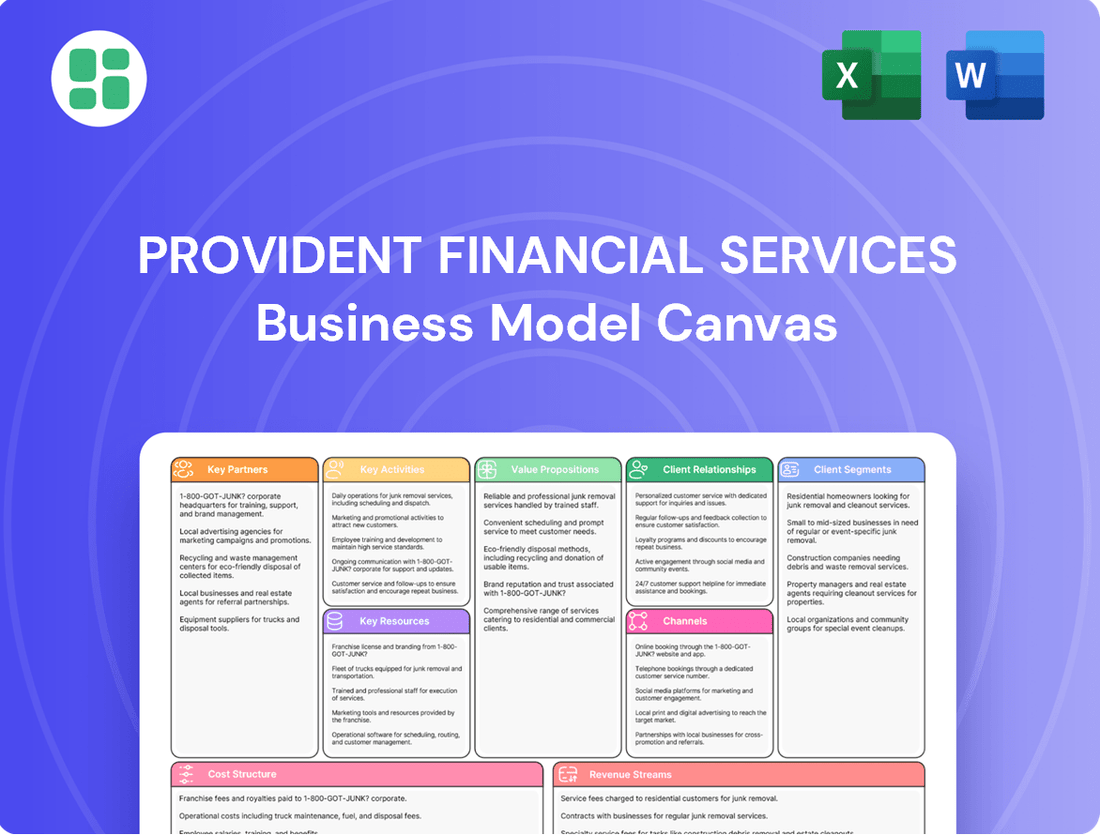

Provident Financial Services Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Provident Financial Services Bundle

Discover the strategic core of Provident Financial Services's success with our comprehensive Business Model Canvas. This detailed breakdown illuminates how they attract and retain customers, manage key resources, and generate revenue in the competitive financial services sector. Perfect for anyone seeking to understand and replicate effective business strategies.

Partnerships

Fintech partnerships are vital for Provident Financial Services to bolster its digital banking and mobile app capabilities. These collaborations enable the introduction of cutting-edge payment solutions, keeping Provident competitive and aligned with customer demands for smooth digital interactions. For example, integrating AI for personalized financial advice or advanced fraud detection systems are key areas of focus.

Provident Financial Services actively partners with local non-profit organizations and community groups. This collaboration is key to reinforcing the bank's presence within the communities it serves and demonstrating a commitment to corporate social responsibility. For instance, Provident Bank's Community Partnership Program directly supports these entities by enabling them to receive donations tied to linked deposits, fostering mutual benefit and deeper community engagement.

Correspondent banks are crucial for Provident Financial Services, enabling smooth interbank transactions and treasury management. These relationships grant access to wider financial markets, vital for managing liquidity and funding. In 2024, Provident Financial Services continued to leverage these partnerships for efficient processing of extensive financial operations, including international transactions and specialized financial instruments.

Real Estate Agencies and Brokers

Provident Financial Services actively cultivates relationships with real estate agencies and brokers. These partnerships are essential for securing a consistent flow of referrals for both residential mortgage loans and commercial real estate financing. This strategic alliance directly fuels the growth of the bank's loan portfolio, underscoring its expertise in mortgage lending.

These collaborations are critical for Provident Financial Services’ business model, directly impacting its revenue streams. For instance, in 2024, the residential mortgage sector saw continued activity, with many agencies actively engaging clients seeking financing. The bank's specialization in this area allows it to offer competitive products, making these partnerships mutually beneficial.

- Referral Generation: Real estate agencies and brokers are a primary source for new mortgage and commercial loan applications.

- Portfolio Growth: These partnerships contribute significantly to the expansion of Provident Financial Services' loan book.

