Provident Financial Services Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Provident Financial Services Bundle

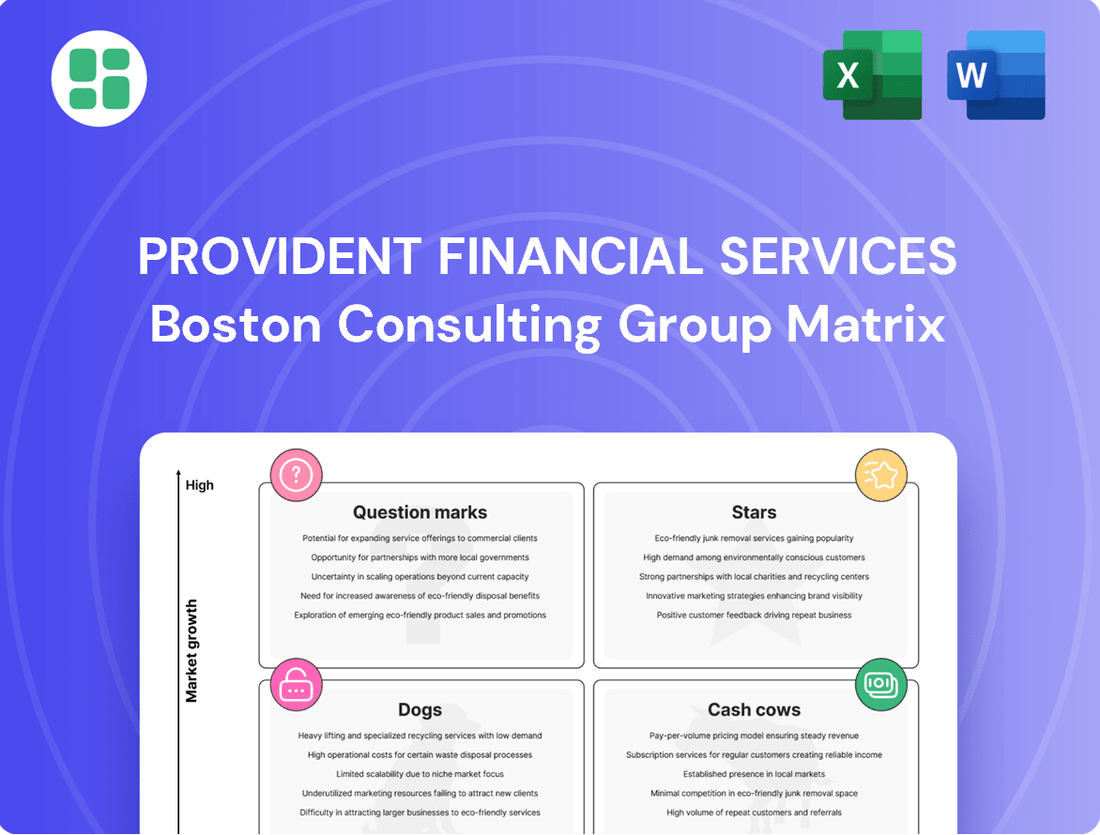

Curious about Provident Financial Services' strategic positioning? Our BCG Matrix preview highlights key product areas, hinting at potential Stars and Cash Cows, but the full picture remains elusive.

Unlock the complete BCG Matrix to see precisely where Provident Financial Services' offerings fall into Stars, Cash Cows, Dogs, and Question Marks. This detailed analysis provides the crucial data you need for informed investment and strategic planning.

Don't miss out on the actionable insights that can drive Provident Financial Services' growth. Purchase the full BCG Matrix report today for a comprehensive breakdown and a clear roadmap to maximizing your returns.

Stars

Provident Financial Services is making a strong push in Commercial & Industrial (C&I) lending, with its portfolio growing at a 6.5% annualized rate as of March 31, 2025. This strategic focus is supported by an expanded commercial lending team and a significantly larger loan pipeline.

