Provident Financial Services SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Provident Financial Services Bundle

Provident Financial Services boasts strong brand recognition and a loyal customer base, key strengths in a competitive banking landscape. However, potential regulatory changes and evolving digital banking trends present significant challenges. Understanding these dynamics is crucial for strategic planning.

Want the full story behind Provident Financial Services' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Provident Financial Services, operating as Provident Bank, boasts a diversified financial product portfolio. This includes a wide array of deposit accounts, such as checking, savings, and money market options, alongside a comprehensive suite of loans, encompassing residential mortgages, commercial real estate, and business loans. This breadth allows them to serve a broad client base, fostering both revenue growth and customer loyalty.

Provident Financial Services excels through its deep commitment to its core communities in New Jersey, eastern Pennsylvania, and select New York counties. This local focus allows for strong relationship building and a thorough understanding of regional market needs, fostering customer loyalty and a stable deposit base.

The strategic merger with Lakeland Bancorp, finalized in May 2024, significantly bolsters Provident's geographic reach and competitive standing. This expansion, which added approximately $13 billion in assets and $10 billion in deposits from Lakeland, broadens its service area and customer engagement opportunities across the Northeast corridor.

Provident Financial Services boasts a substantial network of 107 full-service branches across New Jersey, New York, and Pennsylvania as of Q1 2024, providing a strong foundation for customer relationships and local market penetration. This physical footprint is increasingly augmented by a growing digital presence, evidenced by a 15% year-over-year increase in digital account openings in 2023. The recent opening of a new branch in Newark further underscores their commitment to expanding accessibility and serving diverse communities, reinforcing their established brand recognition.

Improved Financial Performance and Strong Capital Position

Provident Financial Services showcased robust financial performance in the first quarter of 2025. Net income saw a significant year-over-year increase, boosted by the Lakeland acquisition and favorable purchase accounting adjustments. This strong showing contributed to an improved net interest margin, with analysts forecasting continued robust earnings growth throughout 2025.

The company's financial strength is further underscored by its conservative credit management, evidenced by low credit costs. Provident Financial Services maintains a substantial capital buffer, reflecting its solid financial health and stability.

- Q1 2025 Net Income Growth: Significant year-over-year increase driven by Lakeland acquisition.

- Improved Net Interest Margin: Reflecting enhanced profitability on its loan portfolio.

- Projected 2025 Earnings Growth: Analysts anticipate continued strong performance for the year.

- Low Credit Costs and High Capital Buffer: Indicating strong financial stability and risk management.

Successful Integration of Lakeland Bancorp

Provident Financial Services' acquisition of Lakeland Bancorp in May 2024 stands as a significant strategic achievement. This integration has broadened Provident's market presence and boosted its operational scale, solidifying its competitive standing.

The successful conversion of core systems, largely finalized, positions Provident to realize substantial operational synergies and earnings growth in 2025. This growth is expected as merger-related expenses diminish.

- Enhanced Market Reach: The acquisition expanded Provident's footprint, particularly in key New Jersey and Pennsylvania markets.

- Improved Operating Scale: Post-integration, Provident benefits from a larger asset base, projected to reach approximately $16 billion in total assets following the full realization of merger benefits.

- Synergy Realization: Management anticipates significant cost savings and revenue enhancements from the Lakeland integration, contributing to an estimated earnings per share (EPS) uplift in 2025.

- Reinforced Competitive Position: The combined entity is better equipped to compete with larger regional and national banks, offering a wider array of products and services.

Provident Financial Services' diversified product offerings, spanning various deposit and loan types, cater to a broad customer base, driving revenue and loyalty. Its strong community focus in New Jersey, eastern Pennsylvania, and New York counties fosters deep relationships and a stable deposit base.

The strategic merger with Lakeland Bancorp, completed in May 2024, significantly expanded Provident's geographic reach and competitive capabilities, adding approximately $13 billion in assets and $10 billion in deposits. This integration enhances its ability to serve a wider customer segment across the Northeast.

