Provident Financial Services PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Provident Financial Services Bundle

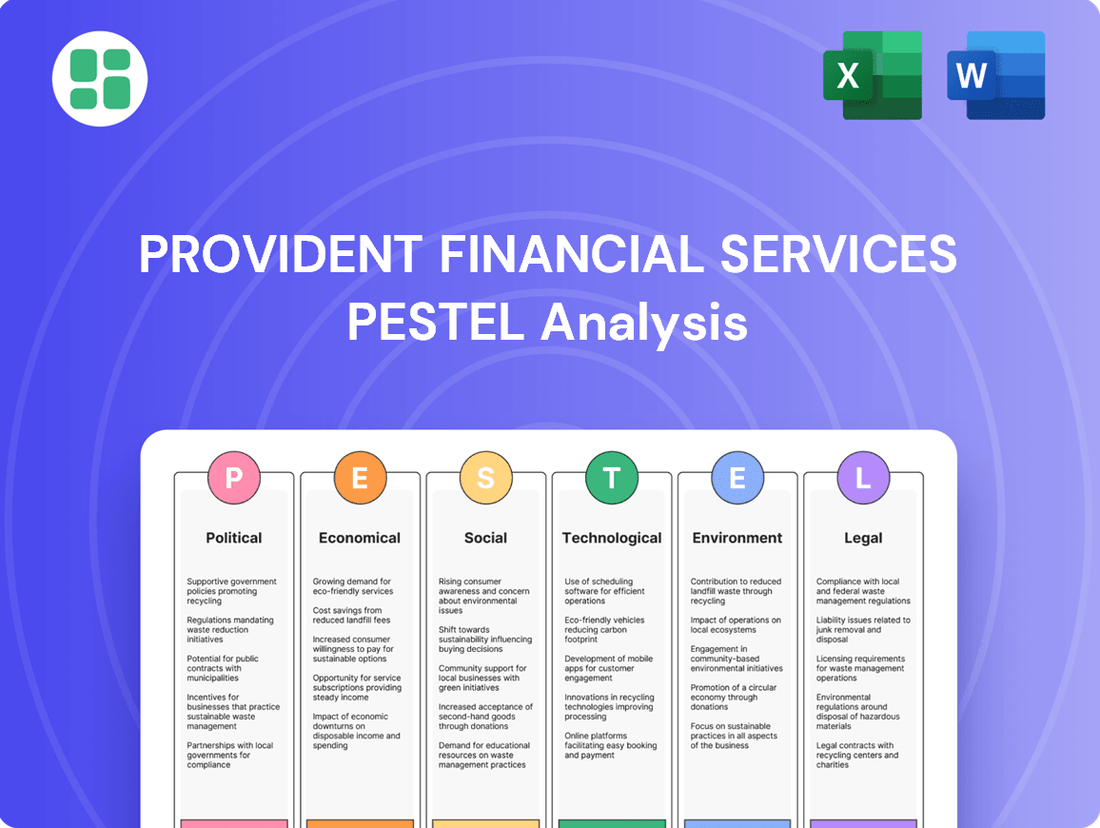

Uncover the critical political, economic, social, technological, legal, and environmental factors influencing Provident Financial Services. Our comprehensive PESTLE analysis offers actionable intelligence to navigate market complexities and identify strategic opportunities. Download the full report now to gain a competitive edge.

Political factors

The banking sector, which Provident Financial Services operates within, is subject to extensive federal and state regulations. A potential move towards deregulation, possibly influenced by a new presidential administration in 2025, could alter capital requirements, affect merger and acquisition activity, and provide greater operational flexibility for institutions like Provident.

Government fiscal policy, encompassing spending and taxation, alongside the Federal Reserve's monetary policy, particularly interest rate adjustments, significantly shape the banking industry's profitability and lending operations. For instance, the Federal Reserve's benchmark interest rate stood at 5.25%-5.50% as of mid-2024, a level that influences borrowing costs and loan demand.

Anticipated interest rate reductions in 2025 are poised to invigorate borrowing and investment, potentially boosting lending volumes for institutions like Provident Financial Services. Lower rates typically encourage consumers and businesses to take on more debt for purchases and capital projects.

