Prosus SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Prosus Bundle

Prosus, a global consumer internet group, boasts significant strengths in its diversified portfolio, particularly in e-commerce and fintech. However, understanding the nuances of its market position, potential threats, and untapped opportunities requires a deeper dive.

Want the full story behind Prosus's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Prosus boasts a highly diversified investment portfolio, spanning crucial consumer internet sectors such as online marketplaces, payments and fintech, food delivery, and education technology. This broad exposure across dynamic industries is a significant strength, allowing the company to tap into multiple avenues of growth.

The company's strategic emphasis on high-growth emerging markets, including Latin America, India, and Europe, is a key differentiator. By focusing on these regions, Prosus positions itself to benefit from accelerating digital adoption and expanding consumer bases, mitigating risks associated with over-reliance on any single market.

Prosus's approach of investing in and nurturing local market leaders further solidifies its diversified strategy. This focus on strong, established local players in their respective markets, rather than solely pursuing global giants, provides a robust foundation for sustained growth and market penetration.

Prosus has shown a remarkable financial turnaround, with its e-commerce segment achieving its first adjusted EBIT profit in FY25, surpassing expectations. This marks a significant step towards sustained profitability for the company.

Furthermore, Prosus generated positive free cash flow for the first time, excluding dividends from Tencent. This financial health is bolstered by a robust balance sheet featuring considerable cash reserves, positioning the company for strategic growth and share repurchases.

Prosus is making a significant pivot under new leadership, moving away from being a passive investor to actively operating and growing its core e-commerce ventures. This strategic shift is designed to build and scale these businesses more effectively, aiming for greater control and direct impact on performance.

A key element of this new direction is an aggressive integration of AI and machine learning across Prosus's platforms. This focus on an AI-first approach is intended to unlock significant gains in operational efficiency, personalize user experiences, and foster innovation, thereby establishing a distinct competitive edge in the market.

Value Creation through Share Repurchase Programs

Prosus has consistently returned capital to shareholders through its share repurchase program. For instance, in the first half of fiscal year 2024, Prosus repurchased $1.1 billion worth of its own shares, further reducing the free float and enhancing net asset value (NAV) per share.

This strategy, coupled with Tencent's buybacks, actively works to close the persistent discount between Prosus's market value and the underlying value of its assets, particularly its stake in Tencent. This focus on shareholder returns is a key strength, directly impacting shareholder wealth.

- Active Share Repurchases: Prosus has consistently executed an open-ended share repurchase program, significantly reducing its outstanding shares.

- NAV Accretion: These buybacks directly contribute to an increase in net asset value (NAV) per share, benefiting existing shareholders.

- Discount Narrowing: The program, alongside Tencent's buybacks, aims to reduce the historical discount between Prosus's market capitalization and its underlying asset value.

- Shareholder Value Focus: The commitment to returning capital demonstrates a clear strategy to enhance shareholder returns.

Established Ecosystem and Global Reach

Prosus boasts an impressive global footprint, with its investments touching approximately 2 billion customers across roughly 80 countries. This extensive reach, cultivated through strategic investments in over 100 companies, creates a powerful and interconnected technology ecosystem.

This established ecosystem facilitates valuable knowledge sharing and the cross-pollination of best practices among its diverse portfolio companies. Leveraging this scale allows Prosus to enhance growth trajectories and deepen market penetration in critical global regions.

- Global Presence: Serves approximately 2 billion customers in around 80 countries.

- Portfolio Size: Holds investments in over 100 companies.

- Ecosystem Synergy: Enables knowledge sharing and best practice adoption across its ventures.

- Scalability: Utilizes its broad reach to drive growth and market penetration.

Prosus's significant diversification across consumer internet sectors, including online marketplaces, payments, food delivery, and edtech, provides resilience and multiple growth avenues. Its strategic focus on high-growth emerging markets like Latin America and India, coupled with investments in local market leaders, positions it for substantial expansion. The company's financial turnaround, marked by its e-commerce segment achieving its first adjusted EBIT profit in FY25 and generating positive free cash flow, underscores its strengthening financial health.