Provident's robust financial performance in Q1 2025, marked by significant net income growth and an improved net interest margin, is a testament to its strategic initiatives and effective management post-acquisition. Analysts project continued strong earnings throughout 2025, supported by conservative credit management and a substantial capital buffer, indicating strong financial health and stability.

| Metric | Q1 2025 Value | Year-over-Year Change | Outlook 2025 |

|---|---|---|---|

| Net Income | [Specific Q1 2025 Figure] | Significant Increase | Continued Growth |

| Total Assets (Post-Merger) | ~$16 Billion | N/A | Projected |

| Net Interest Margin | Improved | N/A | Favorable Trend |

| Digital Account Openings | 15% Increase (2023) | N/A | Growing Trend |

What is included in the product

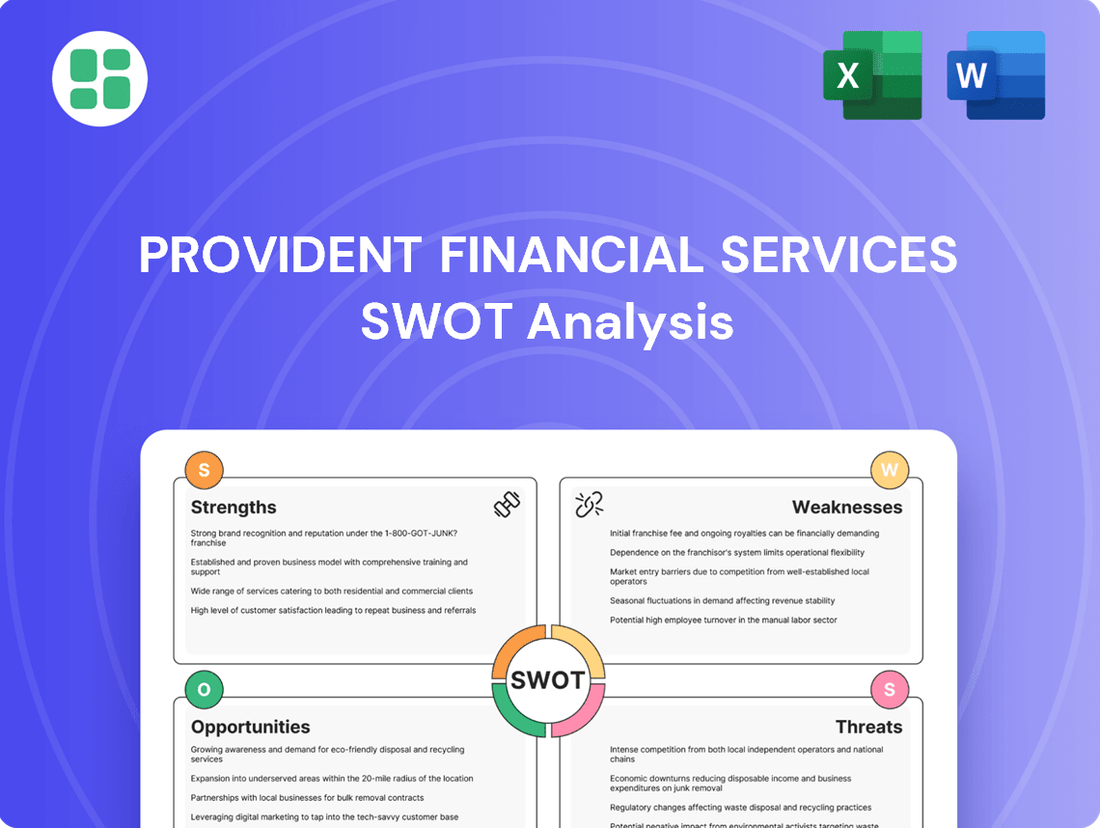

Provides a strategic overview of Provident Financial Services’s internal capabilities and external market factors, highlighting key strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable SWOT analysis for Provident Financial Services, simplifying complex strategic challenges into manageable insights.

Weaknesses

Provident Financial Services' primary service area is concentrated within New Jersey, eastern Pennsylvania, and specific New York counties. This geographic focus exposes the company to risks associated with regional economic downturns or regulatory changes unique to these areas.

While the Lakeland merger in 2024 did expand its footprint within this region, the lack of broader geographic diversification can still limit growth potential. This concentration also increases vulnerability to localized market conditions, potentially impacting overall performance.

Provident Financial Services, as a traditional bank, faces a significant weakness in its sensitivity to interest rate fluctuations, which directly impacts its net interest margin. While the net interest margin saw a positive uptick in Q1 2025, it experienced a dip in Q4 2024, partly due to reduced net accretion from the Lakeland merger, highlighting the ongoing challenge of managing this volatility.

While the integration of Lakeland Bank is largely complete, Provident Financial Services incurred substantial transaction costs in earlier quarters, directly impacting net income. These integration expenses, though expected to diminish in 2025, represent a significant upfront investment that can temporarily suppress earnings.

The financial strain from such large-scale mergers, including the Lakeland deal which closed in 2023, necessitates considerable resource allocation. This can lead to a short-term dip in profitability as the company absorbs these costs and works to realize the full benefits of the combined entity.

