Rémy Cointreau Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Rémy Cointreau Bundle

Curious about how Rémy Cointreau navigates the competitive spirits market? This glimpse into their BCG Matrix reveals which brands are poised for growth and which are generating steady returns. To truly understand their strategic positioning and unlock actionable insights for your own business, dive deeper.

Purchase the full Rémy Cointreau BCG Matrix report to gain a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks. Equip yourself with the data-backed recommendations and strategic clarity needed to make informed investment and product decisions.

Stars

Bruichladdich, an Islay single malt Scotch whisky, is demonstrating significant momentum, especially in markets like Japan, positioning it as a potential star within Rémy Cointreau's diverse offerings. The brand's commitment to showcasing its unique terroirs and its distinctive unpeated whiskies resonates with an expanding base of discerning whisky enthusiasts.

This strong regional performance, particularly in the burgeoning luxury whisky segment, suggests Bruichladdich is effectively capturing market share. For example, Rémy Cointreau's fiscal year 2023-2024 results highlighted the robust growth of its spirits division, with single malts playing a key role, and Bruichladdich is a significant contributor to this trend.

The Botanist Gin, a key player in Rémy Cointreau's Liqueurs & Spirits portfolio, is poised to benefit from the ongoing surge in demand for premium and craft spirits. Its unique distillation process and origin on the Isle of Islay solidify its reputation for exceptional quality, appealing to consumers seeking authentic and artisanal gin experiences.

While precise 2024-2025 market share figures for The Botanist are not publicly disclosed, the broader premium spirits sector continues its upward trajectory. In 2023, the global gin market was valued at approximately $17.2 billion, with projections indicating continued growth, suggesting The Botanist is well-positioned to capture a larger share within this expanding market.

Telmont Champagne, acquired by Rémy Cointreau in 2020, represents a strategic move into the burgeoning sustainable luxury segment. This aligns with the broader industry trend of premiumization, where consumers are increasingly willing to pay more for ethically produced and high-quality products. The Champagne market itself is mature, but Telmont's commitment to organic viticulture and environmental stewardship, including a goal to be 100% organic by 2025, differentiates it significantly.

Within the BCG Matrix, Telmont is positioned as a potential Star for Rémy Cointreau. While its current market share in the vast Champagne category is relatively modest, its high growth potential is fueled by its strong sustainability narrative and appeal to environmentally conscious consumers. Rémy Cointreau's investment signifies a belief in Telmont's ability to capture a growing share of this premium, eco-aware market segment.

RM Club (in China)

Despite a generally tough market for Cognac in China, Rémy Martin's 'Club' expression has shown remarkable strength, actually increasing its market share. This success is largely thanks to direct sales and online platforms, highlighting how specific premium offerings and smart distribution can overcome broader challenges. In 2024, the premium spirits market in China continued to be a key battleground, with brands focusing on exclusivity and targeted experiences to capture consumer interest.

The resilience of Rémy Martin Club suggests a growing appetite for premium Cognac within specific consumer segments. This performance is a positive indicator for the brand's strategy in a vital luxury market. Continued focus on this product and its tailored distribution is crucial for maintaining its star status.

- Market Share Growth: Rémy Martin Club has seen an uptick in market share within China's Cognac sector.

- Distribution Channels: Direct distribution and e-commerce have been pivotal in the 'Club' expression's success.

- Premium Segment Strength: The performance indicates a robust demand for premium Cognac sub-segments despite overall market pressures.

- Strategic Importance: Continued investment is vital to solidify 'Club' as a star performer in the Chinese luxury market.

Cointreau Cocktail Twists (RTD)

Cointreau's introduction of ready-to-drink (RTD) 'Cocktail Twists' is a strategic move into the burgeoning convenience beverage market. This segment is experiencing significant growth, fueled by consumer demand for easy-to-prepare, high-quality cocktails. The RTD market was projected to reach over $32 billion globally by 2026, indicating substantial opportunity.

While Cointreau's presence in the RTD category is new, its established brand equity and the inherent appeal of the cocktail culture position these 'Cocktail Twists' as a potential star. The convenience factor is paramount, with consumers increasingly seeking on-the-go options that don't compromise on taste or quality.