Conversely, shifts in trade policy, such as the implementation of new tariffs, could pose headwinds by dampening consumer spending and corporate capital expenditures, thereby impacting the overall economic environment in which Provident operates.

Political stability is a bedrock for investor confidence, directly impacting the financial services sector. For Provident Financial Services, a stable national and international political landscape in 2024-2025 fosters a predictable environment for economic growth and investment, crucial for banking operations.

Geopolitical events introduce a layer of caution for bank executives. For instance, ongoing trade tensions or regional conflicts in 2024 could lead to market volatility, affecting global economic sentiment and, by extension, Provident Financial Services' regional operating environment and investment prospects.

Consumer Protection Regulations

Consumer protection regulations are a significant political factor for Provident Financial Services. The ongoing focus on safeguarding consumers means banks must adapt their practices, especially concerning data management and customer interactions. For instance, proposed rules around medical debt and digital signage directly influence how financial institutions operate, requiring careful compliance to avoid penalties and uphold customer confidence.

These evolving consumer protection mandates necessitate proactive adjustments within Provident Financial Services. Failing to comply can lead to substantial fines and damage to the company's reputation. In 2024, regulatory bodies like the Consumer Financial Protection Bureau (CFPB) continued to emphasize fair lending practices and data privacy, with enforcement actions often targeting institutions that fall short. For example, the CFPB issued guidance in early 2024 reiterating expectations for clear and accurate disclosures in digital financial products.

Provident Financial Services must navigate this complex regulatory landscape. Key areas of impact include:

- Data Privacy Compliance: Adhering to regulations like the Gramm-Leach-Bliley Act (GLBA) and potential new data security standards.

- Fair Lending Practices: Ensuring all lending decisions are free from bias, as mandated by laws such as the Equal Credit Opportunity Act (ECOA).

- Transparency in Digital Services: Meeting requirements for clear communication and disclosures for online banking and mobile applications.

- Customer Complaint Resolution: Implementing robust systems to address customer grievances effectively, a key focus for regulators.

Anti-Money Laundering (AML) and Counter-Terrorism Financing (CFT) Programs

Provident Financial Services operates within a landscape where strengthening Anti-Money Laundering (AML) and Counter-Terrorism Financing (CFT) programs is a paramount regulatory concern. New rules are anticipated to reshape Bank Secrecy Act (BSA) requirements for financial institutions in 2025, necessitating proactive adaptation.

To effectively navigate these evolving regulations, Provident Financial Services must continually fortify its compliance frameworks. This involves robust systems for detecting and preventing illicit financial activities, which in turn demands substantial investments in advanced technology and comprehensive employee training. For instance, the Financial Crimes Enforcement Network (FinCEN) has been actively proposing enhancements to AML reporting and data collection, aiming for greater efficiency and effectiveness in identifying suspicious transactions.

- Regulatory Focus: AML/CFT compliance is a top priority for regulators, with significant BSA changes expected in 2025.

- Investment Needs: Enhancing compliance frameworks requires substantial investment in technology and specialized training for staff.

- Detection & Prevention: Robust systems are crucial for identifying and thwarting illicit financial activities.

- Industry Trends: Financial institutions are increasingly adopting advanced analytics and artificial intelligence to improve AML/CFT detection capabilities.

Political stability and government policy directly influence Provident Financial Services' operating environment. Anticipated interest rate adjustments in 2025, with potential reductions, could stimulate borrowing and boost lending volumes. However, shifts in trade policy or geopolitical events in 2024-2025 could introduce market volatility and dampen economic activity.

What is included in the product

This PESTLE analysis of Provident Financial Services examines how political, economic, social, technological, environmental, and legal factors create opportunities and threats, providing a strategic framework for decision-making.

A PESTLE analysis for Provident Financial Services offers a structured approach to understanding external influences, acting as a pain point reliever by proactively identifying potential challenges and opportunities in the political, economic, social, technological, legal, and environmental landscapes.

This analysis serves as a pain point reliever by providing a clear, actionable framework for Provident Financial Services to anticipate and navigate the complex external forces that could impact its strategic decisions and operational efficiency.

Economic factors

The trajectory of interest rates, particularly the federal funds rate, is a critical factor for Provident Financial Services. While the Federal Reserve signaled potential rate cuts in 2025, which could ease borrowing costs, banks like Provident may still grapple with elevated deposit costs. For instance, as of early 2024, deposit rates remained significantly higher than pre-pandemic levels, impacting net interest margins.