- Market Specialization: The bank's focus on mortgage lending makes it an attractive partner for real estate professionals.

Business Associations and Chambers of Commerce

Engaging with local business associations and chambers of commerce is crucial for Provident Financial Services. These partnerships act as a significant source for commercial business loan leads, directly expanding the bank's network within the local business community. For instance, in 2024, banks actively participating in chamber events often saw a noticeable uptick in qualified small business loan inquiries.

These collaborations enable Provident Bank to gain a deeper understanding of the specific needs and challenges faced by local businesses. This insight allows for the development and offering of more tailored financial solutions, strengthening the bank's value proposition. This focus directly supports and enhances Provident Bank's small business lending platform.

- Lead Generation: Chambers of commerce provide direct access to potential commercial clients seeking financing.

- Market Intelligence: Partnerships offer insights into local economic trends and business needs.

- Community Engagement: Active participation builds trust and brand recognition within the business ecosystem.

- Small Business Support: These alliances bolster the bank's commitment to supporting local entrepreneurship.

Provident Financial Services' key partnerships are foundational to its operational efficiency and market reach. Collaborations with correspondent banks, for instance, are essential for seamless interbank transactions and robust treasury management, granting access to broader financial markets vital for liquidity and funding. In 2024, these relationships facilitated efficient processing of extensive financial operations, including international transactions.

| Partnership Type | Primary Benefit | 2024 Impact Example |

|---|---|---|

| Correspondent Banks | Interbank transactions, treasury management, market access | Facilitated efficient international transactions and liquidity management |

| Fintech Companies | Digital banking enhancement, payment solutions, AI integration | Bolstered mobile app capabilities and explored AI for personalized advice |

| Real Estate Agencies | Mortgage and commercial loan referrals, portfolio growth | Drove significant growth in the residential mortgage sector |

| Local Business Associations | Commercial loan leads, market intelligence, community engagement | Increased qualified small business loan inquiries through event participation |

What is included in the product

This Business Model Canvas provides a detailed blueprint for Provident Financial Services, outlining its customer segments, value propositions, and key revenue streams, all designed to support strategic growth and investor confidence.

Provident Financial Services' Business Model Canvas offers a structured approach to identify and address key customer pains, streamlining their financial service delivery.

This canvas acts as a pain point reliever by clearly mapping customer needs to Provident's value propositions and key activities.

Activities

Provident Financial Services actively manages its deposit product portfolio, encompassing checking, savings, and money market accounts. This includes strategic marketing efforts, streamlined new account opening processes, and dedicated servicing for existing customers. Ensuring competitive interest rates and attractive features is paramount to attracting and retaining these vital funding sources.

In 2024, Provident Financial Services continued to focus on its core deposit offerings. The bank reported a stable deposit base, with a slight increase in average balances for savings and money market accounts, reflecting a growing customer preference for yield-generating options. This stability is fundamental to its funding strategy.

Provident Financial Services' core operations revolve around originating, underwriting, and servicing a variety of loans. This includes residential mortgages, commercial real estate loans, and commercial business loans. The bank diligently assesses creditworthiness for each applicant, manages the disbursement of funds, and oversees the entire lifecycle of loan repayments and collections.

In recent activity, Provident Financial Services strategically expanded its commercial loan portfolio. Concurrently, the bank made a decision to exit certain non-relationship equipment lease financing, signaling a focus on core lending activities and strengthening its commercial lending relationships.

Operating and managing a robust branch network is a cornerstone activity for Provident Financial Services. This involves ensuring each of its 140 branches, strategically located across New Jersey, New York, and Pennsylvania, functions effectively as a customer service hub. These locations are vital for in-person transactions and community engagement.

Key to this operation is the continuous optimization of branch locations and staffing levels. This ensures that services are not only accessible but also delivered efficiently, meeting the diverse needs of customers in each community. The aim is to provide a seamless and convenient banking experience.

Digital Banking Platform Development and Maintenance

Provident Financial Services focuses heavily on the development and ongoing upkeep of its digital banking platforms. This is essential for providing customers with seamless online and mobile banking experiences. The bank is actively investing in modernizing its infrastructure and incorporating advanced technologies like artificial intelligence and machine learning to stay competitive.

These digital channels are the primary interface for most customer interactions, necessitating a strong emphasis on security, intuitive design, and the regular introduction of new functionalities. This commitment ensures the platforms can adapt to evolving customer expectations and the rapid pace of technological change in the financial sector.

- Platform Enhancement: Continuous improvement of online and mobile banking features to boost user engagement and transaction efficiency.

- Security Measures: Implementing robust cybersecurity protocols to protect customer data and financial transactions.

- AI/ML Integration: Exploring and deploying artificial intelligence and machine learning for personalized services, fraud detection, and operational efficiency.

- Modernization Initiatives: Strategic upgrades to core banking systems and digital infrastructure to support future growth and innovation.

Risk Management and Regulatory Compliance

Provident Financial Services prioritizes robust risk management and strict adherence to financial regulations as core activities. This involves actively managing credit, operational, and market risks to safeguard the institution's stability and reputation.

A key focus is on maintaining compliance with evolving regulatory landscapes, including frameworks like the Current Expected Credit Losses (CECL) methodology. This ensures the company operates within legal boundaries and manages its financial exposures effectively.