The bank's investment in its C&I segment is designed to capitalize on market opportunities and drive future earnings. This expansion is a clear indicator of Provident Financial Services' intent to gain market share in this vital lending area.

Provident Financial Services is actively growing its specialty lending areas, such as mortgage warehouse, asset-based, and healthcare finance. This strategic push, evidenced by new talent acquisition and the appointment of a Chief Lending Officer, signals strong growth prospects in these niche markets.

These expanded or newly introduced lending products are poised to be significant drivers of loan portfolio expansion and diversification. For example, by the end of 2024, Provident Financial Services reported a substantial increase in its commercial and industrial loan portfolio, with specialty lending segments showing particularly robust year-over-year growth.

Provident Financial Services is actively pursuing digital transformation and AI/ML adoption, evidenced by their investment in modern banking platforms. The appointment of an Enterprise Architecture Director underscores a commitment to integrating technology with core business functions, aiming for enhanced scalability and operational efficiency. This strategic pivot is crucial for capturing a significant market share in digital channels as consumer behavior continues to trend towards online banking solutions.

Strategic Commercial Market Expansion

Provident Financial Services is actively pursuing strategic commercial market expansion, notably in eastern Pennsylvania. This involves bringing in seasoned lenders to bolster their team in these key areas. This move is designed to tap into new business and commercial loan prospects within regions exhibiting strong growth potential.

The bank’s expansion into these specific commercial territories reflects a deliberate strategy to enhance its market share. For instance, as of the first quarter of 2024, Provident Financial Services reported a 10% year-over-year increase in its commercial loan portfolio, with a significant portion of this growth attributed to its expanding presence in targeted markets like eastern Pennsylvania.

- Targeted Market Entry: Focusing on regions like eastern Pennsylvania for commercial growth.

- Talent Acquisition: Hiring experienced lenders to drive commercial business development.

- Growth Potential: Identifying and capitalizing on areas with significant commercial opportunities.

- Market Share Increase: Aims to capture a larger portion of the commercial lending market in expansion zones.

Newark Branch Expansion

Provident Financial Services' Newark branch expansion places it in the Stars category of the BCG Matrix. This strategic move involved opening a new location in Newark, a key urban market, despite a broader trend of branch network optimization. The bank's commitment to this growing urban center signals a belief in its high-growth potential.

This expansion is a deliberate investment in a physical footprint designed to capture market share in a vibrant economic area. The Newark branch is positioned to serve both local businesses and consumers, tapping into the city's ongoing development.

- Newark Branch: Represents a significant investment in a high-growth urban market.

- Strategic Focus: Aims to deepen engagement with local businesses and consumers.

- Market Position: Aligns with a strategy of expanding physical presence in promising areas.

Provident Financial Services' strategic expansion into Newark, a market demonstrating robust growth, positions its Newark branch as a Star in the BCG Matrix. This physical expansion into a key urban center, despite broader industry trends, highlights a commitment to high-potential areas.

The Newark branch represents a significant investment aimed at capturing market share within a developing economic landscape. This initiative is designed to foster deeper connections with both local businesses and consumers, leveraging the city's growth trajectory.

This strategic physical presence in Newark is a clear indicator of Provident Financial Services' belief in the market's high-growth potential, aligning with its objective to expand its footprint in promising territories.

| BCG Category | Provident Financial Services Segment | Market Growth | Relative Market Share | Strategic Rationale |

|---|---|---|---|---|

| Stars | Newark Branch Expansion | High | Building | Investment in high-potential urban market to capture share and drive future earnings. |

What is included in the product

Provident Financial Services' BCG Matrix offers a tailored analysis of its product portfolio, identifying units to invest in, hold, or divest.

A clear BCG Matrix for Provident Financial Services helps identify underperforming units, relieving the pain of resource misallocation.

