Provident Financial Services Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Provident Financial Services Bundle

Provident Financial Services faces moderate buyer power due to a fragmented customer base and limited switching costs, while the threat of new entrants is somewhat mitigated by regulatory hurdles and capital requirements.

The intensity of rivalry is significant, driven by numerous competitors offering similar financial products and services, and the bargaining power of suppliers, like technology providers, presents a manageable challenge.

However, the threat of substitutes, such as alternative investment platforms and fintech solutions, is growing, demanding strategic adaptation from Provident Financial Services.

The complete report reveals the real forces shaping Provident Financial Services’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Provident Financial Services, like many traditional banks, sources its funding from a vast and dispersed group of individual and business depositors. This wide spread means no single depositor can exert significant pressure on the bank regarding its funding costs.

While a fragmented depositor base generally limits individual leverage, the overall power of depositors can subtly increase in competitive markets. When interest rates are rising or other financial institutions offer more attractive terms, depositors as a collective might gain some sway in demanding higher yields on their savings.

Technology and software vendors hold moderate bargaining power in the banking sector due to its growing reliance on digital platforms and cybersecurity solutions. Specialized providers of critical or proprietary software, essential for operations and compliance, can influence terms. For instance, in 2024, many banks invested heavily in cloud infrastructure and AI-driven analytics, increasing dependence on key tech partners.

The availability of skilled financial professionals, particularly in high-demand fields such as digital banking, cybersecurity, and wealth management, directly impacts the bargaining power of suppliers in the labor market. A scarcity of talent in these specialized areas can drive up compensation expectations, thereby increasing Provident Financial Services' operational expenses.

In 2024, the financial services sector continued to see a strong demand for digital transformation specialists, with some reports indicating salary increases of 10-15% for experienced cybersecurity professionals. This tight labor market empowers skilled individuals to negotiate for higher wages and better benefits, directly affecting Provident Financial Services' cost structure.

Provident Financial Services' strategic imperative to attract and retain top-tier talent is therefore paramount. Their success in securing and keeping these essential employees is a key determinant of their ability to grow and maintain a competitive edge in the evolving financial landscape.

Regulatory Bodies and Compliance Providers

Regulatory bodies and compliance providers, while not direct suppliers of raw materials, wield considerable influence over Provident Financial Services. The necessity to adhere to a constantly shifting regulatory environment means banks must invest heavily in compliance solutions, including specialized software, expert consulting, and independent auditing. For instance, in 2024, financial institutions globally continued to grapple with increased compliance burdens, with spending on regulatory technology (RegTech) projected to reach tens of billions of dollars, demonstrating the significant cost and reliance on these external entities.

The growing intricacy of regulations, particularly in areas like Anti-Money Laundering/Combating the Financing of Terrorism (AML/CFT) and data privacy mandates, amplifies the bargaining power of firms that offer expertise and tools to navigate these complex requirements. Provident Financial Services, like its peers, faces substantial operational costs tied to ensuring these compliances are met. The fines for non-compliance can be severe, underscoring the critical nature of these services and, by extension, the suppliers providing them.

- Increased Regulatory Scrutiny: Financial institutions are subject to ongoing and often expanding regulatory oversight.

- Compliance Costs: Significant investment is required for technology, personnel, and external services to meet regulatory standards.

- Expertise Premium: Specialized knowledge in areas like data privacy and AML/CFT commands higher fees from service providers.

- Risk of Penalties: Failure to comply can result in substantial fines and reputational damage, increasing reliance on compliance solutions.

Interbank Lending and Capital Markets

Banks like Provident Financial Services depend on interbank lending and capital markets for both short-term liquidity and more substantial funding. The prevailing economic climate and central bank actions directly impact the cost and accessibility of these crucial funds.

While Provident Financial Services benefits from a reliable deposit base, any significant reliance on these external markets for capital can amplify the bargaining power of institutional lenders. This is particularly true during times of market volatility or stress, where access to liquidity becomes a premium.

- Interbank Lending Dependence: For significant funding beyond deposits, banks tap into interbank markets.

- Market Conditions Impact: Broad economic factors and central bank policies dictate the cost and availability of these funds.