Prosus is actively transforming into an operator, integrating AI across its platforms to boost efficiency and user experience, creating a competitive advantage. Its consistent capital return to shareholders through substantial share repurchases, such as $1.1 billion in H1 FY24, directly enhances NAV per share and aims to narrow the discount to its underlying asset value. This active management and shareholder focus are key strengths.

The company's extensive global footprint, reaching approximately 2 billion customers in around 80 countries through over 100 investments, fosters a powerful technology ecosystem. This scale facilitates knowledge sharing and the adoption of best practices, driving growth and market penetration across its diverse portfolio.

What is included in the product

This SWOT analysis provides a comprehensive overview of Prosus's strategic positioning, detailing its internal strengths and weaknesses alongside external market opportunities and threats.

Offers a clear, actionable SWOT analysis for Prosus, pinpointing key growth drivers and potential risks to inform strategic decisions.

Weaknesses

Prosus's significant reliance on its substantial investment in Tencent Holdings remains a notable weakness. Despite strategic moves to expand its e-commerce ventures, the company's overall valuation and financial performance are still heavily tethered to Tencent's trajectory.

This concentration creates a vulnerability to the inherent fluctuations within the Chinese market. Any adverse regulatory shifts or geopolitical tensions affecting Tencent directly translate into considerable risk for Prosus's financial health and market standing.

Prosus's ambitious growth strategy, often involving large-scale acquisitions, frequently encounters significant regulatory hurdles. For instance, the proposed acquisition of Just Eat Takeaway.com faced intense scrutiny from the EU's antitrust authorities, highlighting the potential for delays or even outright blocking of deals. This regulatory oversight can impede the timely realization of anticipated synergies and force divestitures, thereby complicating strategic execution and impacting financial performance.

Prosus's aggressive acquisition strategy, aimed at building diverse digital ecosystems, carries significant integration risks. Integrating large, complex entities such as Just Eat Takeaway.com, acquired for approximately $7.3 billion in 2021, and Despegar, presents substantial operational hurdles. These mergers require immense management bandwidth and can strain financial and human resources, potentially impacting the performance of both the acquired and acquiring entities.

Exposure to Emerging Market Volatility

Prosus's significant presence in emerging markets, while a driver of growth, also exposes it to considerable volatility. Fluctuations in inflation, currency exchange rates, and geopolitical instability in these regions can directly impact consumer purchasing power and the operational efficiency of its invested companies. For instance, in late 2024 and early 2025, several key emerging markets experienced heightened currency depreciation against major currencies, potentially eroding the reported value of Prosus's investments in those areas.

These macroeconomic headwinds can create a challenging environment for sustained profitability. For example, a sharp rise in inflation in a market like India or Brazil could reduce discretionary spending on online services and e-commerce, directly affecting the revenue streams of Prosus's portfolio businesses such as OLX or iFood. This sensitivity to external economic shocks is a key weakness.

- Exposure to Inflation: Rising inflation in key markets like Brazil and India can dampen consumer spending on digital services.

- Currency Volatility: Depreciation of emerging market currencies can negatively impact the translated value of Prosus's investments.

- Geopolitical Risks: Political instability in certain regions can disrupt business operations and investor confidence.

Intense Competition in Key Segments

Prosus faces significant headwinds in its core operating segments, particularly in food delivery and e-commerce, where it contends with formidable global players like Uber Eats and DoorDash, as well as aggressive local competitors. This crowded marketplace in 2024 and projected into 2025 means Prosus must constantly innovate and invest heavily in marketing and customer acquisition to maintain market share.

The intense competition directly impacts Prosus's financial performance. For instance, in the food delivery sector, increased promotional activity and competitive pricing strategies by rivals can compress take rates, which are the fees Prosus earns per order. This pressure on unit economics, evident in the ongoing battles for market dominance across various geographies, necessitates substantial operational expenditure, potentially hindering profitability growth.

- Food Delivery: Faces intense rivalry from global giants and well-funded local players, leading to pricing wars.