New Jersey's economic outlook points to continued recovery and growth, particularly in its strong healthcare and finance sectors. This positive regional trend is a key factor for Provident Financial Services.

The housing market in Provident Bank's core New Jersey area is currently experiencing low inventory. This scarcity is anticipated to fuel increased construction and real estate lending activity throughout 2024 and into 2025.

This dynamic housing market presents significant opportunities for Provident Bank to expand its mortgage origination and commercial real estate loan portfolios, capitalizing on the demand driven by limited supply.

Consumer spending trends and household debt levels are crucial indicators for Provident Financial Services, directly impacting demand for their deposit and loan products. As of early 2025, national consumer debt remains a significant concern, with credit card debt alone surpassing $1.1 trillion. This elevated debt burden could lead to reduced discretionary spending by households.

While New Jersey small business owners surveyed in late 2024 reported optimism for 2025, the broader economic picture of rising national consumer debt presents a potential headwind. This could temper overall consumer spending, consequently affecting the demand for new loans and potentially impacting the credit quality of existing loan portfolios for financial institutions like Provident Financial Services.

Inflation and Unemployment Rates

Moderating inflation and a gradually declining unemployment rate in New Jersey are positive indicators for economic stability, supporting consumer confidence and business investment for Provident Financial Services. For instance, New Jersey's inflation rate saw a notable decrease, with the Consumer Price Index (CPI) for the New York-Northern New Jersey-Long Island region falling to 3.5% year-over-year as of April 2024, a significant drop from its peak. Concurrently, the state's unemployment rate continued its downward trend, reaching 4.2% in May 2024.

However, persistent inflation above the Federal Reserve's 2% target could still pose challenges, influencing the pace of interest rate adjustments and overall economic health. While the headline inflation has moderated, core inflation, which excludes volatile food and energy prices, remained stickier, contributing to ongoing monetary policy considerations. This environment necessitates careful management of lending and investment strategies for financial institutions like Provident Financial Services.

- New Jersey's CPI (April 2024): 3.5% year-over-year.

- New Jersey Unemployment Rate (May 2024): 4.2%.

- Federal Reserve Inflation Target: 2%.

Commercial Real Estate Market Dynamics

The commercial real estate market in New Jersey is showing strong potential for 2025, especially in industrial and data center segments, fueled by anticipated interest rate reductions and consistent demand. This trend offers significant avenues for Provident Bank's commercial real estate financing operations.

While the industrial and specialized sectors are expected to flourish, the office market is undergoing a transformation, with a notable shift towards flexible workspace solutions. This evolving landscape requires strategic adaptation for lenders like Provident Bank.

- New Jersey Industrial Sector Growth: Projections indicate continued expansion in warehouse and logistics spaces, a key area for commercial real estate lending.

- Data Center Demand: The increasing need for digital infrastructure is driving investment and development in New Jersey's data center market.

- Office Market Evolution: A move towards hybrid work models is reshaping demand for traditional office spaces, favoring flexibility and modern amenities.

- Interest Rate Impact: Falling interest rates in 2025 are expected to stimulate commercial real estate investment and borrowing activity.

Economic factors present a mixed but generally positive outlook for Provident Financial Services. Moderating inflation, with New Jersey's CPI at 3.5% year-over-year in April 2024, and a declining unemployment rate of 4.2% in May 2024, support consumer confidence. However, national consumer debt, exceeding $1.1 trillion in credit card debt alone by early 2025, could temper spending and impact loan demand.

| Economic Factor | Status (Early 2025) | Impact on Provident Financial Services |

|---|---|---|

| Interest Rates | Potential for cuts in 2025, but deposit costs remain elevated. | May ease borrowing costs, but net interest margins could still be pressured. |

| New Jersey Economy | Continued recovery, strong finance and healthcare sectors. | Positive regional growth supports business and consumer activity. |

| Consumer Debt | National credit card debt over $1.1 trillion. | Could reduce discretionary spending, impacting loan demand and credit quality. |

| Inflation (NJ) | 3.5% year-over-year (April 2024), down from peak. | Moderating inflation aids economic stability and consumer confidence. |

| Unemployment (NJ) | 4.2% (May 2024), downward trend. | Supports consumer confidence and business investment. |

What You See Is What You Get

Provident Financial Services PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Provident Financial Services offers a deep dive into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

Understand the critical external forces shaping Provident Financial Services' landscape. This detailed report provides actionable insights derived from a thorough PESTLE framework, ensuring you have the complete picture for informed strategic planning and risk assessment.

