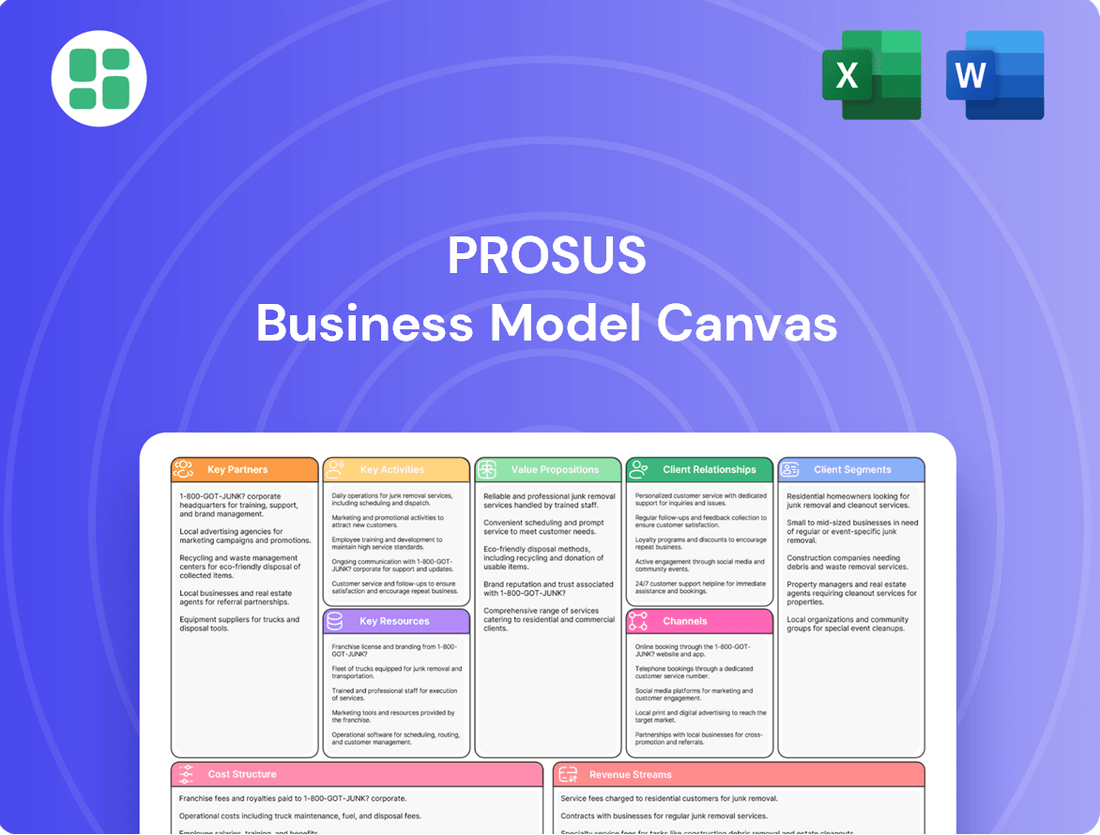

Prosus Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Prosus Bundle

Unlock the strategic blueprint behind Prosus's diversified global operations. This comprehensive Business Model Canvas dissects how Prosus leverages its vast portfolio of internet and technology businesses to create and capture value. Discover their key customer segments, unique value propositions, and robust revenue streams.

Ready to understand the engine driving Prosus's success? Dive into the full Business Model Canvas, revealing their critical partnerships, core activities, and cost structure. This detailed analysis is your key to grasping their growth strategy and competitive advantage.

Gain a competitive edge by studying Prosus's proven business model. Our downloadable canvas provides an in-depth look at their customer relationships, channels, and key resources, offering actionable insights for your own strategic planning. Get the full picture today!

Partnerships

Prosus's core strategy revolves around identifying and nurturing high-growth internet companies, transforming them into vital strategic partners. These relationships are foundational, with Prosus offering more than just financial backing; it provides crucial strategic advice, operational know-how, and leverage from its extensive global network.

The performance and expansion of Prosus are intrinsically linked to the success of these portfolio companies. For instance, in 2023, Prosus reported a substantial increase in its net asset value (NAV) per share, largely driven by the robust performance of its key investments like Tencent and Delivery Hero.

Prosus actively partners with leading technology providers to embed advanced AI capabilities across its diverse portfolio. This strategic move aims to streamline operations, cut expenses, and elevate customer interactions within its various platforms. For instance, its investment in AI startups and collaborations with cloud service providers bolster its ability to innovate and deliver cutting-edge solutions.

Prosus actively cultivates partnerships with local market players and entrepreneurs to facilitate entry and expansion in dynamic, high-growth regions. This strategy is crucial for navigating diverse market landscapes and ensuring alignment with domestic objectives.

By supporting local entrepreneurs, Prosus taps into their intimate knowledge of local market nuances, a critical advantage for scaling operations. This is clearly demonstrated in their substantial investments in markets such as India and Brazil, where these collaborations are paramount.

In 2024, Prosus continued to emphasize these local alliances. For instance, their portfolio company, Delivery Hero, which operates in numerous global markets, relies heavily on local partnerships to optimize delivery networks and customer engagement, reflecting the broader Prosus strategy.

Regulatory Bodies and Governments

Prosus’s ability to navigate the complex and varied regulatory environments across its global markets is a critical component of its success. By actively engaging with and adhering to the requirements of governments and regulatory bodies, Prosus can ensure its operations remain compliant, facilitating smoother market entry and expansion opportunities.

This proactive approach is crucial for managing potential risks and fostering trust with stakeholders. For instance, in 2024, Prosus, like many large tech conglomerates, continued to be under scrutiny from various antitrust regulators globally, particularly concerning its significant stakes in companies like Tencent, requiring ongoing dialogue and compliance efforts.

- Compliance and Market Access: Adherence to diverse national regulations, including data privacy laws and competition policies, is paramount for Prosus's international business model.

- Government Relations: Maintaining open communication channels with governments fosters a stable operating environment and aids in securing necessary approvals for mergers and acquisitions.

- Addressing Regulatory Concerns: Prosus actively manages relationships with bodies like the European Commission, addressing concerns related to market concentration and digital platform competition, as seen in ongoing discussions around major acquisitions in the tech sector.