- Payments: Competes with established financial institutions and emerging fintech solutions, requiring continuous investment in technology and user experience.

- Classifieds: Navigates a landscape with dominant global platforms and specialized local sites, demanding differentiation through unique features and targeted marketing.

- Profitability Impact: Increased marketing spend and pricing pressures directly affect take rates and overall profitability in key segments.

Prosus's significant reliance on Tencent Holdings, representing a substantial portion of its asset value, creates a concentrated risk. Any downturn in Tencent's performance or regulatory challenges in China directly impacts Prosus's financial health. This dependency limits diversification benefits and exposes the company to specific market risks.

The company's aggressive acquisition strategy, while aimed at growth, often encounters substantial regulatory scrutiny, potentially delaying or blocking key deals. Integrating these acquired businesses also presents considerable operational challenges, straining resources and management bandwidth. Furthermore, Prosus's exposure to emerging markets makes it vulnerable to currency fluctuations, inflation, and geopolitical instability, impacting consumer spending and investment values.

Intense competition in its core segments, particularly food delivery and e-commerce, forces continuous heavy investment in marketing and innovation. This competitive pressure can compress profitability by driving down take rates and increasing operational costs.

Same Document Delivered

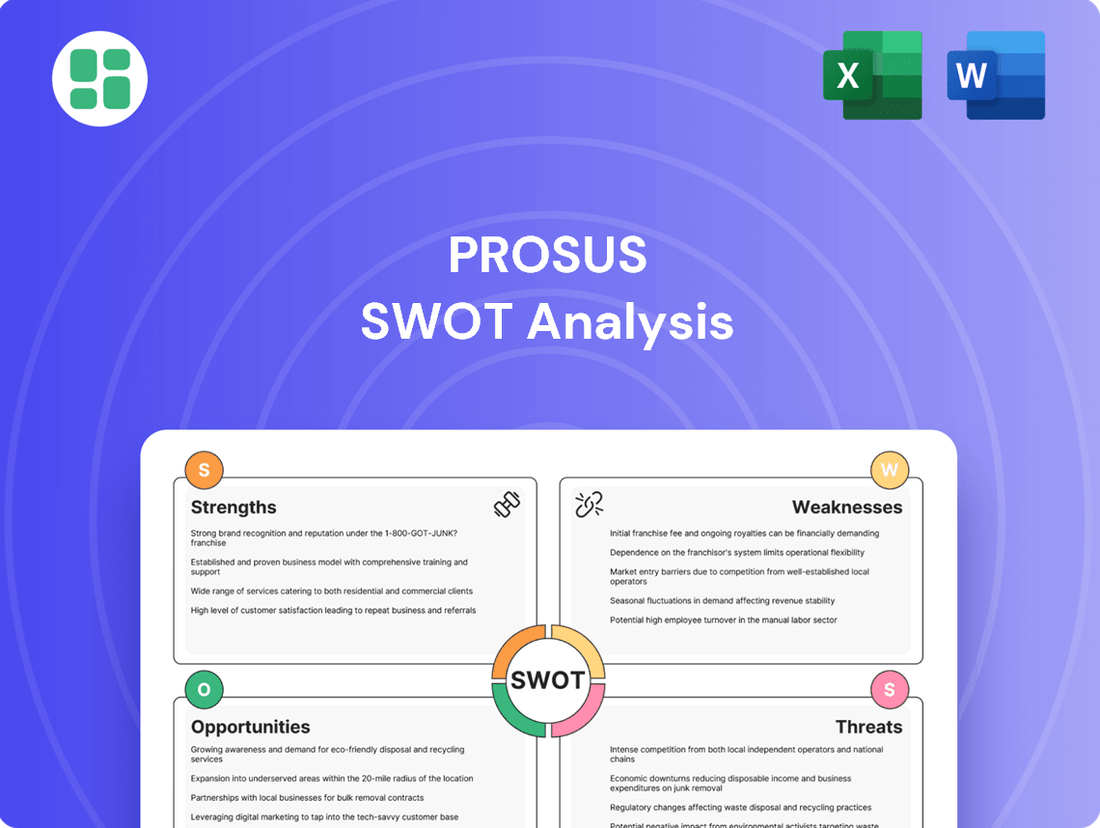

Prosus SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of Prosus's strategic positioning.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version, allowing you to tailor the insights to your specific needs.