Sociological factors

Customers, both individuals and businesses, are demanding more from their digital banking interactions. They expect smooth, intuitive experiences across mobile apps, online portals, and instant payment capabilities. In 2024, a significant majority of banking transactions are already conducted digitally, underscoring this trend.

To keep pace, Provident Financial Services needs to prioritize ongoing investment in its digital infrastructure. This means not just maintaining current platforms but actively improving them to offer advanced features and user-friendly interfaces. Failing to do so risks losing ground to agile fintech competitors and larger banks with more robust digital offerings.

Provident Bank must closely monitor demographic shifts in New Jersey and Pennsylvania. For instance, the median age in New Jersey was 40.1 years in 2022, indicating an aging population that may require different financial products, such as retirement planning services. Similarly, the increasing diversity across these states necessitates culturally sensitive financial education and product development.

Provident Financial Services operates within communities where financial literacy levels directly influence product adoption and the demand for educational resources. A significant portion of the US population still struggles with basic financial concepts; for instance, a 2023 FINRA study indicated that 40% of Americans couldn't cover a $400 emergency expense, highlighting a persistent need for improved financial understanding.

As Provident Bank focuses on individuals and families, it must cater to a wide spectrum of financial needs, from basic savings accounts to more complex lending products. This necessitates tailored approaches and potentially the development of accessible financial education programs to foster greater inclusion and empower customers to make informed decisions.

Workforce Dynamics and Talent Acquisition

Attracting and retaining skilled professionals, especially in tech and compliance, is a critical sociological challenge for Provident Financial Services. The demand for these specialized skills often outstrips supply, leading to competitive hiring environments.

To combat staffing gaps, Provident Financial Services is exploring automation, aiming to streamline processes and reduce the reliance on manual labor for certain tasks. This strategic move is projected to improve efficiency by an estimated 15% in key operational areas by the end of 2025.

Fostering a collaborative and engaging workplace culture is also paramount. Surveys in early 2024 indicated that 60% of employees value a supportive team environment as much as compensation, influencing Provident's investment in employee development programs.

Key workforce considerations include:

- Talent Scarcity: High demand for tech and compliance expertise creates a competitive talent market.

- Automation Adoption: Implementing technology to fill roles and enhance operational efficiency.

- Culture as a Differentiator: Investing in a positive work environment to improve retention.

- Skills Gap Mitigation: Proactive training and development initiatives to upskill the existing workforce.

Community Engagement and Corporate Social Responsibility

Provident Bank actively demonstrates its commitment to corporate social responsibility and community engagement, which is crucial for building trust and enhancing its brand reputation. In 2023, Provident Financial Services, Inc. reported significant contributions to various non-profit organizations and encouraged substantial employee volunteer hours, reflecting a deep investment in the well-being of the communities it serves. This proactive approach aligns with increasing consumer and societal demands for businesses to contribute positively beyond their core financial operations.

The bank's initiatives often focus on key areas such as financial literacy, affordable housing, and local economic development. For instance, their 2024 community outreach programs are projected to support over 50 local charities and educational institutions. This dedication to social impact not only strengthens Provident Bank's image as a responsible corporate citizen but also fosters stronger relationships with customers and stakeholders who value ethical business practices.

- Community Investment: In 2023, Provident Financial Services, Inc. contributed over $1.5 million to community initiatives and non-profit organizations.

- Employee Volunteerism: Employees dedicated more than 10,000 volunteer hours in 2023, supporting local causes.

- Financial Literacy Programs: The bank conducted numerous workshops in 2024, reaching an estimated 5,000 individuals with essential financial education.

- Brand Perception: Surveys indicate that a strong CSR presence positively influences customer loyalty and trust in Provident Bank's services.

Societal expectations are shifting, with customers demanding greater transparency and ethical conduct from financial institutions. Provident Financial Services must align its operations with these evolving values, as demonstrated by its 2023 community contributions totaling over $1.5 million. Furthermore, a growing emphasis on financial inclusion means the bank needs to develop accessible products and educational resources for diverse populations.