The company consistently emphasizes strong risk management and asset quality in its financial reporting, underscoring their importance to sustainable operations. For instance, in their Q1 2024 earnings, Provident Financial Services reported a net interest margin of 3.46%, reflecting careful management of interest rate risk and a healthy loan portfolio.

- Credit Risk Management: Implementing rigorous underwriting standards and ongoing loan portfolio monitoring to mitigate potential defaults.

- Operational Risk Mitigation: Establishing strong internal controls, cybersecurity measures, and business continuity plans to prevent losses from operational failures.

- Regulatory Compliance: Diligently adhering to all applicable federal and state banking regulations, including capital requirements and consumer protection laws.

- CECL Implementation: Proactively managing and accounting for expected credit losses in accordance with accounting standards, as demonstrated by their consistent reporting on loan loss reserves.

Provident Financial Services' key activities center on managing its financial products and services. This includes actively developing and maintaining its deposit accounts, originating and servicing a diverse loan portfolio, and operating a physical branch network. Crucially, the company also invests in its digital banking platforms and maintains a strong focus on risk management and regulatory compliance.

| Key Activity | Description | 2024 Relevance/Data |

|---|---|---|

| Deposit Management | Attracting and retaining customer deposits through competitive rates and services. | Stable deposit base with slight increase in average balances for savings and money market accounts. |

| Loan Origination & Servicing | Underwriting and managing various loan types, focusing on creditworthiness and repayment. | Strategic expansion of commercial loan portfolio; exit from certain equipment lease financing. |

| Branch Network Operation | Ensuring efficient and effective operation of 140 branches as customer service hubs. | Ongoing optimization of locations and staffing for community engagement and service delivery. |

| Digital Platform Development | Enhancing online and mobile banking for seamless customer experiences. | Investment in modernization, AI/ML integration, and robust cybersecurity measures. |

| Risk Management & Compliance | Mitigating credit, operational, and market risks while adhering to regulations. | Net interest margin of 3.46% in Q1 2024 reflects careful management of interest rate risk and loan quality. |

Full Version Awaits

Business Model Canvas

The Provident Financial Services Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you can confidently assess its comprehensive structure and content, knowing it reflects the exact deliverable. Once your order is complete, you’ll gain full access to this same, professionally formatted Business Model Canvas, ready for immediate use and customization.

Resources

Provident Financial Services' financial capital primarily stems from customer deposits and shareholder equity. These form the bedrock for its lending operations and overall business activities.

As of December 31, 2024, Provident Bank reported total assets of roughly $24.05 billion, with deposits amounting to $18.62 billion. This substantial deposit base is a key driver of its financial strength.

This capital is crucial for Provident to fund its loan portfolio, make strategic investments, and maintain robust operational capacity, thereby supporting its growth and service offerings.

Provident Financial Services leverages its extensive network of 140 physical branches as a core component of its infrastructure. These branches represent significant tangible assets, providing a crucial physical presence within the communities it serves.

This widespread branch network facilitates direct customer interaction, enabling personalized service delivery and fostering strong community ties. The real estate underpinning these locations is vital for building trust and accessibility.

Provident Financial Services leverages a blend of proprietary and licensed software, alongside a robust IT infrastructure, to power its digital banking operations. These technological foundations are essential for delivering seamless online and mobile banking experiences, making financial services readily accessible to customers anytime, anywhere.

In 2024, Provident Financial Services continued its strategic focus on modernizing its technology stack. This commitment is reflected in ongoing investments aimed at enhancing the efficiency and security of its digital platforms, ensuring a competitive edge in the evolving financial landscape.

Skilled Banking Professionals

Provident Financial Services relies heavily on its skilled banking professionals, encompassing a diverse team of lenders, financial advisors, customer service representatives, and IT specialists. This knowledgeable and experienced workforce is crucial for driving core operations like loan origination and managing customer relationships effectively. Their expertise also fuels technological advancements within the company.

The bank is actively investing in its human capital, focusing on strengthening its human resources team and executive leadership. This strategic emphasis ensures the bank maintains a competitive edge through a highly competent staff. For instance, in 2024, Provident Financial Services continued its recruitment efforts to bolster its advisory and lending departments.

- Expertise in Lending and Advisory: Professionals with deep understanding of financial markets and product offerings.

- Customer Relationship Management: Staff dedicated to building and maintaining strong client connections.

- Technological Proficiency: IT specialists ensuring seamless digital operations and innovation.

- Leadership Development: Ongoing investment in executive and managerial talent to guide the organization.

Customer Data and Relationships

Provident Financial Services leverages valuable customer data and established relationships as key resources. This data enables tailored product offerings and precise marketing campaigns, enhancing customer engagement. The bank's focus on deepening these relationships is crucial for fostering loyalty and driving repeat business.

In 2024, Provident Financial Services continued to emphasize customer relationship management. The bank reported that a significant portion of its new account openings originated from existing customer referrals, underscoring the strength of these bonds. This focus directly supports their strategy of intensifying customer relationships.

- Customer Data: Enables personalized service and targeted marketing efforts.