Co-investors and Financial Institutions

Prosus actively cultivates relationships with co-investors and financial institutions, a strategy that significantly amplifies its investment capacity and risk diversification. For instance, in 2024, Prosus participated in several large funding rounds alongside prominent venture capital firms, injecting substantial capital into promising technology companies. These collaborations are crucial for backing major acquisitions and providing essential growth capital to its diverse portfolio companies.

These strategic alliances extend beyond mere capital infusion. Prosus leverages partnerships with financial institutions to enhance its fintech offerings. This includes integrating advanced payment processing solutions and developing innovative credit facilities for users of its platforms, thereby strengthening its competitive position in the digital payments and financial services sectors. In 2024, these fintech ventures saw significant growth, partly attributed to these collaborative financial infrastructure developments.

Key aspects of these partnerships include:

- Access to Extended Capital Pools: Co-investment allows Prosus to participate in larger deals than it might undertake alone, spreading financial exposure.

- Risk Mitigation: Sharing investment risk with other reputable firms reduces the potential impact of any single investment underperforming.

- Synergistic Expertise: Partnering firms often bring complementary market knowledge and operational expertise, benefiting portfolio companies.

- Fintech Integration: Collaborations with financial institutions are vital for building robust payment and credit ecosystems within Prosus's digital platforms.

Prosus’s key partnerships are vital for its growth, encompassing technology providers, local market players, and financial institutions. These collaborations provide capital, expertise, and market access, crucial for scaling its diverse portfolio of internet businesses.

In 2024, Prosus continued to leverage co-investments to participate in larger funding rounds, enhancing its investment capacity and diversifying risk. For instance, its significant stake in Delivery Hero relies on local partnerships for operational efficiency and customer engagement across numerous global markets.

Strategic alliances with financial institutions are also central, particularly for strengthening fintech offerings through integrated payment solutions and credit facilities. These partnerships are instrumental in driving growth within Prosus's digital platforms.

| Partner Type | Role/Benefit | Example/Impact |

|---|---|---|

| Technology Providers | AI integration, operational efficiency | Enhancing customer interaction and innovation across portfolio companies. |

| Local Market Players | Market access, local knowledge | Facilitating expansion in high-growth regions like India and Brazil. |

| Co-investors/Financial Institutions | Capital amplification, risk diversification | Enabling participation in larger deals and supporting fintech ventures. |

What is included in the product

Prosus's Business Model Canvas outlines its strategy of investing in and operating e-commerce and internet businesses, focusing on diverse customer segments like online shoppers and content consumers through various digital channels.

This model details Prosus's value propositions centered on convenience, access, and innovation, supported by key resources and activities in technology and talent acquisition.

The Prosus Business Model Canvas offers a structured approach to pinpointing and addressing strategic challenges within its diverse portfolio.

It provides a clear, visual framework to identify and alleviate operational bottlenecks across its various ventures.

Activities

Prosus actively scouts for and invests in internet companies with significant expansion potential, a core part of its strategy. This involves deep dives into market trends and thorough vetting of potential acquisitions and stakes.

In 2024, Prosus continued its focus on sectors like online classifieds, payments, and food delivery. For instance, its stake in Delivery Hero, a global food delivery platform, demonstrated its commitment to this segment. Prosus's investment in Prosus NV's e-commerce portfolio, including its significant holding in Tencent, underscores its long-term growth strategy.

Prosus goes beyond just funding, offering crucial strategic and operational assistance to its portfolio companies. This support helps them grow, become more profitable, and overcome market hurdles. For instance, in 2024, Prosus continued to leverage its expertise in digital platforms to guide companies like Delivery Hero in optimizing their operations and expanding their market reach.

The company provides access to its extensive global network, connecting portfolio businesses with potential partners, talent, and best practices. This collaborative approach fosters innovation and accelerates growth, as seen with Prosus's involvement in supporting e-commerce ventures in emerging markets to enhance their customer acquisition strategies.

Prosus focuses on building enduring relationships, aiming for sustainable, long-term growth within its invested companies. Their commitment is evident in the ongoing mentorship and resource allocation provided to businesses, such as those in the online education sector, to adapt to evolving consumer demands and technological advancements.

Prosus actively manages its diverse investment portfolio, focusing on enhancing the performance of its existing holdings to drive shareholder value. This includes strategic decisions like divesting underperforming or non-core assets and implementing share repurchase programs to boost earnings per share.

In 2024, Prosus continued its commitment to optimizing its e-commerce segments, a key area for value creation. The company consistently analyzes its portfolio to identify opportunities for growth and profitability, ensuring resources are allocated to the most promising ventures.

Developing and Integrating Technology and AI Solutions

A core activity for Prosus involves developing and integrating cutting-edge technology, with a strong emphasis on Artificial Intelligence, throughout its wide range of portfolio companies. This commitment to an 'AI-first' strategy drives improvements in how these businesses operate and interact with customers.

Prosus actively utilizes AI to enhance operational efficiency and customer experiences. For instance, AI is employed in areas like optimizing delivery routes for food platforms or bolstering fraud detection mechanisms within its fintech ventures. This strategic application of AI is fundamental to maintaining a competitive edge.

- AI-driven operational enhancements: Prosus aims to streamline processes, reduce costs, and improve service delivery across its investments through AI.

- Customer experience innovation: Leveraging AI for personalized services, better support, and more intuitive user interfaces is a key focus.

- Data analytics and insights: Developing capabilities to extract actionable insights from vast datasets using AI fuels strategic decision-making and product development.

- Platform integration and scalability: Ensuring that AI solutions can be seamlessly integrated and scaled across different business units and geographies is a critical operational activity.

Market Research and Ecosystem Building

Prosus dedicates significant resources to market research, actively identifying high-growth sectors and emerging technological trends. This proactive approach is crucial for their investment strategy, ensuring they capitalize on future market opportunities. For instance, in 2023, Prosus continued to invest heavily in areas like e-commerce and fintech, reflecting their commitment to forward-looking market analysis.

Building interconnected ecosystems is a core activity. Prosus strategically expands its existing platforms, like food delivery services, into adjacent areas such as grocery delivery and fintech solutions. This strategy, exemplified by their investments in companies like Delivery Hero and iFood, aims to create synergistic value and enhance customer engagement across their portfolio. By late 2023, the company’s focus remained on deepening these ecosystem integrations to unlock further growth potential.