- Market Growth: The global RTD market is a high-growth sector, with projections indicating continued expansion.

- Brand Strength: Leveraging the well-recognized Cointreau brand provides a significant advantage in a competitive landscape.

- Consumer Trends: The demand for convenience and sophisticated at-home cocktail experiences aligns perfectly with the RTD offering.

- Innovation: 'Cocktail Twists' represent Cointreau's adaptation to evolving consumer preferences and market dynamics.

Rémy Martin Club's performance in China, particularly its market share growth in a challenging environment, positions it as a star. This is driven by targeted premium offerings and effective direct/online sales channels. The brand's ability to capture specific consumer segments highlights its potential for sustained high growth in a key luxury market.

What is included in the product

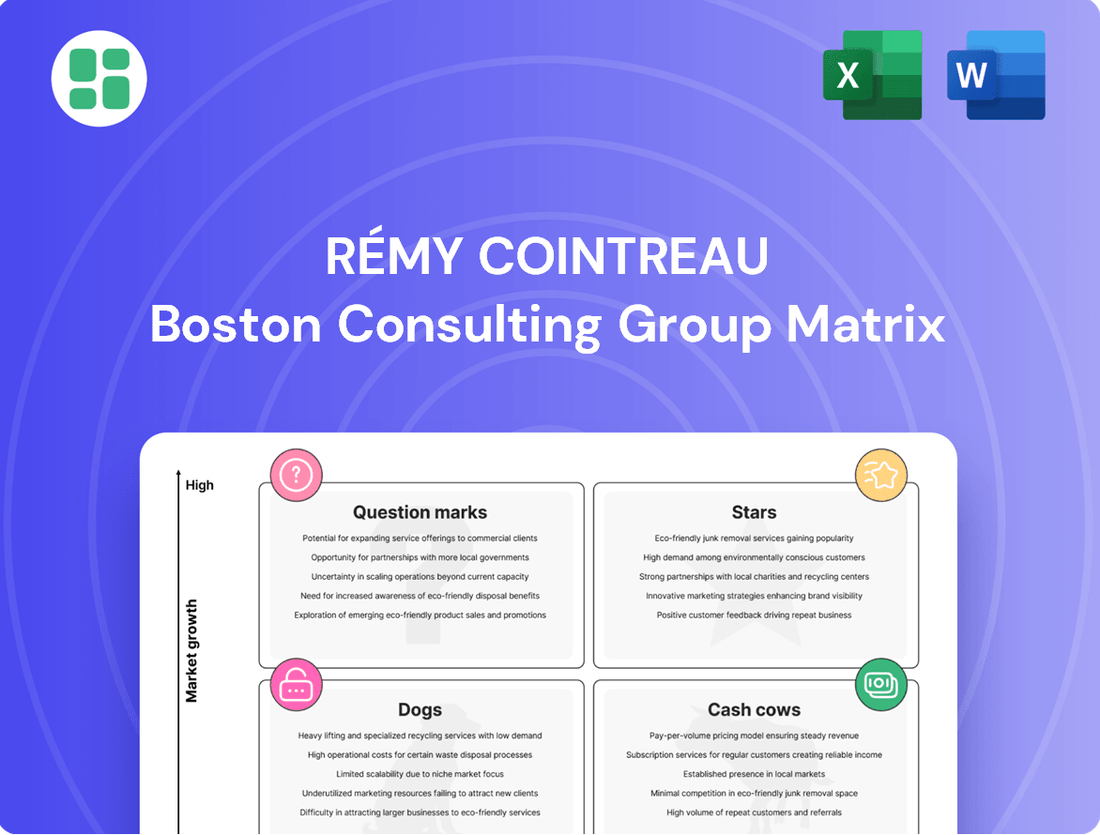

The Rémy Cointreau BCG Matrix offers a tailored analysis of its product portfolio, categorizing brands into Stars, Cash Cows, Question Marks, and Dogs.

This framework highlights which units to invest in, hold, or divest to optimize Rémy Cointreau's strategic resource allocation.

The Rémy Cointreau BCG Matrix simplifies complex portfolio analysis, offering a clear visual guide to strategic decision-making.