The bank's commitment to corporate social responsibility is a key differentiator, with 2024 outreach programs set to support over 50 local charities. This focus on community well-being, alongside initiatives like financial literacy workshops reaching an estimated 5,000 individuals in 2024, directly impacts brand perception and customer loyalty.

Provident Financial Services must also navigate demographic trends, such as New Jersey's median age of 40.1 in 2022, which suggests a growing need for retirement planning services. Similarly, addressing the financial literacy gap, where 40% of Americans in a 2023 FINRA study couldn't cover a $400 emergency, is crucial for product adoption.

| Sociological Factor | Description | Impact on Provident Financial Services | Relevant Data/Initiatives (2023-2025) |

|---|---|---|---|

| Customer Expectations | Demand for transparency, ethical practices, and digital-first experiences. | Requires enhanced CSR communication and robust digital platforms. | Over $1.5M in community contributions (2023); 50+ local charities supported (2024 projection). |

| Financial Literacy | Varying levels of financial understanding within the customer base. | Necessitates accessible educational resources and tailored product offerings. | 5,000 individuals reached through financial literacy workshops (2024). |

| Demographic Shifts | Aging populations and increasing diversity in operating regions. | Requires adaptation of product portfolios (e.g., retirement) and culturally sensitive services. | New Jersey median age 40.1 (2022); need for diverse financial education. |

| Workforce Dynamics | Scarcity of tech/compliance talent and importance of workplace culture. | Focus on talent acquisition, retention through culture, and automation for efficiency. | Automation projected to improve efficiency by 15% by end of 2025; 60% of employees value supportive environment (early 2024). |

Technological factors

Provident Financial Services is actively enhancing its digital capabilities, moving beyond traditional online banking to incorporate sophisticated mobile apps and integrated e-payment solutions. This strategic push aims to streamline customer interactions, such as account opening and loan applications, directly impacting operational efficiency and customer satisfaction.

The banking sector's digital shift is accelerating; by the end of 2024, it's projected that over 80% of banking transactions will occur digitally. Provident Financial Services' investment in advanced platforms, including those for seamless digital onboarding and loan origination, positions it to capture a larger share of this expanding digital market, as evidenced by the increasing adoption rates of digital banking services among consumers.

The financial services industry, including Provident Financial Services, is grappling with an ever-increasing barrage of sophisticated cyber threats. Attacks like ransomware, phishing, and distributed denial-of-service (DDoS) are not just theoretical risks; they represent tangible threats with the potential for massive financial losses and severe reputational damage. For instance, the financial sector experienced a notable surge in cyber incidents in late 2023 and early 2024, with reports indicating a significant rise in ransomware attacks targeting institutions of all sizes.

To counter these evolving dangers, Provident Financial Services must maintain a proactive and substantial commitment to cybersecurity. This involves continuous investment in advanced technologies for fraud detection and mitigation, alongside rigorous data protection protocols. Safeguarding sensitive customer information is paramount, not only for regulatory compliance but also to preserve the essential trust that underpins customer relationships. The company's ability to adapt and fortify its digital defenses directly impacts its resilience and long-term viability in the current threat landscape.

Artificial intelligence and machine learning are transforming the banking sector, enabling institutions like Provident Financial Services to optimize operations and personalize customer experiences. By integrating AI and ML, Provident can enhance its predictive analytics capabilities and automate complex workflows, leading to greater efficiency. For instance, in 2024, many financial institutions reported significant improvements in fraud detection rates, with some seeing reductions of up to 20% through AI-powered systems.

FinTech Partnerships and Embedded Finance

The financial technology (FinTech) landscape is rapidly evolving, presenting Provident Financial Services with both competitive pressures and significant collaboration potential. The increasing sophistication of FinTech solutions means Provident must adapt to new digital-first competitors.

Strategic partnerships with FinTech firms offer a pathway to integrate banking services directly into non-financial platforms, a concept known as embedded finance. This strategy is particularly beneficial for reaching small and medium-sized businesses (SMBs) by offering seamless financial tools within their existing operational software. For instance, by 2024, the embedded finance market was projected to reach over $7 trillion globally, highlighting the immense opportunity for financial institutions to expand their reach and service capabilities through such integrations.