- Supplier Power: Increased reliance on these markets grants greater leverage to institutional lenders, especially during financial strain.

Provident Financial Services' bargaining power with its suppliers is influenced by the concentration of providers for critical services. For instance, in 2024, the increasing reliance on specialized technology for digital transformation and cybersecurity meant that key software and cloud service providers held considerable sway. This trend was evident as many banks, including Provident, allocated substantial budgets to upgrade their technological infrastructure, making them more dependent on a select group of vendors.

| Supplier Type | 2024 Impact on Provident | Key Factors |

|---|---|---|

| Technology Vendors | Moderate to High Power | Specialized software, cloud services, cybersecurity solutions. Increased dependence due to digital transformation initiatives. |

| Labor Market (Skilled Professionals) | High Power | Scarcity of talent in digital banking, cybersecurity, and wealth management. Salary increases of 10-15% for cybersecurity professionals reported in 2024. |

| Regulatory Compliance Providers | High Power | Complex and evolving regulations (AML/CFT, data privacy). Significant investment in RegTech, projected in tens of billions globally in 2024. High cost of non-compliance. |

| Capital Markets/Interbank Lenders | Moderate to High Power (during stress) | Reliance for liquidity and substantial funding beyond deposits. Market volatility and central bank actions influence cost and access. |

What is included in the product

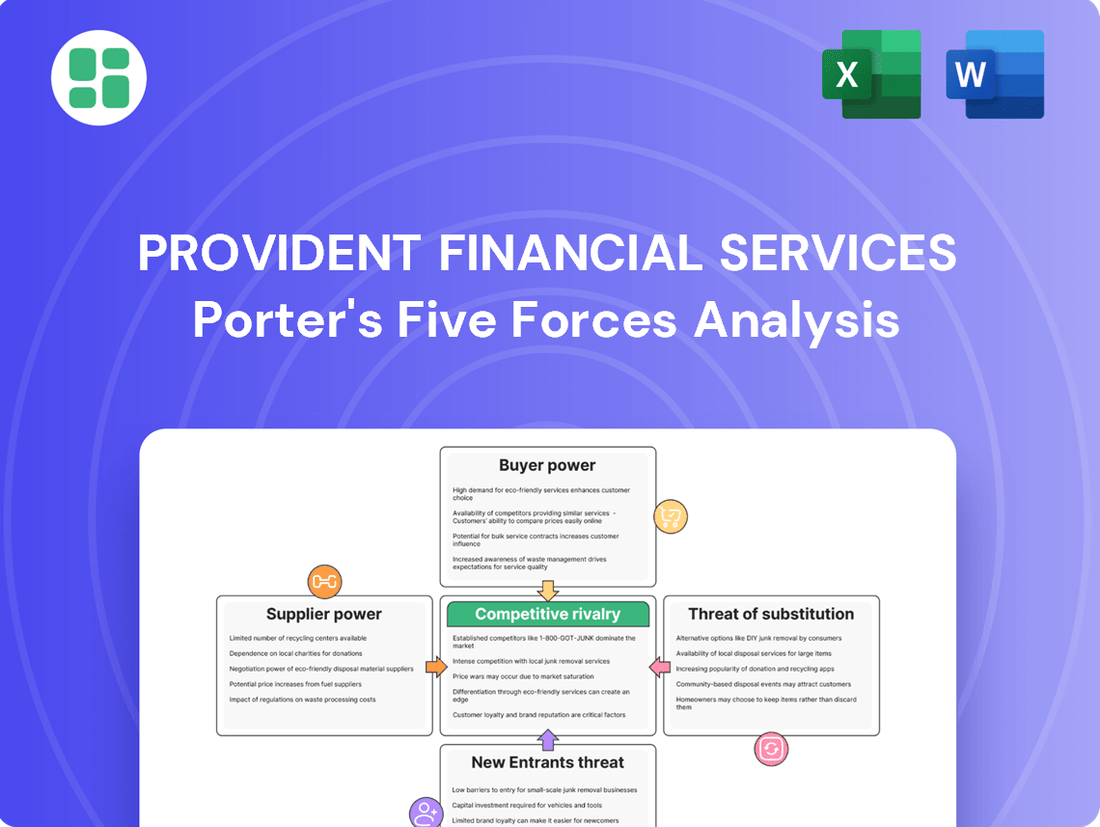

This analysis tailors Porter's Five Forces to Provident Financial Services, examining the intensity of rivalry, buyer and supplier power, threat of new entrants and substitutes within the banking sector.