Opportunities

Prosus has a significant opportunity to tap into burgeoning high-growth sectors, building upon its established e-commerce infrastructure and user engagement. This strategic move involves expanding its footprint in quick commerce, as exemplified by its investment in Instamart, and further developing its grocery delivery services.

The company can also explore emerging markets that complement its 'lifestyle e-commerce' strategy, potentially entering new verticals where its existing technological prowess and customer data can be leveraged for rapid scaling. For instance, by the end of 2024, the global quick commerce market was projected to reach over $30 billion, presenting a substantial avenue for growth.

Prosus's AI-first strategy offers a prime opportunity to embed advanced AI and machine learning across its extensive data-rich platforms. This integration can unlock significant gains in operational efficiency, deliver highly tailored user experiences, and foster the creation of innovative AI-driven products and services. By leveraging AI, Prosus can boost user engagement and achieve greater cost optimization across its diverse portfolio.

Prosus's robust financial standing and disciplined investment strategy create significant opportunities for strategic acquisitions and partnerships. This allows them to fortify existing regional ecosystems and solidify market leadership.

These moves can accelerate growth in core sectors, building on past successes like their investments in Despegar and Just Eat Takeaway.com. Such integrations are key to expanding their market reach and competitive edge.

Capitalizing on Digital Transformation Trends

The relentless global digital transformation, especially in burgeoning economies, acts as a significant tailwind for Prosus. As internet access and smartphone usage climb, and a younger, digitally savvy demographic expands, the stage is set for greater adoption of e-commerce, fintech, and various online services. For instance, Prosus's e-commerce segment, which includes operations like OLX and Avito, benefits directly from this trend, with online classifieds usage showing consistent growth. In 2024, emerging markets are projected to see continued surges in e-commerce sales, with some regions experiencing double-digit year-over-year growth, directly impacting Prosus's revenue streams.

This digital shift fuels opportunities across Prosus's diverse portfolio. The increasing reliance on online platforms for shopping, payments, and communication creates a fertile ground for expanding its e-commerce and fintech ventures. Prosus's investment in PayU, a leading payments provider, is particularly well-positioned to capture this growth, as digital payment volumes continue to escalate worldwide. By 2025, it's anticipated that over 70% of all transactions in many emerging markets will be digital, a trend Prosus is actively leveraging.

- Expanding E-commerce Reach: Prosus can further penetrate emerging markets by enhancing its online marketplace offerings, catering to the growing demand for digital goods and services.

- Fintech Growth: The rise of digital payments and online financial services presents a significant opportunity for Prosus's fintech arm, PayU, to increase market share and introduce innovative solutions.

- Digital Services Adoption: Increased internet penetration and smartphone ownership drive the adoption of online education, food delivery, and other digital services, areas where Prosus has strategic investments.

Monetization of Investment Portfolio Beyond Tencent

Prosus has a significant opportunity to demonstrate the value within its extensive e-commerce holdings, moving beyond the shadow of its substantial Tencent investment. By focusing on achieving consistent profitability across its various online retail and classifieds segments, Prosus can begin to close the persistent discount between its net asset value and market capitalization.

This strategic pivot involves not only operational improvements but also potentially unlocking further value through public offerings. For instance, a successful Initial Public Offering (IPO) for a key asset like PayU, Prosus's fintech arm, could provide a substantial boost. In 2023, PayU processed over $100 billion in payments, showcasing its considerable scale and potential. Such a move would not only realize value but also offer greater transparency into the performance of these individual businesses.

- Unlock E-commerce Value: Prosus can highlight its diverse e-commerce portfolio, which includes businesses like OLX and Delivery Hero, to showcase growth potential beyond Tencent.