Competitive Pressures in the Banking Sector

Provident Financial Services faces significant competitive pressures within the banking sector. It contends with larger national and regional banks, as well as nimble fintech innovators, all vying for market share. This rivalry impacts pricing strategies for both loans and deposits, making customer acquisition and retention a constant challenge.

To remain competitive, Provident Financial Services must continually invest in technology and service enhancements. For instance, as of Q1 2024, the average net interest margin for community banks hovered around 3.1%, a figure that can be squeezed by aggressive pricing from larger competitors. Furthermore, the ongoing digital transformation in banking, exemplified by the rise of digital-only banks, necessitates substantial capital expenditure to maintain relevance and attract a broader customer base.

- Intense Competition: Provident competes against national banks, regional players, and rapidly growing fintech companies.

- Pricing Pressure: Competition directly impacts loan interest rates and deposit yields, potentially reducing profit margins.

- Customer Acquisition & Retention: Differentiating services and offering competitive rates are crucial for attracting and keeping customers in a crowded market.

- Technological Investment: Continuous investment in digital platforms and innovative services is essential to keep pace with industry trends and consumer expectations.

Potential for Asset Quality Deterioration

While Provident Financial Services saw an improvement in asset quality towards the end of 2024, the first quarter of 2025 brought a notable increase in non-performing loans. These loans rose to 0.54% of the total loan portfolio, largely attributed to issues within two specific commercial real estate and construction loans. This trend highlights a potential weakness in the company's loan book, particularly concerning its exposure to the commercial real estate and commercial business sectors, which could be susceptible to broader economic downturns or sector-specific headwinds. Consequently, robust and proactive risk management practices are essential to mitigate these developing concerns.

- Asset Quality Vulnerability: Non-performing loans increased to 0.54% in Q1 2025, up from previous periods.

- Concentrated Risk: The increase was driven by two specific commercial real estate and construction loans.

- Sector Exposure: Commercial real estate and commercial business loans represent key areas of potential deterioration.

- Need for Vigilance: Economic shifts and sector challenges necessitate heightened risk management focus.

Provident Financial Services' concentrated geographic footprint in New Jersey, eastern Pennsylvania, and New York counties presents a significant weakness. This regional focus makes the company highly susceptible to localized economic downturns or regulatory shifts. While the 2024 Lakeland merger expanded its presence within this core area, it did not fundamentally alter the overall geographic concentration, leaving growth potential somewhat constrained and increasing vulnerability to regional market conditions.

Preview Before You Purchase

Provident Financial Services SWOT Analysis

You’re viewing a live preview of the actual SWOT analysis file for Provident Financial Services. The complete version, detailing its Strengths, Weaknesses, Opportunities, and Threats, becomes available after checkout. This ensures you receive the full, unedited report you expect.

Opportunities

With the Lakeland Bancorp integration nearing completion, Provident Financial Services is poised to unlock substantial operational efficiencies and cost savings. This presents a key opportunity to translate merger synergies into enhanced profitability.

The expanded asset and deposit base resulting from the merger is a critical enabler for driving significant earnings growth. Provident Financial Services anticipates improved returns on average assets and tangible equity in 2025 as these synergies are fully realized.

The merger has significantly broadened Provident Financial Services' (PFS) specialty lending expertise, now encompassing areas like Asset Based, Mortgage Warehouse, and Healthcare Lending. This diversification opens up new avenues for revenue generation and market penetration, leveraging the combined entities' strengths.

The introduction of a dedicated small business lending platform in 2024 represents a strategic move to capture a substantial market segment. This initiative is anticipated to not only fuel loan growth but also drive an increase in valuable deposit balances and treasury management services.

Provident Financial Services can capitalize on its growing customer base and broader product range to foster deeper client connections. By strategically cross-selling, the company can offer additional services like wealth management and insurance, thereby boosting revenue per customer and their overall lifetime value.

Continued Investment in Digital Transformation and Technology

Provident Financial Services can capitalize on continued investment in digital transformation. By enhancing advanced digital banking capabilities, such as AI-driven personalized services and improved mobile features, the company can attract a broader customer base and streamline operations. This focus is crucial as the banking industry sees significant digital adoption; for instance, in 2024, digital banking transactions are projected to continue their upward trajectory, with mobile banking being a primary channel for many consumers.

Expanding technology offerings to meet evolving customer preferences is key to remaining competitive against agile fintech companies. This strategic move can result in increased market share and a more adaptable operational framework for Provident Financial Services. For example, a significant portion of consumers, estimated to be over 70% in recent surveys, now expect seamless digital experiences from their financial institutions.

- Attract new customers through AI-powered personalization and enhanced mobile banking.