- Market Research: Prosus actively monitors global tech trends and consumer behavior to pinpoint lucrative investment opportunities, particularly in emerging markets.

- Ecosystem Development: The company fosters synergy by integrating services within its core platforms, such as expanding food delivery into grocery and financial services.

- Strategic Investments: Prosus's market research informs its investment decisions, leading to strategic capital allocation in high-potential sectors like e-commerce and fintech.

- Value Creation: By building interconnected ecosystems, Prosus aims to enhance customer loyalty and create diversified revenue streams across its portfolio companies.

Prosus's key activities revolve around identifying and investing in high-growth internet and technology companies globally. This includes rigorous market analysis to pinpoint promising sectors and technologies, such as e-commerce, fintech, and online classifieds. The company actively manages its portfolio, aiming to enhance the performance of its existing investments and drive shareholder value.

A significant focus is placed on leveraging artificial intelligence across its portfolio to improve operational efficiency and customer experiences. Prosus also concentrates on building interconnected ecosystems within its businesses, expanding services to create synergistic value and customer loyalty. This strategic approach is supported by continuous market research and the development of new technological capabilities.

| Key Activity | Description | 2024 Focus/Example |

| Investment Scouting & Acquisition | Identifying and investing in high-potential internet companies. | Continued focus on e-commerce, payments, and food delivery sectors. |

| Portfolio Management & Optimization | Enhancing the performance of existing holdings and strategic divestments. | Optimizing e-commerce segments for growth and profitability. |

| AI Integration & Development | Implementing AI to boost operational efficiency and customer engagement. | Utilizing AI for route optimization in food delivery and fraud detection in fintech. |

| Ecosystem Building | Expanding platforms into adjacent services for synergistic value. | Deepening integrations in food delivery to include grocery and financial services. |

| Market Research & Trend Analysis | Identifying emerging technologies and high-growth market opportunities. | Investing in areas like e-commerce and fintech based on forward-looking analysis. |

Preview Before You Purchase

Business Model Canvas

The Prosus Business Model Canvas you are previewing is the exact document you will receive upon purchase, offering a transparent look at the comprehensive analysis. This isn't a sample or a mockup; it's a direct representation of the final deliverable, ensuring you know precisely what you're acquiring. Once your order is complete, you'll gain full access to this identical, ready-to-use Business Model Canvas, allowing you to immediately leverage its insights for strategic planning.

Resources

Prosus commands substantial financial capital, a cornerstone of its business model enabling ambitious global investments and acquisitions. This financial muscle is crucial for seizing strategic opportunities and nurturing the expansion of its diverse portfolio companies.

The company's robust financial position, evidenced by its net cash and liquidity, serves as a significant competitive advantage in the dynamic global market. For instance, as of December 31, 2023, Prosus reported a consolidated net cash position of $3.9 billion, underscoring its capacity for significant strategic maneuvers.

A core resource for Prosus is its vast collection of prominent global internet companies and their valuable intellectual property. This diverse array includes leaders in food delivery like iFood and Swiggy, classifieds such as OLX, and payment solutions via PayU, alongside significant players in edtech.

These holdings generate varied income streams and establish strong market positions in crucial, expanding geographies. For instance, as of early 2024, Prosus’s e-commerce segment, which includes classifieds and food delivery, reported significant growth, with its food delivery business alone serving millions of customers daily across various continents.

Prosus's human capital is a cornerstone of its success, encompassing seasoned investment professionals, skilled operational experts, and cutting-edge tech talent. This diverse expertise fuels informed investment decisions and provides crucial strategic guidance to its extensive portfolio companies.

These teams are instrumental in driving technological advancements, with a notable focus on integrating artificial intelligence across operations. For instance, Prosus’s commitment to innovation is evident in its significant investments in AI startups and the adoption of AI-powered tools within its own operations.

The deep knowledge base within Prosus and its portfolio companies represents a significant competitive advantage. This collective intelligence allows for agile responses to market shifts and fosters the growth of promising ventures, as seen in the rapid expansion of its e-commerce and fintech segments in 2024.

Proprietary Data and AI Capabilities

Prosus leverages its extensive user base across companies like Delivery Hero and iFood, generating a massive pool of proprietary data. This data, a critical resource, fuels advanced AI capabilities for deep dives into consumer habits and market shifts.

These AI-driven insights are instrumental in enhancing operational efficiencies. For instance, in 2024, AI was actively deployed to refine logistics and personalize customer interactions across its platforms, aiming for better service delivery and engagement.

- Proprietary Data Generation: Millions of daily transactions across food delivery, e-commerce, and fintech platforms provide rich, real-time user behavior data.

- AI-Powered Insights: Advanced machine learning models analyze this data to predict trends, optimize pricing, and personalize user experiences.

- Operational Optimization: AI is used to improve delivery routing efficiency, reduce customer service response times, and enhance fraud detection mechanisms.

- Competitive Advantage: The continuous refinement of AI algorithms based on unique data sets creates a significant and evolving competitive edge in each market segment.

Strong Brand Reputation and Global Network

Prosus leverages its robust brand reputation as a premier global technology investor, a significant draw for high-potential startups seeking capital and strategic guidance. This established credibility is crucial for attracting quality deal flow and fostering collaborative partnerships within the tech ecosystem.

The company's expansive global network is a cornerstone of its success. This network encompasses a wide array of industry leaders, seasoned entrepreneurs, and fellow investors, enabling Prosus to effectively source, evaluate, and execute investment opportunities. Furthermore, this interconnectedness provides invaluable support for its portfolio companies.

- Brand Recognition: Prosus's name is synonymous with significant tech investments, attracting a disproportionate number of inbound opportunities.

- Global Reach: With operations and investments spanning continents, Prosus benefits from diverse market insights and a broad talent pool.

- Partnership Facilitation: The network allows Prosus to easily connect its portfolio companies with strategic partners, suppliers, and potential acquirers.

- Co-Investment Opportunities: Prosus actively participates in co-investment rounds, spreading risk and leveraging the expertise of its network partners.

Prosus's key resources are its substantial financial capital, its diverse portfolio of leading internet companies, its skilled human capital, and its proprietary data generated through AI-driven insights.

