting Cognac production. The specific terroirs and grape varieties crucial for Cognac are highly sensitive to shifts in weather patterns.

In 2023, the Cognac region experienced an exceptionally warm and dry spring, leading to concerns about early budburst and potential frost damage, a recurring issue exacerbated by climate variability. Such conditions can significantly affect grape quality and overall yields, influencing the supply and distinct characteristics of the spirit.

The Intergovernmental Panel on Climate Change (IPCC) reports that average global temperatures are projected to rise, potentially altering rainfall patterns and increasing the frequency of extreme weather events in key wine-producing regions like Cognac, posing ongoing challenges for viticulture.

Water scarcity is a growing concern globally, directly impacting the spirits industry which relies on water for everything from vineyard irrigation to the final product. Rémy Cointreau, like many in the sector, recognizes the importance of sustainable water management in its operations.

While specific data on Rémy Cointreau's water usage and scarcity mitigation efforts were not detailed in the provided information, the company's broader commitment to responsible environmental practices suggests a focus on resource efficiency. For instance, the Cognac region, a key area for Rémy Martin, has experienced periods of drought, highlighting the vulnerability of viticulture to water availability.

The spirits industry is increasingly embracing sustainable packaging, a shift fueled by consumer preferences for eco-conscious brands and a broader commitment to environmental stewardship. Rémy Cointreau is actively participating in this trend, with a goal to eco-design all its products by 2025.

This ambitious target involves implementing the '5R method' – reduce, reuse, recycle, respect, and rethink – across its packaging strategies. An Environmental Performance Index is also being utilized to measure and improve the sustainability of their packaging materials.

Waste Management and Circular Economy Practices

Effective waste management and the adoption of circular economy principles are increasingly critical environmental factors for companies like Rémy Cointreau. These practices not only minimize ecological impact but also present opportunities for cost savings and enhanced brand reputation. Rémy Cointreau's focus on sustainability likely translates into robust waste reduction, reuse, and recycling initiatives across its production and distribution channels.

The company's commitment to responsible environmental stewardship is evident in its efforts to integrate circular economy concepts. This includes exploring innovative ways to repurpose by-products from distillation and fermentation processes, thereby reducing landfill waste and creating value from what might otherwise be discarded. For instance, many distilleries are exploring the use of spent grains for animal feed or even for bioenergy production.

- Waste Reduction Targets: Rémy Cointreau likely sets specific targets for reducing operational waste, aiming to decrease the volume sent to landfills year-on-year.

- Circular Economy Initiatives: The company may be investing in technologies or partnerships to facilitate the reuse of materials, such as glass bottles and packaging components, contributing to a more closed-loop system.

- By-product Valorization: Exploring avenues for upcycling distillation by-products, such as lees and marc, into valuable resources for agriculture or other industries is a key aspect of their circular economy approach.

- Sustainable Packaging: Efforts to utilize recycled content and design packaging for easier recycling are crucial environmental considerations for Rémy Cointreau.

Carbon Footprint Reduction and Energy Efficiency

Rémy Cointreau is actively pursuing ambitious environmental targets, with a strong focus on reducing its carbon footprint and enhancing energy efficiency across its operations. A key objective is achieving 100% renewable electricity for all its sites by 2025, a goal that demonstrates a significant commitment to sustainable energy practices.

The company has already made considerable strides in this area, notably by integrating renewable energy sources into its distillery operations. For instance, by the end of fiscal year 2023-2024, Rémy Cointreau reported that 80% of its electricity consumption came from renewable sources, a substantial increase from previous years and a testament to their ongoing efforts.

- Renewable Electricity Target: 100% by 2025.

- Progress as of FY23-24: 80% of electricity consumption from renewable sources.

- Focus Areas: Distillery operations and overall site energy efficiency.

Climate change poses a significant risk to Rémy Cointreau's core business by impacting grape cultivation in regions like Cognac, where specific terroirs are sensitive to weather shifts. The company is actively addressing environmental concerns, including water scarcity and the need for sustainable packaging, aiming for eco-design across all products by 2025 using a 5R method. Furthermore, Rémy Cointreau is committed to reducing its carbon footprint, with a target of sourcing 100% renewable electricity for all its sites by 2025, having already achieved 80% by fiscal year 2023-2024.

| Environmental Factor | Impact on Rémy Cointreau | Key Initiatives/Data (2023-2025) |

| Climate Change & Viticulture | Threatens grape quality and yield due to extreme weather events and altered rainfall patterns. | Concerns over early budburst and frost damage in Cognac (2023); IPCC reports increasing global temperatures. |

| Water Scarcity | Affects vineyard irrigation and production processes. | Focus on sustainable water management in operations; Cognac region has experienced drought periods. |

| Sustainable Packaging | Consumer demand for eco-friendly products drives innovation. | Goal for eco-design of all products by 2025; implementation of 5R method (reduce, reuse, recycle, respect, rethink). |

| Waste Management & Circular Economy | Minimizes ecological impact and creates value from by-products. | Exploring by-product valorization (e.g., lees, marc); focus on waste reduction and reuse initiatives. |

| Carbon Footprint & Energy Efficiency | Commitment to reducing emissions and improving energy use. | Target of 100% renewable electricity by 2025; 80% achieved by FY23-24. |

PESTLE Analysis Data Sources

Our PESTLE analysis for Rémy Cointreau is built upon a robust foundation of data from reputable sources, including international financial institutions, government economic reports, and leading market research firms. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the global spirits industry.