Cash Cows

Provident Bank's established core deposit accounts, encompassing checking, savings, and money market options, are the bedrock of its funding strategy. These products hold a substantial market share within a mature banking landscape, ensuring a reliable and cost-effective source of capital. In 2024, Provident's average deposit balance across these core accounts demonstrated resilience, contributing significantly to a favorable cost of funds and bolstering its net interest margin.

Provident Bank’s residential mortgage loan portfolio in its established primary markets represents a significant Cash Cow. Despite a challenging interest rate environment in 2024, this mature segment continues to be a reliable source of consistent interest income, bolstering the bank's profitability.

Traditional Commercial Real Estate Lending within Provident Financial Services' portfolio functions as a Cash Cow. These loans, concentrated in stable, established areas, are a cornerstone of their lending activities, generating consistent income. By focusing on experienced investors in their core markets, Provident secures a high-quality, dependable asset base.

Existing Branch Network (Post-Optimization)

Provident Financial Services' existing branch network, post-optimization, stands as a solid Cash Cow. Following their merger, the company has streamlined its operations to maintain an efficient network of over 140 branches. This optimized structure ensures continued strong customer engagement and service delivery across its operating regions.

These established branches, while not experiencing rapid growth, represent a significant asset due to their high market presence and deep-rooted customer loyalty. They are instrumental in supporting Provident's core banking operations and nurturing ongoing customer relationships, contributing steadily to the company's financial performance.

- Over 140 branches form the optimized network.

- High market presence and customer loyalty in established communities.

- Efficient support for core banking operations and customer relationships.

- Steady contribution to overall financial performance.

Wealth Management and Fiduciary Services

Provident Financial Services, through subsidiaries like Beacon Trust Company, offers robust wealth management and fiduciary services. These offerings are a classic example of a Cash Cow within the BCG matrix, serving a high-net-worth clientele in a well-established market.

These services generate consistent, fee-based revenue, contributing significantly to Provident's financial stability and profitability. The mature nature of this market means that while substantial growth isn't expected, the existing client base ensures a reliable income stream, minimizing the need for heavy investment in expansion.

For instance, in 2024, wealth management and fiduciary services are projected to represent a substantial portion of Provident's fee income. This segment is crucial for revenue diversification, providing a stable counterpoint to potentially more volatile lending activities.

- Stable Revenue: Fee-based income from wealth management and fiduciary services offers predictable cash flow.

- High-Net-Worth Focus: Caters to a lucrative client segment with significant asset management potential.

- Low Investment Needs: Operates in a mature market, requiring minimal capital for growth compared to Stars or Question Marks.

- Profitability Driver: Contributes consistently to overall profitability and revenue diversification.

Provident Financial Services' core deposit accounts, including checking and savings, are key Cash Cows. These established products, vital for funding, maintain a strong market share in mature banking environments, ensuring a consistent and cost-efficient capital source. In 2024, Provident's average deposit balances across these accounts showed resilience, positively impacting its cost of funds and net interest margin.

Residential mortgage loans in Provident's primary markets also function as Cash Cows. Despite a challenging interest rate environment in 2024, this mature segment reliably generates steady interest income, enhancing profitability. Traditional commercial real estate lending in stable, established areas is another cornerstone, providing a dependable asset base through experienced investors and consistent income.

Provident's optimized branch network, comprising over 140 locations post-merger, acts as a significant Cash Cow. These branches ensure strong customer engagement and service delivery in established communities, contributing steadily to financial performance. Furthermore, wealth management and fiduciary services, offered through entities like Beacon Trust Company, generate predictable, fee-based revenue from a high-net-worth clientele, requiring minimal investment for sustained profitability.