Provident can leverage these collaborations to:

- Enhance digital offerings: Partnering with FinTechs can accelerate the development and deployment of innovative digital banking solutions, improving customer experience.

- Expand SMB reach: Embedding financial services into platforms used by SMBs, such as accounting software or e-commerce marketplaces, can unlock new customer segments.

- Improve service capabilities: Collaborations can provide access to specialized FinTech expertise, allowing Provident to offer more tailored and efficient services.

- Drive innovation: Working with agile FinTechs can foster a culture of continuous innovation within Provident, keeping pace with market demands.

Cloud Computing and Data Analytics

Provident Financial Services is leveraging cloud computing to enhance operational flexibility and gain on-demand access to computing power. This shift is critical for modernizing its infrastructure and responding swiftly to market dynamics. For instance, cloud adoption can significantly reduce IT capital expenditure, with many financial institutions reporting savings of 15-30% on infrastructure costs by migrating to the cloud.

Advanced data analytics is another key technological driver, enabling Provident Bank to derive actionable insights from vast datasets. By analyzing customer behavior and market trends, the bank can refine its strategies, identify new opportunities, and personalize customer offerings. Studies in 2024 indicate that banks utilizing advanced analytics see a 10-20% improvement in customer retention rates and a notable uplift in cross-selling success.

- Cloud adoption enables scalable infrastructure and faster deployment of new services, reducing time-to-market for digital products.

- Data analytics allows for predictive modeling to anticipate customer needs and mitigate risks more effectively.

- These technologies are instrumental in optimizing operational efficiency, aiming to lower cost-to-serve ratios by as much as 25% in the coming years.

Provident Financial Services is enhancing its digital capabilities with advanced mobile apps and e-payment solutions, aiming to streamline customer interactions and boost operational efficiency.

The financial sector is seeing an acceleration in digital transactions, with over 80% projected by the end of 2024, making Provident's investment in digital platforms crucial for market share growth.

Cybersecurity remains a critical concern, with financial institutions experiencing a rise in sophisticated attacks in late 2023 and early 2024, necessitating continuous investment in advanced defense technologies and data protection protocols.

| Technology Area | Impact on Provident Financial Services | Key Data/Trend (2024/2025) |

|---|---|---|

| Digital Transformation | Streamlined customer interactions, improved operational efficiency | Over 80% of banking transactions projected to be digital by end of 2024 |

| Cybersecurity | Mitigation of financial losses and reputational damage from cyber threats | Notable surge in cyber incidents, particularly ransomware, late 2023/early 2024 |

| AI & Machine Learning | Enhanced predictive analytics, automated workflows, improved fraud detection | AI systems can reduce fraud detection rates by up to 20% |

| FinTech & Embedded Finance | Access to new customer segments, integration into non-financial platforms | Embedded finance market projected to exceed $7 trillion globally by 2024 |

| Cloud Computing | Increased operational flexibility, reduced IT capital expenditure | Cloud migration can yield 15-30% savings on infrastructure costs |

| Data Analytics | Refined strategies, identification of opportunities, personalized customer offerings | Advanced analytics can improve customer retention by 10-20% |

Legal factors

Provident Financial Services navigates a stringent regulatory landscape, governed by agencies such as the FDIC, Federal Reserve, and OCC. Staying compliant with evolving rules on capital adequacy, deposit insurance, and supervisory fees is crucial for financial stability and avoiding penalties. For instance, in 2024, banks are still adapting to the aftermath of increased capital requirements and ongoing discussions around Basel III endgame implementation, impacting how institutions like Provident manage risk and liquidity.

Provident Financial Services must navigate a complex web of consumer lending regulations. Laws like the Fair Credit Reporting Act (FCRA) and the Equal Credit Opportunity Act (ECOA) dictate how Provident Bank assesses creditworthiness and prevents discrimination, directly influencing its mortgage and personal loan offerings. For instance, in 2024, the CFPB continues to emphasize enforcement actions related to fair lending practices, requiring robust internal controls.