The company's financial strength, demonstrated by its significant net cash position, allows for strategic investments and acquisitions, while its portfolio companies provide varied income streams and strong market positions.

Human capital, including investment professionals and tech talent, drives informed decisions and technological advancements, particularly in AI integration.

Proprietary data, analyzed by advanced AI, offers deep consumer insights and operational optimization, creating a distinct competitive advantage.

Prosus's brand reputation and global network further enhance its ability to attract opportunities and support its portfolio companies.

| Resource Category | Key Components | Financial Year/Period | Data Point/Metric | Significance |

|---|---|---|---|---|

| Financial Capital | Net Cash and Liquidity | As of December 31, 2023 | $3.9 billion | Enables strategic maneuvers and investments. |

| Portfolio of Companies | Food Delivery (iFood, Swiggy), Classifieds (OLX), Payments (PayU) | Early 2024 | Millions of daily customers served (Food Delivery) | Diverse income streams and strong market positions. |

| Human Capital | Investment Professionals, Tech Talent | Ongoing | Focus on AI integration and adoption | Drives innovation and informed decision-making. |

| Proprietary Data & AI | User behavior data from platforms | 2024 | AI deployment for logistics and personalization | Enhances operational efficiency and competitive edge. |

| Brand & Network | Global Investor Reputation, Industry Connections | Ongoing | Attracts high-potential startups and facilitates partnerships | Drives deal flow and portfolio company support. |

Value Propositions

Prosus provides investee companies with significant capital injections, crucial for funding ambitious growth strategies and market expansion. Beyond just money, they bring invaluable operational expertise and strategic mentorship, guiding businesses through complex challenges.

This partnership unlocks rapid scaling opportunities, particularly in high-growth emerging markets, by leveraging Prosus’ extensive global network and proven track record in building successful internet ventures.

Companies partnering with Prosus benefit from an accelerated development trajectory, positioning them to achieve and solidify market leadership through this synergistic relationship.

Prosus offers consumers in emerging markets a gateway to cutting-edge online services tailored to their local needs. Think of it as having a personalized digital assistant for everything from getting your favorite meals delivered quickly to finding great deals on local goods.

Through its investments, Prosus brings a suite of convenient solutions directly to people's fingertips. In 2024, for instance, its food delivery platforms like iFood in Brazil and Delivery Hero's operations in various regions continued to expand, serving millions of users daily and streamlining access to essential services.

These services aren't just about convenience; they're about enhancing daily life and fostering community growth. By providing secure payment options and accessible edtech platforms, Prosus empowers individuals and contributes to the overall digital advancement of the regions it serves.

Prosus provides shareholders with a unique pathway to invest in a broad array of high-growth internet companies, predominantly situated in rapidly expanding economies. This diversification offers exposure to assets that are often challenging for individual investors to access directly, mitigating single-market risks.

The company's commitment to strategic, long-term investments and prudent financial management is designed to generate substantial shareholder returns. Prosus aims to achieve this through both appreciation in the value of its holdings and potential dividend distributions, reflecting a focus on sustainable value creation.

As of the first half of fiscal year 2024, Prosus's e-commerce segment, a core component of its diversified portfolio, demonstrated robust performance. For instance, its consolidated revenue from e-commerce operations grew significantly, underscoring the attractiveness of its internet asset holdings in emerging markets.

For Founders and Entrepreneurs: Long-Term Strategic Partnership

For founders and entrepreneurs, Prosus offers a long-term strategic partnership, going beyond simple financial investment. They provide crucial resources and guidance, leveraging their expertise in scaling internet businesses to help ventures achieve their full potential.

This collaborative approach fosters robust relationships and mutual growth, as evidenced by Prosus's successful incubation and scaling of companies like Delivery Hero, which saw significant revenue growth, reaching €6.2 billion in 2023.

- Strategic Alignment Prosus seeks ventures with long-term growth potential, aligning its investment strategy with the entrepreneurial vision.

- Operational Support They offer hands-on operational expertise, drawing from their experience with global internet leaders.

- Capital Infusion Prosus provides substantial capital, enabling aggressive expansion and market penetration.

- Global Network Access Founders gain access to Prosus's extensive global network, facilitating international growth and partnerships.

For Ecosystems: Fostering Digital Economic Growth and Innovation

Prosus actively fuels digital economic expansion and innovation across its operating regions. By strategically investing in and scaling technology ventures, the company cultivates job creation, enhances digital infrastructure, and stimulates economic advancement.

This commitment translates into building integrated ecosystems that deliver holistic lifestyle experiences, benefiting consumers and businesses alike. For instance, Prosus’s investments in e-commerce and fintech platforms, such as its significant stake in Tencent, have demonstrably contributed to the digital transformation of economies, creating new avenues for commerce and services.

- Fostering Innovation: Prosus supports the development of cutting-edge technologies and digital services, driving progress in sectors like e-commerce, edtech, and fintech.

- Economic Growth Driver: Investments in companies like Delivery Hero and iFood have created thousands of jobs and boosted local economies through expanded digital services and infrastructure.

- Ecosystem Development: Prosus aims to create interconnected digital environments, offering consumers a seamless integration of services from online shopping and food delivery to financial solutions.

- Global Reach, Local Impact: The company's strategy of scaling businesses globally while adapting to local market needs ensures sustained digital economic growth and innovation across diverse geographies.

Prosus acts as a powerful catalyst for its investee companies, providing not just substantial capital but also deep operational expertise and strategic guidance. This dual approach accelerates growth, especially in emerging markets, by leveraging Prosus’s extensive global network and proven success in scaling internet businesses.

Companies partnering with Prosus experience a significantly enhanced development trajectory, positioning them to achieve and solidify market leadership through this synergistic relationship.

Prosus offers consumers in emerging markets access to essential digital services, improving daily life and fostering community growth through convenient platforms and secure payment options.

Customer Relationships

Prosus views its relationships with investee companies as strategic partnerships, not just financial transactions. This means actively engaging to share expertise and operational support, aiming for sustained mutual growth.

In 2024, Prosus continued to emphasize this collaborative approach. For instance, its investment in Delivery Hero, a global food delivery platform, exemplifies this by providing ongoing strategic guidance and operational best practices, contributing to Delivery Hero's continued market presence.

This long-term perspective is crucial for building value. Prosus's commitment to fostering trust and a shared vision ensures that its portfolio companies are well-positioned for future success and innovation.