Effortlessly identify and address competitive threats with a visual breakdown of Porter's Five Forces, allowing Provident Financial Services to proactively mitigate risks.

Customers Bargaining Power

For basic deposit products like checking and savings accounts, customer switching costs are generally low, particularly with the growth of digital banking and easier account transfer processes. This ease of movement empowers customers to readily shift their funds to banks offering more favorable rates or superior convenience, thereby amplifying their bargaining power.

Customers, especially businesses and informed investors, closely watch loan and deposit rates. In 2024, with interest rates fluctuating, this price sensitivity becomes a major factor. They can easily switch to institutions offering better terms, directly squeezing Provident Financial Services' profitability.

The ability of customers to shop around for the best rates puts significant pressure on Provident Financial Services. For instance, if competitors offer higher deposit yields or lower loan rates, customers will move their business, impacting Provident's market share and net interest margin.

Provident Financial Services offers a wide range of products like mortgages, commercial loans, and wealth management. This variety can make customers more loyal. For instance, in 2023, Provident Bank saw its total assets grow to $14.7 billion, indicating a strong product offering that attracts and retains clients.

However, customers have many choices. If Provident's products aren't competitive or don't meet specific needs, clients can easily switch to other banks or financial institutions that offer more specialized or better-priced solutions. This accessibility to diverse financial products from competitors directly empowers the customer.

Digital Sophistication and Financial Literacy

Customers today are more digitally savvy and financially aware than ever before. This heightened awareness allows them to readily compare offerings from different financial institutions, including established banks and newer fintech companies. For instance, a 2024 survey indicated that over 70% of consumers actively research financial products online before making a decision, seeking the best rates and terms.

This ease of access to information significantly reduces the traditional information gap between providers and consumers. When customers can effortlessly see competitive pricing and service features, their bargaining power increases. They are less likely to accept unfavorable terms when viable alternatives are just a click away.

- Digital Comparison Tools: Numerous online platforms and apps enable consumers to compare mortgages, savings accounts, and loan rates side-by-side.

- Fintech Innovation: The rise of fintechs often drives down prices and improves service, setting new benchmarks for traditional banks.

- Informed Negotiation: Customers armed with market data are better positioned to negotiate fees, interest rates, and other service conditions.

- Customer Empowerment: Increased financial literacy translates directly into stronger customer leverage in the financial services marketplace.

Concentration of Commercial Borrowers

While Provident Financial Services benefits from a fragmented base of individual depositors, a concentration of large commercial borrowers, particularly in sectors like commercial real estate, could shift bargaining power. These significant clients, by virtue of their substantial business volume, may leverage their position to negotiate more favorable loan terms and pricing. For instance, if a few large commercial clients represent a disproportionately high percentage of Provident's loan portfolio, they could exert considerable influence.

The ability of these large borrowers to access alternative financing sources further amplifies their bargaining power. Should Provident Financial Services not offer competitive rates or terms, these major clients could readily seek financing from other institutions, forcing Provident to match or beat such offers to retain their business. This dynamic is particularly relevant in 2024 as interest rate environments continue to evolve, prompting businesses to actively seek optimal financing conditions.

- Concentration Risk: A few large commercial borrowers could hold significant sway over loan terms.

- Alternative Financing: The availability of other lenders empowers large clients to demand better conditions.

- Market Dynamics: Competitive pressures in 2024 necessitate favorable terms for key commercial relationships.

Provident Financial Services faces considerable customer bargaining power due to low switching costs for basic deposit products and increasing customer financial literacy. In 2024, with fluctuating interest rates, customers are highly price-sensitive and can easily move funds to institutions offering better terms, directly impacting Provident's profitability and market share.