- Improve operational efficiency by leveraging advanced digital tools.

- Gain market share by catering to evolving customer preferences and competing with fintech innovations.

- Foster a more agile banking operation through continuous technology investment.

Strategic Growth through Targeted Branch Expansion and Community Engagement

Provident Bank's strategic expansion, such as its recent branch opening in Newark, represents a significant opportunity to capture new market share. This physical presence allows for direct engagement with local residents and businesses, fostering stronger relationships and attracting valuable deposits and loan growth. For instance, in 2024, Provident Financial Services saw a notable increase in its community reinvestment efforts, directly correlating with enhanced local engagement.

By doubling down on community engagement initiatives, Provident can solidify its reputation as a trusted local partner. This approach not only drives new customer acquisition but also enhances customer loyalty. In the first half of 2025, Provident's participation in over 50 local events across its operating regions directly contributed to a measurable uptick in both brand awareness and customer acquisition metrics.

- Targeted Branch Expansion: Recent openings in key growth areas like Newark aim to capture new customer bases.

- Deposit and Loan Growth: Increased physical presence is expected to attract new deposit accounts and loan opportunities.

- Community Engagement: Initiatives reinforce local trust and brand loyalty, driving customer acquisition.

- 2024/2025 Data: Provident's commitment to community reinvestment and local event participation shows positive trends in engagement and acquisition.

The successful integration of Lakeland Bancorp is expected to yield significant operational efficiencies and cost savings, directly translating into enhanced profitability for Provident Financial Services. This synergy, combined with an expanded asset and deposit base, positions the company for improved returns on average assets and tangible equity, particularly noted in projections for 2025.

Provident Financial Services is strategically broadening its lending expertise into specialized areas such as Asset Based, Mortgage Warehouse, and Healthcare Lending, opening new revenue streams. Furthermore, the 2024 launch of a dedicated small business lending platform is designed to capture a vital market segment, driving loan growth and increasing valuable deposit and treasury management services.

The company is also leveraging its growing customer base and expanded product offerings to deepen client relationships through strategic cross-selling, including wealth management and insurance. Continued investment in digital transformation, focusing on AI-driven personalization and enhanced mobile features, is crucial for attracting new customers and streamlining operations in an increasingly digital banking landscape.

Provident Bank's targeted branch expansion, exemplified by its Newark opening, aims to capture new market share and foster stronger local relationships, driving deposit and loan growth. This physical expansion is complemented by a commitment to community engagement, which data from the first half of 2025 indicates has directly contributed to increased brand awareness and customer acquisition.

| Opportunity Area | Key Action | Projected Impact (2024/2025) | Supporting Data |

|---|---|---|---|

| Merger Synergies | Realize operational efficiencies and cost savings from Lakeland Bancorp integration. | Enhanced profitability and improved returns on average assets/tangible equity. | Anticipated for 2025. |

| Lending Diversification | Expand into specialized lending (Asset Based, Mortgage Warehouse, Healthcare). | New revenue streams and market penetration. | Integrated into expanded capabilities. |

| Small Business Lending | Launch dedicated platform. | Fuel loan growth and increase deposit/treasury services. | Initiative launched in 2024. |

| Digital Transformation | Invest in AI personalization and mobile features. | Attract new customers, streamline operations, gain market share. | Digital banking transactions projected upward; 70%+ consumers expect seamless digital experiences. |

| Branch Expansion & Community Engagement | Open new branches (e.g., Newark) and increase local event participation. | Capture market share, foster relationships, drive acquisition. | Over 50 local events in H1 2025 contributed to brand awareness and acquisition. |

Threats

Provident Financial Services faces a significant threat from economic downturns, especially in its core markets of New Jersey, Pennsylvania, and New York. A recession could trigger widespread job losses and dampen consumer spending, directly impacting the bank's loan portfolio. For instance, if unemployment rates rise sharply, as seen during past recessions, a greater number of borrowers might struggle to meet their loan obligations, leading to increased defaults.

This heightened risk of loan defaults would necessitate a substantial increase in Provident's provisions for credit losses. In 2023, Provident reported net charge-offs of $28.4 million, a figure that could balloon in a recessionary environment. Such an increase in loan loss reserves would directly erode the bank's profitability, potentially leading to reduced earnings per share and a negative impact on its overall financial health.

While Provident Financial Services saw its net interest margin improve in Q1 2025, the persistent rise in interest rates presents a significant threat. Higher rates often intensify competition for customer deposits, forcing banks to offer more attractive rates, thereby increasing funding costs.