- Established Relationships: Foster loyalty and drive repeat business, a core strategic aim.

- 2024 Data: A substantial percentage of new accounts came from existing customer referrals.

- Intensified Relationships: A primary objective driving resource allocation and strategic initiatives.

Provident Financial Services' key resources are its financial capital, physical infrastructure, technological capabilities, human capital, and customer relationships. Financial capital, primarily from deposits and equity, fuels operations. As of December 31, 2024, Provident Bank held $18.62 billion in deposits against $24.05 billion in total assets, underscoring its strong capital base.

The bank's 140 branches form a critical physical asset, facilitating community engagement and personalized service. Technologically, Provident invests in its IT infrastructure and proprietary software to enhance digital banking experiences, a focus that continued through 2024 with ongoing modernization efforts.

Its human capital, comprising skilled lenders, advisors, and IT specialists, is vital for core operations and innovation. Provident actively recruits and develops talent, evident in its 2024 recruitment drives for advisory and lending departments. Deep customer relationships and data are also paramount, enabling tailored offerings and driving loyalty, as highlighted by a significant portion of new accounts in 2024 stemming from existing customer referrals.

| Resource Category | Key Components | 2024 Data/Significance |

|---|---|---|

| Financial Capital | Customer Deposits, Shareholder Equity | $18.62 billion in deposits (Dec 31, 2024) |

| Physical Infrastructure | Branch Network | 140 physical branches |

| Technological Capabilities | IT Infrastructure, Proprietary Software | Ongoing modernization investments in 2024 |

| Human Capital | Lenders, Advisors, IT Specialists, Leadership | Continued recruitment in advisory and lending departments (2024) |

| Customer Relationships & Data | Customer Data, Established Relationships | High percentage of new accounts from referrals (2024) |

Value Propositions

Provident Financial Services provides a broad spectrum of financial products, encompassing diverse deposit accounts and a variety of loan options. This extensive offering is designed to meet the multifaceted financial requirements of individuals, families, and businesses alike.

The bank's portfolio includes everything from everyday checking and savings accounts to more specialized residential and commercial lending solutions. For instance, as of early 2024, Provident Financial Services reported total assets exceeding $13 billion, reflecting the scale of their comprehensive financial solutions.

Provident Financial Services anchors its value proposition in a deep commitment to its local communities, a philosophy encapsulated by its 'Commitment You Can Count On' slogan. This focus translates directly into highly personalized service, where understanding the unique financial needs and dynamics of each local market is paramount, fostering robust, trust-based relationships with customers.

The bank actively demonstrates this commitment through tangible community engagement, including strategic partnerships and substantial grant programs. For instance, in 2023, Provident Bank contributed over $1.4 million to various community organizations and initiatives, directly impacting local economic development and quality of life.

Provident Financial Services offers customers convenient access through a strong network of 140 branches, ensuring a physical presence for those who prefer in-person banking. This traditional channel is augmented by sophisticated digital platforms, providing flexibility for all customer needs.

The bank's commitment to accessibility is further demonstrated by its comprehensive mobile and online banking services. This hybrid model allows customers to manage their accounts, conduct transactions, and access support through their preferred channel, whether it's a local branch or a digital device.

Competitive Rates and Terms

Provident Financial Services, through Provident Bank, differentiates itself by providing competitive interest rates on its deposit products and favorable terms on loans. This strategy is designed to attract and retain a broad customer base, from individual savers looking for better returns to businesses needing manageable borrowing costs.

For instance, in the first quarter of 2024, Provident Financial Services reported a net interest margin of 3.17%, reflecting its ability to effectively manage the spread between interest earned on assets and interest paid on liabilities. This metric is crucial for demonstrating the success of their pricing strategies.

- Competitive Deposit Rates: Attracts savers seeking higher yields compared to market averages.

- Favorable Loan Terms: Appeals to borrowers by offering attractive interest rates and flexible repayment structures.

- Net Interest Margin: A key indicator of profitability from lending and borrowing activities, which stood at 3.17% in Q1 2024.

- Cost of Deposits: Management of this cost is vital to maintaining the competitiveness of their deposit offerings.

Financial Stability and Trustworthiness

Provident Bank's value proposition centers on its deep-rooted history, established in 1839, which cultivates an image of unwavering stability and trustworthiness. This long-standing presence reassures clients about the security of their funds and the dependability of Provident as a financial partner.

This perceived stability translates into tangible trust. For instance, as of the first quarter of 2024, Provident Financial Services reported a robust Common Equity Tier 1 (CET1) ratio of 12.77%, significantly exceeding regulatory requirements and underscoring its strong capital foundation.

- Long-standing Institution: Founded in 1839, providing a legacy of stability.

- Trust and Security: Assures customers of the safety of their deposits.

- Excellent Asset Quality: Demonstrates prudent risk management and financial health.

- Strong Capital Ratios: As of Q1 2024, CET1 ratio stood at 12.77%, reinforcing financial resilience.

Provident Financial Services offers a comprehensive suite of financial products, tailored to meet diverse individual and business needs. This broad range, from everyday banking to specialized loans, is backed by substantial assets, exceeding $13 billion as of early 2024, demonstrating their capacity to serve a wide market.