| Business Unit | BCG Category | Key Characteristics | 2024 Financial Insight |

|---|---|---|---|

| Core Deposit Accounts | Cash Cow | Stable funding, cost-efficient, mature market | Resilient average balances, favorable cost of funds |

| Residential Mortgages | Cash Cow | Reliable interest income, established markets | Consistent profitability despite interest rate environment |

| Commercial Real Estate Lending | Cash Cow | Dependable asset base, consistent income | High-quality assets from experienced investors |

| Branch Network | Cash Cow | High market presence, customer loyalty, efficient operations | Over 140 branches supporting core operations |

| Wealth Management & Fiduciary Services | Cash Cow | Fee-based revenue, high-net-worth focus, low investment needs | Substantial portion of fee income, revenue diversification |

What You’re Viewing Is Included

Provident Financial Services BCG Matrix

The Provident Financial Services BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. This comprehensive analysis, detailing Provident Financial Services' business units within the Stars, Cash Cows, Question Marks, and Dogs quadrants, is ready for your strategic planning without any alterations or watermarks. You can trust that the insights and visual representation of their market position are exactly as presented, ensuring immediate utility for your business decisions.

Dogs

In December 2024, Provident Financial Services strategically exited its non-relationship equipment lease financing business, a move that saw $151.3 million in loans reclassified as held for sale. This action suggests the segment was a 'Dog' in the BCG Matrix, characterized by low market share and limited growth potential.

By divesting from this less profitable area, Provident Financial Services can reallocate capital and resources towards business lines that offer stronger growth prospects and better align with its core relationship-focused strategy.

Following its merger with Lakeland Bancorp, Provident Financial Services strategically closed 22 overlapping branches in New Jersey by the end of August 2024. This move directly addresses the "Closed Overlapping Branch Locations" within its portfolio, likely categorizing them as Dogs in the BCG Matrix.

These consolidated branches probably held low market share or operated inefficiently due to their close proximity to other Provident locations. By closing them, Provident aims to streamline operations and cut costs, effectively divesting from underperforming assets to boost overall efficiency.

Underperforming legacy financial products at Provident Financial Services, while not explicitly detailed, represent offerings with declining demand or low adoption. These products often tie up valuable resources without contributing substantially to revenue or market share. For instance, in 2024, many traditional savings accounts with minimal interest rates have seen a significant outflow of funds as customers migrate to higher-yield digital platforms.

Certain Non-Performing Loan Segments

Certain segments within Provident Financial Services' loan portfolio might be categorized as Dogs in a BCG Matrix analysis if they consistently show high non-performing loan (NPL) rates and demand significant management resources without promising recovery. For instance, while Provident reported a decrease in its overall NPL ratio to 0.41% as of the first quarter of 2024, specific commercial real estate loans or certain consumer credit lines could still represent problematic areas. These segments tie up valuable capital and yield negligible returns, hindering overall portfolio efficiency.

These underperforming loan segments, despite overall portfolio improvements, represent areas where Provident Financial Services may need to re-evaluate its strategy. Such loans can drain resources that could be better allocated to growth areas.

- High NPLs: Specific loan types with NPL ratios significantly above the company's average, potentially indicating inherent risk or poor underwriting in those areas.

- Low Returns: Segments that generate minimal interest income or fees relative to the capital they consume and the risk they represent.

- Resource Drain: Loans requiring extensive collection efforts, legal action, or restructuring, diverting management attention from more productive activities.

- Limited Growth Prospects: Segments unlikely to see significant recovery or future growth, suggesting a need for divestment or write-offs.

Inefficient Operational Processes (Pre-Synergy Realization)

Before Provident Financial Services fully realized the benefits of its merger with Lakeland, some operational processes may have been less than ideal. These inherited or combined processes, while essential for day-to-day banking, could be seen as cash cows if they were resource-intensive without driving significant growth. For instance, manual data entry or redundant customer onboarding procedures might have been areas of concern.

These inefficiencies could lead to higher operating costs, impacting profitability. In 2023, for example, the banking sector generally saw increased operational expenses due to inflationary pressures and investments in technology upgrades. Provident Financial Services, like its peers, would have been focused on streamlining these areas.