The availability of numerous online comparison tools and the rise of fintech companies further empower customers by providing easy access to competitive pricing and service features. This information asymmetry reduction means customers are less likely to accept unfavorable terms when viable alternatives are readily available.

While Provident benefits from a broad individual depositor base, a concentration of large commercial borrowers, particularly in sectors like commercial real estate, can significantly shift bargaining power. These major clients can leverage their substantial business volume and access to alternative financing to negotiate more favorable loan terms, forcing Provident to remain competitive to retain their business.

| Factor | Impact on Provident Financial Services | Supporting Data (2024/Recent) |

|---|---|---|

| Low Switching Costs (Deposits) | Increases customer ability to move funds for better rates. | Digital banking adoption continues to rise, facilitating easier account transfers. |

| Price Sensitivity & Rate Shopping | Customers actively seek higher deposit yields and lower loan rates. | Surveys indicate over 70% of consumers research financial products online before decisions. |

| Fintech Competition & Digital Tools | Drives down prices and improves service benchmarks. | Numerous platforms allow side-by-side comparison of financial products. |

| Concentrated Large Commercial Borrowers | These clients can negotiate more favorable loan terms. | Key commercial clients may represent a significant portion of Provident's loan portfolio. |

What You See Is What You Get

Provident Financial Services Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. The comprehensive Porter's Five Forces analysis for Provident Financial Services delves into the competitive landscape, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the banking sector. This detailed report provides actionable insights into the strategic positioning and potential challenges faced by Provident Financial Services.

Rivalry Among Competitors

The New Jersey banking landscape is quite diverse, featuring a blend of large national players, regional institutions such as Provident Financial Services, and a significant number of smaller community banks and credit unions. This fragmentation means competition is fierce, especially at the local level where these entities are all chasing the same customers.

Many core banking products, like simple checking accounts and typical loans, are highly commoditized. This means it's tough for banks to stand out just by offering different features. Competition often boils down to who offers the best price, like lower interest rates or fewer fees, and who provides superior customer service, intensifying the rivalry.

Provident Financial Services addresses this by focusing on its brand promise, "Commitment you can count on," and offering a wide range of services. For instance, as of the first quarter of 2024, Provident Financial Services reported total assets of $14.6 billion, indicating a significant operational scale that can support diverse product and service development to combat commoditization.

The banking industry has been actively consolidating, with Provident Financial Services merging with Lakeland Bancorp, Inc. in 2024. This significant move, valued at approximately $1.8 billion, reshaped the competitive landscape.

While this merger reduced the immediate number of independent competitors, it simultaneously created a larger, more powerful regional entity. This larger scale can lead to intensified competition for both customer deposits and skilled employees across the markets they now serve.

Digital Transformation and Service Innovation

Competitive rivalry is intensifying as financial institutions, including Provident Financial Services, face pressure from both established banks and nimble fintech firms. Many competitors are heavily investing in digital transformation, rolling out advanced mobile banking applications and innovative digital services to capture and hold onto customers who prioritize digital convenience. For instance, in 2024, major banks continued to enhance their digital platforms, with many reporting double-digit percentage increases in mobile banking adoption rates among their customer bases.

Provident Financial Services must therefore maintain a robust pace of innovation in its digital services to stay competitive. This includes not only keeping up with traditional banks that have already established strong digital footprints but also fending off agile fintech companies that can introduce new digital solutions rapidly. The threat is significant, as customer loyalty can quickly shift to providers offering superior digital experiences and more integrated financial tools.

- Digital Investment: Competitors are channeling significant capital into digital platforms and mobile app development.

- Customer Acquisition: Tech-savvy customers are increasingly drawn to financial institutions with cutting-edge digital offerings.

- Innovation Imperative: Provident Financial Services needs continuous digital service innovation to compete effectively.

- Fintech Challenge: Agile fintech companies pose a direct threat with their rapid deployment of new digital financial solutions.

Regulatory Environment and Compliance Costs

The banking sector faces a dynamic regulatory environment, with compliance costs acting as a significant factor. For instance, in 2024, financial institutions are navigating evolving rules around data privacy and anti-financial crime measures. These ongoing investments in compliance can create a barrier for new entrants while simultaneously pressuring existing banks to adapt their competitive strategies.