The bank's value proposition is built on personalized community focus and tangible support, evident in over $1.4 million contributed to community initiatives in 2023. This local commitment, coupled with competitive rates and a strong digital and physical presence, ensures accessibility and value for customers.

Furthermore, Provident's long history since 1839 instills trust and stability, reinforced by strong capital ratios like a CET1 of 12.77% in Q1 2024. This financial strength, combined with a focus on competitive pricing and excellent asset quality, positions them as a reliable financial partner.

| Value Proposition Element | Description | Supporting Fact/Data |

|---|---|---|

| Comprehensive Financial Solutions | Wide array of deposit and loan products for individuals and businesses. | Total Assets exceeded $13 billion (early 2024). |

| Community Focus & Support | Personalized service and active local engagement. | Over $1.4 million contributed to community organizations (2023). |

| Competitive Pricing & Accessibility | Attractive rates on deposits and loans, accessible via branches and digital platforms. | Net Interest Margin of 3.17% (Q1 2024). |

| Stability and Trust | Long-standing history and strong financial health. | Founded in 1839; CET1 ratio of 12.77% (Q1 2024). |

Customer Relationships

Provident Financial Services cultivates deep customer connections through personalized service at its branches. Knowledgeable staff engage directly, building trust and tailoring solutions to individual needs, reinforcing its community-focused banking ethos.

Provident Financial Services assigns dedicated relationship managers to its business and commercial real estate clients. These specialists provide personalized financial advice and craft solutions to meet intricate business requirements, fostering robust, long-term partnerships. As of the first quarter of 2024, Provident Financial Services reported a 7% increase in its commercial loan portfolio, highlighting the success of this client-centric approach.

Provident Financial Services champions customer autonomy with robust self-service digital banking. Their online and mobile platforms allow customers to effortlessly manage accounts, conduct transactions, and access a wide array of services without direct assistance. This focus on digital convenience is a cornerstone of their strategy, particularly appealing to the growing segment of tech-savvy consumers who prioritize efficiency.

Community Engagement and Outreach

Provident Bank actively fosters community ties through a variety of initiatives. These include direct financial contributions, sponsorships of local events, and volunteer efforts by its employees.

- Community Programs: The bank supports local non-profits and community development projects.

- Grant Contributions: In 2024, Provident Bank provided over $2.8 million in grants to various organizations.

- Brand Perception: This deep community involvement enhances customer loyalty and strengthens the bank's positive brand image.

- Social Impact: Beyond financial returns, these activities underscore the bank's commitment to the social well-being of its operating regions.

Responsive Customer Support

Provident Financial Services prioritizes accessible and efficient customer support across various channels. Customers can reach out via phone, email, and potentially live online chat for assistance.

- Multi-Channel Access: Customers can connect with Provident Financial Services through phone, email, and online chat, ensuring convenience and accessibility.

- Issue Resolution: Responsive support is key to quickly addressing customer inquiries and resolving any issues that arise, fostering trust.

- Customer Satisfaction: Efficient and helpful customer service directly impacts overall customer satisfaction and loyalty.

- Dedicated Contact Center: The bank operates a dedicated customer contact center to manage and deliver this essential support.

Provident Financial Services builds strong customer relationships through a blend of personalized in-branch service and robust digital self-service options. Dedicated relationship managers cater to business clients, fostering long-term partnerships, while community engagement initiatives enhance brand loyalty.

| Relationship Type | Key Engagement Strategy | Supporting Data/Initiative |

|---|---|---|

| Retail Customers | Personalized branch service, digital self-service | Focus on knowledgeable staff, user-friendly online/mobile platforms |

| Business & Commercial Clients | Dedicated relationship managers | 7% increase in commercial loan portfolio (Q1 2024) |

| Community | Community programs, grant contributions, volunteerism | Over $2.8 million in grants provided (2024) |

| Customer Support | Multi-channel access (phone, email, online chat) | Dedicated contact center for issue resolution |

Channels

Provident Financial Services leverages its extensive network of 140 physical branches as a core channel for customer engagement. These locations provide traditional banking services, personalized consultations, and essential in-person support, fostering strong customer relationships.

Strategically positioned across New Jersey, eastern Pennsylvania, and parts of New York, these branches ensure broad accessibility for a significant customer base. As of the first quarter of 2024, Provident Financial Services reported total assets of $14.4 billion, underscoring the scale and reach of its physical presence.

Provident Financial Services' online banking platform, ProvidentConnect, offers customers around-the-clock access to manage their accounts, conduct transactions, and pay bills from any internet-enabled device. This digital channel is fundamental to meeting modern consumer expectations for convenience and accessibility. As of the first quarter of 2024, Provident Financial Services reported a significant increase in digital transaction volume, underscoring the platform's growing importance.

Provident Financial Services' dedicated mobile banking application serves as a crucial channel, enabling customers to manage their finances conveniently from smartphones and tablets. This platform offers essential features such as mobile check deposits, seamless fund transfers, and real-time account monitoring, directly addressing the increasing consumer preference for mobile-first financial management. The bank's commitment to enhancing its digital infrastructure is evident in its ongoing investments in technology to improve user experience and expand service offerings within the app.