The bank's strategic initiative to enhance operational efficiencies is designed to tackle these very issues. By identifying and rectifying these bottlenecks, Provident aims to improve its overall performance and resource allocation.

- High processing times for loan applications

- Redundant back-office reconciliation steps

- Suboptimal branch network utilization

- Inconsistent customer service protocols across merged entities

Certain segments within Provident Financial Services' loan portfolio may be categorized as Dogs if they exhibit high non-performing loan (NPL) rates and consume significant management resources without promising recovery. For instance, while Provident reported a decrease in its overall NPL ratio to 0.41% as of the first quarter of 2024, specific commercial real estate loans or certain consumer credit lines could still represent problematic areas, tying up valuable capital and yielding negligible returns.

These underperforming loan segments, despite overall portfolio improvements, represent areas where Provident Financial Services may need to re-evaluate its strategy, as such loans can drain resources that could be better allocated to growth areas.

The strategic exit from its non-relationship equipment lease financing business in December 2024, involving $151.3 million in loans, also points to a 'Dog' classification for that segment due to low market share and limited growth potential.

Similarly, the closure of 22 overlapping branches in New Jersey by August 2024, a direct result of the merger with Lakeland Bancorp, likely categorized these locations as Dogs due to low market share or inefficient operations.

Question Marks

Emerging digital lending platforms represent Provident Financial Services' foray into high-growth markets, driven by digital transformation and AI/ML adoption. These initiatives, while promising, are characterized by their unproven nature and limited market penetration, placing them squarely in the question mark category of the BCG matrix.

The potential upside is significant, as these platforms could capture substantial market share if they gain traction. However, they also demand considerable investment to develop and scale. For instance, the global digital lending market was valued at approximately $11.5 billion in 2023 and is projected to grow at a CAGR of over 20% through 2030, highlighting the market opportunity but also the competitive intensity.

Provident must strategically allocate resources to these emerging platforms, aiming to nurture them into Stars. Failure to achieve critical mass or differentiate effectively could lead to these investments becoming Dogs, requiring divestment or restructuring to mitigate losses, a common challenge for companies venturing into nascent digital spaces.

Provident Financial Services' foray into new, high-growth geographic markets beyond its established New Jersey, Pennsylvania, and New York footprint would classify as a Question Mark in the BCG Matrix. These are essentially nascent expansion efforts, akin to testing uncharted waters with a low initial market share but a significant upside for future expansion.

For instance, if Provident were to launch a specialized digital lending service in a market like Austin, Texas, known for its rapidly growing tech sector and a demographic receptive to digital financial solutions, this would represent a Question Mark. Such ventures demand substantial capital infusion and a sharp strategic focus to navigate the competitive landscape and build market presence.

By mid-2024, many regional banks were exploring expansion into Sun Belt states, which often exhibit higher population growth rates than more mature markets. For example, states like Florida and Texas have seen consistent economic expansion, making them attractive targets for financial institutions seeking new customer bases. Provident's strategic evaluation of these or similar markets for specific service offerings would place them squarely in the Question Mark category, requiring careful analysis of market receptiveness and competitive intensity.

Untapped niche commercial lending segments represent potential Question Marks for Provident Financial Services. These are markets with high growth prospects but currently low penetration for the company. For instance, consider the burgeoning market for financing specialized renewable energy infrastructure projects, which saw significant investment growth in 2024, with global investment in the sector reaching over $1.7 trillion by year-end.

Entering these nascent areas requires careful analysis and specialized product development, much like a Question Mark in the BCG matrix. Provident would need to assess the unique risk profiles and operational needs of businesses within these emerging sectors. For example, the market for financing vertical farming operations, a niche with substantial projected growth, requires understanding specific technological and operational challenges.