Prosus’s portfolio companies, like Delivery Hero and Tencent, directly manage customer relationships, prioritizing user experience and satisfaction. This often involves localized services and robust support channels to foster loyalty. For instance, Delivery Hero actively uses customer feedback to refine its app and delivery processes, aiming for higher ratings and repeat business.

These companies continuously invest in product improvement, such as enhancing app features or expanding service offerings, to maintain engagement. Prosus’s strategic focus on AI integration further aims to personalize user interactions and proactively address customer needs, thereby strengthening these crucial relationships across diverse markets.

Prosus prioritizes clear and consistent communication with its investors and shareholders. This is achieved through dedicated investor relations efforts, detailed quarterly and annual earnings reports, and active participation in annual general meetings. For example, in its fiscal year 2024 reporting, Prosus provided extensive updates on its strategy and performance, reinforcing stakeholder confidence.

The company actively informs stakeholders about its financial health, strategic direction, and initiatives aimed at increasing shareholder value. This commitment to transparency builds trust and ensures everyone is on the same page regarding Prosus's business evolution and performance metrics.

Key elements in managing these relationships include the implementation of share buyback programs and clearly defined dividend policies. These actions directly impact shareholder returns and are communicated transparently as part of Prosus's value creation strategy.

Compliance and Engagement with Regulatory Bodies

Prosus actively engages in constructive dialogue with regulatory bodies and governments across its operating regions. This proactive approach is crucial for navigating the complex legal landscapes of digital businesses and ensuring ongoing operational legitimacy.

Compliance with evolving regulations, such as GDPR for data privacy and various antitrust directives, is a cornerstone of Prosus's customer relationships with governmental entities. For instance, in 2024, Prosus continued to adapt its data handling practices to align with updated privacy laws in the European Union and other key markets.

- Antitrust Compliance: Prosus addresses antitrust concerns through transparent engagement and adherence to competition laws in markets like India and Europe, where regulatory scrutiny on large tech platforms remains high.

- Data Privacy Adherence: The company ensures robust compliance with data privacy regulations, including GDPR, by implementing strict data protection measures and transparent user consent mechanisms.

- Favorable Regulatory Environment: Prosus contributes to policy discussions aimed at fostering a supportive regulatory framework for the growth of digital economies and innovative technologies.

Building Trust with Potential Investment Targets

Prosus cultivates trust with prospective investment targets by highlighting its consistent success and long-term commitment, demonstrating its ability to add significant value. This proactive approach involves deep engagement within the venture capital community, showcasing a genuine dedication to fostering entrepreneurial expansion.

Prosus's strategy emphasizes its robust financial backing and operational expertise, reassuring potential partners of stability and growth potential. By consistently delivering on its promises and offering strategic guidance, Prosus solidifies its reputation as a reliable and supportive investor.

- Proven Track Record: Prosus has a history of successful investments, including significant contributions to companies like Delivery Hero and Tencent, demonstrating its ability to identify and nurture high-growth potential.

- Long-Term Horizon: Unlike some shorter-term focused investors, Prosus signals its commitment to sustained growth, offering a stable partnership that aligns with the long-term vision of its portfolio companies.

- Value-Add Capabilities: Prosus actively engages with its investments, providing not just capital but also strategic insights, operational support, and access to its global network, thereby enhancing the target companies' prospects.

- Ecosystem Engagement: Prosus actively participates in industry events and maintains relationships within the venture capital and startup ecosystem, building brand recognition and fostering trust among entrepreneurs and founders.

Prosus's customer relationships are multi-faceted, extending from its direct interactions with investors and regulators to the indirect influence it exerts on the customer experiences of its portfolio companies.

For its investors, Prosus maintains transparency through detailed financial reporting and active engagement, as seen in its fiscal year 2024 updates. This builds trust and aligns expectations regarding value creation strategies like share buybacks.

With regulatory bodies, Prosus prioritizes compliance, adapting to data privacy laws like GDPR in 2024, and engaging transparently on antitrust matters in key markets.

Prosus also cultivates relationships with potential investment targets by showcasing its proven track record and long-term strategic support, evidenced by its continued involvement with companies like Delivery Hero.

Channels

Prosus leverages its specialized internal investment and M&A teams to actively source and execute strategic acquisitions and investments worldwide. These teams are crucial for identifying promising ventures, performing thorough due diligence, and managing the intricacies of deal structuring.

In 2024, Prosus continued to actively deploy capital through these teams. For instance, the company made significant investments in the e-commerce and food delivery sectors, reflecting its ongoing strategy to bolster its portfolio in high-growth markets. These internal capabilities allow for agile decision-making and efficient integration of new assets.

Prosus directly reaches its customers through the digital platforms and mobile applications of its portfolio companies. These apps act as the main way millions of people globally access services from brands like iFood, OLX, and PayU.

In 2024, Prosus's e-commerce and classifieds segments, which heavily rely on these digital channels, continued to show strong user engagement. For instance, iFood, a leading food delivery platform in Brazil, saw a significant increase in order volume, reflecting the growing reliance on its app for everyday needs.

Prosus actively engages its investor base and the financial community through a dedicated investor relations website, comprehensive financial reports, and timely press releases. This approach ensures transparency and effectively disseminates crucial financial and strategic updates to current and prospective shareholders.

The company's commitment to open communication is further demonstrated through proactive engagements with financial media outlets. For instance, in its fiscal year 2024 reporting, Prosus highlighted its strategic focus on e-commerce and fintech, providing detailed performance metrics that investors could analyze.

Industry Conferences and Venture Capital Ecosystem

Prosus actively participates in major industry conferences and technology summits, acting as a vital conduit for discovering emerging companies and understanding evolving market dynamics. For instance, in 2024, Prosus was a prominent presence at events like Web Summit and Slush, known for their strong venture capital and startup communities. This engagement is critical for sourcing new investment opportunities and building relationships within the global tech landscape.

The company's deep involvement in the venture capital ecosystem allows it to cultivate a robust network of entrepreneurs, fellow investors, and industry experts. This network is essential for deal flow and for gaining diverse perspectives on potential investments. Prosus leverages these connections to identify promising startups that align with its strategic focus areas, such as e-commerce and fintech.