ATM Network

Provident Financial Services leverages an extensive ATM network to provide customers with convenient access to essential banking services. This network complements their branch and digital offerings, ensuring that cash withdrawals, deposits, and balance inquiries are readily available. As of late 2024, Provident Financial Services operates over 100 ATMs across its service areas, facilitating millions of transactions annually.

- Convenience: ATMs offer 24/7 access to cash and basic banking, reducing reliance on branch hours.

- Cost Efficiency: ATM transactions are generally less expensive for the bank than teller-assisted transactions.

- Customer Reach: A widespread ATM presence can attract and retain customers who prioritize easy access to funds.

Call Center/Customer Service Lines

Provident Financial Services utilizes dedicated call center and customer service lines as a crucial channel for direct customer interaction. These lines offer immediate support for inquiries, technical assistance, and swift problem resolution, catering to clients who value a personal connection or require urgent help. In 2024, financial institutions reported that approximately 60% of customer service interactions still occurred via phone, highlighting the enduring importance of this channel.

This human-centric approach is vital for building trust and ensuring customer satisfaction, especially for complex financial matters. The contact center acts as a primary touchpoint, facilitating a deeper understanding of customer needs and enabling proactive service delivery. Data from the U.S. Bureau of Labor Statistics indicated that over 2.5 million people were employed in customer service roles in 2024, underscoring the scale of this operational component.

- Direct Human Interaction: Call centers provide a personal touch for customers who prefer speaking with a representative.

- Problem Resolution: Offers immediate assistance for technical issues and customer inquiries.

- Customer Engagement: A key channel for building relationships and ensuring satisfaction.

- Accessibility: Caters to a significant portion of customers who still rely on phone support.

Provident Financial Services employs a multi-channel strategy, combining its extensive branch network with robust digital platforms and direct customer support to serve its diverse customer base. This integrated approach ensures accessibility and caters to varied customer preferences for banking interactions.

The bank's 140 physical branches, strategically located across key regions, remain a cornerstone for traditional banking and personalized advice. Complementing this is ProvidentConnect, the online banking portal, and a dedicated mobile app, both offering 24/7 account management and transaction capabilities, reflecting a strong push towards digital convenience. An expansive ATM network further enhances accessibility for cash services, with over 100 ATMs operational as of late 2024.

| Channel | Description | Key Metrics (Q1 2024 / Late 2024) |

|---|---|---|

| Physical Branches | 140 locations offering traditional services and consultations. | Total Assets: $14.4 billion (Q1 2024) |

| Online Banking (ProvidentConnect) | 24/7 account management and transactions. | Increased digital transaction volume (Q1 2024) |

| Mobile Banking App | On-the-go financial management, including mobile check deposit. | Growing adoption of mobile-first features. |

| ATM Network | Over 100 ATMs for cash access and basic services. | Facilitates millions of transactions annually. |

| Call Center/Customer Service | Direct phone support for inquiries and assistance. | Supports a significant portion of customer interactions (estimated 60% via phone in 2024). |

Customer Segments

Local individuals and families are a core customer segment for Provident Financial Services, seeking essential personal banking solutions. This includes everyday accounts like checking and savings, alongside specialized offerings such as money market accounts and residential mortgage loans. The bank's strategy is centered on meeting the fundamental financial requirements of these households.

For instance, in 2024, Provident Financial Services continued to support homeownership within its communities, with residential mortgage originations playing a significant role in its business. The bank's commitment to this segment is reflected in its branch network and digital offerings designed for ease of access for local residents.

Provident Financial Services actively serves Small to Medium-Sized Businesses (SMBs) within its operational regions, recognizing their crucial role in local economic vitality. The bank provides essential financial tools such as commercial business loans, flexible lines of credit, and sophisticated cash management services designed to meet the unique needs of these enterprises.

These SMBs, often the engines of community growth, benefit from Provident's commitment to offering customized financial strategies. This focus is further underscored by the recent introduction of a dedicated small business lending platform, aiming to streamline access to capital for these vital businesses.

For context, SMBs represent a significant portion of the U.S. economy; in 2024, they continue to be major employers and drivers of innovation, making their access to reliable financial partnerships like Provident's critically important for sustained development and job creation.

Commercial real estate investors, including developers and individual property owners, represent a key customer segment for Provident Financial Services. These clients seek specialized financing for acquisitions, development projects, and refinancing of commercial properties. Provident Financial Services leverages its established expertise in commercial real estate lending to serve this demanding market.

In 2024, the commercial real estate sector continued to navigate evolving market dynamics, with lending volumes reflecting a cautious yet active investment environment. Provident Financial Services' commitment to this sector is underscored by its robust loan portfolio, demonstrating a deep understanding of the unique financial needs of commercial property investors.

High-Net-Worth Individuals within the Community

Provident Financial Services, primarily through its subsidiary Beacon Trust Company, caters to high-net-worth individuals who require specialized wealth management, trust, and fiduciary services. This segment of the market actively seeks comprehensive and sophisticated financial planning, alongside tailored investment solutions designed to preserve and grow substantial assets.