Data privacy laws, such as the California Consumer Privacy Act (CCPA) and its successor, the California Privacy Rights Act (CPRA), significantly impact Provident Bank's operations. These regulations govern how customer data is collected, stored, and used, necessitating stringent data security protocols to safeguard sensitive financial information and maintain customer confidence. Failure to comply can result in substantial penalties, with CCPA fines potentially reaching $7,500 per intentional violation.

Provident Financial Services must navigate stringent Anti-Money Laundering (AML) and sanctions laws, which demand comprehensive compliance programs to ward off financial crime. These regulations are critical for maintaining operational integrity and avoiding significant penalties.

Anticipated shifts in Bank Secrecy Act (BSA) program requirements will likely compel Provident Financial Services to implement more robust internal controls and sophisticated reporting mechanisms. For instance, the Financial Crimes Enforcement Network (FinCEN) continues to update its guidance, with recent advisories in 2024 focusing on emerging risks in digital assets and ransomware payments, directly impacting reporting obligations.

Corporate Governance and Reporting Standards

Provident Financial Services navigates a landscape shaped by evolving corporate governance and reporting standards. Recent trends emphasize board diversity, with many companies aiming for greater representation. For instance, by the end of 2024, a significant portion of publicly traded companies are expected to have at least one director from an underrepresented group, a push that impacts governance structures.

Executive compensation is increasingly tied to performance metrics, including those related to environmental, social, and governance (ESG) factors. This shift requires Provident Financial Services to meticulously link executive pay to measurable outcomes, influencing strategic decision-making. The push for transparency in ESG reporting is also intensifying, with regulatory bodies worldwide introducing stricter disclosure requirements.

Mandatory ESG reporting is becoming the norm, compelling companies like Provident Financial Services to provide detailed information on their sustainability efforts and social impact. For example, new regulations effective in 2025 will require enhanced disclosure of climate-related financial risks, adding another layer of complexity to financial reporting.

Key aspects influencing Provident Financial Services include:

- Board Diversity Mandates: Increasing pressure to diversify board composition with a focus on gender and ethnic representation.

- Performance-Linked Compensation: Executive pay structures are being redesigned to incorporate ESG targets alongside traditional financial metrics.

- ESG Disclosure Requirements: Growing regulatory demands for transparent and standardized reporting on environmental, social, and governance initiatives.

- Enhanced Financial Transparency: A greater need for clear and comprehensive reporting on all aspects of operations, including risk management and sustainability.

Litigation and Legal Challenges

Provident Financial Services, like all financial institutions, operates within a complex legal landscape. The banking sector is particularly prone to litigation stemming from regulatory enforcement actions or customer grievances. For instance, in 2023, the U.S. financial services industry saw significant legal activity, with regulatory bodies like the Consumer Financial Protection Bureau (CFPB) issuing fines for various compliance failures. Provident must remain vigilant in tracking court rulings and evolving legal precedents that could shape its business practices and compliance obligations.

Key legal considerations for Provident Financial Services include:

- Regulatory Compliance: Adherence to banking laws, consumer protection statutes, and anti-money laundering regulations is paramount. Failure to comply can result in substantial penalties.

- Consumer Disputes: Managing customer complaints and potential lawsuits related to services, fees, or lending practices is an ongoing concern.

- Litigation Risk: Monitoring ongoing litigation within the financial sector, particularly cases involving similar business models, can provide insights into potential future challenges.

Provident Financial Services faces a dynamic legal environment, heavily influenced by banking regulations and consumer protection laws. In 2024, the emphasis on fair lending practices by bodies like the CFPB means robust internal controls are essential to avoid enforcement actions. Furthermore, evolving data privacy laws, such as the CPRA, impose strict requirements on how customer data is handled, with potential fines of $7,500 per intentional violation for non-compliance.

Environmental factors

Financial institutions like Provident Financial Services are facing growing pressure to manage climate-related financial risks. This includes understanding how extreme weather events, like those experienced in 2024 with increased hurricane activity impacting coastal real estate values, can affect their collateral. Additionally, the transition to a low-carbon economy presents risks, such as potential devaluation of assets in carbon-intensive industries within their loan portfolios.

Provident Financial Services may need to embed climate risk assessments into its core lending processes and overall risk management strategies. For instance, by 2025, regulators are expected to mandate more robust climate scenario analysis for financial institutions, requiring them to demonstrate how their portfolios would perform under various warming pathways. This could lead to adjustments in underwriting standards and capital allocation decisions.