- Networking Hubs: Industry conferences like VivaTech (Paris) and TechCrunch Disrupt (San Francisco) serve as key platforms for Prosus to connect with over 10,000 startups and investors annually, fostering deal origination.

- Trend Spotting: Participation in these events in 2024 provided Prosus with direct insights into the latest advancements in AI, sustainability tech, and the creator economy, informing its investment thesis.

- Ecosystem Integration: Prosus's active role in venture capital forums and demo days in hubs like Silicon Valley and Tel Aviv enhances its visibility and access to high-potential early-stage companies.

Corporate Website and Official Publications

The Prosus corporate website and its official publications, including annual reports and sustainability reviews, are primary channels for disseminating formal information to the public and engaging with stakeholders. These resources offer in-depth insights into the company's strategic direction, financial performance, corporate governance practices, and overall societal impact.

These platforms are crucial for transparency and building trust with investors, employees, and the wider community. For instance, Prosus's 2023 Integrated Report detailed its commitment to sustainable growth, highlighting investments in e-commerce and fintech sectors. The company reported a 20% year-on-year increase in revenue from its classifieds segment in the first half of fiscal year 2024, showcasing tangible performance metrics.

- Corporate Website: Serves as a central hub for company news, investor relations, and corporate governance information.

- Annual Reports: Provide a comprehensive overview of financial performance, strategic initiatives, and future outlook. Prosus reported a consolidated revenue of $11.1 billion for the fiscal year ended June 30, 2023.

- Sustainability Reviews: Detail the company's environmental, social, and governance (ESG) efforts and impact.

- Investor Presentations: Offer timely updates and insights into business segments and financial results, often accompanying quarterly earnings releases.

Prosus utilizes its portfolio companies' digital platforms and mobile applications to directly engage with millions of end-users globally. These channels are fundamental for delivering services from brands like iFood and OLX. In 2024, the strong performance of its e-commerce and classifieds segments, demonstrated by iFood's increased order volume in Brazil, underscores the effectiveness of these direct digital touchpoints.

Prosus actively cultivates relationships within the tech and venture capital ecosystems through participation in industry conferences and summits. Events like Web Summit and Slush in 2024 provided platforms for deal origination and trend spotting in areas like AI. This engagement is key to identifying and building connections with promising startups.

The company maintains transparency and communicates with its investor base and the financial community via its investor relations website, financial reports, and press releases. This approach ensures stakeholders are informed about strategic updates and financial performance, as seen in its fiscal year 2024 reporting which emphasized e-commerce and fintech growth.

Prosus's corporate website and publications, including its 2023 Integrated Report, serve as primary channels for formal information dissemination. These resources detail strategic direction and financial performance, such as the 20% year-on-year revenue increase in its classifieds segment during the first half of fiscal year 2024.

| Channel Type | Key Activities/Platforms | 2024 Relevance/Examples | Impact on Prosus |

| Digital Platforms of Portfolio Companies | Mobile Apps, Websites | iFood's increased order volume, OLX user engagement | Direct customer reach, revenue generation |

| Industry Conferences & Summits | Web Summit, Slush, VivaTech | Deal origination, trend spotting (AI, sustainability) | Sourcing new investments, ecosystem integration |

| Investor Relations & Financial Reporting | Investor Website, Annual Reports, Press Releases | Fiscal year 2024 reporting on e-commerce/fintech focus | Transparency, stakeholder communication |

| Corporate Website & Publications | Annual Reports, Sustainability Reviews | 2023 Integrated Report, classifieds segment revenue growth | Formal information dissemination, trust building |

Customer Segments

Prosus actively invests in high-growth internet companies and startups, especially those in emerging markets. These businesses are looking for more than just money; they need strategic capital, operational know-how, and a partner committed to their long-term success and market dominance.

The company focuses on key sectors like online marketplaces, food delivery, payments and fintech, and education technology. For instance, in 2024, Prosus continued to bolster its portfolio in these dynamic areas, recognizing the significant potential for expansion and innovation within these digital ecosystems.

Prosus ultimately serves a vast global consumer base, particularly in rapidly expanding economies. These are the individuals who rely on the digital platforms within Prosus's portfolio for their everyday lives.

These consumers are actively engaged in a variety of online activities, from ordering meals and shopping for essentials to managing their finances digitally and pursuing online education. For instance, in 2024, the e-commerce sector, a key area for Prosus, saw continued robust growth, with global online retail sales projected to reach trillions of dollars, driven significantly by emerging markets.

The strategy here is to deliver services that are not only convenient but also tailored to local preferences and needs. This localization is crucial for capturing market share and fostering loyalty among these diverse consumer segments.

Institutional investors, such as pension funds and asset managers, along with individual investors, represent a key customer segment for Prosus. These groups are actively looking for opportunities to invest in a broad range of high-growth internet companies. They are drawn to Prosus's strategy of identifying and nurturing promising digital businesses, aiming for substantial long-term capital appreciation.

Prosus's appeal to these investors lies in its diversified portfolio, which offers exposure to various segments of the internet economy, from e-commerce to fintech and food delivery. For instance, Prosus's significant stake in Tencent, a global technology giant, has historically been a major draw for investors seeking exposure to the Asian internet market. As of early 2024, Prosus continued to focus on optimizing its portfolio, with a notable emphasis on its e-commerce assets, which are expected to drive future growth.

Founders and Management Teams of Portfolio Companies

Prosus views founders and management teams of its portfolio companies as a crucial customer segment. This relationship is built on partnership, with Prosus offering strategic guidance, operational support, and access to capital to foster growth and long-term success.

Prosus actively engages with these teams to ensure strategic alignment and provide resources that accelerate business development. For instance, in 2024, Prosus continued its focus on empowering management teams within its e-commerce and fintech verticals, aiming to drive operational efficiencies and market expansion.

- Strategic Partnership: Prosus acts as a supportive partner, aligning its strategic vision with that of the company's leadership.

- Resource Allocation: Providing access to capital, talent, and operational expertise to fuel growth.

- Performance Enhancement: Collaborating to improve operational metrics and achieve sustainable profitability.

- Long-Term Value Creation: Working together to build enduring businesses with significant market potential.