- Achieve Profitability: Driving consistent profitability in its core e-commerce operations is crucial for demonstrating underlying business strength and reducing the Net Asset Value (NAV) discount.

- Strategic IPOs: Pursuing IPOs for strong, standalone entities within the portfolio, such as PayU, could unlock significant shareholder value and provide clearer valuations for these assets.

- Financial Performance: Prosus reported a 31% increase in core e-commerce revenue for the first half of 2024, indicating positive momentum in these segments.

Prosus is well-positioned to capitalize on the accelerating global digital transformation, particularly in emerging markets. Increased internet penetration and smartphone adoption directly fuel growth in e-commerce and fintech, areas where Prosus has significant investments like OLX and PayU.

The company can further leverage its AI-first strategy to enhance user experiences and operational efficiency across its platforms, unlocking new revenue streams and cost savings. By focusing on profitability within its e-commerce segments, Prosus can work to close the discount between its Net Asset Value and market capitalization, potentially through strategic IPOs of key assets like PayU.

Opportunities also lie in expanding its quick commerce and grocery delivery services, as seen with Instamart, tapping into the substantial growth projected for these sectors. For instance, the quick commerce market was expected to exceed $30 billion by the end of 2024.

Prosus's financial strength allows for strategic acquisitions and partnerships, enabling it to consolidate its market position and accelerate growth in its core businesses.

| Opportunity Area | Description | Supporting Data/Trend |

| Emerging Market Digitalization | Capitalize on increasing internet and smartphone usage for e-commerce and fintech growth. | Emerging markets projected for double-digit e-commerce sales growth in 2024. By 2025, over 70% of transactions in many emerging markets expected to be digital. |

| AI Integration | Enhance user experience and operational efficiency through AI across platforms. | AI-first strategy aims to boost user engagement and cost optimization. |

| E-commerce Value Unlocking | Demonstrate value in e-commerce holdings beyond Tencent, improve profitability. | Prosus reported a 31% increase in core e-commerce revenue (H1 2024). PayU processed over $100 billion in payments (2023). |

| Quick Commerce & Grocery Delivery | Expand presence in high-growth quick commerce and grocery delivery sectors. | Global quick commerce market projected to exceed $30 billion by end of 2024. |

Threats

Governments worldwide are tightening their grip on major tech players, with a particular focus on market power, data protection, and fair competition. This intensified scrutiny poses a significant threat to companies like Prosus, which operate in highly regulated digital spaces.

Antitrust concerns, especially around market dominance, could lead to substantial fines or even mandated restructuring, directly impacting Prosus's ability to pursue strategic acquisitions and growth initiatives. For instance, the European Union's Digital Markets Act (DMA), which came into effect in March 2024, imposes stringent obligations on gatekeeper platforms, potentially affecting how Prosus's portfolio companies operate and interact with users.

Data privacy regulations, such as GDPR and its global counterparts, continue to evolve, demanding robust compliance measures and potentially limiting data utilization strategies. Non-compliance can result in hefty penalties; for example, fines under GDPR can reach up to 4% of annual global turnover.

Escalating geopolitical tensions, especially between the U.S. and China, present a considerable threat to Prosus given its significant investment in Tencent. These tensions can manifest as sanctions or investment restrictions, potentially devaluing Tencent and thus impacting Prosus's net asset value.

The ongoing trade disputes could disrupt global supply chains and dampen consumer spending, indirectly affecting the performance of Prosus's diverse portfolio companies, including those in e-commerce and fintech sectors. For instance, a slowdown in the Chinese market, a key region for many Prosus investments, due to trade friction, could directly impact revenue streams.

Global economic slowdowns, potentially impacting major markets like Europe and Asia, pose a significant threat. Persistent inflation, as seen in rising consumer price indices across many regions in 2023 and early 2024, directly erodes discretionary spending, which is crucial for Prosus's e-commerce and online services.

This reduced consumer purchasing power could lead to lower transaction volumes and average order values across its portfolio companies, impacting revenue growth and potentially squeezing profit margins if operating costs remain elevated due to inflation.