Cash Cows

Rémy Martin VSOP Cognac is a true cash cow for Rémy Cointreau, maintaining a dominant position in the global Cognac market, especially within the highly sought-after VSOP segment. While facing some recent headwinds in the Americas due to inventory adjustments, its enduring appeal in established markets like Europe and Asia continues to fuel robust cash generation.

The brand's deep-rooted heritage and premium image translate into impressive profit margins, allowing it to weather market volatility. In fiscal year 2023-2024, Rémy Cointreau reported that its Cognac division, heavily influenced by Rémy Martin, saw organic growth in net sales, underscoring the continued strength of its flagship brands like VSOP.

Cointreau, a cornerstone of Rémy Cointreau's portfolio, exemplifies a classic Cash Cow. Its enduring global recognition as a premium orange liqueur solidifies its strong market standing within the liqueurs and spirits sector, consistently delivering substantial revenue contributions.

The liqueur's inherent versatility in a wide array of popular cocktails, coupled with its deeply ingrained brand equity, positions it as a dependable engine for generating consistent cash flow within the expanding liqueurs market. This robust performance is further enhanced by a lean promotional investment strategy relative to its sales volume, enabling Cointreau to sustain high profit margins and reliably supply steady cash for the group.

Rémy Martin XO is a quintessential cash cow for Rémy Cointreau. Despite a reported 11.3% decrease in global shipments for the Rémy Martin brand in the first half of fiscal year 2023-2024, the XO expression remains a cornerstone of the ultra-premium Cognac segment. Its ability to command high prices, even amidst market volatility, underscores its consistent profitability and strong brand equity.

The enduring appeal of Rémy Martin XO, even with broader market headwinds like those seen in the Chinese market, solidifies its cash cow status. The brand's loyal consumer base and its established prestige allow it to maintain premium pricing, ensuring robust margins and a reliable revenue stream for the company. This resilience in a challenging environment is characteristic of a mature, highly profitable product.

Louis XIII Cognac

Louis XIII Cognac is a prime example of a cash cow for Rémy Cointreau. It sits at the very top of their offerings, targeting a very select group of consumers willing to pay a premium.

While the sheer volume of Louis XIII sold isn't massive, its incredibly high price point means each bottle contributes significantly to the company's overall profits. This brand's strength lies in its deep heritage and carefully maintained scarcity, solidifying its leadership in the ultra-luxury spirits market.

- Exceptional Profitability: Louis XIII commands an ultra-premium price, generating substantial profit margins per bottle.

- Brand Equity: Its long-standing heritage and limited production foster desirability and exclusivity.

- Market Dominance: Louis XIII holds a commanding position in the high-end Cognac segment.

- Contribution to Revenue: Despite lower volumes, its high price makes it a disproportionately important revenue generator for Rémy Cointreau.

Metaxa Brandy

Metaxa, a Greek spirit, is a significant Cash Cow for Rémy Cointreau. Its unique blend of brandy and Muscat wines has cemented a strong market presence, especially in Eastern Europe and Greece itself.

This established consumer base in mature markets allows Metaxa to consistently generate stable cash flows. While its global reach may not match Rémy Martin or Cointreau, its brand loyalty ensures reliable profitability.

- Market Position: Strong in Eastern Europe and Greece.

- Financial Contribution: Generates stable, predictable cash flows.

- Brand Strength: High loyalty in its core markets.

- Strategic Role: Reliable contributor to overall company profitability.

Rémy Martin VSOP and XO Cognacs, along with Cointreau liqueur, are the primary Cash Cows for Rémy Cointreau. These brands benefit from strong brand equity and established market positions, allowing them to generate consistent profits with relatively low investment needs. Their enduring popularity, particularly in mature markets, ensures a steady stream of cash for the company.

In fiscal year 2023-2024, Rémy Cointreau's Cognac segment, heavily reliant on Rémy Martin, demonstrated resilience. Despite challenges in the Americas, the brand's performance in Europe and Asia contributed to organic growth in net sales, highlighting the dependable cash-generating capabilities of its core Cognac offerings.