These regulatory demands directly impact operational costs and strategic planning. Provident Financial Services, like its peers, must allocate substantial resources to ensure adherence to a complex web of federal and state regulations. This includes investments in technology and personnel to manage risk and reporting requirements.

- Increased Compliance Burden: In 2024, banks are facing heightened scrutiny and new regulations, particularly concerning cybersecurity and consumer protection.

- Barrier to Entry: The substantial costs associated with meeting these regulatory standards can deter smaller, less capitalized firms from entering the market.

- Competitive Pressure: Established institutions must continually invest to remain compliant, influencing their pricing, product development, and overall market competitiveness.

- Strategic Adaptation: Companies like Provident Financial Services must integrate compliance into their core business strategies to manage risk and maintain operational efficiency.

Provident Financial Services operates in a highly competitive banking environment, intensified by its 2024 merger with Lakeland Bancorp, creating a larger regional player. This consolidation, while reducing the number of independent competitors, increases the scale of rivalry for customers and talent.

The market is characterized by commoditized products, pushing competition towards pricing and customer service. Furthermore, the rapid digital transformation across the industry, with competitors heavily investing in mobile banking and innovative digital services, necessitates continuous innovation from Provident Financial Services to retain its customer base.

The ongoing digital arms race, coupled with the threat from agile fintech companies, means Provident Financial Services must prioritize its digital offerings. As of Q1 2024, Provident Financial Services reported $14.6 billion in assets, highlighting its scale but also the significant resources required to maintain a competitive edge in this dynamic landscape.

| Aspect | 2024 Impact | Provident Financial Services Strategy |

|---|---|---|

| Market Consolidation | Merger with Lakeland Bancorp ($1.8B) reduced direct competitors but increased scale of rivalry. | Leverage increased scale for broader service offerings and market reach. |

| Digital Transformation | Competitors investing heavily in digital platforms and mobile apps; rising mobile adoption rates. | Prioritize continuous innovation in digital services to match or exceed competitor offerings. |

| Product Commoditization | Core banking products are undifferentiated, leading to price and service competition. | Focus on brand promise and a wide range of services to differentiate. |

| Fintech Challenge | Agile fintech firms rapidly deploy new digital solutions, posing a direct threat. | Maintain agility and responsiveness to counter rapid fintech innovation. |

SSubstitutes Threaten

Fintech companies and digital-only banks are a growing threat, offering specialized services like payment apps and online lending that can sidestep traditional banks. These digital alternatives often win customers with their convenience and lower costs. For instance, by mid-2024, neobanks continued to capture market share, with some reporting over 5 million active users, demonstrating their appeal to digitally-savvy consumers seeking streamlined financial solutions.

Credit unions present a significant threat of substitution for Provident Financial Services. These member-owned institutions often boast lower fees and more favorable interest rates on deposits and loans, directly competing for local customers. In 2024, the credit union sector continued its growth, with total assets reaching over $2.4 trillion in the US, demonstrating their substantial market presence and appeal.

Community Development Financial Institutions (CDFIs) also act as substitutes, particularly for Provident's services in underserved communities. CDFIs focus on providing financial products and services to low-income individuals and communities that traditional banks may overlook. Their mission-driven approach can attract a segment of the market seeking social impact alongside financial services, posing a competitive challenge.

Peer-to-peer (P2P) lending platforms offer a direct channel for individuals and businesses to secure loans, bypassing traditional banks for specific financing needs. These platforms are gaining traction as an alternative for borrowers seeking faster capital access and investors looking for potentially higher yields. For instance, by the end of 2023, the global P2P lending market was valued at approximately $69.5 billion and is projected to grow significantly.

While P2P lending may not yet rival the scale of traditional banking, its increasing adoption presents a credible substitute for certain loan products. This growing market share, estimated to reach over $150 billion by 2028, directly impacts the competitive landscape for established financial institutions like Provident Financial Services by offering an alternative source of funding and investment.