Regulatory Bodies and Governments

Governments and regulatory bodies are key stakeholders for Prosus, influencing market entry and operational frameworks across its diverse global portfolio. Compliance with evolving regulations, such as data privacy laws like the EU's GDPR or emerging digital asset regulations, is paramount. For instance, in 2024, Prosus's investments in fintech and e-commerce platforms necessitate navigating a complex web of financial services regulations and consumer protection laws in regions like India and Brazil.

Prosus actively engages with these entities to ensure adherence to local tax laws, competition policies, and licensing requirements. This proactive approach is vital for maintaining operational continuity and fostering trust. For example, Prosus’s significant stake in Tencent requires careful consideration of Chinese regulatory policies impacting the technology sector.

- Compliance Costs: Prosus incurs costs related to understanding and implementing diverse regulatory requirements across its operating countries.

- Market Access: Favorable regulatory environments are crucial for Prosus to launch and scale its various online platforms and services, such as its food delivery operations in Europe.

- Policy Influence: Engaging with governments can shape future regulations, potentially creating more favorable conditions for digital businesses.

- Risk Mitigation: Proactive engagement helps Prosus avoid penalties and operational disruptions stemming from non-compliance.

Prosus serves a dual customer base: the end consumers who utilize the digital platforms it invests in, and the institutional and individual investors who provide capital for its growth. The end consumers are primarily located in emerging markets, actively engaging with online marketplaces, food delivery, fintech, and edtech services. For instance, in 2024, Prosus continued to see significant user growth across its food delivery businesses, with platforms like iFood in Brazil reporting millions of daily active users.

The investor segment comprises entities like pension funds and asset managers, seeking exposure to high-growth digital economies through Prosus's diversified portfolio. These investors are attracted to Prosus's proven track record in identifying and scaling successful internet companies, such as its substantial investment in Tencent. In 2024, Prosus's focus on optimizing its e-commerce assets, including those in online retail and classifieds, continued to be a key driver for investor interest.

Founders and management teams of Prosus's portfolio companies are also a critical customer segment, benefiting from strategic guidance, operational expertise, and access to capital. Prosus aims to foster long-term value creation by empowering these teams, as demonstrated by its support for management in areas like online payments and fintech. For example, Prosus continued to bolster its fintech investments in 2024, providing resources to companies aiming for market leadership.

Cost Structure

Prosus's cost structure heavily features investment capital deployment, a significant drain on resources. This encompasses substantial outlays for new ventures, strategic acquisitions, and crucial follow-on funding for its diverse portfolio companies.

In 2024, Prosus continued its aggressive investment strategy, allocating billions towards expanding its reach in e-commerce and fintech sectors. For instance, its investment in Delivery Hero, a global food delivery platform, represents a substantial portion of its capital allocation, aiming to capture market share in rapidly growing economies.

Prosus's operational and management expenses are significant, reflecting the costs of managing a vast global investment portfolio. These include substantial salaries for investment professionals, operational experts, and corporate staff essential for day-to-day business and strategic oversight.

For instance, in 2023, Prosus reported administrative expenses of $1.2 billion, which encompasses a large portion of these operational and management costs. This figure highlights the investment in human capital and the infrastructure required to support its diverse international operations and strategic decision-making.

Prosus dedicates substantial resources to technology development and AI integration, a critical component of its cost structure. These expenses encompass significant investments in research and development, the ongoing maintenance and upgrade of its technology infrastructure, and the complex process of integrating advanced AI solutions across its diverse portfolio companies. For instance, in 2023, Prosus reported a significant increase in its investment in technology, reflecting its commitment to AI-first strategies aimed at boosting operational efficiency and fostering innovation across its various ventures, including its e-commerce and fintech segments.

Marketing and User Acquisition Costs (within portfolio companies)

While portfolio companies directly manage their marketing and user acquisition spending, these expenses represent a substantial portion of Prosus's overall cost structure. This is particularly true in high-growth, competitive markets such as food delivery and online retail, where attracting and retaining users is paramount for expansion.

These investments are critical for building brand awareness, driving customer engagement, and ultimately capturing market share. For instance, in 2024, many of Prosus's e-commerce and food delivery ventures continued to invest heavily in digital advertising, promotional offers, and referral programs to fuel user growth.

- Digital Advertising Spend: Portfolio companies allocated significant budgets to online advertising platforms to reach target demographics.

- Promotional Campaigns: Discounts, first-time user offers, and loyalty programs were frequently used to incentivize adoption.

- Performance Marketing: A focus on measurable acquisition channels, such as app installs and subscription sign-ups, drove efficiency.

- Content and Social Media Marketing: Building community and brand loyalty through engaging content remained a key strategy.

General and Administrative (G&A) Expenses

General and Administrative (G&A) expenses for Prosus encompass a broad range of operational overheads crucial for managing its diverse global portfolio. These include significant legal and compliance costs, particularly pertinent given the ongoing regulatory landscape affecting technology and e-commerce sectors worldwide.

These administrative costs are vital for maintaining the group's smooth functioning across its numerous subsidiaries and markets. For instance, Prosus reported G&A expenses of $1.1 billion for the fiscal year ended June 30, 2023, reflecting the scale of its international operations and the associated support structures required.

- Legal and Compliance: Costs associated with navigating complex international regulations and legal frameworks.

- Administrative Support: Expenses for central management, HR, finance, and IT functions supporting the group.

- Corporate Governance: Costs related to board activities, investor relations, and ensuring ethical business practices.

- General Operations: Other overheads necessary for the day-to-day running of a multinational conglomerate.

Prosus's cost structure is dominated by its investment capital deployment, which includes funding for new ventures, acquisitions, and portfolio company growth. In 2024, this strategy saw billions allocated to e-commerce and fintech expansion, exemplified by its significant investment in Delivery Hero to gain market share in developing economies.

Operational and management expenses are also substantial, reflecting the complexity of overseeing a global investment portfolio. These costs cover salaries for investment professionals and support staff, as seen in the $1.2 billion in administrative expenses reported for 2023, which underpins its extensive international operations and strategic oversight.

Technology development and AI integration represent a critical cost area, with significant R&D, infrastructure maintenance, and AI solution integration across its ventures. This commitment was evident in 2023 with increased technology investments to enhance efficiency and innovation in its e-commerce and fintech segments.