Cointreau, a leading orange liqueur, consistently contributes significant revenue due to its widespread use in cocktails and strong brand recognition. Its lean promotional strategy relative to sales volume further enhances its profitability, making it a reliable cash engine.

Metaxa, while not as globally dominant, acts as a stable Cash Cow, particularly in its core markets of Eastern Europe and Greece. Its loyal customer base ensures predictable cash flows, reinforcing its role as a consistent profit contributor.

| Brand | Category | BCG Status | Fiscal Year 2023-2024 Performance Highlights | Key Strengths |

|---|---|---|---|---|

| Rémy Martin VSOP | Cognac | Cash Cow | Enduring appeal in Europe and Asia, contributing to overall Cognac segment growth despite regional headwinds. | Dominant VSOP market position, premium image, heritage. |

| Rémy Martin XO | Cognac | Cash Cow | Maintains premium pricing and strong brand equity in the ultra-premium segment, ensuring profitability. | Ultra-premium positioning, loyal consumer base, established prestige. |

| Cointreau | Liqueur | Cash Cow | Consistent revenue generation through versatility in cocktails and deep brand equity. | Global recognition, high profit margins, lean promotional investment. |

| Metaxa | Greek Spirit | Cash Cow | Stable cash flows from strong loyalty in core markets like Eastern Europe and Greece. | Established presence in key regions, high brand loyalty, predictable profitability. |

Delivered as Shown

Rémy Cointreau BCG Matrix

The preview of the Rémy Cointreau BCG Matrix you are currently viewing is the identical, fully unlocked document you will receive immediately after purchase. This comprehensive report, meticulously crafted with expert analysis, will be yours to download without any watermarks or demo content, ready for immediate strategic application.

Dogs

Rémy Cointreau's 'Partner Brands' segment is currently a significant concern, exhibiting a consistent negative operating profit and a substantial decline in sales throughout the 2024-25 fiscal year. This performance suggests these brands are situated in stagnant markets where their contribution to the group's overall market share is negligible.

These brands are often characterized by distribution agreements rather than direct ownership of intellectual property, meaning their underperformance acts as a drain on resources without yielding commensurate returns. The ongoing organic sales contraction and negative impact on operating profit clearly mark them as candidates for divestiture or a strategic reduction in investment.

Certain lower-tier Rémy Martin Cognac SKUs, especially those tied to the Americas, are likely categorized as dogs in Rémy Cointreau's BCG Matrix. These products face a double whammy: low market share in their niche and a challenging environment in regions experiencing destocking and heavy promotions.

The company's financial reports for the fiscal year ending March 31, 2024, underscore this. Rémy Cointreau reported a significant 24.4% organic decrease in Cognac sales for the Americas region. This decline points to specific products within the portfolio struggling to gain traction or even maintain their existing share in these pressured markets.

Within Rémy Cointreau's diverse portfolio, certain older or niche rum brands that haven't received substantial marketing or product development might be classified as dogs. These brands often face challenges in the competitive rum landscape due to a lack of premium positioning or a distinct market appeal.

These brands typically exhibit low market share and minimal growth potential, contributing little to overall revenue or profit. For instance, if a brand like Mount Gay, while a strong performer, has smaller, less-invested rum lines, these could fall into the dog category if they aren't showing traction.

Specific Geographic Markets with Persistent Decline

Certain geographic markets, especially within EMEA and APAC outside of Southeast Asia, are exhibiting persistent declines in Rémy Cointreau's Cognac sales. This downturn is attributed to soft consumer trends and unfavorable distribution shifts, effectively positioning these regions as 'dog' markets for specific product lines.

These underperforming regions, while not a product itself, signify a low market share and stagnant growth for certain Rémy Cointreau brands. Consequently, they represent areas where continued investment may not yield significant returns, aligning with the characteristics of a 'dog' in the BCG Matrix.

- EMEA and APAC (excluding Southeast Asia): Identified as regions with persistent sales declines for Rémy Cointreau Cognac.

- Contributing Factors: Soft consumer trends and adverse distribution changes are cited as primary reasons for the underperformance.

- BCG Matrix Classification: These markets, due to low growth and market share for specific products, are considered 'dogs'.