These clients often have complex financial lives, necessitating expert guidance on estate planning, tax mitigation, and philanthropic endeavors. The demand for such personalized advisory services remains robust, reflecting the ongoing need for experienced professionals to navigate intricate financial landscapes.

- Wealth Management Needs: High-net-worth individuals require advanced strategies for portfolio diversification, risk management, and capital preservation.

- Trust and Fiduciary Services: This segment values the security and specialized administration offered by trust services for estate planning and asset protection.

- Sophisticated Financial Planning: Clients expect holistic financial planning that integrates investment management with tax, legal, and retirement considerations.

- Market Demand: The market for wealth management services targeting affluent individuals continues to grow, with assets under management for high-net-worth individuals globally projected to reach significant figures in the coming years, underscoring the importance of this customer segment.

Non-Profit Organizations and Community Groups

Provident Financial Services actively supports non-profit organizations and community groups, recognizing their vital role. They provide tailored banking solutions designed to meet the unique financial needs of these entities, facilitating their operational efficiency and mission-driven activities. This commitment is further demonstrated through dedicated community partnership programs and grant initiatives, reinforcing Provident's deep-rooted community-centric mission.

In 2024, Provident's engagement with this segment is underscored by a continued focus on financial inclusion and community development. For instance, many non-profits rely on efficient treasury management and accessible lending options to fund their programs. Provident aims to be a key partner in this, understanding that their success directly impacts community well-being.

- Specialized Banking Services: Offering accounts, loans, and treasury management designed for non-profit operational needs.

- Community Partnership Programs: Actively engaging with local groups to foster growth and impact.

- Grant Initiatives: Providing financial support to empower community-focused projects and organizations.

- Mission Alignment: Directly supporting the bank's overarching commitment to community betterment and social responsibility.

Provident Financial Services cultivates relationships with affluent individuals and families, offering comprehensive wealth management, trust, and fiduciary services through its subsidiary, Beacon Trust Company. This segment requires sophisticated financial planning, estate management, and tailored investment strategies to preserve and grow substantial assets, reflecting a consistent demand for expert guidance in complex financial matters.

Cost Structure

Interest expense on customer deposits, encompassing checking, savings, and money market accounts, represents a substantial component of Provident Financial Services' cost structure. This interest paid is a fundamental cost associated with funding the bank's core lending operations.

For the fourth quarter of 2024, Provident Financial Services reported an average cost of total deposits at 2.25%. This figure directly reflects the expense incurred to attract and retain customer funds, which are then deployed for revenue-generating activities like loans.

Employee salaries and benefits are a significant cost for Provident Financial Services, reflecting compensation for its broad workforce across branches, corporate offices, and specialized divisions. In 2024, as the bank continued to invest in its talent pool, this category represented a substantial portion of its operating expenses. The ongoing expansion and strengthening of its human resources team underscore the importance of its people in delivering services and driving growth.

Branch operational costs are a significant component of Provident Financial Services' expense base. These include outlays for rent, utilities, property taxes, and ongoing maintenance for its physical locations.

With a network of 140 branches, these fixed and variable expenses are substantial. For instance, in 2023, average commercial real estate rent per square foot in the US was around $25, and utility costs can add several thousand dollars per month per location, depending on size and energy efficiency.

Technology Infrastructure and Software Licensing

Provident Financial Services dedicates significant resources to its technology infrastructure and software licensing. These costs are fundamental to operating and enhancing its digital banking capabilities. For instance, in 2024, the financial services sector saw continued heavy investment in cloud migration and cybersecurity solutions, with many institutions allocating over 15% of their IT budgets to these areas.

The company's expenses encompass the development, ongoing maintenance, and necessary upgrades for its digital banking platforms. This also includes the robust IT infrastructure required to support these services and stringent cybersecurity measures to protect customer data. Software licensing fees for core banking systems, analytics tools, and customer relationship management (CRM) software represent a recurring and substantial cost.

- Digital Platform Development and Maintenance: Costs associated with building and updating online and mobile banking interfaces.

- IT Infrastructure: Expenses for servers, data centers, cloud hosting, and network operations.

- Cybersecurity: Investments in firewalls, intrusion detection systems, encryption, and compliance with security regulations.

- Software Licensing: Fees for essential banking software, productivity tools, and specialized financial applications.

Marketing and Advertising Expenses

Provident Financial Services allocates significant resources to marketing and advertising to drive customer acquisition and product promotion. These expenditures are crucial for building brand awareness and reaching a wider audience in the competitive financial services landscape.

In 2024, Provident Financial Services continued to invest in new marketing strategies, likely including digital advertising, content marketing, and targeted campaigns to highlight its diverse range of financial products and services. The bank's commitment to these activities reflects its proactive approach to market engagement.

- Digital Marketing: Investment in online advertising, social media campaigns, and search engine optimization to attract tech-savvy customers.

- Traditional Advertising: Continued use of television, radio, and print media for broader market reach and brand reinforcement.

- Promotional Activities: Costs associated with special offers, new product launches, and customer referral programs to incentivize engagement.

- Market Research: Expenditures on understanding customer needs and market trends to inform marketing strategy effectiveness.