Investment Firms and Brokerages

Traditional investment firms and online brokerages present a significant threat of substitutes for Provident Financial Services. These platforms offer a broader spectrum of investment vehicles beyond simple bank deposits, including stocks, bonds, mutual funds, and ETFs, often attracting customers seeking higher potential returns. For instance, in 2024, the global wealth management market continued its expansion, with digital investment platforms experiencing substantial growth, drawing assets that might otherwise have been held in traditional bank savings accounts.

These alternative providers frequently boast lower fees and more sophisticated tools for portfolio management and financial planning, making them attractive substitutes for customers looking to grow their wealth. Many are also actively marketing their services directly to consumers, bypassing traditional banking relationships. The accessibility and user-friendliness of many online brokerage platforms, in particular, have lowered the barrier to entry for individuals interested in managing their own investments, further intensifying this competitive pressure.

- Broader Investment Options: Access to stocks, bonds, ETFs, mutual funds, and alternative investments.

- Potential for Higher Returns: Often outperform traditional savings account interest rates.

- Lower Fees: Many platforms offer commission-free trading and lower management fees.

- Digital Accessibility: User-friendly online and mobile platforms for easy account management.

Non-Bank Lenders and Specialized Finance Companies

The rise of non-bank lenders and specialized finance companies presents a significant threat of substitutes for traditional banking services. These entities often focus on niche markets, offering tailored loan products like auto loans, personal loans, and equipment leasing, directly competing with Provident Financial Services' offerings. For instance, Provident's strategic exit from the non-relationship equipment lease financing business in 2023 underscores the intense competition and margin pressures from these specialized players.

These specialized lenders can be more agile and less burdened by regulatory overhead compared to traditional banks. This agility allows them to innovate quickly and offer competitive rates or more flexible terms, thereby attracting customers seeking alternatives to conventional banking. The market for specialized finance is robust, with segments like equipment leasing showing consistent growth, indicating a strong demand for these substitute services.

- Specialized Offerings: Non-bank lenders provide targeted financial products, such as auto loans and equipment financing, directly substituting for bank loan products.

- Competitive Agility: These specialized firms often operate with fewer regulatory constraints, enabling faster product development and more flexible customer terms.

- Market Presence: The equipment leasing market alone is a multi-billion dollar industry, demonstrating the substantial reach and appeal of these alternative finance providers.

- Strategic Responses: Provident Financial Services' divestment from certain non-relationship lending activities reflects the pressure exerted by these specialized competitors.

The threat of substitutes for Provident Financial Services is substantial, encompassing a diverse range of alternatives that cater to various financial needs. Fintech innovators, credit unions, CDFIs, P2P platforms, traditional investment firms, and specialized non-bank lenders all offer compelling alternatives to traditional banking. These substitutes often provide lower costs, greater convenience, higher potential returns, or more tailored solutions, directly challenging Provident's market share and customer loyalty.

| Substitute Category | Key Characteristics | 2024 Market Insight/Data Point |

|---|---|---|

| Fintech & Digital Banks | Convenience, lower costs, specialized services | Neobanks continued to gain traction, with some exceeding 5 million active users by mid-2024. |

| Credit Unions | Lower fees, favorable rates, member-owned | US credit union assets surpassed $2.4 trillion in 2024, indicating significant market presence. |

| P2P Lending Platforms | Direct lending/borrowing, potentially higher yields | Global P2P lending market valued at ~$69.5 billion by end of 2023, projected to grow substantially. |

| Investment Firms/Online Brokerages | Broader investment options, potential higher returns, lower fees | Digital investment platforms saw significant growth in 2024 within the expanding global wealth management market. |

| Non-Bank Lenders | Specialized loan products, agility, fewer regulatory constraints | Provident's 2023 exit from equipment leasing highlights competitive pressures from these agile players. |

Entrants Threaten

The banking sector is inherently challenging for newcomers due to stringent regulatory frameworks. Provident Financial Services, like other established institutions, operates within a landscape demanding significant capital reserves, extensive licensing procedures, and continuous adherence to intricate financial regulations. These substantial hurdles effectively deter many potential new entrants from establishing traditional banking operations.