- Investment Implications: Reduced attractiveness for sustained investment, suggesting a need for strategic re-evaluation of resource allocation in these areas.

Brands Lacking Premiumization Potential

Brands within Rémy Cointreau's portfolio that struggle with premiumization, often found in highly competitive, price-sensitive markets, can be categorized as Dogs. These offerings typically lack the distinctiveness or perceived value necessary for significant margin expansion or market share gains in the luxury spirits arena.

Such brands are unlikely to align with Rémy Cointreau's strategic emphasis on high-end positioning and may represent a drain on resources without substantial future growth prospects. For instance, if a particular brand operates in a segment where price is the primary differentiator, it inherently limits the potential for value-added marketing or product development.

- Low Brand Equity: Brands with minimal perceived differentiation or heritage struggle to command premium pricing.

- Commoditized Markets: Operating in segments with numerous competitors offering similar products intensifies price wars, hindering profitability.

- Limited Innovation Scope: Products lacking unique selling propositions or opportunities for luxury line extensions are unlikely to elevate.

- Declining or Stagnant Demand: Brands in segments experiencing reduced consumer interest or market saturation face uphill battles for growth.

Certain lower-tier Rémy Martin Cognac SKUs, particularly those concentrated in the Americas, are likely classified as Dogs within Rémy Cointreau's BCG Matrix. These products face a dual challenge: limited market share within their specific segments and a difficult operating environment characterized by destocking and aggressive promotional activities in key regions.

The company's financial performance for the fiscal year ending March 31, 2024, highlights this issue. Rémy Cointreau reported a substantial 24.4% organic decline in Cognac sales specifically within the Americas. This downturn suggests that particular products in their portfolio are struggling to maintain or grow their market presence in these challenging markets.

These 'Dog' brands, whether specific product lines or those in underperforming geographic markets like EMEA and APAC (excluding Southeast Asia), exhibit low market share and minimal growth potential. They contribute little to the group's overall revenue or profit, acting as a drain on resources without generating significant returns.

Brands struggling with premiumization in price-sensitive markets, lacking distinctiveness or perceived value, also fall into this category. They do not align with Rémy Cointreau's luxury positioning and offer limited prospects for future growth or margin expansion.

| Product Segment | Market Share | Growth Potential | Profitability | BCG Classification |

| Lower-tier Rémy Martin Cognac (Americas) | Low | Stagnant/Declining | Negative | Dog |

| Niche Rum Brands (under-invested) | Low | Low | Low | Dog |

| Cognac in EMEA/APAC (ex-SEA) | Low | Stagnant/Declining | Low | Dog |

| Brands in Commoditized Markets | Low | Low | Low | Dog |

Question Marks

Westland and Hautes Glaces represent Rémy Cointreau's strategic play in the burgeoning craft whisky market, specifically within the premium and artisanal segments. These distilleries are positioned in high-growth categories, a characteristic of potential stars in the BCG matrix, but their current market share is likely modest, reflecting their early stage of development and the competitive landscape.

Significant investment in marketing, brand building, and distribution is crucial for these emerging brands to capture attention and market share in the premium whisky space. For example, Westland, a pioneer in American Single Malt, has focused on unique regional expressions and barrel programs, aiming to carve out a distinct identity. Hautes Glaces, on the other hand, leverages its French heritage and organic sourcing, appealing to a discerning consumer base.

The success of Westland and Hautes Glaces as future stars hinges on their ability to achieve substantial market penetration and gain widespread consumer acceptance. Rémy Cointreau's commitment to these ventures underscores their long-term vision to diversify their portfolio beyond established spirits, tapping into evolving consumer preferences for authenticity and craft production.

Bruichladdich and The Botanist's expansion into emerging markets like Southeast Asia or certain Latin American countries exemplify Question Marks for Rémy Cointreau. These regions present significant growth potential but demand considerable investment to establish brand recognition and distribution networks against established competitors.

For instance, the premium spirits market in India, projected to grow at a CAGR of over 10% through 2027, offers a compelling opportunity for brands like Bruichladdich. However, navigating local regulations and building consumer loyalty requires substantial upfront capital and strategic marketing efforts.