The increasing focus on Environmental, Social, and Governance (ESG) factors is significantly shaping investor and customer expectations for financial institutions. Globally, sustainable investment assets reached an estimated $37.8 trillion in early 2024, highlighting a strong market demand for companies prioritizing sustainability.

Provident Financial Services can capitalize on this trend by expanding its offerings in sustainable finance. For instance, developing green lending products or actively supporting renewable energy projects could attract a growing segment of environmentally conscious clients, potentially boosting market share.

Provident Financial Services, like many financial institutions, is increasingly focused on minimizing its direct environmental impact. This includes scrutinizing energy consumption across its branch network and the burgeoning digital infrastructure powering its services.

Efforts to curb energy usage, such as optimizing building systems or transitioning to renewable energy sources for its data centers, are becoming key. For instance, in 2024, many banks reported a 5-10% reduction in energy consumption through smart building technologies.

Adopting green building practices for new or renovated facilities can further bolster Provident Bank's sustainability credentials. Such initiatives not only align with growing investor and customer expectations for environmental responsibility but can also lead to tangible reductions in operating expenses through lower utility bills.

Stakeholder Expectations for Sustainability Reporting

Stakeholders, particularly investors and regulators, are intensifying their demand for banks like Provident Financial Services to offer clear and detailed reports on their sustainability objectives, achievements, and environmental footprint. This growing scrutiny necessitates a strategic adaptation in reporting practices to align with these expectations, potentially involving the crucial step of calculating financed emissions.

The financial sector is experiencing a significant shift towards greater accountability in environmental, social, and governance (ESG) matters. For instance, by the end of 2024, a substantial majority of publicly traded companies are expected to face increased pressure to disclose climate-related financial risks, a trend directly impacting how institutions like Provident Financial Services must present their sustainability performance.

- Increased Investor Scrutiny: Many institutional investors now integrate ESG factors into their investment decisions, with a growing emphasis on climate-related disclosures.

- Regulatory Push: Regulators globally are moving towards mandatory climate risk reporting, requiring financial institutions to quantify and disclose their environmental impact.

- Financed Emissions: Banks are increasingly expected to measure and report on emissions generated by their lending and investment portfolios, a complex but vital aspect of sustainability reporting.

- Reputational Risk: Failure to meet stakeholder expectations for transparent sustainability reporting can lead to reputational damage and impact customer and investor confidence.

Disaster Preparedness and Resilience

Provident Financial Services must prioritize robust disaster preparedness and business continuity plans, especially as climate change increases the likelihood of extreme weather events. This focus on resilience is crucial for maintaining operational stability and ensuring continued service delivery to customers in areas impacted by natural disasters.

The increasing frequency and severity of such events, like the severe flooding experienced in parts of the Northeast in 2023, highlight the need for proactive mitigation strategies. For instance, a 2024 NOAA report indicated a 50% increase in billion-dollar weather disasters over the last decade compared to the preceding one, directly impacting infrastructure and financial services.

- Climate Change Impact: Growing threat from more frequent and intense extreme weather events.

- Operational Resilience: Necessity for strong business continuity and disaster recovery plans.

- Customer Service: Ensuring uninterrupted financial services for communities affected by disasters.

- Financial Risk: Potential for increased insurance claims and loan defaults in disaster-prone regions.

Provident Financial Services faces increasing pressure to address climate-related risks, including the financial impact of extreme weather events and the transition to a low-carbon economy. By 2025, regulators are expected to mandate more robust climate scenario analysis for financial institutions, influencing lending and capital allocation.

The growing demand for sustainable investments, estimated at $37.8 trillion globally by early 2024, presents an opportunity for Provident to expand its green lending products and support renewable energy projects.

Minimizing its own environmental footprint is also key, with many banks reporting 5-10% energy consumption reductions in 2024 through smart building technologies.

Institutions like Provident are under scrutiny to report on sustainability, with a significant majority of public companies expected to disclose climate risks by the end of 2024.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Provident Financial Services is built on a robust foundation of data from official financial regulatory bodies, economic forecasting agencies, and leading market research firms. We incorporate insights from government publications, industry-specific reports, and reputable news outlets to ensure comprehensive coverage of all PESTLE factors.