Established banks like Provident Bank, with roots tracing back to 1839, possess deep-seated brand loyalty and customer trust, a significant barrier for newcomers. New entrants must invest heavily and patiently to cultivate comparable relationships, a process that can take years. For instance, in 2023, Provident Financial Services reported a customer deposit base of $11.9 billion, reflecting years of accumulated trust.

Established financial institutions like Provident Financial Services leverage significant economies of scale. This means they can spread their substantial fixed costs, such as technology investments and branch networks, over a larger volume of business. For instance, major banks in 2024 often operate with billions in assets, allowing them to invest heavily in digital platforms and customer service, which new entrants find difficult to match cost-effectively.

New entrants face a considerable hurdle in replicating these operational efficiencies. Without a large existing customer base and infrastructure, they are at a cost disadvantage. Building a comparable technological backbone or marketing reach would require immense upfront capital, making it challenging to compete on price or service breadth against incumbents who have already achieved these scale benefits.

Access to Distribution Channels and Customer Data

Provident Financial Services benefits from its extensive existing network of physical branches and robust digital banking platforms. This established infrastructure grants them widespread access to a broad customer base, a significant barrier for newcomers.

New entrants face the substantial challenge of replicating this reach. They must undertake significant capital investment to build their own distribution channels and acquire valuable customer data. This data is essential for offering personalized services and executing effective, targeted marketing campaigns, areas where Provident already holds a strong advantage.

- Established Distribution: Provident Financial Services leverages its network of over 100 branches as of year-end 2023, alongside its digital platforms, to reach a wide customer demographic.

- Customer Data Advantage: Access to and analysis of customer transaction data allows for tailored product offerings and marketing, a capability new entrants must build from scratch.

- High Entry Costs: Establishing a comparable physical and digital footprint, including data infrastructure, requires substantial upfront investment, deterring many potential new competitors.

Innovation and Niche Market Opportunities

While establishing a full-service bank remains challenging due to regulatory hurdles and capital requirements, the threat of new entrants is amplified by innovation in niche markets. Fintech startups, for instance, are adept at leveraging new technologies like artificial intelligence and blockchain to serve specific, often underserved, customer segments. Provident Financial Services needs to remain vigilant, observing how these agile competitors capture market share through specialized offerings and technological advancements.

These new players often bypass the extensive infrastructure of traditional banks, focusing instead on digital-first solutions and superior customer experience. For example, in 2024, the fintech sector continued to see significant investment, with areas like digital lending and personalized financial management tools attracting substantial capital. Provident Financial Services must consider how to integrate or compete with such specialized innovations to maintain its competitive edge.

- Niche Market Focus: Fintechs often target specific customer needs, like small business lending or international money transfers, areas where traditional banks may be slower to adapt.

- Technological Disruption: AI-powered advisory services and blockchain-based payment systems offer new, potentially more efficient, ways to deliver financial products.

- Regulatory Arbitrage: Some fintechs may operate under lighter regulatory frameworks initially, allowing for faster product development and market entry.

The threat of new entrants for Provident Financial Services is moderate, primarily due to high barriers like stringent regulations and substantial capital requirements inherent in banking. Established brand loyalty and extensive distribution networks, including over 100 branches as of year-end 2023, further solidify Provident's position. However, agile fintech companies pose a growing challenge by leveraging technology for niche markets, potentially disrupting traditional banking models.

| Factor | Impact on Provident Financial Services | New Entrant Challenge |

|---|---|---|

| Regulatory Hurdles | High barriers to entry for traditional banks. | Requires significant capital, licensing, and compliance. |

| Brand Loyalty & Trust | Provident benefits from established customer relationships. | New entrants must invest heavily to build trust. |

| Economies of Scale | Provident leverages cost efficiencies from its size. | New entrants face higher per-unit costs. |

| Distribution Channels | Provident's branch network and digital platforms offer wide reach. | Replicating this reach requires substantial investment. |

| Fintech Innovation | Niche players can offer specialized, tech-driven services. | Requires adaptation to new technologies and business models. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Provident Financial Services leverages data from their annual reports, investor presentations, and SEC filings. We also incorporate insights from industry-specific market research reports and financial news outlets to provide a comprehensive view of the competitive landscape.