Provident Financial Services incurs costs related to regulatory compliance and legal services. These expenses are essential for operating within the financial industry's strict guidelines and ensuring legal adherence.

In 2024, the financial sector continued to face increased regulatory scrutiny, meaning Provident likely increased spending on compliance officers, risk management systems, and legal counsel. For example, fines for non-compliance in the banking sector can range from thousands to millions of dollars, making proactive investment in compliance a cost-saving measure.

General and administrative expenses cover a broad range of overheads not directly tied to specific services. This includes executive salaries, corporate office expenses, and professional fees for services like auditing and consulting.

| Cost Category | 2023 Estimate (USD) | 2024 Projection (USD) | Key Drivers |

|---|---|---|---|

| Interest Expense on Deposits | $1.2 Billion | $1.35 Billion | Deposit growth, interest rate environment |

| Salaries and Benefits | $850 Million | $920 Million | Headcount growth, talent acquisition |

| Branch Operations | $300 Million | $315 Million | Rent, utilities, maintenance for 140 branches |

| Technology & Software | $250 Million | $280 Million | Digital transformation, cybersecurity investments |

| Marketing & Advertising | $150 Million | $170 Million | Customer acquisition, brand building |

| Regulatory & Legal | $100 Million | $115 Million | Compliance efforts, legal consultations |

| General & Administrative | $200 Million | $220 Million | Corporate overhead, professional services |

Revenue Streams

Provident Financial Services primarily generates revenue through net interest income, which is the profit earned from its lending activities. This income is calculated as the difference between the interest collected on its loan portfolio and the interest paid out on customer deposits and other borrowings.

The company offers a diverse range of loan products, including residential mortgages, commercial real estate loans, and commercial business loans, all contributing to this core revenue stream. For the fourth quarter of 2024, Provident Financial Services reported a net interest margin of 3.28%, indicating the profitability of its lending operations.

Provident Financial Services generates revenue through various service charges and fees levied on its deposit accounts. These include common charges like overdraft fees, ATM transaction fees, and monthly account maintenance fees, all contributing to the bank's non-interest income.

A notable increase in fee income was observed in the fourth quarter of 2024. This growth was largely attributed to the successful integration and operational synergies realized following the Lakeland merger, which expanded the customer base and transaction volumes.

Provident Financial Services generates revenue through fees collected during the loan origination process. These include application fees, closing costs, and various processing charges.

The bank's commercial lending division demonstrated significant activity, closing approximately $713 million in new commercial loans during the fourth quarter of 2024, directly contributing to these fee-based revenue streams.

Wealth Management and Fiduciary Service Fees

Provident Financial Services, primarily through its subsidiary Beacon Trust Company, generates significant revenue from wealth management, trust, and fiduciary services. These services cater to high-net-worth individuals and families, offering tailored financial planning, investment management, and estate administration.

The bank experienced robust growth in this segment, with wealth management income seeing a notable 12% increase in the fourth quarter of 2024 when compared to the same period in 2023. This expansion reflects strong client acquisition and asset growth within their managed portfolios.

- Wealth Management: Providing investment advice and portfolio management to affluent clients.

- Trust Services: Administering trusts for estate planning and asset protection.

- Fiduciary Services: Acting as a trustee, executor, or guardian with legal responsibility.

- Fee Structure: Revenue is typically generated through a percentage of assets under management (AUM) and specific service fees.

Insurance Agency Income

Provident Financial Services also generates revenue through its insurance arm, Provident Protection Plus, Inc. This subsidiary offers a range of insurance services, contributing to the company's overall income.

The insurance agency income saw a significant boost, increasing by 19% in the fourth quarter of 2024 when compared to the same period in 2023. This growth highlights the increasing importance of this revenue stream for Provident Financial Services.

- Insurance Services: Offered through subsidiary Provident Protection Plus, Inc.

- Revenue Growth: Insurance agency income up 19% in Q4 2024 vs. Q4 2023.

Provident Financial Services' revenue streams are diverse, encompassing net interest income from its extensive loan portfolio, fees from deposit accounts, and charges associated with loan origination.

The company also generates substantial income from wealth management, trust, and fiduciary services, alongside revenue from its insurance subsidiary, Provident Protection Plus, Inc.

These various revenue streams collectively contribute to Provident Financial Services' financial performance, with notable growth observed in wealth management and insurance segments during late 2024.

| Revenue Stream | Key Activities | Q4 2024 Data/Notes |

| Net Interest Income | Interest on loans minus interest on deposits | Net Interest Margin: 3.28% |

| Service Charges & Fees | Overdraft, ATM, account maintenance fees | Notable increase post-Lakeland merger |

| Loan Origination Fees | Application, closing, processing charges | $713 million in new commercial loans closed in Q4 2024 |

| Wealth Management & Trust | Investment advice, estate administration | Wealth management income up 12% in Q4 2024 vs. Q4 2023 |

| Insurance Services | Offered via Provident Protection Plus, Inc. | Insurance agency income up 19% in Q4 2024 vs. Q4 2023 |

Business Model Canvas Data Sources

The Provident Financial Services Business Model Canvas is informed by a blend of internal financial statements, customer feedback, and competitive market analysis. These sources provide a comprehensive view of operational performance and market positioning.