The success of these ventures hinges on Rémy Cointreau's ability to adapt its strategy to local tastes and competitive landscapes. A failure to gain traction could lead to write-offs, while a successful entry could transform these brands into future Stars within the company's portfolio.

Rémy Cointreau's exploration into innovative product extensions beyond its core Cognac and Liqueurs & Spirits categories positions these ventures as potential question marks in the BCG matrix. These new offerings, perhaps venturing into artisanal spirits or unique ready-to-drink (RTD) cocktails, operate in nascent, high-growth segments with currently low market share. For instance, the global RTD market was projected to reach USD 1.18 trillion by 2027, indicating significant growth potential.

Digital-First or E-commerce Exclusive Offerings

Rémy Cointreau's focus on digital-first and e-commerce exclusive offerings positions newer or less established brands for growth. This strategy leverages the high-growth potential of online sales channels, aiming to build direct-to-consumer relationships. However, success hinges on significant investment in digital marketing, robust logistics, and a seamless customer experience to stand out in a competitive online marketplace.

The company's investment in e-commerce reflects a broader industry trend. For instance, online sales of premium spirits saw significant growth in 2023, with some reports indicating double-digit increases year-over-year. Rémy Cointreau's commitment to these channels is crucial for future market share gains.

- E-commerce Investment: Rémy Cointreau is actively enhancing its digital infrastructure and direct-to-consumer capabilities.

- Brand Development: This strategy is particularly beneficial for nurturing emerging or niche brands within their portfolio.

- Market Challenges: Gaining traction requires substantial spending on digital advertising, efficient delivery networks, and superior online customer service.

- Performance Metrics: The ultimate success of these digital initiatives will be measured by market share growth and customer engagement metrics in the online space.

Sustainability-Focused Product Lines

Rémy Cointreau's sustainability-focused product lines, such as eco-packaged Cointreau or potential low-carbon spirits, align with the high-growth consumer trend of conscious consumption. While these initiatives tap into a rapidly expanding segment willing to pay a premium for environmentally friendly choices, they may currently represent a low initial market share. The company is investing in R&D and sustainable practices to capture this growing demand.

For instance, the spirits industry as a whole saw a significant shift in consumer preference towards sustainability. A 2024 report indicated that over 60% of consumers consider sustainability when making purchasing decisions, with a notable portion willing to pay more for eco-friendly products. Rémy Cointreau's commitment to these areas is crucial for converting this interest into tangible market share, especially as competitors also begin to emphasize their green credentials.

- High Growth Potential: Consumer demand for sustainable products is a significant growth driver, with market research in 2024 showing a substantial increase in spending on eco-conscious goods.

- Investment Needs: Developing and marketing these lines requires considerable investment in research, sustainable sourcing, and transparent communication of environmental efforts.

- Market Share Opportunity: While initial market share might be low, these products address a growing consumer segment, offering a pathway to increased market penetration and brand loyalty.

- Competitive Landscape: As sustainability becomes a key differentiator, Rémy Cointreau's proactive approach positions them to compete effectively against both established players and emerging brands focusing on environmental responsibility.

Rémy Cointreau's ventures into emerging markets, such as expanding Bruichladdich and The Botanist into regions like Southeast Asia or Latin America, represent classic Question Marks. These markets offer substantial growth potential, evidenced by the premium spirits market in India projected to grow at over 10% CAGR through 2027. However, they necessitate significant investment in brand building and distribution to overcome established competitors and local complexities.

The success of these international expansions hinges on Rémy Cointreau's ability to tailor strategies to local tastes and regulatory environments. Failure to gain market traction could result in financial write-offs, while successful penetration could elevate these brands into future Stars within the company's portfolio.

These initiatives are characterized by high potential but currently low market share, demanding substantial capital for marketing and network development. The company's strategic allocation of resources towards these nascent markets reflects a calculated risk to diversify and capture future growth opportunities.

BCG Matrix Data Sources

Our Rémy Cointreau BCG Matrix is built upon a foundation of comprehensive market data, incorporating financial statements, industry growth rates, and internal sales figures to accurately position each business unit.