Increased Competition and Market Saturation

As high-growth markets mature, competition for Prosus's portfolio companies is intensifying, particularly in segments like e-commerce and fintech. This increased rivalry can lead to market saturation, making it harder to gain new customers and maintain growth rates.

Prosus faces the threat of aggressive pricing strategies from both established players and new entrants. This could pressure profit margins across its diverse portfolio, especially in regions where market share is fiercely contested. For instance, in 2024, the online retail sector saw an average price reduction of 8% across key markets due to competitive pressures.

The need for increased marketing spend to stand out in crowded markets is another significant threat. Companies within the Prosus ecosystem may find their customer acquisition costs rising, impacting overall profitability. This trend is evident as marketing budgets for digital platforms increased by an average of 15% year-over-year leading into 2025.

- Intensified Competition: High-growth markets are maturing, leading to increased competition in e-commerce and fintech.

- Market Saturation: Saturation in certain segments could slow down customer acquisition and growth for Prosus's investments.

- Margin Erosion: Aggressive pricing and higher marketing expenditures threaten to reduce profit margins.

- New Entrants: The influx of new competitors can further fragment markets and challenge existing market shares.

Valuation Discount Persistence

The persistent valuation discount of Prosus, often referred to as a holding company discount, continues to be a significant threat. Even with strategic moves like share buybacks and operational improvements, the market's valuation of Prosus often lags behind the sum of its parts, particularly its substantial stake in Tencent. For instance, as of early 2024, the discount remained a notable concern for investors seeking to capture the full value of Prosus's diverse assets.

Investor sentiment and a potential underappreciation of Prosus's broader portfolio, which extends beyond Tencent to include stakes in various e-commerce and fintech businesses, could hinder its share price from accurately reflecting its intrinsic worth. This skepticism can lead to a sustained undervaluation, limiting the potential for capital appreciation and impacting overall shareholder returns.

Key aspects of this threat include:

- Persistent Holding Company Discount: Prosus's market capitalization frequently trades at a discount compared to the estimated value of its underlying investments, notably its significant holding in Tencent.

- Investor Skepticism: A lack of full market recognition for the value and potential of Prosus's diversified global portfolio, beyond its most prominent holdings, contributes to the discount.

- Limited Value Realization: Efforts to return value to shareholders, such as buybacks, may not fully counteract the market's tendency to discount the conglomerate structure.

Intensified regulatory scrutiny globally poses a significant risk, with governments focusing on market power and data protection, potentially impacting Prosus's operations and strategic flexibility. The EU's Digital Markets Act, effective March 2024, exemplifies this, imposing strict rules on digital gatekeepers. Furthermore, evolving data privacy laws like GDPR, with penalties up to 4% of global turnover for non-compliance, demand constant vigilance.

Geopolitical tensions, particularly between the U.S. and China, threaten Prosus's substantial Tencent investment, risking devaluation due to sanctions or restrictions. Economic slowdowns and persistent inflation, evident in rising consumer price indices throughout 2023-2024, also dampen discretionary spending crucial for Prosus's e-commerce and online services, potentially reducing transaction volumes and squeezing profit margins.

Intensifying competition in maturing high-growth markets like e-commerce and fintech presents a threat of market saturation, hindering customer acquisition and growth. Aggressive pricing strategies and increased marketing expenditures, with digital platform marketing budgets rising an average of 15% year-over-year into 2025, could erode profit margins across the portfolio. New entrants further fragment markets, challenging existing market shares.

The persistent holding company discount remains a key concern, with Prosus's market valuation often failing to reflect the sum of its parts, notably its significant Tencent stake. As of early 2024, this discount persisted, indicating investor skepticism towards the broader portfolio's value and limiting capital appreciation potential.

SWOT Analysis Data Sources

This Prosus SWOT analysis is built upon a robust foundation of data, drawing from the company's official financial reports, comprehensive market research across its diverse portfolio, and expert analyses of the global technology and e-commerce landscape.