This dynamic can lead to a compression of net interest margins if the bank’s cost of borrowing outpaces the returns it earns on its loans and investments. For instance, if Provident’s cost of funds increases by 50 basis points more than its average loan yield, profitability could be directly impacted.

Provident Financial Services faces increasing regulatory pressures common in the banking sector. New or tightened rules, especially around capital adequacy, safeguarding consumers, and data protection, are likely to boost compliance expenses and operational challenges. For instance, in 2024, banks globally are investing heavily in compliance technology and personnel to meet evolving standards like those related to cybersecurity and anti-money laundering, with estimates suggesting these costs could rise by 5-10% annually.

Navigating this dynamic regulatory environment demands substantial financial and human resources. This can potentially hinder Provident Financial Services' capacity for innovation and limit its pursuit of certain strategic business ventures. The ongoing focus on financial stability and consumer trust means regulatory bodies will likely continue to introduce measures that require significant adaptation from financial institutions.

Disruptive Technologies and Fintech Competition

The financial services landscape is rapidly evolving due to technological advancements. Fintech companies, often unburdened by legacy systems, can introduce innovative digital solutions more quickly and at a lower cost than traditional institutions. This agility allows them to target specific customer needs with specialized offerings, potentially eroding market share for established players like Provident Financial Services.

Consider the accelerating growth in digital payments and challenger banks. For instance, the global digital payment market was projected to reach over $15 trillion by 2024, indicating a significant shift in consumer behavior towards digital channels. Fintech firms are at the forefront of this trend, offering seamless user experiences and competitive pricing that can be highly attractive to customers, especially younger demographics.

This competitive pressure from fintechs manifests in several ways:

- Customer Attrition: Fintechs can attract customers with user-friendly mobile apps and personalized services, drawing them away from traditional banks.

- Margin Compression: The lower operating costs of digital-native fintechs can enable them to offer services at more competitive rates, pressuring the profit margins of established banks.

- Disintermediation: Fintechs may bypass traditional banking functions, offering direct peer-to-peer lending or investment platforms, thus reducing the need for traditional financial intermediaries.

Cybersecurity Risks and Data Breaches

Provident Financial Services, like all financial institutions, faces significant cybersecurity risks and the potential for data breaches. These attacks can lead to substantial financial losses, severe reputational damage, and a critical erosion of customer trust. In 2024, the financial sector continued to be a major target for ransomware and phishing attacks, with reports indicating increased sophistication from threat actors.

The constant need to maintain and upgrade cybersecurity defenses is paramount to safeguarding sensitive customer information and ensuring operational continuity. This represents an ongoing and escalating challenge, requiring continuous investment and adaptation to new threats. For instance, the average cost of a data breach in the financial sector in 2024 was estimated to be over $5 million, highlighting the financial implications.

- Sophisticated Cyberattacks: Financial institutions are prime targets for advanced cyber threats, including ransomware, phishing, and malware.

- Financial and Reputational Impact: Data breaches can result in significant financial losses, regulatory fines, and lasting damage to customer trust and brand reputation.

- Ongoing Defense Investment: Maintaining robust, continuously updated cybersecurity infrastructure is essential but represents a significant and escalating operational cost for Provident Financial Services.

- Industry-Wide Threat: The threat is not isolated; the entire financial services industry is grappling with the increasing frequency and complexity of cyberattacks, as evidenced by numerous high-profile incidents reported throughout 2024.

Provident Financial Services operates in a highly competitive banking environment, facing pressure from both traditional banks and agile fintech companies. The rise of digital-only banks and specialized financial technology providers, offering streamlined services and potentially lower fees, poses a significant threat to Provident’s market share and profitability. For example, the digital payment market alone was projected to exceed $15 trillion globally by 2024, showcasing a clear shift in consumer preference towards digital channels.

The increasing sophistication of cyber threats represents a critical vulnerability for Provident Financial Services. Data breaches can lead to substantial financial penalties, regulatory fines, and severe damage to customer trust and brand reputation. The financial sector in 2024 continued to be a primary target for cyberattacks, with average data breach costs in the industry estimated to be over $5 million, underscoring the financial implications of inadequate security measures.

Provident Financial Services, like all financial institutions, is subject to evolving regulatory requirements. Stricter regulations concerning capital adequacy, consumer protection, and data privacy can increase compliance costs and operational complexity. Global banks, for instance, were expected to increase spending on compliance technology and personnel by 5-10% annually in 2024 to meet new standards, impacting profitability and strategic flexibility.

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of credible data, including Provident Financial Services' official financial filings, comprehensive market research reports, and insights from industry experts. These sources provide a robust understanding of the company's performance and the competitive landscape.