AI/ML Driven Product Development

Provident Financial Services' AI/ML driven product development initiatives represent a strategic push into emerging technologies. These products, while in their early stages, are designed to capitalize on high-growth trends, indicating potential for significant future returns. However, their current market share is low, placing them in the Question Marks quadrant of the BCG Matrix.

Significant investment is anticipated for these AI/ML products. For instance, industry-wide spending on AI in financial services is projected to reach $30 billion by 2025, with a substantial portion allocated to R&D and market penetration efforts. Provident Financial Services will need to allocate considerable resources to research, development, and aggressive marketing campaigns to foster market acceptance and increase their share.

- Nascent Stage Products: AI/ML driven solutions currently represent a small fraction of Provident Financial Services' product portfolio.

- High-Growth Potential: These products target rapidly expanding technological sectors, offering substantial upside if successful.

- Investment Requirement: Significant capital infusion into R&D and marketing is essential to nurture these products towards market leadership.

- Market Acceptance Uncertainty: The success of these nascent products hinges on their ability to gain traction with customers in a competitive landscape.

Fintech Partnership Initiatives

Fintech partnership initiatives for Provident Financial Services, viewed through a BCG matrix lens, could be strategically placed in the question mark category. These collaborations often aim to tap into emerging markets or customer bases where Provident's current presence is limited, such as offering embedded finance solutions through partnerships with e-commerce platforms. For instance, a 2024 initiative might involve integrating Provident's lending capabilities into a popular online marketplace, targeting a younger demographic that prefers digital-first financial interactions.

These ventures are characterized by high potential but also significant uncertainty. The success hinges on the ability to quickly gain traction and market share in these new territories. A key metric for evaluating these partnerships would be the customer acquisition cost and the lifetime value of customers acquired through these fintech channels. For example, if a partnership with a digital payment provider allows Provident to onboard 10,000 new users in its first year with a CAC of $50, this would indicate early promise for a question mark asset.

- Targeting High-Growth Areas: Partnerships with fintechs focused on areas like Buy Now, Pay Later (BNPL) or digital wealth management could position Provident to capture a share of rapidly expanding markets.

- Exploring New Customer Segments: Collaborations with fintechs serving the unbanked or underbanked populations represent an opportunity to diversify Provident's customer base.

- Uncertainty and Investment Needs: The success of these ventures is not guaranteed, requiring substantial investment in technology integration, marketing, and customer support to achieve scalability.

- Measuring Early Traction: Key performance indicators such as user adoption rates, transaction volumes, and customer satisfaction scores will be crucial in determining the future trajectory of these initiatives.

Question Marks within Provident Financial Services' portfolio represent areas of high potential growth but also significant uncertainty. These are typically new ventures or market entries where Provident has a low market share but operates in a high-growth industry. They require substantial investment to develop and scale, with the outcome uncertain.

For instance, Provident's investment in emerging digital lending platforms or expansion into new geographic regions would fall into this category. The global digital lending market was valued at approximately $11.5 billion in 2023 and is projected for substantial growth, underscoring the opportunity but also the competitive intensity these Question Marks face.

Key to managing these Question Marks is strategic resource allocation. Provident must decide whether to invest heavily to convert them into Stars or to divest if they fail to gain traction. The success of AI/ML driven product development also hinges on overcoming market acceptance hurdles, demanding significant capital for R&D and marketing to compete effectively.

| Initiative Type | Market Characteristic | Provident's Share | Investment Need | Potential Outcome |

| Digital Lending Platforms | High Growth, Emerging Tech | Low | High | Star or Dog |

| New Geographic Expansion | High Growth Potential | Low | High | Star or Dog |

| AI/ML Product Development | High Growth, Nascent Tech | Low | High | Star or Dog |

| Fintech Partnerships | High Growth, New Segments | Low | High | Star or Dog |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data from Provident Financial Services' annual reports and investor relations, alongside industry research from reputable financial analysts and market growth forecasts to ensure reliable, high-impact insights.