Marketing and user acquisition costs, while managed by portfolio companies, form a significant part of Prosus's overall expenditure, especially in competitive sectors like food delivery. In 2024, ventures continued heavy spending on digital advertising, promotions, and referral programs to drive user growth.

| Cost Category | Description | Example (2023/2024 Focus) |

|---|---|---|

| Investment Capital Deployment | Funding new ventures, acquisitions, and portfolio growth | Billions allocated to e-commerce and fintech expansion in 2024; Delivery Hero investment |

| Operational & Management Expenses | Salaries, expert fees, corporate staff for portfolio oversight | $1.2 billion in administrative expenses (2023) supporting global operations |

| Technology & AI Investment | R&D, infrastructure, AI integration | Increased tech investment in 2023 for AI-first strategies |

| Marketing & User Acquisition | Digital advertising, promotions, referral programs by portfolio companies | Heavy spending in 2024 by e-commerce and food delivery ventures |

| General & Administrative (G&A) | Legal, compliance, HR, finance, IT support, corporate governance | $1.1 billion in G&A expenses (FY ended June 30, 2023) |

Revenue Streams

Prosus generates substantial revenue from capital gains realized when it successfully exits or partially divests its investments. This often occurs when portfolio companies achieve an Initial Public Offering (IPO) or are acquired by another entity.

For instance, Prosus has benefited significantly from such strategic sales. The company's stake in Swiggy, a prominent food delivery platform, has been a notable example, with its IPO expected to yield considerable capital gains for Prosus.

Prosus generates revenue from its wholly-owned subsidiaries, such as iFood, which brings in income through transaction fees and subscription services. Additionally, it benefits from its significant stakes in other companies. For instance, its investment in Tencent is a major contributor, with Prosus reporting a substantial share of profit from this equity-accounted investment.

The company's diverse portfolio includes online classifieds and food delivery platforms, each contributing through various revenue streams like advertising income and service fees. In the fiscal year ending June 30, 2024, Prosus's share of profit from equity-accounted investments, notably Tencent, represented a significant portion of its overall earnings, underscoring the importance of these strategic holdings.

Prosus generates significant revenue from its investment income, which includes interest earned on its substantial cash reserves and short-term financial instruments. This steady income stream provides a foundational layer of financial return.

A key component of Prosus's investment income is dividends received from its strategic holdings. For instance, its substantial stake in Tencent, a major Chinese technology conglomerate, historically provides a significant dividend inflow, contributing directly to Prosus's financial performance.

In 2024, Prosus's financial returns are bolstered by its diversified portfolio, which aims to capture growth across various sectors and geographies. The company actively manages its financial assets to optimize yield and capital appreciation, ensuring these investment income streams remain a vital part of its overall revenue generation strategy.

Fees and Monetization from Platform Services

Prosus leverages its diverse portfolio to generate revenue through a variety of fees and monetization strategies across its key segments. In its payments and fintech operations, such as PayU, transaction processing fees are a primary income source, directly correlating with the volume of transactions facilitated. The classifieds segment also relies on listing fees for advertisements and charges for premium placement or enhanced visibility services.

Beyond these core transaction-based revenues, Prosus's platforms often offer additional monetization avenues. These can include subscription services for advanced features, data analytics, or specialized tools, as well as advertising revenue generated from user engagement on its platforms. For example, in 2023, Prosus reported that its classifieds businesses saw strong growth, indicating successful monetization of listing and premium services.

- Transaction Fees: Revenue generated from processing payments and facilitating transactions on its platforms, notably through PayU.

- Listing Fees: Charges applied for posting advertisements or content on its classifieds sites.

- Premium Services: Income derived from offering enhanced features, visibility, or analytics to users and businesses.

- Advertising Revenue: Monetization through displaying advertisements on its various digital platforms.

Strategic Acquisitions and Ecosystem Expansion

Strategic acquisitions, while often a significant investment, are a crucial component of Prosus's revenue stream generation. These moves are designed to expand market reach and diversify its portfolio, ultimately integrating new, profitable ventures into its existing ecosystem. For instance, the acquisition of Delivery Hero in 2021, valued at approximately $7.5 billion, significantly bolstered Prosus's presence in the food delivery sector.

This expansion strategy directly contributes to future revenue by adding new customer bases and service offerings. Prosus aims to leverage these acquired businesses to create synergies and unlock cross-selling opportunities. The company's ongoing investment in its e-commerce and food delivery segments, which includes significant stakes in companies like Tencent and iFood, underscores this approach.

- Acquisition of Delivery Hero: Prosus invested heavily in Delivery Hero, a global food ordering and delivery platform, in 2021.

- Ecosystem Integration: The goal is to integrate acquired companies to create a broader, more robust digital ecosystem.

- Diversification of Revenue: By acquiring businesses in different sectors, Prosus reduces reliance on any single market or service.

- Long-term Value Creation: Strategic acquisitions are viewed as investments that will yield future revenue growth and profitability.

Prosus's revenue streams are multifaceted, driven by both its direct operations and its substantial investment portfolio. The company benefits from capital gains on successful investment exits, transaction fees from its fintech arm, and advertising and listing fees from its classifieds businesses. Additionally, dividends from its significant holdings, particularly Tencent, form a crucial part of its income. For the fiscal year ended June 30, 2024, Prosus reported that its share of profit from equity-accounted investments, primarily Tencent, was a significant contributor to its earnings.

| Revenue Stream | Description | Key Examples/Segments | 2024 Data/Context |

| Capital Gains | Profits from selling investments at a higher price than purchased. | Exits from portfolio companies (e.g., IPOs, acquisitions). | Prosus aims for strategic exits to realize value from its investments. |

| Transaction Fees | Fees earned for processing payments and facilitating transactions. | PayU (Fintech). | PayU processes a significant volume of transactions, generating substantial fee income. |

| Listing & Advertising Fees | Revenue from businesses paying to list items or advertise on platforms. | Classifieds segments (e.g., OLX). | Classifieds businesses showed strong growth in 2023, indicating effective monetization. |

| Investment Income (Dividends) | Income received from dividends paid by companies Prosus invests in. | Tencent, other equity-accounted investments. | Dividends from Tencent are a historically significant income source for Prosus. |

Business Model Canvas Data Sources

The Prosus Business Model Canvas is informed by a blend of financial disclosures, market research reports, and internal operational data. This comprehensive approach ensures each component, from value propositions to cost structures, is grounded in actionable insights.